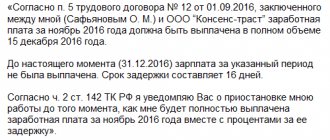

Salary payment - sample

The remaining fees must be returned and paid again.

(subparagraph 4, paragraph 4, article 45 of the Tax Code of the Russian Federation). Also, a payment order can be generated (and sent via the Internet) in Internet banking (for example, Sberbank-online, Alpha-click, client bank). Internet banking is not needed for small organizations and individual entrepreneurs, because it is complicated, expensive and less safe. It is worth considering for those who make more than 10 transfers per month or if the bank is very remote.

You can also generate payments using online accounting, such as this one.

Starting from 2021, someone else can pay taxes for an individual entrepreneur, organization or individual.

Then the details will be as follows: “TIN” of the payer - TIN of the one for whom the tax is being paid; “Checkpoint” of the payer – checkpoint of the one for whom the tax is transferred; “Payer” – information about the payer who makes the payment; “Purpose of payment” – INN and KPP of the payer for whom the payment is made and the one who pays; “Payer status” is the status of the person whose duty is performed.

The procedure for paying salaries to a bank card

136 of the Labor Code of the Russian Federation indicates options for settlement with an employee, where there is information on the procedure for using a bank account or card; Art. Procedure, place and timing of payment of wages When paying wages, the employer is obliged to notify in writing each employee: 1) about the components of the wages due to him for the corresponding period; 2) on the amount of other amounts accrued to the employee, including monetary compensation for the employer’s violation of the established deadline for payment of wages, vacation pay, dismissal payments and (or) other payments,

Accountant's Directory

It is interesting that Resolution No. 566 of the Council of Ministers of the USSR of May 23, 1957 is still in force, which stipulates what percentage of the salary is an advance. Attention

According to this regulatory document, how much percentage of the salary is an advance in 2021 depends on the agreement of the administration of the enterprise (organization) with the trade union cell when concluding a collective agreement.

There is also a clear criterion for what percentage of the salary the advance is. In 2021, its smallest amount must be no lower than the employee’s tariff rate for the time worked. Many people ask whether the advance can be more than the salary. Yes, current legislation does not prohibit this. That is, the advance must be paid, including: if the employee is an external part-time worker; if the employee voluntarily wrote an application for payment of wages once a month; if local regulations of the employer, employment contracts, etc.

Payment order for salary advance - sample

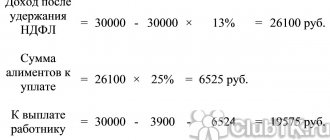

Subscribe to our accounting channel Yandex.Zen If the salary is paid through a bank account, the payment form in both of the above cases is filled out almost identically. The only difference is in filling out the details “Purpose of payment”: when transferring the advance, you need to provide wording reflecting the fact that the salary is transferred specifically for the 1st half of the month.

Detail “Payment amount”: reflects the advance amount according to statement T-51 (or similar), which is compiled for the 1st half of the month. Field "Destination"

Results

Transferring your salary to a bank card has its advantages. For accounting, issuing wages in cash always means additional time costs: compiling statements, counting and issuing funds, depositing wages for employees who, for some reason, did not show up for it.

The payment for a salary advance is drawn up in almost the same way as for the transfer of the final part of the salary - with one difference: in the details “Purpose of payment” it is indicated that the salary is being transferred for the 1st half of the month and information about the payroll for the billing period is provided.

Samples of filling out payment orders 2019

Cm.

Also: . From 2021, tax contributions can be clarified if the correct bank name and correct beneficiary account were provided. The remaining fees must be returned and paid again.

Payments can also be generated using online accounting, for example. Starting from 2021, someone else can pay taxes for an individual entrepreneur, organization or individual. Then the details will be as follows: “TIN” of the payer - TIN of the one for whom the tax is being paid; “Checkpoint” of the payer – checkpoint of the one for whom the tax is transferred; “Payer” – information about the payer who makes the payment; "Appointment

We arrange salary transfers at the request of the employee to third parties

In addition, for transferring money to third parties, your organization will pay a bank commission, which will then have to be collected from the employee.

There are no restrictions on the amount of transfers.

After all, this is not a deduction from an employee’s salary by order of the employer or on the basis of executive documents, but the disposal of the employee’s salary.

So if an employee asks to transfer to someone 100% of his salary due to him after withholding personal income tax and other mandatory payments (for example, alimony, compensation for material damage by decision of the employer), feel free to do it. The employee must draw up an application addressed to the head of the organization in any form.

It must indicate the following data: what amount is to be transferred to third parties (you can specify a fixed amount or a percentage of the wages due); what payments will be made of

Read more: How to calculate electricity payments using a meter

conclusions

A worker can always receive his salary through the company’s cash desk, but for ease of work, speed and safety, most employers choose a non-cash form.

To receive a salary on a plastic card addressed to the director of the enterprise, the employee writes an application indicating all bank account details.

After this, the data is checked by an accounting employee, and the salary is transferred to the employee’s account.

The article describes typical situations. To solve your problem , write to our consultant or call for free:

+7 (499) 490-27-62 — Moscow — CALL

+7 — St. Petersburg — CALL

+8 ext.849 — Other regions — CALL

How to transfer salary

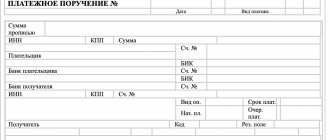

Indicate its number and date, the amount of payment in numbers and in words, TIN, KPP and payment details of your company (current account, name of the bank, its BIC and correspondent account), last name, first name, patronymic, TIN and payment details of the employee.

Receive an electronic digital signature (EDS) to sign and transfer to the bank lists for crediting money to the personal accounts of your company’s employees.

3 Create a general payroll for wages. Prepare

What to write in the payment purpose of a payment order when transferring salary to a card?

04/15/16 Question: Tell me what should be written in the “purpose of payment” field (field 24) of the payment order when transferring part of the earnings to a plastic card?

Answer: The Regulations on the rules for transferring funds, approved by the Central Bank of the Russian Federation on June 19, 2012 No. 383-P, states the following about the purpose of payment:

- Field 20 (Name of pl.) - Payment purpose code. The value of the details is not indicated unless otherwise established by the Bank of Russia.

- Field 24 (Purpose of payment) - The purpose of payment, the name of goods, works, services, numbers and dates of contracts, commodity documents, and other necessary information may also be indicated, including in accordance with the law, including value added tax.B for the total amount with the register, a reference is made to the register and the total number of orders included in the register, while the symbol “//” is indicated before and after the word “register”. In the total amount, compiled on the basis of orders, payers - individuals, a reference is made to the register (application) and the total number of orders included in the register (application), while the symbol “//” is indicated before and after the words “register”, “application”

If you are transferring funds from yours to yours, then you can write “Replenishment, excluding VAT.” If the transfer is made by the employer, then the purpose of payment indicates: Salary for... month... year, number and date of the document on the basis of which the transfer is made (number, date of the employment agreement/contract concluded with the employee). Here a record is made that: payroll taxes were withheld and paid in such and such an amount.

Due to the introduction of a new

“Regulations on the rules for transferring funds”

, it is also worth agreeing with the servicing bank on everything that you should write in the “purpose of payment” section. Full information on how to fill out the props field 24 can be found in the material: “” No comments yet. Commenting disabled 10/24/18 10/26/18

Is it necessary to indicate the purpose of payment?

It is not always necessary to fill in the “Purpose of payment” field

. As with all forms, if a field must be filled out, it is highlighted with a color or an asterisk. Or, without filling out the field, it will simply be impossible to send the payment - the online bank will warn about the error.

Most often, this field is not necessary to fill in, but in this case there is a possibility that the payment will get stuck in the bank or be returned back

.

When filling out a payment form for a personal transfer, it is not necessary to indicate the purpose, but there are also controversial situations when, based on the information in the “Purpose of payment” field, it will be possible to prove the purpose of receiving the money

.

All legal entities must indicate the purpose of the payment, otherwise the bank will not process the payment, and its status in the “client-bank” system will indicate o.

If the sender is an individual, then the “Purpose of payment” field must be filled in if the payment is tax, or it is a payment for goods, work or services

. In this case, the recipient (seller, supplier, online store) mentions this when issues regarding payment for services are discussed.

In general, the purpose of payment is, first of all, necessary for the bank. This is due to the fact that every credit institution has internal control rules to combat money laundering and terrorist financing (in accordance with Law 115-FZ).

In addition, the purpose of the payment will help the recipient more accurately determine what kind of money was received

: wages, payment for a product or service, or financial assistance from relatives.

Sample payment slip for transferring salary to card

To prevent this, it is necessary to take into account the time period that the bank allocates for crediting money to accounts.

A payment order for the transfer of salaries to staff is a document whose execution is not difficult, but it is worth taking into account the nuances of filling out the details.

To ensure the normal passage of the payment, they are filled out, adhering to the following requirements: in the “Payment Recipient” field, indicate the bank institution that has the company’s salary project under the concluded agreement and the account number to which the transfer is made; in the “Payment amount” column, the transfer amount is recorded, which is similar to the calculated amount to be handed over to the company - an advance payment or final payment for the month; in the “Purpose of payment” field they must reflect for what period the transfer is being made.

Why do we need the “Payment purpose” field at all?

The “Purpose of payment” field is necessary so that the bank and the recipient of the money can determine exactly why they received the transfer. The information in this field allows you to clarify the information and make the money transfer safer.

also pay attention

: if, when transferring money to an individual, it is indicated that this is payment for services rendered, the Federal Tax Service will begin to take a closer look at the recipient. If payments for this purpose are repeated too often, then the Federal Tax Service may recognize through the court that the citizen is violating tax laws and conducting business activities without registering a legal entity or individual entrepreneur.

In this case, the recipient of the money may be held administratively liable and additional taxes and penalties may be charged.

.

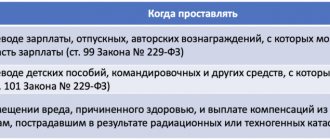

Another situation is if the recipient’s current accounts are blocked by decision of the bailiffs. As you know, the FSSP has the right to seize the accounts of an individual by a court decision or a resolution of the Federal Tax Service for non-payment or partial non-payment of taxes. All money that comes into the account will be automatically debited to pay off obligations.

But if the purpose of the payment states that it is, for example, a benefit for caring for a child under 1.5 years of age, then the bank and the FSSP do not have the right to write off this money

to pay off debt.

In addition, all legal entities must fill out

, since otherwise the bank simply will not process the payment order.

zarplata_na_kartu.jpg

Related publications

Labor legislation establishes the employer’s obligation to pay employees wages at least once every six months. The usual gradation for advance payment and payment. The payment deadlines are (Article 136 of the Labor Code of the Russian Federation):

- 30th day of the current month – for advance payment for the 1st half of the month;

- The 15th day of the next month is for monthly calculations.

Full compliance with these deadlines also applies to salaries transferred to the card, if the company practices issuing salaries not through a traditional cash register, but by bank transfer to staff cards.

Advance payment

Documents for issuing wages for the first half of the month The advance is part of the salary, so the basis for issuance will be the same documents as for the payment of wages:

- staffing schedule;

- a document containing personal data, including information about bonuses (length of service, size of the regional coefficient, tax deductions, length of service);

- time sheet;

- management orders: for regular leave, for bonuses, for leave without pay, for providing financial assistance, withholding accountable amounts, etc.;

- sick leave;

- in some cases - an application for an advance;

- payslip or other payment form.

The main document for calculating the amount of advance payment and wages is the time sheet.

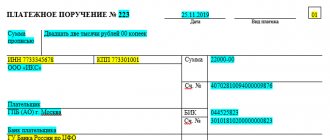

Payment order for salary to card

The transfer is executed by payment order, the details of filling which are discussed in our publication. It is important to take into account the fact that the payment day is usually considered the day the funds are credited to the card, and this day should not be later than the deadlines established by tax legislation. In order to prevent delays in salary payments, it is necessary to take into account the time period that the bank allocates for crediting money to accounts.

A payment order for the transfer of salaries to staff is a document whose execution is not difficult, but it is worth taking into account the nuances of filling out the details. To ensure normal payment processing, they are filled out in accordance with the following requirements:

- in the “Payment recipient” field indicate the bank institution that has the company’s salary project under the concluded agreement and the account number to which the transfer is made;

- in the “Payment amount” column, the transfer amount is recorded, which is similar to the calculated amount to be issued in person in the company’s accounting records - an advance payment or final payment for the month;

- in the “Purpose of payment” field they must reflect for what period the transfer is being made. For example, when transferring an advance, it is formulated as follows: “Payment of wages for the 1st half of the month according to register No. _ dated _._.2018.” A mandatory attachment to the payment order for the transfer of salary amounts is a register indicating the payments due to each employee of the company.

Read more: It is not possible to provide documents

Sample payment slip for transferring salary to a card:

Non-cash payments are becoming increasingly widespread, since this option has many advantages, and the use of bank cards in various places for payment contributes to the popularity of their use when paying an employee.

The legislation provides for the option of using cards at enterprises, but it is necessary to comply with all the requirements and subtleties of the process.

Important nuances

Transferring a salary to an employee’s bank card obliges the payment of personal income tax no later than the next business day: since the payment of funds to the card is their actual issuance, the failure to transfer income tax is a direct violation of the provisions of clause 6 of Art. 226 Tax Code of the Russian Federation.

For more information about the deadlines for paying taxes and other payments to the budget, see the material “What you need to know about the deadlines for paying taxes.”

- Transfer of salary to a bank card at the request of an employee for the account of third parties.

If this clause is specified in the employment contract and there is a statement from the employee requesting the transfer of wages to third parties, the organization has the right to perform this operation (Part 5 of Article 135 of the Labor Code of the Russian Federation). This could be, for example, transfers to banks (to repay loans), to individuals (loans, mutual settlements).

IMPORTANT! To avoid unpleasant situations when an organization is inspected by regulatory authorities, it is not recommended to transfer 100% of wages to third parties.

What other frictions may arise between the employee and the employer, see the material “Financial liability of the employer to the employee.”

Is it possible to perform similar operations

According to legislative acts, payment of wages to an employee is permissible in several ways:

- Cash payment – issuance of funds in person;

- Non-cash – transfer to bank plastic.

If the choice is given to the employee, then he must write an application for the transfer of wages to the card indicating the details of the recipient’s bank 5 days before receiving the money.

Important: the employer does not have the right to prevent an employee from choosing a credit institution, even if all employees receive funds from the same bank.

The procedure for accounting for salary payments on a card in the 1C program is in this video:

The legislative framework

This issue is regulated by several legislative acts:

- Initially, this should be a local internal act of production - a collective or labor agreement, which describes this possibility in detail; if this is not the case, changes can be made if necessary;

- Art. 136 of the Labor Code of the Russian Federation indicates options for settlement with an employee, where there is information on the procedure for using a bank account or card;

- Art. 372 of the Labor Code of the Russian Federation - form of pay slip;

- Regulations on the issue, issued in 2004 by the Central Bank of the Russian Federation on the features of plastic cards and their handling;

- The Tax Code of the Russian Federation and the Civil Code of the Russian Federation indicate the simultaneous deduction of funds to non-budgetary organizations when transferring wages to the employee’s card.

Article 136. Procedure, place and terms of payment of wages

When paying wages, the employer is obliged to notify each employee in writing: 1) about the components of the wages due to him for the corresponding period; 2) on the amount of other amounts accrued to the employee, including monetary compensation for the employer’s violation of the established deadline for payment of wages, vacation pay, dismissal payments and (or) other payments due to the employee; 3) about the amount and grounds for deductions made; 4) about the total amount of money to be paid. The form of the pay slip is approved by the employer, taking into account the opinion of the representative body of employees in the manner established by Article 372 of this Code for the adoption of local regulations. Wages are paid to the employee, as a rule, at the place where he performs the work or transferred to the credit institution specified in the employee’s application, under the conditions determined by the collective agreement or employment contract. The employee has the right to change the credit institution to which wages should be transferred by notifying the employer in writing about the change in the details for transferring wages no later than five working days before the day of payment of wages. The place and timing of payment of wages in non-monetary form are determined by a collective agreement or employment contract. Wages are paid directly to the employee, except in cases where another method of payment is provided for by federal law or an employment contract. Salaries are paid at least every half month. The specific date for payment of wages is established by internal labor regulations, a collective agreement or an employment contract no later than 15 calendar days from the end of the period for which it was accrued. For certain categories of employees, federal law may establish other terms for payment of wages. If the payment day coincides with a weekend or non-working holiday, wages are paid on the eve of this day. Payment for vacation is made no later than three days before it starts.

Important: in connection with this, the employer will not be able to delay the payment of wages, as he will be subject to penalties.

Is such a calculation required?

Important: if wage payments are made to a card without documentation, the employer bears criminal liability.

Read more: How to sell an apartment if one owner is against it

What should you write about tax when transferring an advance to an employee?

If such the nearest day is the day of payment of the advance, then the benefits must be paid along with it.

! Please note: the requirement of the Labor Code to pay wages at least twice a month does not contain any exceptions and is mandatory for all employers to fulfill in relation to all employees (Rostrud Letter No. 3528-6-1 dated November 30, 2009). Attention In addition, the employer cannot “bind” its employees to a specific bank: labor legislation gives the employee the right at any time to change the bank to which his wages should be transferred. In this case, it is enough for the employee to notify the employer in writing about the change in payment details for payment of wages no later than five working days before the day of payment of wages (Art.

136 of the Labor Code of the Russian Federation). The procedure for calculating and paying personal income tax and insurance contributions from wages We have found that wages to employees must be paid at least twice a month.

Payment order to transfer wages to a card: sample for 2021

The employee has the right to choose the bank to transfer his salary. He must notify the employer of this in writing no later than five working days before payment of wages.

This is stated in Part 3 of Article 136 of the Labor Code of the Russian Federation.

Keep in mind that the terms of the agreement with the bank for servicing the card account may stipulate that money is credited after a certain time period (for example, the next day after receiving the corresponding payment document).

Most enterprises, when choosing a method of paying staff remuneration, give their preference to non-cash payments.

For employees, this option for receiving salaries is the most convenient; there is no need to receive cash from the company’s cash desk.

The article describes typical situations. To solve your problem , write to our consultant or call for free:

+7 (499) 490-27-62 — Moscow — CALL

+7 — St. Petersburg — CALL

+8 ext.849 — Other regions — CALL

It's fast and free!

For accounting employees, the non-cash form has many positive aspects; the process of paying employees is easier.

Labor legislation obliges you to pay wages to your subordinates at least once every six months, as a rule, on the 30th day - payment of an advance for the current month, on the 15th day of the next month - final payment for the month.

Notifying the employee about the receipt of funds on the card

If initially, when signing a contract with an employee, the payment section did not provide for payments to be made to the card, when deciding to use them, it is necessary to draw up an appendix to the main document.

In this case, an order is initially issued indicating the date the changes become effective.

Application for transfer of salary to card.

In addition, the following activities are carried out:

- The regulations on remuneration are changing;

- Responsible persons are appointed for processing the entire procedure for the state’s transition to cashless payments;

- The accounting department receives the appropriate order to apply the necessary entries;

- If necessary, the HR department is obliged to provide the bank with information about employees, for example, the number of staff, etc. Here you will learn how to create a report on the average headcount.

Rules for transferring salaries to a card

If there is a payslip, the company must enter into an agreement with the credit institution, since this is precisely the responsibility of the employer, and submit a list of documents:

- List of all employees;

- Copies of their passports;

- Application from each employee to agree to the calculation in a similar way.

At the same time, a schedule for the disbursement of funds is drawn up and the person responsible for the transfer is determined, who, if necessary, will have up-to-date information.

Then, before each issue, a payment order is drawn up indicating the amount of the transfer, to which is attached a register indicating the bank details, full names of employees and the amount of each salary.

Important: the document must be signed by an authorized person and marked with the seal of the enterprise.

If the organization does not have a payslip, the list of documents submitted when issuing cards is supplemented by the constituent documents:

- Charter;

- Memorandum of association;

- Card with sample signatures;

- Registration certificate;

- Minutes of the general meeting of shareholders with the corresponding decision;

- TIN of the enterprise. Here you will learn how to obtain information about the OGRN by TIN.

At the same time, the commission for opening accounts will be slightly higher; the employer must pay it. After the cards are made, they are distributed to employees against signature.

If an employee chooses a bank with an account, all expenses will be borne by him.

If an employee wishes to transfer funds to a relative’s card, this is not prohibited by law; it is necessary to provide:

- Bank details;

- Passport details of the card holder;

- Stipulate the time frame within which the transfer will be carried out, most importantly, in this case the bank will increase the commission.

The conclusion of an agreement with the bank must be completed 5 working days before the payment of wages, and it must display specific deadlines for the receipt of money into the account.

Advantages and disadvantages of non-cash payments

There are many advantages of using a plastic card as a payment method for both parties:

- The procedure for paying funds to the staff for the accounting department will be simplified - there is no need to go to the bank and withdraw huge sums to make payments to staff;

- The employee will receive many benefits as a preferential cooperation with the bank as a salary card holder;

- At the same time, the cards make it possible to travel to other countries without carrying cash;

- The ability to control your account without leaving home through online banking.

However, there is also the other side of the coin:

- Unavailability of funds from the card in rural and remote areas;

- Refusal of the employee to receive wages in this way;

- Some banks impose fees for withdrawing funds from a salary card;

- The organization bears the costs of concluding an agreement and issuing cards.

Application form for salary transfer to card.

Payment order

The costs of transferring money are displayed in the debit and credit of accounts, while the accounting entries displayed in them should be well known to accounting employees.

Before submitting a payment to the bank, certain deductions are made:

- Personal income tax withdrawn from the income of each individual - for this purpose, a paper is attached indicating its payment;

- Insurance, pension and medical contributions, which must be transferred by the 15th of each month.

In addition, the payment card carries the name and details of the bank, the total amount, purpose of payment, as well as the registry number.

How to fill out a payment form

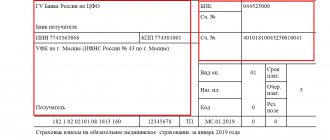

Let us explain what to indicate in some fields of the payment order for the transfer of wages to the cards of several employees:

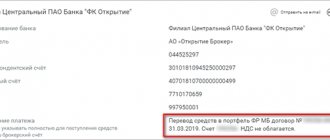

- in the “Recipient” field – the name and location of the bank in which the employees’ accounts are opened (for example, Sberbank);

- in the “Amount” field – the total amount that needs to be transferred to the employees’ accounts;

- in the “Purpose of payment” field – the purpose of the payment and make a reference to the date and register number (for example: “Transfer of wages for January 2021 according to register No. 6 dated February 05, 2021”).

Here is a sample payment order for salary transfers to a card in 2021 based on the register:

If the salary is transferred to the account of one employee, then indicate in the payment order:

- in the “Recipient” field – the employee’s last name, first name, patronymic;

- in the “Recipient's Account” field – the number of his personal bank account.

Here is an example of a payment order for transferring wages to a card in 2021 for one individual:

If you are transferring money to a non-resident When transferring wages to non-resident foreigners, in the “Purpose of payment” field before the text, indicate the currency transaction code (according to Appendix 2 to Bank of Russia Instruction No. 138-I dated June 4, 2012). Namely, code 70060 “settlements related to the payment by a resident to a non-resident of wages and other types of remuneration.” Enclose the currency transaction code in curly brackets: {VO<code of the type of currency transaction>}.