Salary in cash. Photo by in-reutov.ru Almost all people receive their salary on a card. This is beneficial for the company’s immediate managers and the employees themselves. But this method has some disadvantages, so sometimes citizens think about the possibility of receiving their income in the form of cash.

They can write a corresponding application addressed to the manager to refuse to transfer salaries to a bank card

How to start receiving your salary in cash

To begin with, the employee writes a free-form application addressed to the director of the enterprise with reference to Art. 136 Labor Code of the Russian Federation. An employee can ask for approval of his application, but not demand payment in cash - the law does not give such a right.

| General Director of LLC “First Workshop” I.I. Ivanov from mechanic Glushkov D.D. STATEMENT I ask that starting from July 2021, you pay me wages at my place of work in cash in accordance with Article 136 of the Labor Code of the Russian Federation. 30.06.2020. (signature) Glushkov D.D. |

Russia is a world leader in non-cash payments: some statistics

We pay cashless in stores, pay for housing and communal services, taxes, and fees.

According to the Central Bank of Russia in 2021:

for the first half of the year, the number of non-cash payments is already almost 69%, and for the year the regulator predicts that they will completely exceed 70% (source).

During the pandemic, Russia entered the top 5 world leaders in terms of the rate at which the population abandoned cash in favor of non-cash payments (source).

Is it possible for an employee to receive wages in cash? Let's consider the current legislation and answer this question.

Can an employer refuse to pay wages in cash?

The employer is obliged to regularly pay wages to its employees. At the same time, he himself decides in what form - cash or non-cash - to do this. An employee may ask to change the form of payment, but the employer is not required to agree to this.

Judicial practice shows that in most cases the courts do not satisfy the demands of employees to switch to cash payments. The main reason is that the employee initially signs an application for the transfer of salary to a bank account upon employment. Or this is immediately stipulated in the labor or collective agreement.

Moreover, if the employee did not sign an application to transfer his salary to the bank, and such a procedure is not enshrined in an employment or collective agreement, the employer cannot refuse to pay him a salary in cash. In fact, without these documents, the company did not even have the right to open a salary account.

The company may refuse to pay employees wages in cash if a decision has been made to liquidate the cash register. That is, the company uses only non-cash funds.

Keep records of exports and imports in the Kontur.Accounting web service. Simple accounting, payroll and reporting in one service

Permission from Rostrud

By 2021, employers received permission from Rostrud to receive wages in cash. The official statement states that employees independently choose the method of receiving salary.

Using a card has many serious advantages, but it does not always suit a particular person:

- older people are afraid of not being able to cope with modern technology;

- residents of certain areas often do not have the opportunity to make payments by card or receive cash from an ATM;

- in cases of damage or loss of a card or PIN code, the employee may be left without a livelihood.

In order to receive money in hand, the employee is required to draw up an application addressed to the chief accountant, which must be endorsed by the manager. An employer has no right to force a person to receive money through a card.

If an employee decides to change the form of receiving salary, you need to contact the accounting department to change the terms of the contract. This is also done by drawing up an application.

Why is it more profitable for an employer to pay wages by bank transfer?

Typically, it is more profitable for companies to transfer wages to employee cards as part of a salary project. Firstly, making a non-cash transfer is easier than collecting employees and giving them cash. Secondly, the salary project provides a number of advantages to the company, for example, they do not charge a commission for transferring salaries or give a discount for servicing the current account. And when issuing cash, the employer will still have to spend money on a commission for withdrawing money.

Important! Unscrupulous entrepreneurs prohibit employees from even changing the bank where they receive their salary. It is illegal. Even if the company has a salary project in bank A, the employee can demand that the salary be transferred to his card in bank B.

The company's cash withdrawal costs should not in any way affect the employee's convenience in receiving their salary.

Pros and cons for participants

Citizens who decide to receive their salary in cash can enjoy the following benefits:

- there is no possibility of freezing money as a result of seizure by bailiffs;

- there are no difficulties with withdrawing money, and this is especially true if you choose a not very popular bank;

- ease of payments in stores;

- no need to constantly remember how much money is on the card.

But this choice has some disadvantages. These include the need to carry cash with you. If a person is robbed, he will lose all or a significant part of his salary. When receiving funds on the card, you do not have to visit the company’s accounting department or sign different statements.

How to increase your pension with a Komsomol card? More details here.

Thanks to modern technologies, bank card owners can perform various transactions with their funds through a mobile bank, as well as receive interest on the balance. For companies, paying money through a cash register does not have any advantages.

How to pay salary in cash? Watch the video:

The disadvantages include the deterioration of relationships with representatives of the bank chosen for the salary project. The work of an accountant becomes more complicated, and you also have to hire a cashier.

How to issue a salary in cash: procedure and accounting entries

Salaries must also be paid in cash twice a month. The interval is no more than 15 calendar days between payments. To receive a salary, the employee must go to the organization's cash desk.

To process the payment of wages, use a payslip in form T-49 or a payslip in form T-51.

The algorithm for issuing money is simple:

- the manager or chief accountant signs the payroll slip and hands it to the cashier;

- the cashier carefully checks the presence of all signatures and prepares the required amount;

- cash is given to the employee: to establish identity, the cashier may ask for a passport;

- the cashier passes the payment document to the recipient for signature;

- the employee receives his salary and recalculates it without leaving the cash register.

When issuing wages, the accountant makes only one entry: Dt 70 Kt 50 .

Money for salary payments can remain in the cash register for up to 5 days, even if the cash register limit is exceeded. During this time, you need to manage to calculate all employees. The remaining salary must be deposited, that is, returned to the bank. Then the accountant makes the following entries:

Dt 70 Kt 76.4 - uncollected wages deposited;

Dt 51 Kt 50.1 - the deposited salary is transferred to the current account.

At the first request of the employee, the deposited amount must be returned. The accountant will make the following entries:

Dt 50.1 Kt 51 - money was received from the current account to the cash desk for payment of deposited salaries;

Dt 76.4 Kt 50.1 - the employee was given deposited wages.

Transferring salary to a bank card in 2021 - 2021: procedure

- Drawing up a register for salary transfers.

The following data must be reflected in the register:

- Full names of employees;

- personal account numbers;

- amounts to be credited;

- purpose of payments;

- bank details.

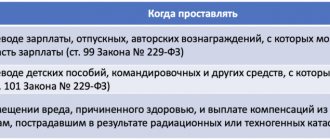

From 06/01/2020, payment documents for payments to employees must indicate one of three income codes. For this purpose, the payment order uses detail 20 “Name. pl". The corresponding code must also be indicated in the register; the bank must provide this opportunity.

Detailed information about working with income codes is available in ConsultantPlus. Get trial access to the system for free and go to Review.

The register must be signed by authorized persons of the organization and have a seal imprint. The form of the register is established by each bank independently and agreed upon when signing an agreement for connection to the salary project.

The procedure for submitting and filling out the salary register and payment slips is established by paragraphs. 1.17, 1.19, 1.24, Appendix 1 to the regulations of the Central Bank of the Russian Federation dated June 19, 2012 No. 383-P.

Most banks use special software to compile and send the register, which reduces the time required to compile the register itself and prevents typos in the details.

- Submitting the register to the bank.

The document flow rules require that the organization provide the bank with 2 registers for the transfer of wages, but if there is an electronic document flow between the bank and the organization, as a rule, this is not necessary.

- Drawing up a payment order and sending it to the bank.

In the payment order, the bank is indicated in the “Recipient” field, and the register number and date are indicated in the payment purpose.

IMPORTANT! Most banks open additional accounts to conduct settlement transactions for salary transfers, so when preparing a payment receipt, you need to check that the “salary” account is indicated correctly.

- Receipt from the bank of the register with a mark of execution.

This point is important for organizations that transfer registers for the payment of wages to the bank on paper, because without a mark of execution, the register is considered unfulfilled, and wages are considered untransferred. If the register is sent to the bank through a special program, then after the employees’ wages are credited, a notification is received in the program and the register is reflected as “Executed”.

In what cases is it prohibited to pay wages in cash?

Paying wages in cash is prohibited only when paying foreigners. The range of cash payments with foreigners is limited by Part 2 of Art. 14 Federal Law dated December 10, 2003 No. 173-FZ, and wages are not included in this list. The position that foreigners can only be paid wages in non-cash form was confirmed by the tax authorities in Letter No. 3N-4-17/15799 of the Federal Tax Service dated August 29, 2016.

Paying wages in cash to a foreign person is a violation of currency laws. Fine under Part 1 of Art. 15.25 of the Administrative Code of the Russian Federation will be 75-100% of the amount issued.

We recommend you the cloud service Kontur.Accounting. The program allows you to calculate, accrue and deposit employee salaries. In addition, the service will help you calculate and pay all taxes and contributions due from your salary and submit all reports on time.

Legal platform

The regulation of the question of how to receive money in cash or on a bank card is found in the field of regulations and provisions on the payment of wages in the Russian Federation:

- Article 131 of the Labor Code of the Russian Federation determines the forms of payments;

- Article 136 of the same code establishes the procedure for issuing money by the employer;

- Federal Law 161 of December 10, 2003 regulates the accounting, conduct and procedure of currency transactions.

These are the main documents valid throughout Russia. This issue can be regulated with the help of additionally adopted legal acts that consider the characteristics of the activity, region or industry.

The Russian employer is obliged first of all to study these documents, since the punishment for violations in the field of remuneration is becoming more stringent from year to year.

The employees themselves should do the same in order to better study their own rights and monitor their compliance.

Why transfer Russians' salaries to a non-cash format?

Transferring salaries to cards will help reduce the share of cash in money turnover, due to the large size of which Russia loses more than 1% of GDP annually. This was stated by Sberbank President German Gref . According to him, the volume of cash in relation to GDP in the Russian Federation is 11.9%, which is noticeably higher than in other countries (5.3% in Mexico, 4.2% in Brazil, 6.6% in the USA and 9. 3% in Europe).

At the same time, according to the Central Bank, many companies continue to give employees only cash. Thus, in 2013, the monetary income of the population amounted to 43.9 trillion rubles, and individuals withdrew from their cards or paid for goods and services in a non-cash format in the amount of 26.1 trillion rubles. Accordingly, without taking into account pensions and other social benefits, the salary card coverage is estimated by the Central Bank at approximately 50%. According to the Central Bank of Russia, currently about 70% of Russians prefer to pay in cash.

How is it proposed to transfer the salaries of Russians to a non-cash format?

In order for Russians to receive their salaries exclusively on their cards, it is necessary to make changes to the Labor Code and the Code of Administrative Violations. At the same time, violators of the law must be held accountable: for example, it is proposed to establish a fine for paying salaries in cash:

Article on the topic Uncut. What you need to know about bank cards

- for company managers - in the amount of 5 thousand rubles;

- for the organizations themselves - from 10 thousand to 50 thousand rubles.