FIFO method (English FIFO, First In First Out, conveyor model) is a method of accounting for the inventories of an enterprise in the chronological order of their receipt and write-off. The basic principle of this method is “first in, first out”, that is, the materials that arrive at the warehouse first will also be used first. Inventories include current assets used in the company's production cycle: raw materials, materials, semi-finished products, finished products. Inventories occupy a significant part of the company's current assets and require proper accounting. There are other methods of accounting for inventories in accounting:

- at the cost of each unit;

- at weighted average cost;

- at the cost of last purchases (LIFO).

FIFO in accounting is...

FIFO is one of the acceptable methods in accounting for writing off the cost of materials for production or when they are otherwise disposed of (clause 73 of the Methodological Guidelines for the accounting of inventories, approved by order of the Ministry of Finance of Russia dated December 28, 2001 No. 119n).

This material will introduce you to other methods of writing off inventories..

This method is applicable in the accounting of companies with different industry specifics:

- industrial enterprises;

- logistics companies;

- wholesale companies, etc.

For retail trade, the FIFO method is unsuitable, since it does not allow accounting to formulate the cost price for individual types of goods in an accurate estimate.

This method is based on the assumption about the order in which inventories are written off: when materials are written off for production or otherwise disposed of, they are assessed in the sequence in which they were acquired. At the same time, a strict chronology of their receipt and write-off must be observed.

If you don’t know which method to choose when writing off inventories, use the recommendations of ConsultantPlus experts. Get trial access and upgrade to the Ready Solution for free.

Because of this assumption, the FIFO method is often called the "pipeline model" or the "natural queue method." Based on the basic principle of the FIFO method (“first in, first out”), the materials that arrive first at the warehouse are used first.

Impact of the choice of assessment method on reporting indicators

So, we can generally characterize the impact of the choice of inventory valuation methods on reporting indicators as follows:

- the method of calculating the cost of each unit of inventory makes it possible to identify the financial result from the sale of each unit of inventory and present their assessment in reporting in strict accordance with the purchase price of each specific element (unit) of the organization’s inventory;

- the average price method hides (shades out, blurs, veils) the impact of changes in purchase prices for inventories on their valuation indicators as an element of a balance sheet asset, period expenses and financial results (profit and loss);

- The FIFO method, in conditions of rising prices for the acquisition of inventories, forms the maximum estimate of inventories at the end of the period, the minimum estimate of expenses for the period and the maximum estimate of the financial result. In conditions of declining prices, FIFO, on the contrary, gives us a minimum estimate of inventories at the end of the period in the balance sheet, a maximum estimate of expenses for the period and a minimum value of the financial result;

- The LIFO method, in conditions of rising prices for purchased inventories, forms the minimum estimate of inventories in the balance sheet at the end of the period, the maximum amount of expenses for the period in the income statement and the minimum estimate of the financial result (profit or loss). In an environment of declining prices, LIFO gives us a maximum estimate of inventory on the balance sheet, a minimum estimate of period expenses, and a maximum estimate of financial result.

FIFO Application Models

There are 2 types of FIFO method:

- standard (ordinary), which involves the calculation of incoming and consumable materials, and unused materials are taken into account once at the end of the month;

- modified (sliding), which assumes the reverse order of calculations - first, the balance of materials at a certain point in time is determined at the price of the last ones at the time of acquisition, and then the cost of inventories written off for production is calculated.

Example

A special additive is used in the production of Tekhnologiya LLC products. At the beginning of the month, the company’s accounting records the balance of the additive in the amount of 60 kg (the price of 1 kg is 245 rubles, the cost of the balance is 14,700 rubles).

Within a month, the warehouse received an additive for a total amount of 274,200 rubles:

- 1st arrival - 600 kg (254 rub./kg);

- 2nd entry - 300 kg (270 rub./kg);

- 3rd entry - 150 kg (272 rub./kg).

720 kg of additive were written off for production.

Calculation using the standard FIFO model:

1. Let's calculate the cost of the written-off additive:

- 60 kg from the balance at the beginning of the month (RUB 14,700);

- 600 kg from the 1st receipt (600 kg × 254 rub./kg = 152,400 rub.);

- 60 kg from the 2nd receipt (60 kg × 270 rub./kg = 16,200 rub.).

————————————————————

Total: 14,700 + 152,400 + 16,200 = 183,300 rubles.

2. Determine the cost and amount of remaining material at the end of the month:

14,700 + 274,200 − 183,300 = 105,600 rub.

60 + (600 + 300 + 150) − 720 = 390 kg.

Calculation using the modified FIFO model:

1. With a balance of 390 kg (240 kg from the 2nd receipt and 150 from the last), the cost of the additive remaining in the warehouse at the end of the month will be:

240 × 270 + 150 × 272 = 105,600 rub.

2. Calculation of the cost of the additive written off for production:

14,700 + 274,200 − 105,600 = 183,300 rub.

Conclusions from the considered example:

- the cost of written-off materials and balance are the same when using both FIFO models;

- with the second option, it is enough to accurately determine which materials from which batches make up the balance in the warehouse, and the cost of written-off materials is determined by calculation without necessarily being allocated to a specific batch;

- with the first option, you need to accurately determine from which batches the materials are written off and remain at the end of the month.

Thus, the standard FIFO calculation model has increased labor intensity if materials are purchased quite frequently during the month.

ConsultantPlus experts explained in detail how to account for goods in wholesale and retail trade. If you don't have access, get a free trial online access to the system.

For postings when writing off materials, see here.

General content of reserve valuation methods

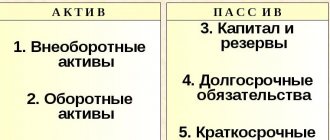

The choice of inventory valuation method is relevant in the context of changes in acquisition prices for company inventories (goods, materials, etc.). Changes in purchase prices and the presence of balances at the end of the period create the problem of their valuation. Indeed, stocks were received during the period at different prices, only part of the stocks were sold (released into production), and if batch records were not kept, then how to evaluate the balances, at what prices? And this is not the only question here. After all, how we evaluate the balance of unsold (unused) inventories at the end of the reporting period will depend on the assessment of inventories sold or used in production, that is, the assessment of expenses for the period, and therefore profit. So, we have three elements of reporting, the assessment of which depends on the methods we choose - these are:

1) the company's reserves on the balance sheet as an element of its current assets, 2) the expenses of the period in the income statement, and 3) the financial result (profit or loss) in the income statement, and, subsequently (in terms of retained earnings ( uncovered loss)) and in the balance sheet.

Consequently, the assessment of reserves determines how the indicators will look in the eyes of reporting users:

1) the solvency of the company, 2) its profitability and 3) the structure of sources of financing its activities.

The former are determined by the ratio of current assets and short-term liabilities, and the valuation of inventories, accordingly, determines the value of the valuation of the company’s current assets as a whole. The latter are calculated by the ratio of profits to assets or costs reflected in the profit and loss statement - here the impact of the valuation of inventories on the value of the financial result takes place. Still others depend on the share of own sources of funds in the total volume of liabilities, and this ratio is influenced by the amount of retained earnings (uncovered loss).

So, how to value inventories in the context of the dynamics of their acquisition prices? Possible answers to this question are the so-called methods for estimating reserves.

In modern practice, four methods for estimating an organization’s reserves are widely known:

1) estimates of the cost per unit of inventory; 2) average price method; 3) FIFO method and 4) LIFO method.

Which method of writing off materials has been cancelled?

Until 2008, FIFO and LIFO were considered acceptable methods for writing off materials. The basic principle of LIFO is that materials that are the last to arrive at the warehouse are removed from the inventory first.

Since 01/01/2008, by order of the Ministry of Finance dated 03/26/2007 No. 26n, LIFO was excluded from possible write-off methods for accounting purposes, therefore, at present, consideration of examples of calculation using the LIFO method has become irrelevant.

In addition to LIFO and FIFO, Russian taxpayers use the average cost write-off method. The essence of this method is described in the material “The procedure for writing off materials at average cost.”

Regulatory information

Speaking about the possibilities of using inventory valuation methods in practice, first of all, you should pay attention to the fact that currently regulatory documents on accounting and the Tax Code of the Russian Federation provide organizations with various opportunities to choose a method for valuing inventories for the purposes of financial accounting and tax accounting, respectively.

In the first case, we are talking about the formation of an organization’s accounting policy, in the second – an accounting policy for tax purposes. Current accounting regulations do not provide for the possibility of using the LIFO method. According to the Tax Code of the Russian Federation, when forming an accounting policy for tax purposes in terms of income tax, organizations can choose any of the 4 methods we have considered.

Let us present the relevant requirements of regulatory documents that give exactly those definitions of inventory valuation methods that should be followed in the practice of financial and tax accounting.

Results

The FIFO method provides for the write-off of materials into production (or other disposal) in the sequence in which they were acquired. The method of writing off inventories at the cost of the latest receipts (LIFO) has not been used in accounting since 2008.

Sources: Guidelines for accounting, approved. by order of the Ministry of Finance of Russia dated December 28, 2001 No. 119n

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Advantages and disadvantages

The FIFO method has the following qualities:

| pros | Minuses |

| 1. Quickly calculated and easy to use in accounting. 2. The creditworthiness of the organization and the chance of attracting large investment investments increases. | 1. Inflation is not taken into account in the case of uneven use of commodity reserves. 2. There is a risk that during the calculations the wrong strategy for the development of the organization will be chosen. |

The LIFO method has the following features:

| pros | Minuses |

| 1. It is possible to reduce tax obligations if small volumes of material assets are used.2. It is better to estimate economic profit when determining the replacement cost of inventories. | 1. Tax fees increase if frequently liquidated inventories are taken into account.2. There is no way to reflect the real movement of inventory items in production. |

Disadvantages of the FIFO technique

No matter how universal the method may seem, it still has its negative sides, which can affect the activities of the enterprise. These include:

- ignoring inflationary processes when accounting, which leads to an overestimation of the cost of inventories;

- an increase in the amount of tax liabilities due to an increase in the size of the organization’s financial results;

- complication of the cost planning process;

- deterioration in enterprise management and forecasting of future activities.

Perhaps all of the above points boil down to the first: insufficient attention to inflation processes. Uneven consumption of inventories can lead to the write-off at a much lower price of property that originally cost many times more. The result is inflated indicators that confuse management when drawing up a further development plan.

To avoid negative consequences, first of all, do not forget about the features of the method when analyzing the results of financial activities and planning the further development of the enterprise. Before using the FIFO method, it is advisable to carefully consider its need for an organization's accounting.

Analytical value of reserve valuation methods

What should we show in the financial statements when applying inventory valuation methods?

So, we have determined the nature of the influence of the choice of one or another method of inventory valuation on the content of financial statements. We now need to talk about how this impact relates to the overall objective of reporting - to present a true picture of a company's financial position that is as close to reality as possible. In this case, reality should be understood as the impact on the company’s state of affairs of changes in the acquisition prices of its inventories.

Let's see what this impact is. So, we have at least four elements (indicators) of financial statements, the assessment of which should reflect, among other things, changes in “incoming” inventory prices - these are:

1) the balance of inventories at the end of the period, reflected as part of current assets in the balance sheet,

2) expenses of the period in the income statement,

3) the financial result of the period in the income statement and, as a consequence,

4) the amount of retained earnings (uncovered loss) in the liabilities side of the balance sheet, if any.

Current assets are resources that should bring us income in the future, including those considered as security for the organization’s existing obligations.

First of all, if we talk about analytical ratios calculated on the balance sheet, the assessment of current assets determines the value of the total liquidity ratio (or total solvency), determined by the ratio of the values of current assets and short-term liabilities. The reality of the assessment of current assets in this case is ensured by its maximum compliance with the current price level. Hence, the most realistic assessment of current assets on the balance sheet should be as close as possible to the “last” purchase prices.

Profit is a measure of the growth of a company's capital, an increase in capital that is not associated with an increase in its liabilities. Demonstration in the reporting of the growth of a company’s capital indicates either the possibility of expanding the scope of its activities in comparison with the “starting point”, or the possibility of withdrawing from the organization’s circulation part of the funds “earned” by it without prejudice to its financial position, which it had at the beginning of the period, for which profit was calculated in accounting. A change in purchase prices for inventories means that in the next reporting period, subject to the continuation of the activities of our company, we will need funds to purchase these inventories in an amount close to the “last” prices for their purchase in the past period.

Consequently, the most realistic values of expenses and financial results will also be given to us by using in the calculations the “last” prices in the chronology of inventory purchases.

Now let's pay attention to what the use of each of the considered valuation methods allows us to show (here we will deliberately consider the LIFO method in connection with the possibility of its use in management accounting).

The method for calculating the cost of each unit of inventory, in our opinion, does not require special comments. In this case, we separately keep records of the acquisition and sale of each item of inventory, and receive the corresponding reporting data. Let's move on to the average price method.

Average price method

The use of the average price method actually allows us to smooth out the impact of changes in inventory purchase prices on reporting indicators. We calculate the average purchase price of inventory for the period (taking into account the estimate of the opening balance) to estimate the ending inventory as an asset on the balance sheet; costs of the period are assessed at average prices as the cost of inventories written off the balance sheet and reflected in the income statement; “average” results in profit accordingly.

Hence, by applying the average price method and thereby blurring the influence of their dynamics on reporting indicators, we actually demonstrate to users the absence of a significant influence of price dynamics on the financial position of the company. To what extent and in what cases is this fair? Obviously, we must show the absence of the influence of price changes in cases where there really is no such effect (significantly). In other words, the use of the average price method is suitable for situations where the accountant’s professional judgment allows him to assess the impact of changes in the purchase prices of current assets on reporting indicators as insignificant or insignificant.

For example, prices during the period could change frequently, but by insignificant amounts, and the selling prices of inventories also changed accordingly. Hence, the influence of such dynamics can be considered insignificant, which allows us to demonstrate the average price method.

FIFO method

The FIFO method, as you remember, in conditions of rising prices shows the maximum estimate of inventories and profits, and in conditions of declining prices for the acquisition of inventories - the minimum estimate of these indicators. The correspondence of the valuation of inventories in the balance sheet at the end of the reporting period with their “last” prices using the FIFO method brings their valuation as close as possible to the immediate state of affairs. And the larger the share of the “latest” prices in the calculation of the estimate of the remaining inventory, the more realistic it will be in this sense.

Thus, from the point of view of assessing current assets and calculating the solvency indicators of an organization, the FIFO method is the best assessment option. However, the choice of the FIFO method does not have such a positive impact on the assessment of the financial result. Inventories are written off using the FIFO method in the order of acquisition, that is, at “first” prices. This actually overstates the financial result compared to the inventory acquisition price level at the reporting date. The amount of profit, therefore, demonstrates the exaggerated capabilities of the owners to withdraw funds from the company’s turnover and/or expand business volumes. The company looks exaggeratedly profitable.

LIFO method

Using the LIFO method leads us to the opposite situation. The assessment of the balance of inventory at the end of the period in the balance sheet is based in this case on the “first” prices. At the same time, the specificity of the LIFO method is that if there is a balance, the “first” prices can serve as the basis for valuation for as long as desired, and after some time the valuation of inventories on the balance sheet completely loses touch with reality. Hence, when applying the LIFO method, the assessment of current assets distorts reality, and first of all this concerns the indicator of current solvency (liquidity), which, in conditions of rising prices, becomes underestimated, the more significant the share of the remaining inventory in the total volume of current assets of the company.

At the same time, the financial result, as a consequence of an adequate assessment of current expenses, on the contrary, receives an assessment that is most adequate to the real state of affairs. The amount of reported profit takes into account the rise in prices for renewable resources, which determines the volume of free cash outflow required in the future. Hence, profit as a “signal” for the distribution of funds more realistically shows the possibilities of owners for such withdrawal of funds from the company and/or their reinvestment.