Form TORG-12 contains all the required details specified in Art. 9 of the Federal Law of December 6, 2011 No. 402-FZ. You can start filling out TORG-12 by assigning a serial number and date. to fill it out correctly!

A consignment note is a type of primary document used to formalize the shipment of material assets.

If the goods are sold with VAT, an invoice is attached to the invoice.

Companies are allowed to develop their own forms of primary documentation. In practice, TORG-12 is rarely replaced by another document, since the unified form is very convenient to use.

General rules for drawing up

The rules for filling out TORG-12 in 2021 are regulated by regulations:

- Resolution of the State Statistics Committee of the Russian Federation No. 132 of December 25, 1998;

- Letter of the Federal Tax Service of Russia No. ED-4-15/ dated November 25, 2014.

The document is generated in two copies, one of which the supplier keeps and the other transfers to the customer. Based on the received TORG-12, the buyer’s accounting department comes and, if necessary, writes off the received inventory items. The filling date must strictly coincide with the delivery date, and a contract (agreement) must be indicated as the basis for the sale of inventory items. All signatures must be decrypted, and the entered data must correspond to the invoice. Some suppliers have automated the process of drawing up primary documentation and prefer to fill out TORG-12 online; this can be done on many accounting services.

IMPORTANT!

Before signing the invoice, the accounting department needs to check it. An accountant can accept a document for accounting only if it is drawn up correctly.

Evasion of the buyer from registration of the fact of acceptance

In practice, cases often arise when, after receiving the goods, the buyer avoids registering the fact of acceptance. What should I do if the buyer does not sign the invoice? In this case, the supplier has the right to demand registration of the fact of acceptance in court .

In court it will be necessary to prove that the goods are in the possession of the buyer or the consignee specified by him. The following may be brought in as evidence:

- transport and postal documents confirming delivery of goods to the address specified by the buyer;

- transport and postal documents confirming the sending of waybills to the consignee and the requirement to return the documents with his signature;

- reconciliation reports;

- correspondence with the buyer and the consignee indicated by him, including claims regarding evasion of signing the consignment note.

If the consignee refuses to sign the invoice, a note to this effect is made in it . An invoice signed by one party can be declared invalid by the court only if the reasons for the refusal of the second party are considered justified by it. If the consignee unreasonably refuses to formalize acceptance of the goods and pay for it, the court will oblige him to do so.

A completely different situation arises if the refusal to accept the goods occurs for objective reasons. Then the recipient must draw up an act of refusal to accept the goods and send it to the supplier along with the received goods and received documents.

Drawing up an act of refusal

Refusal to accept goods can only be made by a commission, the composition of which is approved by the consignee organization. The number of members of the commission is at least three people.

The act contains the following mandatory details:

- document's name;

- Date of preparation;

- place of compilation;

- information about the composition of the commission indicating positions, surnames and initials;

- an indication of identified inconsistencies with the technical specifications or supply contract, as well as the quality requirements established by regulatory legal acts;

- decision of the commission to refuse to accept the goods (indicating the invoice on the basis of which the goods were received) and to return them to the supplier;

- signatures of the commission members.

Both parties are interested in the correct execution of accounting documents confirming the transfer of goods. This will help them avoid unnecessary labor costs not only in relationships with each other, but also with regulatory authorities, as well as in court.

If you find an error, please select a piece of text and press Ctrl+Enter.

Didn't find the answer to your question? Find out how to solve exactly your problem - call right now:

Features of filling out a paper invoice

The delivery note can be filled out both in paper and electronic form. If an organization draws up an invoice for goods in paper format, it is not required to use the TORG-12 form. You can use your own developed register. The form can include the required number of columns in accordance with the needs and industry specifics of the enterprise. The decision in what form the primary documentation reflecting the supply of goods will be generated is made by the manager. After developing and approving an independent form, it must be fixed in the accounting policies of the organization.

Include the required details in your own delivery note form:

- number and date of formation;

- name of the consignee and his details;

- name of the shipper and his details;

- a document on the basis of which goods are shipped - a contract, invoice, invoice, etc.;

- a table containing a list of supplied goods, unit of measurement and price characteristics;

- space for signatures of responsible persons indicating their positions;

- space for imprints of seals of the parties if they are used by organizations.

Order to an authorized person

An order can only be issued in relation to employees who have signed an employment contract. It can be compiled in any form if the sample is not approved by local regulations.

Such an order must contain instructions on the employee who is given the right to sign documents, and what documents he receives the right to sign. The list of documents can be detailed or their main features can be indicated, for example, primary accounting documents.

Signing the invoice only on the basis of an order is not allowed, in which case it is considered invalid.

Filling out the paper waybill TORG-12

If the supplier uses the unified form TORG-12 from the album of unified forms of primary accounting documentation for recording trade operations, it is necessary to comply with the rules for register design. The TORG-12 invoice can be generated both in paper and electronic form, but for an electronic form you will need an electronic digital signature. The unified document is drawn up in two copies, one for each of the parties. It must be formed directly during the delivery of the goods - either at the time of delivery or immediately after its completion.

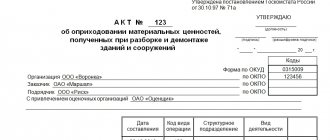

Step 1. Fill out the introductory part.

Data is entered on the name, address and bank details of the following organizations:

- sending organization and its structural unit (if necessary);

- consignee;

- provider;

- payer.

Step 2. It is mandatory to indicate the basis on which the supply is made - an agreement or a government contract. The basis may be an account.

Step 3. It is necessary to reflect the codes in a specially designated table on the right.

They prescribe both the encoding according to the OKUD form (0310001), and the enterprise indices according to OKPO and OKDP, and indicate the number of the consignment note, if available.

Step 4. Enter the current document number and date.

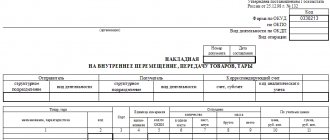

Step 5. Fill out the tabular part of TORG-12.

| Line number | Column name | Description |

| 1 | Number in order | Items shipped are listed in order |

| 2 | Name, characteristics, grade, article goods | Name of the supplied goods with their accounting characteristics |

| 3 | Product code | Product coding (if data is available) |

| 4 | Unit name | The unit of measurement is indicated |

| 5 | Unit code | Here is the coding of the unit of measurement according to OKEI |

| 6 | Type of packaging | The shape of the product packaging is noted |

| 7 | Quantity in one place | Quantitative parameters of shipped goods or batches |

| 8 | Number of seats, pieces | |

| 9 | Gross weight | |

| 10 | Quantity (net weight) | |

| 11 | Price | The cost of one unit is indicated in rubles |

| 12 | Amount excluding VAT, rub. cop. | The amount is calculated as the product of the number of products and price |

| 13 | VAT rate | The current tax rate for organizations that pay VAT. If the company does not pay tax, then it is indicated “without VAT” |

| 14 | VAT amount | Tax amount for each item |

| 15 | Amount including VAT | The total value is noted here - product cost + estimated VAT indicator |

Step 6. The bottom line displays the final quantitative and cost indicators for the invoice. If an organization does not pay value added tax, then zero values are entered in the columns.

Step 7: Add applications to the register.

These lines are filled in in cases where additional or accompanying documentation is provided along with the shipped products - passports, certificates, etc. The total number of application sheets must be specified. If there are no attachments for delivery, then a dash is placed in the line.

The situation is similar with the sections “Total places”, “Cargo weight”. They are filled in if necessary; in general cases, the specialist puts dashes. The “Dispensed” section indicates the total amount that the customer must transfer to the supplier.

What is it for?

When looking at examples of completed TORG-12 invoices with mandatory fields to fill out, you should remember that this document is actively used by two parties: the selling and the buying. With its help, the seller controls the shipment of goods from the warehouse, and the buyer issues acceptance. According to this type of technical specification, the supplier writes off product items. The document is usually drawn up by an accountant, storekeeper or other person authorized to carry out such transactions. The consignee, in turn, records the receipt of the cargo according to this form.

Representatives of regulatory authorities are often interested not only in the paper itself, but also in the additions that come with it: product certificates, passports, and various certificates.

Filling out an electronic delivery note

For this purpose, there are services and programs for generating an electronic invoice. The rules for compiling electronic primary documentation are similar to the rules applied for paper forms. The document is filled out in two files and signed with an electronic digital signature.

To generate an electronic document, the user goes to the service website and enters all the information about the upcoming delivery of goods to the cells. When all lines are completed, the register is saved, signed with an electronic digital signature and sent to the customer. If necessary, the form can be printed.

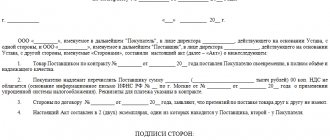

How to sign an invoice

The completed TORG-12 must be signed by all authorized persons on the part of the supplier and the customer.

There are situations when the buyer’s representative independently picks up the cargo by proxy. In such cases, in the “Cargo accepted” column, information about the person who picks up the products and the details of the basis - the power of attorney - are entered. The column “Cargo received” is signed by the employee responsible for placing the products in the warehouse.

If the delivery note is drawn up and sent to the customer electronically, then both parties must sign it with a digital signature. Electronic TORG-12 is generated in one copy, but the document contains two files. One is created from the buyer's side, the other from the supplier's side.

The electronic invoice can be sent to the territorial Federal Tax Service in XML format via telecommunication channels. This document is signed by the manager, chief accountant and other responsible persons.

Five signatures are placed under the invoice, which is drawn up in paper form:

- In the column “Cargo received” the authorized person of the customer puts his signature. The right to sign is enshrined in the organization’s charter or is formalized by a special order or power of attorney.

- The section “Cargo accepted” is signed by the financially responsible person of the customer. This line can also be signed by the employee who directly accepts the goods. If the party is accepted by the director, then the power of attorney is not issued. Any other employee can act only on the basis of a power of attorney.

- Three signatures are placed on the supplier’s side: the manager, the accountant and the employee responsible for the shipment of inventory items. You can issue an order that will secure the right of a specific employee to sign from the supplier in all three sections.

Stamps are affixed by both parties only if they are used in institutions.

IMPORTANT!

A seal is not a mandatory requisite in the documentation, but it is better to put it in TORG-12, since the form itself provides space for a seal imprint. When checking, the Federal Tax Service may find fault with the procedure for filling out the document if it is missing.

If the customer’s representative received the products under the manager’s power of attorney, which was certified by a seal, you can attach the power of attorney form to the delivery note as accompanying documentation and store these registers together. This will be enough for the inspection inspector.

Doverus.ru

Attention

A power of attorney for the right to sign invoices is issued in cases where the responsible person delegates his powers to another person in order to certify the invoices in his absence. The document is a type of power of attorney for the right to sign documents, which must indicate that the documents that the authorized person has the right to sign are invoices.

A power of attorney for the right to sign invoices is issued by a legal entity or individual entrepreneur. The role of a trustee can be either an individual or a legal entity.

How to make corrections

It is not recommended to correct the invoice, like any other primary accounting document. But if errors are found in the register, corrections are made to both copies - both in the supplier’s documentation and in the form transferred to the customer.

Erroneous information is crossed out, corrections are certified by the signatures of authorized persons of both parties. Below is the date the corrections were made.

If an error is detected in the electronic register, the organization corrects the violation and sends a new invoice to the customer. There are no strict rules for making corrections in the electronic form.

Shelf life of the consignment note

The beginning of the storage period for primary documentation on the delivery of goods is the beginning of the year following the reporting period, that is, the year of delivery.

Article 17 402-FZ “On Accounting” states that the storage period for primary documentation is 5 years.

IMPORTANT!

TORG-12 must be stored in the organization for five years.

The exception is when the delivery note confirms the amount of the loss, which is carried forward to future periods. For such situations, the storage period for primary documents increases (Article 283 of the Tax Code of the Russian Federation).

Acceptance of goods according to TORG-12

If the document is drawn up in paper form, then the verification is carried out as follows: the employee responsible in the organization for the acceptance and storage of goods and materials, checks the delivered products with the data specified in the invoice and, if all items comply with the terms of delivery, puts his signature in the column “Cargo received " Then he submits the paper for verification to the accounting department.

If the customer organization receives the goods according to a document drawn up by the supplier in electronic form, then the acceptance procedure looks like this:

- The supplier creates an invoice, signs it with his electronic signature and sends it online to the customer’s accounting department.

- The customer receives an electronic version of the unified form TORG-12.

- Prints out the document, checks that it is filled out correctly and hands it over to the person in charge to check the goods against the invoice.

- The financially responsible person checks the data of the receipt documentation with the delivered products and signs the document.

IMPORTANT!

If the delivery note is drawn up in a form that does not comply with the terms of the contract, then it is invalid and does not confirm the transfer of goods and materials to the buyer.

Accounting and legal services

Company GARANT

Particular attention should be paid to the fact that this is primarily a document of civil circulation, therefore more flexible requirements for the preparation of primary accounting documents do not apply to powers of attorney. Sample power of attorney for the right to sign invoices Limited Liability Company "IKS" 129344, Moscow, st.

Verkhoyanskaya, 18 Tel. OKPO 02376423, OGRN 1077712345678, December twenty-ninth two thousand seventeen Validity period: until December 31, 2021 inclusive. The power of attorney was issued without the right of substitution. Signature of E. S. Larionova —————- I certify. General Director ———— A. A.

“The cargo was accepted without recalculation or quality check.” Attention: it is “accepted”, and the consignee received the cargo - this is the storekeeper in the warehouse (at the place of its permanent location). This signature not only indicates that the cargo has arrived at the place (final point), the signature in this place “The cargo was received by the consignee” indicates that there are no comments on the cargo, either in terms of quantity or quality.

It is here that if there are comments on the goods (if you did not sign in the place “The cargo was received by the consignee”) all possible acts arise (misgrading, shortage, defects, damage, etc.). It is when signing “The cargo was received by the consignee” that the STOREMAN does not just sign, but indicates that there is an act.

In addition, the consignee is repeated twice in the consignment note; moreover, the place where the consignee receives the cargo is indicated exactly (at the top of the consignment note). Conclusion: The cargo was accepted by: any person outside the location of the CONSIGNEE'S warehouse (even self-pickup, a power of attorney, or simply if you gave it on the street) The cargo was received by the consignee: the financially responsible person of the CONSIGNEE at the location of the CONSIGNEE, which is indicated in the header of the invoice.

Regarding the mark: any stamp with a decoding of the position, surname and initial. If in doubt, request a written, registered request with a notification that they provide a copy of the order approving the register of seals of the enterprise.

And remember: everything that is not directly stated in the law is interpreted in favor of the taxpayer.

And the judicial practice in favor of the taxpayer is simply immeasurable, incl. YOU

What to check when receiving the goods

Before signing at the time of receipt of the cargo, the document must be carefully checked and attention to a number of important nuances that arise when filling out:

- If goods and materials are accepted by power of attorney, then the person who accepted the goods puts his signature with a transcript, as well as the date and number of the power of attorney, which must be attached to the invoice. In such cases, no stamp is placed.

- If the financially responsible person of the organization acting as the customer receives the products independently, then a signature, transcript and seal are placed in the lower right corner.

- If both organizations do not officially use a seal, then the document can be issued without a stamp.

IMPORTANT!

If there are no signatures in TORG-12, full name. signatories and a seal impression, then it is considered invalid and does not prove the fact of transfer of the goods to the customer.

Signatures for auction12

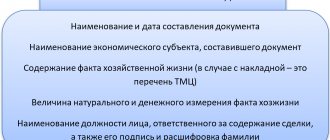

Required details include:

- name of the organization that draws up the document;

- document's name;

- a number that corresponds to the date of compilation;

- name of the business transaction;

- in what units of measurement the implementation takes place;

- the names of the positions of the persons who perform the sales action;

- signatures of persons responsible for the implementation process.

This document is unified, which means there are special requirements for its completion. If it is filled out incorrectly, with errors, then the right to justify the write-off of inventory items is lost. Also, it cannot be used as a justification for expenses in tax accounting. The very top section of the form contains information about the organization that ships the goods.

How to return a product

Return of delivered products is permitted only when the return procedure is carried out in accordance with current legislation and is strictly specified in the contract or agreement.

The Civil Code of the Russian Federation establishes the customer’s right to return goods to the supplier if it is discovered that they do not comply with the requirements of the contract (including procurement documentation), quality characteristics, as well as the declared assortment, configuration and packaging (clause 2 of article 475, clause 3 Article 468, paragraph 2 Article 480, paragraph 3 Article 482 of the Civil Code of the Russian Federation).

In civil legislation there is no direct prohibition on the return of goods supplied and accepted of proper quality. Products may be returned in parts or in full, even when the customer has transferred funds to the supplier. In a government contract, agreement or additional agreement, you can indicate the following reasons for the return of supplied products:

- the need to update the assortment;

- expired;

- delayed payment;

- impossibility of selling or realizing the supplied inventory items;

- detection of discrepancies between the quality characteristics of the product and the goals, requests and needs of the customer, etc.

After delivery of a consignment, the customer must check the complete set, quantity, quality and packaging during or after acceptance of inventory items; this requirement is specified in clause 2 of Art. 513, paragraph 2 of Art. 474 Civil Code of the Russian Federation.

If, during acceptance, the responsible employee of the customer discovered shortcomings and discrepancies with the procurement documentation and the terms of the contract, then before the inventory items are registered, the parties can draw up an act that will reflect all discrepancies in the quantitative and qualitative characteristics of the delivered products. This act is drawn up in the unified form TORG-2 or in free form.

When discrepancies are discovered after inventory items have been capitalized and registered or accepted for temporary storage, the parties must formalize the return with shipping documentation - a delivery note according to the unified form TORG-12 for return.