Astral

February 1, 2021 5631

EGAIS

Any delivery of goods is accompanied by a consignment note. Upon receipt of the goods, you must check the goods that arrived to you with those indicated in the invoice. If everything is correct, information is sent to EGAIS that the invoices from the supplier have been accepted. If the invoice indicates the wrong product that you received, then a discrepancy report will be sent to EGAIS.

TTN must be confirmed in EGAIS within three days from the date of delivery if the supplier’s warehouse is located within your city. If the warehouse is located in the region, then confirmation of the invoice should take no more than seven days.

Confirmation of the TTN takes place in your personal EGAIS account using the connection of your accounting program and UTM with the system.

- Before confirming the TTN, recalculate the quantity of the products that were delivered to you. Compare it with the nomenclature and electronic invoice from the supplier in EGAIS.

- If the quantity of goods actually received matches the electronic invoice, a report is sent to EGAIS that the invoice has been accepted - this is confirmation of the TTN in EGAIS. After this, the system debits the amount and quantity of delivery from the supplier’s account and credits it to your account.

There are situations when the wrong product may be delivered that you ordered, or glass containers may be damaged during transportation. In this case, a certificate of refusal to accept the invoice is submitted to EGAIS, and the goods are returned to the supplier.

- If there is a significant discrepancy between the data in the invoice and the actual products delivered

- The supplier did not deliver the goods: regardless of whether you were warned about this or not, you can still refuse

- The delivered goods do not meet the quality: expired, damaged packaging, missing excise stamps, etc.

How does the TTN load into EGAIS?

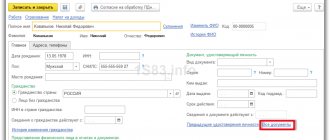

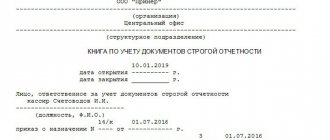

The corresponding document is drawn up in a special accounting program. An information system is also used to record all data. To process the invoice after scanning the stamps in EGAIS, you need to issue a TTN manually or perform the operation using the special tab “Exchange UTM with EGAIS”. After uploading a document, it must acquire the appropriate status, for example, “Accepted for processing,” “Confirmed,” or “Rejected.” If EGAIS does not receive invoices, you need to edit the document in accordance with the methodological recommendations and then try to upload the document again.

What services can we offer you:

We also provide services for the preparation and submission of declarations to Rosalkogolregulirovanie, we can help you submit a declaration to the FSRAR. We help you connect to EGAIS on a turnkey basis. We are engaged in servicing individual entrepreneurs in the EGAIS system, we confirm the TTN and make write-offs in the EGAIS, call us!

| Electronic signature for EGAIS | Beer Declaration | Subscriber service EGAIS fixation of purchases for individual entrepreneurs |

| 2000 rub. | from 1000 rub. | 1600 rub./month. |

Features and timing of confirmation of invoices in EGAIS

Recording of relevant information is usually carried out through your personal account on the egais web portal. Before uploading a document, it is necessary to check the invoices in the Unified State Automated Information System using the TTN. To do this, the manufacturer will need to perform the following steps:

- Calculate the available number of APs and compare them with nomenclature information.

- Compare the information on the consignment note provided in paper form with the data in the electronic system.

Wholesale and retail companies, at the time of receiving the goods, must check the invoices in the Unified State Automated Information System, checking all the data. If everything agrees, a corresponding act is drawn up. Then, automatically, the quantity and amount of the AP supply is debited from the account of the production association and transferred to the account of the wholesale and retail company.

If there are discrepancies in the data, you must ask the manufacturer to make the appropriate adjustments and re-send the invoice to EGAIS using your personal account. In addition, you will also have to send a discrepancy report to the production company. In the event that the production association refuses to accept the discrepancy report, your store will need to return the AP to the production association.

Based on the current legal norms and approved standards of the law regulator, the period for confirming the delivery note in the Unified State Automated Information System is 3 days after the official delivery date. This applies to all those production associations that are located in the city or near it. When the warehouse of a production association is located in a rural area, 7 days are allocated to confirm the document. If, after checking the status of the invoices, any difficulties arise, you will need to contact technical support on the official egais website.

Important! Data uploaded to the unified state information platform cannot be changed. If errors are subsequently identified during registration, it is necessary to post the invoice in EGAIS, that is, reject the document.

How does the receiving company accept the invoice?

- Acceptance of goods. On the unified information portal, select the corresponding “Acceptance” tab.

- Excise scanning. During the period of receiving the AP, a representative of the wholesale and retail company scans each excise stamp from the bottle.

If the number of bottles of alcoholic beverages matches the invoice, you will need to select the “Accept” button. In case of refusal, a discrepancy report is automatically generated.

Who should confirm invoices and what is needed for this?

In accordance with current practice, the invoice in Unified State Automated Information System is usually accepted by the recipient of alcohol-containing products. He will need to upload the document and check the electronic information with the submitted papers and the number of APs. If there are no discrepancies, you need to confirm the invoice document in the Unified State Automated Information System, and if there are discrepancies, issue a statement of disagreement.

The manufacturer or supplier company has the right to provide the relevant document within 3 days. Therefore, usually the document is confirmed within a few days; of course, the reconciliation time also needs to be taken into account here, since the recipient also needs to check everything.

What to do if your actual data differs from the electronic invoice?

Sometimes it may happen that a supplier will provide some products more than you ordered, and another - less. You must send the supplier a statement of discrepancies with the actual data on the delivered products. If the supplier refuses to confirm the act, you must return the goods to him. If the discrepancy report is confirmed by the supplier, you transfer it to EGAIS. Then the products confirmed in the discrepancy report are written off from the supplier’s account, and they are credited to your account.

Where and how to view invoices in EGAIS?

Heads of production associations or their authorized representatives can do this by going to the official egais website. You can check the status of the invoice through your EGAIS personal account. In this case, you will need to enter the following information:

- Identification number of the sending holding company.

- ID of the recipient company.

- Corresponding invoice number.

It should be noted that if a manufacturing enterprise does not know the number, it can obtain the data by contacting the official fsrar resource. As soon as you find the invoice in EGAIS by the corresponding number, you will be able to see the answer in the status. The answers may be as follows:

- "Accepted". In this case, you can be sure that all data is entered correctly. All you have to do is wait for a response from the recipient company.

- “Waiting for a response from EGAIS.” In this case, you should immediately write to technical support indicating the store identification number and TTN.

- "Refusal". This means that some of the data was entered incorrectly.

At the moment, in addition to the official service, there are special applications through which you can track the status of a document, which greatly simplifies many processes. When using third-party resources, you must be sure that the information will not become available to unauthorized persons. Therefore, it is imperative to read reviews about a specific application.

If the TTN is successfully registered, the sending company receives a registration receipt; in case of refusal, a receipt of refusal is received. After confirming the data, the TTN is redirected to the sender. In some cases, it happens that invoice documentation is lost. In most cases, this happens due to a failure in the 1C platform or due to the reinstallation of UTM. To solve the problem, you can contact fsrar support directly. When applying, you will definitely need to provide your identification information.

In some cases, situations arise when it is necessary to re-send the received TTN. The presented function is provided only for the recipient company. The manufacturer, unfortunately, cannot send its own documentation through the web resource a second time. In this case, you will need to select the “Resend” tab on the official web portal. If you have any difficulties, contact technical support, where they will tell you how to re-request an invoice in EGAIS.

Checking information from EGAIS document flow

The virtual platform check1.fsrar.ru is designed to search for invoices and acts in UTM.

In order to find out where the invoice or act is located in the document flow system, you only need to know the identification number of the transport package, which was assigned before sending.

The search can also be carried out using the invoice identifier. Thus, you can obtain information about the date and time the document entered the recipient’s UTM, as well as clarify its status in the EGAIS system.

In addition, you can find the invoices of interest sent from the EGAIS-manufacturer.

How to find an invoice

To find a TTN in the fsrar system, you need to know its WBRegId (identifier). Obtaining information about a document is carried out in the “Search by invoice identifier” tab. You must fill in the required fields of the form: enter the WBRegId of the invoice, indicate the fsrarid of the sender or recipient and enter the security code from the image. When finished, click the “Request” button.

Based on the results of an automatic check of the entire database, the requested consignment note will appear with all the information on it and related documents.

Checking the TTN in EGAIS - the manufacturer will allow you to find information about invoices sent through the system only starting from 02/15/2016. Documents that were sent before this date cannot be obtained from the system.

To search by transport package identification number, you must first find out what number is assigned to the TTN sent to EGAIS by the manufacturer. It must be requested directly from the accountant of the relevant company.

After the information is received, you can find the invoice yourself through the system. To do this, you will need the “Search for an invoice from EGAIS - manufacturer” tab. A form will appear where you need to fill in the required fields: indicate the registration number of the TTN and fsrarid of the recipient.

After entering all the data, you need to click on “Request” with your computer mouse and wait for the system to respond.

To obtain information from check1 by searching by transport package identification number, you need to know some data - package id from the Transport database. If the file is outgoing, you need to look among the UTM log files. If incoming, request the number from the counterparty.

After the id is received, you need to go to the page https://check1.fsrar.ru/. The search will be carried out in the “Search by transport package identifier” tab. You will need to fill in the required fields in the same way as in the previous cases. The sender's idfsrar must be the company identification number in the PAP system.

After filling out the data, you need to enter the number from the picture and click “Request”.

After a while, the search results will appear on the screen. The report will contain information about when the TTN was sent to UTM. And further to EGAIS. You can also find out when and what documents were sent in response to the TTN from EGAIS

No invoices found. What to do?

It may happen that the TTN disappeared from the UTM system or was not received from it. This happens due to 1C failures and when reinstalling UTM. To solve these problems, you can try to check the location of the invoice, request that it be resent from the system, or contact FSRAR.

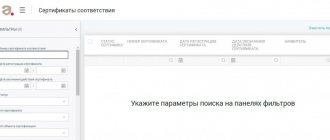

To use any of the options, you need to know your idfsrar. This is the 12-digit number that is located on the envelope of the JaCarta kit. In addition, it can also be taken from the JaCarta Single Client program. This information is contained in the PKI section. Another place where the required identification number is located is the UTM system itself. You need to go to the “Certificates” section.

The invoice number, which you also need to know, can be requested from the supplier. In addition, it may be in the email received from FSRAR.

Having found out these basic data, you can proceed to receiving invoices that have not arrived. Their repeated request is carried out through the “Personal Account” on the EGAIS website - https://service.egais.ru/checksystem/check.

After passing the verification, entering the PIN code and selecting a certificate, you need to select the “Resending invoices” section.

A form will appear on the screen, you need to fill out all its fields, check the accuracy of the data and click on the “Submit” button.

To find out the location of the invoice, you must follow the steps listed in the instructions in the previous section.

If the problem cannot be solved and you need to contact FSRAR, you should use the “Contacts” section on the EGAIS or FSRAR website.

There are several opportunities for feedback: fill out the feedback form and send it, write an email, call the support line.

Responsibility for violation of terms of confirmation of TTN

All alcohol market entities are required to keep records and promptly enter information required by law. If this is not done, supervisory units may issue orders and then impose penalties. In addition to the enterprise, a fine may also be imposed on the general director of the production association. Both the supplier company and the recipient organization can be held administratively liable for the lack of an invoice in the Unified State Automated Information System. In this case, all unaccounted products may be confiscated by supervisory authorities. Therefore, a market participant must always monitor the status of the invoice to avoid negative legal consequences.