Delay of wages violates the employee’s rights to timely payment of wages.

In case of untimely payment of wages to employees, the employer is liable according to the provisions of Art. 236 of the Labor Code. This article obliges the employer to pay compensation to the employee for delayed wages. Dear readers! To solve your specific problem, call the hotline or visit the website. It's free.

8 (800) 350-31-84

Compensation for delayed payment of wages under the Labor Code of the Russian Federation

In times of crisis, many Russian companies, often small businesses, are increasingly delaying wages (hereinafter referred to as wages) to their employees.

In most cases, this is not the fault of the company: each of them is a link in a dependent chain of counterparties. Consequently, as soon as payment interruptions (payment under contracts from customers/purchasers are not received on time) occur in one link, this automatically affects all subsequent ones. As a result, this may lead to the fact that employees of one, or perhaps several levels, will not receive salaries on time. If this happens and the employees do not receive the wages due to them on time, then the employing company will subsequently be obliged to pay the employees not only their wages, but also compensation (which in its content represents interest on late payments). This is stated in Art. 236 Labor Code of the Russian Federation.

IMPORTANT! Failure to pay wages on time, among other things, gives the employee the right to temporarily suspend the performance of his labor functions, as well as apply for compensation for moral damage (Articles 142, 237 of the Labor Code of the Russian Federation).

Compensation for late payment of wages is accrued from the day following the established payment deadline until the day the employer repays the debt to employees, inclusive.

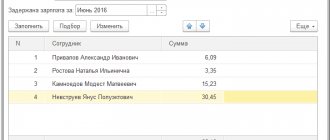

Example 1

If the salary, for example, was supposed to be paid on the 5th, but was actually paid on the 12th, then the compensation will be calculated for 7 days (from the 6th to the 12th inclusive).

If a delay did occur, the employing company will have to pay the employee appropriate compensation, regardless of whether it is directly to blame for the delay in the salary or not.

NOTE! Today, the situation is especially relevant when, due to the revocation of the license, the bank did not transfer the salary to the employees of the organization - the payroll client. This circumstance does not relieve the employer of the risk of falling under Art. 236 of the Labor Code of the Russian Federation, since the fact of guilt does not matter. Therefore, in order to minimize this risk, the company should more carefully select a bank for its salary project.

Moreover, if, for example, the bank is to blame for the delay (in particular, it did not fulfill the payment order of the client organization on time to transfer the salary to employees), then the company should remember that it has the right to make a recourse claim to the bank for the fact that it did not timely transferred the salary to the employees, which means he violated the terms of the salary project with the company. However, you will still need to pay workers' compensation first.

Criminal liability of the manager

The head of an organization may be held criminally liable provided that he was directly or indirectly interested in the delay in wages. It does not matter how many employees’ payments were delayed (one is enough). The deadlines for delaying wages, in case of violation of which the manager may be brought to criminal liability, are as follows:

- complete non-payment – over two months;

- payment of wages in an amount below the minimum wage (minimum wage) - more than two months;

- partial non-payment – over three months.

For a manager who has allowed partial non-payment of wages for more than three months, the following types of criminal liability are provided:

- a fine of up to 120,000 rubles. (or in the amount of salary or other income of the convicted person for a period of up to one year);

- deprivation of the right to hold certain positions or engage in certain activities for a period of up to one year;

- forced labor for up to two years;

- imprisonment for up to one year.

The head of an organization in which wages were not paid in full for two months or were paid in an amount below the minimum wage is subject to more stringent criminal liability measures. Namely:

- a fine in the amount of 100,000 to 500,000 rubles. (or in the amount of salary or other income of the convicted person for a period of up to three years);

- forced labor for a period of up to three years, while the court may additionally impose deprivation of the right to hold certain positions or engage in certain activities for a period of up to three years;

- imprisonment for a term of up to three years, while the court may additionally impose deprivation of the right to hold certain positions or engage in certain activities for a term of up to three years.

These types of liability are listed in parts 1 and 2 of Article 145.1 of the Criminal Code of the Russian Federation.

If the delay in wages entailed serious consequences, then the punishment will be even more severe (Part 3 of Article 145.1 of the Criminal Code of the Russian Federation).

Criminal liability can be avoided if the cause of the delay did not depend on the will of the manager.

Calculation of monetary compensation for delayed wages

The Labor Code of the Russian Federation does not establish in what specific amount the company must pay compensation to employees for delays in wages. The legislator gave organizations the right to independently determine this in a collective agreement.

At the same time, the lower limit of compensation has been determined - not less than 1/150 of the key rate for the period of delay in the salary, calculated for each day of delay:

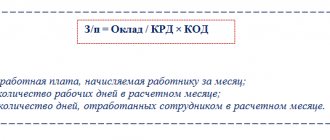

MRK = ZPnach × Kl.St. / 150 × Dpr,

where: MRK is the minimum that the employer is obliged to pay to the employee for a delay in salary;

ZPnach - the amount of wages that should have been paid to the employee on a strictly established day (minus personal income tax);

Class.St. — refinancing rate (key rate) of the Central Bank of the Russian Federation for the period of delay;

DPR - the number of days for which the employer was late in paying employees wages.

In the collective agreement, the company can only increase the amount of compensation for delay; the organization does not have the right to set it in a smaller amount than according to the above formula.

IMPORTANT! For information on the size of the key rate (refinancing rate), see here.

Example 2

Salary in the company is paid, according to the collective agreement, on the 5th (for the second half of the previous month) and the 20th (for the first half of the current month) of the month. The collective agreement does not contain special provisions regarding compensation for late wages.

For the first half of February, the employee was accrued salary in the amount of 30,000 rubles. However, it was actually paid only on March 6.

The refinancing rate in force during the period under review (conditionally) was 7.5%.

Under these conditions, the organization should pay the employee on March 6, in addition to the salary, also compensation for delay for 15 calendar days in the minimum amount:

MRC = 30,000 × (100% – 13%) × 7.5% / 150 × 15 = 195.75 (rub.)

However, it is not enough to simply correctly calculate the amount of compensation for late salary payments. It is also important for an organization to clearly know whether personal income tax should be withheld from such compensation, whether insurance premiums should be charged and paid for such an amount, and what to do with expenses for profit tax purposes.

Determining the period for missing payment deadlines

The period of delay is calculated on the basis of the dates approved by the enterprise within the framework of the requirements of labor legislation.

The timing of payments due to employees is established in any of the internal documents of the enterprise - a local act, a collective or labor agreement. There is no need to determine the dates of settlement with the employee simultaneously in all documents.

Deputy Director of the Ministry of Labor and Social Development A.V. Frolova (department letter dated September 23, 2016 No. 14-1/OOG-8532)

| Conditions for determining the period of delay | Explanations |

| Beginning of the period of delay | The period of delay is determined from the day following the due date of payment |

| End date of the period | The end of the period of delay is the day the actual payment is made in cash through the cash register or by transfer to the employee’s card account |

| Days included in the period of delay | The period takes into account all calendar days - both working days and weekends |

Material compensation for losses to an employee is also provided if the payment deadline is one day late. If the settlement date coincides with a holiday, payment is made on an earlier date.

An example of determining the day the delay begins. Enterprises have set the payday to be the 4th of each month. In the billing month, the date coincided with a Saturday, which is considered a non-working day in the organization. The employer paid the due amounts to the employees on Monday, the 6th, having been late. Payments to employees had to be made on the 3rd day of the month.

Personal income tax on compensation for late payment of wages

On the one hand, the Tax Code of the Russian Federation establishes that it is not necessary to pay personal income tax to the budget on compensation if it must be paid to an employee due, in particular, to the performance of labor functions in the company (clause 3 of Article 217 of the Tax Code of the Russian Federation).

On the other hand, the Labor Code of the Russian Federation limits the scope for establishing a specific amount of compensation to a minimum limit. The upper limit is not standardized. Consequently, the employer can set arbitrarily high compensation by fixing it in the collective agreement.

The question arises: will the amount of compensation be subject to personal income tax (both in terms of the minimum and in terms of exceeding the minimum under the Labor Code of the Russian Federation)?

Regarding the minimum amount of compensation, the answer is transparent: it will not be subject to personal income tax. This has been confirmed more than once by the regulatory authorities in their explanations (letters of the Federal Tax Service of the Russian Federation dated 06/04/2013 No. ED-4-3 / [email protected] , Ministry of Finance of the Russian Federation dated 02/28/2017 No. 03-04-05/11096, 01/23/2013 No. 03- 04-05/4-54, etc.).

In the case of exceeding the minimum allowable amount, controllers take a similar position: the amount of excess is not subject to personal income tax, but only if such excess is consistent with an employment or collective agreement (letter of the Ministry of Finance of the Russian Federation dated November 28, 2008 No. 03-04-05-01/450, dated 06.08 .2007 No. 03-04-05-01/261).

NOTE! If a company abuses this exemption and, under the guise of compensation, pays, for example, the salary itself to employees, then this is fraught with disputes with inspectors and additional personal income tax amounts being assessed during the inspection. In this case, the court will most likely side with the inspectors, since content has priority over form: regular payments of compensation in an amount significantly exceeding the amount of wages accrued to employees prove that wages were actually paid. This means that it is necessary to pay personal income tax (resolution of the Federal Antimonopoly Service of the Ural District dated November 30, 2012 No. F09-11655/12 in case No. A60-7589/2012).

Whether it is necessary to accrue personal income tax when paying other compensation payments, read the materials in the section “Compensation and personal income tax” .

Insurance premiums for payment of compensation for late wages

If a company pays personal income tax as a tax agent, that is, at the expense of an employee, then the burden of insurance premiums falls directly on the organization.

So, is interest on late payments subject to insurance premiums? There are two points of view on this issue.

One is that amounts of monetary compensation for violation by the employer of the established payment deadline are not subject to inclusion in the base for calculating insurance premiums. This conclusion was reached, for example, by the judges of the Arbitration Court of the Far Eastern District dated December 21, 2017 No. F03-4860/2017 in case No. A73-2697/2017 (the decision of the Supreme Court of the Russian Federation dated May 7, 2018 No. 303-KG18-4287 refused to transfer the case to the court Collegium for Economic Disputes).

The arbitrators motivated their decision by the fact that compensation for late payment of wages is not remuneration, but a type of financial liability of the employer to the employee, which is paid by force of law to an individual in connection with the performance of his labor duties, providing additional protection of the employee’s labor rights. For this reason, compensation for late payment of wages is not subject to insurance contributions on the basis of subclause. “and” clause 2, part 1, art. 9 of Law No. 212-FZ (since January 1, 2017, similar provisions are given in paragraph 2 of Article 422 of the Tax Code of the Russian Federation).

See also “Compensation for non-payment of wages on time: contributions”.

Another point of view is that the types of payments not subject to insurance premiums are listed in Art. 422 of the Tax Code of the Russian Federation. Compensation for late payment of wages in Art. 422 of the Tax Code of the Russian Federation is not given, therefore, contributions must be calculated from this payment. This position is adhered to by the Ministry of Finance of the Russian Federation in letter dated March 21, 2017 No. 03-15-06/16239.

As you can see, this issue is controversial. And it's up to you to decide.

Bankruptcy

Let’s say that due to insufficient funds, the employer has an outstanding debt for payments due to employees (wages, severance pay, etc.) for more than three months. In this case, the head of the debtor organization or the individual entrepreneur himself must apply to the arbitration court with an application for bankruptcy. This is provided for in paragraph 1 of Article 9 of the Law of October 26, 2002 No. 127-FZ.

In addition, employees (including former employees) can apply to the arbitration court to declare the employer bankrupt for debts on wages and other payments. This is stated in paragraph 1 of Article 7 of the Law of October 26, 2002 No. 127-FZ.

Employees have the right to hold a meeting. Deadline – no later than five working days before the date of the meeting of creditors. The organization and holding of the meeting of employees is entrusted to the arbitration manager. At the meeting, employees elect their representative who will protect their interests in the bankruptcy process of the employer. The procedure for holding a meeting is described in detail in Article 12.1 of the Law of October 26, 2002 No. 127-FZ.

Claims for payment of arrears of wages and other remuneration to employees (including former employees) are included in the register of creditors' claims by the insolvency administrator or the registrar upon the proposal of the insolvency administrator. If such claims are disputed, they are included in the register on the basis of a judicial act establishing the composition and amount of these claims (clause 6 of Article 16 of the Law of October 26, 2002 No. 127-FZ).

Accounting for compensation for late wages in income tax expenses

Regarding income tax, the situation is somewhat more complicated. The Tax Code of the Russian Federation does not contain any provisions regarding whether such compensation can be taken into account as expenses or not.

The code only says that a company can include in its expenses compensation, the payment of which to employees is related to any working conditions (Article 255 of the Tax Code of the Russian Federation).

In addition, paragraph 13 of Art. 265 of the Tax Code of the Russian Federation allows sanctions for violation of contracts to be taken into account in expenses. However, no restrictions or sanctions have been established. There are also no special conditions regarding whether this rule applies only to civil contracts or to employment contracts as well.

Therefore, on the one hand, it is possible to consider compensation for the delay of the PO as a sanction and take it into account as part of the expenses. Previously, the courts agreed with this logic (resolutions of the Federal Antimonopoly Service of the Volga District dated August 30, 2010 in case No. A55-35672/2009).

At the same time, later the regulatory authorities took the position that such compensation cannot be included in expenses, since it is not related to working conditions (Article 255 of the Tax Code of the Russian Federation does not apply), and the norms of Art. 265 of the Tax Code of the Russian Federation does not apply to this compensation (letter of the Ministry of Finance of the Russian Federation dated October 31, 2011 No. 03-03-06/2/164).

Therefore, today it is quite risky to take into account compensation for delays in salary payments in expenses.

How and where to contact

The interests of the working population are protected by law, so people whose wages have been delayed have several options to defend their rights. They can contact various government agencies, the prosecutor's office and judicial authorities, it all depends on the situation and the desire of the employee who was deceived in his financial expectations.

Commission for Enterprise Disputes

Large enterprises have dispute commissions. Their task is to quickly resolve conflicts between a manager and an employee due to failure to comply with the provisions of an employment contract or other document on the basis of which employees were hired.

It is necessary to draw up a written statement about the delay in wages, the commission accepts it for consideration and no later than 10 days after its registration, it is obliged to take action.

At most enterprises, commissions are represented by ordinary trade unions. They guard the interests of their employees; the commission includes ordinary workers without representatives of the administration.

This is proof that the funds were never received within the time limits established by law. The dispute is considered in the presence of the employee and the manager, who must be held accountable for failure to fulfill his obligations.

State Labor Inspectorate

A body such as the State Labor Inspectorate can consider complaints from enterprise employees within 30 days. Regardless of the decision made, after this period the inspector contacts the employee and explains further steps to him. A written order is sent to the organization, which sets out the requirements to pay wages and penalties.

It is important to fill out the application correctly; a sample is available on the Internet. The only inconvenience is the lack of privacy

In the application, the employee states the reason for his appeal, but management will become aware of this within thirty days.

Many are afraid of such actions, since unauthorized contact with government agencies will change the employer’s attitude towards them in a negative direction. The only way out is to use Article 358 of the Labor Code, which regulates the employee’s right to ask to remain incognito.

Court

You can file a claim in court, guided by the provisions of Article 131 of the Code of Civil Procedure. The trial can be lengthy, but almost always the verdict is in favor of the injured party.

The employee, independently or with the help of a lawyer, draws up a statement of claim, which displays the following information:

- full details of the position held;

- period of work at this enterprise;

- terms of payment, including established days for payment of the advance and balance;

- debt calculation (you can do this yourself);

- information confirming the employee’s attempt to obtain debt and compensation peacefully.

The period for consideration of the application in court is no more than 30 days. If the violations are found to be valid, a hearing date is set. The employee must attend it without fail.

Prosecutor's office

The prosecutor's office is an effective lever in the fight against negligent employers who, of their own free will, delay wages for a considerable period. If an employee does not see the money owed to him by law for two or more months, he has the right to count on the initiation of a criminal case.

It is imperative to indicate that the labor inspectorate did not take any measures to force the employer to pay the money earned.

At the same time, a lawsuit is filed in court, and an employee of the prosecutor's office represents the interests of the injured party personally. The case is under control until the head of the enterprise begins to pay the amount of wages, advance payments, as well as the compensation due.

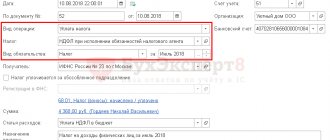

Procedure for paying compensation for delayed wages

The mechanism for documenting payment for delays in the Labor Code of the Russian Federation has not been established.

Therefore, a company can, for example, provide in a local regulatory legal act that when paying compensation, an order is issued from the manager (for personnel). It is compiled in any form. However, such an order should indicate that compensation is paid specifically for the delay in payment of the salary, and also indicate the period of delay.

NOTE! Such an order must be brought to the attention of the employee under his personal signature.

Question

I suspended work on July 30, 2015 and served a notice to the general. I have a salary debt to the director against signature as of July 30, 2015 in the amount of 141,000 thousand rubles, and to this day I am on the staff of the organization. Since November 2015, a bankruptcy procedure has been underway, the bankruptcy trustee still cannot calculate the amount to be paid for the entire period and all the compensation for the calculation and reduction (I received the notification in December). I have been working since 04/16/2013: 1st-1st vacation 12.05-25.05.2015 in the amount of 14 days, 2nd from 01 to 26.07.2015 in the amount of 26 days., 3rd from 18.05 to 16.07.2015 in the amount of 59 days and 5 days of vacation per non-standard day, and went to work on July 22. Now the question is how to correctly calculate and calculate the monthly amount of compensation (salary) and whether interest is charged on the amount of this compensation for the delay in payment. And how much compensation will be paid in case of redundancy? For the period from April 16, 2014 to April 15, 2015, the average is 2176.85.

Results

Calculating compensation for delayed wages is not a difficult task for an accountant, since the calculation formula is directly provided for in the Labor Code of the Russian Federation and does not require any complex data and calculations.

It is enough to know the size of the overdue salary, as well as the current refinancing rate. Employees should understand that they can count on such compensation in any case, even if the employer is not to blame for the delay. It is important for the company not to forget that personal income tax may not be charged on the amount of compensation, but insurance premiums will have to be paid. In relation to income tax, it will most likely not be possible to include compensation as expenses. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Employee rights

An employee has the right to stop working if the salary is delayed for more than 15 days. In this case, the amount of debt and the guilt of the organization (lack of guilt) in the delay do not matter (clause 57 of the resolution of the Plenum of the Supreme Court of the Russian Federation of March 17, 2004 No. 2). The maximum period of termination of work is until the debt is fully repaid. Before stopping work, employees are required to notify their supervisor in writing of their actions. After this, they have the right not to come to work at all (Part 3 of Article 142 of the Labor Code of the Russian Federation, Clause 57 of the Resolution of the Plenum of the Supreme Court of the Russian Federation of March 17, 2004 No. 2). In this case, employees are required to return to work only the next day after receiving written notification from the organization of their readiness to repay their arrears. At the same time, the organization must pay the delayed salary on the day they return to work.

Such conditions are provided for in Article 142 of the Labor Code of the Russian Federation. There is also a list of cases when stopping work due to delayed wages is prohibited.

During the period of suspension of work due to delays in salary, the employee is paid in the amount of average earnings. They also pay compensation for late payment.

These are the requirements of Part 4 of Article 142 and Article 236 of the Labor Code of the Russian Federation.