Where to buy an online cash register

It is very difficult for entrepreneurs to master new technology that carries out financial reporting via the Internet, since the payment system requires the presence of some nuances. One of them is the possibility of making an advance payment when paying for goods - the procedure for using cash register in this case will be carried out according to certain rules.

This situation is most often faced by sellers who carry out wholesale trade. They can receive an advance payment for any product or service. The prepayment mode implies partial payment of the advance, and the main difficulty for entrepreneurs is that a standard online receipt must display information about the name of the organization, the number of purchased product items, and must also contain detailed information about the price. All these parameters may not be known in advance when carrying out wholesale trade.

According to the new law No. 54 Federal Law, all calculated indicators must be recorded on a strict reporting form. When conducting business legally, it is necessary to take into account in detail the quantity and cost of commodity items. But in some cases, when making advance payments, the buyer does not always know the exact quantity of the required goods. Its purpose is only to pay an advance payment for a consignment of goods that will later be purchased. Therefore, entrepreneurs are faced with a serious problem of correctly formatting fiscal data on reporting forms.

Advance checks: changes to 54-FZ

The inscription “advance” in the fiscal document was conceived to formalize transactions in which the client pays for a product or service in advance and receives it a little later.

Thus, after July 2021, when receiving money in advance, a check must be issued at least twice:

- at the time of transfer of money (for each transfer of money, if there were several tranches);

- when issuing the goods (after full provision of the service).

In the first case - an example of a check for an advance, in the second - a check for offset of an advance.

However, 54-FZ presupposes several features of a calculation method with similar functions:

- prepaid expense;

- prepayment;

- prepayment 100%.

At the online checkout, 100% prepayment is indicated as “1”, prepayment – “2” and advance payment – “3”.

We will discuss the details in which cases it is necessary to write “advance payment” on the check, and in which cases it is necessary to write “prepayment” below.

What it is

In the most general terms, this is the name of an official document confirming that the buyer paid for a product or service, and the seller received the money and delivered the goods of proper quality. But unlike the usual receipt, which is printed immediately at the time of purchase, the client must request this form himself.

It is important to note that a sales receipt is never issued on its own. A standard paper version is attached to it. The exception is individual entrepreneurs providing paid services. They do not necessarily have to install a cash register, which means there is simply nothing to accompany the issuance of a special form.

As for the appearance, unlike the familiar document that is printed at the time of the transaction, PM does not have a specific unified form. It can be filled out by hand, without the use of special equipment at all. But there is still a list of details that must be indicated on the form. But we'll talk about them a little later.

Checks for advance and prepayment: what is the difference

With what type of payment method a check should be issued depends on the situation.

For example, if the organization and the buyer know exactly what goods and services the funds are being transferred for, then it is better to make an advance payment.

If the product has not yet been fully selected, the service has not been generated, you must select a command on the cash register with the attribute for calculating an advance payment.

More details about this are in the table below.

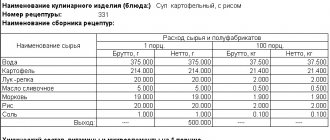

Table 1. Difference between a cash advance check and a prepayment check

| Name | brief information | In what cases is it formed? |

| Prepayment 100% | Full payment for goods and services, while the goods are transferred to the buyer (the service is provided) not at the time of payment, but later. | Both the buyer and the seller can clearly define the product and service (that is, a specific product model or a specific service with a specific price in the price list). The price of goods and services will not change. |

| Prepayment | Partial prepayment before delivery of goods or provision of services. | The buyer and seller can clearly name the product or service (specific product model, service). The price of goods and services does not change. |

| Prepaid expense | Transferring money before receiving goods and services. | At the time of this calculation, it is impossible to accurately determine the product model or list of services. Price may change. |

If the buyer bought for cash and wants to receive a refund by bank transfer

Yes, a non-cash refund can be made if the buyer, in the return application, expresses a desire to receive funds in a non-cash form and indicates his details. In this case, the funds are debited from the organization’s current account. If the buyer paid by card, then the refund occurs only in non-cash form. Refunds are issued only to the same card with which the purchase was made.

Returning goods by non-cash means takes place in several stages:

- The buyer brought the goods, a receipt or other document confirming the fact of purchase, a passport, a card.

- The seller checks the goods for compliance and integrity. If everything is in order, a refund will be issued. If the goods are returned in improper condition due to the fault of the buyer, then a statement of non-conformity is drawn up. The return certificate is drawn up in free form, which must include a description of the product, the reason for the return, the amount, and the buyer’s passport details. A payment order is sent to the bank.

How to return goods through a Pos terminal.

The procedure in this case looks something like this:

- Go to the operations menu (for some terminals this is the F key);

- Financial transactions - return of goods, insert the buyer's card;

- information about the card will appear on the screen, check it, press the green button, then enter the refund amount;

- If it is necessary to enter a PIN code, we transmit it to the client;

- Two checks are issued, one for the seller, the other for the buyer;

- We return the card and check.

The period for returning goods depends on the bank and payment system. Usually the transfer of money takes from 3 to 5 days. The return of goods in this way does not take place on the day of purchase. If the buyer returns the product on the day of purchase, the transaction is canceled.

Canceling an operation when returning on the same day looks like this:

- Go to the financial transactions menu, sub-item cancel transaction by number;

- enter the check number, click confirm;

- Confirm payment information;

- The refund receipt is printed.

Sample check for advance payment: details

The photo above shows a classic check for an advance payment, which in terms of details is practically no different from a standard sales check.

The main difference is the indication instead of the product - ADVANCE. Attribute of the subject of payment (product, service, work - not indicated in the check).

Standard details that must be present on the check, regardless of the payment method:

- calculation sign;

- Seller's TIN;

- Name of the organization;

- place of settlement;

- amount (without and with VAT);

- form of payment (non-cash and cash), etc.

A complete list of details of fiscal documents, including in checks for advance payments, is specified in Appendix 2 of Order No. ММВ-7-20 dated March 21, 2017/ [email protected] >>

Writing an application

The buyer must come with a receipt and passport.

If we are talking about the interaction between the cashier and the buyer, product returns through online cash registers begin with filling out an application. The buyer writes an application in any form, but it must include his full name, passport details, reason for refusing to purchase, purchase price, date of application and signature. Some stores print such application forms in advance to avoid errors during registration. After the buyer has filled out the form, the cashier is obliged to verify the correctness of the passport data and check details specified in the application.

Many entrepreneurs are wondering: how to process returns through online cash registers if the receipt was not saved, for example, it was lost by the buyer. In this case, it is necessary to restore the purchase information from the fiscal registrar and indicate in the application that the receipt was lost.

In order to securely save all information about your purchases, we recommend purchasing an ATOL 25F cash register. This fiscal recorder fully complies with the requirements of 54-FZ and is characterized by ultra-fast printing speed - up to 250 mm/sec.

Please note that you do not need to collect the check from the buyer (although many do this), just make a copy. An application for a refund written by the buyer is an effective confirmation for the Federal Tax Service that the money was actually returned to the client and was not withdrawn by the entrepreneur in order to avoid taxes.

Registration of an invoice for the return of goods

Since there is no single standard for the invoice form for returning goods at an online checkout, an entrepreneur can independently develop a sample and use it in such situations. The invoice is drawn up in two copies and signed by two parties: one is the buyer, the other is the seller.

Printing a receipt for returning goods at the online checkout

After the buyer writes an application, confirms the fact of purchase, and issues an invoice, a return receipt is printed. The only difference between a refund check and a regular check is that in a refund check, in the “payment attribute” field, not “receipt” is indicated, but “return of receipt”, i.e. the same check is issued as you saw above in the example picture.

Transfer of funds to the buyer

After all the documents have been prepared and signed, all that remains is to return the money he paid for the goods in cash. If the return occurs only partially (for example, the buyer bought fish, milk and slippers, and wants to return the slippers), then the whole procedure follows the same algorithm, the name and quantity of the product and the amount of the return are indicated in the application.

Cases when an advance check is used and when it is not

To understand the peculiarities of issuing advance checks, we will describe two standard situations.

- A furniture store sold a table and four chairs to a customer with free delivery. Received money for the goods in the morning, delivery will be in the evening. What indicator of the calculation method should I set?

If it is clear what exactly the buyer pays for (a table and four chairs), then we are talking about an advance payment, not an advance payment. And in this situation, we are not talking about “full payment”, since the client pays before the furniture is handed over to him (delivery in the evening).

In general, there is only one option - prepayment.

- The furniture salon makes custom-made kitchens. The price of 100,000 rubles includes the kitchen furniture itself, plus delivery and installation. The buyer pays 50% at the time of signing the contract. The remaining 50% is after installation in the house. Is the first check for an advance payment or for an advance payment?

Since at the time of signing the contract you are not going to write down in the check what it is for (for the furniture itself or for the furniture and delivery), you need to punch out a check for the advance payment.

After installing the kitchen, you need to close it - punch a document on the cash register to offset the advance payment. The money that the buyer will pay after installation (50%) will be reflected at the checkout as a full payment.

When to return goods via online checkouts

Returns through online cash registers occur differently than returns to old-type cash registers. How to technically carry out the return procedure depends on the model of your online cash register and its capabilities, as well as the software and firmware version.

To return a purchase, the buyer must punch a special receipt. The sign of settlement in which funds are returned to the buyer—an individual—is called return of receipts. It is issued when:

The need to return money to the buyer for the goods he purchased, which he refuses.

Incorrect value or quantity of goods in the receipt (seller's error during registration).

After returning the goods and receiving funds in the amount of its full cost, the buyer is given a cash receipt, which states that a “return of receipt” has occurred. However, for the tax inspectorate, a receipt alone is not enough, so you need to take care of preparing other documents that confirm the correctness of the procedure for returning goods through the online cash register.

On the left you see what a receipt for a refund looks like.

Other questions regarding prepayment (advance payment) in a check

In what cases is it necessary to make one check for all advances?

Companies and individual entrepreneurs that accept a large number of advances may not be able to cope with the flow of cash advance receipts that they are required by law to issue. Imagine how much time it takes for the conductor to count all the advance checks at the end of the trip and issue a check for payment?

For some companies there are concessions - they can issue one general check for the advance payment for the billing period, in which all cash receipts for the advance payment can be combined. Unfortunately, the list does not include trade organizations.

It is allowed to generate one (final) check that covers the advance:

- organizers of cultural events;

- carriers of various types;

- companies providing communication services;

- organizations in the field of electronic services (from Article 174.2 of the Tax Code of the Russian Federation);

- management companies and utilities (housing and communal services);

- private security companies and organizations in the field of security systems;

- companies from the educational sector.

Organizations on this list have 10 days after the service is provided to generate a check for the advance payment.

What to put in the name of a product (service) if it is impossible to accurately determine the model (list of services)?

We recommend writing “advance payment” in the name of the product (service) on the cash register receipt. Similarly, indicate the attribute of the calculation method -.

In the receipt for the advance payment, write down the name of the product (service) specifically.

Buying a wardrobe in a furniture showroom. The package has been agreed upon, but at the buyer’s request, we will negotiate with the supplier for a discount on components. The price may be lower in the end. What payment indicator should be on the check - advance or prepayment?

Insure yourself against potential problems and indicate that you received an advance from the client. However, write in the contract that the client gives you money in advance and that the final cost may change.

Is it possible to cancel a knocked out advance check? The client changed his mind and took the money an hour after the check was generated. Didn't receive the goods.

You need to cancel an advance check (including an erroneous one) using a refund. It is necessary to punch the return check (a special command at the online cash register), and indicate in the payment attribute that this is a refund of the advance payment.

How to indicate the amount in a check for an advance payment if the company is paid by a foreign client (payment in dollars)?

According to 54-FZ, it is necessary to indicate the price of the goods in the receipt only in rubles, that is, at the time of payment you will have to convert dollars into rubles (the exchange rate of the Central Bank or the bank in which you hold an account).

You can indicate the cost of a product (service) in dollars only in the form of additional details (in a free field).

When receiving payment for a trip, a travel agency is required to draw up a document indicating which method of payment? Closing time of the advance check: on the day of departure or on the last day of the tourist’s vacation?

Since at the time of payment the tourist and the agent know what the trip will be like (tickets, hotel, etc.), it is necessary to issue a check for prepayment. We recommend not to select the “100% prepayment” option, but to make a regular prepayment, since before the trip the tourist’s ideas may change and the payment will increase. It is allowed to make several checks for prepayment (regular).

A general, single check with all prepayments offset should be issued on the last day of the tourist’s vacation.

Link to full version:

https://www.business.ru/article/2497-chek-na-avans-zachet-i-vozvrat-avansa-nyuansy-i-pravila

Why do you need a sales receipt?

The purpose of this strict reporting form coincides with the standard one - the document confirms the very fact of the purchase, as well as the total amount for which the transaction was made. Its main functions are as follows:

- It can be used as proof of spending cash on a particular item to recoup your losses later.

- As a supporting document if you need to exchange a purchased product or return it.

- To prove the very fact of the transaction, if for some reason the cash register at the point of sale does not work or is completely absent (as is the case with individual entrepreneurs providing services without registering a cash register).

The main thing to understand is that this strict reporting form must be issued immediately if such a request is received from the buyer. Otherwise, you may receive punishment from regulatory organizations. In addition, there are several groups of goods for which filling in PM is mandatory.

Evotor and return using smart terminal data

Evotor devices allow this procedure to be carried out in five stages:

- Find the “Return” section in the general menu. We are looking for the right one among all the operations. It is advisable to find it using the check number received from the buyer - enter it in the blank line to speed up the search for the document.

- Click on the line with information.

- We proceed to return using the button of the same name.

- We deposit funds, choosing between cash or a bank card.

- We are waiting for the window to open indicating the payment amount. Enter the amount.

Ready.

Is it possible to use a sales receipt without a cash receipt?

Despite recent changes in legislation in the field of trading business, there are still categories of individual entrepreneurs who do not need to install and register a cash register to operate. These include “private owners” who provide services to the public if they do not have other employees on their staff.

At the same time, consumers still have the right to receive a document confirming the transaction and the transfer of money. Accordingly, you can issue them a strict reporting form without supplementing it with a fiscal receipt. Such a system allows you to keep correct records of expenses and income, and timely fill out paperwork for submission to the tax service.

Difference between PM and waybill

Outwardly, these strict reporting forms are even more similar than the receipt printed at the cash register and the sales receipt. But there are unique differences here too. If the issuance of a goods order can be carried out by any store, individual entrepreneur and everyone who conducts trading activities, and in relation to each client, then the invoice is drawn up only when an agreement is concluded between the outlet and another legal entity.

In addition, more details that must be indicated are entered into the invoice. This includes information about your current account and some other trading features. Additionally, a standard fiscal receipt can be attached to the document, although this does not always happen, because many settlements between two companies are carried out exclusively through banks.

Knowing how to write out, fill out and register a sales receipt, we recommend that you do not neglect its timely preparation.

This will speed up the sale procedure and increase the purity of the transaction. If you need to purchase any equipment for cash accounting, contact specialists. We will select the right equipment for you and help you set it up properly, so that issuing documents to your clients will become much easier. Number of impressions: 7008

Instructions on how to fill out sales receipts

To the above we will only add the location of all the details on the receipt. The upper left corner is devoted to personalized data, registration information, and the current address of the trading enterprise. The right side can be occupied by the date and time the document was issued, although some prefer to enter this data below.

After this, the number of the strict reporting form itself is placed in the center of the sheet. It will fit into other cash papers, so there should be no errors. Next, you can arrange the table. It contains a description of all services that the consumer received or things he purchased. The units of measurement and cost of each category are also placed in one of the columns.

As for the bottom of the document, the total amount is written here, the full name of the employee who prepared the receipt, and the signature of the responsible person. You can also put a stamp here.