Nuances in issuing travel allowances

Close Every year the SKB Kontur company holds a competition for entrepreneurs, hundreds of businessmen from different cities of Russia take part in it - from Kaliningrad to Vladivostok. Through the competition, we have created an inspiring collection of business stories told by people who are turning small start-ups into successful companies. Their experience and advice will be useful to anyone who is thinking about starting their own business. To start, you need some prerequisites: an idea, some money and, most importantly, a desire to start Fred DeLuca Founder of Subway Subscribe to notifications about new articles Subscribe I'm not interested

Pavel Timokhin July 29, 2014 The process of processing travel allowances involves working with several documents.

Filling out some of them has its own characteristics.

What should you pay attention to? Registration of employees on a business trip begins with an Order to send the employee on a business trip. It indicates for what period the employee is going on a business trip, to what place and for what purposes. The accompanying document is an official assignment, which indicates in more detail the purpose of the business trip, the stages of interaction with counterparties, clients, potential buyers or other persons. After completing the order and official assignment, an advance amount is paid, intended to be spent during the business trip. The advance covers daily expenses: accommodation, meals and related expenses (travel to the place).

When an employee is sent on a business trip, he is given a cash advance to pay for travel expenses, rental accommodation and additional expenses associated with living outside his place of permanent residence (daily allowance). Final payments are made upon the employee’s return from a business trip, after he has drawn up an advance report and transferred all expenses that were incurred.

If the advance payment issued before the trip does not cover these expenses, then the remaining amount is paid to the employee.

Purpose of payment when paying daily travel expenses

» Housing law This article will focus on payments related to business trips, their accounting reflection and taxation.

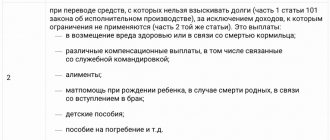

An employee sent on a business trip is entitled to the following payments:

- reimbursement of expenses incurred during a business trip (travel, accommodation, etc.).

- daily allowance;

- payment for days spent on a business trip;

Based on this, he is given an advance in the amount of daily allowance, as well as upcoming travel expenses.

The advance can be issued either in cash from the cash register or by transfer to the employee’s bank card. Upon returning from a business trip, within three working days, the employee submits to the accounting department an advance report with supporting documents, on the basis of which the previously issued advance is adjusted: either the employee is reimbursed for the overexpenditure, or he pays the balance of the unspent advance.

Wages for days of business travel are accrued to the employee based on the results of the corresponding month, together with wages for days worked, and are paid on the next day scheduled for payment of wages. This is how settlements with an employee sent on a business trip look in general.

The first of them guarantees the preservation of the average salary for the time worked on a business trip, the second determines the types of expenses that are subject to compensation:

- amounts spent on rental housing;

- other expenses incurred as directed or in agreement with the administration.

- amounts spent on meeting other needs - daily allowances;

- money spent on travel to the destination;

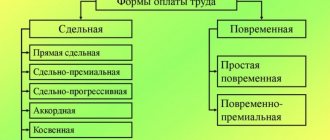

The easiest way is to divide these payments into three groups:

- Reimbursement of documented expenses.

- Daily allowance.

- Wage.

The issues of business trips and payment of associated costs are discussed in more detail by the Regulations on Business Travel approved by Government Resolution No. 749 of October 13, 2008 (hereinafter referred to as Resolution No. 749).

Reimbursement of expenses to an employee without issuing a report

Contents The legislation does not contain a direct prohibition on compensation of employee expenses in the interests of the organization. And at the same time, it does not provide specific recommendations for the execution of this operation.

Moreover, this type of operation occurred at least once in every organization. If for a specific issue of accounting (AC) the federal standards do not establish methods for maintaining accounting, then the organization itself develops an appropriate method (clause.

7.1 PBU 1/2008). Thus, the Organization needs to prescribe in its Accounting Policy the method and procedure for compensating employees for expenses incurred for the needs of the organization, including approval of the document on the basis of which compensation for expenses will be made to the employee. In our opinion, the use of account 71 “Settlements with accountable persons” is not appropriate, since the account is intended for settlements with employees for amounts issued to him on account (Instructions for the use of the Chart of Accounts, approved by Order of the Ministry of Finance of the Russian Federation dated October 31, 2000 N 94n ).

And in this situation, the employee was not given accountable amounts. To reflect settlements with an employee, in our opinion, it would be more correct to use account 73.03 “Settlements for other transactions”. Since when purchasing goods at his own expense, the employee acted with the permission and in the interests of the organization, it is necessary to document that the organization approved such a transaction (clause.

1 tbsp. 183 Civil Code of the Russian Federation). Such documents may be:

- An employee’s application for reimbursement of expenses, approved by the manager (the resolution on the application is “pay”).

- An order on behalf of the manager to reimburse expenses to an employee.

- An approved report on the funds spent with documents for purchase and payment attached to it (sales receipt, delivery note, invoice, etc.), including in the form based on AO-1.

Funds spent by an employee on the purchase of goods or services for the needs of the organization and reimbursed to the employee by the organization on the basis of supporting documents

How to fill out a payment form for daily allowance

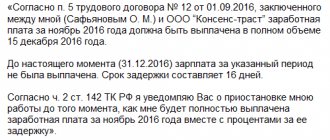

Untimely transfer of accountable amounts may cause the disruption of a business trip or other violations.

- An incorrectly drawn up payment slip is the basis for tax authorities to issue a fine. Why? Some employees of the Federal Tax Service qualify the sub-report listed on the card as wages and require the money paid to be subject to taxation (personal income tax and insurance contributions).

The Russian Ministry of Finance fundamentally disagrees with the tax authorities’ claims; officials presented their position in letter dated 04/08/2010 No. 03-04-06/3-65.

However, it is easier to convince the tax inspector of the correctness of accounting with correctly executed documents.

Contents: Almost everything about business trips. payment of travel expenses to the employee’s card account. Unified social tax, personal income tax, mandatory pension insurance contributions, penalties and fines. Since the organization submitted advance reports for part of these payments and a cash receipt order for the return of part of the unspent advance, as well as an order from the director authorizing the issuance of money on account from the cash register and from the current account to the bank card of the accountable person, and, in addition, since payment orders the transfer of money did not contain an indication that this was wages, the court came to the conclusion that the tax authority did not have sufficient grounds to recognize the amounts issued by the company to the employee as the employee’s wages.

Budget accounting Of course, the use of such a scheme will lead to the fact that the entries in budget accounting will differ from those compiled when paying an advance for travel expenses in cash. If an advance is issued for a business trip in accordance with paragraph.

For example, about accounting policies. However, just the other day, the Russian Ministry of Finance, together with the Federal Treasury, developed an unambiguous position: it is possible to transfer travel allowances to a salary card, the main thing is that the procedure for such payments is properly formalized (Letter of the Russian Ministry of Finance N 02-03-10/37209, Federal Treasury N 42-7.4 -05/5.2-554 dated 09/10/2013).

Rules for transferring travel allowances to an employee’s card.

Sample payment order

» » » 09/10/2021 The employer is obliged and has the right to transfer travel amounts to the employee’s salary card. However, such a condition must be documented. In this article we will figure out how to make the transfer correctly. The article describes typical situations. For a transfer to a salary card to be considered legal, the following conditions must be met:

- The payment order correctly indicates the purpose of the payment.

- The agreement with the bank stipulates the possibility of transferring travel amounts to the card. When there is no such clause, all transferred amounts are classified as wages and are subject to taxes.

- Errors and typos in payments are not allowed.

If the conditions are met, nothing prevents the employer from transferring travel funds to the employee using a bank card. If the transfer is not designated as a business trip, you will have to pay income tax. Or the banking organization will not allow it at all, and the business traveler will be left without money. A number of actions to be able to transfer travel funds to salary card:

- Regulatory acts regulating business trips and payments for them are drawn up.

- consent to control the status of the account.

- Before going on a business trip with data designation:

- consent to transfer funds to the card;

- consent to control the status of the account.

- consent to transfer funds to the card;

- Each employee must familiarize himself with the acts upon signature.

The order must contain the required information:

- manager's signature;

- Company name;

- date of issue of the order;

- visa to familiarize yourself with the order of the employee himself.

- business trip period;

- Full name, position and structural unit of the seconded employee;

After issuing the order and familiarizing the employee with it, the organization transfers the required travel allowances. They must be paid before departure on a business trip.

To solve your problem - or call for free: - Moscow - - St. Petersburg - - Other regions - It's fast and free!

We transfer money against the report to the employee’s bank card

Transferring money to an employee's card against a report is much more convenient compared to cash payments: there is no need to draw up cash documents or go to the bank to withdraw cash. However, as practice shows, these conveniences are negated by writing off the money received to pay off the employee's debts (for example, loans ), blocking the employee’s card. The company can transfer accountable money to the employee’s salary or personal bank card. The list of accountable expenses includes hospitality, travel expenses, expenses for administrative and business needs (purchase of office supplies, business equipment, maintenance of office equipment and similar expenses).

The basis for payment of the accountable amount is an order (instruction, decision) signed by the head of the company. There is no need for the employee to fill out an application for the issuance of funds on an accountable basis. However, the issuance (transfer to a bank card) of accountable amounts can be carried out even if the accountable person has a debt. The legislation does not establish a specific period during which the employee must report on the accountable amounts spent.

According to clause 6.3, the employee is obliged to provide the accounting department with a report on the amounts received no later than three working days after the expiration of the period for which these amounts were issued.

If the company does not have such an order, we can assume that the deadline for issuing accountable amounts has not been established, which means that settlements on accountable amounts must be made within one business day (Letter of the Federal Tax Service of the Russian Federation dated January 24, 2005 No. 04-1-02/ 704).Important! Funds issued on account to their employees can be transferred to employees’ bank cards for transactions related to: payment of expenses of organizations for the supply of goods, performance of work, provision of services; travel expenses; documented compensation to employees

Free legal assistance

// Payment to a Sberbank card to pay for household needs We process accountable money correctly You can issue accountable money to an employee of an organization in three ways:

- through the employee’s personal bank card.

- through a debit card issued by TOUFC for cash payments;

- from the cash register in cash;

Moreover, it is important to comply with the intended purpose of accountable funds: expenses for the economic needs of the institution, travel or entertainment expenses.

IMPORTANT! A report can be issued on a card or in cash only to an employee of an organization with whom an employment and civil law contract has been concluded. The timing, maximum amount and reporting period must be established by a separate order of the manager.

The procedure for filing a report on an employee’s card from a current account:

- The employee prepares a written statement indicating the amount, purpose, justification and reporting period.

Attention: From what position is it dangerous? In terms of violation of what? Reply with quotation

- 09-04-2015, 14:32:20 #4 Message from nastasy Good afternoon! How would you transfer a subaccount to a salary card - make a regular payment order or through a salary project, where the transfer code is not “subaccount”, but only “other payments of other types of remuneration”? According to the bank employee, you can use this code. Do you have a “subreport” code in your payroll projects? Thank you. I always transfer only by payment to the account, put the code 5, and write in the assignment that this is an issue to the account. In my opinion, the salary project is still a salary project and the registers are intended specifically for the transfer of salaries. I asked at the bank about the reporting, they also said that I needed a payment. We do not issue reports through the cash register.

The difference is good.

By the way, from 04/01/2015 in Sberbank transfers to an individual’s card/account have a commission of 1%.

And before that, it was just like for a regular payment - 30 rubles. When I transferred the rent to an individual, I was stunned by the amount of the commission. They sent a reminder about the increase in tariffs, the tariffs themselves - on 15 sheets.

Business trip expenses

Contents First of all, it is necessary to draw up an order or instruction from the manager about sending him on a business trip. Until January 8, 2015, when sending employees on business trips, employers were required to approve job assignments and issue travel permits.

However, now there is no need to do this.

From this date, the actual length of stay of the employee at the place of business trip is determined by travel tickets presented upon return from the business trip. If the employee is sent on a business trip by personal transport, then the actual length of stay at the place of business trip the employee must indicate in the memo.

Note that for organizations that regularly send employees on business trips, it is better to prepare a local regulatory act, for example, a regulation on business trips.

It should include all the details: the amount of daily allowance, the amount of compensation for business trip expenses, etc.

Such a document can become one of the decisive arguments in favor of the taxpayer during audits or in court.

In the working time sheet (unified forms No. T-12 and T-13), working days that fell during a business trip are indicated by the code “K” or its digital equivalent “06”. The number of hours worked is not entered.

If during a business trip the employee worked on his day off or on a holiday, the report card is marked with the code “РВ” or its equivalent “03”. In the column reserved for the number of hours worked, the value previously agreed upon with the employer is indicated. If there was no agreement to work on a day off, the employer has the right not to indicate the number of hours in the timesheet and, as a result, not to pay for this time.

This is stated in the letter of the Ministry of Labor of Russia dated February 14, 2013 No. 14-2-291. A situation is possible when on a day off the employee was on the road, that is, either going to the place of business trip or returning back.

It is not entirely clear whether this time should be counted as worked. In our opinion, a road that falls on Saturday, Sunday or a holiday is nothing more than work.

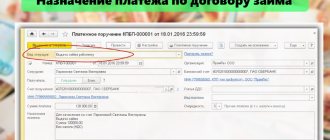

Purpose of payment when transferring money for a business trip

“But it would be safer to make changes to the agreement with the servicing bank to maintain tariffs when transferring accountable amounts to employees’ cards.

Representatives of the Ministry of Finance and the Treasury of Russia are of the opinion that funds can be transferred to employee salary cards in order to: - pay for travel expenses; — compensation for documented expenses. To do this, in the organization’s accounting policies, provide for such a procedure for settlements with accountable persons.

In addition, indicate in the payment order that the funds transferred are accountable.

The employee, in turn, must provide the organization with an application for the transfer of accountable amounts to his salary bank card and indicate the details for the transfer. Question: Is it possible to transfer funds for travel expenses and business expenses to an employee’s personal salary account?

Transferring wages to a card has not surprised anyone for a long time.

Today, many companies transfer money to the employee’s card on account. The employer is obliged to pay for the business trip and has the right to transfer travel amounts to the employee’s salary card. In this article we will figure out how to make a translation correctly.

The article describes typical situations. To solve your problem, write to our consultant or call for free:.

It's fast and free! For a transfer to a salary card to be considered legal, the following conditions must be met:. Dear readers! Our articles talk about typical ways to resolve legal issues, but each case is unique. If you want to find out how to solve your particular problem, please use the online consultant form on the right or call the numbers provided on the website.

If the conditions are met, nothing prevents the employer from transferring travel allowances to the employee using a bank card.

The procedure for issuing an advance for a business trip.

A number of actions to be able to transfer travel funds to a salary card:.

After issuing the order and familiarizing the employee with it, the organization transfers the required travel allowances.

conclusions

On the presented topic, we will draw several main conclusions:

- Travel funds are allowed to be transferred to the employee’s salary card.

- The company’s internal regulations must contain the procedure for transferring non-cash funds for business trips.

- The employee must be familiar with the internal regulations of the organization upon signature.

- Funds are transferred to the employee on the basis of a business trip order.

- Non-cash transfer is carried out with

- the power of a payment order.

- The purpose of payment in the payment slip must contain information about compensation for travel expenses or the issuance of funds on account. Otherwise, you will have to pay taxes on the funds paid: personal income tax and insurance premiums.

- An incorrectly completed payment may result in penalties for the organization.

Purpose of payment when paying daily travel expenses

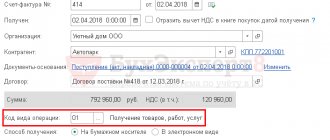

The following details are filled in in the header of the document (Fig.

2):

- Obligation - selected from the Contracts directory or other grounds for the occurrence of obligations.

- Employee - by selecting from the Counterparties directory, the accountable person for whom the advance is issued is indicated;

Next, fill out the Application tab:

- Purpose of the advance - describes the purpose of issuing the advance;

- Enter monetary obligations - in this example it is established;

- Advance amount in rubles - indicates the amount issued;

- Personal account - indicates the personal account in which the acceptance of a monetary obligation is reflected in accounting;

- The advance was issued according to: - the period for issuing the advance;

- Personal account section—select the personal account section for which the accepted obligation is taken into account.

Rice.

Is it possible to transfer money for a business trip to an employee’s salary card? From this article you will learn:

- What documents should I fill out so that I can freely transfer money to the card?

- Is it possible to transfer money for a business trip to employees’ salary cards?

- How to confirm that an employee spent travel money for its intended purpose.

If you have a “simplified” approach with the “income” object. ->

- Application for cash expense;

- Payment order.

Rice. 4. Funds to pay for travel expenses are transferred by the institution to a special salary account.

A register of employees indicating their personal accounts and the amounts to be credited to each account is attached to the transfer document (Application for Cash Expenses or Payment Order).

[/info] 2.2.

- type of payment made – advance payment; for work already performed, service provided or products or goods supplied; advance payment or final payment; additional payment to the previously transferred payment, etc.

- When filling out the name of a product, work or service, you can make either a complete list of goods, work or services, or a generalized name (information services, goods transportation services, installation work, household or office equipment; utility bills, salaries, etc. .).

What could be the consequences of incorrect registration?

If errors were made during the process of registering a payment order, events can develop according to 2 scenarios:

- The bank will simply refuse to accept such a payment, since some banking institutions have approved specific examples of forms for assigning payments. In this case, you should clarify with bank employees how to correctly indicate the purpose of the payment report.

- The tax inspectorate may perceive funds transferred according to the purpose of payment to an accountable person as wages. In this regard, tax officials may require personal income tax to be withheld from the transferred amount. In turn, the funds may be required to pay social security contributions.

But if the employee did not use the accountable funds, he is obliged to return them.

Travel allowances on a salary card

Contents From this article you will learn:

- Is it possible to transfer money for a business trip to employees’ salary cards?

- What documents should I fill out so that I can freely transfer money to the card?

- How to confirm that an employee spent travel money for its intended purpose.

If you have a “simplified” approach with the “income” object.

This article will be of interest to all employers who send their employees on business trips, including you. Most often, employers, when sending their employees on a business trip, give them cash for food, accommodation and other expenses. In this case, an expense cash order is issued for a certain amount.

However, not everyone is comfortable with this. Now there are more and more companies transferring salaries to cards. And there may simply be no money in the cash register, because many people work on a cashless basis. In such cases, is it possible to transfer travel allowances in the same way - directly to the employee’s salary card?

The answer to this question was not clear for a long time. Because there is no clear prohibition on such actions in regulatory documents, but there are also no permissions.

In such a situation, accountants were forced to independently decide what to do, transferring money to a salary card at their own peril and risk. An important point. You can transfer travel allowances to employees’ salary cards after such a procedure is formalized in an internal document. For example, about accounting policies.

However, just the other day, the Russian Ministry of Finance, together with the Federal Treasury, developed an unambiguous position: it is possible to transfer travel allowances to a salary card, the main thing is that the procedure for such payments is properly formalized (Letter of the Russian Ministry of Finance N 02-03-10/37209, Federal Treasury N 42-7.4 -05/5.2-554 dated 09/10/2013). Let us note right away: despite the fact that this Letter is addressed to budgetary institutions, its provisions can easily be extended to commercial firms. And we offer you a commentary on these clarifications.

List travel allowances

Travel allowances to an employee’s card: transfer rules, whether and how to transfer money to a salary card, purpose of payment in the payment slip

Home > Accounting > Cash > Non-cash > Payment order > Rules for filling out a payment order for a salary - sample payment order for payment to an employee’s card January 8, 2021 Payment order

- For accounting employees, the non-cash form has many positive aspects; the process of paying employees is easier.

- For employees, this option for receiving salaries is the most convenient; there is no need to receive cash from the company’s cash desk.

- Labor legislation obliges you to pay wages to your subordinates at least once every six months, as a rule, on the 30th day - payment of an advance for the current month, on the 15th day of the next month - final payment for the month.

The transfer of workers' salaries to their current accounts is carried out using a payment order. It should be remembered that the day of crediting funds to the accounts of subordinates is the day of payment of remuneration for work. The payment document for transferring wages to staff is easy to fill out, but when sending it to a credit institution, you must adhere to the following requirements:

- in the “payee” field, the details of the bank indicated in the agreement between the bank and the company, the current account number in accordance with the signed salary project are recorded;

- in the “payment purpose” field, the period of the money transfer is reflected, for example, “transfer of advance payment (salary for the first half of the month) for November 2021 according to statement No. 56 dated December 15, 2021.”

- in the “payment amount” field, the amount calculated by the accounting department for transferring the advance or final payment of wages is entered;

A register indicating the amounts for each employee serves as a strict attachment to the payment order.

Payment order.

Step-by-step filling instructions

This is the form number of the unified form valid today. We begin to fill out the fields of the document one by one.

Field 3 – number. The payer indicates the payment number in accordance with its internal numbering order.

The bank can provide the number to individuals.

This field cannot contain more than 6 characters.

Field 4 – date. Date format: two digits day, two digits month, 4 digits year. In electronic form, the date is formatted automatically. Field 5 – type of payment. You need to choose how the payment will be made: “urgent”, “telegraph”, “mail”. When sending a payment through a client bank, you must indicate the encoded value accepted by the bank.

Field 6 – amount in words. The number of rubles is written with a capital letter in words (this word is not abbreviated), kopecks are written in numbers (the word “kopek” is also without abbreviations).

It is acceptable not to indicate kopecks if the amount is a whole amount.

Field 7 – amount. Transferred money in numbers.

Daily allowance 700 per card from account payment purpose

Important! A prerequisite is that the payment purpose field of the payment order must contain the phrase “travel needs.”

Purpose of payment in a payment order In order to correctly fill out a payment order for transferring amounts for a business trip, you need to follow the algorithm of actions:

- the purpose of the payment must be stated as “accountable amounts for travel expenses”

- have details of the account to which funds will be transferred in order to control the sending of money to the required details;

It is the correct display of the payment purpose that will protect the company from claims during inspections.

The purpose of payment can be formulated in different ways.

Attention If this limitation is not overcome, then all expenses can be taken into account when calculating taxes (income tax or tax in connection with the use of the simplified tax system).

What to do if expenses exceed acceptable limits?

In such cases, the employer can reimburse the employee for all expenses, despite the fact that the norm is exceeded, but he will be able to take them into account when calculating taxes only in the part that is covered by the law, and write off the rest as losses. Payment of daily allowances Amount of daily allowances Currently, the law allows for the payment of daily allowances, which are not subject to personal income tax, up to 700 rubles. per day. But if, for example, a director goes on a business trip, then we can assume that 700 rubles.

a day is not enough for him. Contents: Read this article for the rules and example of filling out payment orders.

Postings for the transfer of funds to the employee's card in the account The issuance of accountable funds to the employee's card in accounting is recorded by the following posting: Dt 71 Kt 51 (52).

When returning unused accountable funds in cash through the cash register, an entry is made: Dt 50 Kt 71. When transferring unused accountable funds by non-cash method - from an employee’s card to the company’s current account - an entry is made:

Sample of filling out a payment order in 2021

22 Code The payment UIN should be entered if it is assigned for a specific type of transfer.

If the organization pays independently, and not according to the stated requirement, then write “0” 24 Purpose of payment Here, indicate for what and on what basis (documentation) the payment is made. The accountant can indicate the deadlines for fulfilling obligations under the contract or the deadlines for paying tax obligations, if necessary.

Or establish a legislative reference establishing the basic requirements for making payments 60, 61 TIN Write in these fields the TIN of the payer (60) and the recipient (61) 102, 103 KPP Specify the KPP of the organization of the payer (102) and the recipient (103) Block of fields 104–110 filled in ONLY when transferring payments to the budgetary system of the Russian Federation and extra-budgetary funds 101 Payer status Filled out only when making payments to the budget or customs duties (fees).