The reasons why it is necessary to restore accounting in a company can be very diverse. What steps should I take to restore my accounting records?

Let us note that the concept of “accounting restoration”, as well as the methodology for carrying out this procedure, is not spelled out in any accounting standard.

And therefore, there is no single universal method for restoring records, since everything depends on specific circumstances (the presence or absence of primary accounting documents, the state of the electronic database, etc.).

Important! As a rule, along with restoring accounting records, companies also need to restore tax accounting registers and submit updated declarations on taxes and fees. REASONS FOR ACCOUNTING RESTORATION

What does accounting restoration mean?

Restoring accounting involves carrying out a set of actions that will help bring the company’s reporting documentation into compliance with the primary one, restore lost or incorrectly executed papers relating to financial and cash transactions, and bring them into compliance with the law.

Obviously, in the process of restoring accounting, you can encounter a number of difficulties. So, you will have to restore all lost documents: for example, you will have to contact the bank for statements from your current account. And the accounting database in electronic form will have to be created anew or significant changes made to it. This process may take time.

In addition, it may turn out that after restoring your accounting, you will have to pay additional taxes. Their total amount may turn out to be insignificant, but it can be almost impossible to calculate it in advance (it depends, among other things, on the presence of primary documentation).

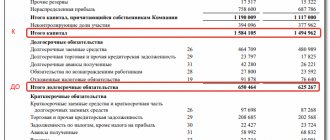

Balance sheet: assets

To restore data, you need to obtain the last submitted report to the Federal Tax Service. Information in the balance sheet is recorded from the General Ledger. If it is missing, then the restoration of the accounting records of companies is carried out according to the accounts.

NMA (p. 110). If there is a certain amount on the accounts, then you need to find out from the management what trademarks or intellectual property the company owns. Appraisers will help you correctly determine the value of such objects.

OS (Article 130). For enterprises engaged in construction, this line reflects the cost of equipment for installation and invested in intangible assets. If there is a balance sheet on page 135, it means that the organization has property leased out. To restore accounting data, you need to request a lease agreement.

Special bank accounts (p. 140). This line reflects the amount of investments in short-term deposits. This information should be reflected in the bank statement and in account 55 of the general ledger.

Inventory (p. 211). Information about the quantity and cost of materials is entered into the balance sheet according to inventory data. The figures may differ from those presented in the last submitted report.

The balance sheet reflects the amount of tax received from transactions with all counterparties. If the company has many buyers, then the amounts indicated on pages 220 (VAT) and 230 (DZ) will not help restore accounting records.

Data on funds in the cash register and on current accounts are filled in based on bank statements.

When is it usually necessary to restore accounting records for the year?

Full or partial restoration of accounting is required in cases where it is necessary to restore order to all the company’s documentation. Such actions will help avoid negative material consequences in the future. After all, ignoring accounting can lead to huge losses and even blocking of the organization’s accounts.

Restoration of accounting must be done in the following cases:

- Loss of primary documentation or accounting information base;

- Change of founders. New owners will likely require outsourcing of accounting and tax risks. In crisis conditions, tax claims can hurt the well-being of an organization. Therefore, before selling the property, you need to organize normal accounting. This will present the organization in a favorable light as a company with transparent accounting and without friction with authorities;

- Lack of accounting for a long time;

- Identification of the fact of incompetence of the chief accountant, his inadequacy for his position;

- Detection of errors in primary documentation, its inconsistency with the real financial position of the company;

- Detection of errors in documentation by tax authorities, assessment of fines and penalties;

- Blocking the company's current account;

- Preparing for a tax audit. Most often, company managers do not think about the need for systematic control over accounting. Most directors pay close attention to working with documentation only in anticipation of an audit by tax inspectors or OBEP. But even an emergency “combing” of documents can significantly reduce the risk of large tax claims;

- Dismissal of the chief accountant. An incompetent employee can create a lot of problems for you, which will accumulate like a snowball over time, and then erupt into a scandal and a huge amount of incorrectly drawn up or lost documentation.

Accounting restoration will help analyze and adjust accounts, restore tax registers and financial reporting.

The main task of full or partial restoration of accounting is to bring all documentation - from primary documents to final reports - into compliance with the norms and requirements of the law. Documents must be in such a condition that they do not cause any complaints from regulatory authorities. Thanks to such actions, it is possible to minimize the risks that penalties will be applied to the organization or its officials.

Here are a few examples of cases in which accounting restoration is required.

Example No. 1

The company has been operating on the market for many years; the chief accountant, who once completed specialized courses, has always kept accounting records and submitted reports on time. One day, auditors or third-party experts decided to check the accounting and discovered the unreliability of the accounting reports and the discrepancy between the balance sheet items and the real state of affairs. In such a situation, it is necessary to restore accounting, find items that do not reflect reality, identify system errors and create new accounting that reflects the changes made.

Example No. 2

At the very beginning of its activities, the company began to use a simplified taxation system, according to which it was freed from the need to maintain accounting records. The chief accountant, who did not want to do extra work, did not keep accounting as a whole, limiting himself only to the book of income and expenses. But any commercial company is created to make a profit as a result of a certain activity. And you can calculate profits only during accounting. Because of this, strange situations constantly arose: many limited liability companies did not reveal the material result of their activities for many years; Many chief accountants only knew how to work using simplified language; they were not familiar with accounting. In 2013, accounting became mandatory for everyone. Companies that previously did not maintain it had to restore accounting. It implied not only the completion of accounting work for several years, but also the restoration of the balances of balance sheet items needed for subsequent accounting as of certain dates (for example, as of January 1, 2005).

Restoring accounting is a rather complex procedure that requires professional knowledge and an individual approach to each situation.

Read material on the topic: Accounting outsourcing of a company

Partial and complete restoration of accounting: what is the difference

Accounting restoration is a procedure that includes the reconstruction and processing of various documentation: contracts, payment orders, invoices, receipts, invoices. Papers are prepared from both sides - from the client and his counterparties. In addition, it is necessary to calculate the amounts of loans, accountable income and expenses.

Accounting restoration can have varying degrees of depth and complexity depending on the task and the available information. The procedure is divided into two types: full and partial restoration of accounting.

Partial accounting restoration is performed at specific stages of the process. For example, personnel records, cash transactions, bank payments, etc. can be restored. This type of restoration has a number of advantages: it is more efficient and cheaper.

Full restoration of accounting means working with the internal procedures of the company as a whole. During such restoration, all stages of accounting are analyzed and corrected. Primary documentation for past reporting periods is processed, accounting and tax reports are submitted to the Federal Tax Service, the Pension Fund of the Russian Federation, the Social Insurance Fund, and Rosstat.

Invoice

If an invoice is lost or destroyed, the buyer has two ways to restore the document. You can request a certified copy of the invoice or a duplicate from the seller. The Supreme Arbitration Court clarified back in 2010 that the deduction of VAT can be confirmed by copies of invoices (Resolution of the Presidium of the Supreme Arbitration Court of November 9, 2010 No. 6961/10). The legality of the deduction for a duplicate invoice will have to be defended, because the official position of the Russian Ministry of Finance, set out in letter No. 03-07-09/9057 dated February 14, 2021, denies this possibility.

The courts believe that the taxpayer has such a right while maintaining the identity of the data. The controversial point is the mismatch of the signature. But the arbitrators recognize the right to deduct VAT when this is caused by objective reasons (for example, dismissal of employees); changing the autograph does not affect it (Resolution of the Central District Court of June 1, 2021 No. F10-1645/2016). But please note that if there are any doubts about the authenticity of the signature on the invoices, a handwriting examination may be ordered.

Subscribe to the magazine “Calculation” or “Calculation. Premium" for the 1st half of 2021!

If you need to restore accounting, where to start?

First of all, it is necessary to establish the presence and determine the condition of fixed assets. To do this, it is necessary to conduct an inventory of funds. If we talk about the general principles of conducting an inventory, then based on its results the actual presence of fixed assets will be established. To determine the value of the funds found, you need to order their independent assessment. Appraisers will provide you with a detailed report detailing the residual value of the assets as well as the length of time the assets have been in operation. Based on this information, you can put assets on the balance sheet and determine the future period for their effective use.

If you own a plot of land on a leasehold basis, you will have to register such a contract with the Main Directorate of the Federal Registration Service.

If the main type of property of your company is federal or municipal state property, then you can contact the property management committee, where the Charter of your organization is stored with attachments in the form of acts of acceptance and transfer of property for economic or operational management.

If your company is a limited liability company or a public joint stock company, you need to find out whether it was converted from state ownership during privatization. If this is the case, company documentation can also be found in the property management committee.

Also carry out an inventory of goods and material assets stored in warehouses and other company structures.

Reserves

Next, you should conduct an inventory of goods and materials by recalculating and weighing goods in warehouses. Based on the results of the audit, the accountant:

- Reflects the identified inventory balances according to DT10, and the remaining goods according to DT41. Registration is carried out in quantitative and total terms at market value.

- If, based on the results of the inventory, workwear was discovered, then it should be recorded in separate cards. One document is issued to one responsible person. If the useful life of clothing exceeds 1 year, then depreciation must be charged monthly for each item.

- The order on accounting policy must set out the procedure for recording and disposal of minimum wages and goods in the accounting and accounting records.

What are the stages of accounting restoration?

Restoring accounting in specific areas of production consists of restoring calculations for transfers to extra-budgetary funds, calculation of wages, transactions on the current account and cash receipts, accounting for the movement of inventories, registration and depreciation on fixed assets.

The accounting restoration process is divided into the following stages:

- The first stage: preliminary processing of documentation, its analysis and sorting. At the same stage, an unscheduled inventory is carried out, with the goal of restoring goods and material assets, as well as accounting for fixed assets; then technological solutions are developed for accounting, development of accounting policies and other regulatory and accounting regulations.

- Second stage: search for missing documents, their restoration and processing. At this stage, accounting and reporting registers are formed: adjustments are made to existing registers or, if they are completely absent, the registers are compiled anew.

During the restoration of the company's accounting, documents will be analyzed, document flow will be organized, and updated reporting will be submitted for the period subject to restoration. The accuracy of tax calculations, further preparation of declarations, and organization of accounting in accordance with legal requirements will be checked.

Gaps in the provision of accounting and tax reports are filled through the submission of adjusted accounting forms and updated tax returns. During this process, information will be generated that can later be used when submitting quarterly and annual reports to the Federal Tax Service and extra-budgetary funds.

The restoration of accounting will be carried out by specialized accountants, programmers and auditors. The latter will prepare primary documentation, set general tasks, analyze ways to reduce the tax burden, and accept completed work. The task of programmers is to develop software that can help restore accounting.

In general, the following processes are performed at this stage:

- Receiving and analyzing primary documents, recovering lost papers (if required). The scale of the work largely depends on the number of documents, including missing ones, the volume of the company, the number of branches and some other factors;

- Creation of accounting software (if necessary). Application databases can be completely restored, even if they were seriously damaged or missing altogether. Sometimes not only the direct restoration of documentation is carried out, but also information and technical measures are applied;

- Drawing up and submitting reports and declarations, renewing personnel records, calculating salaries;

- Reconciliation and other processes, including submission of responses to regulatory and supervisory services;

- Drawing up reporting documents and without data. Involved experts will provide you with information and technical support and protect you from further force majeure and emergency situations.

Based on the results of the procedure for restoring accounting and tax control, you will be able to:

- Analysis of documents and bringing them into proper form;

- Checking the accuracy of tax calculations, drawing up updated tax reports;

- Submission of updated accounting and tax reports for the specified period;

- Restoration of primary documentation, correction of the accounting database.

After accounting has been restored, you will be able to submit truthful reports to participate in competitions and tenders. Also, restored accounting will help you correctly assess tax risks.

Read the material on the topic: Remote accounting: pros and cons

Choosing a performing company: recommendations from experts

If it is discovered that there are problems with the company’s accounting, there are gaps in documentation and reporting, and so on. As a result, its restoration is required.

In this case, you should listen to the following advice from experts:

- Conclude cooperation agreements only with special companies. You should not trust the recovery procedure to “lone specialists.” Their services are most often useful to those who work under the simplified taxation system, but restoring accounting is not their specialty. To protect yourself as much as possible, you need to contact professionals who have the following advantages: they enter into a formal contract, compensate for possible losses, and can provide accounting support in the future;

- Seek independent free consultations. By the way, you can get them for free, for example, if you use online services;

- Control the accounting in your company. It is best to do this by uninterested outside specialists. This will eliminate the situation when detected abuses or violations are simply hushed up. It is worth using this method of control when the manager himself does not have sufficient knowledge in accounting. registration or is awaiting inspection by regulatory authorities.

Is it necessary to carry out an inventory when restoring accounting?

The Accounting Law and the regulations on its maintenance define situations in which inventory is a prerequisite:

- Renting out property;

- Purchase or sale of property;

- Reorganization or liquidation of the company;

- Reorganization of a state unitary enterprise or municipal unitary enterprise into other forms of ownership;

- Preparation of annual accounting reports;

- Change of founders or owners of the company (on the day of acceptance and transfer of affairs);

- Identification of facts of theft or damage to property, abuse of it (as soon as the facts have been established);

- Natural disaster, fire and other force majeure circumstances.

The inventory is ordered by order of the director of the company, who also appoints an inventory commission, which may include employees of the administration, accounting department and other experts capable of assessing the state of the company’s property and obligations. The order must indicate what kind of property and what obligations will be checked by a specific commission.

Before proceeding with the inventory, the accountant must provide the commission with accounting information fixing the list and price of the company's property. The accounting registers must indicate:

- Date and name of a particular business operation;

- The amount of a particular business transaction;

- Account balances at the beginning and end of the reporting period.

The chairman of the inventory commission endorses receipts and expenditures and makes a note on them “before inventory on (date).”

These papers help the commission determine the price of the company's property and liabilities at the time the inventory process starts. This information is entered into inventory records and acts (line “According to accounting data”).

An inventory list (act) is a document that reflects the results of the past inventory. Each type of property must be recorded in its own form.

The inventory of property is carried out with the participation of persons bearing financial responsibility for the property (storekeepers, cashiers). These employees are given receipts stating that the received assets have been capitalized, the released assets have been written off, and all primary documents for them have been submitted to the accounting department.

The inventory must be signed by all commission members and company employees who are responsible for the integrity and safety of the property. If the document is not endorsed by all these persons, the inventory results will be considered invalid. Inventory documents are stored in the company archives for at least five years.

The actual availability of property held by the company at the time of inventory is verified by simple counting, weighing and measuring.

If the inventory takes several days, the warehouses are sealed each time the commission leaves.

Before conducting an inventory of fixed assets, the following is checked:

- The fact of filling out inventory cards, books and inventories;

- Availability of technical passports and other documentation for assets;

- Availability of documents for assets handed over or leased.

During the audit, the commission will inspect the assets and enter into the inventory their full names, purpose, inventory numbers, basic operational characteristics and technical information. Inventory of real estate involves checking documents on ownership of them.

The inventory commission must enter information regarding the company's main assets into the inventory in form No. INV-1. If an asset has been reconstructed, modernized or re-equipped with a change in purpose, then it is entered into the inventory in accordance with the updated data.

Objects of the same type (machines, tools, household equipment, etc.) are included in the inventory in groups. Machines, equipment and vehicles are recorded separately, indicating serial numbers, registration data, year of manufacture, purpose, power, etc.

An inventory of fixed assets located outside the company at the time of the audit (for example, vehicles in transit or undergoing major repairs) is carried out until the moment of their departure.

The company's main assets that have fallen into disrepair and cannot be restored must be described separately. The document lists the dates when the objects were put into operation and the reasons why they fell into disrepair (damage, long service life, etc.).

Read material on the topic: Types of tax audits and their features

How to avoid mistakes when restoring accounting

Tip 1

When reconciling settlements with tax authorities, keep in mind that the figures reflected by the tax service on the personal account card and the amounts of taxes and fees accrued in accounting at the time of signing the reconciliation report may not coincide with each other. For example, a reconciliation report was received for December 31st. The accrual for the year in accounting is reflected using the final turnover for December of this year, and in the taxpayer’s personal account they will be accrued only at the time of their payment, that is, March 28 of the year following the reporting year.

Tip 2

During the accounting restoration procedure, do not allow yourself the mistakes that your predecessor made. Do not under any circumstances destroy documents that serve as the basis for restoring accounting records. Bring them together, add them to the consolidated register or list of types of documentation. You can find out how long primary documents should be stored in the List of Standard Documents approved by the Main Archival Directorate under the USSR Council of Ministers on August 15, 1988 (as amended on July 31, 2007), in Art. 17 of the Accounting Law of December 6, 2011 and Art. 23 of the Tax Code of the Russian Federation dated July 31, 1998 (as amended on December 28, 2016). These regulatory documents regulate the storage of papers generated during the work of state committees, ministries and departments, as well as other organizations and enterprises. Remember that the head of the company, as well as the chief accountant, bear full responsibility for the safety of primary documentation, accounting registers and reporting.

Tip 3

If you have accounting and tax reports in your hands, keep in mind that they may contain inaccurate information and errors. Also, after signing and submitting the documents, situations could arise that affect the information in them. In fact, the events that affect the final result are only those facts that were recorded after the reporting date, but before filing the reports. You cannot be sure that the previous owner took these circumstances into account. As an example of a fact that arose after the reporting date, one can cite dividends that were recommended or declared based on the results of the company’s activities, replenishment of the reserve fund from profits, or an unexpected loss of expensive material assets.

Tip 4

When you organize and conduct a control run, keep in mind that the leaders of the audited organizations, who want to hide the fact of violation or abuse, may persuade employees or use deceptive methods to adjust the conditions of the experiment in order to fabricate its results. Therefore, independent experts or a group of auditors should be involved to monitor and control the experimental conditions. Clause 39 of the regulation controlling accounting and reporting on the territory of the Russian Federation, which was approved by Order of the Ministry of Finance dated July 29, 1998 No. 34n, states that any adjustments to reporting documents for the current year and previous periods are carried out only in papers for a given reporting period (within which misrepresentations were recorded).

Calculations

Restoration of accounting records of companies under this item is formed from reconciliation acts in the accounting system and is reflected in account 60:

- debit – if there is an overpayment to suppliers;

- credit – if there is a debt to suppliers.

If an organization uses the services of only a few counterparties, then for detailed calculations it is recommended to open subaccounts separately for each counterparty.

All settlements with customers are reflected in account 62. The counterparty's debt is in debit, and overpayment is in credit. In the same way as with suppliers, settlements with each buyer can be carried out on a separate sub-account.

Maintaining and restoring accounting records for non-cash funds is carried out on the basis of data from bank statements. Residual balance on current accounts is reflected in DT51. If the organization has balances of currency assets, then they are taken into account up to DT52, converted into rubles at the Central Bank exchange rate on the date of the inventory. Cash on hand is reflected at DT50.

Restoration of accounting and reporting from the Pension Fund of the Russian Federation, Social Insurance Fund, and Compulsory Medical Insurance Fund is carried out based on reconciliation reports received from these institutions. All amounts are accounted for in account 69, to which corresponding sub-accounts are opened, reflecting settlements under the Unified Social Tax in the part transferred to the Social Insurance Fund, the federal budget, for health insurance and payments for contributions to the Pension Fund. The amounts reflected in the act must match those indicated in the payment documents from the bank. The identified discrepancies may be caused by the fact that funds appear in the budget account several days after they are transferred. There could be an error in the payment documents, then the funds are credited to another account. In any case, if deviations are identified, it is recommended to contact the Pension Fund or the Social Insurance Fund for clarification.

The balance on account 69 will be:

- Credit, if the amount of accruals exceeds the amount of payment.

- Debit if funds were transferred to the budget in advance.

- Zero if there is no overpayment and no debt.

Reconciliation acts with the Federal Tax Service will help you find out which taxation system your organization is on. The balance indicated in the documents should be reflected in the accounting system for account 68.

What happens if you don’t restore accounting?

Heads of companies and officials who carry out accounting in violation of the rules of accounting, distortion of information in reporting and violation of deadlines for its submission bear administrative and criminal liability.

In the absence of reporting or its unreliability, the following occurs: owners, directors and other affiliated persons (partners, creditors, counterparties) cannot obtain accurate information about the company’s operation and its financial position. If a company does not have an accounting system or primary documentation, additional taxes, penalties and fines will be assessed during a tax audit.

Due to the lack of accounting registers or primary documentation, you will not be able to exercise control over the safety of commodity and material assets, money and other assets of the company, as well as promptly receive reliable information about the procedure for settlements with creditors and debtors. However, most importantly, the lack of full-fledged accounting will not allow you to present arguments in your defense in response to tax claims during an appropriate audit.

If the amount of taxes not paid within three years approaches two million rubles, the company’s management will face not only penalties, but also criminal liability (Article 120 of the Tax Code of the Russian Federation).

Read material on the topic: Tax fines for individual entrepreneurs: types, features, conditions

Examination

As you know, it is easier to prevent the problem so as not to waste time and money on restoring accounting and tax records. To do this, it is enough to conduct a small express test - compare the reporting data with the information in the program. If deviations are found, it means that the records are being kept with errors. The consequences can be unpredictable: from a counter inspection to the disqualification of a manager.

Mistakes can be made for various reasons: change of employee, lack of documents, department workload. Be that as it may, it is better to restore accounting and tax records in a timely manner. This will avoid penalties for non-compliance with the law and will increase the efficiency of the organization as a whole. Do not forget that the manager bears administrative or criminal responsibility for maintaining records in the organization.

What is the cost of restoring accounting per year?

The cost of restoring accounting is directly dependent on its volume, the duration of the period during which accounting was kept incorrectly or was not kept at all, as well as the scale of document flow and timing of work. In addition, the cost of services is influenced by the tax regime applied by the customer organization (the main tax system or “simplified tax system”), the fact of foreign trade transactions with currency, the availability of loans and borrowings, complex production processes, a large number of items, etc.

Since there are so many indicators that influence the price of accounting restoration, it is impossible to calculate even the approximate cost of services in advance. In some cases, restoring accounting will cost 19 thousand rubles, in others - three times less or significantly more. The cost can be clarified by specialists who will familiarize themselves with your situation in detail.