From 2021, SZV-STAZH is filled out according to new rules. They were approved in September 2021 by PFR Resolution No. 612p dated September 2, 2020, and when filling out the SZV-STAZH in 2021, they must be taken into account.

Let us remind you that from 2021, insurance premiums are administered by tax inspectorates. She also accepts the corresponding calculations for them. But some of the personalized reporting remained under the jurisdiction of the Pension Fund. Employers fill out the SZV-STAZH once a year. We'll tell you how to do it correctly.

Why did you enter the report?

Resolution of the Board of the Pension Fund of the Russian Federation No. 507p dated December 6, 2018 explains in detail what it is and who takes the SZV-STAZH in 2021. A form has been developed in accordance with paragraph 2 of Art. 8 Federal Law of April 1, 1996 No. 27 “On individual (personalized) accounting in the compulsory pension insurance system.” This report is necessary to collect information about length of service and contributions, which will be reflected in the future on the individual personal accounts of the insured persons, on the basis of which an insurance pension is then assigned.

How to fill out the SZV experience in SPU ORB in 2020 - Citizens' rights

In this mode, information about the experience of SZV-K is entered.

When entering this mode, we find ourselves in the following window.

As you can see, the upper half of the window is actually the same personal data. They can also be viewed, edited and deleted, just like personal data.

The lower half of the window represents the actual information about the experience.

When you select an employee in the upper table, ONLY information about the length of service of THIS EMPLOYEE will be displayed in the lower table.

The first column in the table with individual information also serves to mark individual people, who can then be uploaded to PFR packs.

At the bottom of the window, the “Add” button is used to enter new information, the “Change” button is for editing already entered information, the “Delete” button is for deleting information, and the “Print” button is for printing the information on which the cursor is located.

When entering the adding or editing mode, we find ourselves in the following window.

This window has two tabs: “Basic data” and “Total preferential length of service”.

In the “Basic Data” tab, you enter data on the type of information, conditions, total length of service, enterprise and length of service in these enterprises.

In the “Total preferential length of service” tab, enter data on the employee’s total preferential length of service.

First of all, here we enter the organizations from the work book. To do this, click the “Add” or “Change” button for the already entered organizations. The window will look like this: Here the number is filled in in order (set automatically), the name of the organization and the type of activity (by default: WORK). The name of the organization can be selected from the directory.

If the required organization is not in the directory, then when you enter a new organization in the “Name of Organization” field, the entered organization will automatically be added to the directory of organizations, i.e.

It is enough to write a new organization manually once and subsequently you can select it from the directory.

After entering all the information, click the “Accept” button.

Next, after entering the organization, you need to fill out the length of service in this organization. To do this, click the “Experience in the organization” button. The window will look like this.

The length of service is entered in the same way as in the SZV-4 forms.

After entering the length of service, exit using the “Exit” button. In this case, the total and preferential total length of service will be recalculated. The total length of service is on the “Basic data” tab, and the preferential length of service is on the “Total preferential length of service” tab. It can be edited manually if necessary.

When you go to the “General preferential length of service” tab, we get the following window.

Here, experience is presented by type of experience (territorial conditions, special working conditions and length of service), which is highlighted in the appropriate color. Within the experience type, it is divided by experience code. By clicking the “Calculation” button, you can recalculate the entire total and preferential length of service. You can also change your experience manually using the “Add”, “Change” and “Delete” buttons. When editing the experience, we get the following window.

Here we enter the type of experience, the experience code and the experience itself. After this, save the experience by clicking the “Accept” button.

This completes the introduction of SZV-K.

SZV-STAZH supplementary: in what cases

Current as of: March 19, 2021

We talked about when the SZV-KORR form is submitted in our consultation. Why do you need the supplementary SZV-STAZH form and in what cases is the supplementary SZV-STAZH submitted?

SZV-STAZH: complementary form

The SZV-STAZH form, in which in the “Information Type” position it is not “Initial” and not “Pension Assignment”, but “Additional”, is considered a supplementary SZV-STAZH form.

In what case is the complementary work experience filled out?

In what cases the supplementary SZV-STAZH is submitted is indicated in clause 2.1.5 of the Filling Out Procedure, approved. By Resolution of the Pension Fund of January 11, 2017 No. 3p.

Thus, the SZV-STAZH form with the “Additional” type is submitted to insured persons, the data on which, presented in the form with the “Initial” type, is not taken into account on individual personal accounts due to an error contained in them.

In other words, the initial information of SZV-STAZH was submitted, but was not taken into account on the individual personal accounts of the insured persons due to:

- errors in the full name and SNILS of the insured persons;

- lack of necessary indicators.

Therefore, it is necessary to submit a supplementary SZV-STAZH, including the workers for whom errors were identified.

When passing the SZV-STAZH with the “Additional” information type, you must also submit an inventory according to the EDV-1 form with the “Initial” type.

Supplementary form SZV-STAZH: will there be a fine?

Source: https://konsaltdo.ru/kak-zapolnit-szv-stazh-v-spu-orb-v-2020.html

Who rents

All economic entities that have employees are required to submit reports to the Pension Fund. Not only organizations, but also individual entrepreneurs, lawyers, notaries, and detectives are required to submit it.

IMPORTANT!

Having an employment contract with an employee is not the only condition. A report should be submitted to the Pension Fund for employees working under civil contracts, as well as under copyright contracts and licensing agreements.

Reporting is generated not only for working citizens. You will also have to report on the unemployed. The responsibility falls on government agencies. The Employment Center reports to the Pension Fund on citizens officially recognized as unemployed.

IMPORTANT!

If the organization’s staff includes a manager, who is also the only founder, then you will still have to submit a SZV-STAZH.

Form

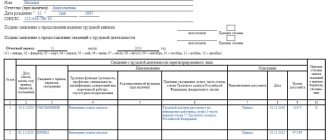

The report, the form of which was approved by Resolution of the Board of the Pension Fund of the Russian Federation No. 507p dated December 6, 2018, contains 5 sections:

- information about the policyholder - the organization that submits the report;

- reporting period;

- information about the periods of work of insured persons - the tabular part of the report, which describes information separately for each employee;

- information on accrued insurance contributions to the Pension Fund;

- information on pension contributions paid under early non-state pension agreements.

In addition to the form, the Resolution of the PFR Board approved the procedure for filling it out. In 2021, this procedure has undergone minor changes: a new code “VIRUS” has been introduced, which is entered in column 10 if the corresponding codes are entered in columns 9 or 12. This code is used when filling out reports regarding employees of medical organizations and their departments working with COVID -19.

Otherwise, the procedure for filling out the SZV-STAZH form has not changed.

Made a mistake? Use free instructions from ConsultantPlus experts to correctly fill out and submit the correction form. If you don't do this on time, you will pay a fine.

to read.

Due dates

The form must be submitted no later than March 1 of the year following the billing period. Since in 2021 March 1 is a Monday, a working day, the deadline for submitting the report will not be postponed. The report must be submitted no later than March 1, 2021.

We recommend preparing and sending information to the Pension Fund in advance. This will protect the institution from penalties. If an error is discovered in the reporting, there is time to correct it and submit an adjustment report. Otherwise, the organization will be punished with a ruble.

| Employee category | Deadline and where to apply |

| Current employees | Until 03/01/2021 - to the Pension Fund of Russia (*within five days from the date the request was received by the employee) |

| Those working under civil contracts (in case of calculation of insurance premiums) | |

| Fired in 2020 | |

| Those leaving in 2021 | In the hands of the resigning employee on the day of dismissal + to the Pension Fund of the Russian Federation in the next reporting period (until 03/01/2022) |

| All employees during liquidation and reorganization of the enterprise | In the hands of those dismissed on the day of dismissal + to the Pension Fund of the Russian Federation within one month from the date of the interim liquidation balance sheet or transfer act |

| Retiring | To the Pension Fund of the Russian Federation within three calendar days from the date of the employee’s application for a pension |

| Individual entrepreneur without employees | They don't rent |

Submission of the SZV-STAZH report to the Pension Fund of the Russian Federation is possible only together with the EDV-1 form, which contains information on the policyholder.

Software

Program for preparing reporting documents for the Pension Fund of Russia "Spu_orb" version 2.93 according to forms ADV-1, ADV-2, ADV-3, ADV-8, ADV-9, SZV-1, SZV-3, SZV-4-1, SZV-4 -2, SZV-6-1, SZV-6-2, SZV-6-3, SZV-6-4, SPV-1, SPV-2, ADV-10, ADV-11, ADV-6-4, SZV -K, SZV-SP, DSV-1, DSV-3, RSV-1, RSV-2, RV-3, SZV-M, ODV-1, SZV-ISKH, SZV-KORR, SZV-STAZH, application for appointment pensions, birth information, death information.

The “Spu_orb” program provides the ability to prepare reporting documents for submission to the Russian Pension Fund.

Here you have the opportunity to enter, print and upload bundles of documents for the Pension Fund. The program works with the following forms of documents: Questionnaires of insured persons: ADV-1 Application for exchange of an insurance certificate: ADV-2 Applications for the issuance of a duplicate insurance certificate: ADV-3 Information about death: ADV-8, Information about birth, Information about death Individual information : SZV-1, SZV-3, SZV-4-1, SZV-4-2, SZV-6-1, SZV-6-2, SZV-6-3, SZV-6-4, SPV-1, SPV -2, ODV-1, SZV-ISKH, SZV-KORR, SZV-STAZH

Special Moments

Providing pension information in the SZV-STAZH form has a number of characteristic nuances. Here are the instructions for filling out the SZV-STAZH in 2021:

- Submit the report even if there were no accruals in favor of the insured persons during the reporting period. The regulation mainly affects companies whose staff includes a manager who is the only founder. In other situations, when there have been no accruals for a long time, you will have to submit information in any case.

- If during the reporting period your organization has already submitted data to the Pension Fund of the Russian Federation on an employee (for example, the employee retired in May), then still include it in the annual report. Otherwise, discrepancies will arise in the database of the controlling fund, and the lack of information will entail the imposition of an administrative penalty on the company.

- If in the reporting year citizens from places of deprivation of liberty were involved in work in the organization, then they should also be included in the reporting. Request the necessary information about prisoners in FSIN institutions. Periods of work will be included in the length of service on the basis of Art. 1 of Law No. 27-FZ of 04/01/1996.

- If there are no employees on the staff of an individual entrepreneur, but the functions of the head of the company are performed by the merchant himself under a contract, there is no need to submit data to the Pension Fund. This is all explained by the fact that individual entrepreneurs independently calculate and pay insurance premiums for their own benefit. Therefore, there is no need to submit information about the individual entrepreneur’s experience.

Be sure to check whether the listed exceptions occur in the activities of your organization.

Filling out the 2021 CORR SZV: instructions, sample, example

Starting from 2021, filling out the CORR SZV is carried out according to new rules.

What has changed - read the article, here is everything about filling out the report, sample documents, free reference books for 2021 and useful links.

The SZV KORR form is an independent reporting form that is designed specifically for adjusting data for past periods. It must be submitted if you make changes to your reporting. From January 1, 2021, the new form and rules were approved by Government Decree No. 507p dated December 6, 2018.

You will have to submit information on this form to the Pension Fund if an error has crept into the submitted personalized reporting for previous periods. The following documents and reference books will help you prepare the report correctly and submit it to the Pension Fund on time.

Download for free: Download for free Complies with all legal requirements Complies with all legal requirements Find out how to report in 2021.

Delivery format

The type of reporting to the Pension Fund of the Russian Federation directly depends on the average number of employees.

If a company employs 25 people or more, the SZV-STAZH report must be filled out online on the Pension Fund website and sent electronically; a paper report will not be accepted. For non-compliance with the reporting format requirements, separate administrative measures are provided.

If the number of the company does not reach 24 people, then calmly report on paper. The company has the right to simplify and speed up document flow with regulatory authorities by switching to electronic data exchange, that is, sending reports electronically.

IMPORTANT!

To generate electronic reporting, you will need a special enhanced digital signature. It should be issued in the name of the manager or another responsible person vested with the appropriate authority (signature authority).

An electronic signature that does not meet the current requirements for cryptographic information protection is not used to sign electronic reports. The Pension Fund of Russia will refuse to accept such a report.

Separate divisions: how to report

Check that two prerequisites are met:

- Who calculates and pays wages to employees of the department.

- Does the separate division have a separate current account?

If a separate division has opened an independent current account in any banking organization (with the Federal Treasury for public sector institutions), and the OP independently calculates wages and pays them from its current account in favor of employees, then you will have to submit a separate SZV-STAZH for the separate division .

The rule only applies if two conditions are met simultaneously. If only one of the above conditions is met, then the parent agency is required to report.

Filling out SZV-STAZH for a separate unit has several nuances:

- Information must be submitted to the territorial office of the Pension Fund at the location of the separate unit.

- The report should indicate the registration number of the policyholder that was assigned to the separate unit upon registration with the Pension Fund of Russia.

- Fill out the checkpoint and tax identification number in the same way as the registration number. Indicate the values that were assigned to the separate division, not the parent organization.

How to make a report to the Pension Fund of the Russian Federation in the spu_orb program?

To enter data, generate a report and upload data to magnetic media, you will need the latest version of the Spu_orb program, which can be downloaded and used for free without fear of inspections by regulatory authorities.

Spu_orb is an official program from the Pension Fund of the Russian Federation. Distributed free of charge. Designed for filling out reporting forms to the Pension Fund. Allows you to fill out the forms: DSV-1, DSV-3, ADV-1, ADV-2, ADV-3, ADV-8, ADV-9, ADV-10, ADV-11, RSV-1, RSV-2, RV- 3, SPV-1, SZV-6-1, SZV-6-2, SZV-1, SZV-3, SZV 4-1, SZV 4-2, SZV-K. The program is written and supported by the Orenburg branch of the Pension Fund of Russia.

The work of “Spu_orb” is shown using a simple example of preparing annual reports for an individual entrepreneur without employees.

1. Install the latest version of “Spu_orb”

Download, unpack and install the latest version of Spu_orb (If you already have it installed, you can see the program version in the very top line of the window or in the top menu - “Help” - “About the program”). During installation, you will be able to select the version of the installed KLADR - select KLADR for all Russia. Launch the program.

2. Entering details.

Now you need to enter your details (or someone else’s, if you are going to submit reports for several individual entrepreneurs or organizations). To do this, in the top menu, click “Settings” and “Company details”.

On the first tab, do the following:

- ABOUT.

- Enter your registration number in the Pension Fund of the Russian Federation (it can be found in the Notice of registration of an individual in the territorial body of the Pension Fund of the Russian Federation at the place of residence - you were given it when registering an individual entrepreneur with the registering tax office or in the Pension Fund of the Russian Federation)

- Enter your full name

- Enter your insurance number (SNILS)

- Enter your year of birth

- Enter your TIN

- Enter your registration number in the TFOMS (you can find it in the Certificate of Registration of the policyholder in the territorial compulsory health insurance fund for compulsory health insurance - you were given it when registering an individual entrepreneur with the registering tax office or in the TFOMS).

- Enter your OGRNIP number (you can find it in the Certificate of Registration of an individual as an individual entrepreneur - you received it when registering an individual entrepreneur with the registering tax office).

- Enter your codes for OKATO, OKPO, OKOPF, OKFS (they can be found in the Notification of assignment of statistical codes, which you received when registering an individual entrepreneur with the registering tax office or Rosstat) and the main OKVED - it is in the Extract from the Unified State Register of Individual Entrepreneurs, which you received when registering as an individual entrepreneur)

- Enter your legal form and contact phone number

- Enter the main taxpayer category: individual entrepreneur

Go to the "Officials" tab

- In the line “Position” write “IP” (or “individual entrepreneur”), in the line “Last name and initials” - your last name and initials.

Go to the "Business Address" tab.

- Fill in the “Zip Code” and “Country” lines. To fill in the lines “Region”, “District”, “City”, “Settlement” and “Street”, you need to click on the button with three dots and select the desired option (instead of writing everything manually). Fill out the lines “House”, “Building” and “Apartment”.

Details are filled in. Click the "Save" button.

3. Data entry for SZV-6

- In the top menu, click “Data Entry”, then “Individual Information”, then “SZV-6 Forms”.

- In the window that opens, click the “Add” button.

- In the window that opens for entering personal data, click on the “Transfer data from enterprise details for individual entrepreneurs” button. This will transfer your insurance number and full name. Fill out the remaining lines (TIN, Gender, Date of Birth, Locality, District, Region, Telephone).

- If your residential address differs from your registration address, go to the “Actual Address” tab and enter your address. Click the "Save" button

- Now click on the “Add” button which is located in the middle of the left menu.

- In the window that opens, in the “Calendar year” line, select the year for which you are reporting, in the “Reporting period” line - your reporting period (“0 - year 2010”), in the “Payer category” line, select “Personal Individual”.

- Go to the “Basic and preferential experience” tab and click on the top “Add” button.

Source: https://www.vseznaniya.ru/useful/business/726-pfrrf

Filling rules

Instructions on how to fill out the SZV-STAZH are as follows:

Step 1. Fill out section No. 1.

In the information about the policyholder we indicate:

- registration number;

- INN of a legal entity is 10 digits, dashes are placed in the last two cells of the form;

- KPP - reason code for registration;

- name of the insured organization.

The type of information is marked based on the following conditions: if the information is submitted for the first time - “initial”, in case of errors in the initial data - “additional”, when assigning a pension to the insured person (accounting for the data of the reporting period (year), for which the SZV-STAZH form is still not submitted) - “appointment of pension”.

Step 2. Fill out section No. 2.

Enter the year of the billing period. In our case, this is 2021.

Step 3. Fill out section No. 3.

Columns 6 and 7 “Operation period” are filled out within the reporting period. If the report is submitted for 2021, then the dates are indicated only within this year (from 01/01/2020 to 12/31/2020). If work is carried out under two contracts (labor and civil partnership), both periods are indicated on different lines. When assigning a pension, column 7 indicates the date of expected retirement.

Columns 8–13 of Section 3 are filled out according to the classifier (appendix to the procedure for filling out the SZV-STAZH form).

Columns 9, 12, 13 of Section 3 are filled in if special working conditions are documented; the employee’s employment in special conditions complies with the requirements of current regulatory documents; there is payment of insurance premiums at an additional tariff or pension contributions in accordance with pension agreements for early non-state pension provision.

If it is necessary to display more than one code at the same time, they are indicated in two lines.

Step 4. Fill out sections No. 4 and No. 5.

The answer to the question whether or not to fill out paragraph 4 in SZV-STAZH and paragraph 5 of this report depends on the type of information specified earlier - these sections are filled out only for the form where the type of information is “Pension assignment”.

The preparation of the final details looks traditional - the name of the position of the responsible person, signature, transcript of the signature, date and seal.

Example of filling out SZV-STAZH:

How to make a SZV experience report on SPU Orb

New form of the annual report to the Pension Fund of Russia Deadlines for submitting SZV-STAZH Example of filling out the SZV-STAZH report Resolution of the Board of the Pension Fund of the Russian Federation dated December 6, 2018 No. 507p approved a new form of the annual report - SZV-STAZH.

The resolution also provides the procedure for its preparation.

All insurers, without exception, are required to submit this report to the Pension Fund for each working (insured) individual - both for individuals with whom employment contracts have been signed, and for those employed under GPC agreements.

The updated SZV-STAGE form, submitted in 2021 based on the results of 2020, can be downloaded from the link below. SZV-STAZH 2021 The business entity-insurer submits a new report to the Pension Fund with the accompanying report - EDV-1, the form of which is also updated by Resolution No. 507p.

These reports are linked to each other and are presented as a single package.

How to make a report to the Pension Fund of the Russian Federation in the spu_orb program?

To enter data, generate a report and upload data to a magnetic medium, you will need the latest version of the Spu_orb program, which you can use without fear of inspections by regulatory authorities. Spu_orb is an official program from the Pension Fund of the Russian Federation.

Distributed free of charge. Designed for filling out reporting forms to the Pension Fund. Allows you to fill out the forms: DSV-1, DSV-3, ADV-1, ADV-2, ADV-3, ADV-8, ADV-9, ADV-10, ADV-11, RSV-1, RSV-2, RV- 3, SPV-1, SZV-6-1, SZV-6-2, SZV-1, SZV-3, SZV 4-1, SZV 4-2, SZV-K. The program is written and supported by the Orenburg branch of the Pension Fund of Russia.

The work of “Spu_orb” is shown using a simple example of preparing annual reports for an individual entrepreneur without employees.1. Installing the latest version of “Spu_orb”, unpack and install the latest version of Spu_orb (If you already have it installed, you can see the program version in the very top line of the window or in the top menu - “Help” - “About the program”).

Sample of filling out SZV-STAZH and ODV-1

Copyright: Lori's photo bank The SZV-STAGE form is being submitted by employers for the first time this year.

A report on the length of service of employees for 2021 must be submitted to your Pension Fund office at the place of registration of the policyholder no later than March 1, 2021. Explanations on how to fill out the SZV-STAZH, a sample of filling out the report and the accompanying list of EDV-1 can be found in our material.

The employer’s obligation to annually report on insured persons within the framework of personalized accounting is provided for in paragraph.

Instructions for filling out the SZV corr for 2021 in the SPU orb

> > The third type is needed when the filler has not added information about the employee to the reporting.

Let's look at the step-by-step procedure for filling out the SZV CORR form. It consists of 6 sections. Sections 1-2 are completed for all three types of forms.

You can find the form in the Resolution of the Pension Fund Board of January 11, 2017 No. 3p (Appendix 3). In addition, it can be downloaded from the Pension Fund website. To do this, go to the “Employers” section, click on the “Free programs, forms, protocols” link.

For example, in 2021, an accountant discovered incorrect information about an employee in reporting to the Pension Fund for 2021.

SZV-experience: sample of filling out reports

/ / / 7, In 2021, SZV-STAZH new reporting for all employers was introduced. The author of its creation was the Pension Fund, since when the administration of social contributions was transferred to the Federal Tax Service, the fund stopped receiving information about the length of service of employees.

This year, a new form must be handed out to resigning employees, but starting from 2021, all business entities must report on it.

articles

Until 2021, organizations and entrepreneurs submitted a RSV-1 report to the Pension Fund, from which the body received information about the guardianship of the insured persons.

SPU orb program

Depending on the type of the SZV-KORR form, certain sections indicated in the table are filled out: Form type Sections to be filled out in the form SZV-KORR form with the “KORR” type Sections 1-3 and at least one of the sections 4-6 of the form.

Only the data specified in sections 3-6 of the form are corrected: Section 4, columns 1-6 - data on earnings (remuneration), income, amount of payments and other remunerations of the insured person REPLACE the data recorded on the ILS AP Section 4, columns 7-13 - data on accrued and paid insurance premiums SUPPLEMENT the data recorded on the ILS of the AP Sections 5 - 6 - REPLACE the data recorded on the ILS of the AP Form SZV-KORR with the type “OTMN” Only Section 1 and Section 2 are subject to completion - the data recorded on the ILS for reporting period, which is being adjusted Form SZV-KORR with the type “SPECIAL” Sections 1-3 must be filled out - data on “forgotten” employees is entered Territorial conditions (code), Special working conditions (code), Calculation of length of service, Conditions for early assignment of labor pensions - Filled out in accordance with the Classifier of parameters used when filling out information for maintaining individual (personalized) records (Appendix to the Resolution of the Pension Fund of the Russian Federation Board of January 11, 2017 No. 3p).

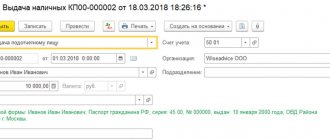

Registration of SZV-STAZH in 1C and other programs

submitted annually, the first time it will be submitted to the local Pension Fund before March 1, 2021, with the exception of cases and.

Organizations that have labor relations with more than 25 employees and contract workers during the reporting period are required to submit the form electronically. and need information about salary, etc.

payments to insured persons, periods of work and corrective information. Bukhsoft online - the program allows you to freely test reports sent to government agencies, including the Pension Fund of Russia in accordance with its technical requirements. Program:

- provides technical support, guarantees and instant updates when introducing new forms, as is the case with the SZV-STAZH form.

- performs automatic calculation;

- is a universal and simple solution for an accountant;

- covers all reporting submitted by legal entities and individual entrepreneurs;

- forms everything automatically;

When using the paid version of the program, the user can:

Software

Program for preparing reporting documents for the Pension Fund of Russia "Spu_orb" version 2.93 according to forms ADV-1, ADV-2, ADV-3, ADV-8, ADV-9, SZV-1, SZV-3, SZV-4-1, SZV-4 -2, SZV-6-1, SZV-6-2, SZV-6-3, SZV-6-4, SPV-1, SPV-2, ADV-10, ADV-11, ADV-6-4, SZV -K, SZV-SP, DSV-1, DSV-3, RSV-1, RSV-2, RV-3, SZV-M, ODV-1, SZV-ISKH, SZV-KORR, SZV-STAZH, application for appointment pensions, birth information, death information.

The “Spu_orb” program provides the ability to prepare reporting documents for submission to the Russian Pension Fund.

Here you have the opportunity to enter, print and upload bundles of documents for the Pension Fund.

The program works with the following forms of documents: Questionnaires of insured persons: ADV-1 Application for exchange of an insurance certificate: ADV-2 Applications for the issuance of a duplicate insurance certificate: ADV-3 Information about death: ADV-8, Information about birth, Information about death Individual information : SZV-1, SZV-3, SZV-4-1, SZV-4-2, SZV-6-1, SZV-6-2, SZV-6-3, SZV-6-4, SPV-1, SPV -2, ODV-1, SZV-ISKH, SZV-KORR, SZV-STAZH

We fill out and submit the SZV-STAZH form to the Pension Fund of Russia

Didukh Yulia Author PPT.RU January 24, 2021 The SZV-STAZH report is a relatively new format for reporting to the Pension Fund.

Employers must submit this form annually.

A new form has been approved for reporting for 2021. Let's take a closer look at the procedure for drawing up a report for the Pension Fund; the current sample can be downloaded for free.

ConsultantPlus TRY FOR FREE The reporting procedure for Russian organizations and individual entrepreneurs who are insurers of their employees in pension, social and medical insurance has changed significantly since 2021. The administration of insurance funds is now handled by the Federal Tax Service of Russia, which accepts a new unified calculation from contribution payers.

However, funds that retained a number of their functions also introduced new reports. In particular, the Pension Fund adopted, which approved four new forms at once.

But in 2021, the forms have been adjusted.

Programs for filling out SZV-STAZH: 1C, SPU ORB, PFR, ZUP and others

Online application Full name (required) Phone (required) Question (required) The SZV-STAZH report is submitted annually, the first time it will be submitted to the local Pension Fund before March 1, 2021, with the exception of cases of liquidation of the organization and retirement of the employee. Organizations that have labor relations with more than 25 employees and contract workers during the reporting period are required to submit the form electronically.

To fill out this form, organizations and individual entrepreneurs need information about salary, etc.

payments to insured persons, insurance premiums, periods of work and corrective information. Bukhsoft online - the program allows you to freely test reports sent to government agencies, including the Pension Fund of Russia in accordance with its technical requirements.

The program: covers all reporting submitted by legal entities and individual entrepreneurs; is a universal and simple solution for an accountant; generates everything automatically; carries out

> > Reproduction in the spu_orb program of the entire database for periods starting from 2010, for which in the “Service” - “Data Import” mode, the ability to import (download) files (XML, DBF format) for various reporting periods is implemented (Fig.

12). Reproducing in the spu_orb database only the amount of debt for insurance premiums in the context of insured persons, which arose at the beginning of the current reporting period, for which in the “Service” mode - “Data import” - “Debt SZV-6 according to the Pension Fund of Russia” (Fig.

2) the ability to download the amount of debt at the beginning of the period for insured persons for documents SZV-6-1 and SZV-6-2 from a special file with data on the policyholder on the amount of existing debt in the context of insured persons has been implemented. Rice. Info RSV-1: Formation and printing ATTENTION!

For the 1st quarter of 2012, the amounts indicated in the tables of the RSV-1 report (with the exception of some lines) are indicated in rubles and kopecks!!!

You might also be interested in:

Source: https://em-an.ru/kak-delat-otchet-szv-stazh-na-spu-orb-70519/

Filling out a report upon dismissal

Upon dismissal, the employee is issued a SZV-STAZH only with his personal data (clause 4 of article 11 of Law No. 27-FZ). If this requirement is violated, Rostrud will impose a fine (key provisions are posted on the Rostrud website).

IMPORTANT!

It is advisable to keep a log of issued forms so that written confirmation from the employee of receipt of the document is preserved.

The SZV-STAZH is filled out for a resigning employee in almost the same way as for existing employees. The differences concern only two points:

- the first is filling out the reporting period (if leaving in 2021, indicate the current year);

- the second is column 7 in part 3 (the last working day or the date on which the contract (labor or civil law) was terminated is entered in this column).

Here is an example of filling out SZV-STAZH when dismissing an employee in 2021:

Seeing you off to retirement

When applying for a pension, an employee must submit information to the Pension Fund using the SZV-STAZH form. The filing deadline is within three days from the date of receipt of a written application from the employee. Consequently, the future pensioner is required to submit an application to the employer. There is no unified application format; draw up the document in any form. For example, it looks like this:

An example of filling out a report when registering an employee for retirement:

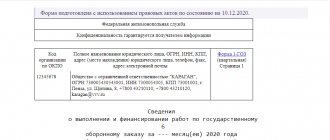

How to fill out the accompanying inventory

You cannot send the SZV-STAZH form alone to the Pension Fund. It is mandatory to fill out an accompanying list of submitted documents. Without it, the report will be returned. For the inventory, use the unified form EDV-1.

Form EDV-1 was approved by Resolution of the Board of the Pension Fund of the Russian Federation No. 507p dated December 6, 2018 and has not changed in 2021.

The structure of the accompanying inventory contains five sections:

- Details of the policyholder. We fill in the same order. We indicate the registration number of the organization or separate division. Then enter the tax identification number and checkpoint. And only then enter the short name of the organization.

- Reporting period. We indicate for what period we submit information to the Pension Fund. We select the type of information from the proposed options: initial, corrective or canceling.

- List of incoming documents. It is necessary to indicate the number of insured persons for whom information is sent to the regulatory authority.

- Data on the policyholder on the presence of debts on insurance, funded pensions and other tariffs of insurance contributions. The report contains a separate table to reflect information about debt repayment.

- Section to reflect the grounds for early receipt of a pension.

The accompanying inventory is signed by the head of the insured organization. Or another responsible person vested with appropriate authority.

Filling out EDV 1 for 2021 in the Orenburg program

Next, go again to the EDV-1 tab on the left and change the “Document Type” from SZV-KORR to SZV-STAZH.

Fill in the year again and 0 for outgoing. Click “Save.” Next, we upload the data. In the program “Upload (button at the top) - upload individual information - Upload ODV-1, SZV-STAZH….

Both SZV-STAZH and ODV-1 should be printed and recorded in 1 file. Good afternoon, SZV EXPERIENCE is not done in 1C ZUP? Do I need to additionally download the program?

Reply with quotation Up ▲

- 02/06/2018, 00:42 #17 Message from yater To pass SZV-STAZH, you need to pass 2 forms, SZV-STAZH itself and EDV-1. We go to Spu_orb and click “Data Entry” (top left) - “Individual Information” - Forms EDV-1, SZV-STAZH……….We get to the “Document Package” window Button - Add. “Document type” - SZV-STAZH. We fill in the reporting years and 0 is the original. Go to the SZV-STAGE tab at the top right. There are employees here.

Extract from the form

How to punish for violations and mistakes

Fines are provided for under Article 17 of the law on personal registration of insured persons and under the Code of Administrative Offenses.

| Violation | Fine |

| The report was not submitted on time | 500 rubles for each insured person |

| An error was made | 500 rubles for each employee whose information is found to contain errors |

| The format for providing information in electronic form is broken | 1000 rubles |

| The procedure for submitting SZV-STAZH when registering an employee for retirement was violated | 50,000 rubles (Part 1 of Article 5.27 of the Administrative Code) |

IMPORTANT!

Information from the SZV-STAZH reporting must coincide with the monthly SZV-M form and the quarterly DAM. If information about the employee was not received by the Pension Fund on a monthly basis, then the controllers will have a discrepancy. There is a fine for failure to provide information. The form and sample for filling out the SZV-M report (experience) can be found in the special material “Submitting reports: instructions for filling out the SZV-M.”