“TORG-4” is the primary accounting document that is consulted when the ordered products are delivered to the buyer’s storage facility without accompanying documentation, or its contents are incomplete for various reasons.

If the enterprise is faced with such a situation, then the person in charge of storage must accept the cargo. In the absence of an invoice or consignment note, accounting will not be able to determine what price should be set when registering the cargo, and what is the total cost of the delivered products. Then you need to fill out a special form called “Act of acceptance of goods received without a supplier’s invoice,” which is intended to reflect the quantity of goods arrived from the counterparty.

- 1 When and what is it used for?

- 2 Rules for drawing up the TORG-4 act

- 3 The importance of the document for accounting

- 4 Videos on the topic

When to use the TORG-4 act Certificate of acceptance of goods received without a supplier’s invoice

There are cases when suppliers bring goods to an organization without accompanying documents , and it turns out that it is registered with the company in safekeeping. Sometimes papers for invoice valuables are still found and transferred later, but most often the documents never arrive, or they exist, but not in full. And then it will not be possible to establish what price to assign to the product after capitalization, and what the cost of the entire delivery will be.

The TORG-4 act is intended to help in this situation, so that a warehouse employee can take into account the supply and determine the values for storage before prices and other data are known. Form TORG-4 reflects the actual availability of delivered goods.

Basically, an act in the TORG-4 form comes in handy when delivering goods by rail or water transport , since here the absence of a package of accompanying documents has become a fairly common occurrence.

The goods arrive, but the only paperwork contains instructions for its transportation.

Section 2. Retail services

The section is similar to the previous one. Enter amounts to the decimal place. Disclose retail information here. Indicate the total turnover on line 01 in column 4. And the breakdown by group - in lines 02-185. Please note: some lines reveal other lines. For example, in line 02 indicate turnover for food products. From line 02 to line 03, highlight fresh fruits and vegetables. And from line 03, select the turnover for potatoes - 04 and vegetables - 05.

Section 2 contains subsection 2.1. Only gas station owners fill it out. You need to indicate the number of multi-fuel and gas filling stations in lines 02 and 03, respectively. The total number of stations appears in line 01.

Who fills out the TORG-4 act

For the competent and legal drawing up of the TORG-4 act, it is necessary to assemble a commission consisting of at least three people , the participants of which must be an employee of the enterprise financially responsible for the property he has accepted, and a representative of the supplier of these goods (for example, the delivery driver). After the meeting, all members of the commission sign an act drawn up on the basis of the supply agreement and the order on the creation of the commission, on the first page of which the director of the recipient organization puts the stamp of approval. Next, a copy of the act goes to the accountant, a second copy to the supplier, and a third to the employee who accepted the delivery.

Is it necessary to use a unified form?

The form was developed by Resolution of the State Statistics Committee of Russia No. 132 of December 25, 1998. The use of this form is optional. Companies have the right to develop their own form for recording discrepancies (inf. Ministry of Finance of Russia No. PZ-10/2012 dated December 4, 2012, letter of the Federal Tax Service of Russia No. ED-4-2/11941 dated June 23, 2014).

It is recommended that the form developed independently be approved as one of the annexes to the supply agreement.

An approximate example of a simple act of discrepancies upon acceptance of goods, developed and approved independently:

| ACT on establishing discrepancies in quantity upon acceptance of goods from "___"_____________ 20__ Name of company _________________________________________________________________ Taxpayer Identification Number______________________________________________________________________________ Place of drawing up the act ___________________________________________________________________________ in the presence of a representative ________________________________________________________________ (certificate No. ________________ dated “___”______________ 20__) Received the goods and established:

Number of places according to the waybill_________________________________________________________ Number of seats received from the transport company___________________________________________ Quantity of goods and completeness in prefabricated boxes ________________________________________________________________________________ Detailed description of the packaging before use, indicating the labels on the boxes ________________________________________________________________________________ ________________________________________________________________________________ ________________________________________________________________________________ Detailed description of the condition of the goods by appearance inside the transport boxes ________________________________________________________________________________ ________________________________________________________________________________ ________________________________________________________________________________ ________________________________________________________________________________ |

Rules for drawing up the TORG-4 act

First of all, it is necessary to clarify what kind of acts are generally drawn up when accepting deliveries without accompanying documentation:

- raw materials or supplies arrive at the warehouse , but there are no papers on them, an act is drawn up in form No. M-7 .

- When goods are supplied for further sale without delivery notes and invoices, Act No. TORG-4 .

- If there is a need, an act is also drawn up in form No. TORG-5 on the receipt of packaging , about which there is no information in the supplier’s invoices.

The TORG-4 form was not registered and published by the Ministry of Justice; therefore, organizations can develop proprietary, simpler forms. The act must indicate the actual presence of inventories, quantity and cost .

Methods for determining the price of goods received without papers:

- Look at the documents for the previous delivery of similar goods;

- Check with the supply agreement;

- Set the average market value.

The line “ Packaging Condition ” cannot be ignored. When the integrity is preserved, the mark “Intact” is placed, but if the wrapper is not intact, its appearance must be described in detail. Weight of station goods is in doubt ; the weight of goods weighed first at the point of departure and then at the point of receipt is recorded here. Read also the article: → “Form TORG-2. How to fill out a statement of discrepancy (shortage of goods)?”

Important! It is imperative to verify the quantity of goods received. The calculation must be carried out in the same units as were specified in the agreement concluded with the supplier. The accounting department, having not received any documents for the registered property, is obliged to conduct additional checks regarding the delivered goods. Property may be listed on the books as something for which payment has already been made earlier, but which for some reason was not removed from the warehouse. Or goods may be in transit, but listed as purchased. A check is made to see if the cost of these goods is included in the accounts receivable.

Section 1. Services for wholesale trade of goods

Enter the sales volume in column 4 up to the first decimal place. On line 01, indicate the actual wholesale trade turnover for all products. Please indicate the breakdown by product groups in lines 02-120. You don’t need to fill them all out; your lines are only those that indicate the group of your products. To make it easier to find exactly your products, use OKPD2, which is indicated in column 2.

Keep records of exports and imports in the Kontur.Accounting web service. Simple accounting, payroll and reporting in one service

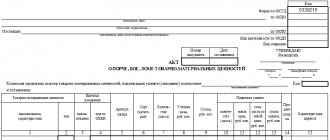

Filling out the TORG-4 form (sample)

SuperAvto LLC, whose main activity is the resale of batteries and some types of household appliances, on October 10, 2015, accepted 20 boxes of 10 batteries each from its supplier Kul LLC, but there was no invoice or delivery note. Last month, the company already received similar batteries under an agreement with Kul LLC, and the price for them was 3,300 rubles apiece.

Let's enter the information received into the TORG-4 form:

Section 5. Warehouse network facilities

Fill in only column 5. On line 01, indicate the number of warehouses, and separately on line 02, the number of premises for storing fruits, vegetables and potatoes.

Write down the area of all warehouses in line 03, and their volume in 04. In line 05, allocate the volume for storing vegetables and fruits. Rosstat is also interested in the volume of potatoes, fruits and vegetables that a company can store at a time. Line 06 is provided for this.

Submit statistical forms and keep accounting and tax records of sales in the Kontur.Accounting web service. The program is suitable for wholesale and retail. We give the first two weeks absolutely free to all newbies.

How to take into account the TORG-4 act when paying taxes

Be that as it may, the property delivered under the contract, even if an accompanying package of papers was not attached to it, is considered the property of the recipient on the basis of an agreement with the supplier.

The accountant is obliged to reflect the receipt of goods on account 41 “Goods” or 10 “Materials” , and also enter data into account 60 “Settlements with suppliers and contractors” .

1) Income tax.

| The goods received were not sold, the supplier brought documents | Valuables delivered without documentation were used in production or were sold |

| The price indicated in the invoice is set; data from TORG-4 is not taken into account. | The profit from the sale of these goods is indicated, but their cost, indicated in the TORG-4 act, does not reduce the amount of income tax, since there is no evidence of the costs incurred (they could be accompanying documents), and only documented expenses are subject to deduction. If the supplier sends papers, the accountant will record the cost of goods sold in the list of costs or (if the goods were used in the production process as materials) will take into account their cost (excluding VAT) in the goods sold by submitting an updated declaration or adjusting the tax base of the current reporting period. |

2) VAT. It is not possible to take into account VAT on deliveries without invoices, because an invoice is required. But when the supplier provides it, the “input” tax can be deducted (precisely at taxation for the month when the papers were delivered). The tax office will require proof that the deduction was made late. To present the date of receipt of documents, a note in the register of incoming correspondence and a stamp on the letter (if the documents arrived by mail) are suitable.

Deadlines and procedure for submitting form 1-TORG

Respondents submit the form once a year. Until February 17 after the reporting period. If this day falls on a weekend, the form can be turned in on the next working day. For example, if February 17th falls on a Saturday, the form can be turned in on Monday, February 19th.

The form is filled out by legal entity, taking into account all separate divisions located with it in the same entity. If the unit is located in another region, a separate report must be prepared and submitted for it.

Typical errors when drawing up a TORG-4 act

Error : 2 copies of the TORG-4 act are drawn up, one is stored in the organization, the second is given to the supplier.

Comment : It is advisable to draw up this act in triplicate, since another participant in the preparation of the act is the financially responsible person, and having him with a copy will not be superfluous.

Error : Refusal of any registration of goods for which the supplier does not require money due to the lack of documentation on them.

Comment : In this situation, the brought goods will become gratuitously given property; the accountant is obliged to take into account its market value and include it in the list of income subject to taxation. It is illegal to contribute this amount to expenses; it is possible to write off these costs by conducting an inventory and recording the resulting surplus.

Error : The accountant draws up a TORG-4 act when the enterprise receives cargo for the supply of which there was no contract, or it was delivered by mistake. Comment: This situation does not apply to goods without an invoice. Accounting will simply reflect the goods off-balance sheet in account 002, and then they will be written off from off-balance sheet accounting.

Error : Lack of signature of the supplier's representative on the TORG-4 act due to the fact that the delivery was carried out by the driver of the recipient company or a transport company.

Comment: The signature must be in any case; it is necessary to ask the forwarder TC or another uninterested person to sign the acceptance certificate.

Error : Inaction of the accountant when the materials and equipment had not yet been used, and the supplier provided documentation for their supply after the preparation of the TORG-4 act.

Comment: It will be necessary to adjust the cost of the inventory; it is impossible to leave the previously drawn up TORG-4 act.

Error : Inaction of the accountant after the supplier sent the missing documents after the execution of the TORG-4 act, when the received goods had already been sold.

Comment: The accounting employee is obliged to take into account the difference between the documented proven cost of the goods used and the price previously taken into account in the TORG-4 act. The data will be reflected in account 91 “Other income and expenses”.

Section 3. Wholesale and retail trade turnover by month

The rows represent months, and line 01 is the annual total. In column 3, indicate the total wholesale turnover, retail turnover in column 5. If there is income from agency agreements or commission agreements, separate it from column 3 in column 4.

In line 14, enter the amount of sales of goods outside of stores, markets and tents. This is, for example, e-commerce or mail order sales. E-commerce is disclosed from line 14 to line 15, and postal commerce is disclosed in line 16. Record the amount of credit sales in line 17. Finally, fill out line 18 and indicate the number of retail delivery items.

All values are specified to 1 decimal place.

Important! Trade is recognized as distribution if transport is used for sale: auto shops, vans, store wagons, tonars, trailers, tanks, store ships, and so on.