It is difficult to imagine the activities of an organization without the use of household supplies and production equipment. Items and means for cleaning premises, means of communication, devices for minor household repairs - one way or another, it is difficult for even a very small company to do without these items.

The question of what applies to inventory and household supplies is quite common. Indeed, a detailed and clear list of items that can be considered inventory and accessories is not defined, so assigning certain items to this category can be difficult. Industrial inventory - does this or that object belong to it? Are office furniture, equipment for meeting rooms and conference rooms, air conditioners, and lighting equipment considered inventory? Let's try to figure it out.

Industrial equipment is various items that are involved in the production process, but are neither equipment nor structures. For example, the offices of organizations must be equipped with communications equipment, furniture necessary for work, equipment, etc.

The second question is household equipment. What does it have to do with it? These are household items that are not used in the production process, but which are difficult to do without during the work process. Thus, all office and industrial premises need cleaning, disinfection products, etc.

So, inventory and household supplies.

What does this group belong to and what does it consist of:

- office furniture (for example, tables, chairs, meeting room equipment, filing cabinets, etc.);

- equipment for cleaning the premises and territories of the organization, workplaces (for example, buckets, mops, brooms, brooms, etc.);

- tools;

- communication means (for example, telephones, faxes, walkie-talkies, tablets, etc.);

- lighting, heating devices (for example, table lamps, heat guns, fans, etc.);

- coolers, kettles, coffee machines;

- materials used for household needs, toiletries (for example, soap, napkins, paper towels, air fresheners, dishes, etc.).

We figured out what applies to production and household equipment. Of course, the amount of equipment required will vary depending on the size of the organization, number of employees, number of premises, field of activity, etc.

What applies to household equipment and accessories?

What may be included in the list of tools, household equipment and accessories (hereinafter referred to as material assets, MC) has not been determined by anyone. The organization regulates this itself. Typically it includes:

- office furniture and equipment;

- lighting;

- stationery;

- Appliances;

- means related to fire safety;

- hygiene products;

- cleaning equipment and materials;

- tools, etc.

It is possible to purchase such goods both by bank transfer and through accountable persons.

How to account for the purchase of materials through accountable persons, read in Art. “What kind of posting reflects the acquisition of material assets under the report .

To organize accounting, it is necessary to correctly classify MC.

There are 2 options for inventory accounting:

- as part of fixed assets (fixed assets);

- as part of the MPZ.

In any option, objects are taken into account at their acquisition cost, which is the sum of all costs associated with the purchase. In general, VAT is not included in this amount. It is included in the price only if MCs are used for non-taxable activities (clauses 2, 5, 6 PBU 5/01 “Accounting for inventories”, approved by order of the Ministry of Finance of Russia dated 06/09/2001 No. 44n, clause 8 PBU 6 /01 “Accounting for fixed assets”, approved by order of the Ministry of Finance of Russia dated March 30, 2001 No. 26n).

simplified tax system

The tax base of simplified organizations that pay a single tax on income, expenses for inventory and household supplies are not reduced (clause 1 of Article 346.14 of the Tax Code of the Russian Federation).

If an organization pays a single tax on the difference between income and expenses, expenses for the purchase of inventory and household supplies reduce the tax base.

Inventory with a useful life of more than 12 months and an initial cost of more than RUB 100,000. refers to depreciable property (clause 4 of article 346.16, clause 1 of article 256 of the Tax Code of the Russian Federation). Therefore, when calculating the single tax under simplification, the cost of inventory can be taken into account as expenses for the acquisition of fixed assets (subclause 1, clause 1, article 346.16 of the Tax Code of the Russian Federation).

If inventory is not recognized as depreciable property, the costs of its acquisition can be taken into account as part of material expenses (subclause 5, clause 1 and clause 2, article 346.16, subclause 3, clause 1, article 254 of the Tax Code of the Russian Federation).

Input VAT on purchased inventory and household supplies is also included in expenses (subclause 8, clause 1 and clause 3, article 346.16 of the Tax Code of the Russian Federation).

Situation: is it possible to take into account the costs of purchasing toiletries (paper towels, air fresheners, soap, etc.) when calculating the single tax? The organization applies a simplification and pays a single tax on the difference between income and expenses.

Yes, you can.

When calculating the single tax, expenses for the purchase of toiletries can be taken into account as part of material costs (subclause 5, clause 1 and clause 2, article 346.16, paragraph 4, subclause 2, clause 1, article 254 of the Tax Code of the Russian Federation). Moreover, such costs must be economically justified and documented (clause 2 of article 346.16, clause 1 of article 252 of the Tax Code of the Russian Federation). The purchase of toiletries should be justified by internal documents. For example, a collective agreement may stipulate that, to ensure normal sanitary and hygienic conditions, toilet rooms are provided with paper towels, air fresheners, soap, etc.

A similar point of view is reflected in the letter of the Ministry of Finance of Russia dated September 1, 2006 No. 03-11-04/2/182.

Accounting for inventory and household supplies as part of OS

Inventory is classified as fixed assets if its useful life is more than 12 months and its cost is more than 40,000 rubles. (Clause 4 PBU 6/01). At a lower cost, it is allowed to take it into account as part of the inventory (clause 5 of PBU 6/01). At the same time, the organization can set its own cost limit between fixed assets and inventories at the above limit. For example, how to take into account objects costing over 20,000 rubles as fixed assets, and cheaper ones as inventories. The cost threshold must be fixed in the accounting policy.

Important! From 2022, PBU 6/01 will no longer be in force. It will be replaced by the new FSBU 6/2020 “Fixed Assets,” which, among other things, allows organizations to independently set a limit on the value of fixed assets, taking into account the materiality of information about such assets.

Let's consider a sample of accounting entries that are generated upon receipt, movement and disposal of fixed assets.

| Accounting entry | Action, document |

| Dt 08 Kt 60 (10, 71, 76) | The OS is purchased. Consignment note, form OS-1 |

| Dt 19 Kt 60 | VAT allocated. Invoice |

| Dt 01 Kt 08 | The cost of the OS has been determined. He is assigned an inventory number and an OS-6 inventory card is filled out. |

| Dt 20 (23, 25, 26...) Kt 02 | Depreciation has been calculated. There are 4 ways to calculate depreciation in accounting. The chosen method is recorded in the accounting policy |

| Dt 02 Kt 01 | Depreciation written off. This occurs at the time of disposal, sale, gratuitous transfer, shortage or damage to the OS |

| Dt 91.2 Kt 01 | The residual value has been written off. If the fixed assets are fully depreciated, the residual value is 0. Form OS-4 |

This is only a small part of the possible set of transactions for accounting for fixed assets in an organization.

Read more about asset accounting in Art. "Accounting for fixed assets - accounting entries" .

As for documentation, in this case, for inventory, you need to use documents that are usual for registering OS or approved by Decree of the State Statistics Committee of the Russian Federation dated January 21, 2003 No. 7. For example, such as:

- OS-1 - act of acceptance and transfer of an OS object;

- OS-2 - invoice for internal movement of fixed assets;

- OS-3 - act of acceptance and delivery of repaired, reconstructed, modernized OS facilities;

- OS-4 - act on write-off of an asset (except for vehicles), etc.

Or an organization can develop such documents independently. We remind you that they must contain the mandatory details specified in Art. 9 of the Law “On Accounting” dated December 6, 2011 No. 402-FZ. Below we will present only unified forms.

What other documents may be required to register the OS movement, read here.

Accounting for tools and household equipment as part of the inventory and postings to it

Inventory with a useful life of up to 12 months must be taken into account as part of the inventory. Moreover, regardless of its cost.

It is included in the organization’s warehouse based on the corresponding primary order:

- TN (TORG-12);

- receipt in form M-4 (can be replaced with the corresponding stamp on the seller’s invoice).

After this, accounting cards are created for the registered objects, using, for example, form M-17.

What data is filled out in the M-17 form, read in Art. "Material warehouse card - form and sample" .

At this moment, an entry is made in the accounting records as the debit of account 10.9. The corresponding account depends on the method of receipt of inventories into the organization.

During the transfer of tools and accessories from the warehouse for the needs of the organization, a demand invoice is drawn up in form M-11. Also, forms M-8, M-15 (approved by Decree of the State Statistics Committee of Russia dated October 30, 1997 No. 71a) are used as primary accounting documents.

What data is indicated when filling out forms M-11, M-15, read in the articles:

- “Procedure for filling out form M-11 requirement-invoice”;

- “Unified form No. M-15 - form and sample”.

To transfer special tools from the warehouse, it is necessary to first set limits, which are developed by the organization by decision of the manager.

Form M-8, a limit-fence card, is used both for issuing special tools and for monitoring compliance with the limit. It is written out in 2 or 3 copies.

In the ConsultantPlus system you can form M-8 and see a sample of how to fill it out. Get a free trial and get to the documents.

Inventory can be released from the warehouse to intermediate units without indicating the exact quantity of required inventory. As it is used, the unit draws up acts (reports) in any form, but with mandatory disclosure of such details as name, quantity, cost, confirmation of the feasibility of its use. Based on these acts, the cost of inventories will be written off as expenses (clauses 97, 98 of the Guidelines).

The method of writing off inventory for production must be fixed in the organization’s UP (clause 73 of the Methodological Instructions, approved by order of the Ministry of Finance of Russia dated December 28, 2001 No. 119n, clause 16 PBU 5/01):

- at the cost of each unit of inventory;

- FIFO;

- at average cost.

If the inventories are damaged or lost, a write-off report is drawn up indicating the reason for disposal, and the losses are written off.

Read more about write-offs in the article “The procedure for writing off materials in accounting (nuances)” .

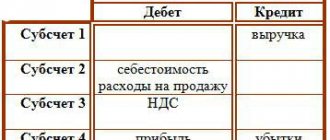

The write-off of inventory is reflected in the following accounting entries.

Let's look at inventory accounting as part of the inventory using an example.

Example

In February, LES LLC purchased computer chairs (5 pieces) for employees at a cost of 16,155 rubles, including VAT - 2,464.32 rubles.

The organization’s CP states that for accounting purposes, fixed assets costing less than 40,000 rubles. are written off as expenses when they are put into operation. At the same time, an entry is made on off-balance sheet account 012 “Materials transferred for operation.” Once the chairs were delivered, the accountant wrote off their cost as an expense and recorded their transfer to use in an off-balance sheet account.

In October, the management of LES LLC decided to move to a new office, which already had all the necessary furniture. In this regard, it was decided to sell the chairs to one of the employees. The transaction amount was 11,150 rubles. (including VAT - RUB 1,700.85).

The following entries were made in accounting.

In February:

- Dt 10.9 Kt 60 — 13,690.68 rub. (come computer chairs);

- Dt 19 Kt 60 — 2,464.32 rub. (we charge VAT);

- Dt 68 Kt 19 — 2,464.32 rub. (we accept VAT for deduction);

- Dt 26 Kt 10.9 - 13,690.68 rub. (we take into account the cost of computer chairs in the costs);

- Dt 012 - RUB 13,690.68. (we take into account computer chairs put into operation).

In October:

- Dt 62 Kt 91.1 - 11,150 rub. (we reflect revenue from the sale of computer chairs);

- Dt 91.2 Kt 68 - 1,700.85 rub. (we charge VAT on revenue);

- Kt 012 - RUB 13,690.68. (we write off sold computer chairs).

When generating income tax calculations for 12 months of LES LLC:

- we include in expenses for February the cost of computer chairs included in expenses - 13,690.68 rubles;

- we include in income the proceeds from the sale of computer chairs - 8,474.58 rubles.

Documentary support

When releasing tools from warehouses, it is necessary to issue a demand invoice. The document is executed according to form No. M-11. The requirement was established by the State Statistics Committee of the Russian Federation in 1997 (resolution No. 71a). The document indicates, in accordance with Order of the Ministry of Finance of the Russian Federation No. 119n, the following information:

- The name of the department that requested the inventory.

- Account number for accounting costs for supporting the activities of the unit.

Accessories can be transferred to an intermediate unit (this concept refers to accounting departments and purchasing departments). In such a situation, it is difficult to determine the exact amount of inventory that will be used by the departments. The way out is to draw up reports as supplies are used up. The acts are drawn up in free form, but they must contain the following information:

- department name;

- number of supplied accessories;

- price;

- the purposes for which the object is requested.

Based on the drawn up acts, objects are written off as expenses. The procedure was approved by MU No. 119n.

Accounting in a simplified form

Companies classified as small businesses can conduct accounting in a simplified form. The release of objects involves a connection with the account “Production expenses” or account 44 “Expenses for sales”. The accountant must issue a demand invoice. It is performed according to form No. M-11. At the same time, posting is carried out: DT 25, 26, 44 KT 10-9 (release of objects).

Writing off accessories involves setting a price at which they will be written off. The operation is performed from a count of 10-9. The cost is determined based on the following methods:

- At the cost of one piece.

- FIFO.

- Average cost.

The methods are approved by paragraph 16 of the PBU. The method used must be reflected in the accounting policy. This is needed for accounting purposes. This provision was introduced by paragraph 73 of MU No. 119n.

When reflecting, security control is used. This is due to the fact that when a facility is put into operation, costs are transferred into costs.

Only objects whose service life exceeds a year and are registered in the list of materials are controlled.

The law does not stipulate the procedure for accounting for objects transferred to use. Therefore, it is installed by the enterprise itself. To track the movement of objects across departments, the following documents are used:

- Statement.

- Off-balance sheet accounting.

The chosen option for maintaining papers is fixed in the company policy. Documentation is maintained by an employee with financial responsibility. The Plan does not have an individual off-balance sheet account, and therefore it is created independently. For example, an enterprise opens account 013 “Households. accessories".

When transferring inventory to use, the following transactions are made:

- DT 25, 26, 44 KT 10-9 (release of objects from warehouse).

- DT 013 (accounting of objects).

- KT 013 (inventory write-off).

When objects are disposed of, it is necessary to create a write-off report. Its form is not established by law. Its independent approval is allowed. The procedure for recording related expenses is determined depending on the taxation system adopted by the enterprise.

Control over the movement of economic and production equipment transferred to operation

We have already said above that assets that meet the criteria for classification as fixed assets and are valued within the limit established by the organization, but not more than 40,000 rubles, can be reflected in the accounting system as part of the inventory. At the same time, clause 5 of PBU 6/01 directly requires that the organization is obliged to establish control over them in order to track their movement and ensure safety after they are put into operation.

Such property, as a rule, is accounted for on account 10.09 and its value is written off at a time when it is put into operation. At the same time, this property must continue to be taken into account off the balance sheet until it is completely worn out or lost. For this, as a rule, account MC.04 is used. When writing off an off-balance sheet, you need to draw up an act in the MB-8 form.

A sample act MB-8 was prepared by ConsultantPlus experts. Get free trial access to the system and proceed to the sample.

As for the MCs related to the MPZ, the organization is not obliged to establish control over their movement, but can do this, guided by its interests.

How exactly control over inventory should be exercised has not been determined by anyone. The organization itself develops norms and rules for its implementation.

This is often done using a separate off-balance sheet account, for example 012, on which they keep records of inventory transferred into operation (Dt 012) until it is written off due to expiration of its service life, sale, loss, etc. (Dt 012) .

Results

Household inventory may be either goods or fixed assets. Depending on the qualifications of the property, a suitable method of accounting and documentation is selected. Basic accounting rules must be reflected in the accounting policies.

Sources:

- Order of the Ministry of Finance of Russia dated 06/09/2001 N 44n

- Order of the Ministry of Finance of Russia dated March 30, 2001 N 26n

- Resolution of the State Statistics Committee of the Russian Federation dated January 21, 2003 N 7

- Federal Law of December 6, 2011 N 402-FZ “On Accounting”

- Resolution of the State Statistics Committee of the Russian Federation dated October 30, 1997 N 71a

- Order of the Ministry of Finance of Russia dated December 28, 2001 N 119n

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Decision No. 21-263/2016 7-411/2016 dated March 9, 2021 in case No. 21-263/2016

- Administrative 7-411/2016 (21-263/2016) DECISION ES Judge of the Perm Regional Court Spiridonov E.V., having considered on March 09, 2016 at a court hearing in the city.

Perm under secretary D.A. Pokrovskaya A.’s complaint against the decision of the judge of the Leninsky District Court.

Perm dated January 15, 2021 in the case of an administrative offense provided for in the article of the Code of the Russian Federation on Administrative Offences, established: 03.11.2015 based on the results of the investigation carried out on the basis of the order of the head of the Territorial Administration of the Federal Service for Financial and Budgetary Supervision in the Perm Territory dated 09/01/2015 No. ** of the scheduled on-site inspection of the Rosreestr Office for the Perm Territory in relation to the official - the head of the Rosreestr Office for the Perm Territory A. - a protocol was drawn up on an administrative offense under the article of the Russian Federation. From the protocol it follows that A.

violated