Thanks to the abolition of the use of mandatory unified forms for primary documents in 2013, organizations were able to significantly reduce document flow. One of the most successful examples of such optimization is the combination of a tax invoice and an accounting shipping document in one form. As a result of this merger arose universal transfer document.

- Form and sample

- Free download

- Online viewing

- Expert tested

FILES

Why was UPD invented?

The main task of UPD is to simplify document flow by replacing several documents with one.

Initially household Entities using the STS, for transactions, presented their counterparties with a package of documents, which, among others, included delivery notes, acts and invoices for them. At the same time, the information in the invoices/acts and invoices was duplicated. To correct this situation, the UPD was invented - a universal transfer document. Its versatility lies not only in combining the functions of a primary document and an invoice: in one UPD you can reflect data on the goods/products being sold, as well as simultaneously on the work performed/services rendered. That is, the UPD can replace up to 6 documents .

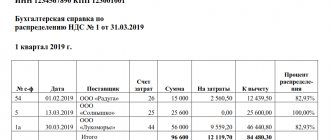

Let's put in the table what operations can be issued for UTD:

You can download various samples of filling out the UPD 2021 later in the article. We will also provide instructions on how to fill out the UPD regarding some of the controversial details.

Why do many organizations and entrepreneurs refuse to use the UTD document?

The block of signatures on the universal transfer form is quite voluminous. It is not always possible to place all the required information on one sheet of paper. Because of this, small fonts are often used when typing, making them difficult to read.

In addition, the new documentation does not enjoy much confidence among accountants (this is mainly due to the deduction of VAT). When switching to working with UTD papers, find out in advance whether this option is suitable for your counterparties. It would be a good idea to coordinate the implementation of the updated form with regular partners.

Separately, it should be said about the need to automate internal processes in any commercial organization, regardless of whether it works with UPD documents or not. You can make the work of enterprise employees easier and automate reception and transfer using special mobile accounting systems. The right decision in this case would be to purchase software for solving business problems in wholesale or retail trade in our company. The software presented in the catalog is compatible with most models of modern trading and accounting equipment. All the information you are interested in can be obtained on the official website cleverence.ru.

Is it necessary to use UPD?

The use of UPD is not a mandatory procedure. Transactions can be completed with any package of documents. So, it is permissible to act the old fashioned way and issue invoices and acts, or you can use UPD. It is also allowed to use one set of documents with some counterparties, and another with others.

As a rule, the composition of closing documents is specified in the contract. Therefore, you need to take care of what documents to draw up for the transaction in advance and discuss this with your partners.

Since 2013, the obligation to use unified forms of documents has been abolished. At the moment, you can develop your own forms, samples of which are approved by the accounting policy of the enterprise. The only condition is the presence of the required details . Including when filling out the UPD.

Status Definition Meaning

This detail can be reflected under the number “1” or “2”. By indicating the unit in the required field, you confirm that the paper is used simultaneously as an invoice and a form of primary accounting (primary).

According to the information presented in the annex to letter 20-3/96 from the Federal Tax Service of the Russian Federation, the status acts only as an information category. In fact, it depends on the absence or presence of data required for accounting documentation and accounts. Thus, in a situation where the seller makes a mistake when filling out the form and puts a two instead of a one, the buyer still has the right to take advantage of the deduction.

Which form to use for UPD

A sample UPD was developed based on the invoice form. A standard example of the UPD form is given in the letter of the Federal Tax Service of Russia dated October 21, 2013 No. ММВ-20-3/96.

As already mentioned, this form can be used as a recommended one . It is also permissible to add other details or remove some existing ones. That is, we leave only those that are classified as mandatory by law.

Below we will look at how to correctly fill out the UPD sample.

In what situations is it used?

When studying the question: how to correctly fill out the UPD, according to line numbers, you should understand the capabilities of this document. Companies and individual entrepreneurs can engage as:

- invoices;

- overhead transfers;

- combined documentation.

The use of the form is advisable when:

- documenting the work done or services provided to the client;

- shipment of commodity items;

- property transactions.

Do you want to implement Warehouse 15? Get all the necessary information from a specialist.

Thank you!

Thank you, your application has been accepted!

Explanations on some UPD details

Let us pay attention to the design of any sample of filling out the UPD regarding some details.

UPD status

There are 2 options for filling out this field:

Status is mandatory UPD requisite.

Code of goods/works/services (column B)

A detail that often raises questions is column B. It is not required to fill out the product code in the UPD. That is, this props can be removed from your own developed form. If left, then:

- for services and works it is permissible to use the OKVED code in this column;

- for goods - article number.

Product type code (column 1a)

It is clear here that this column is used only for goods. And even then: not for every product, but for those exported to the EAEU countries from the territory of the Russian Federation.

Country of origin of the goods (columns 10, 10a, 11)

Fill in for goods whose country of origin is not the Russian Federation.

Signatures of responsible persons

Signatures in the UPD are considered mandatory details. Since the UPD includes two documents - the primary document and the invoice, the rules for filling out a sample transfer document regarding the signatures of the responsible parties can be divided into two points:

- the part related to the invoice is signed by the general director and chief accountant;

- the part related to the primary part can be signed by persons responsible for carrying out operations for the shipment of goods/works/services (for the receipt of goods/works/services).

If the document must be signed by the same person, it is permissible to put a signature in one of the fields, and indicate only the last name and position in the others.

Reflection of UPD with status “1” in tax accounting

Let's look at how the seller and buyer can determine income and expenses in tax accounting when applying UTD with status “1”.

Seller's income tax

Let us recall that for the purpose of calculating income tax when the taxpayer uses the accrual method, the date of recognition of income received by the seller is the date of sale of goods, work, services, property rights (clause 3 of Article 271 of the Tax Code of the Russian Federation).

Taking into account the rules of Article 39 of the Tax Code, this is the date of transfer on a paid basis (including the exchange of goods, works or services) of ownership of goods, the results of work performed by one person for another person, the provision of services for a fee by one person to another person, regardless of the actual receipt of funds (other property, work, services, property rights) in payment for them.

Income is determined on the basis of primary documents or other documents confirming income received, as well as tax accounting documents (clause 1 of Article 248 of the Tax Code of the Russian Federation).

Attention

UPD with status “2” is equated to a simple primary document, and therefore is reflected in tax accounting in the usual manner.

Let’s apply these rules to the UTD with status “1” and it turns out that the date of recognition of income for inclusion of revenue in the tax base for income tax will be considered:

- the date of registration of the release of the cargo (line indicator (1) or a later line indicator [11]), if ownership of the transferred cargo passes at the moment of transfer of the thing by the seller to the buyer (customer) or his authorized person, or the carrier;

- the date of registration of receipt of the cargo (line indicator [16]), if ownership of the transferred cargo passes at the moment the item is delivered to the buyer or his authorized person;

- date of registration by both parties of the fact of acceptance and transfer of services, property rights, work results, that is, the latest value of the indicators of lines (1), [11] and [16]

In all of the above cases, if there are other documents confirming these facts, for tax purposes the seller (performer, copyright holder) will apply the earlier date resulting from the other document.

Buyer's income tax

Similar dates are used by the buyer (customer) when determining the date of expenses in order to reflect them in tax registers. The values accepted under the UPD are reflected in tax accounting as purchased materials, goods, fixed assets, property rights, consumed services and the results of work received for further application to them of the relevant accounting rules as part of expenses established by Chapter 25 of the Tax Code for various types of expenses.

Keep in mind that the date of recognition of the amount reflected in the UPD with status “1” to reduce the tax base for income tax by the buyer (customer, legal recipient) cannot be earlier than the line indicator [16], unless otherwise follows from the content of the fact of economic life recorded in the document.

UPD for various operations

Next, we will consider various samples of filling out the UTD.

UPD for services with VAT

So, let’s say that an organization provides consulting services and is on the general taxation system. We will show you a sample of filling out the UPD for services.

SAMPLE UPD FOR SERVICES WITH VAT

UPD for services without VAT

Special regime officers must pay special attention to the rules for filling out the UTD: if a VAT evader issues an invoice with the allocated tax amount, he will have to pay VAT to the budget and submit it to the tax return.

We remind you that the special regime officer, when using the UPD as the primary one, enters the UPD status as “2”.

Here is a completed sample UPD for services without VAT:

SAMPLE UPD FOR SERVICES WITHOUT VAT

UPD during implementation

Let the organization sell goods/products and apply a general taxation system. To process her sales, she uses UPD instead of the package delivery note + invoice.

Here is an example of filling out the UPD for these operations:

SAMPLE UPD FOR SALES WITH VAT

The rules for filling out a sample UPD form for sales without VAT are similar to the rules for filling out a sample UPD form for services without VAT. You should ensure that:

- the document status was correct – “2”, defining the UPD as a primary document;

- in columns 7 and 8 there was no information about VAT.

UPD when combining the sale of goods and performance of work

Now let’s look at the correct execution of a sample UPD, which reflects both the shipment of goods and the execution of work.

There are no special rules in this case . The lines should include data on all types of operations performed. At the same time, by the time payment is made for the shipment of goods/products, the work must have already been completed (UPD is not issued ).

SAMPLE UPDA FOR GOODS AND WORKS

When filling out a similar document, a special regime officer must also monitor the status of the document (“2”) and ensure that VAT is not highlighted in the appropriate columns.

Types of universal transfer documents

This documentation can be used in two versions:

- simultaneously as an account-f and a primary account (one is entered in the status);

- solely as confirmation of the transfer of goods and materials (a two is registered).

Depending on how exactly the application is recorded, you will have to fill out the forms differently.

Rules for filling out UPD 1

In this case, all details are required (for s/f and transfer papers). This is the only way to use the completed form to receive VAT deductions and account for income tax expenses.

UPD document with status 2

In the second option, there is no need to enter information for the invoice. This UPD form is used exclusively as transfer documentation to confirm the conduct of business transactions. And the account-f, if necessary, is generated additionally.

Do you want to implement “Store 15”? Get all the necessary information from a specialist.

Thank you!

Thank you, your application has been accepted.

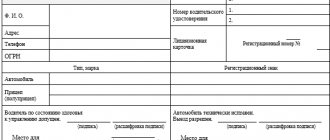

How to sign IP UPD

Often the individual entrepreneur is faced with the question of how to properly sign the UPD. Both parties to the transaction - the seller and the buyer, or their authorized representatives - are required to certify the document with signatures. We show where to sign the UPD in the table:

| Field in UPD: where to put signatures | Who signs | What does the signature confirm? | Notes |

| In the subsection with the invoice | Individual entrepreneur - the seller (or his representative) signs the UPD and indicates the details of the state registration certificate | The fact of the transaction and its documentation | |

| In field 10 | Salesman | Fact of shipment | |

| In field 13 | Salesman | Reliability of data in UPD |

|

| In field 15 | Buyer | Receiving goods/services | |

| In field 18 | Buyer | Correctness of the document |

|

For greater clarity, we offer an example of the formation of UTD without VAT. Sample form for 2021:

Filling out the document

Two new fields A and B are filled in at the request of the product supplier and indicate the item number and activity codes. For example, for an individual entrepreneur who has chosen USN 6 for the sale and installation of air conditioners, the code OKUN 042403 is indicated in field B.

The status in the upper left corner indicates its purpose. If it will be used as an invoice and a primary document, the number 1 should be entered. This status allows you to present the UTD as a basis for deducting VAT.

The number 2 in the field indicates that the UPD acts as a primary document reflecting the taxpayer’s transaction. UPD for individual entrepreneurs on the simplified tax system and unified agricultural tax have status 2. Many simplifiers are more accustomed to working according to the old scheme, using invoices and acts. However, situations often arise when the buyer has to issue an invoice. Therefore, UPD is just convenient here.

The purpose of a document is determined not only by its status, but by what details are filled in it. The UTD number also depends on its status. According to the filling rules, invoices indicate a serial number. If the status is 1, the number must correspond to the numbering in the invoices. In primary documents, the number does not belong to the mandatory details, therefore in the UPD it is determined by the chronology of the primary documentation.

Field 8 must contain information about the date and number of the agreement, according to which services are provided and shipment is made.

On video: What you need to know about UPD and integration with the enterprise accounting system

Universal PD form

IMPORTANT!

This form is just a recommendation from officials. The company has the right to use other UPD, the forms of which are developed and approved in the company’s accounting policies. However, when creating an individual form of transfer documentation, take into account the mandatory details for primary documents (Article 9 of Law No. 402-FZ).

Instructions for filling: continued

Further along the center of the document are the following lines.

- Line 8 is entitled “Base of transfer/receipt”. Information characterizing the relationship between the parties is indicated here. The number of the contract, agreement or other document is included.

- Line 9 contains information regarding transportation and cargo. This information includes various transportation details: transport document numbers, details of the organization covering the transportation costs. This is where you enter information that defines the load, such as net weight and gross weight. This item is not required to be completed.

- Line 10 contains information about the person loading the goods or transferring the results of the work. Enter your full name, position, and sign at the end. The data in this line reveals the circumstances in which the transaction was completed. If this employee is authorized to sign invoices and has put his signature above, it is not required to duplicate it. It is enough to indicate only your full name and position.

- Line 11 indicates the date of the transaction or other business fact. It is not required to be filled out according to legal requirements. The date when this event actually occurred is entered in the field. Even if the document is drawn up on November 29, and the loading of the goods should take place on November 30, November 30 is indicated on the form.

- Line 12 contains other information about the business fact. It is not required by law to fill it out. This includes details of passports, certificates and similar documents. The field is completed when there are significant details that are not included in the UPD (universal payment document).

Important: the dates of the transaction are indicated in lines 1, 11, 16. In this case, for accounting purposes, the seller enters the loading date (number 11), and the buyer enters the acceptance date (number 16).

You should approach filling out date fields responsibly. This will avoid disputes regarding the date of the economic fact.

back to menu ↑