An application to the Federal Tax Service (FTS) is a type of official application from citizens. Unlike a complaint, a statement does not indicate violations, but contains a request for the exercise of rights.

An application is a citizen’s request for assistance in realizing his constitutional rights and freedoms or the constitutional rights and freedoms of others.

Article 4 of the Federal Law “On the procedure for considering appeals from citizens of the Russian Federation”

The documentation of fiscal authorities is characterized by formalism, therefore most applications to the Federal Tax Service are submitted on special forms and filled out according to instructions.

Application to the tax office: general points

Many citizens believe that the application is drawn up in free language and written on a white sheet of paper by hand. This is not true - most applications to the tax office must be filled out according to instructions and specialized forms must be used for this. Regardless of what application you are preparing to submit to the inspector, you must remember the basic rules:

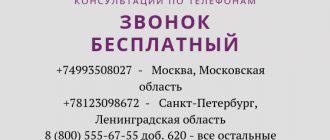

- The upper right corner of the application is always occupied by the details of the tax department. To find out them, you can log on to the website nalog.ru and enter your address. The system will tell you which tax office the citizen belongs to at his place of residence, and, accordingly, will offer the details, address and operating hours of the branch.

- The header of the application must contain the personal data of the applicant - here you need to indicate passport details, full name and TIN number. If a citizen does not have information about the payer identification number, he can use the “Find out TIN” service launched by the country’s tax service.

- If the document is filled out by hand, it must be written in block letters, only black or blue ink is allowed, and it is forbidden to cross out or correct errors.

- If a document contains several sheets, each must be endorsed with the citizen’s personal signature. Some applications are required by law to contain a certified autograph - for this the paper must be signed in the presence of a tax inspector.

- Any information in the application must be current, reliable and verified. It is necessary to double check all information provided on the application, especially the numbers.

Now let's move on to the features of filling out and examples of statements that are used most often.

Filling out the form on the Federal Tax Service website in the “contact another question” section

In the application form for a legal entity on another issue on the website of the Federal Tax Service of the Russian Federation there are slightly more fields.

Additionally you will have to indicate:

- place of work of the applicant (filling out the form)

- OGRN of a legal entity:

- TIN of a legal entity:

- position, last name/first name/patronymic of the person who filled out the application

- contact number

- Which government agencies have already been contacted regarding the issue under consideration?

- E-mail address

The application form for an individual is similar

Obtaining a TIN

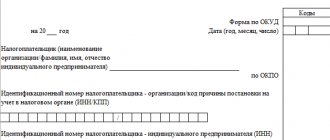

Every citizen of Russia, no matter whether a future (minor) payer or an existing tax payer, must register with the Federal Tax Service. To do this, you need to obtain a document - TIN. This can be done through the Federal Tax Service website. Within five days after the application, the tax service will be ready to provide the TIN. If a citizen prefers to interact with paper media or prefers to visit government agencies in person, he must download and fill out form No. 2-2-Accounting. We recommend downloading this form, like the form for any other application, exclusively from the official resource of the Russian Tax Service. In the case of an application for a TIN, it would be most advisable to type keywords in a search on the site and get a sample form from the first link. It looks like this.

The application for registration with the tax authorities is very simple to fill out.

Using an example, we demonstrate the upper part of the form that a citizen needs to fill out. Next comes a field in which information about the official representative of the payer is entered, if he cannot independently contact the Federal Tax Service, as well as fields for filling out by tax specialists. As you can see, nothing complicated.

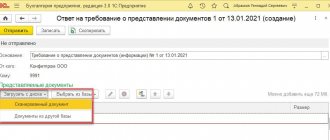

Actions of the taxpayer upon receipt of requests for clarification from the Federal Tax Service

In all cases, the taxpayer must accept the request for consideration, determine for himself the nature of the issues raised, draw up his action plan and provide an adjusted version of the package of documents, which may contain:

- Corrected declaration 3-NDFL under the number of the corresponding adjustment at the top of the title page of the document.

- Supplemented supporting documentation in the form of a certificate of income in form 2-NDFL, contracts for the sale of registered movable or immovable property with profit and the tax base formed as a result of these actions. This also includes missing papers confirming the person’s expenses for treatment, education or residential real estate, which are proven by checks, cash orders or documents confirming payments on a mortgage or other targeted loan. Legal entities in this case should pay special attention to income tax and VAT with the formation of an evidence base.

Persons reporting under the simplified system must provide documentation of advance income tax for each quarter, otherwise, the simplified person risks being transferred to a full-fledged taxation system

The response to the request for clarification on property tax must be completed with certificates of ownership and cadastral documents for the property submitted for reporting. If a person belongs to the category of those applying for benefits, this must also be indicated in the explanations.

- Covering letter with explanations according to the form established at the level of tax legislation.

These documents are drawn up in a single set and submitted together with an explanatory note for re-inspection to the tax authority.

Certificate of absence of debts

A document indicating that a citizen has no debt to the state may be needed in a number of cases, for example, for mortgage lending. To obtain such a certificate, you need to contact the territorial Federal Tax Service with a corresponding application. There is no strict form for paper yet, but the tax office recommends following the same content and structure of the request.

Even such a simple application requires tax details at the top right

Possible negative consequences.

After considering the complaint and collecting evidence of the employer’s guilt, it is held accountable and bears additional costs. At the same time, measures are being taken within the organization to eliminate identified violations. And subsequent payments to employees will be made in full in compliance with tax laws.

In turn, the final result will be negative for the company as a whole and may result in a number of disadvantages for the employee himself. These negative aspects may include:

- Deterioration of the relationship between the employee and the company management;

- Reducing the amount received “on hand”, as the amount of taxes will increase;

- The size of the official salary will increase, as a result, the opportunity to receive social benefits will be lost.

Before filing a complaint, you should carefully weigh all the pros and cons of subsequent developments. Perhaps a complaint to the tax office will not always be the optimal solution and way out of the situation.

Installment or deferment of tax payments

Before December 1, most citizens are required to pay for certain types of taxes, for example, on land, transport or property. But it happens that a person finds himself in a difficult situation when the financial situation becomes extremely unstable. In this case, you can contact the tax office with a request to postpone the date of tax payment or break the amount into smaller parts. You must bring an application to the institution using the following form.

An application requesting a deferred payment will be on one sheet of paper.

The form of this application is very simple; you can also download it from the official website of the Federal Tax Service. You can discuss filling out the second part of the document with the tax inspector, telling him about your current life situation.

Important point! The state can provide deferred or installment payment when we are talking about the amount of debt that does not exceed the value of the citizen’s property, in addition to what cannot be collected (a single apartment, for example).

What to do if the bank made a mistake in the payment order

It happens that the taxpayer promptly submitted the correct paper version of the payment slip for taxes (contributions) to the bank. The bank executed it, but the payment went unaccounted for due to an error by the bank clerk.

As a rule, the taxpayer learns about arrears and penalties from a request from the Federal Tax Service. To correct the situation, you can do the following:

- Request a written explanation of the situation from the bank.

- Send an application to the Federal Tax Service to clarify the payment with a request to recalculate the accrued penalties and indicating the guilt of the bank employee.

- Attach to the application an explanation from the credit institution, a stamped payment slip and a bank statement for that day.

Tax deduction

The procedure for returning thirteen percent for income tax payers can be associated with various events: the purchase of real estate, payment for medical or educational services, and so on. The two types of deductions we have named are property and social, the most common. They allow you to return quite significant sums of money - for example, the maximum for property return is 260 thousand rubles.

Read more about property deductions in our article.

Tax service employees accepted applications from citizens in free form until 2021. Now a fixed form has come into effect, according to which the application form must be filled out. We recommend downloading the form from the official website of the tax service nalog.ru, since third-party sources pose a risk of receiving inappropriate paper. The application is included in the standard package of documents for receiving a deduction, so its incorrect spelling may become grounds for refusal to return the funds. The format of this statement is somewhat similar to a declaration, but it is intuitive and should not cause any difficulties.

The first page of the application with the citizen’s personal data

The application is drawn up on several sheets, which must contain the citizen’s data, the full amount of the deduction for which he is applying and the year of expenses incurred. Next, indicate the contact details and address of the payer, the current account for the refund, the name of the bank, the budget classification code and the number of sheets and attachments that make up the application. We remind you that each page is certified by a signature.

Providing benefits

A number of taxpayers are legally entitled to tax benefits - for example, a complete cancellation or reduction in the amount of payments for land, property or transport taxes. Tax inspectors will definitely tell every citizen whether he can qualify for the so-called “fiscal amnesty”. If the answer is positive, you should immediately submit an application for benefits to the Federal Tax Service. It looks like this.

Filling out an application to receive benefits is a matter of two minutes

The application must indicate personal data, as well as attach a copy of the document on the basis of which the citizen is applying for a tax break. This can be a pension or veteran's certificate; in regions where benefits are provided to large families - a corresponding certificate.

Refund or credit of tax paid in excess

In the process of fulfilling tax obligations, citizens may overpay - for example, round the tax amount up or not know that they are entitled to a benefit. A simple typo in documents can also lead to overpayment. The tax office itself can report this, but if the payer discovered the overpayment earlier, he can write a corresponding statement. The overpayment amount can be requested to be returned or “transferred” to account for another type of tax. The application form should not cause any difficulties.

An overpayment application is similar to a tax deduction form

Such an application can be submitted within three years from the moment (day) when the overpayment took place. The tax authority will return the excess amount for the month. However, he can be notified of the overpayment to the Federal Tax Service electronically. You need to go to the portal of the Federal Tax Service, go to the section of the same name - “Overpayment/Debt” and fill out the form online.

Video - Make an application for a refund of overpaid personal income tax

Results

If the taxpayer made an error in the KBK or other fields of the payment order and the payment was received in the budget system of the Russian Federation, then the payment is considered executed. In this case, you should send an application to the Federal Tax Service to clarify the payment.

If critical errors were made: in the recipient's account number or the name of the recipient bank, the payment does not go to the budget. In this case, you need to re-transfer the tax amount to the correct details, pay penalties and write an application for a refund of the incorrectly paid tax to your current account.