How are business transactions reflected in accounting? Any enterprise performs certain actions in the process of carrying out business activities. Accounting must reflect all these transactions . For this purpose, special accounts are used, and the operations themselves are called business ones. Their commission has a direct impact on how reporting is prepared in a particular company.

Definition of business operations

A business operation (HO) is a procedure for transforming the parameters of property, its location, and resources for the emergence of property.

In addition, economic entities participate in the formation of the company’s own, reserve and borrowed capital, and influence the company’s budget.

Any enterprise must be registered in the accounting department with the appropriate posting. Justification will require documentation proving its necessity. Economic change entails the transformation of some parameters, for example, the size of property and capital may change upward or downward. Equity conversions ultimately result in asset and liability adjustments.

The essence of the business transaction

HO can reflect changes in the assets and liabilities of the balance sheet simultaneously or separately in each of them. Each enterprise must be registered electronically or in paper form for the initial recording of changes. When registering operations, it is necessary to adhere to the order of their occurrence and record events according to this order. Thanks to this technique, the accountant is given the opportunity to:

- maintaining permanent and complete records of all property of the company

- confirmation of each completed transaction with relevant documentation

- application of accounting data for ongoing control activities over the work of the company and for operational management purposes

Primary accounting also maintains financial order in the enterprise, because this information is used to control the legality of ongoing operations and their rationality.

How to set the operation type

To determine the type of transaction, you need to analyze which accounts were used in the transactions and what changes in the balance sheet currency were made. The following information will help make the determination easier (A – active, P – passive):

- Active XO. Correspondence: both accounts A. Dt increases, and Kt decreases. The balance does not change.

- Passive XO. Correspondence: both accounts P. Dt decreases, Kt increases. The balance does not change.

- Mixed XO for an increase. Correspondence: Dt - A, Kt - P. Dt and Kt increase. The balance increases.

- Mixed XO for reduction. Correspondence: Dt - P, Kt - A. Dt and Kt indicators are decreasing. The balance will be reduced.

To accurately establish the type of transaction, you need to have information about the chart of accounts and balance sheet structure.

FOR YOUR INFORMATION! An asset is the company's property, and a liability is the sources of this property. There are mixed forms in both assets and liabilities.

Recognizing types of operations

The accounting system distinguishes 4 types of financial assets, characterized by their impact on assets and liabilities:

- A – balance sheet asset

- P – balance sheet liability

- Od – debit turnover

- Ok – loan turnover

- sch. - check

Type 1 is represented by transactions reflecting a decrease in a balance sheet asset (one item is reduced due to transformations of another). For example, if goods are delivered to the warehouse, money is transferred to the cash register from the current account. These operations are characterized by transforming the structure of property objects and maintaining balance:

A + One count.1 – Ok count.2 = P

Type 2 is characterized by postings relating to the liability. For example, the profit received was used to increase reserve capital. The result of financial accounting in accounting will be an adjustment to the sources of financing and obligations of the company, that is, the final indicators will remain unchanged:

P + Oct count 1 – Odt count 2 =A

Type 3 of entries reflects a parallel increase in liabilities and the value of property, which is due to changes in the final indicators. An example is the acquisition of fixed assets and the issuance of a loan:

A + ODT account 1 = P + Oct account 2

Type 4 is represented by enterprises that contribute to a decrease in total indicators due to entries reflecting a decrease in the equity capital or liabilities of the enterprise due to a decrease in the share of assets:

A – ODT account 1 = P – Oct account 2

CWs can also be classified according to their essence. According to this criterion, there are 3 types of them:

- transactions with funds (cash)

- movement of inventory items (material)

- settlement transactions with counterparties (settlement)

Primary accounting documentation is classified using the same method.

Video about business transactions in accounting:

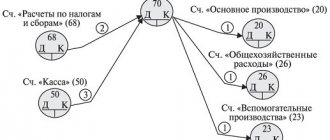

Accounting entries depending on the type of transaction

Let's consider transactions for the first type of business transactions:

- Direction of raw materials to production: Dt20 KT10.

- Receiving funds from the buyer: Dt51 KT60.

- Directing funds to the cash desk: DT50 KT51.

Accounting entries for type 2 transactions:

- Withholding personal income tax from salary: Dt70 KT68.

- Increase in reserve due to profit: Dt84 Kt82.

- Advance payment to the supplier from borrowed money: Dt60 Kt66.

Postings for transactions of type 3:

- Receiving material from the supplier: Dt10 Kt60.

- Payment of salaries: Dt20 Kt70.

- Receipt of borrowed funds: Dt51 Kt66.

Postings for transactions of type 4:

- Loan repayment: Dt66 Kt51.

- Payment of salaries: Dt70 Kt51.

- Direction of payment to the supplier: Dt51 Kt60.

These are the accounting entries that are used most often.

Tabular classifier of operations in accounting

Business transactions in accounting can be classified as follows (Table 1).

| Impact on the bottom line | Correspondence by Dt | Correspondence by CT |

| Asset conversion | Assets | Assets |

| Passive Conversion | Passive | Passive |

| Increasing assets and liabilities | Assets | Passive |

| Decrease in assets and liabilities | Passive | Assets |

What to do with household operations in accounting:

Accounting for “late” documents

Explanations from the auditor about the peculiarities of reflecting lately received documents in accounting and tax accounting.

Reflection in accounting of documents received late does not lose its relevance, and every year before the preparation of annual reports it raises a lot of questions among accountants. The current legislation provides for special rules for reflecting “late” documents, which we will discuss in more detail.

Accounting

Clause 1 of Article 9 of Law No. 402-FZ “On Accounting”

It has been established that every fact of economic life is subject to registration with a primary accounting document.

The primary accounting document is confirmation of the fact of a particular business transaction ( clause 3 of Article 9 of Law No. 402-FZ

).

In addition, paragraph 4 of Article 9 of Law No. 402-FZ

provides that the absence of a primary document is a direct violation of accounting legislation

A “late” document is considered to be a document in which the receipt date is dated later than the date of the business transaction: in the next reporting or tax period.

Important!

In the event that

the primary document was received by a representative of the organization, but for some reason did not reach the accounting department, it will not be considered a document received late and must be reflected in accounting according to the date of the business transaction (fact of business activity), as error according to the rules of PBU 22/2010.

Only a primary document that is dated last year and was received by the organization (or director) on time, but for some reason did not reach the accounting department on time, which led to the appearance of an error in the accounting of the previous year, can be regarded as an “error of the previous period.” The procedure for correcting errors, both in accounting and tax accounting, is described in detail in our information report No. 6 for February 2012, “He who does not work makes no mistakes.”

In the absence of supporting documents in relation to an expense that has grounds and the accountant can estimate the amount of this expense, the primary accounting document for recognizing expenses in accounting

may be an accounting certificate, if there are mandatory details established by

paragraph 2 of Article 9 of Law No. 402-FZ

.

However, an organization has the right to recognize expenses in tax accounting only after receiving the originals of the relevant documents, which is expressly provided for in Article 252 of the Tax Code of the Russian Federation.

According to paragraph 2 of PBU 22/2010

Inaccuracies or omissions in the reflection of facts of economic activity in the accounting and (or) financial statements of an organization identified as a result of obtaining new information that was not available to the organization at the time of reflection (non-reflection) of such facts of economic activity are not considered errors.

Therefore, the fact that documents were received late and reflected in accounting is not an error in understanding PBU 22/2010

.

This standard should be applied “by analogy”, using in combination other PBUs, in particular PBU 4/99 “Accounting statements of organizations”, PBU 9/99 “Income of organizations”, 10/99 “Expenses of organizations” and PBU 7/98 “ Events after the reporting date"

in order to ensure the reliability of financial statements.

The procedure for reflecting business transactions on documents received late depends on whether they were received before or after the moment of signing and submission to tax and other accounting authorities.

1) If the primary document was received by the organization after the end of the reporting year (for example, 2013), but before the date of signing the financial statements for this year, then entries in the corresponding accounting accounts are made on December 31 of the reporting year (2013).

2) If the document was received after the reporting was signed and submitted (to the tax authority, statistics authority or owners), then new information is always reflected in accounting in the current (2014) year using account 91 “Other income and expenses”. Accounting standards do not establish requirements for revision of financial statements in this case, which means that the financial statements of the previous period are not subject to adjustment, regardless of materiality

.

This is the difference between “late documents” and significant errors identified in the period after the submission of financial statements, but before the date of approval - the errors should lead to a revision of the financial statements.

Please note that the organization determines materiality independently, based on the professional judgment of the chief accountant in each specific case.

(

“Recommendations for audit organizations on conducting an audit of annual financial statements for 2010”,

set out in

Letter of the Ministry of Finance of the Russian Federation No. 07-02-18/01 dated January 24, 2011

).

3) Since receiving a document late is not an error according to the definition established by PBU 22/2010, we believe that the organization can decide (possibly enshrine it in the accounting policy) that upon receipt of last year’s document, the financial statements are not revised, but a new one information is reflected in the current year (in our example, 2014), using account 91 “Other income and expenses” as profits and losses of previous years, regardless of the amount.

Please note that when preparing reports and explanations thereto, it is necessary to take into account the requirements of PBU 7/98 “Events after the reporting date”. According to paragraph 3 of this standard, an event after the reporting date is recognized as a fact of economic activity that has had or may have an impact on the financial condition, cash flow or results of operations of the organization and that occurred in the period between the reporting date and the date of signing the financial statements for the reporting year.

An approximate list of such events is given in the Appendix to

PBU 7/98

.

In this case, events after the reporting date are reflected in synthetic and analytical accounting as the final turnover of the reporting period before the date of signing the annual financial statements in the prescribed manner.

If an event occurred after the reporting date indicating that business conditions arose after the reporting date

x, then it is disclosed in the notes to the balance sheet and the income statement. At the same time, no entries are made in accounting (synthetic and analytical) accounting during the reporting period.

We will present the procedure for reflecting late documents in accounting schematically.

Tax accounting

According to paragraph 1 of Article 252 of the Tax Code of the Russian Federation

Expenses are recognized as justified and documented expenses incurred (incurred) by the taxpayer.

Consequently, the taxpayer can recognize expenses in tax accounting only if there are supporting documents

, at the same time, the accounting department can accept an electronic document for accounting, but only if it is signed with an electronic signature.

From a tax point of view, if an organization lately receives documents that are dated from the previous reporting (tax) period and indicate that a particular business transaction was completed in the past period, this is a distortion of data for past periods, that is, an error in tax accounting.

In tax accounting, Article 54 of the Tax Code of the Russian Federation

rules for correcting errors (distortions) in the calculation of the tax base have been established.

Let us remind you that expenses related to previous tax periods are subject to reflection in tax accounting in compliance with the requirements of Article 54 and Article 272 of the Tax Code of the Russian Federation

(

Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated 09.09.2008 No. 4894/08

).

When the amount of income increases

, i.e.

if, as a result of the reflection of the primary accounting document, income tax is subject to additional payment to the budget , an updated tax return is submitted for the period to which the adjustment relates

(

paragraph 2 of paragraph 1 of Article 54 of the Tax Code of the Russian Federation

).

When the amount of recognized expense increases

, i.e.

if, as a result of reflection in the accounting registers of the primary accounting document, the profit tax is reduced, the taxpayer has the right to choose ( paragraph 3 of paragraph 1 of Article 54 of the Tax Code of the Russian Federation

):

ü submit an updated tax return for the period to which the primary accounting document relates,

ü or adjust the tax base in the current tax period (year).

For your information!

A taxpayer has the right to adjust the tax base of the current period only if, according to tax accounting data, the taxpayer has a profit in the period to which the error relates.

If, according to tax accounting data, a loss is received, then there is no fact of excessive tax payment - therefore, an updated tax return is submitted! The financial department in its letters has repeatedly expressed a similar point of view: the receipt by the taxpayer of information regarding expenses that was not available at the time of drawing up the tax return is not an error, therefore, there is no need to adjust the tax base of previous periods ( Letter of the Ministry of Finance of the Russian Federation dated January 30, 2012 No. 03 -03-06/1/40, from 05.10.2010 No. 03-03-06/1/627

).

But if a loss was incurred in the previous tax period, it is impossible, according to officials, to recognize previously unaccounted expenses in the current tax period ( Letter of the Ministry of Finance of the Russian Federation dated 08/11/2011 No. 03-03-06/1/476, dated 03/15/2010 No. 03-02 -07/1-105

).

If the expenses of the previous period are reflected in the primary document drawn up and received in the current tax period, for tax accounting purposes the expenses on such a document will be considered current, since the date of the document is a fundamental condition for reflecting business transactions.

For example, for December services, the contractor prepared a package of primary accounting documents dated January 10, in this case, these are services of the 1st quarter - this rule is contained in paragraph 2 of Article 272 of the Tax Code of the Russian Federation

.

Similar explanations are given by the Ministry of Finance of the Russian Federation in Letter dated December 14, 2011 No. 03-03-06/1/824 and by the Federal Tax Service for Moscow in Letter dated December 22, 2011 No. 16-15 /

[email protected] .

In practice, tax inspectors are not happy with the taxpayer’s ability to correct errors in the current period, especially since additional income and expenses in the tax return should be shown in the appropriate types of income and expenses, without using line 101 “Income of previous years identified in the reporting (tax) period” Appendix No. 1 to Sheet 02 and line 301 “Losses of previous tax periods identified in the current (reporting) tax period” of Appendix No. 2 to Sheet 02. That is, corrections are “not visible” during desk tax audits in the absence of additional documents being provided by the taxpayer.

However, Article 54 of the Tax Code of the Russian Federation

provides such an opportunity to taxpayers, and the right to use it is obvious and does not lead to tax risks, although taking into account the standard “depth” of error - 3 years (

clause 7 of Article 78 of the Tax Code of the Russian Federation).

A situation may arise when the performing organization provided services to the customer or performed certain work, and the acts of services provided (work performed) provided for in the contract as of the reporting date were not returned to the organization or were returned, but the date of signing of the primary document by the customer refers to the next reporting period.

The difference in tax accounting will arise depending on whether we are talking about services or works

.

According to paragraph 5 of Article 38 and paragraph 1 of Article 39 of the Tax Code of the Russian Federation, the service is sold

at the time of its consumption by the customer and does not imply the transfer of property or results of work.

As a rule, in addition to the signed act, in most cases there is evidence confirming the actual provision of the service or its consumption by the customer. If such evidence is available, the contractor has every reason to reflect the revenue and charge VAT on the date of drawing up the act of providing the service, without waiting for the document to be signed by the customer.

According to the financial department, income from the sale of services using the accrual method is recognized in tax accounting on the date on which the customer has an obligation to pay for the services provided to him, determined in accordance with the contract for the provision of paid services ( Letter of the Ministry of Finance of the Russian Federation dated November 13, 2009 No. 03-03- 06/1/750

).

As the VAS indicated in its Determination No. VAS-15640/10 dated 08.12.2010,

The act records only information about services already provided; the absence of acts signed by the customer in this case has no legal significance.

A similar opinion is shared by the Federal Tax Service of Russia for Moscow ( Letter No. 20-12/041989 dated 04/30/2008

).

Consequently, in the absence of an act of services rendered signed by both parties, the contractor is obliged to recognize revenue on the date of provision of the service. By the way, the customer recognizes costs for tax purposes no earlier than the date of signing the act of services rendered.

Please note that the situation regarding completed work is somewhat different.

– they are considered executed precisely from the date of acceptance of their result by the customer (

clause 1 of Article 720 of the Civil Code of the Russian Federation

), that is, it is necessary to focus precisely on the date of signing the work acceptance certificate by the customer (

Letter of the Ministry of Finance of the Russian Federation dated March 16, 2011 No. 03-03-06 /1/141

) to recognize income from the contractor and expenses from the customer for tax purposes.

VAT

If there is confirmation of receipt of the primary accounting document and invoice in a later reporting (tax) period, then in the period to which the primary accounting document relates, one of the requirements established by Articles 171 and 172 of the Tax Code of the Russian Federation

, giving the taxpayer the right to apply a tax deduction.

In general, in order to apply VAT deductions, the following conditions must be met:

– availability of an invoice issued by the seller;

– goods (work, services), property rights must be registered;

– availability of relevant primary documents.

Upon receipt of an invoice from the seller and fulfillment of other conditions provided for in Article 172 of the Tax Code of the Russian Federation

, the buyer has the right to apply a tax deduction.

By virtue of paragraph 2 of the Rules for maintaining a purchase book used in calculations of value added tax, approved by Decree of the Government of the Russian Federation of December 26, 2011 No. 1137

, the buyer registers in the purchase book invoices (including adjustment ones) received from sellers and registered in part 2 of the log of received and issued invoices, as the right to tax deductions arises in the manner established by Article 172 of the Tax Code of the

Russian Federation

.

When receiving an invoice in a later tax period, the taxpayer does not experience any errors or distortions in the calculation of the VAT tax base relating to previous tax periods, and there is also no fact that information is not reflected or is incompletely reflected. Consequently, the taxpayer has no grounds for submitting an updated declaration to the tax authority in the manner prescribed by Article 81 of the Tax Code of the Russian Federation

.

The Ministry of Finance of the Russian Federation adheres to a similar position. In its letters, the financial department indicates that if an invoice is issued by the seller in one tax period and received by the buyer in the next tax period, then the tax amount should be deducted in the tax period in which the invoice was actually received (Letter from the Ministry of Finance RF dated 10/02/2013 No. 03-07-09/40889, dated 07/09/2013 No. 03-07-11/26592

,

dated 05/03/2012 No. 03-07-11/132)

. The moment of receipt of the “input” invoice is recorded through the log of received invoices. You can also use other evidence: envelopes, receipt marks on documents, etc.

Judicial practice on the issue of deducting the amount of VAT on invoices received late is currently ambiguous.

In most of their decisions, the judicial authorities support the right of the taxpayer to apply a VAT deduction during the period of a business transaction, regardless of the date of receipt of the invoice, giving a weighty argument that the moment of presentation for VAT deduction is directly related to the registration of goods, works, services ( Resolution FAS North-Western District dated July 30, 2013 in case No. A42-6538/2012, FAS Resolution of the Ural District dated May 24, 2011 No. F09-1652/11-S2, FAS Resolution of the Volga District dated April 26, 2012 in case No. A65-18893/ 2011, Determination of the Supreme Arbitration Court of the Russian Federation dated August 30, 2010 No. VAS-11269/10

).

But there is also an opposite opinion ( Resolutions of the Federal Antimonopoly Service of the Moscow District dated November 22, 2011 No. A41-19287/10, dated March 9, 2010 No. KA-A40/1561-10

). True, such decisions are the exception rather than the rule.

Taxpayers who are not ready to argue with regulatory authorities will most likely choose the consistent option of applying the VAT deduction, namely, in the quarter in which the “late” invoice is received and registered.

Principles for recording them in accounting

All financial transactions must be recorded in accordance with the time of their occurrence and monetary value. The moment of the operation shows:

- redistribution of ownership of a certain product, work, service

- making payments

- processing credit loans, etc.

Each financial entity is displayed in accounting as a double entry, since it has a parallel impact on the asset and liability of the balance sheet. The correspondence of accounts represents the dependence of debit and credit. Dt shows the volume of the enterprise’s property, and Kt shows the sources of its formation. The creation of the necessary postings is carried out during the conduct of operations.

Each account has its own number. The double entry method ensures that changes in debit and credit are equivalent and helps determine the nature of the posting. If different values of assets and liabilities are revealed, then there is an error in accounting.

Production costs

When considering the issue of a special procedure for recognizing expenses for profit tax purposes, one cannot fail to mention clause 2 of Art. 272 of the Tax Code of the Russian Federation , which determines the procedure for recognizing expenses for payment for work and services of a production nature .

Let us remind you that such expenses are recognized in tax accounting on the date the customer signs the acceptance certificates for work and services. In this case, the taxpayer is not given the right to choose a specific method of accounting for material costs. At the same time, to include the cost of work (services) in tax expenses, a primary document is required, on the basis of which these works will be accepted for accounting. Therefore, obtaining information about costs that was not available to the taxpayer at the time of drawing up the declaration does not give rise to the taxpayer’s obligation to adjust the tax base of the previous period by filing an updated declaration.