How to correctly fill out the UTII declaration for the 4th quarter of 2021? What form should I submit the declaration on? What is the deadline for submitting the declaration for the Ⅳ quarter? The article provides answers to the most common questions and provides a specific example of filling out.

The payer of the single tax on imputed income is obliged to draw up a declaration every quarter and submit it to the tax office, as well as pay the calculated amount of tax to the budget. To help fill out the declaration correctly, the UTII declaration for the 4th quarter of 2021 is considered as an example: a sample completion is presented taking into account certain features that you need to know when drawing up the declaration.

Next, we will dwell in detail on how the declaration should be filled out correctly.

How to fill out the form

The current UTII declaration form for filling out is approved by Appendix No. 1 to the order of the Federal Tax Service of Russia dated June 26, 2018 No. MMV-7-3/414.

The official name of the imputation report is “ Tax return for a single tax on imputed income for certain types of activities .”

The same order of the Federal Tax Service approved the procedure for filling out the UTII declaration (Appendix No. 3, hereinafter referred to as the Procedure).

Composition of the UTII declaration

The imputation report consists of (always fill out all sections):

| STRUCTURAL PART | NAME/WHAT IT REFLECTS |

| First sheet | Title |

| Section 1 | Amount of UTII to be paid to the budget (fill in last) |

| Section 2 | Tax calculation by type of activity |

| Section 3 | Calculation of UTII for the tax period |

| Section 4 | Calculation of expenses for the acquisition of a cash register that reduces tax for the tax period |

For the convenience and correctness of filling out the UTII declaration, the sequence of filling out its sections is important. The best way to do it is listed in ConsultantPlus:

We recommend filling out the declaration in the following sequence: first... (read more).

Next, we will consider the procedure for filling out each part of the UTII declaration. But first, general requirements for filing a declaration.

One of the ways to calculate UTII

Let's look at the algorithm for calculating imputed tax for the 4th quarter of 2020 using an example.

IP Gavrilov Petr Stepanovich is engaged in cargo transportation using his own truck and uses UTII. An entrepreneur has no employees.

To calculate the tax for the 4th quarter, P.S. Gavrilov used a special calculator posted on our website.

Algorithm for using the calculator:

- First, businessman P. S. Gavrilov chose taxpayer status from the proposed options:

- At the next step, I selected the required type of UTII activity from the drop-down list, next to which the corresponding basic profitability is already indicated:

- Then, in the proposed fields, he entered the number of vehicles in each month of the 4th quarter, the value of K2 and the amount of the part of the fixed payment for insurance premiums paid in the 4th quarter (the tax rate and K1 were entered automatically). And the calculated tax amount appeared in a separate field:

This service allows you to save the calculation result to the clipboard and/or print:

How individual entrepreneur Gavrilov filled out the UTII declaration for the 4th quarter, see the sample.

General rules for filling out the UTII declaration

All values of cost indicators are indicated in full rubles:

- less than 50 kopecks (0.5 units) - discarded;

- 50 kopecks (0.5 units) or more - rounded to the nearest ruble (whole unit).

The pages of the declaration have continuous numbering, starting from the title page, regardless of the presence (absence) and number of sections and sheets to be filled out.

The serial number of the page is written in the field specified for numbering from left to right, starting from the first (left) familiarity.

The page number indicator (the “Page” field) has 3 familiar places. For example:

- for the first page – 001;

- for the tenth page – 010.

When filling, use black ink.

Invalid:

- correcting errors by corrective or other similar means;

- double-sided printing of the declaration.

Each indicator corresponds to one field, consisting of a certain number of familiarities. Only one indicator is indicated in each field. The exception is a date or decimal fraction.

To indicate the date, use 3 fields separated by a dot in order.

- day - a field of two familiar places;

- month – a field of two familiar places;

- year - a field of four acquaintances.

That is:

| DD.MM.YYYY |

For decimal fractions, use 2 fields separated by a dot:

- the first one corresponds to the whole part of the decimal fraction;

- the second is the fractional part of the decimal.

The declaration fields are filled in with the values of text, numeric and code indicators from left to right, starting from the first (left) familiarity.

When filling out fields on a computer, numerical values are aligned to the right (last) space.

The text fields of the UTII declaration are filled in with CAPITAL PRINTED characters.

If any indicator is missing, a dash is placed in all familiar places in the corresponding field (a straight line in the middle of the familiar places along the entire length of the field).

If for any indicator it is not necessary to fill out all the information in the corresponding field, a dash is placed in the unfilled fields on the right side of the field. For example, when an organization indicates a 10-digit TIN in the “TIN” field out of 12 acquaintances, the indicator is filled out as follows - “5024002119–”.

When printing on a printer:

- it is acceptable to have no frames for familiar places and dashes for empty signs;

- the location and size of indicators should not change;

- font Courier New 16 - 18 points.

Filling out the title page

| PROPS | HOW TO FILL OUT |

| INN checkpoint | INN, as well as KPP, which is assigned to the organization as a single tax payer on imputed income by the tax authority to which you submit the declaration. Indicated at the top of each page. |

| Correction number | When submitting an initial declaration, enter “0–”; when submitting an updated declaration, indicate the adjustment number (for example, 1–, 2–, etc.). |

| Taxable period | For which you are submitting a declaration. Taken from Appendix No. 1 to the Procedure:

|

| Reporting year | For which you are submitting a declaration |

| Tax authority code | According to documents on registration with the tax authority |

| Code at the place of registration | This is the code for the place of submission of the declaration at the place of registration of the taxpayer. Taken from Appendix No. 3 to the Procedure:

|

| Taxpayer | The full name of the organization in accordance with its constituent documents (if there is a Latin transcription in the name, indicate it) or line by line the full last name, first name, patronymic of an individual entrepreneur |

| Reorganization (liquidation) form code | Taken from Appendix No. 2 to the Procedure:

|

| TIN/KPP of the reorganized organization | Accordingly, the TIN and KPP that were assigned to the organization before the reorganization by the tax authority at the place of registration as a UTII payer. |

| Contact phone number | In the format: country code, city code, number without spaces or symbols between numbers |

| Number of pages | On which the declaration was drawn up |

| Number of sheets | Supporting documents or copies thereof, incl. confirming the authority of the representative (in case of submission by the representative of the taxpayer) attached to the declaration. |

| I confirm the accuracy and completeness of the information specified in this declaration | Indicate:

When submitting a declaration by an organization, in the field “last name, first name, patronymic - line by line the full last name, first name, patronymic of the manager + personal signature and date of signing. When submitting an IP, the “last name, first name, patronymic” field is not filled in . Only a personal signature and the date of signing are affixed. When submitted by a representative-individual, in the field “last name, first name, patronymic” - line by line the full last name, first name, patronymic of the representative + personal signature and date of signing. When submitted by a representative-legal entity, in the field “last name, first name, patronymic” - line by line the full last name, first name, patronymic of the individual authorized in accordance with the document of this legal entity to confirm the accuracy and completeness of the declaration information. In the field “name of organization – representative of the taxpayer” indicate the name of the legal entity – representative of the taxpayer. Sign the person whose information is indicated in the “last name, first name, patronymic” field and the date of signing. In the field “Name of the document confirming the authority of the taxpayer’s representative” - the type of document confirming the authority of the representative. |

Do not touch the section “To be completed by a tax authority employee” : it is for the Federal Tax Service.

When submitting to the Federal Tax Service at the place of registration by the successor organization a declaration for the last tax period and updated declarations for the reorganized company (in the form of incorporation/merger/division/transformation):

- on the title page in the field “at place of registration (code)” – 215;

- in the upper part - TIN and KPP at the location of the successor organization;

- in the “Taxpayer” field – the name of the reorganized organization.

When filling out sections of the UTII declaration, pay attention to the tips and formulas that are in the names of the lines themselves.

What to do with reporting on UTII if an organization plans to close a separate division? How to proceed, see ConsultantPlus:

In this case, the organization is obliged to submit a declaration and pay tax for those periods when the organization was registered as a payer of UTII (see letter of the Ministry of Finance of Russia dated 04/06/2011 No. 03-11-11/83).

Read the complete solution.

Method of submitting a tax return

There are three ways to submit a declaration to the tax authority:

- in paper form in person or through a representative - reporting is submitted in duplicate. A copy with a mark from the tax authority confirming acceptance of the declaration will serve as confirmation of submission of the reports;

- send as a postal item with a description of the attachment. In this case, confirmation of the submission of the reports will be an inventory indicating the declaration to be sent, and the date of dispatch in the postal receipt will be considered the date of submission of the declaration;

- transmit electronically via telecommunication channels under an agreement through an EDF operator or through a service on the Federal Tax Service website.

Declarations must be submitted to the tax authority at the actual place of business. With the exception of situations where it is impossible to clearly determine the place of business (distribution trade, transportation of goods, etc.). In such cases, organizations submit declarations on EBIT to the Federal Tax Service at the location (legal address), individual entrepreneurs - at the place of registration (registration). The address and code of your tax office can be found on the Federal Tax Service website.

Completing section 1

| LINE | HOW TO FILL OUT |

| Each block of lines 010 – 020 | On line 010 – OKTMO code of the municipality, inter-settlement territory, settlement that is part of the municipality at the place of business (place of registration of the UTII payer). Indicated in accordance with the All-Russian Classifier of Municipal Territories OK 033-2013. When filling out the OKTMO code, 11 acquaintance spaces are allocated. If the code has 8 characters, the empty spaces on the right are filled with dashes. For example, for an eight-digit OKTMO code 12445698, write the eleven-digit value “12445698—”. If there are not enough lines with code 010, you should fill out the required number of sheets in section 1. Indicate the code of the municipality in whose territory the reorganized company was registered as a UTII payer. |

| Line 020 | The amount of UTII payable for the tax period. See the formula in the UTII declaration form. |

Do not forget to put your signature and the date of signing this section in the line “I confirm the accuracy and completeness of the information specified on this page.”

Where and how to submit a declaration

The declaration must be sent to your Federal Tax Service at the place of registration of the company (clause 2 of Article 346.28 of the Tax Code of the Russian Federation). This means that if only their own separate divisions are involved in activities subject to UTII, and the head office is located in a different tax system, there is no need to submit a declaration with the data of the “separate divisions” to the address of the head division (clause 5.1 of the Completion Procedure).

If the imputed person operates in one region, one declaration must be submitted to the inspectorate in whose territory he works (the number of units does not play a role here).

If the imputed person works in different places, but are subject to the same inspection, he must also submit one tax return.

Working in different regions belonging to different tax inspectorates obliges special regime officers to submit declarations to each of the inspectorates.

There are three ways to submit an imputation declaration:

- Through the Internet.

- By post, enclosing a copy in the letter (it is safer to issue a letter with a valuable inventory).

- Bring it in person to the Federal Tax Service (clause 3 of Article 80 of the Tax Code of the Russian Federation).

If the declaration is not submitted on time, the company (IP) may be punished financially (Article 106 of the Tax Code of the Russian Federation). The fine will be 5% of the amount of tax declared. The Federal Tax Service will take a fine for each overdue month, and it doesn’t matter whether it’s a full month or not. The current legislation establishes the amount of maximum (no more than 30% of the tax) and minimum (1,000 rubles) fines for violating reporting deadlines (Article 119 of the Tax Code of the Russian Federation). Mitigating circumstances presented by the taxpayer may reduce the fine (clause 1 of Article 112, clause 3 of Article 114 of the Tax Code of the Russian Federation).

The main danger of not submitting the approved form on time is that the tax inspector may block the company's bank account. This will certainly happen if the delay is more than 10 working days (clause 2 of Article 76 of the Tax Code of the Russian Federation).

Completing section 2

Fill out separately for each type of business activity. When conducting the same type of activity in several separately located places, section 2 of the UTII declaration is filled out separately for each place (each OKTMO code).

| LINE | HOW TO FILL OUT |

| 010 | Code of the type of business activity carried out by which you fill out this section in accordance with Appendix No. 5 to the Procedure:

|

| 020 | The full address of the place of conduct of the type of business activity indicated on page 010. The region code is indicated in accordance with Appendix No. 6 to the Procedure. See all codes in a separate file here. |

| 030 | Code according to OKTMO of a municipality, inter-settlement territory, settlement that is part of the municipality at the place of business (place of registration of the UTII payer) |

| 040 | The value of the basic profitability per unit of physical indicator per month for the corresponding type of business activity. Taken from clause 3 of Art. 346.29 Tax Code of the Russian Federation. |

| 050 | The value of the deflator coefficient K1 established for the calendar year. They are taken from the relevant order of the Ministry of Economic Development. |

| 060 | The value of the adjustment coefficient of basic profitability K2, which takes into account the totality of the features of doing business. They take it from local law. Values are rounded after the decimal point to the third decimal place inclusive. |

| 070 – 090: | Column 2 – the value of the physical indicator for the corresponding type of business activity in each month of the tax period. The values of physical indicators are indicated in whole units. Column 3 – the number of calendar days of business activity in the month of registration (deregistration) as a UTII payer. Calculate accordingly:

Column 4 – tax base (amount of imputed income) for each calendar month of the tax period. This is the product of lines 040, 050 and 060, as well as lines 070 or 080 or 090 of column 2. If during the tax period an organization or individual entrepreneur was registered (deregistered) as a UTII payer, the tax base for each calendar month of the tax period is determined as the product of lines 040, 050 and 060, as well as the corresponding indicators of lines 070 or 080 or 090 column 2 - 3, taking into account the number of calendar days of activity in the month of registration (deregistration) as a UTII payer. If during the tax period the payer did not register (was not deregistered) as a UTII payer with the tax authority to which the declaration was submitted, dashes are added in all lines 070 - 090 of column 3. |

| 100 | Tax base (amount of imputed income) for the tax period for the corresponding type of business activity at the specified address. This is the sum of lines 070 – 090, column 4. |

| 105 | The tax rate is 15% or the rate established by regulatory legal acts of representative bodies of municipal districts, city districts, laws of Moscow, St. Petersburg and Sevastopol. |

| 110 | The amount of UTII calculated for the tax period for the corresponding type of business activity at the specified address. This is line 100 × page 105 / 100. |

Are you planning to change the type of assigned activity? Report this to the Federal Tax Service

The tax legislation does not describe the procedure that must be followed by companies and individual entrepreneurs using UTII when switching from one imputed type of activity to another. For example, you first engaged in hairdressing services, and then decided to switch to catering services. Or, instead of trading, they started providing taxi services.

In any case, the following notification measures are required:

- make changes to the Unified State Register of Legal Entities (USRIP) ─ you need to add a new type of activity and exclude the previous one;

- notify the tax authorities of the termination of the previous type of activity by submitting, within 5 working days, applications for deregistration using the UTII-3 form for companies or UTII-4 for individual entrepreneurs (forms approved by order of the Federal Tax Service of December 11, 2012 No. ММВ-7-6/941) ;

- inform the Federal Tax Service about registration as a UTII payer for a new type of activity using form No. UTII-1 for organizations or No. UTII-2 for individual entrepreneurs (forms approved by order No. MMV-7-6/941) ─ 5 working days are allotted for this from the moment of commencement of activity (clause 6 of article 6.1, clause 3 of article 346.28 of the Tax Code of the Russian Federation). Failure to timely submit such an application may result in a fine of RUB 10,000. (clause 1 of article 116 of the Tax Code of the Russian Federation).

Completing Section 3

| LINE | HOW TO FILL OUT |

| 005 | The taxpayer's characteristics can be one of two:

|

| 010 | The amount of UTII calculated for the tax period. This is the sum of lines 110 of all completed sheets in section 2. |

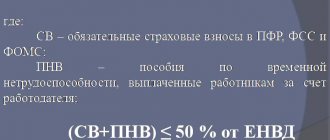

| 020 | The amount of insurance premiums, payments and expenses (clause 2 of Article 346.32 of the Tax Code of the Russian Federation), by which the UTII calculated for the tax period can be reduced - if they are paid in favor of employees engaged in areas of activity on imputation. The question of reducing UTII for insurance premiums of individual entrepreneurs who do not make payments to individuals, is considered in a letter from the Ministry of Finance of Russia, which is in the ConsultantPlus database: According to paragraph 3 of paragraph 2.1 of Article 346.32 of the Code, individual entrepreneurs who apply UTII and do not make payments and other remuneration to individuals have the right to reduce the amount of UTII by the amount of paid insurance premiums in a fixed amount without applying a limitation of 50 percent of the amount of this tax. Read the explanations from the Ministry of Finance in full. |

| 030 | The amount of insurance premiums paid by individual entrepreneurs for compulsory health insurance and compulsory medical insurance in the amount determined by clause 1 of Art. 430 Tax Code of the Russian Federation |

| 040 | Sum of all lines 050 of all completed sheets of section 4 |

| 050 | The indicator value cannot be less than 0. When submitting a declaration by an organization or individual entrepreneur making payments and other remuneration to individuals (page 005 is “1”), the value is determined as follows: Page 010 – (page 020 + page 030) – page 040 In this case, the difference between lines 010 and (020 + 030) cannot be less than 50% of the calculated UTII (p. 010). When submitting a declaration of individual entrepreneurs without employees (line 005 is equal to “2”), the value is determined as the difference between lines 010 and 030 and 040. In this case, the difference between lines 010 and 030 must be greater than or equal to zero. |

Crushing and UTII - how to defend against controllers’ accusations

Often businessmen who use a special regime in the form of UTII are involved in various optimization schemes. Carelessness in this matter may result in accusations of obtaining illegal tax benefits and catastrophic amounts of additional assessments.

So, an individual entrepreneur on UTII had a spare parts store with an area of 300 sq.m. In order not to lose the UTII, he rented out half of the store to another individual entrepreneur (his wife). In fact, he single-handedly continued to manage his entire business himself:

- issued salaries to employees;

- conducted job interviews;

- In the media he positioned himself as a store director and sole owner.

In addition, the store premises were not divided in any way; they had a single sign and checkout area. Many employees found it difficult to answer which individual entrepreneur they worked for, and the price tags for all goods were the same in appearance and contained the businessman’s initials. The spouse did not pay rent. That is, the businessman only demarcated the business on paper, but in reality did not take care of ensuring signs of independence and integrity.

The result is deplorable - the businessman will have to pay 22 million rubles to the treasury for his carelessness. (Resolution of the Arbitration Court of the North-Western District dated September 13, 2018 in case No. A05-14805/2017).

In another trial, the fate of 30 million rubles was decided. additional charges ─ and also an individual entrepreneur on UTII was involved in the case of illegal division of business (Resolution of the North Caucasus District Administrative District dated June 17, 2019 No. F08-4285/19). However, the tax authorities lost the case. The taxpayer wisely approached the organization of his business processes, so he was able to provide the court with evidence that the company and the individual entrepreneur on the UTII had different personnel, different suppliers, different staffing schedules, independent payroll, etc.

The judges noted that in this case, the division of the business meets business goals, since the differentiation of activities and the division of financial flows allows for more efficient management of assets.

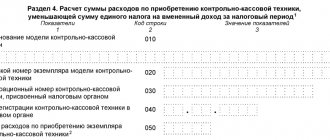

Completing section 4

| LINE | HOW TO FILL OUT |

| 010 | Name of the cash register model included by the Federal Tax Service in the Register of Cash Register Equipment |

| 020 | Serial number of the KKT model in accordance with the documents related to its purchase |

| 030 | CCP registration number assigned by the tax authority |

| 040 | Date of registration of the cash register with the tax authority |

| 050 | The amount of expenses incurred for the purchase of cash register equipment. Cannot exceed 18,000 rubles. |

If lines 010, 020, 030, 040 and 050 are insufficient, fill out the required number of sheets in section 4 of the UTII declaration.

Example of filling out a UTII declaration: sample

Let’s assume that Guru LLC (TIN 5032123456) provides household services to the population for the repair of shoes and leather goods (OKVED 95.23). It is registered as a UTII payer with the Interdistrict Inspectorate of the Federal Tax Service of Russia No. 22 for the Moscow Region (KPP 503235001).

In the 2nd quarter of 2021, the company operated through 2 workshops located in the Odintsovo district:

- in Golitsyno (OKTMO 46755000006). Number of employees – 4 people;

- Kubinka (OKTMO 46755000016). Number of employees – 3 people. This workshop opened in May 2021 and was open for 18 days this month.

In these municipalities, a UTII rate of 15% of imputed income is applied.

The basic profitability for the provision of household services is 7,500 rubles. per month per unit of physical indicator. That is, for each employee (clause 3 of Article 346.29 of the Tax Code of the Russian Federation).

The deflator coefficient K1 in 2021 is 2.005 (Order of the Ministry of Economic Development dated October 21, 2019 No. 684, Article 346.27 of the Tax Code of the Russian Federation).

The coefficient K2 is 0.8 (Appendix No. 1 to the decision of the Council of Deputies of the Odintsovo City District of the Moscow Region dated November 5, 2019 No. 5/10).

In the 2nd quarter of 2021, the organization transferred insurance premiums and sick leave benefits at the expense of the employer in the amount of 57,000 rubles.

The following link shows a correct and fully completed sample UTII declaration for the 2nd quarter of 2021. You can watch it, download it for free and use it in your work.

SAMPLE OF COMPLETING THE UTII DECLARATION

Read also

01.09.2020

Deadlines for submitting the declaration in 2021

Reports are submitted no later than the 20th day of the month following the reporting month. Since no dates this year fall on weekends, the following dates will not be postponed:

| 4th quarter 2019 | 20.01.2020 |

| 1st quarter 2020 | 20.07.2020 |

| 2nd quarter 2020 | 20.07.2020 |

| 3rd quarter 2020 | 20.10.2020 |

| 4th quarter 2020 | 20.01.2021 |

IMPORTANT!

Starting from 2021, the EVND will be cancelled.

To understand which regime you should switch to, use the special tool “Comparison of tax regimes” in the 1C: BusinessStart program.

TRY IT FOR FREE