All information about the presence, receipt and expenditure of cash at the cash desk of a business entity is recorded on active accounting account 50 with the eloquent name “Cash”.

Account 50 reflects both cash and monetary documents.

This possibility is provided for by Russian accounting regulations.

Separate accounting of the types of financial assets reflected in account 50 is carried out through the formation and maintenance of subaccounts (for example, an organization's cash desk - subaccount 50/1, operating cash desk - subaccount 50/2, monetary documents - subaccount 50/3).

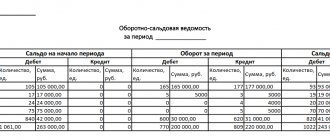

An important role in the accounting of cash assets is given to a simple and convenient register - the balance sheet (TCS).

It is necessary to consider what SALT is under account 50, what its purpose is, and how it is filled out correctly.

Count 50: basic information

Account 50 is the active accounting account. An increase in the resource account on it is reflected as a debit, and a decrease as a credit. For example, if funds from an accountable person are deposited at the cash register, then debit entries will be generated on the account, and if a certain amount of funds is withdrawn from the cash register for transfer somewhere, then account 50 will be involved in credit entries.

Account balance 50 is debit. It is calculated by adding debit turnover to the opening balance and subtracting credit turnover from it. The ending balance shows the balance of funds in the cash register on a specific date.

Cash resources on hand are assets. The cash balance at the reporting date is reflected in the enterprise's balance sheet in the asset category (line 1250). When preparing annual financial statements, most business accountants try to bring account balance 50 to zero.

Accounting is carried out in both national and foreign currencies.

Leave a comment on the document

Do you think the document is incorrect? Leave a comment and we will correct the shortcomings. Without a comment, the rating will not be taken into account!

Thank you, your rating has been taken into account. The quality of documents will increase from your activity.

| Here you can leave a comment on the document “Sample. Statement No. 1", as well as ask questions associated with it. If you would like to leave a comment with a rating , then you need to rate the document at the top of the page Reply for |

Analytics and subaccounts

Analytical accounting for account 50 is carried out in the context of additionally opened sub-accounts:

- 50.1 “Cash of the organization” - used when accounting for the movement of cash resources in the cash desk of the enterprise;

- 50.2 “Operating cash desk” – used to account for funds in operating cash desks;

- 50.3 “Cash documents” – reflects the value of documents stored at the cash desk. These could be tickets, stamps, etc.

The number and composition of subaccounts may change based on the specifics of the organization’s accounting policies.

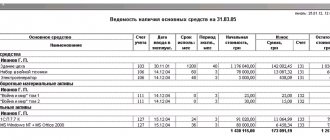

Examples of filling out the order journal No. 1-No. 2, statements No. 1-No. 2

A sample cash book is shown in Table 1

Table 1. Cash book for 03/05/15

| № | From whom it was received and to whom it was issued | Corresponding check | Coming | Consumption |

| Balance at the beginning of the day | 10 000 | |||

| 1 (PKO) | From the bank by check No. 25 | 51 | 60 000 | |

| 2 (RKO) | Issued to Ivanov for travel expenses | 71 | 9 000 | |

| Total per day | 60 000 | 9 000 | ||

| Balance at the end of the day | 61 000 |

Specifics of working with the account

Transactions are recorded only on the basis of documentary evidence. Typical forms used to reflect movement on a count of 50 are:

- cash receipt order – confirms the receipt of funds (regardless of the type of receipt);

- expense cash order - used to formalize the issuance of money from the cash register;

- cash book - all incoming and outgoing cash orders are recorded in it.

These forms allow you to document the movement of funds in the cash register. To maintain accounting for account 50, other accounting registers are used:

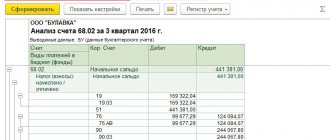

- turnover balance sheet;

- journal-order;

- statement of account 50.

All of the listed registers duplicate information.

The company has the opportunity to establish accounting in accordance with its accounting policies. You can use only one of the specified registers, especially since, if necessary, the software product can generate any of the specified documents.

Found documents on the topic “Statement 1”

- Sample. Payment statement .

Form No. 253 Accounting statements, accounting → Sample. Payment statement. Form No. 253 standard form no. 253 organization page shop - to calculation. statement no. department payroll no . for issuance for 20 years - time sheet - last name, first name, patronymic amount of receipt... - Statement calculation and payment of salaries

Documents of the enterprise's office work → Statement of accrual and payment of wagesstatement of calculation and payment of wages No. organization (division): No. ...

- Sample. Statement № 11

Accounting statements, accounting → Sample. Statement No. 11statement no. 11 movement of material assets (at accounting prices) for 20 to workshops, farms (in production) (unnecessary...

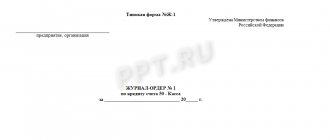

- Sample. Statement № 1

Accounting statements, accounting → Sample. Statement No. 1statement no. 1 on the debit of account no. 50 “cash” from the credit of accounts +-+ balance at the beginning of the month rub. +- cash register date line 46...

- Calculated statement. Form N T-51

Enterprise records management documents → Payroll. Form N T-51... from to payslip ...

- Sample. Statement № 2

Accounting statements, accounting → Sample. Statement No. 2statement no. 2 on the debit of account no. 51 “current account” from credit accounts +-+ balance at the beginning of the month rub. +- string date of issue...

- Sample. Statement № 2.1

Accounting statements, accounting → Sample. Statement No. 2.1statement no. 2/1 on the debit of account no. 52 “currency account” on account credit +-+ balance at the beginning of the month rub. +- string date you...

- Statement inventory results

Accounting statements, accounting → Statement of inventory resultsstatement of inventory results appendix to the letter of the USSR Ministry of Finance dated December 30, 1982 no. 179 led...

- Settlement and payment statement. Form N T-49

Documents of the enterprise's office work → Payroll. Form N T-49document “payroll statement . form n t-49″ in excel format you can get from the link “download file”

- Sample. Statement № 5

Accounting statements, accounting → Sample. Statement No. 5statement no. 5 analytical accounting of settlements with suppliers in the order of scheduled payments (account no. 60 - regarding these calculations) ...

- Weight statement (Unified form N MX-9)

Enterprise records management documents → Weight sheet (Unified form N MX-9)The document “Weight sheet (unified form n MX-9)” in excel format can be obtained from the link “download file”

- Payment log statements. Form N T-53a

Enterprise records → Payroll register. Form N T-53apayroll register for the period from “ ” ...

- Sample. Statement № 15

Accounting statements, accounting → Sample. Statement No. 15statement no. 15 general business expenses, deferred expenses and commercial expenses for 20 +-+ line debitable...

- Sample. Loose sheet 2 k statements № 7

Accounting statements, accounting → Sample. Loose sheet 2 to statement No. 7loose leaf 2 to statement no. 7 analytical data on accounts no. 06, no. 58 +-+ financial object type term amount of investment financial...

- Payment statement. Form N T-53

Enterprise records management documents → Payroll. Form N T-53... payroll document number date of preparation ...

Operation Log 4

What type of document: Application for cash expense or payment order - should be filed with the transaction journal “Transactions with non-cash funds”?

Answer

The journal of transactions with non-cash funds (f. 0504071) is compiled on the basis of primary, consolidated accounting documents, which serve as the basis for the receipt or debit of funds from the institution’s personal account.

Such documents are:

application for cash expenses (f. 0531801);

application for cash expenses (abbreviated) (f. 0531851);

application for receiving cash (f. 0531802);

application for receiving funds transferred to the card (f. 0531844).

Recommendation: How can a budgetary (autonomous) institution take into account funds received from income-generating activities?

In accounting for budgetary institutions:

Budgetary institutions carry out operations with funds from income-generating activities in the Procedure approved by Order of the Treasury of Russia dated July 19, 2013 No. 11n. To pay monetary obligations using funds from income-generating activities, they submit one of the following documents to the Treasury of Russia:

- application for cash expenses (f. 0531801);

- application for cash expenses (abbreviated) (f. 0531851);

- application for receiving cash (f. 0531802);

- application for receiving funds transferred to the card (f. 0531844).

This is stated in paragraph 4 of the Procedure, approved by order of the Treasury of Russia dated July 19, 2013 No. 11n.

On whether a budgetary institution has the right to use revenue from paid activities received at the cash desk, bypassing a personal account with the Treasury of Russia, see Does an institution have the right to use revenue from paid activities received at the cash desk?

2. Situation: is it necessary to file supporting documents in the folder (file) created for the journal of transactions with non-cash funds (f. 0504071): contracts, bills, invoices, acts, invoices, etc.

No no need.

The journal of transactions with non-cash funds (f. 0504071) is compiled on the basis of primary, consolidated accounting documents, which serve as the basis for the receipt or debit of funds from the institution’s personal account.

Such documents are personal account statements in paper and (or) electronic form with attached copies of payment documents. This conclusion follows from the Guidelines approved by order of the Ministry of Finance of Russia dated December 15, 2010.

No. 173n, and paragraph 159 of the Procedure approved by order of the Treasury of Russia dated December 29, 2012 No. 24n.*

Thus, there is no need to file supporting documents (contracts, bills, invoices, etc.) in a folder created for the journal of transactions with non-cash funds (f. 0504071).

File statements from your personal account along with payment documents that serve as the basis for recording transactions on your personal account.

This conclusion follows from paragraph 11 of the Instructions to the Unified Chart of Accounts No. 157n.

Payment transactions with suppliers and contractors are reflected in the journal of settlement transactions with suppliers and contractors (f. 0504071). Therefore, supporting documents, such as contracts, bills, invoices, acts, invoices, etc.

, should be filed in the folder created for this journal. This conclusion follows from the provisions of the Methodological Guidelines approved by Order of the Ministry of Finance of Russia dated December 15, 2010 No. 173n, and the letter of the Ministry of Finance of Russia dated May 6, 2011.

№ 02-06-10/1910

Article: When primary documents are filed with journals. The official answers

Invoices and acts in the institution are filed with the journal of transactions with non-cash funds. Is it necessary to file documents with the journal of settlements with suppliers and contractors?

At the end of each reporting period, primary (consolidated) accounting documents on paper related to the corresponding transaction logs are chronologically selected and bound (clause 11 of Instruction No. 157n).

Entries in the Journal of transactions with non-cash funds (f. 0504071) are made on the basis of primary (consolidated) accounting documents attached to the daily account statements (personal account).* Entries in the Journal of transactions of settlements with suppliers and contractors (f.

0504071) are entered on the basis of primary (consolidated) accounting documents confirming the institution’s acceptance of monetary obligations to suppliers (contractors, performers), other parties to contracts (agreements), as well as primary (consolidated) accounting documents confirming the fulfillment (repayment) of accepted monetary obligations.

This is stated in the Guidelines for the use of forms of primary accounting documents (Appendix No. 5 to Order No. 173n).

Thus, only attachments to bank documents (or similar ones) should be filed with the journal of transactions with non-cash funds.*

4. ORDER OF THE TREASURY OF RUSSIA DATED 10.10.2008 No. 8N

On the procedure for cash services for the execution of the federal budget, budgets of constituent entities of the Russian Federation and local budgets and the procedure for the implementation of certain functions by territorial bodies of the Federal Treasury... (as amended on September 6, 2013)

2.1. Grounds for conducting operations on cash payments from the federal budget

2.1.1.

To make cash payments, recipients of federal budget funds and administrators of sources of financing the federal budget deficit submit to the Federal Treasury (Federal Treasury bodies) at the place of service in electronic form or on paper the following payment documents (paragraph as amended, entered into force on April 18, 2010 by order of the Treasury of Russia dated December 25, 2009 N 15n, - see the previous edition) Application for cash expenses in accordance with Appendix No. 1 to this Procedure (code according to the departmental classifier of document forms (hereinafter referred to as the form code according to KFD) 0531801);*

Statement for the provision of special clothing

Sometimes company employees are given special clothing. The organization must take care of its condition. Clothes are issued on the basis of a statement compiled according to the MB-7 form. The given form is universal. It can be used for any warehouse accounting. The document must contain this mandatory information:

- Full name of the recipient of the workwear.

- Employee personnel number.

- Name and nomenclature of clothing.

- Number of issued protective clothing.

- Start date of use.

- Life time.

The employee signs both when receiving the workwear and when handing it over. Based on the document, you can control the amount of clothing and shoes issued to employees.

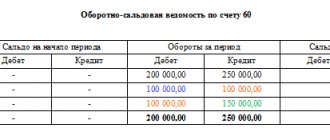

Turnover balance sheet

The balance sheet is a reporting document. Based on it, reporting on the financial condition of the company is created. It records balances on individual accounts and subaccounts. From the balance sheet you can obtain data on the movement of finances and the turnover of funds for the reporting period. It is divided into these types:

- Monthly.

- Quarterly.

- Annual.

The need for a balance sheet arises in the following cases:

- Analysis of the company's financial position.

- Analytics of results for a certain period.

- Analysis of general indicators.

The document records all actions with the organization’s money. Accounting will be conducted based on the statement.