VAT is an indirect tax that is withdrawn to the state budget as part of the cost of goods, work or services as they are sold. The value added tax rate is 18%. In some cases, the VAT rate can be 10% or 0%.

In our article we will focus on the question of what points you should pay attention to when filling out this document. In addition, this page contains a sample payment order for VAT 2020 and its form.

When to pay VAT in 2020

As a general rule, VAT calculated for the quarter must be paid to the budget monthly in three equal installments for three months following the reporting quarter (Article 163, paragraph 1 of Article 174 of the Tax Code of the Russian Federation).

In one payment, VAT is transferred only (Article 163, paragraph 5 of Article 173, paragraph 4 of Article 174 of the Tax Code of the Russian Federation):

- VAT defaulters and persons who are exempt from paying tax;

- tax agents for transactions with non-residents when purchasing works or services from them.

VAT calculated based on the results of the 2021 quarter must be paid monthly in three equal installments. Each third of the calculated tax must be transferred to the budget no later than the 25th day of each of the three months following the expired quarter (Article 163, paragraph 1 of Article 174 of the Tax Code of the Russian Federation). If the 25th day of the month falls on a weekend or non-working holiday, the payment deadline is postponed to the next working day (Clause 7, Article 6.1 of the Tax Code of the Russian Federation).

Example:

For the first quarter of 2021, the amount of tax calculated for payment to the budget is 150,000 rubles. You need to pay VAT to the budget as follows: no later than April 27 - 50,000 rubles. (postponed to 05/06/2020 due to coronavirus); no later than May 25 – 50,000 rubles; no later than June 25 – 50,000 rubles.

Also see:

- VAT payment deadlines in 2021: table

- VAT rates in 2021

- How to check VAT returns in 2021

If the tax is transferred by a defaulter

As is known, persons who are not VAT payers, for example, “simplified people”, in the case of issuing an invoice with the tax allocated in it, are obliged to pay it to the budget (clause 5 of Article 173 of the Tax Code of the Russian Federation). When making a payment, these persons may be asked what payer status to indicate in field 101.

There is no special code specifically for this situation in the order of the Ministry of Finance of Russia dated November 12, 2013 No. 107n, which determines the procedure for filling out this detail. In this regard, we believe that it is possible to set status 01, corresponding to the category “taxpayer-legal entity” or status 09 if VAT is paid by an individual entrepreneur. The remaining details must also be filled out according to the rules established for VAT taxpayers.

NOTE! These persons do not have the right to pay tax in installments (clause 4 of Article 174 of the Tax Code of the Russian Federation).

When is tax considered paid to the budget?

The Tax Code of the Russian Federation regarding the payment of VAT in 2021 stipulates what errors in the payment order for the payment of taxes, incl. VAT are dangerous. This means that the transferred VAT on payments with such errors will not be considered paid, and the obligation of the taxpayer or agent to pay the tax will remain unfulfilled.

Such errors include incorrect indication:

- Federal Treasury account numbers;

- name of the recipient's bank.

The specified details can be clarified in your Federal Tax Service, or you can contact the service “Address and payment details of your inspection” on the Federal Tax Service website nalog.ru

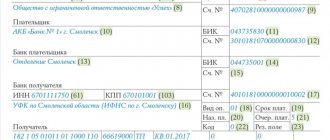

If VAT is transferred for a third party

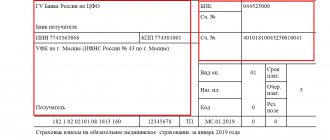

The procedure for filling out a payment order in case of payment for another person is described in the information of the Federal Tax Service of Russia “On tax payments transferred by another person.” When paying VAT for another person in the field:

- 101 “Payer status” indicates the status of the person for whom the tax is transferred.

- 60 “TIN of the payer”, 102 “KPP of the payer” indicates the TIN and KPP of the payer for whom the tax is transferred.

The payer's details indicate the details of the person who fills out the payment order for the transfer of tax to the budget.

The recipient's details indicate the details of the tax authority - the recipient of the VAT.

Fields 22, 104–109 are filled in with data provided by the person whose tax obligation is being fulfilled.

In the “Purpose of payment” field, you need to indicate your INN, KPP, then through the “//” sign the name of the organization for which you are transferring the tax, and through the “//” sign the purpose of payment.

A payment order to pay tax for a third party is available on our website.

Basic details of VAT payment in 2020: explanation

Please pay attention to the correct filling of individual fields of the VAT payment form. Here are the payment details to be filled in when paying VAT in the table:

| Field | What is indicated | How to fill |

| 101 | Payer status |

|

| 104 | KBK |

|

| 105 | OKTMO | OKTMO at the location of the organization (place of residence of the individual entrepreneur) |

| 106 | Basis of payment |

|

| 107 | Tax period indicator | КВ.XX.YYYY, where XX is the quarter number (for example, for the 1st quarter, code 01), YYYY is the year for which payment is made (for example, 2020) |

| 108 | Number of the payment basis document | When paying current payments on the basis of a tax return or when voluntarily repaying debt in the absence of a requirement from the Federal Tax Service (payment basis “TP” or “ZD”), indicate 0 |

| 109 | Date of payment basis document |

|

| 24 | Purpose of payment | For example, “Value added tax on goods (work, services) sold on the territory of the Russian Federation (3rd payment for the 1st quarter of 2020)” |

This might also be useful:

- VAT penalties in 2021

- VAT accounting for individual entrepreneurs using the simplified tax system in 2021

- VAT return 2021

- KBK for VAT 2021

- Filling out a VAT invoice

- Tax system: what to choose?

Is the information useful? Tell your friends and colleagues

Dear readers! The materials on the TBis.ru website are devoted to typical ways to resolve tax and legal issues, but each case is unique.

If you want to find out how to solve your specific issue, please contact the online consultant form. It's fast and free!

General concept of penalties and what they are paid for

In the economic world, three concepts of debt are used, namely: penalty, penalty and fine.

Let's try to understand their differences. (click to expand)

| Penya | Penalty | Fine |

| In fact, the penalty is the same penalty, only more applicable by the tax authorities and is also charged for each day of delay as a percentage according to the formula. | Penalty is used to repay the debt of one legal entity to another; it is the most common method of resolving disputes and is provided for when an agreement is concluded between counterparties. It is calculated either as a percentage or a specific amount is indicated. The actual penalty or penalty in the narrow sense is established, as a rule, for a continuing violation, calculated as a percentage of the amount of the unfulfilled obligation or in a fixed sum of money; | The fine is paid one-time and must be initially agreed upon in the contract. The fine is collected for a one-time or ongoing violation in a fixed monetary amount or as a percentage of the amount of the unfulfilled obligation. |

The penalty, as a rule, is paid by one counterparty to another. Penalty is applied, as a rule, to debts of enterprises, as a measure of punishment for delay in monetary obligations. It is a type of penalty and is paid for each day of delay.

According to tax legislation, penalties are charged for late payment of taxes, as well as advance payments thereon. If the company does not transfer the fine on time, its account may be blocked. Since the payment of penalties is given a certain period specified in the tax requirement and in case of its violation, a notification is sent to the bank about blocking the account and writing off the required amount.

Important! If your organization has several accounts, then one bank fulfills the tax requirement.

It is necessary to check payment orders in 2021

It is necessary to indicate new details of the Federal Treasury. Although I didn't notice any changes in the details.

You need to fill out detail “15” of the payment order - the account number of the recipient’s bank, which is part of the single treasury account (STA).

The details can be checked using the service of the Federal Tax Service website.

A payment order or payment document is a document to the bank on behalf of the owner (client) of the current account: transfer money to another account (pay for a product or service, pay taxes or insurance premiums, transfer money to the account of an individual entrepreneur or pay a dividend to the founder, transfer wages to employees, etc. .everything is below)

A payment order can be generated (and sent via the Internet) in Internet banking (for example, Sberbank-online, Alpha-click, client bank). Internet banking is not needed for small organizations and individual entrepreneurs because... it is complicated, expensive and less safe. It is worth considering for those who make more than 10 transfers per month or if the bank is very remote. Payments can also be generated using online accounting.

Where can I get a payment order for free? How to fill out a payment order? What types of payment orders are there? I will post here samples of filling out payment slips in Excel for 2016-2017, made using the free Business Pack program. This is a fast and simple program. In addition to payment slips, it also contains a bunch of useful documents. I recommend to all! Especially useful for small organizations and individual entrepreneurs who want to save money. Some additional functions in it are paid, but for payment orders it is free.

Feature 3 – field 107 “Tax period”

Depending on what served as the basis for the payment, filling out this field will vary:

- In case of voluntary payment of penalties (the basis of the PP), there will be 0 here, because penalties do not have a frequency of payment, which is inherent in current payments. If you are listing penalties for one specific period (month, quarter), it is worth indicating it, for example, MS.08.2020 - penalties for August 2021.

- When paying at the request of tax authorities (basis of TR) - the period specified in the request.

- When repaying penalties according to the verification report (the basis of the AP), they also put 0.

Read about filling out field 107 in your personal income tax payment form here.

Controversial issues

If, when filling out a payment order, the taxpayer made a mistake in the KBK, such payment will fall into the unknown. Such a situation threatens the payer with penalties and payment of penalties and fines.

To avoid penalties, the specialist must correct the error in the KBK. To do this, he needs to draw up and submit to the tax office an application to clarify the payment details, indicating in it the correct KBK to which the payment should be sent. In this case, the Federal Tax Service will cancel all penalties previously accrued for this payment.

If the accountant did not notice the error, the tax office will charge penalties and fines for late or unpaid fees. However, the payer has the opportunity to challenge such penalties in court.

Many accountants are concerned about the question: can import VAT be taken as a tax deduction?

For taxpayers on the general taxation system who pay basic VAT according to the general rule, there is an opportunity to deduct import VAT. To do this, documents confirming the transfer of the fee to the tax office must be attached to the declaration.

For individual entrepreneurs and organizations under special regime, the right to include import value added tax in the price of sold imported products is allowed.

For tax agents

Tax agents for VAT are, in accordance with Art. 161 Tax Code of the Russian Federation:

- tenants of property from government agencies and local governments;

- purchasers of goods, work and services from foreign organizations operating in the Russian market, which themselves are not registered as taxpayers in the Russian Federation;

- buyers of state property, with the exception of individual entrepreneurs;

- bodies, companies and individual entrepreneurs authorized to sell confiscated property, etc.;

- from 01.10.2011 - buyers of property and (or) property rights of debtors declared bankrupt (with the exception of individuals who do not have the status of individual entrepreneurs);

- registered as taxpayers (organizations and individual entrepreneurs) carrying out business activities using agency agreements, commission agreements or agency agreements, and making settlements under them with foreign persons who are not registered with the tax authorities as taxpayers.

The tax agent indicates its status in field 101, which is designated by the code “02”.

| Status | BCF value |

| Tax agent | 182 1 0300 110 |

Indirect taxes customs union - VAT

Value added tax is included in the group of indirect taxes - it is established in the form of a price surcharge and is levied when carrying out operations of importing goods into the territory of the countries of the customs union (Russia, Belarus and Kazakhstan).

VAT charged when importing goods into the customs territory of the Customs Union of the EAEU (established according to the internal legislation of the EAEU countries).

Indirect taxes + when importing goods from the countries of the Customs Union.

In the Russian Federation, customs VAT on imports, in accordance with subparagraph 4 of paragraph 1 of Article 146 of the Tax Code of the Russian Federation, is included in customs payments, therefore, in relation to such operations, along with the norms of Chapter 21 “Value Added Tax” of the Tax Code of the Russian Federation, the norms of customs legislation apply.

Calculation of late fees

The first step is to decide on the amount of the penalty: as a rule, it is set by the tax office, indicating why and on what basis it was calculated, but if you have to calculate it yourself, there is a calculation formula:

SP = N x Kd x 1/300 x SR

SP – amount of penalty;

N – the amount of tax not paid on time;

Kd – number of days of delay;

SR – refinancing rate valid during the period of delay.

According to this formula, the penalty will be calculated until October 1, 2021 for the first thirty days of delay at the rate of 1/300, and then at a rate of 1/150 of the rate of the Central Bank of the Russian Federation, currently it is 7.25%

So, for example, the employee’s salary was supposed to be paid on March 31, 2021, but in fact the employee received it on April 20, 2021, the amount of the salary was 32,000, the delay was 20 days

Penalty=32000*20*1/300*7.25%=154.66 rub.

In total, the company must pay 154.66 rubles to the budget.

Incorrectly issued invoice

Payment of tax to the budget on an illegally issued invoice is an exception to the general rules of payment. An exception applies in cases where:

- the seller is not a VAT payer (exempt from VAT);

- Sales of goods (works, services) are not subject to VAT.

The tax payment deadline in this case is no later than the 25th day of the month following the last month of the quarter. For example, for the third quarter - no later than October 25.

This conclusion follows from the provisions of paragraph 4 of Article 174 and paragraph 5 of Article 173 of the Tax Code of the Russian Federation. This is confirmed by the letter of the Federal Tax Service of Russia dated October 29, 2008 No. ШС-6-3/782.

Let's sum it up

- VAT is one of the taxes calculated quarterly. It is calculated based on data covering the quarter preceding the moment of calculation. The result of the calculation is formed in the tax return.

- You can pay the tax amount corresponding to the quarterly accrual not at once, but in installments equal to 1/3 of the accrued amount, monthly during the quarter following the quarter for which the calculation was made. The payment deadline for each and such months becomes the 25th. But if it coincides with a weekend, it shifts to a later day.

- A payment order for each VAT payment is drawn up according to the same rules. And these rules correspond to those established for payment documents for tax transfers. Mandatory completion in such documents requires information necessary to identify the tax payment.

If you find an error, please select a piece of text and press Ctrl+Enter.

Import from EAEU countries - BCC for import VAT

Since May 29, 2014, the EAEU has existed - the Eurasian Economic Union. The unification of the Russian Federation, the Republic of Belarus and the Republic of Kazakhstan into a single economic zone has simplified the procedure for trade policy and commodity exchange between countries. The main idea of creating the EAEU is to ease the tax burden in the process of trade between participants. Also, a Customs Union has been created for the EAEU member countries, establishing uniform rules for regulating foreign trade with third parties. Currently, Armenia and Kyrgyzstan have also joined the EAEU. Thus, a special regime for paying value added tax for taxpayers from the Russian Federation has been established when trading with Belarus, Kazakhstan, Armenia and Kyrgyzstan.

VAT when purchasing goods from EAEU countries is paid by taxpayers both with a general tax regime and with special regimes.

It is important to remember that VAT when importing from EAEU countries is paid not upon import at customs, but to the territorial Federal Tax Service through a payment order. VAT must be transferred even if the counterparty is not from the countries of the Customs Union, but imports goods from the territory of the EAEU countries.

You will also have to pay VAT if the purchased products were previously imported into the EAEU countries.

This VAT can be calculated using a special formula:

From 01/01/2019, the tax rate has been increased from 18 to 20%.

If a product is purchased in a foreign currency, its price must be converted into rubles at the current exchange rate at the time the product is accepted for accounting.

After registering goods from the EAEU countries, it is necessary to transfer VAT (KBK - 182 1 0400 110) to the tax office by the 20th day of the month following the period in which imported products were accepted for accounting.

During this period, the taxpayer is also required to submit a declaration on indirect taxes (import VAT - indirect tax) along with an application for the import of products and the transfer of value added tax. The territorial Federal Tax Service must provide all settlement and payment documents for imported goods (invoice, delivery note, etc.) and a certified copy of a bank statement reflecting the VAT payment transaction.