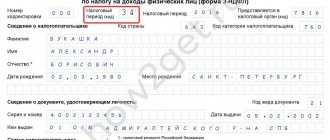

When is it necessary to draw up and register 3-NDFL?

Drawing up a 3-NDFL tax return may be necessary in 2 cases:

- If in the reporting year income was received on which tax was not withheld (for example, from the sale or rental of property, from entrepreneurship, donations, winnings). In this case, you need to find out how to correctly fill out 3-NDFL for the income on which you need to pay tax. The corresponding sample of filling out 3-NDFL can be found here.

- If in the reporting year personal income tax was paid in excess (and there is no way to return it through a tax agent) or expenses were incurred for which personal income tax can be reimbursed from the budget (property or social deductions). In this situation, it is important to understand how to fill out 3-NDFL so that there are no problems with tax refunds.

IMPORTANT! For reporting for 2021, Form 3-NDFL must be completed on an updated form.

ConsultantPlus experts told us what has changed in the form. Get free demo access to K+ and go to the Ready Solution to find out all the details of the innovations.

You can familiarize yourself with a sample of filling out 3-NDFL for the relevant deductions in the materials:

- “Filling out the 3-NDFL declaration for property deduction”;

- “Declaration 3-NDFL for treatment”;

- “Tax return 3-NDFL for studies - sample.”

General requirements for filling out a tax return on paper

The paper tax return form must be filled out by hand or printed out. When filling, use blue or black ink.

Text fields must be filled in CAPITAL letters.

Each page of the declaration is printed on a separate sheet. Double-sided sheets are not allowed in the declaration submitted on paper .

Declaration (calculation) sheets must be located on one side of the sheet with a “Book” type orientation. Sheet format: A4 (210 mm × 297 mm). Margin sizes: minimum 5 mm.

It is highly advisable to use standard office paper with a density of 80 g/m2 for printing.

The declaration cannot be amended. If something needs to be corrected during the preparation of a document, you need to fill out/print out the necessary sheets again, immediately without errors.

Even partial loss of information on the declaration sheets when the sheets are stapled is not acceptable

Rules and procedure for submitting 3-NDFL

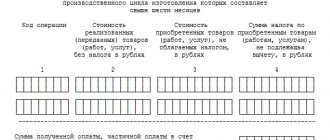

How to fill out the 3-NDFL declaration on income received? If the 3-NDFL tax return is prepared on the basis of income, the sheets related to income must be filled out. Example - Appendix 1 of the 3-NDFL declaration for income received in the Russian Federation. If it is possible to use the right to deductions for these incomes, you must also fill out the sheets corresponding to these deductions.

The declaration must be accompanied by documents confirming the correct completion of the 3-NDFL declaration, as well as copies of documents giving the right to deductions.

The declaration is drawn up separately for each calendar year and submitted to the Federal Tax Service no later than April 30 of the following year (unless it is a holiday). If for some reason it is not submitted for any of the past 3 years, you need to fill out 3-NDFL for the corresponding period, using the 3-NDFL sample that is relevant for the corresponding year and the instructions for the 3-NDFL declaration corresponding to that year, and submit ready report to the tax office.

For more information about the deadlines for submitting 3-NDFL, read the article “What are the deadlines for submitting the 3-NDFL tax return?”.

ConsultantPlus experts explained how to fill out and submit the 3-NDFL declaration for 2021 for an individual entrepreneur. Get trial access to the system and upgrade to the Ready Solution for free. It's free.

Who is obliged to take

Before moving on to step-by-step instructions for filling out 3-NDFL, we will consider the key requirements for this tax reporting form. Let’s determine who, when and how is obliged to report to the Federal Tax Service:

- Private traders and individual entrepreneurs, that is, those citizens who do business independently or carry out private practice.

- Citizens recognized as tax residents in the reporting period and who received income outside the Russian Federation. That is, these are those individuals who stayed in Russia for at least 183 days a year.

- Persons who sold real estate, land plots or vehicles during the reporting period.

- Citizens who received income in the form of lottery winnings, valuable gifts and other income exceeding the maximum permissible limit established for such types of income.

- Persons who received income in the reporting period under work contracts or civil contracts.

- Individuals applying for tax deductions (property, professional, social or treatment).

Income Tax Refund Instructions

What are the rules for filling out the 3-NDFL tax return to receive a tax refund? If it is necessary to fill out the 3-NDFL declaration to receive a tax refund from the budget, it contains sheets for income paid by the tax agent (agents), as well as sheets for deductions that give the right to a tax refund.

The declaration must be accompanied by documents confirming the correctness of the data indicated on income (certificates in form 2-NDFL) and deductions, as well as copies of documents confirming the right to them.

For more information about the documents required to receive a deduction, read the materials:

- “Documents for tax deduction when purchasing an apartment”;

- “Documents for obtaining a tax deduction for treatment.”

Filling out the 3-NDFL declaration to receive reimbursement from the budget is carried out separately for each calendar year. The deadline for its submission has not been established, and therefore it can be submitted to the Federal Tax Service not only in any month of the year following the reporting year, but also within three years following the reporting year. The occurrence of a 3-year period in the absence of a specified deadline is explained by the fact that such a period is valid for filing an application for a tax refund. Thus, in 2021, a declaration can be submitted for 2021, 2021 and 2020, i.e. for those for which the tax can be refunded.

For information about the refund procedure, read the material “Procedure for the return of income tax (NDFL): nuances”.

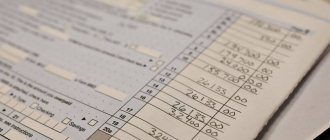

Tax calculation and submission of declaration

So, all the data for calculating the tax has been entered. The program automatically displays the result and shows that the tax payable is 44.2 thousand rubles.

This amount is displayed:

- in section 2, which provides the calculation of tax based on income from Appendix 1 and expenses/deductions from Appendix 6;

- Section 1, which contains information about the BCC, OKTMO and the amount of tax payable to the budget.

The declaration has been generated, now it needs to be saved.

The saved version can be printed in .pdf format, or you can send it to the tax office without printing it.

To send the report, it is signed with a non-qualified signature by entering a password.

Filling out a report online has its advantages: you don’t need to think about which line of the declaration this or that indicator belongs to - the program itself fills it out line by line, based on the data entered by the taxpayer.

Where to get the declaration form for 2021 and 2021

Filling out the 3-NDFL tax return for the corresponding year must be done on the form that was valid for that year, and according to the filling rules that accompanied each of the forms. These rules, which are essentially a description of the step-by-step filling out of the 3-NDFL declaration, are contained in each of the documents that approve the form for the next year.

Over the past 3 years, the 3-NDFL declaration form has changed annually. Thus, in 2021 you may need:

- certificate 3-NDFL sample 2021;

- sample certificate 3-NDFL 2021;

- declaration 3-NDFL 2021.

You can find these forms and find out how to fill out the 3-NDFL declaration for each of the listed periods on our website. Here you can also see a sample of filling out the 3-NDFL tax return for each year.

For the report for 2021, you should use form 3-NDFL, approved. by order of the Federal Tax Service dated October 7, 2019 No. ММВ-7-11/ [email protected] This form can be downloaded in our material “3-NDFL: new form for 2021”.

The 3-NDFL declaration form for 2021 was approved by order of the Federal Tax Service of Russia dated October 3, 2018 No. ММВ-7-11/ [email protected]

You can download it from the link below:

If the taxpayer has a personal account on the website of the Federal Tax Service, you can fill out the declaration directly there, based on the sample for filling out the 3-NDFL declaration posted here.

Our experts have also prepared material on how to fill out 3-NDFL for 3 years.

For details, see the article “How to fill out the 3-NDFL declaration for 3 years?”

Example

Artemenko Ruslan Nikolaevich purchased an apartment in 2021 for 3,500,000 rubles. To pay the seller Artemenko R.N. took out a mortgage in the amount of 1,001,387 rubles, he paid the rest of the funds from personal savings. At the end of the year, Artemenko R.N. filed a 3-NDFL declaration for property deduction. First of all, he filled out the title page.

Artemenko recorded data on income in Appendix 1 of the 3-NDFL declaration.

In 2021 Artemenko R.N. received income from:

- LLC "Alternativa" in the amount of 90,008.07 rubles, of which the taxable base was 56,408.07 rubles, from which personal income tax was withheld in the amount of 7,333 rubles.

- Sigma LLC in the amount of 78,085.27 rubles, from which the employer withheld personal income tax in the amount of 10,151 rubles.

He transferred the final information to section 2 of the form:

| Line | Decoding | Amount (rub.) | Calculation |

| 010 | Total income | 168 093,34 | 90 008,07 + 78 085,27 |

| 080 | Amount of tax withheld | 17 484 | 7 333 + 10 151 |

| 160 | Amount of tax to be refunded | 17 484 |

Expanded list of income codes to fill out

There will be 17 of them (from 10). Here is a table of updated codes:

| Code | Name |

| 01 | Income from the sale of residential houses, apartments, rooms, including privatized residential premises, dachas, garden houses or land plots or share(s) in the specified property, determined based on the price of the object specified in the agreement on the alienation of property |

| 02 | Income from the sale of residential houses, apartments, rooms, including privatized residential premises, dachas, garden houses or land plots or share(s) in the specified property, determined based on the cadastral value of this object, multiplied by a reduction factor of 0.7 |

| 03 | Income from the sale of other property (except for securities) |

| 04 | Income from transactions with securities |

| 05 | Income from property rental (hire) |

| 06 | Income in cash and in kind received as a gift |

| 07 | Income received on the basis of an employment (civil) contract, the tax from which is withheld by the tax agent |

| 08 | Income received on the basis of an employment (civil) contract, the tax from which is not withheld by the tax agent, including partially |

| 09 | Income from equity participation in the activities of organizations in the form of dividends |

| 10 | Other income |

| 11 | Income from the sale of other real estate, determined based on the price of the object specified in the agreement on the alienation of property |

| 12 | Income from the sale of other real estate, determined based on the cadastral value of this property, multiplied by a reduction factor of 0.7 |

| 13 | Income from the sale of vehicles |

| 14 | Income in the form of remuneration received by the heirs (legal successors) of the authors of works of science, literature, art and authors of inventions, utility models and industrial designs |

| 15 | Income in the form of winnings paid by lottery operators, distributors, organizers of gambling conducted in a bookmaker's office and totalizator |

| 16 | Income in the form of winnings paid by the organizers of gambling, not related to gambling in a bookmaker's office and totalizator |

| 17 | Income in the form of the cash equivalent of real estate and (or) securities transferred to replenish the endowment capital of non-profit organizations in the manner established by Federal Law dated December 30, 2006 No. 275-FZ “On the procedure for the formation and use of endowment capital of non-profit organizations” (Collected Legislation of the Russian Federation) Federation, 2007, No. 1 (Part 1), Article 38; 2013, No. 30 (Part 1), Article 4084) |

Other changes:

- new format for recording phone numbers;

- in line 030 you will have to indicate the method of purchasing a residential building;

- an additional line to indicate the social deduction for the purchase of medicines.

How to fill out 3-NDFL correctly: declaration form, example of filling out for 2021

How to fill out the 3-NDFL declaration correctly? The following sequence of actions must be followed:

- Find the declaration form for the corresponding year. Collect all the necessary documents on the basis of which data will be entered into the declaration. In particular, the procedure for filling out the 3-NDFL declaration to receive a tax refund from the budget involves the use of information from certificates of income from places of work in the 2-NDFL form.

- Select the sheets from the declaration that need to be filled out.

- Find in reference and legal databases or the Internet at the request “tax return 3-NDFL example of filling out” an example of filling out the 3-NDFL declaration for your situation and fill out the declaration.

If the declaration is filled out on the website of the Federal Tax Service, in the taxpayer’s personal account, then the necessary declaration sheets for the relevant situation will be selected automatically. Thanks to the system of tips available in your personal account, you can do without searching for a sample of filling out 3-NDFL.

To generate a report, you can also use the program for filling out the 3-NDFL declaration, available on the website of the Federal Tax Service.

You can download it here.

For the report for 2021, use the updated declaration form from the order of the Federal Tax Service of Russia dated August 28, 2020 N ED-7-11/ [email protected]

A sample of filling out Form 3-NDFL by an individual entrepreneur for 2021 is available in the ConsultantPlus system. To see an example of filling out the updated form, get a free trial access to the K+ system.

What to do if an error is made in 3-NDFL? The answer to this question is in ConsultantPlus. If you don't have access to the system, get a free trial online.

What to include in “Information about the declarant”

You have entered the initial conditions, finally let's move on to the sections.

Let's start with where you indicate information about yourself - “Information about the declarant”. Select the “document drawer” icon at the top. Enter your passport details. Print any text (including last name, first name and patronymic) in the usual form. Let's say our last name is Kondratyev. The program itself converts all letters to capital letters.