An organization can have accounts not only in rubles, but also in the currencies of other countries. Such accounts are opened when, due to the type of activity, a company needs to conduct settlements with foreign partners, purchase raw materials and supplies for foreign currency, and import other material assets. The law does not impose restrictions on businessmen to open such accounts.

Question: When calculating income tax, is the exchange rate difference from the revaluation of fund balances (100% advance payment under an export contract) in a foreign currency bank account taken into account when exchange rates change and on what date? View answer

However, since all financial obligations, as well as tax and accounting on the territory of the Russian Federation, are carried out exclusively in the national currency, due to exchange rate fluctuations, the readings of foreign currency accounts periodically change, and these changes must be monitored and taken into account.

Let's consider the features of revaluation of balances on foreign currency accounts of organizations, the intricacies of accounting and tax accounting for these operations.

How to revalue the balance of funds in a foreign currency account ?

Revaluation of foreign currency balances upon purchase

The acquisition of foreign currency by companies is necessary for business development, for example, in order to import goods. The following entries should be made in accounting:

| Debit | Credit | A comment |

| 57 | 51 | Funds were transferred to purchase foreign currency |

| 52 (1-3) | 57 | Foreign currency is credited to a special account |

| 10 | 57 | Reflection of revaluation of foreign currency balances (difference between Central Bank rates and purchases) |

| 91.2 | 57 | Bank commission accounting |

| 51 | 57 | Crediting unused amounts |

In the case when foreign currency is not purchased for import operations, the following should be recorded in accounting:

| Debit | Credit | A comment |

| 57 | 51 | Funds for the purchase of foreign currency have been transferred |

| 52 (1-3) | 57 | Money has been credited to the transit account |

| 91.2 | 51 | Remuneration paid to the bank |

The financial result of the transaction is subsequently reflected:

- When the Central Bank exchange rate is less than the purchase rate, the difference (exchange rate) is taken into account as a component of costs:

Dt 91.2 Kt 57

The amount reduces the company's profit.

- Operating income appears provided that the Central Bank quotation exceeds the purchase rate:

Dt 57 Kt 91.1

The company's profits are growing.

Example 1. Bought $4500. The purpose of purchasing currency is to pay travel allowances to employees going abroad.

265.5 thousand RUB were transferred to the bank.

The bank purchased $ at the rate of 57.3 rubles/dollar. For the operation he wrote off the commission:

(265,500/4500 – 57.3) 4500 = 7,650 rubles.

On the day when the operation was carried out, the Central Bank exchange rate was 56.8 rubles/dollar.

IFRS, Dipifr

Exchange differences are differences that arise when converting the value of assets/liabilities from one currency to another. They inevitably arise as currency exchange rates are constantly changing.

Accounting for transactions in foreign currencies is regulated by the international standard IAS 21 “The Effects of Changes in Exchange Rates”. In Russian accounting, these operations are regulated in PBU 3/2006.

IFRS 21 introduces the concepts of monetary and non-monetary balance sheet items, functional currency and presentation currency, which are not present in PBU 3/2006 due to a narrower scope of application, as well as different accounting rules.

Read below in this article:

IAS 21 is used to account for foreign exchange transactions in the following cases:

- if the company transacts in foreign currencies (and has assets and liabilities denominated in foreign currencies) (examples)

- if the company has decided to prepare consolidated statements in a foreign currency (for Russia this may be IFRS statements in dollars or euros) (example)

- if the company has a foreign division and it is necessary to provide the results of the activities of this division in national currency

The scope of application of Russian PBU 3/2006 applies only to individual reporting of an organization when converting transactions into Russian rubles, i.e. does not include items 2 and 3 from the above list.

In IFRS, exchange differences can be charged to both profit and loss and other comprehensive income.

In RAS, exchange rate differences are reflected by postings in correspondence with 91 accounts:

- Dt 50, 52, 55, 57, 60, 62, 66, 67, 76 Kt 91-1 - positive exchange rate difference

- Dt 91-2 Kt 50, 52, 55, 57, 60, 62, 66, 67, 76 - negative exchange rate difference

Functional and presentation currency

Functional currency

is the currency used in the primary economic environment in which a company operates. For Russian companies that make sales and purchases in rubles, pay salaries and take out loans in rubles, the functional currency is the ruble.

Foreign currency

— any currency other than the functional currency of the entity.

Presentation currency

is the currency in which financial statements are presented.

If a Russian company prepares consolidated financial statements under IFRS in dollars, then the dollar is the reporting currency.

In this case, it is necessary to convert all balance sheet and income statement items from rubles (functional currency) to dollars (presentation currency). How to do this is prescribed in IFRS 21.

Two main questions that arise in connection with the accounting of foreign exchange transactions are:

- 1) what exchange rate to use when converting currencies

- 2) where to reflect exchange rate differences in reporting.

To answer these questions, IFRS 21 divides balance sheet items into monetary and non-monetary.

Monetary and non-monetary items

Monetary items are a) cash in currency or b) assets and liabilities that are to be received or paid in cash. Monetary items are accounts receivable and payable, financial instruments denominated in foreign currency.

Non-monetary items include fixed assets, intangible assets, inventories, goodwill, advances issued and advances received and settlement obligations, the settlement of which must be made by providing a non-monetary asset. Advances issued/received (for example, prepayment for rent) according to IFRS 21 are classified as non-monetary assets, since they are repaid not in cash, but in services or goods.

Examples of calculating exchange rate differences - from foreign currency to functional

Exchange rate of the ruble to the dollar of the Central Bank of the Russian Federation:

- December 15, 2014 - 58.3461

- January 31, 2015 - 68.9291

Example 1. Monetary asset

Let's say you bought 1,000 dollars on December 15, 2014 at the rate of 58.3461 for the amount of 58,346.1 rubles. After 1.5 months, on January 31, 2015, the exchange rate between the ruble and the dollar increased significantly, and $1,000 now costs 68,929.1 rubles. The difference between the purchase price and the valuation amount as of January 31 is 10,583 rubles.

This is the exchange rate difference for the currency purchase transaction. In this case, this is an exchange rate gain (positive exchange rate difference), since the value of our asset (cash) has increased due to the rise in the dollar exchange rate.

If we had sold $1,000 on January 31, 2015, then this profit would have been realized: we would have received 10,583 rubles more than we paid for dollars in mid-December 2014.

- 12/15/14 Dr Cash (currency) Kt Cash (rubles) - 58,346.1

Source: https://msfo-dipifr.ru/kursovye-raznicy-primery-rascheta-i-provodki-msfo-21/

Features of revaluation when selling currency

In modern conditions, organizations can sell from 0 to 25% of their foreign currency earnings to the state. This process is reflected as follows:

| Debit | Credit | A comment |

| 57 | 52.1 | sending currency for sale |

| 51 | 91.1 | crediting the proceeds from the sale to the account |

| 91 | 57 | sold foreign currency written off |

| 91.2 | 51 | sales costs taken into account |

On the last day of the reporting period, currency balances are revalued. Possible entries upon receipt:

- arrived Dt 91 Kt 99

- loss Dt 99 Kt 91.9

Important! Unrealized earnings in foreign currency are credited to the account:

Dt 52.1 Kt 52.(1, 2)

Advance payments and exchange rate differences

Amounts of advance funds issued or received are subject to accounting at the rate current on the date that corresponds to the moment of transfer of the money supply or its receipt.

When, for example, raw materials are purchased on account of an advance payment previously paid, it is paid at the rate prevailing on the day the advance money was transferred.

Problems in accounting are possible if they are insufficient to fully cover the cost of the supplied raw materials. The value of the purchased product will be formed from two components:

- The advance amount, which is calculated in accordance with the quotation on the date of its sending.

- Cost not covered in advance. It is calculated using the exchange rate in effect on the day the raw materials were accepted for accounting.

The previously transferred advance payment is not subsequently subject to revaluation.

Features of payment in foreign currency for loans and borrowings

Loans received by companies are:

- Short-term (up to 12 months).

- Long-term (more than a year).

In the first case, accounts are used to account for them. 66, 66.21, 66.22, and operations are reflected as follows:

| Debit | Credit | A comment |

| 52 | 66.21 | Money was credited to the foreign currency account as a short-term loan |

| 66.21 | 52 | Transfer of funds to cover a loan in foreign currency |

| 66.22 | 52 | Interest coverage |

In accounting for long-term loans in $, €, £, accounts are used. 67, 67.21, 67.22:

| Debit | Credit | A comment |

| 52 | 67.21 | Money is credited to a foreign currency account as a long-term loan |

| 67.21 | 52 | Funds transferred to repay the loan |

| 67.22 | 52 | Transferred interest |

Accounting for loans in foreign currency is carried out in a similar way using accounts 66.23 and 67.23.

Calculation of exchange rate differences when purchasing non-current assets

When a company purchases fixed assets, intangible assets in foreign currency under previously concluded contracts, their value is determined either at the Central Bank exchange rate or at another quotation agreed upon by the parties on the date the assets were included in accounting. After a while it is not recalculated.

Only payment arrears (if any) are subject to revaluation. Then exchange rate differences arise, positive or negative.

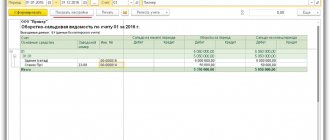

Example 2. The company purchased refrigeration equipment for $20 thousand. The Central Bank exchange rate on the day of purchase: 57.4361. Payment is deferred for a month.

| Description | Debit | Credit | Amount in rub. |

| Refrigeration equipment purchased | 08 | 60 | 1 148 722,00 (20 000·57,4361) |

On the last day of the month, the debt payment should be recalculated. The Central Bank quote is 57.6587, which is higher than the previous one. The company incurs costs - for a full settlement, it needs a larger amount of ruble money to pay the counterparty:

| Description | Debit | Credit | Amount, rub. |

| Reflection of exchange rate differences according to settlements with the counterparty | 91 | 60 | 4 452,00 (20 000·(57,6587-57,4361)) |

Example No. 4

The LLC entered into a deal for the supply of goods with a foreign organization in the amount of 11.8 thousand dollars. The cost of production is 200 thousand rubles. On October 10, 2015, the partner transferred $5,000 in advance to the LLC. On October 20, 2015, the LLC shipped the entire shipment. The final payment was made on 11/25/15. On the same day, ownership of the product was transferred to the buyer. The supplier uses a general tax system, NPP pays quarterly.

The dollar exchange rate is:

- on 10.10 - 29.4 rubles/dollar;

- on October 25 - 29.70 rubles/dollars;

- on 25.11 - 30.00 rub./dollar.

In BU, advance payment and shipment are recorded using the following transactions:

- DT52 KT62 – 147 thousand rubles. (5,000 x 29.4) – prepayment for the goods has been received.

- DT76 KT68 – 22.424 thousand rubles. – VAT is charged on the advance payment.

- DT62 KT90-1– 348.96 thousand rubles. (147+ 6.8 x 29.7) – sales revenue is taken into account.

- DT62 KT62– 147 thousand rubles. - the advance has been credited.

- DT90-3 KT68 – 53.46 thousand rubles. (10,000 x 29.7 x 0.18) – VAT charged.

- DT68 KT76 – 22.424 thousand rubles. – the tax amount is accepted for deduction.

- DT90-2 KT41– 200 thousand rubles. – the cost of production is taken into account. The same amount is included in non-operating expenses.

Since the contract provides for an advance and the final payment is made after shipment, an exchange rate difference arises in accounting in relation to the second part of the payment, i.e. 6.8 thousand dollars. It is reflected in the statements on the date of receipt of funds:

- DT52 KT62 – 204 thousand rubles. (6.8 x 30) – the second part of the payment has been received.

- DT62 KT91-1– 2,040 thousand rubles. (6.8 x (30–29.7)) – reflects the exchange rate difference.

Exchange differences in tax accounting

The income received from the translation of foreign currency balances does not relate to profit from the sale of products. It is logical that it is not subject to VAT taxation.

The company revaluates foreign currency balances depending on the accounting method used.

How exactly fluctuations in currency quotes are reflected in VAT accounting are shown in the table:

| Payment Features | Tax accounting and revenue accounting | VAT |

| Full payment after sending the goods | on the date of transfer of ownership of the goods | No recalculation |

| Full prepayment | the day the advance funds appear in the account | |

| Partial payment | on the date of receipt of partial payment + on the day when the goods become property |

Example No. 3. Goods worth €12,000 were shipped on November 2 (rate 74.2256), and paid for on November 26 (rate 75.1258). VAT at the rate of 18% must be paid in the following amount when using the method:

- accruals 160,327.30 (12,000 74.2256 0.18)

- cash 162,271.72 (12,000 75.1258 0.18)

Differences in exchange rates are taken into account in non-operating income (expenses) exactly as in accounting. This means that when they are positive, they are included in the amount subject to income tax.

Is it necessary to recalculate the value of assets abroad?

If an enterprise has branches in other countries and in these branches activities are carried out that lead to the emergence of foreign currency assets and liabilities, then such assets and liabilities are subject to conversion into rubles when preparing the reporting of the parent enterprise in the Russian Federation.

In general terms, the revaluation procedure is similar to the similar procedure for converting value in foreign currency into rubles on the territory of the Russian Federation:

- in the same way, the exchange rate of the Central Bank of the Russian Federation in force in the Russian Federation on the date of recalculation is taken;

- the procedure for recalculation depending on the type of asset or liability is also similar to the domestic Russian one.

The differences provided for in Section IV of PBU 3/2006 are that:

- Foreign turnover within the period (income and expenses) can be recalculated at the average exchange rate of the Central Bank of the Russian Federation for the currency used. And such a rate is calculated according to the formula:

(K1 × KDD1 + K2 × KDD2 + … + Ki × KDDi)

SK = ———————————————————-,

DP

Where:

SC - average rate;

K is the exchange rate value in effect during the period;

KDD - the number of days during which the K rate was in effect in the period;

DP - number of days of the period.

- Differences arising as a result of recalculation of income and expenses are included in the financial results of the period. But the differences from recalculation of the value of foreign assets and liabilities (balance sheet items) apply to the additional capital of the enterprise and do not affect the financial results. Only if an enterprise closes a branch or winds down its activities, the final results of exchange rate differences that arose during the operation of this branch can be transferred from additional capital to the financial result.

Foreign exchange income under the simplified tax system and OSNO

Simplified people freely open foreign currency accounts for settlements with foreign partners.

Under the simplified tax system, income and expenses in foreign currency are recalculated into RUB at the Central Bank rate used on the relevant dates.

According to the Tax Code, simplifiers are not obliged to:

- revaluate foreign currency balances due to changes in quotes;

- carry out accounting of costs and income from such recalculation.

Therefore, unlike OSNO companies, simplified companies:

- no amounts arise in the form of positive (or negative) exchange rate differences.

- income and costs are established once - on the date of occurrence of income or expenses.

The explanation for such features is the cash method, which is the basis of the simplified tax system.

Important! Foreign exchange earnings are subject to conversion into RUB at the Central Bank exchange rate valid on the day it is included in income. It will be credited to a transit (not current) currency account. Advance amounts in foreign currency are included in income in the same way.

The company's costs incurred due to foreign currency loans and credits include:

- interest that must be paid regularly;

- exchange differences resulting from the revaluation of accrued %%;

- minus differences between the quotes of the Central Bank and the domestic market, which arise when purchasing foreign currency necessary for the timely execution of loan agreements;

Additional costs associated with expenses under surety agreements, credit risk insurance, and bank guarantees are also included in this list.

Popular questions

Question 1. Is exchange rate difference included in the VAT tax base?

Answer: Exchange differences that inevitably appear when recalculating currency balances are recognized in tax accounting as non-operating income, and not from sales. Therefore, their amount is not included in the VAT tax base.

Question 2. Is it necessary to calculate the amount differences in parallel with exchange rate differences?

Answer: The concept of amount differences was excluded from the Tax Code back in 2015. All differences arising when recalculating currency balances are considered to be exchange rate differences.

Question 3. When does the exchange rate difference appear?

Answer: It is formed as a result of the revaluation of foreign currency liabilities and assets as of the date:

- Reporting;

- Repayment of obligations.

Question 4. Which exchange rate difference is the most common and simplest?

Answer: This includes the difference that appears when revaluing foreign currency balances on the company’s account.

Question 5. How to recalculate if the value of liabilities or assets is expressed in a foreign currency, the exchange rate of which is not provided by the Central Bank?

Answer: The Central Bank quote is used: US$ to RUB and non-standard currency to the dollar. You can take into account data from information systems such as Bloomberg or Reuters.

During the development of economic relations with foreign companies, domestic entrepreneurs open accounts in foreign currency. Financial workers have to become closely acquainted with what revaluation of currency balances and exchange rate differences are, and therefore be able to correctly reflect them in accounting documents.

Rate the quality of the article. We want to become better for you: If you have not found the answer to your question, then you can get an answer to your question by calling the numbers ⇓ Legal Consultation free Moscow, Moscow region call

One-click call St. Petersburg, Leningrad region call: +7 (812) 317-60-16

Call in one click From other regions of the Russian Federation, call

One-click call

Rules for revaluation of currency balances

In order to carry out the revaluation of currency as prescribed, the following rules should be followed:

- Each transaction in foreign currency carried out with the participation of financial institutions should certainly be entered into the daily balance sheet in rubles.

But for monitoring and analysis, the use of transaction registers and software in foreign currency is permitted. The bank provides its clients with bi-currency statements.

- Recalculation is required for all incoming balances on foreign currency accounts. Exceptions are amounts of advance payment for goods (issued or received), advances for services or a complex of works performed. To reflect them, you should use balance sheet accounts for mutual settlements that are carried out for transactions with partners.

- In the case when analytical accounts are prepared only in foreign currency, the balances of each matching balance sheet account are reflected in rubles at the Central Bank exchange rate simultaneously in:

- accounting registers;

- forms of analytical and synthetic accounting.

This procedure is necessary for subsequent reconciliation of accounting documents.