Insured persons are informed about the status of their individual personal account using the SZI-6 form.

We would like to remind you that the composition of information on the state of the ILS in the SZI-6 form was approved by Resolution of the Pension Fund Board of June 15, 2016 No. 491p.

You can obtain information on the SZI-6 form as follows:

- by contacting the territorial office of the Pension Fund or MFC in person. In this case, you must have an identity document and SNILS with you.

- using the “Personal Account of the Insured Person” posted on the official website of the Pension Fund of Russia

- via postal service. In this case, the applicant sends a corresponding application, to which is attached a copy of the applicant’s identity document and SNILS.

The Pension Fund of the Russian Federation keeps records of the pension rights of citizens to the ILS, which, among other things, displays information about the periods of work experience before registration in the individual (personalized) accounting system. This information for the specified periods was submitted to the Pension Fund by employers in 2003-2004. Information about periods of labor activity before registration in the OPS system was included in the ILS based on the information available in the work book.

If you think that your personal information system does not contain information about the periods of work before registration in the persuet accounting system, you can come to the Pension Fund of the Russian Federation with a passport, SNILS, as well as documents confirming the periods of work, the capital branch of the fund reports.

In addition, the ILS displays personal accounting information (about salary, amounts of insurance contributions and length of service) after registration in the OPS system. This information has been submitted by policyholders to the Pension Fund of the Russian Federation, starting from 1997, only for persons registered in the compulsory insurance system.

Information is included in the ILS only when the policyholder calculates and pays contributions to compulsory health insurance; periods for which insurance premiums are not paid are not included in the length of service and are not entered into personal accounts. Responsibility for providing reliable information rests with the policyholder in accordance with the provisions of Federal Law No. 27-FZ dated April 1, 1996.

According to Art. 18 of this law, disputes between policyholders and insured persons on issues of transfer accounting are resolved by the court.

When is this certificate needed?

Today, an extract from a personal account with the Pension Fund is usually made at the request of civil servants or a bank. This certificate contains data on the accumulated pension, and you can also see where, when and how long the person worked, and whether he is currently employed. With the help of SZI-6, working citizens can monitor the honesty of their employer, as well as:

- confirm data on your average annual salary for any period;

- determine the amount of pension contributions;

- calculate the amounts of the funded and insurance parts of your pension;

- take part in various government social programs.

SZI-6 is available, including in electronic form, so you can check your pension “reserve” regularly.

1. INTRODUCTION.

Since January 2002, the personalized accounting system has been fully operational in the Russian Federation. All citizens of Russia, as well as citizens of foreign states who worked in the Russian Federation, must be registered in the system, since from this moment information on pension rights and other information is displayed exclusively on the individual personal account of the insured person.

Thus, from this moment, all entries in the work book that are not confirmed by employers’ contributions to the Pension Fund have no significance from the point of view of the formation of pension rights.

Moreover, in order to accumulate all information about work before 2002, employers were required to electronically collect data from the work record book for each employee and transfer it to be reflected on an individual personal account. This reporting form is called SZV-K.

At the same time, as it now turns out, many employers “didn’t give a damn” about their responsibility, which has now led to massive problems for people who, based on the new legislation, are acquiring a new status - pre-retirees.

The fact is that when exercising pre-retirement rights, government agencies turn to the SPU (personalized accounting system), and there quite often there is no complete information about the rights formed before January 1, 2002, and citizens simply do not receive the right not only to pre-retirement benefits, but sometimes even the right to a pension.

For information: in order to retire, citizens who turned 55 years old in 2019 - women, 60 years old for men, taking into account transitional provisions, need to have 10 years of work experience and 16.2 pension points (IPC). Without this, the right to a pension does not occur.

Because of this, unfortunate people begin to storm the Pension Fund client services in order to solve problems.

And the first document that is generated for applicants is information about the insured person in the compulsory pension insurance system, which is called SZI-6. It is this document that will be discussed in this material, which will undoubtedly be of interest not only to pre-retirees, but also to other persons insured in the compulsory health insurance system and having SNILS - the insurance number of an individual personal account - an analogue of a personal bank deposit, but unlike banks - this not money, but generated pension rights, and this number is assigned to the person for life and does not change even if the last name and other data are changed.

What data is displayed in SZI-6?

The Pension Fund collects and stores information about all citizens and creates their own individual personal account for each. Data from policyholders' reports is entered into the fund's database, and SZI-6 displays all information related to compulsory pension insurance and factors influencing the future calculation of pensions. In 2016, a new certificate form was installed, now it contains the following data:

- the amount of insurance premiums;

- work experience until 2002, since the electronic database of the Pension Fund began to be maintained in 2003-2004, the insured citizen can see information about himself only until 2002, previous places of work and credited experience are taken from paper media - work books;

- length of service and number of pension points of the insured person;

- data on invested pension savings;

- average citizen's salary.

In the certificate you can see how many contributions for compulsory pension insurance were paid by the policyholder, as well as the amount of these charges. If the employer did not pay any contributions, then the information about them will not be taken into account in the certificate. Accordingly, the document will immediately show how conscientiously the employer makes payments for its employee, and whether the citizen is accrued pension experience.

This certificate is extremely convenient because you can control what savings and in what amount go towards your future pension. Therefore, regularly checking the information contained in SZI-6 should become a good habit for every working Russian.

How is sick leave calculated using the SZI-6 certificate to confirm the length of service?

ImportantAnonymous, you wrote: piropark, you wrote: I am a former individual entrepreneur, now a defendant for arrears of penalties and contributions... Chain letters are pouring in from tax authorities about contributions. 71% of seconded employees firmly believe that daily allowances are not compensation for additional work... Employers pay business travelers Employees' daily allowances are too low With the help of advanced telecommunications, we will open up all the possibilities of the digital world to our citizens. And... "The Night Accountant." A fresh batch of amendments to the Tax Code. Internet, goodbye? This fine has been paid. Why are they writing about him again? Maybe they don't see him? You can go to the magistrate’s court... Pension Fund: “Did you find and correct the mistake yourself? Great. We are fining you” Anonymous, you wrote: More tests for the last six months and fluorography... and first of all... How to complain in a new way from April 21 about a bank that does not open or blocks an account. And why complaining can hurt Yes. Retention of the right to early assignment of a labor pension to certain categories of citizens It is worth noting that the assignment of other pensions may require an additional set of documents. Registration of a certificate of insurance experience It is important, first of all, to say that for 5 years it is necessary to save copies of all documents that are submitted to the regional office of the Pension Fund. This requirement is regulated by Article 29 of Federal Law No. 402. This is due to the fact that the information specified in these documents may be required by Fund employees to quickly organize the issuance of certificates of insurance experience and contributions. An application for insurance experience must be submitted because, on the basis of this document, an employee of the Pension Fund will be able to provide detailed information about the state of the applicant’s personal account.

You can request such a document at your last place of work, since upon employment they always make a photocopy of the work record book. Just like a regular certificate, the employer prepares this paper in no more than 3 working days.

When drawing up a certificate, the personnel service employee simply adds up the periods of work by the number of years, months and days in the manner prescribed by Chapter 3 of the Law “On Insurance...” dated December 28, 2013 No. 400-FZ. Further, the document reflects the total duration of working time.

The basis indicates the numbers of entries in the work book. A sample certificate of insurance work experience can be downloaded here.

How to obtain a certificate from the Pension Fund of the Russian Federation? If for various reasons it is not possible to obtain information about the length of service from the employer, a citizen can apply for the issuance of such information directly to the Pension Fund of the Russian Federation.

Who can order this certificate?

SZI-6 can be obtained in electronic or paper form:

- Every citizen of the Russian Federation. He has the right to receive such information, since he is covered by compulsory pension insurance.

- Citizen of another country. This applies to persons temporarily or permanently residing in the territory of the Russian Federation if they make contributions to the Pension Fund and, accordingly, are covered by pension insurance.

- A stateless person, if he lives in Russia and belongs to the category of insured persons, pays contributions for compulsory pension insurance.

The SZI-6 certificate displays only information about official places of work and payments of the insured; therefore, in some situations, serious discrepancies with the real state of affairs may arise. This happens in such cases:

- the employer paid wages “in an envelope” and did not pay the necessary contributions for the employee;

- a person does not work anywhere for a long time;

- there were problems with documents when applying for a new job;

- a citizen worked abroad and cannot confirm his work experience, etc.

To solve problems with obtaining a certificate or to enter corrected data into the Pension Fund database, you should contact qualified lawyers. Experienced specialists will help you understand the situation and advise you on what documents you will need to collect.

To whom is it provided?

Information about the status of an individual personal account under OPS can be provided:

- insured persons - citizens of the Russian Federation;

- non-citizens of the Russian Federation (foreigners) - in cases where they were subject to the Pension Legislation of the Russian Federation in terms of pension insurance (persons who temporarily resided and were officially employed in the territory of the Russian Federation);

- stateless persons permanently or temporarily residing in the territory of the Russian Federation, officially employed, who are subject to the OPS.

How to get a certificate?

There are several ways to obtain data on the current status of your PF account:

- Order a document in paper form from one of the fund’s divisions. This is a traditional method - you will need to personally visit the institution and write an application for a certificate. If it is not possible to come to the Pension Fund, then you can send a request by regular mail. As identification documents, you will need copies of a civil passport and SNILS certified by a notary.

- Contact your local MFC. A convenient and fast way to receive an official certificate in paper form. To complete the application, you will need a passport and SNILS, and you can receive a response by mail - the Pension Fund sends SZI-6 by registered mail, since the certificate contains confidential information. In this case, you need to wait up to ten days to receive the letter.

- Electronic certificate via the PF website. To receive SZI-6, you need to register and then complete the request through the appropriate section in your “Personal Account”. If the user has already been registered on the State Services website, then he can use the same data without re-registration - the system will open access automatically. Here you can view general information about your pension rights, points earned and the total amount of insurance and work experience. More detailed information (in what period, by whom and where the person worked, what deductions he has to the account, the amount of salary) is indicated in the account statement.

- Through the State Services portal. The site contains detailed data on the status of an individual personal account.

- Via a mobile application. A convenient and modern method, you need to install the official application from the Pension Fund on your smartphone. After registering and logging into your account, you can receive the latest information about your account status, as well as make requests for various statements. A consultation with a Pension Fund specialist is available by appointment.

All services for obtaining an SZI-6 certificate, both in paper and electronic form, are free.

How can I get SZI 6 information from government services? What other ways are there?

- Contact the territorial bodies of the Pension Fund. It is difficult if you are registered in Kaluga, but are temporarily in Novosibirsk or another city. The law states that you can apply in person or through a legal representative. Take your passport and SNILS with you. To order an SZI 6 certificate from the pension fund, you need to write an application.

- Submit a request via gosuslugi.ru. You can order an SZI 6 certificate on the portal, but to do this you will have to register and deal with the technical issues. The service completion period is 10 working days. You choose which form of document is preferable: electronic with a qualified signature or issued on paper.

- Contact the bank with which the Pension Fund has an agreement. Statement 6 can be ordered from Sberbank of Russia, Uralsib Bank, Gazprombank, Bank of Moscow or VTB 24 Bank.

Now you know where to get information information 6, how to do it, how long you will have to wait, and in what situations you need to order information.

“Moscow Law Company” has been providing similar services for new and regular clients since 2007. Lawyers help to cope with complex and confusing situations when the pension fund refuses SZI 6, there are problems with obtaining an extract or confirming the length of service. We monitor changes in legislation and help obtain up-to-date samples of SZI 6, which are 100% compliant with the requirements of government agencies. We have a large administrative resource, and specialists can closely interact with all government agencies operating in the Russian Federation. This gives us a serious advantage and allows us to easily resolve customer issues.

Don’t know how to order SFI 6 from a pension fund? Have you been rejected more than once? Call us right now and you will receive a free consultation from an experienced lawyer. With us it is fast, profitable and professional! Contact us!

Related topics:

- Certificate 001 GS Order of the Ministry of Health and Social Development of the Russian Federation dated December 14, 2009 N 984n “On ...

- Certificate of no criminal record Certificate of no criminal record - validity period of the certificate of no criminal record Consultation with a lawyer MOSCOW AND MOSCOW…

- How long is an academic certificate valid? Procedure for registration The document is provided to expelled students after submitting a written application. The document cannot be provided to listeners...

How to order a certificate through the State Services portal

This resource is used by most Russians to receive various administrative services, including here you can order the receipt of SZI-6. This method of obtaining a document is simple and accessible to almost every citizen. Step-by-step instructions for obtaining help look like this:

- Go to the State Services website gosuslugi.ru and log in using your phone or e-mail and password. Or you can select the “SNILS” tab and enter the digits of the number in the first column.

- Click the "Login" button. If the user is not registered on the site, then you must register. This is a standard procedure, but you must carefully fill out all fields with accurate information. After this, you will need to confirm your identity through online banking, electronic signature, or submitting your passport to a service center.

- Select the “Services” line in the top menu.

- From the several categories that open, select the “Authorities” tab at the top.

- The service for generating the required certificate is provided by the Pension Fund of Russia, so select “PFR” from the list.

- In the list of available ones and select it.

- A button “Get a service” will appear on the right; you need to click on it with the mouse.

- A window will open with the recipient’s personal data already filled in. Choose the option to receive help - save the document for printing or send it to the user by email.

If the document is needed by government agencies, then the electronic format by e-mail is suitable; if the certificate is required for personal use, then it can be saved and then printed. In the second case, the document will not have legal force.

If the user has difficulty obtaining help, you can contact the site support service.

The meaning of the SZI-TD form

The SZI-TD form is a document that will replace the paper work book after the transition to electronic ones.

Now employers issue copies of work records at the request of employees. For example, so that an employee can get a loan. Upon dismissal, the employee receives the original paper work record book. You must also issue the original book if the employee applies for a pension.

But due to the transition to electronic work books, the situation is changing. Working with paper documents is gradually being abandoned in favor of digital ones. And instead of paper work books, the employer will now issue employees with the SZI-TD form.

The SZI-TD form is generated by the employer on the basis of orders and other personnel records. It is presented to the employee upon his request (within 3 days), as well as on the day of dismissal.

The SZI-TD form contains 3 blocks of information:

- Full name, date of birth and SNILS of the employee who requests the information;

- information about the employer and information about the employee’s work activity (in tabular form);

- signature of the authorized person, seal and date of formation of the SZI-TD.

This is what the form looks like:

Also see:

Results

Certificate SZI-6 contains complete information about the status of an individual personal account with the Pension Fund of the Russian Federation, from the start of a career to the current moment. It indicates the employers of the insured person, as well as the average monthly salary of a person in each workplace, you can see the amount of employer contributions and length of service. This information is confidential and can only be obtained independently or by transferring this right to your lawyer under a notarized power of attorney.

SZI-6 is often required to speed up obtaining a loan; it is needed to participate in government programs and is required when filing for bankruptcy. To obtain a certificate, you no longer have to contact one of the Pension Fund departments; you can order an electronic version of SZI-6 through the State Services portal at any day and time of day.

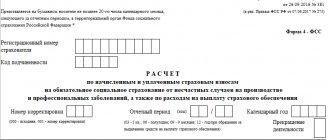

Application

See this form in MS-Word. Approved by Resolution of the Pension Fund Board of June 15, 2021 N 491p

| Form SZI-6 | OKUD code | OKPO code |

Information about the status of the individual personal account of the insured person <1>

| Details of the request on the basis of which the information was generated: | |

| System number | _________________________ |

| date of receipt | "__" ____________ ____ of the year |

| Outgoing number of the personalized accounting system ________________________ | |

This information was generated as of “__” _________ ____ Information about the insured person: Last name ____________________________ First name ____________________________ Patronymic ____________________________ Date of birth “__” _________________ ____ Insurance number of the individual personal account: ______________ Pension option in the compulsory pension insurance system chosen by the insured person in 1967 birth and younger ___________________________________________________________________________ (direction of insurance contributions for the formation of only an insurance pension, direction of insurance contributions for the formation of insurance and funded pensions (6% of the individual rate of insurance contributions)) The value of the individual pension coefficient (IPC) _________ Experience (taken into account for the purposes of assigning a pension) ______ years ______ months _______ days 1. Information on the value of the individual pension coefficient (IPC) and its components <2>:

| Period | Amount of payments and other remuneration accrued in favor of the insured person, rub. cop. | The amount of accrued insurance contributions for the insurance pension, on the basis of which the value of the individual pension coefficient is calculated, rub. cop. | The value of the individual pension coefficient (IPC) | Duration of work periods (years, months, days) | Employer |

| until 2015 | X | X | X | ||

| from January 1, 2015 | |||||

| … |

2. Information (pension rights) on the basis of which the value of the individual pension coefficient was calculated for periods before 2015: 2.1. average monthly earnings for 2000 - 2001 ____ rub. ___ kop.; 2.2. total length of service until 2002 ______ years ______ months ____ days; 2.3. information on the basis of which the data specified in subclauses 2.1 and 2.2 of this clause are calculated

| Employer | Calendar year | Duration of work periods (years, months, days) | Information about earnings (remuneration), income taken into account when assigning an insurance pension <3> |

2.4. estimated pension capital formed from insurance contributions for 2002 - 2014 (taking into account indexations of the estimated pension capital) ______ rub. __ kop.

| Employer | Calendar year | Amount of insurance premiums, rub. cop. | Duration of work periods (years, months, days) |

3. Your insurer from __________________________ is the Pension Fund date, month, year of the Russian Federation. Funds are invested in ______________________________________________ name of the management company (investment portfolio) 3.1. The amount <4> of the pension savings of the insured person, guaranteed by the Deposit Insurance Agency upon the occurrence of a guarantee event <5> in relation to the pension savings accounted for in the individual personal account of the insured person: - the amount of insurance contributions to finance the funded pension: _____ rub. __ kop.; — funds (part of the funds) of maternal (family) capital: _________ rub. __ kop.; - the amount of additional insurance contributions for a funded pension, the amount of employer contributions in favor of the insured person and the amount of contributions for co-financing the formation of pension savings: ________ rub. __ kop. 3.2. The amount of pension savings taking into account the result of their investment: ______ rub. __ kopecks, including <6>: - at the expense of the amount of insurance contributions to finance the funded pension, taking into account the result of their investment: _______ rub. __ kop.; - at the expense of funds (part of the funds) of maternal (family) capital, taking into account the result of their investment: ________ rub. __ kop.; — due to additional insurance contributions for funded pension, employer contributions and amounts of co-financing of pension savings, taking into account the result of their investment: ________ rub. __ kop. 3.3. The amount of guarantee replenishment (compensation) upon the occurrence of a guarantee event <7> in relation to pension savings accounted for in the individual personal account of the insured person: - the amount of guarantee replenishment, compensation, including in the current calendar year, is ________ rubles. __ kop. — the amount of warranty compensation, including in the current calendar year, is _______ rubles. __ kop. 3.4. Information on additional insurance contributions for funded pensions, including those received under the State Co-financing of Pension Savings Program:

| Year | Your voluntary contributions, rubles, kopecks. | Amounts of state co-financing <8>, rub., kopecks. | Additional contributions from your employer, rub., kopecks. |

4. Your insurer with _________________________ is: ___________________________________________________________________________ name of the non-state pension fund 4.1. The amount <9> of the pension savings of the insured person, guaranteed by the Deposit Insurance Agency upon the occurrence of a guarantee event <10> in relation to the pension savings accounted for in the individual personal account of the insured person: - the amount of insurance contributions to finance the funded pension: _____ rub. __ kop.; — funds (part of the funds) of maternal (family) capital: _________ rub. __ kop.; — the amount of additional insurance contributions for a funded pension, employer contributions and amounts of co-financing of pension savings: _______ rub. __ kop. 4.2. The amount of guarantee replenishment (compensation) upon the occurrence of a guarantee event <11> in relation to pension savings accounted for in the individual personal account of the insured person: - the amount of guarantee replenishment, compensation, including in the current calendar year, is ________ rubles. __ kop. — the amount of warranty compensation, including in the current calendar year, is ________ rubles. __ kop. 4.3. Information on additional insurance contributions for funded pensions, including those received under the State Co-financing of Pension Savings Program:

| Year | Your voluntary contributions, rubles, kopecks. | Amounts of state co-financing <12>, rub., kopecks. | Additional contributions from your employer, rub., kopecks. |

4.4. The actual amount of pension savings can be found in your chosen ___________________________________________________ name of the non-state pension fund 5. As of “__” ____ ____ You have established(s): 5.1. Insurance pension _________________________________________________ (type of insurance pension: old age, disability, loss of a breadwinner) and a fixed payment to the insurance pension (taking into account increases in the fixed payment) from “__” ________ ____ to ____________ in the amount of ______ rubles. __ kopecks, including the amount of the fixed payment to the insurance pension (taking into account increases in the fixed payment): _______ rub. __ kop. <13> 5.1.1. The amount of the insurance pension and fixed payment to the insurance pension (taking into account increases in the fixed payment), paid during the period of labor and (or) other activities ________ rub. __ kop. 5.2. Funded pension with “__” _____ ____ in the amount of ____ rub. __ kop. 5.3. Term pension payment from “__” ______ ____ to “__” _____ ____ in the amount of _________ rub. __ kop. 5.4. One-time payment of pension savings in the amount of ________ rubles. __ kop. (one time) <14>. Name of the position of the head of the territorial body of the Pension Fund of Russia <15> ______________ _______________ _________________________ Date Signature Explanation of signature M.P. ——————————— <1> When creating a form, a reduced set of its details can be used. <2> The IPC is calculated based on information received from employers, as well as information about the periods of your other socially significant activities (the period of military service under conscription, periods of caring for children, caring for the disabled, etc.), reflected in your individual personal account. The IPC for the period up to 2015 was calculated based on the conditions for assigning an old-age insurance pension on a general basis and can be clarified when assigning an insurance pension, taking into account the selected pension option. <3>Earning information began to be provided by employers to the Pension Fund only in 1998. <4> The amount of insurance premiums transferred by your employers or you to your individual personal account, as well as funds from maternity (family) capital and funds from state co-financing of your voluntary insurance contributions. <5> A warranty case is recognized as insufficient pension savings when the insured person changes the insurer for compulsory pension insurance or when a payment is established to you from pension savings. <6> For reference: pension savings funds that are not taken into account when establishing payments from pension savings funds. <7> A warranty case is recognized as insufficient pension savings when the insured person changes the insurer for compulsory pension insurance or when a payment is established to you from pension savings. <8> The amount of state co-financing is credited to your individual account in the year following the year in which you paid voluntary insurance contributions. Co-financing is carried out based on the amount of additional contributions ranging from 2 to 12 thousand rubles per year for 10 years, starting from the year of your first payment under the Program, if the first payment was made before January 31, 2015. <9> The amount of insurance premiums transferred by your employers or you to your individual personal account, as well as funds from maternity (family) capital and funds from state co-financing of your voluntary insurance contributions. <10> A warranty case is recognized as insufficient pension savings when the insured person changes the insurer for compulsory pension insurance, when the insurer for compulsory pension insurance is liquidated, or when a payment is established to you from pension savings. <11> A warranty case is recognized as insufficient pension savings when the insured person changes the insurer for compulsory pension insurance, when the insurer for compulsory pension insurance is liquidated, or when a payment is established to you from pension savings. <12> The amount of state co-financing is credited to your individual account in the year following the year in which you paid voluntary insurance contributions. Co-financing is carried out based on the amount of additional contributions ranging from 2 to 12 thousand rubles per year for 10 years, starting from the year of your first payment under the Program, if the first payment was made before January 31, 2015. <13> Information on the fixed payment (taking into account increases in the fixed payment) is not reflected in relation to persons specified in Part 6 of Article 3 of the Federal Law of December 15, 2001 N 166-FZ “On State Pension Security in the Russian Federation” (Collection of Legislation of the Russian Federation , 2001, No. 51, Article 4831; 2009, No. 30, Article 3739; 2010, No. 30, Article 3739; 2014, No. 30 (part 1), Article 4217). <14> Reflected only if the SZI-6 form is generated on the day of the month in which a lump sum payment of pension savings was made. <15> To be completed upon receipt of the form “Information on the status of the individual personal account of the insured person” at the territorial office of the Pension Fund of the Russian Federation.

COMPONENTS OF FORM SZI-6.

The SZI-6 form consists of successive blocks of information content, where information on the insured person is reflected and supplemented step by step.

The very beginning of the document is its details, which contain:

1. Indication of the original source, name of the form, OKUD and OKPO codes, name.

initial document details

2. Request details for the personalized accounting system, which consist of:

- system number of the request in the SPU (personalized accounting system);

- date of receipt of the request;

- outgoing request number (output form);

- the date on which the information was generated.

requisites

It is worth noting that changes can occur constantly, but information is automatically updated on January 01, April 1, July 1, October 1 of each year.

GENERAL INFORMATION ABOUT THE INSURED PERSON.

This section of the statement contains personal information, which consists of the following information:

- Surname.

- Name.

- Middle name (if available).

- Date of Birth.

- SNILS (individual personal account insurance number).

- Option for pension provision in the compulsory pension insurance system, chosen by an insured person born in 1967 or younger (direction of insurance contributions only for the formation of an insurance pension, or direction of a 6% part of insurance contributions for the formation of a funded pension).

It is necessary to note that at present and approximately until 2021, the replenishment of 6% of the individual insurance premium rate for those insured persons who individually expressed their desire to form a funded pension is “frozen”.

For those who did not specifically write an application for the formation of a funded pension (6% of the transferred tariff), insurance premiums are sent only to the insurance pension.