14.06.2018

To make a transfer from your Alfa-Bank account in favor of a client of another bank, you must indicate:

- name of the recipient of funds

- beneficiary account number

- Recipient's TIN

- BIC of the recipient's bank

- purpose of transfer

- account for debiting funds

- transfer amount in rubles

Let's look at the rules for filling out some parameters in more detail.

- In the “Name of Recipient” field, you must enter the name of the legal entity or the full name (full name) of the individual - the recipient of the payment. For example, LLC “Name of Organization” or “Ivanov Ivan Ivanovich”;

- In the “BIC of the beneficiary's bank” field, you must indicate the BIC (Bank Identification Code) of the payee's bank. As you enter the code, a list will appear on the screen from which you can quickly select the desired bank by clicking on it with the mouse: the bank name, city and correspondent account will be filled in automatically;

- In the “Recipient INN” field, you must indicate the TIN (Taxpayer Identification Number) of the payment recipient.

Name of the payee what to write

To make a transfer from your Alfa-Bank account in favor of a client of another bank, you must indicate:

- name of the recipient of funds

- beneficiary account number

- Recipient's TIN

- BIC of the recipient's bank

- purpose of transfer

- account for debiting funds

- transfer amount in rubles

Let's look at the rules for filling out some parameters in more detail.

- In the “Name of Recipient” field, you must enter the name of the legal entity or the full name (full name) of the individual - the recipient of the payment. For example, LLC “Name of Organization” or “Ivanov Ivan Ivanovich”;

- In the “BIC of the beneficiary's bank” field, you must indicate the BIC (Bank Identification Code) of the payee's bank.

Moscow Budget classification code: 182 1 0800 110 OKATO code: 45286555000 Payer (full name): Petrov Ivan Fedorovich Payer address: 105425, Moscow st. Znamenskaya, house 24, bldg. 2., apt. 33 INN of the payer: 771908377721 Personal account number of the payer: 40101810800000010245 Payment by due date Amount of tax (fee) Penalty Fine Total payable TPL 3500 rub. 00 kop.

To another bank

Important

As you enter the code, a list will appear on the screen from which you can quickly select the desired bank by clicking on it with the mouse: the bank name, city and correspondent account will be filled in automatically;

- In the “Recipient INN” field, you must indicate the TIN (Taxpayer Identification Number) of the payment recipient. This field is required for legal entities.

For individuals, if the recipient has not been assigned a TIN, the field can be filled in with zeros;

- In the “Transfer number” field, the serial number of the transfer will be automatically entered by default. You can leave the default value in this field or enter your own numbering of transfers;

- In the “Purpose of payment” field, indicate the purpose of the payment as agreed with the recipient.

State duty on cases considered in courts of general jurisdiction, justices of the peace (with the exception of state duty on cases considered by the Supreme Court of the Russian Federation) 182 1 0800 110 State duty on cases considered by the Supreme Court of the Russian Federation 182 1 0800 110 State duty for state registration legal entity, individuals as individual entrepreneurs, changes made to the constituent documents of a legal entity, for state registration of liquidation of a legal entity and other legally significant actions 182 1 0800 110 State duty for the right to use the names “Russia”, “Russian Federation” and formed based on them, words and phrases in the names of legal entities.

Payee's name

For transfers in favor of legal entities, the name of goods, works, services, numbers and dates of documents: contracts, invoices, etc. may be indicated (for example: “Payment of invoice No. 85 dated March 25, 2011”). For transfers in favor of individuals, you must indicate the reason for the transfer (for example: “Financial assistance”, “Gift”, “Repayment of debt”, etc.). In addition, the Internet bank supports transfers in rubles using details from a resident (individual).

person) to a non-resident - a client of another bank. Always check the name and bank details of the recipient before sending the transfer. If you specify one of these parameters incorrectly, your money will be temporarily blocked, but as soon as the payment is verified and rejected, it will again be available for use for any purpose.

Purpose of payment: what to write? rules for filling out payment documents

Attention

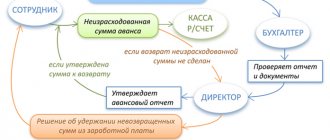

We recommend that you read Problems of division and development of the Arctic shelf 'Document' Initially, the development of the Arctic went through a romantic period - the development of something new, the heroism of national victories in this field. Then - the scientific stage (research... completely Lyazh tour Novokuznetsk, st.

Rokossovsky, 3 'Document' "Great Peterhof Road - the road of emperors and presidents" to the imperial residence of Peterhof. Visit to the Great Peterhof Palace. Truancy...in full Recommend to the Mayor of Moscow to introduce the specified draft law 'Law' Currently, in Moscow, taking into account contaminated soils and sludge from treatment facilities, more than 18 million tons of industrial waste and consumed...in full Musical repertoire (1) 'Lesson' by F. Chopin. "Polonaise". 11 What the musical genre is about (continuation of the topic). F. Chopin. "Waltz". 1 Game library. P.I. Tchaikovsky.

Type of transfer (for what)? Reply from 2 replies[guru]Hi! Here is a selection of topics with answers to your question: What is the Name of the payee? What should I write there? What name of payment should be indicated in the payment order. If I transfer the amount of goods and materials to the accountable person on the card? tags: Cards Payment order: how to correctly write “payment in form KS-2 or KS-3” in the name of the payment? Wrote KS-2.

What is the name of the payee? What should I write there? tags: Sberbank online payments. Purpose of payment, please tell me the purchase and sale agreement with installment payment for a car or motorcycle vehicle. What should I do if I indicated the wrong name of the recipient (another company altogether) on the payment order, and all other details are the same? What are PAYMENT DETAILS? You must indicate them in your refund application.

Purpose of payment: what to write

State duty for carrying out actions related to licensing and certification in cases where such certification is provided for by the legislation of the Russian Federation.

182 1 0800 110 State duty for state registration of commercial concession (subconcession) agreements, changes made to such agreements, other state fees for state registration, as well as for the performance of other legally significant actions.

In the “OKATO Code” field, the value of the OKATO code of the municipality is indicated in accordance with the All-Russian Classifier of Objects of Administrative-Territorial Division, on the territory of which funds from paying taxes (fees) are mobilized into the budget system of the Russian Federation.

Source: https://kodeks-alania.ru/naimenovanie-poluchatelya-platezha-chto-pisat/

Housing and communal services payments and more

When paying for housing and communal services, mobile communications, or making other payments using templates, the field can be left blank. In this case, the system independently identifies the recipient of the funds.

If the payment is made in favor of a legal entity for purchased goods or services, you will need to fill out the column.

The following information is entered:

- What is the payment for?

- Based on what agreement?

- For what period?

For example, “payment for services for high-speed Internet provision under contract No. 123 dated 05/01/1029 for the period from 05/01/2019 to 05/15/2019.”

When paying taxes, you will not need to fill out the column if you use the payment number indicated on the receipt.

When paying using the details, the type of tax is indicated in the purpose of payment, for example, “transport tax”, “land tax”. Even in the absence of information, banks will not return the transfer of payments to the budget due to lack of grounds.

Details are the most important thing in any banking transaction! :

What is it? Of course, we will be talking about bank details, and not about theater props. Although these words have in common not only the spelling, but also partly the meaning. Indeed, in various dictionaries the meaning of the word “details” is a combination of something, something necessary, obligatory.

Bank details. What are they for?

Everyone in their career or in some life situations has had to deal with this concept. Details are bank account details that are necessary in order to make a payment.

Even without conducting any business activity or making bank transfers or non-cash payments, each person indicates them, for example, when paying utilities or some kind of state duty.

Of course, you don’t always have to do this manually; most often, a bank or some organization gives you forms with the data already entered into them. There are often situations when you may be asked to provide your details for transferring, for example, social benefits to you.

For legal entities

Among the data of any organization or individual entrepreneur, bank details are one of the required items.

After all, a legal entity is required to have a bank account, which must be registered with the tax office, and the details of this account, and if there is more than one, then the main account available, are necessarily indicated in many documents.

For example, they must appear in any contracts, as well as invoices issued by the organization, invoices, invoices and other documents. Without them, these organizations are considered incomplete, and the document may be deprived of legal force.

Composition of bank details

The following data is required; it is with them that the fields in the payment order or receipt drawn up when making payments are filled in:

It is worth noting that when making a payment to the state budget, the correspondent account number will not be among the details.

Instead, the name of the bank indicates the branch number of the Moscow State Technical University of the Bank of Russia - this is where tax and other similar payments are distributed.

Be careful with the name of the payment recipient! Often there, among other details, the personal account number necessary for the correct direction of funds is indicated.

How to find out bank details

The last three of the listed items (name, correspondent account, BIC) are bank details. They are the same for all recipients within the same institution. In addition, there are special electronic databases used by employees of accounting departments of enterprises, as well as banks and other institutions, which are constantly updated and contain the necessary details for payment through all well-known banks.

They can be found out by contacting bank employees, as well as by visiting the website of the desired institution. The remaining details are individual information for each recipient.

In order to find out your bank details, namely the current account number, you need to refer to the documentation drawn up when concluding an agreement on opening a bank account, as well as to bank employees who, having verified your identity, will provide you with the necessary information.

All of the above also applies to transferring money to a bank card. In addition to the card number, there is also the account number to which it is linked. In some cases, a card number alone may not be enough to send or receive money and full bank details may be required.

Source: https://www.syl.ru/article/186408/new_rekvizityi—eto-samoe-vajnoe-pri-lyuboy-bankovskoy-operatsii

Where are they indicated?

Before making a payment or transfer, you must indicate the recipient's bank account details in the payment order (payment order). Essentially, this is how you give a command to the bank to transfer funds from your account opened with the bank (transfers are possible without opening an account). You enter all the necessary information in writing on the order provided by the bank, issued in the form of a paper form.

If you make a transfer online without visiting a bank branch (in online banking or a mobile application), then you enter the necessary details into the appropriate payment form. After confirming the payment, the bank will generate a payment order for you, which will be proof of the transfer you sent.

As a rule, when making online transfers, the process of filling out the details is greatly simplified - just enter the bank’s BIC in the appropriate field, and the program itself will find the official name of the bank and correspondent account (see an example of a real transfer at the above link to a review of interbank transfers).

Payee account: what is it and how to find out its number

To use a bank card every day, you do not need to know your account details.

The details on the surface of the plastic (16-digit and CVC2/CVV2 numbers) are enough to replenish it, make purchases and make online payments.

In some cases, you may need a PIN code, for example, if you need to cash out at ATMs or when paying with certain terminals.

It is necessary to know the recipient's account (RA) when transferring funds between legal entities and individuals, repaying a loan, or transferring money from a foreign bank. Also, to perform these operations, you may need the correspondent account number of the recipient's bank.

What is a payee account?

SP is a bank account consisting of 20 digits. The card acts as a kind of access to it, protecting it from hacking and other unauthorized actions.

After the expiration date of the plastic, if it is lost or replaced with a new one, the personal account does not change. This means that it remains unchanged until the client himself wants to close it or open another one.

It is important not to confuse the SP number with the card number.

There are three ways to find out the details :

- online;

- by calling;

- by contacting a banking institution.

✅ RECOMMENDED: What is the difference between a current and personal account

Contact a banking institution

To use the first two methods, you need to know all the verification information that the bank will request. However, it happens that the client does not remember it or did not indicate it at all.

The surest and fastest way to obtain data in this case is to visit the nearest bank branch.

By providing documents identifying the owner, he will receive all the necessary information.

Bank staff can provide information printed on paper. Such a printout is required if another bank requests data for a funds transfer.

Via online service

The second way to find out the details is to use online banking (for example, the Sberbank-online service), if this function was enabled during registration.

If it turns out that the user does not have access to information online, he can make a request to the nearest bank branch and connect to this service. Its annual cost is determined by the bank.

Call the bank

Find out the details by phone call. To do this, you need to call the code word specified during registration.

If the recipient names the correct word, then he is provided with all the data by phone or by mail.

To receive and send money you need to know the SP. You can find out by contacting or calling the bank, as well as using the online service.

Source: https://rubliplus.com/banki/chto-takoe-schet-poluchatelya-platezha-i-kak-ego-uznat.html

To another bank

If you find any errors, please let us know.

Thank you for choosing ONLINECHANGE.

QUESTIONS AND ANSWERS

Question: Unfortunately, the payment data entry page does not provide a field for entering the payment basis. When transferring funds, my bank relies on the physical card number. the person indicated on the basis of the payment; he does not accept other payment options. How can I transfer money now?

Answer: Use filling option No. 2. Check box 8 “Transfer to Personal Account/Bank Card”, enter your full name and card number. The operator knows how to send such transfers.

Question: Tell me, how many days does it take for a transfer to Sberbank of the Russian Federation? Answer: We ship same-day. You can find out the crediting period from your bank.

Bank account details - how to find them out

What information is included in bank account details?

How to find out bank account details

How to find out account details using the Internet

How to find out someone else's account details

What information is included in bank account details?

There are different types of accounts opened by a banking organization for clients (see Chapter 2 of Bank of Russia Instruction No. 153-I dated May 30, 2014). At the same time, the composition of the details of any account (including card account) usually includes:

- The name of the recipient's bank (i.e. the actual bank in which the account is opened).

- TIN, KPP and BIC of the recipient's bank (and not the account owner himself).

- Correspondent account of the recipient's bank.

- Recipient's name: last name, first name, patronymic of the account owner - an individual or name if the account owner is an organization. If the account is opened for an individual entrepreneur or other individual engaged in private practice in accordance with the procedure established by law, the full name of such person and his form/type of activity (for example, individual entrepreneur, notary, etc.) are indicated.

- Name of the account (for example, current account, current account, trust account, etc.).

- The actual account number.

How to find out bank account details

You can obtain account details in the following ways:

- Inquire at a bank branch. In this case, the individual must have an identification document and a card (if we are talking about a card account). The representative of the legal entity also presents an identification document and a document confirming his authority (power of attorney, order, etc.). On this issue, we also recommend that you read our article Power of attorney to a bank from a legal entity - sample.

- Look in the application form for opening an account or the bank account agreement. Account details (including card details) are issued by the credit institution immediately after opening such an account, drawn up on a separate form or included in the bank account agreement.

- Call the hotline at the call center of the servicing bank. It must be borne in mind that in order to identify the account owner, call center employees may require certain personal data (for example, passport data), a code word specified in the account opening application form, or the answer to a secret question, also recorded in advance in questionnaire.

- Use a self-service terminal or ATM. This method is suitable for plastic card holders (including corporate ones). A plastic card is inserted into an ATM or terminal, then the corresponding tab is selected in the menu (usually called “My payments”, “My account”, etc.), which contains the “Account details” tab.

How to find out account details using the Internet

You can also find out the details using special banking resources on the Internet or the account user’s personal account. Thus, for these purposes you can use:

- Internet bank. Usually, to manage the account of both an individual and a legal entity, an Internet bank connection is made. In this case, by opening a special tab (most often it is called “Accounts and Cards”, “My Account”, etc.), you can view the account details, including saving them on electronic media for future use. An alternative option is to create any payment order, which will automatically include the sender’s details.

- The official website of the bank without logging into the account holder’s personal account. This option is relevant in the case when the account owner has information about his account number, but, for example, does not remember the general details of the servicing bank (correct name, BIC, correspondent account, etc.).

- Email. Some banks may send the account owner his details in response to a request sent to the address of a special service in the bank in the prescribed form.

How to find out someone else's account details

Often in practice there is a need to find out the details of someone else's account (for example, a debtor, a counterparty, etc.). To obtain this data, if it is not possible to establish it using existing documents (agreement with a counterparty, company card, etc.), you can resort to the following methods:

- searching for information about the details of the entity on its official website on the Internet (usually only possible in relation to business entities that post bank details on their pages on the Internet);

- requesting information from the Federal Tax Service of the Russian Federation (see paragraph 8 of Article 69 of the Law “On Enforcement Proceedings” dated October 2, 2007 No. 229-FZ);

- requesting information from banks or other credit institutions.

Source: https://rusjurist.ru/bank/bankovskie_scheta/kak_uznat_rekvizity_bankovskogo_scheta/

How to fill out the bank transfer form correctly

IMPORTANT! The correct bank details of your account, card or account of your company can always be obtained from the Bank. The success of the translation is directly related to the correctness of the details. Never use the method of “guessing” missing details, and especially take the first details you come across from the Internet - just call your Bank or branch and find out everything.

Questions and answers (FAQ) for filling out the form are given at the end of the page.

The fundamental point of any transfer is knowing the account to which the transfer is made. According to accepted banking practice, personal (personal) accounts must be opened for the following cards: VISA Classic (Gold, Platinum), MasterCard Standard (Gold, Platinum) cards. For VISA Electron and MasterCard Maestro cards, personal accounts are not opened - such cards are linked to an internal bank special account “for debits and deposits by bank cards.” Naturally, you can attach any card to any already opened Personal Account, but we will consider exactly the option in which a card is initially opened, and not an account.

According to our statistics at the end of 2013, only VTB24 Bank uses intra-bank accounts for crediting to all cards - in this case it is necessary to use the “transfer to card” method, and in other cases we recommend using the “transfer to account” method. An important advantage of using the “transfer to account” method is the guaranteed crediting of the payment on the current day.

A description of the terms and abbreviations used can be found at the end of this page.

Payment order details

A payment order is a document that is filled out and submitted to the bank by its client in order to initiate the transfer of funds from his account to the account of another person in the same or any other bank. Payment order details contain a comprehensive amount of information about the payer, recipient, their banks and the purpose of the payment.

In this case, the payer’s order must be formalized accordingly. Currently, all of its fields are regulated by separate instructions of the Central Bank of the Russian Federation and official letters of the Ministry of Finance, and the nature of their location on a sheet of paper must comply with the rules for designing the form 0401060.

From a legal point of view, settlements using payment orders are regulated by Article 863 of the Civil Code of the Russian Federation.

General principles

In order to fulfill the client’s order, the executing bank must know about:

- Who will be the recipient of the money;

- What amount should be transferred from account to account;

- What is the purpose of the payment?

Despite the fact that the executing bank is aware of its own details and the payer’s data, they are still indicated in separate fields of the order. The document itself receives a specific number and the date of payment is fixed.

This is important due to the fact that, according to the law, if the payer and recipient’s bank are located within the territory of one subject of the country, then the payment should take no more than two banking days, and if in different ones, then no more than five. This requirement becomes especially relevant for non-cash payments, which provide for the payer’s responsibility for each day of delay.

The payer can be a legal entity or an individual. In the latter case, its main payment details differ only in that instead of the company name, the last name, first name and patronymic will be indicated, and the checkpoint field is not filled in at all.

Main fields of a payment order

Let's look at the main fields that the form contains. At the top of it there is a column “Type of payment”. It contains data about how the transaction was carried out. If BESP is used for this purpose, then a corresponding mark is made above the line. For example, “electronic”. When using other methods, now almost completely outdated, such as postal or telegraphic transfer, nothing is usually specified.

Below is a spacious field for indicating the amount in words. It is required to be filled out, regardless of the method of generating the document - manually or electronically. In the latter case, if some special software is used, then the numbers are converted into words programmatically. It is important that the words “rubles” and “kopecks” are written in full, without abbreviations.

This is followed by the most important columns that the payment order contains - details of the payer and recipient:

- Names of organizations for legal entities or first and last names for individuals;

- Individual taxpayer number (TIN), which can be checked with the tax service if it is unknown;

- Registration reason code (RPC) is a combination of numbers indicating the registration characteristics of a legal entity;

- Name of the payer's bank.

It is typical that for both the payer and the recipient, bank details, which are expressed in numbers, must be indicated on the right side. This is the BIC and account numbers - settlement and correspondent. The settlement account is opened for the bank client, and the correspondent account is assigned by the Central Bank to the bank itself serving the recipient.

Also to the right of the data about the recipient and his bank are the following fields:

- Type of payment - code 01 is always indicated, which means transferring money from account to account;

- Payment term - usually the field is left blank and is filled in only if it is established by the bank’s rules;

- Payment purpose is a destination code, which also depends on the bank’s rules;

- order of payment - indicated by a number, in accordance with the law;

- Code - was not filled in until March 31, 2021, now the value of the unique payment identifier (UPI) code is entered in the field;

- Reserve field - remains empty unless any other rules are established by the bank.

All this data relates to the recipient, and the fields are filled in if his bank communicated them and its rules to the payer.

General filling requirements

A correctly completed order guarantees timely execution of the transaction. It can be in paper or electronic form. Registration rules are regulated by the Central Bank. The payment form consists of fields in which details are written. Each column is intended strictly for a specific detail. We are interested in field 24 “Purpose of payment”.

The Central Bank has set a limit on the number of characters in the 24th column - 210 characters (for the electronic document format). And he outlined what information it should contain:

- purpose of payment (for example, payment for services rendered, delivery of goods, work performed, donation, wages);

- the name of specific goods, works and services for which money is transferred (for example, for transport services, window installation, supply of computer equipment);

- type of payment (final payment, advance payments, partial payment);

- numbers of contracts with the dates of their preparation, on the basis of which money is transferred;

- indication of other documents (invoices, statements, orders, acts, etc.);

- other payment details (for example, the period for which payment is made in cases of rent, payment of utilities);

- allocation of VAT (“Including VAT”) or information that there is no tax (“Without VAT”, “VAT not subject”).

There are no strict requirements for the text. The main principle is to indicate all the necessary information about the operation, its essence, the purpose of transferring money: for what, on what basis, for what period, etc.

When numbers two

If a taxpayer has two or more TINs, only one of them is recognized as valid, the rest are canceled and posted, indicating the date of their invalidation, on the websites of the departments of the Federal Tax Service of Russia for the constituent entities of the Russian Federation. All valid TINs are collected in the Unified State Register of Taxpayers.

However, confusion and overlap of numbers still occur , for example due to late submission of data.

It happens that a taxpayer has already been assigned a TIN in one territorial tax authority without his knowledge, and the citizen turns to another tax office with a request to issue him a TIN (for example, when moving or getting a job).

But this is still a rare exception.

The Federal Tax Service has special forms for canceling “extra” TINs, after filling which a notification is issued that the number is invalid. Usually, the TIN issued first, or the one for which the paper certificate was issued, is left.

JSC Alfa Bank: details

You can go to an Alfa Bank branch or the official website - the bank details are publicly available information, but you will only find out your account account from the Internet bank or card agreement.

In order for you to be able to transfer money to your card, the sender needs to know Alfa Bank's details and the recipient's current account (20 characters, do not confuse it with the card number). In Alfa Bank, details for transferring to a card may be required in the following cases: Bank details and the recipient's full name are not enough - you must indicate to the sender your personal account number, which will allow the bank to identify you for crediting the transfer. The account number and card number are different things: the sender needs a 20-digit account. You can find it in your Alfa Click personal account by selecting the “account details” option in the card transactions menu or look at the paper agreement issued by the bank when you received the card.

What is a TIN?

TIN (individual taxpayer number) is a code containing information about its owner. Every citizen or subject of the Russian Federation is required to have a TIN. TIN is issued to individuals, individual entrepreneurs, organizations, banks, and funds. An individual number allows you to regulate the procedure for accounting for taxes and fees.

A taxpayer number is issued at birth and remains constant throughout life. It cannot be changed upon receipt of a passport, change of place of residence or surname. After the death of a person, the TIN is considered invalid and is sent to the archives. The same applies to organizations - the TIN is assigned upon registration of an enterprise and is unchanged.

What does the sequence of numbers mean?

TIN of an individual is a code consisting of 12 digits:

- The 1st and 2nd digits of the code determine the rank of the subject of the Russian Federation;

- 3 and 4 – serial number of the tax authority that issued the TIN;

- numbers 5 to 10 – the serial number under which all data about a given taxpayer is stored in the tax register;

- the last two digits are verification digits, calculated using a specific algorithm and designed to prevent errors when entering data.

The TIN of a legal entity consists of 10 digits:

- 1st and 2nd digits rank of the subject of the Russian Federation;

- 3 and 4 serial number of the tax office that issued the certificate;

- numbers 5 to 9 - serial number of the taxpayer;

- 10 is a verification digit.

Where can I get a TIN

An individual tax number is issued by the tax service located at the place of registration of an individual. According to paragraph 7.

1 of Article 83 of the Tax Code of the Russian Federation, a citizen who does not have a place of permanent registration may also have a certificate of registration with the Federal Tax Service.

To do this, you need to contact the tax office at the place where the citizen actually lives and submit an application to register him with the tax authorities.

Read more: When buying an apartment, when is the money given?

What does a TIN look like and how can an individual obtain it?

The TIN of an individual looks like this - this is a strict reporting form with certain degrees of protection. It indicates the full name, gender, date and place of birth, place of residence, date of registration and date of issue of the certificate, the inspection that issued the certificate and the individual number itself.

In order to make a TIN, a citizen should contact the Federal Tax Service (FTS) and fill out an application for a TIN. List of documents required when obtaining a TIN:

- original passport;

- photocopy of passport;

- application of the established form (the sample can be taken directly from the tax office).

The period for issuing a tax certificate usually does not exceed 5 days. If there is a desire or need for information about the individual tax number to be indicated in the passport, then you should also contact the tax service, present your passport as a citizen of the Russian Federation and TIN, and information about it will be indicated in the passport on page 18.

With the development of progress, the procedure for obtaining a TIN has also become much simpler. Now there is no need to waste your personal time to get to the Federal Tax Service. You can also apply for a TIN without leaving your home or without leaving your workplace. To do this, you need to fill out an online application on the official website of the Federal Tax Service:

- activate the line “fill out a new application”;

- enter a selection of numbers indicated in the picture;

- fill out each item of the application;

- click the “save” button;

- print the application.

This type of application is very convenient, as it allows you to avoid jostling in queues and saves a lot of time. You can also monitor online what stage of processing your application is at.

The period for registration and receipt of a TIN, therefore, increases slightly and can be 15 days.

However, it should be taken into account that after the TIN is ready, you can receive the TIN in person when visiting the tax office.

How to obtain a TIN for a legal entity

A legal entity, regardless of its form of ownership or methods of taxation, is assigned a TIN. To register, within 10 days from the date on which the enterprise was registered with government agencies, an application is submitted to the Federal Tax Service at the enterprise's registration address.

To assign a TIN, an application form is filled out, to which the “Certificate of Registration” and all statutory documents are attached.

An application to the Federal Tax Service is submitted and signed only by the head of the enterprise or a person who has the right to sign the company’s documents, with the provision of legally certified documents for the right to sign.

When making additions or changes to the statutory documents, changing the place of registration of the enterprise or tax service, the TIN of the enterprise remains unchanged. Only after the bankruptcy procedure of the enterprise is the TIN considered invalid and subject to archiving.

If your TIN is lost

In fact, it is impossible to lose your TIN, since data about it is stored in the Federal Tax Service database. The certificate of registration with the Federal Tax Service may be lost. The process of restoring the TIN is also quite simple. To do this, you need to contact the tax office and provide the package of documents necessary to restore the certificate:

- original passport;

- photocopy of passport;

- applications of the established form for the restoration of a lost TIN;

- government payment receipt duties in the amount of 200 rubles.

You can also send documents to restore your TIN by mail (registered letter), or use the tax service website. But you can only obtain a duplicate certificate in person at the tax office.

How to find out TIN

You can find out the certificate number on the tax service website. To do this, you need to go to the “Find out your TIN” section on the Federal Tax Service website and fill out the application form, indicating your data (full name, date and place of birth, etc.).

-instructions:

You cannot find out the TIN only by your full name. To avoid errors and to ensure that information about the taxpayer cannot be accessed by anyone, entering passport data is a prerequisite.

Also on the Federal Tax Service website, using the “Check yourself and your counterparty” service, knowing the tax payer’s number, you can find out his full name. and residential address, but on the condition that this person is registered with the tax authorities as an individual entrepreneur (when registering as an individual entrepreneur, he is automatically assigned his TIN issued at birth).

Is it possible to change the TIN

There are situations when there is a need to change the number, for example, if you want to change your last name after marriage. In this case, a new certificate will be issued under a new surname confirming registration with the Federal Tax Service. Documents required to change the certificate:

- photocopy and original passport;

- photocopy and original marriage certificate;

- old TIN certificate;

- application of the established form for changing the certificate and issuing a new one.

The application will be processed within a few days, after which you will need to personally come to the tax office and receive a new certificate.

What is bank TIN

A bank's TIN is a bank identification code (BIC), which is assigned to a bank or its division upon registration and is an integral requisite.

The bank code is a set of 9 digits that contain all the information about the institution:

- 1 and 2 determine the country code (code 04 is used for Russian banks);

- 3 and 4 indicate the territorial location of the bank;

- 5 and 6 number of division, branch in the Bank of Russia network;

- 7 and 9 directly the bank number.

All banks of the Russian Federation, as well as their branches, divisions, departments are included in the register of the Central Bank of the Russian Federation. Re-use of the BIC after removal from the directory is possible only after one year has passed from the date of deletion. The BIC is indicated in all documents or transactions related to the activities of this bank.

What can you find out from the TIN, and why is it needed?

The individual taxpayer number provides complete information about the citizen - full name, region of residence, registration address, where and by what authority it was registered with the tax service.

The TIN must be indicated in reports, declarations, applications or any other documents submitted to the tax service.

It is also used not only in the economic sphere or to improve the quality of tax control, but also in almost all social spheres of society.

The existence of an individual number speeds up the processing of any personal data and prevents the repetition of information and errors that the applicant may make.

The TIN allows you to eliminate confusion when identifying persons with the same last names, first names, patronymics, and residential addresses.

TIN of organizations also prevents errors when finding organizations with the same name or type of activity.

Source:

Details of the recipient, legal entity

U.S. dollar. Translation in foreign currency has its own characteristics. Enter the details as follows: in the “Recipient” column, enter the name of the bank in Latin letters: “ALFA-BANK”. Please also indicate the bank address in English: 27 Kalanchevskaya, Moscow. SWIFT code is ALFARUMM. In the “Correspondent Bank” field, you must indicate one of these financial organizations: THE BANK OF NEW YORK MELLON (SWIFT - IRVTUS3N), Bank of America NA (SWIFT - BOFAUS3N), CITIBANK NA (SWIFT - CITIUS33), DEUTSCHE BANK TRUST COMPANY AMERICAS ( SWIFT - BKTRUS33). We fill in the recipient's last name, first name, and patronymic in Latin. Euro. To send a transfer in euros, indicate the bank as the recipient, and enter the name in Latin: “ALFA-BANK”, then the legal address in Latin: 27 Kalanchevskaya str., Moscow, and SWIFT code ALFARUMM. One of the following organizations must be named as a correspondent bank: DEUTSCHE BANK AG (SWIFT - DEUTDEFF), ING BELGIUM SA/NV (SWIFT - BBRUBEBB), COMMERZBANK AG (SWIFT - COBADEFF), LANDESBANK BADEN-WUERTTEMBERG (SWIFT - SOLADEST), SOCIETE GENERALE SA (SWIFT - SOGEFRPP), RAIFFEISEN BANK INTERNATIONAL (SWIFT - RZBAATWW). Details of the recipient , individual

- Full name of the credit institution: JSC Alfa-Bank.

- Correspondent account 3010-1810-2000-0000-0593.

- BIC (Bank Identification Code) - 044-525-593.

Types of payments

Depending on who makes the payment, where and for what the funds are transferred, there are payments when it is not necessary to fill out the “Payment Purpose” and when the payment will not be made without entering the information.

It is not necessary to enter data for the following operations:

- Transfer funds from your account to your account;

- Transfer of funds to an electronic wallet account;

- Payment for mobile communications, housing and communal services;

- Repayment of debt under a loan agreement executed at Sberbank;

- Payment of taxes;

- Payment of traffic fines.

In these cases, the field is left blank or filled in at the discretion of the payer, in agreement with the recipient of funds. In any case, the bank will not return the payment due to incorrectly filled in data.

The field is required to be filled in when making the following types of payments:

- Repaying a loan from another bank. You will need to indicate the number and date of the loan agreement, full name. borrower. For example: Repayment of debt under a loan agreement concluded with Ivan Ivanovich Ivanov No. XXX dated 01/01/2019;

- Interbank transfers. For example: Debt repayment, Donation;

- Payments to government bodies and organizations;

- Social Security contributions;

- Payment for goods and services. For example: Payment for goods under contract No. XXX dated 01/01/2019. Payment for repair work under contract No. ХХХ dated 01/01/2019 and acceptance certificate No. ХХХ dated 01/01/2019.

When creating a payment order, you should take into account that the bank has the right to request documents specified in the purpose of the payment, therefore it is not recommended to enter incorrect information.

If a large amount of money is transferred, the bank may request additional confirmation. You will need to call the Call Center operator and confirm the transaction.