Sometimes an organization that is an intermediary has to purchase services from a foreign company for a principal from Russia. And then, accordingly, she has to pay VAT. And the accounting service faces the question: “How to re-issue an invoice from a tax agent to the principal using the 1C: Accounting 8 software (rev. 3.0)?

We will try to explain this in as much detail as possible.

We solve the questions raised

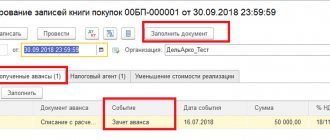

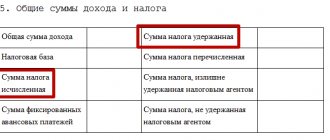

According to Art. 148 and paragraphs 1-2 of Article 161 of the Tax Code of the Russian Federation, if an agent (intermediary) purchases services from a foreign organization for the principal that must be provided on the territory of Russia, he becomes a tax agent for value added tax. To pay VAT, a company must create an invoice and record it in the sales ledger. Since the transaction was carried out for another company using an intermediary agreement, the same invoice must be reissued to the principal by the organization providing the services and entered into the log of received and issued invoices used in VAT calculations.

Let's consider a sequential algorithm of actions necessary in this case.

Accounting for financial assets

We register the money received from the principal using “Receipts to the current account”, indicating the type of operation “Payment from the buyer”, and the payment to the foreign service provider - by creating a file “Write-off from the current account” (type of operation, which is obvious, “Payment to the supplier”) . We establish accounts for settlements with the first and second parties to the transaction in the form. called “Accounts for settlements with counterparties”, selecting it in the “Counterparties” directory.

We record the payment of agent value added tax using “Write-off from current account” (operation “Payment of tax”). VAT accounting for the tax agent is carried out using account 68.32. Since agent VAT is not automatically charged during an intermediary scheme, it will be more convenient to use account 68.02.

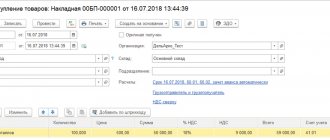

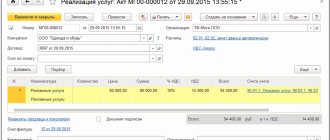

Registering received services

Those provided by the foreign supplier are reflected in the document “Receipt (act, invoice)” (select the transaction type “Goods, services, commission”). We indicate a foreign company as a counterparty at the top of the document. In its table, select the tab called “Agency services”, where we set the name and price of the services provided, the value of the VAT rate, the details of the principal (i.e. the principal), and the purchase agreement concluded with him.

The procedure for issuing “consolidated” invoices by the committent in “1C: Accounting 8”

We will consider the procedure for issuing “consolidated” invoices by the consignor when selling commission goods in the 1C: Accounting 8 program, edition 3.0, using the following example.

Example

The organization Trading House LLC (committent) entered into a commission agreement with Delta LLC (commission agent), under which the commission agent sells the principal's goods to customers for a fee. Under the terms of the agreement, the commission agent sells goods at prices not lower than the prices specified in the invoice for the transfer of goods and participates in settlements. The commission agent's remuneration is 10% of the proceeds for goods sold and is withheld from funds received from customers. The additional benefit belongs to the principal. Sequence of operations:

The sequence of operations is given in the table. |

Setting up the program

The organization Trading House LLC, which sells goods under commission agreements, needs to check the use of the functionality Sale of goods or services through commission agents (agents) in the Program Functionality directory (Section Main - subsection Settings - Functionality) on the Trade tab.

Transfer of goods to the commission agent

Registration of transaction 2.1 “Transfer of goods to a commission agent for sale” in the program is carried out using the document Sales (act, invoice) with the type of operation Goods, services, commission (section Sales - subsection Sales), Fig. 1.

Rice. 1. Transfer of goods to the commission agent for sale

The header of the document indicates:

Information about goods transferred for sale (name, quantity, price, VAT rate) and data for reflecting the operation in accounting are entered in the tabular section on the Goods tab.

Since an invoice is not drawn up when transferring goods from the principal to the commission agent, the information Not required is reflected in the Invoice line of the Sales document (act, invoice).

If necessary, by following the Signatures and (or) Delivery hyperlinks (Fig. 1), you can specify information about the transfer operation to issue an invoice (or UPD). After posting the document, the following entry is entered into the accounting register:

Debit 45.01 Credit 41.01 - for the cost of goods transferred for sale.

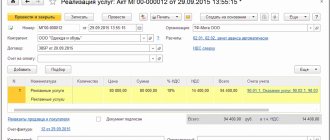

Registration of the commission agent's report for February

Registration of transactions 3.1 “Reflection of the sale of goods transferred to commission”; 3.2 “Calculation of VAT on sales transactions”; 3.3 “Write-off of cost of goods sold”; 3.4 “Reflection of commission agent’s deduction of commission”; 3.5 “Reflection of commissions in cost accounts”; 3.6 “Accounting for VAT on commission fees” in the program is carried out using the document Report of the commission agent (agent) on sales (section Sales - subsection Sales).

You can create a document Report of commission agent (agent) on sales based on the document Sales (act, invoice) by clicking the Create based button (Fig. 1).

On the Main tab in the document header the following is indicated:

Information for determining the amount of the commission agent's remuneration is filled in automatically with the data specified in the agreement from the directory Contracts of counterparties.

If the principal reissues a “consolidated” invoice to the commission agent on the basis of invoices drawn up by the commission agent for one date when selling goods to two or more customers, then in the document Sales report of the commission agent (agent) it is necessary to check the presence of the flag for the value Issue invoices consolidated (EDO is not supported), which is entered by default.

Actual buyers and the number of goods sold are entered manually on the Sales tab in accordance with the commission agent's report.

If a report is registered for the sale of goods, the transfer of which to the commission agent is reflected in the Sales document (act, invoice), then the document Sales report of the commission agent (agent) is recommended to be entered on the basis of the shipment document (Fig. 1) or using the Fill button. In this case, the header details and the tabular part on the Implementation tab will be filled with data from the base document.

As a result of automatic filling, in the upper part of the table, by default, the commission agent will be indicated as the buyer, and in the lower part - the nomenclature, price and quantity of goods that were transferred to the commission agent for sale.

To fill in information about real buyers and actual sales of goods based on the commission agent’s report, it is necessary to make changes to the upper and lower parts of the table.

The following information is indicated at the top of the table (Fig. 2):

Rice. 2. Sales agent report

For each line of the upper tabular part, information is indicated in the lower part (Fig. 2):

- about goods sold (name, quantity, price at which goods were sold, price of goods when transferred to the commission agent, tax rate);

- the amount of commission agent's remuneration and the amount of tax on remuneration;

- the account in which the transferred goods were recorded;

- accounts for recording income and expenses for the sale of goods;

- VAT account for the sales transaction.

Thus, each row in the top table corresponds to a separate bottom table. The transition between lower tables is carried out by moving through the rows of the upper table. For the example under consideration, three rows were created in the upper table, for each of which a separate lower table was filled in (Fig. 2).

After posting the document Report of the commission agent (agent) on sales, the following accounting entries will be entered into the accounting register:

Debit 90.02.1 Credit 45.01 - for the cost of goods sold, for each line of the lower tabular part;

Debit 60.01 Credit 76.09 - for the total amount of commission withheld;

Debit 76.09 Credit 90.01.1 - for the sale price of goods including VAT, for each line of the lower tabular part;

Debit 44.01 Credit 60.01 - for the cost of intermediary services excluding VAT;

Debit 90.03 Credit 68.02 - for the total amount of accrued VAT on the sales transaction;

Debit 19.04 Credit 60.01 - for the total amount of VAT presented by the intermediary for commission fees.

For tax accounting purposes for corporate income tax, the corresponding amounts are also recorded in the resources Amount Dt and Amount Kt for accounts with the NU attribute.

Entries are entered into the Sales VAT register for the sales book for each customer, reflecting the accrual of VAT payable to the budget.

An entry with the type of movement Receipt and with the event Submitted VAT by the Supplier is entered into the VAT presented register for the amount of VAT presented by the commission agent for the commission.

Also, when posting the document Report of the commission agent (agent) on sales, as mentioned above, the document Invoice issued is automatically generated (operation 3.7 “Reissuing a consolidated invoice for goods sold”). Since a “consolidated” invoice is being generated, a link to the same invoice appears in each line of the upper part of the table in the Issued to commission agent column (Fig. 3). The created posted document Invoice issued is a “consolidated” invoice re-issued by the commission agent to the commission agent with indicators similar to those of the invoices issued by the commission agent to the buyer when shipping goods on this date (clause 1 of the Rules for filling out an invoice, approved. Resolution No. 1137).

Rice. 3. Formation of a consolidated invoice

From any row at the top of the table in the Agent's Sales Report document, you can go to this reissued “consolidated” invoice.

In the new posted document Invoice issued, all fields will be filled in automatically based on the data in the document Sales report of the commission agent (agent). In this case, in the field Operation type code the value 27 will be indicated, which corresponds to the preparation of an invoice based on two or more invoices for the sale of goods (work, services), property rights in the case provided for in paragraph 3.1 of Article 169 of the Tax Code of the Russian Federation (Appendix to Order of the Federal Tax Service of Russia dated March 14, 2016 No. ММВ-7-3 / [email protected] ).

By clicking the Print button in the document Invoice issued (Fig. 3), you can view the form of the invoice and print it in two copies (clause 6 of the Rules for filling out an invoice, approved by Resolution No. 1137).

In the “consolidated” invoice reissued to the commission agent in accordance with the Rules for filling out the invoice, approved. Resolution No. 1137 will indicate:

- in line 1 - the date of issue of the “consolidated” invoice by the principal, which coincides with the date of the invoices issued by the commission agent (agent) to the buyer. The serial number of the invoice is indicated by the committent in accordance with its chronology (clause “a”, clause 1 of the Rules);

- in lines 2, 2a and 2b - the name and location of the principal (principal) in accordance with the constituent documents, identification number and code of the reason for registration of the principal (principal) (clauses “c”, “d”, “e” clause 1 of the Rules);

- in line 4 - the names of all consignees and their postal addresses from the invoices issued by the commission agent (through the sign “;” (semicolon) (clause “g” of clause 1 of the Rules);

- line 5 is filled in in case of receipt of payment, partial payment for the upcoming delivery of goods (performance of work, provision of services), transfer of property rights. In this case, line 5 indicates the details (number and date of preparation) of payment and settlement documents on the transfer of funds by buyers to the commission agent (agent) and by the commission agent (agent) to the committent (principal) (through the sign “;” (semicolon) (paragraph “ 3" clause 1 of the Rules);

- in lines 6, 6a and 6b - names, locations, INN/KPP of buyers in accordance with the constituent documents from invoices issued by the commission agent (through the sign “;” (semicolon) (paragraphs “and”, “ j", "l" clause 1 of the Rules);

- in columns 1-11 the data corresponding to the data from the invoices issued by the commission agent is indicated (letter of the Federal Tax Service of Russia dated 02/04/2010 No. ШС-22-3 / [email protected] ). In this case, the names of the shipped goods are indicated in separate positions for each buyer (clause “a”, clause 2 of the Rules).

After the Invoice document has been issued, entries are made in the Invoice Journal register for each buyer of goods.

Despite the fact that since 01/01/2015 the principals (principals) do not keep a log of received and issued invoices, register entries in the Invoice Log are used to store the necessary information about the issued invoice.

To register an invoice for remuneration received from a commission agent (operation 3.8 “Registration of an invoice for commission”), you must enter the number and date in the Invoice for remuneration number and from fields on the Main tab of the document Sales report of the commission agent (agent) respectively. incoming invoice and click the Register button. In this case, the document Invoice received will be automatically created, and a hyperlink to the invoice will appear in the form of the basis document.

The fields of the Invoice document received will be filled in automatically based on information from the document Sales report of the commission agent (agent).

In addition, in the Invoice document received:

- in the Ground Documents field there will be a hyperlink to the corresponding report of the commission agent;

- in the Transaction Type Code field the value 01 will be reflected, which corresponds to the acquisition of goods (work, services), property rights (Appendix to the order of the Federal Tax Service of Russia dated March 14, 2016 No. ММВ-7-3/ [email protected] ).

Registration in the purchase book of an invoice for commission services received from a commission agent (operation 3.9 “Application for deduction of input VAT on commission fees”) can be done by checking the box in the line Reflect VAT deduction in the purchase book by the date of receipt of the document Invoice received, if committent:

- does not maintain separate accounting (in the accounting policy settings (section Main - subsection Settings - Taxes and reports) on the VAT tab, the flag for the value Maintains separate accounting of incoming VAT by accounting methods is not set);

- does not transfer the tax deduction for the purchased commission agent service to the following tax periods in accordance with paragraph 1.1 of Article 172 of the Tax Code of the Russian Federation.

After posting the document, an accounting entry is generated:

Debit 68.02 Credit 19.04 - for the amount of VAT claimed for tax deduction on commission fees for February 2021.

An entry is made in the information register of the Invoice Journal to store the necessary information about the received invoice. An entry is made in the Purchase VAT accumulation register about the amount of tax presented by the commission agent for the intermediary service to create a purchase book entry for the first quarter of 2021.

An entry with the type of movement Expense is entered into the VAT register for the amount of VAT accepted for deduction.

Purchase by an intermediary of goods for himself and the consignor

A more difficult situation to reflect in accounting is when the intermediary purchases goods not only for the principal, but also for himself. Let's look at it with an example.

The Intermediary purchased goods from the Supplier for a total amount of 177 thousand rubles, including VAT of 27 thousand rubles. The cost of each unit of goods, as in the first example, is 11.8 thousand rubles, including VAT - 1.8 thousand rubles. In this case, 10 units of goods were intended for the Principal, and 5 units for the Intermediary himself.

The intermediary receives from the Supplier an invoice in his name in the amount of 177 thousand rubles, including VAT - 27 thousand rubles. Please note that the Supplier registers the issued document in its sales book with code 01. The Intermediary, in turn, reflects the received invoice in Part 2 of the Journal for the total amount, but in column 15 (“Including the amount of VAT on the invoice ") it indicates the amount of tax on the goods purchased for the Principal.

In our example, the Intermediary must record the invoices received in Part 2 of the Journal as follows.

Table 5. Reflection of the operation in part 2 of the Intermediary's Journal

| Column number | 3 | 8 | 14 | 15 |

| 15 | LLC "Supplier" | 177 000,00 | 18 000,00 |

And the same invoice is reflected by the Intermediary in his purchase book. At the same time, he indicates the full cost of the purchase, and VAT (column 16) - only in part of the goods owned by him. The following table shows what an entry in a reseller's purchase ledger should look like.

Table 6. Reflection of the transaction in the Intermediary’s purchase book

| Column number | 2 | 9 | 15 | 16 |

| 01 | LLC "Supplier" | 177 000,00 | 9 000,00 |

Now the commission agent (agent) issues a new invoice to the principal (principal) and indicates the amount of goods purchased for him, as well as the VAT due on this amount. In our example, the Intermediary issues an invoice to the Principal in the amount of 118 thousand rubles, including VAT - 18 thousand rubles.

The Intermediary reflects the specified document in part 1 of its Journal with code 15, and the Principal - in its purchase book with code 01. In the following two tables you can see how these entries should look.

Table 7. Reflection of the new invoice in part 1 of the Intermediary’s Journal

| Column number | 3 | 8 | 10 | 14 | 15 |

| 15 | LLC "Committent" | LLC "Supplier" | 118 000,00 | 18 000,00 |

Table 8. Reflection of a new invoice in the Principal’s purchase book

| Column number | 2 | 9 | 11 | 15 | 16 |

| 01 | LLC "Supplier" | LLC "Posrednik" | 118 000,00 | 18 000,00 |

The process of creating an agency agreement in the 1C program

In order to register the relationship between the agent and the principal in the 1C program, it is necessary to draw up an agreement with the counterparty indicating the type of agreement. There are two types of contracts: with a commission agent (agent) and with a principal (principal). In contracts with counterparties, it is possible to specify the procedure for calculating commissions.

In the 1C: Accounting program, the amount of commission is calculated in two ways. The first method is calculated as a percentage of the cost of goods (services) sold. The second method is as a percentage of the difference between the cost at which goods (services) were sold to the agent and the cost of their sale to the buyer.

Note 2

The commission calculation parameters can be left blank, but in this case they will need to be filled in manually each time the “Report of the commission agent (agent) on sales” or “Report to the principal (principal) on sales” documents are generated.

Creating an agreement in the 1C program

In the program that opens, select the “Directory” section. In the subsections that appear, we find “Purchases and sales” and go to the “Counterparties” item. In the window that opens, you must fill in information about the type of counterparty, its name, which group it belongs to, INN, KPP, bank account, address and telephone number of the counterparty. After you fill in all the data, click on the “Record” button.

Now go to the “Agreements” tab and click on the “Create” button.

In the window that opens, the “Counterparty” field is filled in automatically. You need to fill in the “Type of agreement” field: “With a principal (principal) for sale” or “With a commission agent (agent) for sale.” The next step is to fill in the contract number, date and name.

In the “VAT” field, if you select the type of agreement “With a commissioner (principal) for sale,” you must clear the checkbox “The supplier submits VAT under the agreement,” but if you select the type of agreement “With a commission agent (agent) for sale,” leave the checkbox.

The “Commission” field is filled in only when selecting the type of agreement “With the principal (principal) for sale.” In the line “Settlement method” put “Percentage of the difference between sales and receipts” and the amount “100%”. After filling out, you can “Record and close” the contract. As a result of creating an agency agreement, it will be necessary to create an agent report, which will be the final part of the agreement.

schet-faktura_agent.png

An invoice under an agency agreement, a sample of which is presented, is not recorded in the agent’s purchase book, since he does not have the obligation to charge VAT on goods purchased not for himself. He registers the SF in the SF accounting journal and transfers the document to the principal.

If the agent, fulfilling the customer’s instructions to purchase goods, acts on his behalf, then the supplier issues an invoice directly to the principal. The agent passes it on to the customer as confirmation of the purchase transaction, and he, in turn, registers the SF in the purchase book.

Invoice under an agency agreement for the acquisition of goods and materials by an intermediary on its own behalf

In the case when the principal instructs the agent to search for a suitable supplier and purchase goods and materials from him on behalf of the intermediary, the invoices received by the latter from the seller are issued in the name of the agent, who is indicated on them by the buyer. These invoices are registered by the agent in the invoice journal, and their certified copies are transferred to the customer.

Since the acquired assets do not belong to the agent, he is obliged to reissue the invoice, indicating the name of the actual buyer, and transfer it to the principal. All sum and quantitative indicators from the document received from the seller are transferred to the reissued SF, and only the lines are adjusted:

— No. 1, where the date of the invoice issued in the name of the agent is preserved, but the document number is entered according to the chronology of the intermediary’s accounting;

— No. 3, where the intermediary company is indicated as the consignee;

— No. 5, where details of payment orders are entered to transfer money from the customer to the agent and from the agent to the seller;

— No. 6, 6a and 6b, which indicate the name and details of the purchasing company, i.e. the customer.

Agent invoice under an agency agreement: example of filling

07/10/2019 Alpha LLC (intermediary), acting on its own behalf, purchased a batch of coffee for the customer Dora LLC in the amount of 600,000 rubles. (including VAT RUB 100,000) from the supplier Bella LLC.

According to the terms of the agency agreement, 600,000 rubles. Dora LLC transferred by payment order No. 1265 dated 07/05/2019 to the intermediary Alpha LLC, he in turn transferred the money by payment order No. 6589 dated 07/08/2019 to the seller Bella LLC.

The supplier issued invoice No. 124 to Alpha LLC dated July 10, 2019. The agent reissued the SF for the purchase of goods for Dora LLC, filling it out as follows:

Simultaneous sale by an intermediary of its own goods and the goods of the consignor

If, along with the principal’s goods, the commission agent also sells his own, the reflection of the transaction in accounting will be somewhat different.

Let's give an example. The intermediary sold to the buyer 10 units of goods belonging to the Principal and 5 units of its own goods. The cost of each of them was 11.8 thousand rubles, including VAT - 1.8 thousand rubles. Thus, the Intermediary sold goods for a total amount of 177 thousand rubles, of which its own goods amounted to 59 thousand rubles, and the Principal’s goods amounted to 118 thousand rubles. The VAT amount was, respectively, 9 thousand rubles on the own goods, and 18 thousand rubles on the goods of the Principal.

As in the first case, first the Intermediary issues an invoice to the Buyer, indicating himself as the seller. The document is drawn up for all goods – both your own and those belonging to the Principal. That is, the intermediary issues an invoice to the buyer in the amount of 177 thousand rubles, highlighting VAT in the amount of 27 thousand rubles (9 thousand + 18 thousand).

The intermediary registers this document in his sales book. In column 13B he reflects the total cost of goods, in column 14 - the cost of his own goods without VAT, and in column 17 - VAT payable on his own goods.

The table below shows how the Intermediary should complete certain sections of the sales ledger to reflect the specified invoice.

Table 1. Reflection of the transaction in the Intermediary’s sales book

| Column number | 2 | 7 | 13b | 14 | 17 |

| 15 | LLC "Buyer" | 177 000,00 | 50 000,00 | 9 000,00 |

Note! In this case, transaction type code 15 is used.

The issued invoice must be registered in 1 part of the Journal. It is necessary to reflect here the amounts of sales subject to VAT and taxes that relate only to the Principal’s goods. The following table shows how this would be done in our example.

Table 2. Reflection of the operation in part 1 of the Intermediary's Journal

| Column number | 3 | 8 | 14 | 15 |

| 15 | LLC "Posrednik" | 118 000,00 | 18 000,00 |

The Buyer makes an entry in his purchase book for the total amount of the transaction with transaction type code 01. In our case, in column 15 the Buyer must indicate 177 thousand rubles, and in column 16 - 27 thousand rubles.

Dali The Intermediary transfers the invoice data to the Principal. On its basis, the Principal issues a new invoice to the Intermediary for the amount of sales of its goods, that is, 118 thousand rubles, including VAT - 18 thousand rubles. The Principal reflects the data of this invoice in his sales book, and the Intermediary - in the second part of the Journal. The following two tables show how to do this.

Table 3. Reflection of a new invoice in the Principal’s sales book

| Column number | 2 | 7 | 9 | 13b | 14 | 17 |

| 01 | LLC "Buyer" | LLC "Posrednik" | 118 000,00 | 100 000,00 | 18 000,00 |

Table 4. Reflection of the operation in part 2 of the Intermediary's Journal

| Column number | 3 | 8 | 14 | 15 |

| 15 | LLC "Committent" | 118 000,00 | 18 000,00 |