Inventory cards of fixed assets in 1C reflect all information about the object - characteristics, whether there has been modernization, movement since its acceptance for accounting, etc. At the same time, in 1C cards, most of the data is transferred automatically from fixed asset accounting documents. Let's look at how to create, assign a number and, finally, print inventory cards in 1C: Enterprise Accounting 3.0. If you still have questions related to the work of the directories, please contact the 1C consultation line, and also leave requests on our website. Our specialists will contact you as soon as possible.

You can generate a card from the directory “Fixed assets” (menu section “Directories” - “OS and intangible assets”).

Fig. 1 “Directories” - “OS and intangible assets”

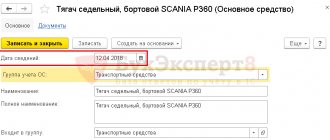

Let's open the directory element and see what data is displayed in it, and what we can add additionally.

Fig.2 System and manually entered data

Data on acceptance for accounting, location, and method of reflecting depreciation expenses are reflected automatically from the document of receipt or acceptance of an asset for accounting. The user should fill out some of them “by hand” - this is the data in the “Information for the inventory card” section, such as manufacturer, serial number, object passport number, date of issue or construction (for the property).

Fig.3 Information for the inventory card

Having filled in the necessary data, print the card using the “OS Inventory Card (OS-6)” button.

Fig.4 OS inventory card (OS-6)

Fig.5 Printing form OS-6

If working with inventory cards causes you difficulties, contact our technical support line for 1C users by phone or leave a request on the website.

Before opening the card

Before creating this accounting document, it is necessary to draw up an act of acceptance and transfer of fixed assets - it is from this that information about the object comes into the card. In addition, to fill it out, data is taken from other accompanying papers, such as, for example, technical passports of products, equipment and machinery.

The inventory card refers to the internal accounting documentation of the enterprise and information is entered into it for any actions with the property registered in it (purchase, transfer from one department to another, repair, reconstruction, modernization, write-off, etc.).

General useful information

The purpose of the document is to reflect in accounting the movement of groups of fixed assets of the company.

The paper must be filled out by an accountant and kept in the accounting department. For each group of objects, one copy of the inventory card is issued, this is done on the day of commissioning (the date must coincide with the day in the OS acceptance certificate in the OS-1b form). Form OS-6a was introduced on January 21, 2003 by Resolution of the State Statistics Committee of Russia No. 7. Since the beginning of 2013, entrepreneurs have received the right to use their own developed forms in their work, but some companies have remained faithful to the unified forms.

Inventory card - what is it and what is it for?

An inventory card is maintained for each fixed asset item (non-financial asset). You can call it a “passport” of the fixed asset; it contains all the information about it. Today, the current form for the OKUD inventory card for accounting for non-financial assets is 0504031 (approved by Order of the Ministry of Finance of the Russian Federation dated March 30, 2015 No. 52n, applied from December 29, 2021). For a group of homogeneous objects of fixed assets (software, library collections, stage and production equipment (scenery, furniture and props, props)), items of production and household equipment worth up to 40,000 rubles inclusive, the form according to OKUD 0504032 is used.

A card in 1C:BGU (f. 0504031) is opened by the institution for each inventory item, filled out on the basis of the Acceptance and Transfer Certificate of fixed assets, passports of manufacturers, technical and other documentation characterizing the object, reflecting the date of acceptance for accounting and the transaction log number .

Form 0504031 consists of 5 sections:

- Information about the object.

- The cost of the object, changes in book value, depreciation.

- Information about acceptance for accounting and disposal of an object.

- Information about internal movement of the object and repairs.

- Brief individual characteristics.

Rules for document execution

The inventory card of a fixed asset object has a unified form with code OS-6, approved by Resolution of the State Statistics Committee of Russia dated January 21, 2003 N 7.

The document is drawn up for each object separately and in a single copy, and if the cards are kept in electronic form, then there must be a copy of it on paper (it is the paper versions that contain the “live” signature of the financially responsible person). It is not necessary to certify the document with the company seal, because it refers to its internal documentation.

Inventory principles

To exercise control over the registration of new cards and further recording of their movement, there are inventories. They are registered in the accounting department and archived after the OS is written off. State authorities use a mandatory form approved on March 30, 2015 by Order No. 52n.

The document contains information for a certain period of time (indicated in the header) in the form of a table with the following fields to fill out:

- card number

- assigned inventory number of the OS object

- name of property

- date and number of the item disposal record

At the top of the form there are lines to indicate the names of the institution and its division (as well as codes), and at the bottom - the contents of the document are certified by the signature of the responsible person (his position, decoding), with a date.

Example of registration of an inventory card according to the OS-6 form

Filling out the document header

At the beginning of the document write:

- name of the company that owns the fixed asset,

- the structural unit to which the property is assigned,

- inventory card number,

- date of its preparation,

- name of the registered object.

Here, in the column on the right, the enterprise code according to OKPO (All-Russian Classifier of Enterprises and Organizations) is indicated - it is contained in the constituent papers and the code of the fixed asset object according to OKOF (All-Russian Classifier of Fixed Assets). Continuing to fill out the right column, we enter detailed information about the object:

- number of the depreciation group to which it belongs according to the accounting of the enterprise,

- passport registration number,

- serial and inventory numbers,

- date of registration of the fixed asset for accounting,

- number of the account (sub-account) through which it passes.

Below, the location of the fixed asset object is entered in the corresponding lines (indicating the department code, if such coding is used at the enterprise) and information about the manufacturer (this data can be found in the technical passport).

Filling out detail tables

The second part of the document opens sections dedicated to the registered object.

Please note: information is entered into the first section only if the property was already in use at the time of entry into the card. If it is new, you do not need to fill out this section.

The second section includes the cost of the object at the time of acceptance for accounting and its useful life.

The third section is drawn up when revaluing a fixed asset - and the price can vary both upward and downward. The difference between the original cost and after revaluation is determined as the replacement price.

The fourth section of the card contains information about all movements of recorded property. The data is entered here strictly on the basis of accompanying papers indicating the type of operation, the structural unit to which the asset belongs, the residual value and information about the responsible person.

If the fixed asset is owned by several persons, then they must be indicated under the fourth table with the percentage distribution of shares.

Filling out sections of the reverse side of the OS-6 form

The fifth section indicates all changes in the original value of the object, regardless of the actions performed with it. The type of operation, data from the supporting document, as well as the amount of expenses incurred by the organization in the process of carrying out the necessary procedures are written here.

The sixth section includes information about repair costs, with a full breakdown of each operation performed (type of repair, accompanying documentation, amount of expenses).

The seventh section contains special data about the fixed asset object, including data on the content of precious and semi-precious metals, stones and materials in its composition.

The last table of the card records structural units, elements and other features that are a distinctive feature of the property, as well as its qualitative and quantitative indicators. If there are any comments, they are entered in the last column of the table.

Finally, the document is certified by the employee responsible for maintaining inventory cards at the enterprise (his position must be indicated here and a signature must be affixed with a transcript).

Sample

To visually familiarize yourself with the structure of the document and the rules for filling out individual columns and fields, we will give an example situation and a form for filling out OS-6.

Documents for download (free)

- Form No. OS-6

- Sample form No. OS-6

- Form No. OS-6a

- Form No. OS-6b

On November 29, 2016, I purchased a specialized cutting machine worth 1.5 million rubles, incl. VAT RUB 228,813.56 Serial number 238541, date of issue – 10/01/2016. By order No. 55 dated 12/01/2016, the object is included in the OS, depreciation group 5, useful life is determined at 85 months, OKOF - 330.28.41.3.

The object was transferred to the warehouse to the chief engineer A.N. Stepanov for storage. On 07/01/2017, the main cutting saw broke down, about which defect sheet No. 12 was compiled. Repairing the damaged part cost RUB 10,000.00. (excluding VAT).

How to create an inventory book in 1C 8.3

In 1C 8.3 with OSNO and USN

You can find the inventory card as follows: on the section panel, select the OS and intangible assets section, then select the Reports subsection and go to the Inventory book report (OS-6 b):

Open the selected report and click the Generate button:

Sample of filling out the inventory book according to form No. OS-6 b in 1C 8.3:

Sections of the Inventory Book, which reflect:

- OS object name;

- Its inventory number;

- Date ;

- Date of registration. accounting;

- Structural subdivision;

- Responsible person;

- Initial cost of the OS;

- Useful life of the OS;

- Amount of accrued depreciation:

- Residual value of fixed assets;

- OS revaluation;

- Internal transfer, disposal, write-off of fixed assets:

Complete instructions on how to correctly fill out and register the Inventory Book in 1C 8.3 can be found in the same report. To do this, use the More button. When you press this button, an additional menu opens with functions, when selected, you can supplement or change the report plate itself in order to make it convenient to work with it.

So, select the Help function:

We open it and get instructions for creating an inventory book:

There are two ways to create an inventory book in 1C 8.3. To do this, open the Select settings button on the report panel:

Select a specific department:

Indicate the person who is financially responsible for this division for the safety of the OS:

We create an inventory book for the required period (month, quarter, year):

There is another possibility for filling out the inventory book in 1C 8.3 - choosing the person who is responsible for the information in this book:

All personal data of the person (full name), personnel number are recorded on the title page of the inventory book:

In order not to perform the Select settings function each time, there is a function in this report - Save settings. Select the required setting and use the Save button to fix the desired setting in 1C 8.3:

You can study the features of reflecting operations for accounting for fixed assets in 1C 8.3 (main documents, accounting accounts, cost formation and depreciation in accounting and accounting records) in the module.

When putting a fixed asset into operation, an inventory number must be assigned. What nuances there are, see our video lesson:

Please rate this article:

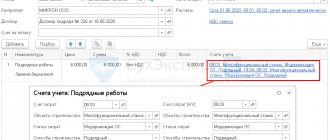

OS accounting is carried out using inventory cards that are created for each object. In this article we will look at:

- where to find the OS inventory card in 1C;

- how to create it;

- how to print an inventory card in 1C 8.3.

The organization must approve the form of the inventory card for further accounting of fixed assets. In 1C 8.3, a card of the OS-6 form is used. It reflects all operations carried out with the OS object from the moment it was accepted into the OS (clause 12, clause 13 of the Guidelines for accounting of OS, approved by Order of the Ministry of Finance of the Russian Federation dated October 13, 2003 N 91n).

Where can I find the OS inventory card (OS-6) in 1C 8.3? The fixed asset card in 1C 8.3 is located in the section.

An inventory card is entered into the organization. In general, the card is filled out automatically when documents are processed, but some data must be entered manually.

The data in the fields filled in automatically is relevant as of the current date. If you are analyzing (printing) past data, then in the Information Date

indicate the desired date.

If you don’t see such a field in the card, then add it using the More button - Change form.

Accounting for fuels and lubricants

New documents:

- Tractor waybill (form No. 412-APK),

- Registration sheet for tractor driver (form No. 411-APK).

Forms of travel documents and tax receipts are optimized for ease of use on small monitors.

The following features have been added to tax documents:

- entering and storing data on gas stations using transport cards and fuel coupons,

- summary calculation and write-off of fuel and lubricants in the reporting period in one document,

- refined calculation of the actual consumption of lubricants and special liquids based on the actual fuel consumption.