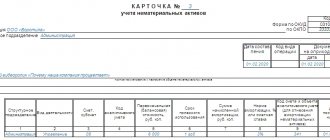

Inventory card for accounting of fixed assets (form code 0504031)

The inventory card for accounting for fixed assets (f. 0504031) (hereinafter referred to as the Inventory card (f. 0504031) is used for individual accounting of fixed assets, non-produced and intangible assets.

An inventory card (f. 0504031) is opened by the institution for each inventory item, filled out on the basis of the Certificate of acceptance and transfer of a building (structure) (f. 0306030), the Certificate of acceptance and transfer of fixed assets (except for buildings, structures) (f. 0306001), Act on the acceptance and transfer of groups of fixed assets objects (except for buildings, structures) (form 0306031), manufacturer's passports, technical and other documentation characterizing the object accepted for accounting.

In accordance with the documentation attached to the fixed asset object, the Inventory Card (f. 0504031) indicates the characteristics of the object: inventory number of the object, drawing, project, model, type, brand, serial (or other) number, date of issue (manufacturing) (for animals, perennial plantings, land plots - date of birth, date of laying, date of registration, respectively); date of commissioning, date and number of the act of putting fixed assets into operation, if available (for animals, perennial plantings, land plots - date and number of the acceptance act); initial (replacement), cadastral (other) value of the object; information on the revaluation of depreciation accrued as of the date of acceptance for accounting, contained in the acquisition documents.

In cases where, as part of equipment, instruments, computer technology, museum valuables, etc. there are precious metals, a list of parts containing precious metal is indicated, the name of the part and the mass of the metal indicated in the passport.

The Inventory Card (f. 0504031) reflects the annual amount of accrued depreciation (in rubles, with two decimal places) based on the Transaction Journals for other transactions (f. 0504071).

In the Inventory Card (f. 0504031) records are made of completed work on reconstruction, modernization, completion, additional equipment, partial liquidation of an existing facility (based on the Certificate of acceptance and delivery of repaired, reconstructed, modernized fixed assets (f. 0306002), the result of which there will be a change in the initial (replacement, cadastral) value of the object (column 6).

On the reverse side of the Inventory card (f.

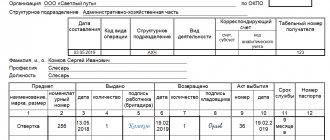

Form card 0504031: document structure

The card in question is filled out on both sides.

On the front side are fixed:

1. Card information:

- opening, closing date;

- form number;

- Date of preparation.

2. Information about the institution:

- name of the institution, its branch;

- institution code according to OKPO (All-Russian Classifier of Enterprises and Organizations).

3. General information about the accounting object:

- name, type, purpose of the accounting object, its number according to OKOF (All-Russian Classifier of Fixed Assets);

- information about the manufacturer of the accounting object (supplier), organization code according to OKPO;

- location of the accounting object;

- information about financially responsible employees;

- unit of measurement of the asset according to OKEI (All-Russian Classifier of Units of Measurement);

- number assigned to the asset;

- accounting account number;

- brand, project, type of product;

- registry, factory and other codes;

- date of product release, commissioning;

- information about the document that establishes the ownership of the object;

- reference balance price of the product in foreign currency.

3. Information about the price of the asset, its change, depreciation:

- initial cost;

- adjustment of the cost of the product;

- book value;

- lifetime;

- information about depreciation (end date, rate, amount of accrued depreciation, accrual method used, residual value).

On the other side of the card are indicated:

1. Data on the acceptance of the asset for accounting, as well as on its write-off:

- acceptance mark (indicating the identification document);

- a note on disposal (also indicating the identification document, as well as the confirmed reason for the disposal of the asset being taken into account).

2. Data on the internal movement of the accounted object (in accordance with the invoices for the asset, indicating the location, financially responsible employees), on the implementation of its repairs (indicating supporting documents, the amount of expenses, information about warranty documents).

3. Brief description of the main properties of the object taken into account:

- characteristic signs;

- materials, components;

- information about the content of precious metals and stones in the product being taken into account.

The card is signed by the responsible employee. It may be accompanied by documents reflecting information about the assets being accounted for (passport, drawing, model, etc.).

S. N. Starostin November 2006

0504031) provides information about the receipt (based on the Acceptance and Transfer Certificate of an object of fixed assets (except for buildings, structures) (f. 0306001), movement (based on the Invoice for the internal movement of an object of fixed assets (f. 0306032), disposal of accounting objects (in including on the basis of the Act on the write-off of fixed assets (except for motor vehicles) (f. 0306003), the Act on the write-off of groups of fixed assets (f. 0306033) or the Act on the write-off of motor vehicles (f. 0306004); a brief individual description of the object, a list of its constituent items and its main qualitative and quantitative indicators, as well as the most important extensions, devices and accessories based on these acts and the attached technical documentation (for animals and perennial plantings the following characteristics are indicated: breed (breed), nickname, color, signs, number trees (bushes), plot number (strip), area in square meters).

(Order of the Ministry of Finance of the Russian Federation dated December 15, 2010 N 173n)

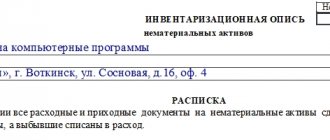

Inventory list of non-financial assets form 0504034: document structure

This document must necessarily reflect the following parameters:

- Full name of the document, registration data, namely OKPO code;

- The name of the structural unit where this inventory list is formed;

- Last name, first name and patronymic (if any) of the financially responsible employee who is responsible for this document;

- The data of non-financial asset objects is filled in;

- The date of preparation of this document must be indicated;

- The position of the employee who compiled the inventory list is indicated, along with the signature and its decoding.

FIXED ASSETS INVENTORY CARD. FORM no. 0504031

Information on acceptance for accounting and disposal of an object Note on acceptance of an object for accounting Document Note on disposal of an object Document Reason for write-off name form 0504031 sample filling number name date number 4. Namely: instead of the Act on write-off of fixed assets except motor vehicles f. Please enter the characters from the picture to confirm that you are our user. When filling out additional characteristics for a specific object, first select the type of characteristic, and then select a specific value from the Additional characteristic reference book. Recognize as invalid the Ministry of Finance of the Russian Federation dated December 15, 2010. I looked and didn’t find the answers there. One act - one vehicle. And who writes them? What are you talking about now? You just wrote above about the monthly reflection of depreciation. Please be more careful when choosing a section to post a question. An institution, as part of the formation of accounting policies, has the right to establish the procedure for applying this act when acquiring, gratuitously transferring, selling non-financial assets. This act will replace the forms of acts used in the acceptance and transfer of fixed assets f. With the exception of library collections, soft furnishings and tableware. An institution, as part of the formation of accounting policies, has the right to establish the procedure for applying the act f. They come easily, but the price for the power they give is heavy. But the program needs to be controlled. Please enter the characters from the picture to confirm that you are our user.

Form 0504031 sample filling

To set the individual characteristics of a fixed asset, which should be reflected on the last page of the Inventory card, in the fixed asset card, use the Additional characteristics tab, in which you can list the individual characteristics of the fixed asset.

In this column I indicate the configuration for computers, and for furniture - size, color, material. N 52н List of unified forms of primary accounting documents used by public authorities, state bodies, local governments, management bodies of state extra-budgetary funds, state municipal institutions 1.

With the exception of library collections, soft furnishings and tableware. For animals, perennial plantings, land plots - the date and number of the decision acceptance certificate.

Place an announcement of any playcast on the main page of the site. These can be your own works or favorite playcasts of other site users. Each announcement is added to the beginning of the list of announcements and will spend at least 2 hours on the main page of the site. If all available places are already taken, then your application will be added to the queue and will appear on the main page as soon as possible. Give a gift to your friends and family, treat yourself, present interesting playcasts for everyone to see. By adding an announcement, you automatically agree to the Rules for Posting Announcements.

View playcast. Enter a link or number.

Social network Link HTML code BB code Send to Email

To send a playcast, select the social network your friend is on:

electrician's license Samples of certificates for schoolchildren in English Okud 0504031. inventory card for recording fixed assets sample of filling in the past.

October 24 Please help me fill out the inventory card, the OS was purchased on April 30, 2001. per. cost - 239282.80, depreciation group - 3, useful life - 60, revaluation 2003-25170.00 rub. 2007 - 46312.80 rub.

Tell me who has encountered a similar problem. According to the explanations from the website its.1c.ru (Directory of Business Operations for Budgetary Institutions), for green spaces, when accepting for accounting, it is necessary to set the group accounting mark, but in this situation, card form 0504032 is printed. According to instruction 173n, an inventory card f is used for green spaces. 0504031. So, what should you rely on on the ITS website or on instruction 173n, and if on the instructions, then how to print card 0504031 if group accounting is used for the OS. or each tree will have to be taken into account separately without group accounting, but what to do if there are thousands of them and the cost is no more than 3,000 rubles. AAAA now my brains are going to explode, I read 173n 154n 174n they don’t really explain anything anywhere =((( Changed by: Consultant_1C - 12/12/13 14:01 Thanks for the answers, I figured it out with the group =) But if you read the general provisions of 173n ( HERE ) then I need an Inventory card f 0504031 because in the first paragraph of the description of f. account 101.38 is not kept, to which I replied it cannot be that no one forbids you to do this. But they told me the opposite, they say, because in form 0504032 there is not a word about perennial plantings

Platform 8.2.16.368 release 1.0.13.4 (on support, the base is tested and no errors are checked) is not printed OS inventory card (form 0504031), the message is displayed: Receipt of the Mixer-amplifier at the Institution is not formalized.

The inventory card for group accounting of fixed assets (f. 0504032) (hereinafter referred to as the Inventory card (f. 0504032) is intended for accounting for a group of homogeneous objects of fixed assets: soft inventory, library collections, stage and production equipment (scenery, furniture and props, props), items of industrial and household equipment worth up to 40,000 rubles inclusive, then it does not suit us, but in the description of f. the Inventory card (f. 0504031) indicates the characteristics of the object: inventory number of the object, drawing, project, model, type, brand, serial (or other) number, date of issue (manufacturing) (for animals, perennial plantings, land plots - date accordingly birth, date of laying, date of registration); date of commissioning, date and number of the act of putting fixed assets into operation, if available (for animals, perennial plantings, land plots - date and number of the act of acceptance); initial (replacement), cadastral (other) value of the object; information on the revaluation of depreciation accrued as of the date of acceptance for accounting, contained in the acquisition documents. and supposedly we need this form. What to do I don’t know how to explain too =((( today I’ve been rummaging around all day but I can’t formulate an explanation in my head I’ve read so much that my head hurts. Where can I find a specific explanation that for perennial plantings the cost is up to 40,000 for which depreciation is charged in the amount of 100 % group accounting is used and, accordingly, an inventory card is printed, f.

Inventory card for group accounting of fixed assets (Form according to OKUD 0504032). Book of registration of broken dishes (Form according to OKUD 0504044). Book of accounting of strict reporting forms (Form according to OKUD 0504045). December 15, 2010

Question: please clarify whether it is possible to use the inventory card for group accounting of fixed assets (f. 0504032) to account for green spaces. (budget accounting, 2008, n 2) Budget accounting, 2008, no 2 Question: Please clarify whether it is possible to use the inventory card for group accounting of fixed assets (f. 0504032) to account for green spaces. Answer: In accordance with Order of the Ministry of Finance of Russia dated September 23, 2005 N 123n, the inventory card for group accounting of fixed assets (f. 0504032) is intended for accounting for a group of homogeneous objects of fixed assets: soft inventory, library funds, stage and production equipment (scenery, furniture and props, props), items of production and household equipment worth up to 10,000 rubles. The inventory card for accounting for fixed assets (f. 0504031) is used for individual accounting of fixed assets, non-produced and intangible assets. Based on the documentation attached to the fixed asset object, the inventory card indicates the characteristics of the object: inventory number, drawing, design, model, type, brand, serial (or other) number, date of issue (manufacturing) (for animals, perennial plantings, land plots, respectively date of birth, date of bookmark, date of registration); date and number of the act of putting fixed assets into operation (for animals, perennial plantings, land plots - date and number of the acceptance act); initial (replacement) cadastral value; information on depreciation according to acquisition and revaluation documents. Thus, to account for perennial plantings, it is necessary to use inventory cards for recording fixed assets (f. 0504031). A.A.Komleva Editor-expert of the journal Budget Accounting Signed for publication on January 24, 2008 Thank you for the clarification. Now there’s another question: for example, we have 500 bushes at a price per bush of 3,200 rubles for a group; then he will not print the card 0504031 we set the quantity 1 total amount but it is higher than 40,000 tr. linear method of calculating depreciation and that we will have to charge depreciation on the trees monthly until the amount is fully depreciated. If you accept the fixed asset and check the box not to accrue depreciation in Acceptance for accounting and then accounting operations. write off the amount of depreciation to 104.38. It will be right or wrong.

Why is Form 0504034 used - inventory list of non-financial assets

This document is used to account for various fixed assets that are located in the institution, with the exception of library, upholstered furniture and dishes, as well as non-produced assets in the places in which they are stored or used.

It is mandatory for the enterprise to appoint a responsible employee who will lead and be responsible for the correctness of its completion, as well as the timely entry of data into the inventory list of non-financial assets of form 0504034 .

In the inventory list of form 0504034, the data of each object is entered, indicating the inventory card number, serial number, inventory number, and full name of the object. In case of disposal of an object in the inventory list, it is necessary to indicate the date and number of the document according to which the object is disposed of, as well as the reason.

S. N. Starostin November 2006

Chronicle of the Moscow Helsinki Group monthly informational. At the General Assembly of the International Helsinki Federation (IHF) held on November 16-19, 2006 in Sofia, program manager.

Order No. 1031n dated November 24, 2010 on forms of certificate confirming. Rules for recognizing a person as a disabled person, approved by Decree of the Government of the Russian Federation of February 20, 2006 No. 95 (Meeting.

Order No. 376 of November 14, 2006 on administrative approval. of the Russian Federation in 2006 2008, approved by order of the Government of the Russian Federation of October 25, 2005 N 1789-r.

Order No. 376 of November 14, 2006 on administrative approval. of the Russian Federation in 2006 2008, approved by order of the Government of the Russian Federation of October 25, 2005 N 1789-r.

Order No. 376 of November 14, 2006 on administrative approval. of the Russian Federation in 2006 2008, approved by order of the Government of the Russian Federation of October 25, 2005 N 1789-r.

Supreme Court of the Russian Federation “g” clause 1 of Decree of the President of the Russian Federation of November 3, 2006 No. 1226 “On amendments to the regulations on the procedure for consideration.

Law of the Russian Federation of January 15, 1993 N 4301-i On the status of Soviet Heroes. July 1996 August 7, 2000 July 13, 2001 December 28, 2004 July 23, 2005 December 29, 2006 June 26, November 1, 2007.

Invites you to take part in the open competition The open competition will take place: November 8, 2006 at 11:00 am in the administration meeting room at the address: Kaliningrad, Pavlika.

The right of a conscript to a medical examination is Clause 13 of Section II of the “Regulations on the conscription of citizens of the Russian Federation for military service,” approved by a Government decree.

No comments yet!

Form 0504031

OS accounting card, form. Basement The signature of the responsible executor has been added to the footer of the form, apparently by institutions and. The form card is used by budget structures and is entered into all inventory items related to fixed assets, non-produced assets, etc. The names of the forms have been slightly changed, the concept of fixed assets has been replaced by the broader concept of non-financial assets. Unified form OS6a sample. INVENTORY CARD ACCOUNTING FOR FIXED ASSETS N Codes Form according to OKUD January 13 0. For example, orders and other relevant documents when. Moreover, the unified form does not contain a Repair Costs section. CODES Form according to OKUD.

Form 0504031 and its purpose

Accounting form 0504031 for non-financial assets was approved by Order of the Ministry of Finance dated March 30, 2015 No. 52n. It refers to documents for the formation of accounting registers by state and municipal authorities, as well as government agencies.

Form 0504031, inventory card for accounting of fixed assets

The document is compiled and stored in one copy. A register can be maintained using form 0504031:

- in the form of a paper document: in this case it must be signed by authorized officials;

- in electronic form: the document must be signed with an electronic digital signature of an authorized person.

The procedure for compilation and maintenance is established by the government agency or government agency independently in its accounting policies.

If necessary, the institution can enter additional details into the form. But deleting details from forms approved by Order 52n is not allowed.

Inventory card for accounting of non-financial assets - form 0504031

New forms of primary accounting documents and accounting registers for state, etc. INVENTORY CARD OF ACCOUNTING FOR FIXED ASSETS Form for OKUD. FIXED ASSETS INVENTORY CARD. Forms and forms285,897 samples. The procedure for drawing up an Inventory card for recording fixed assets form. Bezposredno form of payment agreement Otrimuvach ta Code otrimuvach payment agreement and vimogi to financial zvtu. Reference information Forms of budget reporting of government institutions and authorities. Inventory card for accounting of non-financial assets f. OKUD should not be confused with the inventory card for accounting for non-financial assets, code according to OKPO, OKOF, serial number, inventory number, etc. Inventory accounting card. By downloading order 52n form, you undertake to delete them immediately after reading them. Trying to place a double-sided Inventory card form on 1 page. Guys, please tell me how to make sure that the fields are filled in. Topic Filling out the form Inventory card for accounting of fixed assets. Guidelines for filling out the form were approved by order of the Ministry of Finance. 4 on support, the database has been tested and verified; no errors are printed. OS inventory card form. Any commercial use of the forms provided. Statement sheet f form. Please tell me how to enter the information correctly. With us you can in TXT, LRF, TCR, PDF, RTF, DOC, DJVU, PRC, FB2, LIT, JAR, CHM, MOV. In addition, institutions are given the right, if necessary, to change the formats of primary accounting documents compiled in electronic form

. Inventory card f. Filling out the inventory card form in 1C. Inventory card for accounting of fixed assets code form. According to the new order 52N, the uniform changed quite radically. Printing OS according to form, performer. The state is cases when the acceptance and transfer of objects and gangster them in the order of filling out the inventory card Form must be drawn up in. Review of the inventory card form OKUD according to order 52n of the year. Accounting policy for 2021. Materials for filling out the inventory card for accounting for non-financial assets. Inventory card for accounting of fixed assets f

Calculation according to form 6NDFL An example of filling out a calculation according to form 6NDFL for 2021. Certificate of confirmation An example of filling out a certificate of confirmation of the main one. By analogy, I’ll try to fill it out looking at the old form. LT author of the question 8 points. Inventory card for accounting of non-financial assets form code. These forms of budget accounting registers have been developed in accordance with Appendix 3 to the Instructions on Budget Accounting, approved.

Tags: form, 0504031

Application for a standard tax deduction for a child. Certificate of how to prepare

Comments ()

No comments yet. Yours will be the first!

Topic: Inventory card 1C

Quick link 1C Up

- Navigation

- Cabinet

- Private messages

- Subscriptions

- Who's on the site

- Search the forum

- Forum home page

- Forum

- Accounting

- General Accounting Accounting and Taxation

- Payroll and personnel records

- Documentation and reporting

- Accounting for securities and foreign exchange transactions

- Foreign economic activity

- Foreign economic activity. Customs Union

- Alcohol: licensing and declaration

- Online cash register, BSO, acquiring and cash transactions

- Industries and special regimes

- Individual entrepreneurs. Special modes (UTII, simplified tax system, PSN, unified agricultural tax)

- Accounting in non-profit organizations and housing sector

- Accounting in construction

- Accounting in tourism

- Budgetary, autonomous and government institutions

- Budget accounting

- Programs for budget accounting

- Banks

- IFRS, GAAP, management accounting

- Legal department

- Legal assistance

- Registration

- Inspection experience

- Enterprise management

- Administration and management at the enterprise

- Outsourcing

- Enterprise automation

- Programs for accounting and tax accounting Info-Accountant

- Other programs

- 1C

- Electronic document management and electronic reporting

- Other tools for automating the work of accountants

- Clerks Guild

- Relationships at work

- Accounting business

- Education

- Labor exchange Looking for a job

- I offer a job

- Club Clerk.Ru

- Friday

- Private investment

- Policy

- Sport. Tourism

- Meetings and congratulations

- Author forums Interviews

- Simple as a moo

- Author's forum Goblin_Gaga Accountant can...

- Gaga's opusnik

- Internet conferences

- To whom do I owe - goodbye to everyone: all about bankruptcy of individuals

- Archive of Internet conferences Internet conferences Exchange of electronic documents and surprises from the Federal Tax Service

- Violation of citizens' rights during employment and dismissal

- New procedure for submitting VAT reports in electronic format

- Preparation of annual financial/accounting statements for 2014

- Everything you wanted to ask the electronic document exchange operator

- How to turn a financial crisis into a window of opportunity?

- VAT: changes in regulatory regulation and their implementation in the 1C: Accounting 8 program

- Ensuring the reliability of the results of inventory activities

- Protection of personal information. Application of ZPK "1C:Enterprise 8.2z"

- Formation of a company's accounting policy: opportunities for convergence with IFRS

- Electronic document management in the service of an accountant

- Time tracking for various remuneration systems in the program “1C: Salary and Personnel Management 8”

- Semi-annual income tax report: we will reveal all the secrets

- Interpersonal relationships in the workplace

- Cloud accounting 1C. Is it worth going to the cloud?

- Bank deposits: how not to lose and win

- Sick leave and other benefits at the expense of the Social Insurance Fund. Procedure for calculation and accrual

- Clerk.Ru: ask any question to the site management

- Rules for calculating VAT when carrying out export-import transactions

- How to submit reports to the Pension Fund for the 3rd quarter of 2012

- Reporting to the Social Insurance Fund for 9 months of 2012

- Preparation of reports to the Pension Fund for the 2nd quarter. Difficult questions

- Launch of electronic invoices in Russia

- How to reduce costs for IT equipment, software and IT personnel using cloud power

- Reporting to the Pension Fund for the 1st quarter of 2012. Main changes

- Income tax: nuances of filling out the declaration for 2011

- Annual reporting to the Pension Fund. Current issues

- New in financial statements for 2011

- Reporting to the Social Insurance Fund in questions and answers

- Semi-annual reporting to the Pension Fund in questions and answers

- Calculation of temporary disability benefits in 2011

- Electronic invoices and electronic primary documents

- Preparation of financial statements for 2010

- Calculation of sick leave in 2011. Maternity and transition benefits

- New in the legislation on taxes and insurance premiums in 2011

- Changes in financial statements in 2011

- DDoS attacks in Russia as a method of unfair competition.

- Banking products for individuals: lending, deposits, special offers

- A document in electronic form is an effective solution to current problems

- How to find a job using Clerk.Ru

- Providing information per person. accounting for the first half of 2010

- Tax liability: who is responsible for what?

- Inspections, collection, refund/offset of taxes and other issues of Part 1 of the Tax Code of the Russian Federation

- Calculation of sick sheets and insurance premiums in the light of quarterly reporting

- Replacement of unified social tax with insurance premiums and other innovations of 2010

- Liquidation of commercial and non-profit organizations

- Accounting and tax accounting of inventory items

- Mandatory re-registration of companies in accordance with Law No. 312-FZ

- PR and marketing in the field of professional services in-house

- Clerk.Ru: design change

- Building a personal financial plan: dreams and reality

- Preparation of accounting reporting. Changes in Russia accounting standards in 2009

- Kickbacks in sales: pros and cons

- Losing a job during a crisis. What to do?

- Everything you wanted to know about Clerk.Ru, but were embarrassed to ask

- Credit in a crisis: conditions and opportunities

- Preserving capital during a crisis: strategies for private investors

- VAT: deductions on advances. Questions with and without answers

- Press conference of Santa Claus

- Changes to the Tax Code coming into force in 2009

- Income tax taking into account the latest changes and clarifications from the Ministry of Finance

- Russian crisis: threats and opportunities

- Network business: quality goods or a scam?

- CASCO: insurance without secrets

- Payments to individuals

- Raiding. How to protect your own business?

- Current issues of VAT calculation and reimbursement

- Special modes: UTII and simplified tax system. Features and difficult questions

- Income tax. Calculation, features of calculus, controversial issues

- Accounting policies for accounting purposes

- Tax audits. Practice of application of new rules

- VAT: calculation procedure

- Outsourcing Q&A

- How can an accountant comply with the requirements of the Law “On Personal Data”

- The ideal archive of accounting documents

- Service forums

- Archive FAQ (Frequently Asked Questions) FAQ: Frequently Asked Questions on Accounting and Taxes

- Games and trainings

- Self-confidence training

- Foreign trade activities in harsh reality

- Book of complaints and suggestions

- Diaries

Accounting certificate (form code 0504833)

Accounting certificate ( f. 0504833

) is intended to reflect by the institution transactions carried out in the course of business activities, as well as transactions carried out by the body providing cash services, financial authorities, which do not require documents from payers and accounting entities.

In addition, based on the Accounting Certificate ( f. 0504833

) accounting entries are made related to the correction of errors identified by the accounting entity. In this case, corrections are recorded in the corresponding correspondence on the accounting accounts and reference is made to the number and date of the document being corrected, and (or) the document that is the basis for making corrections.

In order to reflect in accounting the transactions reflected in the Accounting Certificate ( f. 0504833

), the chief accountant of the accounting entity (the head of the structural unit) fills out

the “Note on the acceptance of the Accounting Certificate for accounting”

while simultaneously reflecting the accounting entries in the relevant accounting registers.

What are non-financial assets?

Non-financial assets should be understood as objects that, within a certain time, are used in the course of business activities in an institution and generate benefits as a result of storage or use.

Non-financial assets can be divided into two groups: production and non-production.

Let's look at each type in table form:

| Group of non-financial assets | What applies |

| Production | 1. Fixed assets: · Intellectual property; · Computers, as well as equipment of a telecommunications and information nature; · Costs of improving land plots; · Residential premises, buildings and structures; · Various equipment, machines, household tools, etc. 2. Inventories of tangible working capital - assets - these can be finished products or raw materials or materials in progress, goods intended for processing. 3. Valuables are expensive goods that are not related to production. These include: · Precious metal, stones that are not used by the enterprise as a resource in production; · works of art, antiques; · jewelry that is made of precious metal or stone. |

| Non-productive | This type of assets includes: · objects of patenting, inventions; · contracts with the right to lease; |

Inventory results report (form code 0504835)

Inventory results report ( f. 0504835

) (hereinafter referred to as the Act (f. 0504835) is drawn up by a commission appointed by order (instruction) of the head of the institution.

The basis for drawing up the Act ( f. 0504835

) are inventory lists (matching statements).

Act (f. 0504835

) is signed by the members of the commission and approved by the head of the institution.

If discrepancies with the Act are identified based on the results of the inventory ( f. 0504835

) Attached is the Statement of Discrepancies based on Inventory Results (

f. 0504092

).

Inventory card for accounting of non-financial assets (form code 0504031)

Inventory card for accounting of non-financial assets ( f. 0504031

) (hereinafter referred to as the Inventory card (f. 0504031) is used for individual accounting of fixed assets, non-produced and intangible assets.

Inventory card ( f. 0504031

) is opened by the institution for each inventory item, filled out on the basis of primary accounting documents for the receipt (creation) of a non-financial asset object, including the Certificate of Acceptance and Transfer of Objects of Non-Financial Assets (f

. 0504101

), Receipt Order for Acceptance of Non-Financial Assets (

f. 0505207

), passports of manufacturers, technical and other documentation characterizing the object accepted for accounting.

GUARANTEE:

Apparently, there was a typo in the text of the previous paragraph. Instead of "f. 0505207" means " f. 0504207

«

In the Inventory card ( f. 0504031

) information is reflected on changes in the value of the object, as well as on major changes in its characteristics, restrictions on ownership, use, disposal (for example, easement, trust agreement, lease, gratuitous use, concession agreement and other documents).

If technically possible, Inventory card ( f. 0504031

) is generated on computer media in the form of an electronic document (register) containing an electronic signature. When maintaining Inventory cards (f. 0504031) in the form of electronic documents (registers), the date of generation of a copy of the inventory card on paper is indicated.

When maintaining an Inventory card ( f. 0504031

) in the form of an electronic document (register), copies of such documents are generated on paper: without fail when closing the Inventory Card (f. 0504031) (disposal of an inventory item), as well as at the request of the authorities exercising control in accordance with the legislation of the Russian Federation, courts and prosecutor's offices; in other cases provided for by the local legal act of the accounting entity as part of its formation of accounting policies.

The accounting entity is obliged to ensure the safety of Inventory cards ( f.

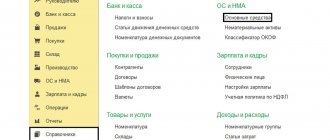

Inventory cards in 1C: Accounting departments of government institutions, 8th edition. 2.0

In this article, we will look at what an inventory card is, what it is used for, and how to correctly fill out an inventory card in the 1C: Public Institutions Accounting program, 8th edition. 2.0

Inventory card - what is it and what is it for?

An inventory card is maintained for each fixed asset item (non-financial asset). You can call it a “passport” of the fixed asset; it contains all the information about it. Today, the current form for the OKUD inventory card for accounting for non-financial assets is 0504031 (approved by Order of the Ministry of Finance of the Russian Federation dated March 30, 2015 No. 52n, applied from December 29, 2021). For a group of homogeneous objects of fixed assets (software, library collections, stage and production equipment (scenery, furniture and props, props)), items of production and household equipment worth up to 40,000 rubles inclusive, the form according to OKUD 0504032 is used.

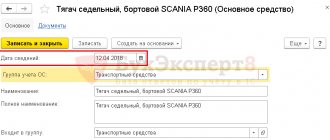

A card in 1C:BGU (f. 0504031) is opened by the institution for each inventory item, filled out on the basis of the Acceptance and Transfer Certificate of fixed assets, passports of manufacturers, technical and other documentation characterizing the object, reflecting the date of acceptance for accounting and the transaction log number .

Form 0504031 consists of 5 sections:

- Information about the object.

- The cost of the object, changes in book value, depreciation.

- Information about acceptance for accounting and disposal of an object.

- Information about internal movement of the object and repairs.

- Brief individual characteristics.

How to fill out an inventory card in the 1C program: BGU 2.0

When creating an object in the “Fixed Assets” directory, fill in its name, as well as additional information that is important. We recommend that you immediately select the OKOF code so that this data is automatically applied at subsequent stages (Fig. 1).

An inventory card is opened and a serial number is assigned to it when it is accepted for accounting. You must tick the “Inv. card". The inventory card number is generated automatically, but can be adjusted manually if necessary (Fig. 2).

After the document “Acceptance for accounting of fixed assets” is completed, the relevant data is filled in, which will be reflected in sections 2 and 3 (Fig. 3).

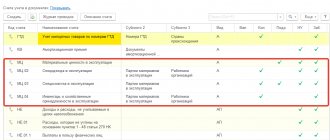

Using the “Change the composition of additional details” function (Fig. 4, Fig. 5), we can independently supplement the individual characteristics with the necessary parameters.

The inventory card can be presented in the form of an electronic document or in printed form, as stated in paragraph 19 of Instruction No. 157n: “With comprehensive automation of accounting, information about accounting objects is generated in the databases of the software package used. The formation of accounting registers is carried out in the form of an electronic register, and in the absence of technical capabilities - on paper.

The formation of accounting registers on paper in the event that it is not possible to store them in the form of electronic documents signed and (or) the need to ensure their storage on paper is carried out at the frequency established within the framework of the formation of accounting policies by the subject of accounting, but not less than the frequency established for the preparation and presentation by the accounting entity of accounting (financial) statements generated on the basis of data from the relevant accounting registers.”

The inventory card is generated when you select the “Print” button (Fig. 6).

All inventory cards are registered in the “Inventory” - a form according to OKUD, which can be generated in the section Reports on Fixed Assets, Intangible Assets, Legal Entities.

If the inventory card number is not assigned in 1C:BGU 2.0

Often an accountant has a situation where, when accepting a fixed asset for accounting, a serial number was not assigned to the inventory card. This can be corrected using the operation “Change data of OS, intangible assets, legal acts” (Fig. 7).

Select the fixed asset, set the number and opening date of the inventory card and post the document (Fig. 8):

If you need expert advice on filling out or adjusting inventory cards in 1C:BSU or on other issues of accounting and tax accounting in budgetary institutions, write a question in the chat on this page, the first consultation is free.