General provisions on statistical reports

There is no single universal list of reporting forms to Rosstat that would be suitable for all types of economic entities. The need to provide specific information is determined by territorial statistical bodies. Organizations check which reports to submit in 2020 on the official statistics website (Federal State Statistics Service) or directly at the territorial office of Rosstat. Note that most of the forms for delivery are determined by the main type of activity of the company. Information is provided not only electronically, but also on paper. Department specialists prefer electronic forms.

Statistical reporting has become electronic, but Rosstat has allowed it to be submitted on paper for now

In 2021, the law allowed organizations and individual entrepreneurs to submit statistical data to Rosstat authorities on paper or electronically, at their choice.

In 2021, respondents do not have such a choice - all reports to statistical authorities must be submitted only in the form of an electronic document signed with an electronic signature. Federal Law No. 500-FZ dated December 30, 2020 amended Federal Law No. 282-FZ dated November 29, 2007 “On official statistical accounting and the system of state statistics in the Russian Federation” on the obligation to provide statistical reporting in electronic form. The type of electronic signature is determined by the subjects of official statistical accounting independently. Legislators made an exception for SMEs; they must begin reporting to Rosstat electronically from 01/01/2022. But Rosstat published information dated January 14, 2021, in which it indicated that many respondents do not have such an opportunity. They were allowed to temporarily submit statistical reports on paper. This procedure will remain in effect until the conditions for the presentation of statistical data are changed. Rosstat recommends that you hurry up with the transition to electronic document management, since soon paper reports will not be accepted, and you will be fined for failure to provide data.

Who is required to report?

Rosstat has determined the reporting frequency for different types of reporting organizations. Federal Law No. 282-FZ of November 29, 2007 establishes deadlines for submitting reports to statistics. In accordance with Art. 6 and 8 of the law, the following are required to report:

- state authorities and local governments;

- legal entities officially registered on the territory of the Russian Federation;

- branches, separate divisions and territorial representative offices of Russian organizations;

- branches and representative offices of foreign companies operating in the Russian Federation;

- individual entrepreneurs.

IMPORTANT!

Economic entities that have the right to maintain simplified accounting records or not to maintain them at all, and taxpayers using simplified taxation systems, are not exempt from submitting statistical reports!

Why does Rosstat collect statistical information?

Rosstat prepares publicly available official information on the state of the economic, social, demographic and environmental spheres in the Russian Federation.

Analysis of statistical data becomes the basis for determining:

- Level of taxation of individual entrepreneurs and organizations.

- Conditions of various industries.

- Directions and levels of state development.

- Degrees of improvement or deterioration in various areas of life.

Based on the information received, Rosstat assigns statistics codes to organizations and individual entrepreneurs. It is not necessary to receive codes, but there are situations in which you cannot do without them:

- compilation, preparation and transmission of reports;

- generation of payment orders or receipts for payment of insurance fees and taxes;

- opening a bank account;

- registration of a branch of an enterprise;

- changing the registration address of an individual entrepreneur, as well as the location of an organization or enterprise;

- changing the name of the enterprise, as well as changing the full name of the individual entrepreneur.

How to find out the required forms for a business

If you do not know what reporting forms you will have to send to statistics this year, call the territorial office of the statistical agency or check the information on the official website of Rosstat for the basic details of the organization. Verification is carried out using TIN, OKPO or OGRN. Here's how to find out from OKPO which reports to submit to statistics in 2021:

- Go to the official website of the FSGS - reporting collection system.

- We enter the code according to the All-Russian Classifier of Enterprises and Organizations (OKPO).

- Click the “Get” button.

As a result, you will see a complete list of forms required for the enterprise with deadlines for their submission. Here is an article with step-by-step instructions on how to find out from your TIN which reports to submit to statistics in 2020.

Basis and legal basis

Business entities (organizations and entrepreneurs), along with accounting and tax reporting, are required to provide statistical reporting to the state; this obligation is established at the legislative level. In Federal Law No. 282-FZ of November 29, 2007 “On official statistical accounting and the system of state statistics in the Russian Federation” and government resolution No. 620 of August 18, 2008 adopted in pursuance of this law “On the conditions for the mandatory provision of primary statistical data and administrative data subjects of official statistical accounting" indicates why they should prepare statistical reports - this is required for collecting and analyzing profile information about the activities of economic entities.

Statistical reporting must be submitted in accordance with established forms in electronic form, starting in 2021. According to the rules, the formation of statistical reporting is divided into continuous and selective. Continuous is something that requires reporting constantly, within the deadlines established by law. Selective observation is when statistical bodies do research on a sample they have determined, and there is a chance of getting into this sample for each specific organization or individual entrepreneur, but it is not 100%.

IMPORTANT!

In 2021, statistical reporting must be submitted electronically. An exception for SMEs - they were allowed to report on paper until the end of 2021.

What to submit for statistics in 2021

Statistical registers are divided into three groups:

- annual, which companies submit once a year (some forms require every two years);

- quarterly - formed once a quarter, that is, every three months;

- monthly.

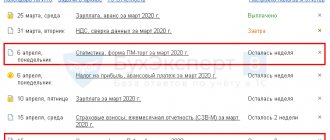

For your convenience, a table of deadlines for submitting statistical reports in 2021 has been prepared according to the frequency of submission of documents.

IMPORTANT!

Almost all reporting forms to Rosstat have been updated! Be careful when filling out registers; use only current forms.

Responsibility for failure to submit statistical reports

Failure to submit or untimely submission of statistical data to the territorial bodies of Rosstat, or submission of false data entails liability in accordance with Article 13.19 of the Code of Administrative Offenses of the Russian Federation - an administrative fine:

- for officials in the amount of 10,000 to 20,000 rubles;

- for legal entities - from 20,000 to 70,000 rubles.

Repeated failure to submit or untimely submission of statistical data entails the imposition of an administrative fine:

- for officials in the amount of 30,000 to 50,000 rubles;

- for legal entities - from 100,000 to 150,000 rubles.

Annual statistical reporting for 2021

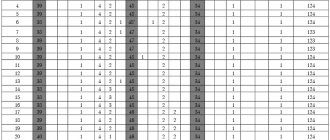

| Form | Deadline | Form |

| No. 1-T “Information on the number and wages of employees” (Rosstat order No. 404 dated July 15, 2019) | No later than 01/30/2020 | |

| No. 7-injuries - on injuries at work and occupational diseases (Rosstat order No. 417 dated June 21, 2017) | No later than 01/27/2020 (January 25 and 26 - Saturday and Sunday) | |

| No. MP (micro) - data on the main performance indicators of a micro-enterprise (Rosstat order No. 461 dated July 27, 2018) | No later than 02/05/2020 | |

| No. 1-Enterprise - on the activities of the organization (Rosstat order No. 461 dated July 27, 2018) | Until 04/01/2020 | |

| No. 12-F - on the use of funds (Rosstat order No. 421 dated July 24, 2019) | Until 04/01/2020 | |

| No. 57-T - on wages of workers by profession and position (Rosstat order No. 404 dated July 15, 2019) | Once every two years for odd-numbered years No later than November 30, 2020 | |

| No. 23-N - on the production, transmission, distribution and consumption of electrical energy (Rosstat order No. 419 dated July 22, 2019) | Until 02/01/2020 | |

| No. 4-TER - on the use of fuel and energy resources (Rosstat order No. 419 dated July 22, 2019) | Until 02/17/2020 (February 16 - Sunday) |

What's canceled

Declarations on transport and land taxes replaced by notifications from the tax authorities about the calculated amount of tax (clauses 17 and 26 of Article 1 of Law No. 63-FZ of April 15, 2019, Order of the Federal Tax Service of September 4, 2019 No. ММВ-7-21/440 ).

So far, there are more questions than answers: how the tax authority will keep records of objects, what reconciliation acts are provided for such settlement accruals, how interdepartmental exchange will be implemented. At the moment, the Federal Tax Service has not given any additional explanations; we can only wait for the implementation of this project.

By the way, no one exempted the organization from paying advance payments. And companies must calculate these advance payments independently. Needless to say, the calculated tax amounts may not agree with the amounts from the notifications, and these discrepancies will have to be justified.

Information on the average number of employees. Data on the number of employees will be included in the calculation of insurance premiums (DAM) from January 1, 2021 (clause 2 of Article 1 of Law No. 5-FZ dated January 28, 2020).

Declaration on UTII . As you know, starting from 2021, UTII will cease to exist. And along with the abolition of the taxation regime, the filing of a declaration is also canceled. The last time UTII payers will have to report by January 20, 2021 is for the fourth quarter of 2021.

Quarterly statistical reports in 2021

| Quarterly statistical reporting forms for 2021 (date and number of legal acts) | Deadline | Form |

| No. P-4 (NZ) “Information on underemployment and movement of workers” (dated 07/15/2019 No. 404) | No later than the 8th day of the month following the reporting period | |

| No. P-4 - on the number and wages of employees (dated July 15, 2019 No. 404) Organizations with fewer than 15 people on staff report. Other institutions must submit P-4 monthly. | Until the 15th of the next month | |

| No. P-2 - on investments in non-financial assets (dated July 18, 2019 No. 414) | No later than the 20th day of the month following the reporting period | |

| No. PM - on the main performance indicators of a small enterprise (dated July 22, 2019 No. 419) | No later than the 29th day after the end of the quarter | |

| No. P-5 (m) - basic data on the organization’s activities (dated July 22, 2019 No. 419) | No later than 10 working days after the reporting period | |

| No. 5-Z - on the costs of production and sale of products (goods, works, services) (dated July 15, 2015 No. 320) | On the 30th of the next month - for the 1st quarter, 1st half of the year, 9 months |

Who should submit reports to Rosstat

Statistical reports are submitted by organizations and individual entrepreneurs. Small and medium-sized enterprises report in a simplified form, but for representatives of large businesses a large list of reporting forms has been approved.

Representatives of small businesses submit reports if they are included in the Rosstat sample. Any organization can be included in the sample. Sample observations are carried out on a regular basis. Depending on the data required by Rosstat, reports are submitted once a month, quarter or year. However, reporting forms may change.

Every five years, Rosstat also conducts continuous monitoring. Organizations and individual entrepreneurs selected for continuous observation receive a preliminary notification, as well as a paper form for submitting reports.

Participants in sample and continuous observations independently choose in which format to submit reports - electronic or paper. However, there are forms that require delivery only in a specific format.

What forms of statistical reporting exist?

The list of reporting forms is regularly updated. You can view the full list of forms on the official Rosstat website. The most commonly used forms are listed below.

Annual reports:

- MP - data on key performance indicators of microenterprises.

- 1-Enterprise - detailed information about the work of the company.

- 1-T - information about the number of employees and their salaries.

- 7-injuries - data on occupational diseases, as well as the number of traumatic cases at a production enterprise.

- 12-F - information about the waste of monetary resources.

- 57-T - information on employee salaries, taking into account their professional field and position.

- 23-N - data on production, transportation, redistribution and consumption of electricity.

- 4-TER - information on the disposal of fuel and energy resources.

Quarterly reports:

- P-4 (N3) - information about the movement of workers, as well as about part-time employees.

- P-4 - information about the number of employees and their salaries.

- P-2 - information about investing in non-financial assets.

- PM - basic information about the work of small businesses.

- P-5 (M) - basic information about the work of medium and large organizations.

- 5-Z - information on production costs, as well as expenses for the sale of services, work and goods.

Monthly reports:

- P-1 - information on production volumes, as well as on the shipment of products and sales of services.

- P-3 - data on the financial condition of the organization.

Reports without a clearly established deadline (the deadline must be clarified with Rosstat):

- 1-3 - questionnaires for a sample survey of employees of an enterprise or organization.

- 1-KSR - data on the activities of collective accommodation facilities (hotel business, etc.).

- 1-IP (auto cargo) - a questionnaire to obtain information about the activities of individual entrepreneurs who are engaged in the commercial transportation of goods.

- PM-1 (truck) - a sample study of the activities of small businesses engaged in the niche of road transport.

Basic forms of statistical reporting for small businesses

The set of statistical reports for small businesses is significantly smaller than for medium and large-sized companies. Some organizations submit reports no more than once every 5 years - during continuous monitoring.

Small business representatives are mainly faced with the need to fill out and submit the following forms:

- MP (micro) - the report is submitted once a year. The deadline is January 25. It is preferable to submit the report electronically, but it can also be submitted in paper form.

- 1-IP - the report is submitted once a year. The deadline is March 2.

- PM - the form is filled out and submitted quarterly. The deadline for submission is the 29th day of the month that occurs after the reporting quarter.

Forms for small enterprises engaged in a specific direction or industry are also submitted to Rosstat. These forms include 1-NANO. The report is submitted quarterly and displays information on the shipment of goods related to the field of nanotechnology.

Penalties for violating deadlines for submitting reports to Rosstat

For late submission of reports, as well as failure to provide reporting forms at all, fines are imposed on individual entrepreneurs and organizations. This could be a fine of 20-70 thousand rubles for the entire company or a fine for only the manager in the amount of 10-20 thousand rubles.

In case of repeated violation, the fine increases. Thus, the company undertakes to pay 100-150 thousand rubles, and the manager – 30-50 thousand rubles.

By working with the Postal Agent program, you 100% eliminate the risk of receiving a fine.

We would like to draw your attention to the fact that, starting with the report for 2021, Rosstat does not accept audit opinions on accounting (financial) statements.

Federal Law No. 444-FZ of November 28, 2021 “On Amendments to the Federal Law “On Accounting” establishes that starting with the report for 2021, the Federal Tax Service of Russia creates, maintains a state information resource for accounting (financial) reporting and provides users with access to information contained in the specified state information resource. You can find out how to submit electronic reports to the Federal Tax Service using the Postal Agent program here.

For failure to submit statistical reports, fines are provided in accordance with Art. 13.19 Code of Administrative Offenses of the Russian Federation:

- for a primary violation 10-20 thousand rubles. for officials; 20-70 thousand rubles. for legal entities;

- in case of repeated violation, 30-50 thousand rubles. for officials; 100-150 thousand rubles. for legal entities.

Companies and individual entrepreneurs can submit reports to Rosstat both on paper and in electronic form. The second option has certain advantages, since it allows you to reduce the costs of the subject.

How to submit electronic reports to Rosstat?

If you plan to submit statistical reporting in paper form, you need to bring it to the specialists yourself or send it by Russian Post.

If you plan to send reports to Rosstat electronically, use a special program for submitting reports “Postal Agent”. This software is designed to transmit various information to government agencies in encrypted form, inaccessible for use by third parties. Attach your report as in regular mail and click send.

Working with the program requires a minimum of effort

- download the file to your computer;

- unpack it and install it;

- submit an application to connect to the service;

- pay for the service electronically.

Important! The Postal Agent service can be used not only to send reports to Rosstat, but also to send documentation to the Federal Tax Service, Pension Fund or Social Insurance Fund, simple correspondence with counterparties and official correspondence with employees. In any case, the information will be transmitted in encrypted form, which will maintain its confidentiality. Even if you do not send reports, simply use the “Postal Agent” as simple mail for your personal purposes or in your organization. It's free.

Advantages of using the Postal Agent electronic reporting program

The advantages of submitting reports to Rosstat electronically through the “Postal Agent” are as follows:

- the program can be used by LLCs and individual entrepreneurs;

- electronic document management involves the rapid transfer of information;

- all information is sent in encrypted form, which eliminates the risk of its use by third parties;

- the optimal cost of using the program is only 1,500 rubles/year;

- the service is convenient and easy to use;

- the user can completely abandon paper document flow with government agencies, contractors and employees;

- possibility of use throughout Russia without reference to the region;

- storing all contact information and sent files in one place.

- Using the Postal Agent service, you can ask arbitrary questions to any reporting authorities and request clarification of information from the Federal Tax Service, the Pension Fund of the Russian Federation, the Social Insurance Fund, and Rosstat. Departments will definitely respond to these requests electronically.

How to use the program

To submit reports to Rosstat using the TIN, you need to find a list of documents on the website of government agencies, fill out the documents and send them through the Postal Agent service, attaching the completed file to the letter.

A postal agent is a special mail program for sending and any LLC manager or individual entrepreneur can use it. There is no need to look for Rosstat addresses to send reports. The postal agent will send the reports to Rosstat at the required address. To do this, you just need to install the program, connect to data transfer and pay for its use. Just fill out the application form and a personal manager will call you back free of charge in any city in the Russian Federation to clarify the details and place an order.

It is convenient to submit financial statements on time with the Postal Agent electronic service. You can send reports to Rosstat using your TIN at 23.58 local time and the system will record the submission of reports.

If you have any questions while working, detailed and step-by-step instructions for working with the reporting program will always help. You can also contact technical support directly. A specialist will advise you by phone or connect to the user’s program (with your consent), diagnose its operation and offer options for solving problems.

Submit electronic reports quickly with the inexpensive Postal Agent program.

All rates are posted on this page.

All files sent through this system have a strictly regulated structure and must be created using special software in order for electronic document management to be accepted by the regional department of Rosstat.

Appearance of the program for sending electronic reporting to Rosstat “Postal Agent”

This system “electronic reporting in ROSSTAT” contains the following control elements:

- “For sending” – contains a list of files added for sending. In this window, procedures for adding, monitoring and sending selected files are carried out.

- “Sent” – contains a list of sent files with relevant information for each of them. This window displays sent documents and their status/status.

- “Information panel” is part of the “Sent” section (bookmark) and is used to display the available information for each sent report.

Sending an online report to Rosstat

To add a file, you must click on the “New Report” button located on the toolbar. The message creation window looks like this:

Creating a letter to Rosstat

The report is added to the letter using the “Attach file” button. When you click the “Save” button, the letter is added to the “To be sent” section. If several files were added, several emails will be created (according to the number of files)

Reporting files to Rosstat

After clicking the “Submit” button, the report entry will appear in the sent section:

Sent files with status

This tab displays sent reports, as well as its status (sending stages). Additionally, this tab displays an information panel.

ROSSTAT electronic reporting - receiving messages

In the electronic reporting program and the “Reporting to Rosstat” system, in response to a sent report, related messages are sent to the user’s mailbox, signaling the stages of sending a specific report.

To start the procedure for receiving mail, use the “Accept from server” button in the toolbar, as shown in the figure:

Reception of messages statistics

At the bottom of the “Sent Items” section (tab) there is an “Information Panel”

Four types of service messages are available for this system:

- “Confirmation of date of dispatch” is a document indicating that your report was actually sent on the specified date and time, and arrived at the EDF operator’s server.

- “Notice of receipt of document” - indicates that the report was received by the correspondent and will contain the corresponding signature of the Rosstat correspondent.

- “Protocol” is a response from the Rosstat department notifying whether the submitted report has been accepted.

Monthly statistical reports 2021

| Statistical report form | Deadline | Form |

| No. P-1 “Information on the production and shipment of goods and services” (dated July 22, 2019 No. 419) | On the 4th working day of the next month | |

| No. P-4 - on the number and wages of employees (dated July 15, 2019 No. 404) | No later than the 15th of the next month | |

| No. P-3 - on the financial condition of the organization (dated July 24, 2019 No. 421) | No later than the 28th of the next month |

Form No. 2-RTs

Statistical form No. 2-RTs “Information on the composition of the retail price and costs of retail trade organizations for the sale of certain types of goods” has been simplified:

- the list of products has been moved to the Application, there are still empty lines that you need to fill in yourself;

- in the table the order of the lines “Product name” and “Line number” has been changed;

- The column “Unit of measurement of goods” has been excluded;

- added the column “Product code” (to be filled out in accordance with the list of codes in the application).

Separate divisions located in one subject of the Russian Federation can submit a consolidated report for all divisions. If the “isolation” operates outside the Russian Federation, information on it is not included in the organization’s report.

The procedure for submitting the form by reorganized legal entities has been clarified: the legal successor submits a report from the beginning of the reporting month in which the reorganization took place. According to the current rules, it is necessary to submit a report from the beginning of the year of transformation, that is, for the reorganized entity.

The company can send a zero report if there is no data to fill out the form or if the retail organization pays UTII.

Statistical reporting of budgetary institutions

For state and municipal institutions operating in the social and scientific spheres, officials have provided special statistical forms (approved by order No. 404 dated July 15, 2019). Registers must be submitted within 10 days after the end of the reporting period (quarter). There are exceptions:

- The established deadlines for submitting the salary for education in 2021 are no later than the tenth day after the end of the reporting period.

- The standard deadlines for submitting the ZP-culture in 2021 are similar to other registers - on the tenth day after the end of the reporting quarter.

| Report | Form |

| Salary education “Information on the number and remuneration of employees in the education sector by personnel category” | |

| ZP-science “Information on the number and remuneration of employees of organizations carrying out scientific research and development, by personnel category” | |

| ZP-health “Information on the number and remuneration of healthcare workers by personnel categories” | |

| ZP-social "Information on the number and remuneration of workers in the social service sector by personnel category" | |

| ZP-culture “Information on the number and remuneration of cultural workers by personnel category” |

Form No. 1 - manufacturer prices

A number of changes have also been made to price form No. 1:

- sections of the form were given new names;

- section 1: a new code “13” has been added for the column “Reasons for price changes”, and code “10” for the column “Reasons for changes in shipment volume”.

A list of control ratios has also been added to check the correctness of entering information into the form.

Document:

Order of Rosstat dated July 21, 2020 N 400

Among the updated forms on the availability, movement of fixed assets and transactions with them, forms No. 11, 11 (short), 11 (transaction).