In 2021, companies will have to report to statistical authorities using updated forms. Rosstat finalized the reports on prices and finances, and also made a number of technical and substantive amendments to the reporting on the activities of companies, on the availability and movement of fixed assets, and on wages. The changes affected both the forms themselves and the procedure for filling them out.

A general change for all Rosstat forms - if there are no indicators to reflect the observed event, it is necessary to send a blank report to the statistical authorities. According to the new rules, it will not be possible to send an information letter.

Companies with separate divisions will be able to submit both separate forms for each division and a consolidated report for all.

Form No. 12-F

Annual statistical form No. 12-F “Information on the use of funds” has not undergone significant changes, but the procedure for filling it out has been clarified.

Thus, from the report for 2021, the form must include indicators for separate divisions that operate outside the Russian Federation.

The list of capital investments (line 295) is supplemented with costs for the purchase of vehicles.

It is clarified that lines 312-321 of the form reflect labor costs and accruals for wage payments.

What to take

There are quite a lot of forms and statistical reporting forms, but for each company their list is determined individually, depending on the type of activity, staffing levels and other criteria of the entity.

Find out what templates for statistical reporting forms are submitted to Rosstat on the official website of statistical authorities, through a special Internet service owned by the Federal State Statistics Service.

Form No. P-6

Clarifications have been made for filling out the quarterly form No. P-6 “Information on financial investments and liabilities” (applied from the report for January-March 2021).

The report must reflect indicators for separate divisions, including those operating abroad.

Data in lines 450 and 460 are entered without taking into account internal turnover: the turnover of material assets within the enterprise, including between divisions and settlements between them related to the movement of fixed and working capital, should not be taken into account.

Nonprofit organizations do not need to submit the form unless they have business income and operate from earmarked proceeds.

Updated forms due in 2020

Any individual entrepreneur or legal entity is required to report on its activities to Rosstat. This requires timely completion of certain reports in the form established by regulatory enactments. Recently, the Statistics Service has made a number of changes. Therefore, pay attention to the following forms:

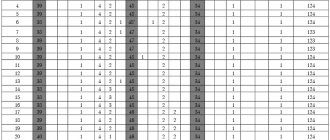

| Form | Who provides | What changed | Forms |

| No. 1-nature-BM, reflecting information on production, capacity balance and shipment. | Organizations registered as a legal entity, with the exception of small businesses, working in the areas of logging, fishing, supply of electricity, steam or gas, as well as other organizations working in the mining and manufacturing industries. | Changes have been made to the wording in Rosstat Order No. 461 dated July 27, 2018. | |

| No. 1-enterprise, containing information about the direction of the company’s activities. | Legal entities, with the exception of small businesses and financial and credit institutions. Budgetary organizations are also exempt from provision. | Changes in Rosstat Order No. 461 dated July 27, 2018 affected the specifics of filling out. Fully reflected in the reporting form. | |

| No. 4-TER, which contains information on the use of fuel and energy resources. | Legal entities that consume fuel in the course of their activities or sell it to other companies or the public. Small businesses do not submit the form. | Added line "Biofuel". Now it is numbered 1731 in the first section and 25 in the second of Rosstat Order No. 461 dated July 27, 2018. | |

| No. 12-F, which displays information about the current use of funds. | Commercial and non-profit organizations formed as a legal entity that sell their products to other companies. They do not provide:

| Changes have been made to the wording in Rosstat Order No. 461 dated July 27, 2018 | |

| No. 1-manufacturer prices. | Individual entrepreneurs, if the number of employees exceeds 100 people, and legal entities operating within the scope of activities provided for by law, such as:

| The need to compile and submit a zero report was introduced into Rosstat Order No. 485 dated August 4, 2018. Previously, in a similar case, the organization sent a letter that brought to the attention the lack of information. | |

| No. 1-T (working conditions and compensation for hazardous production). | All subjects with the formation of a legal entity that work in the area:

Small businesses are exempt from submitting a report. | First of all, Rosstat Order No. 485 dated August 4, 2018 moved the submission deadline from January 19 to January 21. Moreover, if the company does not carry out activities for a certain part of the reporting period, it still fills out and submits the form on a general basis, indicating the date when the work was not carried out. |

Form No. 2-RTs

Statistical form No. 2-RTs “Information on the composition of the retail price and costs of retail trade organizations for the sale of certain types of goods” has been simplified:

- the list of products has been moved to the Application, there are still empty lines that you need to fill in yourself;

- in the table the order of the lines “Product name” and “Line number” has been changed;

- The column “Unit of measurement of goods” has been excluded;

- added the column “Product code” (to be filled out in accordance with the list of codes in the application).

Separate divisions located in one subject of the Russian Federation can submit a consolidated report for all divisions. If the “isolation” operates outside the Russian Federation, information on it is not included in the organization’s report.

The procedure for submitting the form by reorganized legal entities has been clarified: the legal successor submits a report from the beginning of the reporting month in which the reorganization took place. According to the current rules, it is necessary to submit a report from the beginning of the year of transformation, that is, for the reorganized entity.

The company can send a zero report if there is no data to fill out the form or if the retail organization pays UTII.

Form No. 2 - purchase prices

From the reporting for January of the next year, you need to use the adjusted form No. 2 - purchase prices “Information on purchase prices of certain types of goods”.

The table is supplemented by column 8 “Reasons for changes in the volume of acquisition”, where you need to indicate one of seven codes explaining the change in volume.

The list of respondents includes individual entrepreneurs whose number of employees exceeds 100 people.

According to the recommendation, when selecting information to fill out the form, you should select the most representative product groups, and from them - individual types of goods regularly purchased during the reporting year.

To simplify filling out the columns “Name of product type” and “Product code OKPD2”, the instructions provided a list of types of goods that are included in the report.

For the column “Reasons for price changes”, a new code 13 has been added: “There is no change in price/tariff or the change is insignificant.”

Form No. 1 - manufacturer prices

A number of changes have also been made to price form No. 1:

- sections of the form were given new names;

- section 1: a new code “13” has been added for the column “Reasons for price changes”, and code “10” for the column “Reasons for changes in shipment volume”.

A list of control ratios has also been added to check the correctness of entering information into the form.

Document:

Order of Rosstat dated July 21, 2020 N 400

Among the updated forms on the availability, movement of fixed assets and transactions with them, forms No. 11, 11 (short), 11 (transaction).

Form No. 11 and 11 (short)

For section 1 of form No. 11, a table of correspondence of OKOF codes to the type structure of funds was added to the instructions. A clarifying footnote has been added to column 4: completion, modernization, reconstruction must be reflected regardless of the amount of costs incurred.

Section 2 of the report for 2021 is filled out only for fixed assets by type of economic activity - there is no need to indicate general indicators for all objects. For column D “FEA code according to OKVED2”, a table of correspondence between the alphabetic and digital FEA codes has been added to the instructions.

For both sections, control ratios for columns 6 and 13 have been added.

The table in section 5 has been formatted, but its content has not changed.

Similar adjustments have been made to Form No. 11 (short).

Form No. 11 (transaction)

The deadline for submitting the statistical form for 2021 has been postponed to July 1 (previously it was June 30). Information on detachments outside the Russian Federation is not included in the report.

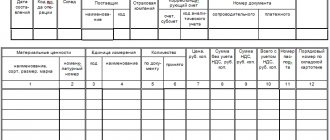

In section 1, column 4 “Depreciation group number” is excluded from the table. The procedure for filling out column 3 “Order number of the object” has been clarified: the numbering is in Arabic numerals from 1 to 5. When moving to a new type of fixed assets, the numbering begins again. When filling out column 6 “Full accounting cost of the object at the time of sale in the reporting year,” if the object was acquired or sold at the end of the financial lease (leasing) agreement, you must indicate the full value under the agreement, and not the purchase price.

In section 2, column 5 “Depreciation group number” is excluded from the table. It is clarified that in column 7 “Full accounting cost of the object as of the end of the reporting year” for objects acquired under a financial lease (leasing) agreement, the full cost under the agreement is indicated. Column 11 “The rental period of the object provided for in the contract” does not take into account objects for which the rental period is not specified in the contract.

Document:

Order of Rosstat dated July 15, 2020 N 384

Rosstat has updated a number of forms on the activities of enterprises, including No. P-1 “Information on the production and shipment of goods and No. 1-enterprise.

Registration of a personal account

Access to reporting appears only after registration in the system. To do this you need to follow simple steps:

- In the “Respondents” section, select “Submit reporting.”

- Click on the “Registration” button.

- Fill in general information about the organization, including OKPO, full and short name, email address, postal address, and password.

- Confirm your registration by clicking on the link from the letter that will be sent to your e-mail.

In the settings of the personal profile of the enterprise or during registration, you must fill in other information about the company, including activity codes, tax identification number, and information about the manager.

As an alternative to register, you can contact the Rosstat employee who is responsible for electronic reporting. Through telephone or email consultations, a civil service employee will assist in creating a profile.

Form No. 1-enterprise

The form “Basic information about the organization’s activities” has been adjusted:

- section 1 – the line “Date of registration (last registration) of a legal entity” and the table “Information on the method of formation and reorganization of a legal entity” were removed;

- Section 9 – the lines “No. of territorially separate subdivision” and “Main activity” were removed.

Document:

Order of Rosstat dated July 24, 2020 N 411.

14 statistical forms on pay and working conditions, number of personnel have been updated, and the procedure for filling them out has also been clarified. Among them:

- Form No. 1-T “Information on the number and wages of employees”

- Form No. P-4 “Information on the number and wages of employees.” The procedure for filling out the report has been adjusted. If there is no information, a blank report is sent to the statistical authorities. There is no need to include data on separate divisions operating outside Russia in the form.

- Form No. 3-F “Information on overdue wages.” We adjusted the years to fill in lines 09-11. Information on foreign divisions is not required to be included in the report.

Document:

Order of Rosstat dated July 24, 2020 N 412

Let's define the problem

Literally every company or businessman knows that, along with tax and accounting reporting, it is necessary to report to the territorial statistical authorities.

An economic entity will be punished for failure to provide the requested information. Fines for violating delivery deadlines are up to 70,000 rubles. And for a repeated offense, the organization will be fined 150,000 rubles. Submitting statistical reporting forms 2021 on time is the only way to avoid sanctions. Filling out paper reports takes a long time, and a document with corrections and erasures will not be accepted. It is easier to prepare reports on a computer, but there is a risk of downloading an outdated form. Rosstat will not accept such a report and will apply penalties to the company. How to protect yourself?

Representatives of Rosstat strongly recommend switching to electronic document management. Moreover, this transition requires a minimum of technical capabilities: you only need a computer and Internet access.

IMPORTANT!

It is legally established that statistical reporting is submitted to regulatory authorities either in electronic format or on paper. Representatives of statistical authorities have no right to refuse to accept a paper report.