Let's define the problem

Literally every company or businessman knows that, along with tax and accounting reporting, it is necessary to report to the territorial statistical authorities.

An economic entity will be punished for failure to provide the requested information. Fines for violating delivery deadlines are up to 70,000 rubles. And for a repeated offense, the organization will be fined 150,000 rubles. Submitting statistical reporting forms 2021 on time is the only way to avoid sanctions. Filling out paper reports takes a long time, and a document with corrections and erasures will not be accepted. It is easier to prepare reports on a computer, but there is a risk of downloading an outdated form. Rosstat will not accept such a report and will apply penalties to the company. How to protect yourself?

Representatives of Rosstat strongly recommend switching to electronic document management. Moreover, this transition requires a minimum of technical capabilities: you only need a computer and Internet access.

IMPORTANT!

It is legally established that statistical reporting is submitted to regulatory authorities either in electronic format or on paper. Representatives of statistical authorities have no right to refuse to accept a paper report.

Results

Every year, the Statistical Office updates and supplements the forms of reports submitted by economic entities to its territorial bodies.

To see the full list of reports, just look at the Rosstat website. To find out which forms a specific economic entity needs to report on, you can contact the territorial office in person or use a special service. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

How to switch to electronic format

It is quite convenient to work in electronic format:

- We don’t waste paper - there is no need to print out the report, it is stored on the computer;

- free software - the program can be downloaded from the official website of Rosstat. But the most convenient way is to download the program for filling out statistical reporting forms 2021 in our article;

- work in offline mode - an Internet connection is not required to fill out the report, the program works offline;

- eliminate errors - the filling program will instantly report a technical error;

- current checks - the finished report is checked, the system will notify you of shortcomings and errors;

- new formats - the program will automatically remind you to download statistics templates that meet the latest requirements;

- you don’t have to go to the territorial office, wait in line, or waste time - the electronic report is sent via secure communication channels (quickly, conveniently and safely).

IMPORTANT!

To submit 2021 statistical reporting forms online, you will need to obtain an enhanced digital signature. Most companies already use this UEP: for example, for filing tax reports. It is enough to contact the certification center that issued the electronic certificate to update the settings. You may have to pay extra for this procedure.

It is not necessary to use the official program from Rosstat. Most specialized accounting programs require filling out statistical forms. It is convenient to prepare templates for statistical forms for 2021 through specialized programs designed for sending electronic reports. It is acceptable to use online services that allow you to prepare a report on the Internet.

Statistical reports in 1C

Submission Reminders

It is very convenient when the program reminds the accountant about important events, including the submission of reports. Set the need for reminders to submit reports to Rosstat in 1C in the Main section – Taxes and reports – link All taxes and reports. Next, select the Statistics and check the forms that your organization submits to Rosstat.

After you mark your reports, reminders about their preparation will appear in the Accountant's Task List.

Generating reports

The reports themselves are generated in the Reporting – Regulated reports section.

Organizational information is filled in automatically and can be edited if necessary.

Purpose of fields:

- light green fields - automatic filling according to program data, if necessary, edited manually;

- dark green fields are summary data and cannot be edited;

- yellow fields are for manual filling.

1C already provides a lot of things for preparing statistical reports, but not everything has automatic completion yet. After all, first of all, we maintain regulated accounting in the program: accounting and tax. And the data with the analytics and in such a context as Rosstat wants to see is not entered into the database. As a result, the program simply cannot find the data necessary to automate filling out statistical forms.

If you regularly submit a lot of statistical reports, and there is no automatic completion for them in 1C, you can modify them with the help of a programmer.

What to take

There are quite a lot of forms and statistical reporting forms, but for each company their list is determined individually, depending on the type of activity, staffing levels and other criteria of the entity.

Find out what templates for statistical reporting forms are submitted to Rosstat on the official website of statistical authorities, through a special Internet service owned by the Federal State Statistics Service.

Who should report to Rosstat

Statistical reporting is provided for any business entity, regardless of the type of their activity. Large organizations are required to report regularly; they often submit several reporting forms at once. Representatives of small and medium-sized businesses, as well as micro-enterprises, submit statistical reports when they participate in continuous statistical observations once every 5 years, and in the period between this they can be included in the Rosstat sample based on various criteria - type of activity, revenue volume, number, etc. (Resolution of the Government of the Russian Federation dated February 16, 2008 No.).

Reports within the framework of sample studies can be submitted quarterly or monthly, and for micro-enterprises only annual statistical reporting is acceptable (Clause 3, Article 5 of Law No. 209-FZ dated July 24, 2007).

Current forms of statistical reporting

If an enterprise reports to statistics on paper, we recommend using only current reporting forms. If you provide information on an outdated form or in another officially unestablished way, Rosstat representatives have the right not to accept it.

We offer to download statistical reporting forms 2021 in xls format:

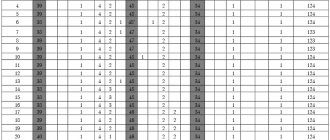

| Form | Period and deadline for submission to Rosstat | Category of reporting entity | Type of main activity |

| MP (micro) | Year, February 5 next year | Microenterprises | All economic entities, no exceptions |

| Quarter, 29th day after the reporting quarter | Small businesses | All economic entities, no exceptions | |

| 1-T | Year, January 20 next year | Legal entity, except SMP | All economic entities, no exceptions |

| 1-T (working conditions) | Year, January 19 next year | Legal entity, except SMP | All economic entities, no exceptions |

| 1-IP | Year, March 2 next year | IP | Everything except retail trade (excluding motor vehicle trade) |

| 1-enterprise | Annual, April 1 next year | Legal entity, except SMP | Everything except insurance, banks, government agencies, financial and credit organizations |

| P-2 | Quarter, 20th day after the reporting quarter | Legal entity, except SMP | All economic entities |

| P-2 (invest) | Annual, April 1 next year | Legal entity, except SMP | All economic entities, no exceptions |

| P-3 | Month, 28th day after the reporting month Quarter, 30th after the quarter | Legal entity with a total capital of more than 15 people, except for self-employed enterprises | All economic entities, no exceptions |

| P-4 | Month, if the average number of employees is more than 15 people - the 15th of the next month Quarter, if the average number of employees is 15 people or less - the 15th day after the reporting quarter | Legal entity, except SMP | All economic entities, no exceptions |

| P-4 (NZ) | Quarter, 8th day after the reporting quarter | Legal entity with a total capital of more than 15 people, except for self-employed enterprises | All economic entities |

| P-5 (m) | Quarter, 30th day after the reporting quarter | Legal entity with a total capital of more than 15 people, except for self-employed enterprises | All economic entities |

| P-6 | Quarter, 20th day after the reporting quarter | Legal entity, except SMP | All economic entities |

| 5-З | Quarter, 30th day after the reporting period (1st quarter, half year, 9 months) | Legal entity, except SMP | All economic entities, except insurance, banks, government agencies, financial and credit organizations |

| Annual, April 1 next year | Legal entity, except SMEs and non-profit organizations | All economic entities, no exceptions | |

| 12-F | Annual, April 1 next year | Legal entity, except SMP | All economic entities, except insurance, non-state pension funds, banks, government agencies |

| 18-KS | Annual, February 4 next year | Legal entity, except SMP | All economic entities |

What OKVED codes to enter?

In reports submitted to statistical authorities, it is necessary to indicate codes of types of economic activity.

When preparing financial statements for 2021, transitional difficulties may arise. They are due to the fact that in 2021 the OKVED classifier was in effect (OK 029-2007 (NACE Rev. 1.1)). Starting from January 2021, it was replaced by the OKVED2 classifier (OK 029-2014 (NACE Rev. 2)). It is not entirely clear which classifier companies and entrepreneurs (also called respondents) should use when filling out forms for the past year. Recently, Moscow City Statistics Service published a letter dated January 11, 2017 No. OA-51-OA/4-DR. It states that in the annual statistical observation forms for 2021, the codes of the old OKVED (OK 029-2007 (NACE Rev. 1.1)) should be indicated. Whereas the codes of the new OKVED2 need to be used later, namely, when filling out forms, starting with the reporting periods of 2017 (see “The capital branch of Rosstat reported which OKVED codes to indicate in statistical reporting for 2021”).

To fill out and submit reports, it is most convenient to use web services, where all relevant details are installed automatically, without user intervention. Accordingly, the accountant does not need to monitor changes in legislation and independently install updates in his program. If an accountant, when filling out a form, indicates an outdated or invalid value, the web service will indicate the error and tell him what to do.

Fill out and submit all reports to Rosstat for free via the web service

Accounting financial statements

Until 2021, companies not only filled out statistical reporting forms for 2021, but also submitted their accounting reports to statistics. Once a year, before March 31, they submitted to the statistical authorities:

- Balance sheet.

- Statement of financial performance (formerly income statement).

- Appendixes to the balance sheet.

Starting with reporting for 2021, it is no longer necessary to send these documents to statistics, with the exception of companies whose reporting contains state secrets, or which fall under the scope of Decree of the Government of the Russian Federation of January 22, 2020 No. 35.

What does Form C-1 include?

Form C-1 and instructions for filling it out are given in Appendix No. 8 to Rosstat Order No. 562 dated August 30, 2017. Changes were made to the order on January 1, 2021, and the newest version of the instructions for filling out was issued on January 17. We'll tell you what changes you need to take into account when filling out the form.

Using this form, developer organizations report on commissioned capital construction projects and their characteristics. In total, the form includes a title page and five sections with tables.

Title page

Form C-1 has a standard title page for all statistical forms.

Indicate on it the period for which you are submitting the report. Enter the name of the company in accordance with the registration documents, legal address with index and OKPO code.

Section 1

In this and the next section you need to provide information on objects that have already been put into operation.

The main difficulties arise with the indication of codes in columns 3 - 5. These are codes for the capacity and nature of construction. The columns must be filled out in accordance with Appendices 1 and 2 to Rosstat Order No. 13 dated January 17, 2020. They must be entered only in lines 01 and 16.

Column 6 indicates the area of residential premises put into operation.

Columns 7 - 9 contain information about the buildings introduced: their number, volume and area, respectively. There is no need to take into account the number, volume and area of the premises in which repairs or reconstruction were carried out, as well as structures. If buildings have a common wall, but are independent structures, then they are counted as separate buildings.

Column 10 includes the actual cost of the building for the developer. When calculating it, it is necessary to take into account revaluations of unfinished construction. The basis for filling out is accounting documents.

Next, we will analyze the filling line by line. In the first line you need to indicate general data on residential buildings: houses, including apartment buildings, shelters, dormitories, etc. They cannot include objects for temporary or seasonal residence. In line 02 from line 01, you need to highlight individual types of buildings in accordance with Appendix No. 1.

On line 07, data on non-residential buildings put into operation is indicated, and then they are detailed on lines 08 - 14, depending on the type of building.

In line 15, separately write down information about residential premises located in a non-residential building.

Section 2

Line 16 must be filled out in accordance with the list from Appendix No. 2.

Columns 3 - 5 are filled out in the same way as in section 1. In column 6, indicate the size of the entered power with one decimal place.

If at the facility in question the capacity was partially introduced before the reporting month, but was completed this month, then only the capacity that was commissioned in the reporting month needs to be recorded in the report. Don't take the past into account.

Section 3

In this section you need to describe the number of apartments and rooms in the entered buildings. Here are some rules:

- if the house is single-family or intended for one family, one apartment is indicated;

- if the house has an extension (superstructure), which appears to be a separate apartment, this also needs to be taken into account;

- if the house is a hotel type, then the number of apartments is determined by the number of rooms with their own access to the corridor

Column 3 is intended for residential buildings, column 4 - for non-residential buildings.

In line 21 the total number of apartments is highlighted, and in lines 22 - 24 they must be distributed by the number of rooms. Studio apartments are considered one-room apartments, as they do not have partitions inside.

Section 4

In the fourth section, all commissioned residential buildings and residential premises in them are distributed according to wall materials and number of floors.

In column 3 it is necessary to indicate the area of apartments of the corresponding types, and in column 4 - the number of buildings.

On lines 26 - 32 you need to distribute the data from columns 6 and 7 of line 01 according to wall materials. If there are several materials in the construction of the walls, you need to classify the house into the group whose materials predominate in the composition.

On lines 33 - 45 you need to distribute the data from columns 6 and 7 of line 01 by the number of floors. If the house is built with a “staircase” or in another way that implies a variable number of floors. It must be entered in the line for the topmost floor.

Section 5

This section needs to be completed only at the end of the year. It includes information on all buildings and structures whose construction has not yet been completed, is temporarily suspended or mothballed.

In column 3 you need to indicate the total number of buildings and structures in unfinished construction, and in column 4 you need to highlight residential buildings from there. In column 5, write down the area of apartments in residential buildings.

The table includes only two lines to fill out. Line 46 is for all unfinished buildings, and line 47 is for separating from line 46 suspended and mothballed buildings.

In the “For reference” section, you need to indicate data on the total area of housing that was sold to individuals during the reporting month, and the amount of proceeds from the sale (including from escrow accounts).

Form C-1 Sample filling

Who submits Form C-1

Only organizations are required to report to Rosstat using Form S-1. Individual entrepreneurs are exempt from this.

The report is submitted by companies that have received permission to commission capital construction projects, and those who have unfinished construction projects on their balance sheets. It does not matter what types of activities the company has, form of ownership and organizational and legal form.

If you haven’t put objects into operation in a month, then don’t report. Rosstat is not waiting for a zero form S-1.

When and where to submit Form C-1

Form C-1 must be reported every month if observable actions were performed. Deadline: until the 3rd day of the month following the reporting month. You will have to submit another form for the year, even if you entered objects only once, there is a deadline for this - until February 1 of the year following the reporting one.

Organizations submit the form to the territorial body of Rosstat at their location. If the company or its division does not operate at the place of registration, the report must be submitted to the authorities at the place of actual work.

If there are separations, then the form must be filled out separately for the legal entity and separately for each division and submitted to the relevant departments of the statistics service.

Construction companies that operate on the territory of several constituent entities of the Russian Federation fill out and submit separate forms for each territory to the Rosstat authorities for the location of capital construction projects.

Penalties

Rosstat sets deadlines and formats for delivery, which must be strictly observed. Violations are subject to administrative liability.

According to Article 13.19 of the Code of Administrative Offenses of the Russian Federation, organizations will be punished for late delivery, violation of the submission procedure, or false information. In these cases, fines range from 20 to 70 thousand rubles. If you break the rules again, the fines will increase significantly and range from 100 to 150 thousand rubles.

There is also the Law of the Russian Federation dated May 13, 1992 No. 2761-I, which establishes the obligation of the violator to compensate for damage caused to statistical authorities. It arises when, due to the respondent’s dishonesty, Rosstat has to make changes to the prepared consolidated statements.

Zero report C-1

If the organization did not put buildings into operation in the reporting month, then there is no need to report on it. Zero form C-1 is not provided.

Moreover, if such a building was commissioned at least once a year, then the annual form must be submitted in the general manner. It also needs to be handed over if at the end of the year the company has buildings and structures whose construction has not yet been completed.

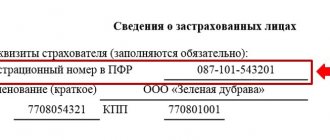

Form No. P-6

Clarifications have been made for filling out the quarterly form No. P-6 “Information on financial investments and liabilities” (applied from the report for January-March 2021).

The report must reflect indicators for separate divisions, including those operating abroad.

Data in lines 450 and 460 are entered without taking into account internal turnover: the turnover of material assets within the enterprise, including between divisions and settlements between them related to the movement of fixed and working capital, should not be taken into account.

Nonprofit organizations do not need to submit the form unless they have business income and operate from earmarked proceeds.