Documentation

Employer reporting Denis Pokshan Expert in taxes, accounting and personnel records Current on 28

All organizations that pay income tax submit a profit declaration. In this declaration

From June 1, 2021, when paying wages and other payments to an employee, employers must

VAT declaration 2021 – form From the first quarter of 2021, a new declaration form will be used

Payroll calculation made easy! Automated calculation of salaries, personal income tax and contributions in a few clicks. Service

VAT declaration 2021 – form From the first quarter of 2021, a new declaration form will be used

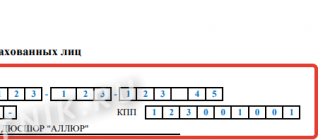

From 2021, SZV-STAZH is filled out according to new rules. They are approved in September 2021

Why does an accountant need to look at the contract for the purchase of goods? Firstly, in order to

Indirect expenses are those that, due to the nature of their occurrence, cannot be attributed to any one