All tax agents - organizations and entrepreneurs who accrued and paid income to individuals in January-March - must report in Form 6-NDFL by May 2, 2017. To submit 6-NDFL calculations for the 1st quarter of 2021 to the tax office, you should use the same form as for 2021 - approved. by order of the Federal Tax Service of the Russian Federation No. ММВ-7-11/450 dated October 14, 2015. Let's look at how tax agents should fill out the calculation of accrued and withheld personal income tax, what features to take into account, and also give an example of a completed form 6-NDFL.

Where to submit: nuances

Typically, the calculation is submitted by tax agents to “their” Federal Tax Service, that is, at the place of registration of the company or at the place of registration of the individual entrepreneur. But for certain cases, separate rules are established.

Separate units

A legal entity that has separate divisions submits a calculation at the place of registration of each of them. The form includes the income and personal income tax of employees of this division.

If two separate divisions are registered with the same Federal Tax Service, but they have different OKTMO codes (belong to different municipalities), then 6-NDFL is submitted separately for each of them. If the situation is the opposite, that is, two separate divisions with one OKTMO are registered with different Federal Tax Service Inspectors, then a legal entity can register with one of the inspectorates and report to it under 6-NDFL for both divisions.

It happens that an employee managed to work in different branches during one tax period. If they have different OKTMOs, then you will have to submit several forms.

On the title page of 6-NDFL, if there are divisions, you must indicate:

- TIN of the parent organization;

- Checkpoint of a separate unit;

- OKTMO of the municipality in whose territory the employees’ place of work is located (indicate it in the payment order).

Change of address

If during the tax period to another Federal Tax Service, then at the new place of registration it is necessary to submit two forms 6-NDFL :

- the first - for the period of stay at the previous address, indicating the old OKTMO;

- the second - for the period of stay at the new address, indicating the new OKTMO.

The checkpoint in both forms indicates the one assigned to the new Federal Tax Service.

Results

For the 3rd quarter of 2021, 6-NDFL must be submitted by all tax agents for personal income tax by November 2.

If there is no data to fill it out, you can submit a zero calculation to the tax authorities, or you can send them a letter stating that income in favor of individuals was not accrued or paid. The calculation is quite difficult to complete; accountants constantly have questions about how to correctly fill out this or that line, so in the article we tried to briefly highlight all the main points of entering data into the report. We also told you what form the calculation should be submitted on and gave an example of filling it out for 9 months. And we already have an example of filling out 6-NDFL for 2021. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

New form 6-NDFL

On January 18, 2021, the Federal Tax Service, by its order No. ММВ-7-11/ [email protected], approved a new form 6-NDFL, but it will come into force only on March 26, 2018 . For now, you need to report using the old form, approved by order of the Federal Tax Service dated October 14, 2015 No. ММВ-7-11/ [email protected]

However, for the next quarter, in any case, you will have to submit a new form, so let’s look at what has changed in it.

Innovations mainly concern reorganized legal entities . From January 1 of the current year, if the company fails to file 6-NDFL before the reorganization, its legal successor must do so. In this regard, changes to the form and the procedure for filling it out are as follows:

- Appeared fields for the legal successor's details on the title page:

- field for indicating the form of reorganization, in which you need to put the appropriate code: 1 - transformation,

- 2 - merger,

- 3 - separation,

- 5 - connection,

- 6 - separation with simultaneous joining,

- 0—liquidation;

- field for indicating the TIN/KPP of the reorganized company (the rest are filled with a dash).

- Introduced codes for assignees, which must be indicated in the field “at location (accounting)”:

- 216 - for successors who are the largest taxpayers;

- 215 - for everyone else.

- In the field to confirm the accuracy and completeness of the information, an indication of the legal successor of the tax agent has appeared (code “1”).

- When submitting the form by the legal successor, in the “tax agent” field you must indicate the name of the reorganized organization or its separate division.

In addition, minor changes will affect all tax agents , namely:

- in the field “at location (accounting)”, taxpayers who are not large ones must indicate code “214” instead of code “212” ;

- To confirm the authority of the authorized person, you will need to indicate the details of the document , not just its name.

Title page

When filling out 6-NDFL for the 2nd quarter of 2021, at the top of the title page you need to note the TIN, KPP and the abbreviated name of the organization (if there is no abbreviation, the full name). If you need to submit a settlement in relation to individuals who received payments from a separate division, then fill in the “separate” checkpoint. Individual entrepreneurs, lawyers and notaries only need to indicate their TIN.

In the line “Submission period (code)”, enter 31 - this means that you are submitting 6-NDFL for the first half of 2017. In the “Tax period (year)” column, mark the year for which the semi-annual calculation is submitted, namely 2021.

Indicate the code of the division of the Federal Tax Service to which the annual reports are sent and the code on the line “At location (accounting).” This code will show why you are submitting 6-NDFL here. Most tax agents reflect the following codes:

- 212 – when submitting a settlement at the place of registration of the organization;

- 213 – when submitting the calculation at the place of registration of the organization as the largest taxpayer;

- 220 – when submitting a settlement at the location of a separate division of a Russian organization;

- 120 – at the place of residence of the individual entrepreneur;

- 320 – at the place of business of the entrepreneur on UTII or the patent taxation system.

If filled out correctly, a sample of filling out the title page of the 6-NDFL calculation for the first half of 2021 may look like this:

Sanctions for violations

For violations of the deadline and form for filing 6-NDFL, tax and administrative liability is provided. All sanctions are collected in the following table.

Table 1. Possible sanctions for violating the procedure and deadline for filing 6-NDFL

| Violation | Sanction | Regulatory Standard |

| Form not submitted | 1 thousand rubles for each month (full and part-time) | clause 1.2 art. 126 Tax Code of the Russian Federation |

| The calculation was not received by the Federal Tax Service within 10 days after the deadline for submission | Blocking the current account | clause 3.2 art. 76 Tax Code of the Russian Federation |

| Error in calculation (if identified by the tax authority before the agent corrected it) | 500 rubles | Art. 126.1 Tax Code of the Russian Federation |

| Failure to comply with the form (submission on paper instead of sending via TKS)* | 200 rubles | Art. 119.1 Tax Code of the Russian Federation |

| Submission deadline violation | 300-500 rubles per official | Part 1 Art. 15.6 Code of Administrative Offenses of the Russian Federation |

* Note. Tax agents submitting calculations in respect of 25 or more insured persons must submit it electronically using the TKS. Everyone else can choose the form at their discretion.

Company officials are held administratively liable. For example, a fine for late filing of 6-NDFL will be imposed on the chief accountant if his job description states that he is responsible for the timely filing of reports.

All tax agents must report

Tax agents for personal income tax are organizations, individual entrepreneurs, notaries engaged in private practice, lawyers who have established law offices, separate divisions of foreign companies that pay income to citizens. The duty of tax agents is to calculate, withhold and transfer personal income tax on paid income to the budget.

Responsibilities of employers and customers

All tax agents for income tax are required to submit to the Federal Tax Service the calculation in form 6-NDFL for the 2nd quarter of 2021 (clause 2 of Article 230 of the Tax Code of the Russian Federation). That is, in particular, companies and individual entrepreneurs paying income under employment contracts and customers paying income to performers on the basis of civil contracts (for example, a contract or the provision of services) must submit reports.

How to fill out 6-NDFL

The form consists of a title page and two sections. The title indicates the name of the tax agent, his basic details, as well as information about the tax authority. Sections 1 and 2 indicate information about all income of individuals from whom personal income tax is calculated. This includes not only employees, but also persons with whom civil contracts were concluded, if personal income tax is charged on payments thereunder. But income that is not taxed (for example, child benefits) is not reflected in the form.

Title page

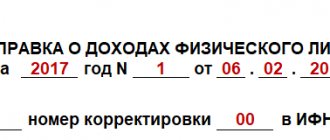

The following image shows an example of filling out the informative part of the title page of form 6-NDFL (old form for the 2021 report).

Example of filling out 6-NDFL

If the calculation will be submitted after March 26, 2021 and the new form , you should take into account the features that we described at the beginning of the article. This is what the top of the title page looks like in the updated 6-NDFL:

Fragment of the title page of the new form 6-NDFL

Filling out the 6-NDFL cover page usually does not raise any questions. We described above how to fill out the TIN, KPP and OKTMO in the presence of separate divisions. Accordingly, in the absence of branches, their own codes are prescribed. The remaining fields are filled in like this:

- “ Adjustment number ” - upon initial submission, “000” is indicated, otherwise the serial number of the declaration is indicated “001”, “002” and so on.

- “ Submission period ” - for a yearly form this is code “34”.

- «Taxable period» — 2021.

- «Tax authority code" consists of two values:

- the first two digits are the region code;

- the last two digits are the tax office number.

- The code “ at location (registration) ” is taken from the appendix to the Order that approved the form. Organizations registered at the place of registration put “212” in the old form, and “214” in the new one.

Section 1

In this section, information is indicated on an accrual basis for the entire reporting period. It is filled out in the same way both in the new and in the old form - this section was not changed. Line by line completion of section 1 of form 6-NDFL is presented in the following table.

Table 2. Filling out the lines of section 1 of form 6-NDFL

| Line | What is indicated |

| 010 | Personal income tax rate |

| 020 | Total income of all persons since the beginning of the period (year) |

| 025 | Dividend income |

| 030 | Deductions for income from line 020 |

| 040 | Total calculated personal income tax |

| 045 | Personal income tax on dividends (included in line 040) |

| 050 | Amount of advance payment paid by a migrant with a patent |

| 060 | Number of persons for whom the form is submitted |

| 070 | The amount of personal income tax withheld for the entire period |

| 080 | The amount of tax that the agent was unable to withhold (for example, on income in kind). Personal income tax, which will be withheld in the next period, is not subject to reflection |

| 090 | The amount of personal income tax that was returned to the payer |

Attention! If income was taxed with personal income tax at different rates , you need to fill out several blocks of lines 010-050 and indicate in each of them information at one rate. In this case, in lines 060-090 the indicators are reflected in the total amount.

Section 2

Section 2 contains information only for the last 3 months of the reporting period. That is, in section 2 of form 6-NDFL for 2021, you need to indicate data for the last quarter of this year.

There are 5 fields in this section that reflect the following information:

- on line 100 - date of receipt of income;

- on line 110 - the date of personal income tax withholding from this income;

- on line 120 - the date of transfer of the tax to the budget.

- on line 130 - the amount of income received;

- on line 140 - the amount of personal income tax withheld.

The main difficulties when filling out section 2 are determined by the dates of receipt of income and transfer of personal income tax . They differ for different types of income. To avoid confusion, we recommend checking the following table.

The table does not contain a column with the date of tax withholding, since most often it coincides with the date of receipt of income. Exceptions to this rule are below the table.

Table 3. Determination of dates for 6-NDFL

| Income _ | date of receiving | Deadline for transferring personal income tax |

| Salary. Prepaid expense*. Bonus (as part of salary) | The last day of the month for which the salary or bonus for the month included in wages was calculated | No later than the day following the day of payment of the bonus or salary upon final payment. |

| One-time bonus (annual, quarterly, in connection with any event) | Bonus payment day | |

| Vacation pay, sick pay | Pay day | No later than the last day of the month in which vacation pay or temporary disability benefits were paid |

| Payments upon dismissal (salary, compensation for unused vacation) | Last day of work | No later than the day following the day of payment |

| Dividends | Pay day | |

| For LLCs - no later than the day following the day of payment. For JSC - no later than one month from the earliest of the following dates:

| ||

| Help | Pay day | No later than the day following the day of payment |

| Gifts in kind | Day of payment (transfer) of the gift | No later than the day following the day the gift was issued |

* Explanation . Personal income tax is not deducted from the advance payment - it will be deducted from the salary for the second part of the month. However, it happens that the advance is paid on the last day of the month. In this case, it is recognized as wages for the month, and personal income tax is withheld as from wages.

The date of receipt of income and personal income tax withholding do not coincide in the following cases:

- When paying daily allowances in excess of established standards. The tax withholding day is considered to be the nearest day of payment of wages in the month in which the advance report is approved.

- When receiving material benefits - expensive gifts, other income. The tax withholding day is considered to be the nearest salary payment day.

When filling out lines 100-120, all incomes for which all 3 dates coincide respectively are summed up. That is, you can sum up your salary and monthly bonuses. But quarterly bonuses, vacation pay, sick leave will be shown separately. The form will contain the required number of blocks of lines 100-140.

Important! When filling out line 130, income is indicated in full. That is, there is no need to reduce it by the amount of personal income tax and deductions.

So, when filling out 6-NDFL for 2021, we have the following:

- Section 1 will reflect income actually received in 2021 .

- Section 2 will include income for which personal income tax payment expires in the last quarter of 2021 .

Read about the nuances of reflecting wages for December in a separate article. If it is paid in January, it will not be reflected on the annual form.

Section 1

Let's look at how to fill out 6-personal income tax for the 1st quarter of 2021 line by line. First, let's enter the general indicators of Section 1:

- 010 – tax rate 13%.

- 020 – accrued income for January-March 1,600,000 rubles. When filling out this line, do not indicate income that is completely exempt from personal income tax (for example, maternity benefits or gifts up to 4,000 rubles). If only part of the income is not subject to personal income tax, then the income is reflected in the full amount, and the non-taxable part is indicated as a deduction on line 030 (letter of the Federal Tax Service dated August 1, 2016 No. BS-4-11/13984). 6-NDFL for the 1st quarter, the example of which we are considering, does not contain completely non-taxable income.

- 030 – tax deductions for January-March 75,000 rubles.

- 040 – we calculate personal income tax: line 020 – line 030 * 13% = 198,250 rubles.

- 060 – number of individuals who received income – 10 people.

- 070 – when reflecting the withheld tax, it is necessary to take into account that in the calculation of 6-NDFL for the 1st quarter, line 070 may not include the amount of tax calculated for March if the March salary is paid to employees in April, that is, in the next quarter. This explains the inequality that often arises between lines 040 and 070, because personal income tax is calculated along with the salary and is withheld when it is paid. In our example, we will indicate the withheld personal income tax for January and February ((500,000 + 535,000 + 15,000) – (25,000 + 25,000)) x 13% = 130,000 rubles.

- 080 – do not fill in, because here the tax is reflected exclusively on natural income, or on material benefits, which was not withheld due to the lack of cash income from the individual in the reporting period. Many, when filling out 6-NDFL for the 1st quarter of 2021, mistakenly indicate the difference between lines 040 and 070, but this cannot be done (letter of the Federal Tax Service dated May 16, 2016 No. BS-4-11/8609).

- 090 – individuals did not have any excess tax withholding, set “0”.

Filling example

Let's look at the procedure for filling out form 6-NDFL using the example of Romashka LLC. The organization was created at the beginning of 2021, the number of employees is 6. The data for the year is as follows:

- the total income of employees amounted to 5,100,000 rubles ;

- they were provided with standard deductions in the amount of 14,000 rubles ;

- the amount of personal income tax on income for the year is 661,180 rubles ;

- the amount of personal income tax withheld for the year was 610,480 rubles (tax on December salary in the amount of 50,700 rubles was withheld in January 2018).

This is what Section 1 of Form 6-NDFL of Romashka LLC will look like for 2017:

Section 1 of form 6-NDFL LLC Romashka

The following table lists the transactions for the fourth quarter that will be needed to be reflected in section 2 of form 6-NDFL.

Table 4. Operations of Romashka LLC in the fourth quarter of 2021 for payment of income and withholding personal income tax

| date | Transactions and amounts |

| 02.10.2017 | Personal income tax was transferred from vacation pay paid on September 12, 2017. The amount of vacation pay is 90,000 rubles, the amount of personal income tax is 11,700 rubles. |

| 05.10.17 | Salary paid for September in the amount of 290,000 rubles, personal income tax withheld - 37,700 rubles |

| 06.10.01 | Transferred to the personal income tax budget from September salaries |

| 31.10.01 | Salaries for October were accrued in the amount of 410,000 rubles, personal income tax was calculated - 53,300 rubles |

| 03.11.01 | Salaries for October have been paid, personal income tax has been withheld |

| 07.11.17 | Personal income tax transferred for October |

| 30.11.01 | The salary for November was accrued in the amount of 390,000.00 rubles, personal income tax was calculated - 50,700 rubles |

| 05.12.01 | Salary for November and bonus for the third quarter in the amount of 150,000 rubles were paid (personal income tax on bonus - 19,500 rubles), personal income tax was withheld |

| 06.12.01 | Personal income tax transferred from salaries for November and bonuses for the third quarter |

| 31.12.01 | Salaries for December were accrued in the amount of 390,000 rubles, personal income tax was calculated - 50,700 rubles* |

* Note . Wages for December, paid in January, will not appear in the calculation for 2021, since the deadline for paying personal income tax on it expires in January.

And here’s what Section 2 of the 6-NDFL calculation, completed using these data, will look like:

Section 2 of calculating 6-personal income tax for the company from the example

No room for error

When filling out the 6-NDFL document, you must carefully monitor what data you enter into it. It is extremely undesirable to make a mistake in such a matter, because the company may suffer serious losses in the form of fines imposed on it. To avoid making mistakes, remember:

- In the first section, indicate only the total amounts for income and personal income tax. Each bet must be displayed in its own section No. 1. For example, employees have income that is taxed at a rate of 13, 30, 35 percent. It turns out that three sections No. 1 will be filled out in the calculation, each on a separate sheet.

- Fields “060-090” should be filled in with the total amount for all available bets and only on the first page. On subsequent sheets you should put “0” and then write dashes. For example, you have one rate of 13%, and section No. 2 displays income on several sheets. This means that section No. 1 must be filled out only on the first page.

- In section No. 2, income is distributed by date. Here you should enter only those incomes that were received within three months.

- If an operation began in one reporting period and ended in another, then in section No. 2 the period of its completion must be indicated.

Reflecting benefits

Article 217 of the Tax Code of the Russian Federation provides a list of cash payments that are exempt from calculating personal income tax on them. But, if we are talking about benefits in connection with illness, then this type of income is fully included in the tax base. The report reflects this amount in the same way as the main type of income received by individuals. But, if these are, for example, benefits of state importance, payments for state pensions, material assistance in 6 personal income taxes (an example of filling is presented below), then such types have restrictions on the amount. That is, if the amount of benefits accrued exceeds the established limit, then this amount is summed up in cell 020 of Section 1, but the non-taxable part is recorded in cell 030 as a tax deduction.

To whom and where should I give it?

The obligation to fill out the 6th personal income tax form is assigned to individual entrepreneurs and legal entities acting as employers of labor, paying wages and other remunerations to hired workers.

The document should be sent to the fiscal service at the place of registration of the legal entity, if the taxpayer is an individual entrepreneur, then to the control service at the place of his residence. If wages are paid to employees performing their official duties under the supervision of a separate branch, then 6 personal income tax, a sample of which readers will find on our website, is submitted to the fiscal authority at its location.

6 personal income tax

How to show sick leave

The date of actual receipt of income (line 100) for sick leave is the date of its payment (clause 1, clause 1, article 223 of the Tax Code of the Russian Federation). It also coincides with the date of tax withholding (line 110), since on the date of actual payment of income, personal income tax must be withheld by the tax agent (clause 4 of Article 226 of the Tax Code of the Russian Federation).

But the deadline for transferring personal income tax on sick leave is special. The employer can sum up the tax on sick leave paid during the month and transfer it to the budget in one payment - no later than the last day of the month in which such payments were made (paragraph 2, paragraph 6, article 226 of the Tax Code of the Russian Federation). If the last day of the month falls on a weekend or holiday, then personal income tax must be paid on the next working day (clauses 6, 7, Article 6.1 of the Tax Code of the Russian Federation).

Is it necessary to reflect sick leave benefits accrued in June but paid in July in 6-NDFL for the six months? No no need. Sick leave income must be taken into account on the day when it was paid to the employee (subclause 1, clause 1, article 223 of the Tax Code of the Russian Federation).

In the situation under consideration, sick leave benefits were accrued, that is, calculated in June. But they paid already in July. In this case, there is no reason to include the benefit in the calculation of 6-personal income tax for the six months. Reflect the amount in sections 1 and 2 of 6-NDFL for 9 months.

What to do with paid vacation pay

With regard to income in the form of wages, the date of actual receipt of income is the last day of the month for which the employee was accrued income (clause 2 of Article 223 of the Tax Code of the Russian Federation). However, for vacation pay, this date is defined as the day of payment of income (letter of the Ministry of Finance of Russia dated January 26, 2015 No. 03-04-06/2187). The date of withholding personal income tax will coincide with the date of payment of income, because the tax agent is obliged to withhold tax from the income of an individual upon their actual payment (clause 4 of article 226 of the Tax Code of the Russian Federation).

The deadline for transferring personal income tax from vacation pay, i.e., the deadline when the tax agent must transfer the tax withheld from an individual, is the last day of the month in which the employee’s vacation pay was issued. Below we give an example of including vacation payments in 6-NDFL. Information about holidays is given in the table. For convenience, we will agree that there were no other payments.

| Worker | Vacation pay date | Vacation pay amount (including personal income tax) | Personal income tax (13%) |

| Lyskova A.A. | 42880 | 39 816,78 | 5 176 |

| Kravchenko T.P. | 42527 | 25 996,12 | 3 379 |

| Petrov A.S. | 42533 | 13 023,41 | 1 693 |

| Total | 78 836,31 | 10 248 |

If the employee goes on annual paid leave in July 2017 (in the third quarter). According to the Labor Code of the Russian Federation, the employer is obliged to pay vacation pay in advance - no later than 3 working days before the start of the vacation (Article 136 of the Labor Code of the Russian Federation). It is therefore possible that holiday pay was paid in June 2021 (in the second quarter). The company had to calculate and withhold personal income tax from vacation pay on the day of payment, and transfer the withheld amount to the budget no later than June 30. That is, no difficulties should arise with such vacation pay, since operations do not carry over to the third quarter. They are reflected in exactly the same way as in the example above.

What amounts are included in the calculation?

The document must include the amounts calculated and handed over to hired workers, which assign the status of a tax agent to an individual entrepreneur or legal entity. All such reimbursements form the tax base, they are reflected in line 020 6 personal income tax; we will analyze what is included there further. This:

- payment for performance of official duties;

- various types of bonuses;

- benefits, including payment for the days the employee is on sick leave;

- payment for vacation days;

- accrued and issued dividends;

- remuneration according to civil law agreements.

Article 217 of the Tax Code of the Russian Federation provides a list of income amounts that are not taxed and, accordingly, excluded from the base of 6 personal income taxes, which can be found on our website. But each type of income has its own amount limit. Therefore, if this limit is exceeded, then the accountant must include the amount of non-taxable income in the total composition, but he must reflect the non-taxable part as a tax deduction. The deduction is written in line 030 of form 6 of personal income tax; the instructions for filling out, approved by Order of the Federal Tax Service of the Russian Federation No. ММВ-7-11/450, will allow you to avoid possible errors in such calculations.