A letter on the application of the simplified tax system for a counterparty is an important part of the business life of an entrepreneur. Thus, he has the right to inform his business partner of the reasons why he does not include VAT in the cost of his products or services.

- Form and sample

- Free download

- Online viewing

- Expert tested

FILES

The difficulty lies in the fact that each manager himself has the right to choose the form of taxation and switch from one to another. And the counterparties with whom he works are not always ready for changing conditions. They may not be aware of changes that have occurred in the form of taxation of the organization with which they interact, or cooperation between the parties is just being established.

For these reasons, a letter on the application of the simplified tax system for a counterparty is a useful document for organizing fruitful business communication.

Why do you need a certificate?

In most cases, business partners require confirmation of the chosen taxation system in order to correctly calculate and pay fiscal VAT payments. Let us remind you that for violation of the rules, significant fines and liability are provided, including the seizure of accounts and the freezing of activities for up to 90 calendar days.

If the company has received documents from a partner that contain o, then it should request appropriate confirmation that the entity has the right not to allocate value added tax. Your company may receive a similar request. In this case, you will have to prepare a response sample: a certificate about the taxation system.

What does a letter about working with VAT contain?

Unlike simplifiers, organizations applying the general taxation regime will not be able to receive an information letter from the Tax Inspectorate stating that they work with VAT. Previously, they were issued a certificate of registration as VAT payers, but in the early 2000s this document was abolished.

The sale of a share in an apartment to another owner occurs according to the most simplified scheme.

In what cases can land be used without providing it and establishing an easement? We talked about this.

Some categories of the population have the opportunity to receive land for individual housing construction for free. You will find the algorithm in our article.

Therefore, the organization on OSNO will need to compose a letter in any form. It indicates that the organization is under the general tax regime and transfers VAT to the budget. The letter is signed by the head of the organization or the chief accountant.

As an additional confirmation of the partner’s good faith, he may be asked for a copy of the cover page of the latest quarterly VAT return with a mark from the tax authorities.

A link to a sample notification is here.

The current fiscal legislation provides for the right to choose a taxation system. That is, the taxpayer has a legal opportunity to significantly reduce the tax burden when choosing simplified taxation regimes. Of course, officials have identified a circle of people and a significant list of criteria that must be met in order to switch to lightweight tax systems.

Consequently, companies and entrepreneurs have the right to choose exactly the mode that is most beneficial in carrying out their activities. The variety of taxation systems has become a stumbling block for most taxpayers regarding the imposition of value added tax.

How to prepare

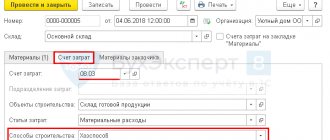

Taxpayers who have switched to simplified tax regimes confirm their status with an official notification from the Federal Tax Service or provide a special form No. 26.2-7. Consequently, it is enough for “simplified” clients to send a copy of the Federal Tax Service’s notification about the transition to a preferential regime to the business partner. Or request a special information letter from the inspection.

For subjects using the general regime (OSNO), a similar form is not provided. To confirm the selected mode, you will have to notify your partner by letter, drawn up in any form.

Process specifics

A taxpayer who decides to apply the exemption must thoroughly study the pros and cons of not charging VAT.

It is necessary to conduct an inventory of balances to determine the restored amount payable, either return the balances to the supplier or transfer them to another organization for safekeeping with posting to the warehouse.

Otherwise, the amount of tax payable could be substantial.

For legal entities

Legal entities that begin to apply the benefit must provide an extract from the balance sheet.

A Form 2 balance sheet (report) is provided, which indicates the revenue received for the period.

Additionally, the Inspectorate may require the submission of Form 1 to clarify the available amount of VAT for deduction, accounted for as a separate line.

An LLC can also receive an exemption when switching from a special regime to a general system. Unlike individual entrepreneurs, legal entities draw up a balance sheet for any form of taxation.

For individual entrepreneurs

Entrepreneurs keep records in the form of a ledger of income and expenses. The document is used in various forms both in OSNO and in the case of using the simplified tax system.

An extract from the book is attached to the notification, in which you can determine the revenue received by the individual entrepreneur.

The difficulty concerns only the amounts that will be received by the entrepreneur from income from goods shipped in the VAT-taxable period. Based on these amounts, the taxpayer will have to pay VAT to the budget.

Help for OSNO

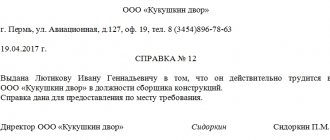

To compose a letter in any form, use A4 letterhead. Follow the general rules of business correspondence. Do not forget to indicate the required details of the written notification of the chosen taxation system:

- Information about your organization, individual entrepreneur. Enter the full name in accordance with the registration documents. Please indicate your actual and legal addresses. Enter the TIN, KPP, OGRN and other information if necessary.

- Date of registration. Separately indicate the date of registration with the tax authority. It is acceptable to attach a copy of the document.

- Data that the company is a payer of VAT or other fiscal obligation, depending on the request of the business partner.

Results

In order to legally avoid paying VAT, you must meet certain conditions and take the necessary actions. They have been discussed in detail above. But before you switch to exemption, determine whether it will be beneficial for you.

Read about this in the article “Working with or without VAT (pros and cons)”.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Demand or ask?

The current tax legislation does not provide for the obligation of the simplified tax operator to provide his counterparties with any evidence of the application of the simplified tax system. Therefore, it is impossible to demand such documents from a simplifier. However, he can be asked to provide evidence that he uses a special regime. Moreover, some simplifiers themselves, together with a set of documents, for example, an invoice or an agreement, submit a letter on the application of the simplified tax system for the counterparty. After all, it is easier to submit such documents than to spoil relations with your partners.

Requested by the counterparty: why?

A certificate of the applicable taxation system is usually included in the documents

requested from potential partners before concluding an agreement, along with a certificate of absence of debt to the budget and title documents (a copy of the registration certificate, an extract from the Unified State Register of Legal Entities/Unified State Register of Individual Entrepreneurs, a copy of the charter).

The presence of such a certificate is necessary for the organization so that in the future it will not have problems with VAT compensation from the budget. This document will serve as confirmation of the fact of preliminary verification of the counterparty at the request of the tax authorities.

What information indicates that the organization is a VAT payer? This means that the company is on the general tax regime or OSNO. By default, all organizations are transferred to OSNO, unless they submit a notification about the transition to the simplified tax system. Therefore, if the extract from the ERIP/Unified State Register of Legal Entities does not indicate the fact of filing a notification, then this serves as an indirect sign of being on OSNO and paying VAT.

As additional confirmation, in addition to a certificate of the applicable tax regime, a copy of the latest VAT return with a mark from the tax office or income tax return can be used.

While simplified organizations can always request a certificate from the Tax Inspectorate about working under a special regime and exemption from VAT in the prescribed form, such a document is not provided for organizations using OSNO. Therefore, there is no strictly established form of the certificate and it is drawn up in free form.

If you want to find out how to solve your particular problem, please contact us through the online consultant form or call:

Organizations that have been operating in the market for a long time may have a certificate of registration as a VAT payer. But since 2003, such a document has been abolished. Moreover, he cannot guarantee that after this the company did not switch to a special regime without VAT.

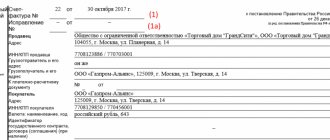

What should a certificate stating that an organization is a VAT payer contain:

- name and details of the sending organization (TIN for individual entrepreneurs, TIN/KPP for LLC);

- details of the organization to which the certificate is provided;

- an indication that the company applies the total amount of taxation, pays VAT and submits returns for this tax;

- it is advisable to indicate the date from which this regime applies;

- information on the use of special regimes;

- outgoing number and date of issue;

- signature of an authorized person;

- contact information;

- list of attachments (extract from the Unified State Register of Individual Entrepreneurs, copy of the title pages of the declaration).

A certificate is signed stating that the company pays VAT:

- director of the organization;

- individual entrepreneur;

- a person authorized to sign documents under a power of attorney; chief accountant.

If there are a large number of counterparties, an organization can create a standard form indicating the applicable tax regime.

Thus, a certificate of application of OSNO and payment of VAT is a document that has a free form. The obligation to provide a certificate is not regulated in any way by law, but it can serve as a prerequisite for concluding profitable contracts.

What document confirms the use of the simplified tax system?

Let us remind you that when switching to the simplified tax system, an organization or individual entrepreneur must submit to its tax office a Notification of the transition to a simplified taxation system (form No. 26.2-1, approved by Order of the Federal Tax Service dated November 2, 2012 No. ММВ-7-3 / [email protected] ) . In general, this must be done no later than December 31 of the previous year (clause 1 of Article 346.13 of the Tax Code of the Russian Federation) in order to become a payer of the simplified tax system from January 1 of the new year.

However, the tax inspectorate does not have the obligation to confirm that the organization (IP) has switched to the simplified tax system; the Federal Tax Service does not send in response either a permit or a notification about the application of the simplified tax system.

However, by order of the Federal Tax Service of Russia dated November 2, 2012 No. ММВ-7-3/ [email protected] Form No. 26.2-7 – Information Letter was approved. With this letter, the inspectorate can confirm that the organization or individual entrepreneur has submitted a Notification of the transition to the simplified tax system (in the form it is called an application), and also submitted declarations under the simplified tax system. Information about submitted declarations may not be available if the deadline for their submission has not yet arrived at the time of preparation of the information letter.

Free form notification

You can inform your counterparty of your right to work without VAT in free form. To do this, on behalf of the company or individual entrepreneur, a letter is drawn up about the application of the simplified procedure with a seal (if there is one) and a signature.

This option is not suitable for everyone, since some organizations fundamentally insist on providing official documents from the Federal Tax Service.

The last option by which you can confirm your right to use the simplified tax system is a copy of the title page of the tax return under the simplified tax system with a mark on its acceptance by the tax inspectorate.

I am an individual entrepreneur and am not a VAT payer. I work according to the simplified tax system. But the customer demands from me an official letter from the Federal Tax Service stating that I am exempt from paying VAT. The fact is that the Federal Tax Service takes a long time to complete this letter. Is there any way to do without it to conclude a contract?

By and large, it is possible to conclude an agreement without such confirmation. It’s just that, apparently, your customer wants to reliably understand the conditions regarding the formation of the contract price. In fact, it is enough to write everything directly in the contract.

The reasons for the desire to check the counterparty are clear: for example, an incorrect statement of the terms of the contract price can lead the customer to unnecessary expenses in the amount of VAT.

When you notified the Federal Tax Service about the application of the simplified tax system, you should have been given a letter confirming that you notified about the application of the simplified tax system. Do you have this? If not, then, of course, you need to request it from the Federal Tax Service.

In order not to wait a month for the required letter from the Federal Tax Service, you can invite the customer to familiarize yourself with your tax return for the previous period or show the notification itself that you sent to the Federal Tax Service.

If the customer is not satisfied with this and decides not to enter into a contract, that is his right. But it is important to understand that the law does not provide for any requirement regarding the mandatory provision of such documents confirming the application of the simplified tax system from the Federal Tax Service. Also, the law does not give the Federal Tax Service the right to authorize or not to authorize the use of the simplified tax system. Therefore, the Federal Tax Service in the information letter only reports that the individual entrepreneur or legal entity has notified of its decision to apply the simplified tax system.

Try to talk to the customer from these positions and convince him to either wait or enter into an agreement without a letter from the Federal Tax Service.

In some circumstances, a company may require a certificate of the applicable taxation system and whether the company is a VAT payer. How to draw up this certificate and what information should it contain?