Step-by-step instruction

The organization decided to build an additional warehouse to store finished products on its own.

In the second quarter, construction work was carried out using economic methods. The costs of building the warehouse were:

- material costs - 250,000 rubles;

- wages - 80,000 rubles;

- insurance premiums - 24,160 rubles.

On July 2, construction was completed and the warehouse was put into operation.

On July 10, an extract from the Unified State Register of Real Estate was received regarding the registration of ownership of the property.

Let's look at the step-by-step instructions for creating an example: PDF

| date | Debit | Credit | Accounting amount | Amount NU | the name of the operation | Documents (reports) in 1C | |

| Dt | CT | ||||||

| Write-off of materials for OS construction | |||||||

| II quarter | 08.03 | 10.01 | 250 000 | 250 000 | 250 000 | Write-off of materials | Request-invoice |

| Payroll | |||||||

| II quarter | 08.03 | 80 000 | 80 000 | 80 000 | Payroll | Payroll | |

| 68.01 | 10 400 | 10 400 | Withholding personal income tax | ||||

| 08.03 | 69.XX | 24 160 | 24 160 | Calculation of insurance premiums | |||

| Accrual of VAT on construction and installation works in a self-employed manner | |||||||

| 30 June | 19.08 | 68.02 | 63 748,80 | Accrual of VAT on construction and installation work using the economic method | Accrual of VAT on construction and installation work using the economic method | ||

| — | — | 417 908,80 | Submitting a SF for construction and installation works in an economic way | Invoice issued for sales | |||

| — | — | 63 748,80 | Reflection of VAT in the Sales Book | Sales book report | |||

| Acceptance of VAT for deduction on construction and installation works in a self-employed manner | |||||||

| 30 June | 68.02 | 19.08 | 63 748,80 | Acceptance of VAT for deduction | Generating purchase ledger entries | ||

| — | — | 63 748,80 | Reflection of VAT deduction in the Purchase Book | Purchase Book report | |||

| OS commissioning | |||||||

| July 02 | 01.08 | 08.03 | 354 160 | 354 160 | 354 160 | OS commissioning | Acceptance for accounting of fixed assets - Construction objects |

| Registration of ownership of real estate put into operation | |||||||

| July 10 | 01.01 | 01.08 | 354 160 | 354 160 | 354 160 | Transfer of ownership of real estate | Manual entry - Operation |

Formation of the initial cost when creating an OS

Initial cost of fixed assets in accounting

In accounting, assets are recognized as fixed assets (clause 4 of PBU 6/01):

- used for a long time (more than 12 months);

- not intended for resale, i.e. the asset is intended for use in the production of products, performance of work (provision of services), management needs, rental;

- the use of which is aimed at generating income in the future.

Fixed assets are accepted for accounting at their original cost (clause 7 of PBU 6/01).

When creating an OS, the initial cost consists of all the actual costs of constructing, manufacturing, producing the OS and preparing it for working condition (clause 8 of PBU 6/01).

Accounting and formation of costs for the production of fixed assets is determined similarly to the accounting of costs for finished products (clause 26 of the Guidelines for accounting of fixed assets, approved by Order of the Ministry of Finance of the Russian Federation dated October 13, 2003 N 91n).

The amount of VAT and other refundable taxes is not taken into account in the initial cost of fixed assets (clause 27 of the Guidelines for accounting of fixed assets, approved by Order of the Ministry of Finance of the Russian Federation dated October 13, 2003 N 91n).

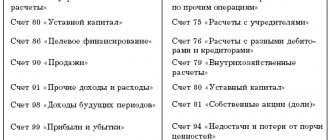

All actual costs associated with the creation of fixed assets are taken into account in Dt 08.03 “Construction of fixed assets” (Chart of Accounts 1C).

Initial cost of fixed assets in tax accounting

In tax accounting, assets are divided into depreciable and non-depreciable.

Depreciable property is recognized as having (clause 1 of Article 256 of the Tax Code of the Russian Federation):

- useful life more than 12 months;

- initial cost more than 100,000 rubles.

Fixed assets include depreciable property, which is a means of labor in the activities of the organization (paragraph 1, paragraph 1, article 257 of the Tax Code of the Russian Federation).

The initial cost of the OS is determined based on all the actual costs of constructing, manufacturing and bringing the OS to working condition, and when producing the OS on its own - as the cost of the finished product (clause 1 of Article 257 of the Tax Code of the Russian Federation).

VAT

If, when creating an operating system, construction and installation work (CEM) was carried out in an economic way for one’s own consumption, it is necessary to charge VAT on the amount of construction and installation work performed (clause 3, clause 1, Article 146 of the Tax Code of the Russian Federation).

Study the accrual of VAT on construction and installation work performed in-house for your own needs

Accounting in 1C

When creating an OS on your own, the costs that form the initial cost of the OS are reflected in different documents depending on the type of costs, for example:

- document Payroll - to reflect in the initial cost of the fixed assets the costs of wages for employees creating the fixed assets;

- document Requirement invoice - for writing off the necessary materials when creating an operating system;

- other documents, the costs of which will be reflected in Dt 08.03 “Construction of fixed assets”.

If the creation of fixed assets is carried out by contract or mixed method, the costs are also charged to account 08.03 “Construction of fixed assets”.

In this case, the documents may be the following:

- Receipt (act, invoice) - to reflect the services of contractors in the costs of constructing fixed assets;

- Transfer of equipment for installation - to reflect the installation and construction of OS by contract.

In 1C, the distinction between the creation of fixed assets using an economic method or a contract method is carried out by analytics on account 08.03 “Construction of fixed assets” subconto Construction Methods .

Filling out the Construction Methods is required for correct accounting, since VAT must be charged at the end of the quarter on construction and installation work carried out in a self-employed manner.

Creation of fixed assets by the enterprise's own resources

Creation of fixed assets by the enterprise's own resources

Accounting

The initial cost of fixed assets manufactured by the organization's own resources, determined in accordance with paragraph 8 of PBU 6/01, is recognized as the amount of actual costs for acquisition, construction, and production, with the exception of value added tax and other refundable taxes.

Let us dwell on the procedure for reflecting the creation of a fixed asset in the accounting accounts.

When creating fixed assets, components, materials, spare parts, etc. are used. In accordance with paragraph 2 of the Accounting Regulations “Accounting for Inventories” PBU 5/01, approved by Order of the Ministry of Finance of the Russian Federation dated June 9, 2001 No. 44n “On approval of the Accounting Regulations “Accounting for Inventory Inventories” PBU 5/ 01", purchased individual components are taken into account as inventories.

In accordance with the Chart of Accounts for accounting of financial and economic activities of organizations and the Instructions for its application, approved by Order of the Ministry of Finance of the Russian Federation dated October 31, 2000 No. 94n “On approval of the Chart of Accounts for accounting for financial and economic activities of organizations and Instructions for its application” (hereinafter Chart of accounts), the availability and movement of inventories (hereinafter referred to as inventories) is carried out on account 10 “Materials” on separate sub-accounts opened for this account.

If the created fixed assets are expected to be used for a period exceeding 12 months, they are taken into account as part of the organization's fixed assets in accordance with paragraph 4 of PBU 6/01.

Based on paragraphs 7 and 8 of PBU 6/01, created fixed assets are accepted for accounting at their original cost, which is determined based on the total cost of the components included in the fixed asset (excluding VAT), as well as the amount of costs incurred for their creation. Such costs are the amount of wages accrued to employees, as well as the amount of unified social tax and insurance contributions accrued on wages.

The organization's costs associated with the acquisition and creation of fixed assets are reflected in account 08 “Investments in non-current assets” in correspondence with account 10 “Materials”, as well as with cost accounts.

The cost of fixed assets collected and put into operation is reflected in the debit of account 01 “Fixed assets” and the credit of account 08 “Investments in non-current assets”.

Procedure for accounting for value added tax

In accordance with paragraph 2 of Article 159 of the Tax Code of the Russian Federation (hereinafter referred to as the Tax Code of the Russian Federation), when performing construction and installation work for its own consumption, the organization must charge VAT. The tax base, in this case, will be determined as the cost of work performed, calculated on the basis of all actual expenses of the taxpayer for their implementation.

Subsequently, the organization will be able to deduct the amount of accrued VAT, in addition, the organization can also reimburse “input” VAT on inventories and contract work used in the creation of a fixed asset item. This follows from paragraph 6 of Article 171 of the Tax Code of the Russian Federation, which, in particular, states that tax amounts presented to the taxpayer by contracting organizations (customers - developers) when they carry out capital construction, assembly (installation) of fixed assets, tax amounts presented to the taxpayer for goods (works, services) purchased by him to perform construction and installation work, and the amount of tax presented to the taxpayer upon his acquisition of unfinished capital construction projects.

Subject to deductions are tax amounts calculated by taxpayers in accordance with paragraph 1 of Article 166 of the Tax Code of the Russian Federation when performing construction and installation work for their own consumption, the cost of which is included in expenses accepted for deduction (including through depreciation deductions) when calculating corporate income tax.

The moment when an organization can accept VAT amounts for deduction is determined in paragraph 5 of Article 172 of the Tax Code of the Russian Federation. Deductions of amounts of “input” VAT on inventories and contract work are made as the corresponding objects of completed capital construction (fixed assets) are registered from the moment specified in paragraph two of paragraph 2 of Article 259 of the Tax Code of the Russian Federation (that is, from the moment the depreciation of fixed assets begins, which begins on the 1st day of the month following the month in which these objects were put into operation) or when selling an unfinished capital construction project.

Deductions of tax amounts for construction and installation work for own consumption are made as taxes are paid to the budget, in accordance with Article 173 of the Tax Code of the Russian Federation.

Inventory and equipment for creating fixed assets on your own can be purchased long before the creation of fixed assets, which means that the amount of VAT on them will already be deducted. The creation of fixed assets can be carried out in another period. In this situation, the amount of VAT previously accepted for deduction must be restored for payment to the budget and accepted for deduction only after the created objects have been registered as part of fixed assets. If the acquisition of materials and the acceptance of objects created from these materials into fixed assets occur in the same VAT tax period, then VAT on components transferred for construction of an object or for assembly may not be restored.

Note!

Federal Law No. 118-FZ of July 22, 2005 “On Amendments to Chapter 21 of Part Two of the Tax Code of the Russian Federation” (hereinafter Federal Law No. 118-FZ) introduced a significant addition to Article 159 of the Tax Code of the Russian Federation. Moreover, since this law comes into force after one month from the date of publication (Rossiyskaya Gazeta No. 166 of July 30, 2005) and applies to legal relations starting from January 1, 2005 (that is, “retroactively”), then take advantage of VAT taxpayers are entitled to these changes now.

The change establishes the procedure for determining the tax base for construction and installation work during the reorganization of legal entities. Let us note that the construction of facilities is a fairly lengthy process, so in practice it often turns out that while constructing a particular facility, a legal entity may reorganize. Since, in accordance with paragraph 1 of subparagraph 3 of Article 146 of the Tax Code of the Russian Federation, the performance of construction and installation work for one’s own consumption is an object of VAT taxation, therefore, tax on such an operation must be accrued and paid to the budget. However, when calculating VAT in this case, a whole host of questions arise, because before the introduction of such an amendment, Chapter 21 “Value Added Tax” did not at all consider the case of charging tax on construction and installation work during the reorganization of a legal entity. As a result of the reorganization, an unfinished capital construction facility is transferred under a transfer deed to a legal entity formed as a result of the reorganization, which continues construction of the facility. Before the introduction of this amendment, it remained unclear how the successor should have determined the tax base: based only on the amount of expenses collected in account 08, which was transferred to him under the act, or include in the tax base only his own expenses for the construction of the building. After all, it must be said that due to the vagueness of the wording of paragraph 2 of Article 159 of the Tax Code of the Russian Federation, even “ordinary” VAT taxpayers who construct objects “for themselves” in an economic way every now and then have problems with the tax authorities. What to say if the organization is reorganized? After all, the wording of paragraph 2 of Article 159 of the Tax Code of the Russian Federation does not give a clear idea of what should be understood as the actual expenses of the developer for carrying out construction and installation work.

The tax base when performing construction and installation work for one’s own consumption is calculated as the cost of the work performed, calculated on the basis of all the actual expenses of the developer for their implementation. In this case, does this mean the implementation of construction and installation work by the taxpayer itself, or does this include all the taxpayer’s expenses, both his own and those purchased from specialized organizations, associated with the construction of the facility?

Let us recall that in paragraph 3.2 of the Methodological Recommendations approved by Order of the Ministry of Taxes and Taxes of the Russian Federation dated December 20, 2000 No. BG-3-03/447 “On approval of Methodological Recommendations for the application of Chapter 21 “Value Added Tax” of the Tax Code of the Russian Federation” (hereinafter referred to as Methodological Recommendations recommendations on VAT) it is noted that:

“For the purpose of applying subparagraph 3 of paragraph 1 of Article 146, the object of taxation is the cost of construction and installation work performed for own consumption. Such work includes construction and installation work performed in an economic way from January 1, 2001 directly by taxpayers for their own needs. Construction and installation work performed by individual entrepreneurs on objects intended for their personal consumption are not subject to taxation.”

This formulation of the Methodological Recommendations allows us to conclude that when calculating the tax base for construction and installation work for their own consumption, VAT taxpayer organizations should take into account only construction and installation work performed on their own and not include in the tax base construction and installation work performed during construction object by third parties. Such

Write-off of materials for OS construction

On June 04, Brick 100M was written off for the construction of a warehouse for finished products - 6,000 rubles. for a total amount of 37,500 rubles.

Write off materials for the creation of fixed assets using the document Requirement-invoice in the section Warehouse – Warehouse – Requirements-invoices.

Please note when filling out the Cost Account :

- Cost account - 08.03 “Construction of fixed assets”;

- Construction objects - Finished products warehouse , i.e. a construction site where all costs for creating an operating system are collected;

- Cost item - cost item with Expense Type Material costs ; PDF

- Construction methods - Economic : construction is carried out by the organization’s own resources.

Find out more about writing off materials for creating an operating system

Postings according to the document

The document generates the posting:

- Dt 08.03 Kt 10.08 - the cost of materials is taken into account when determining the initial cost of the fixed assets.

Payroll

On May 31, wages were accrued to employees involved in the construction of a warehouse for finished products.

To calculate salaries for employees involved in warehouse construction, complete the Payroll in the Salaries and Personnel section – Salaries – All accruals – Create – Payroll.

For employees involved in the creation (construction) of fixed assets, the method of accounting for wages must be determined according to account 08.03 “Construction of fixed assets” with the correctly completed analytics Methods of construction - Economic . PDF

See also Payroll

Postings according to the document

The document generates transactions:

- Dt 08.03 Kt - wages are taken into account when forming the initial cost of fixed assets;

- Dt 08.03 Kt 69.XX - insurance premiums are taken into account when determining the cost of fixed assets.

Transfer of equipment for installation

The next stage is installation or assembly of equipment. Naturally, we will collect them from the material assets received from the supplier, which are already on account 07.

The 1C document that will help us carry out the assembly is called “Transfer of equipment for installation”; in the interface it is located on the “OS and Intangible Materials” tab. Let's create a new document:

The construction object, in our case, is just a new OS made from components. In the “Equipment” tabular section, you need to indicate the quantity of the item and the accounting account - 07.

Get 267 video lessons on 1C for free:

In wiring, the 1C 8.3 system will generate wiring 08.03-07, that is, the transfer of components for assembly:

If you plan to involve a third-party service provider in the assembly of components, this operation can also be reflected on account 08.03 using the document “Receipt of goods and services”, where the value of the subconto will be our new computer.

OS commissioning

Real estate objects suitable for exploitation are accepted into the fixed assets, regardless of the moment of registration of ownership, and are accounted for at their original cost in a separate subaccount to the fixed assets accounting account (clause 52 of the Guidelines for accounting of fixed assets, approved by Order of the Ministry of Finance of the Russian Federation dated October 13, 2003 N 91n, clause 7 PBU 6/01).

The commissioning of the constructed fixed assets facility is documented with the document Acceptance for accounting of fixed assets, type of operation Construction objects in the section fixed assets and intangible assets - Receipt of fixed assets - Acceptance for accounting of fixed assets.

Fill out the document:

- MOL - the materially responsible person to whom the commissioned OS is assigned, is selected from the directory Individuals ;

- OS location - the division to which the OS object is assigned is selected from the Division directory;

- OS event - an event associated with a change in the accounting of an asset in an organization, selected from the FA Event . During commissioning, the OS event type should be Acceptance for accounting with commissioning .

On the Non-current asset , specify the characteristics of the created asset before commissioning:

- Method of entry - Construction (creation) ;

- A construction object is a created OS that is put into operation. Selected from the Construction Objects ;

- Account - 08.03, i.e. the cost account on which the initial cost of the object is formed.

Click the Calculate to automatically fill in the amounts in the Cost and NU Cost .

These fields will reflect all actual costs accounted for in account 08.03 “Construction of fixed assets” for the specified Construction Project .

On the Fixed Assets , select the operating systems to be put into operation from the Fixed Assets . The following data must be filled in the OS object card: PDF

- OS accounting group;

- Classification section .

The cost of fixed assets in the accounting system is repaid by calculating depreciation (clause 17 of PBU 6/01).

The date of registration of ownership of real estate does not affect the start of depreciation. Depreciation on a real estate property, the ownership of which is not registered, is accrued in the usual manner after commissioning (clause 4 of article 259 of the Tax Code of the Russian Federation).

Find out more Depreciation of fixed assets

On the Accounting , specify:

- Accounting account - 01.08 “Real estate objects for which ownership rights are not registered”;

- Accounting procedure - Depreciation : in our example, the cost of fixed assets is repaid through depreciation;

- Method of calculating depreciation - the method of calculating depreciation established in the accounting policy of the organization;

- Depreciation (wear and tear) account - 02.01 “Depreciation of fixed assets accounted for on account 01”;

- Accrue depreciation checkbox must be checked, since it is this that affects the automatic calculation of depreciation when closing the month;

- The method of reflecting depreciation expenses is the method of accounting for the costs of depreciation of fixed assets, selected from the directory Method of reflecting expenses ;

- Useful life (in months) — estimated useful life.

On the Tax Accounting , specify:

- The procedure for including cost in expenses - Accrual of depreciation , since in tax accounting the asset is recognized as depreciable property;

- Accrue depreciation checkbox must be checked, since it is this that affects the automatic calculation of depreciation when closing the month;

- Useful life (in months) - useful life, according to the established depreciation group of the fixed asset.

Postings according to the document

The document generates the posting:

- Dt 01.08 Kt 08.03 - acceptance for accounting of fixed assets, the ownership rights for which have not yet been registered.

To check the initial cost of the fixed assets, you can generate the report Turnover balance sheet for account 08.03 on the date of commissioning of the fixed assets.

The absence of a balance in account 08.03 “Construction of fixed assets” means that the initial cost of the fixed assets has been formed correctly for the entire amount of costs for creating the fixed assets.

Documenting

The organization must approve the forms of primary documents, including the document on commissioning of the property and the form of the inventory card for further accounting of fixed assets. In 1C, the Certificate of Acceptance and Transfer of Buildings (Structures) (OS-1a) and the OS Inventory Card (OS-6) are used.

The form Certificate of acceptance and transfer of buildings (structures) in form OS-1a can be printed by clicking the button Certificate of acceptance and transfer of fixed assets (OS-1) of the document Acceptance for accounting of fixed assets .

The OS Inventory Card form in the OS-6 form can be printed by clicking the OS Inventory Card (OS-6) in the fixed asset card (section Directories - OS and Intangible Assets - Fixed Assets). PDF

If the organization itself manufactured the device for the machine

Question: The organization manufactured a device for the machine with its own resources - an overhead jig. It is designed for drilling holes in the hub housing on a drilling machine. How to reflect the costs of manufacturing the specified device in accounting?

Answer: The costs of manufacturing a special machine tool in-house can be included both in fixed assets and in inventories.

Rationale: In the interstate standard GOST 31.010.01-84 “Machine devices. Terms and definitions”, put into effect by Resolution No. 3, the terms with corresponding definitions are given:

— machine tool — a device used on a metal-cutting and (or) woodworking machine;

- special machine fixture - machine fixture for installing workpieces of the same standard size;

- universal machine fixture - a machine fixture for installing workpieces of various designs in a specified range of sizes.

Devices are accepted for accounting purposes as inventories and are included in funds in circulation <*>.

An overhead jig is a device placed on the end of the hub and fixed with clamps, in which there are holes for guiding the cutting tool (drill). In other words, an overhead jig should be considered as a special device designed to guide the cutting tool when drilling a part of a certain design within a certain value of its parameters. Essentially, the patch jig is a template for drilling.

The procedure for writing off the cost of special tools and special devices (tools and devices for special purposes, dies, molds, etc.) is provided for in paragraph. 2 clause 107 of Instruction No. 133. Thus, it is transferred to cost accounts in accordance with standard rates, which are calculated based on the cost estimate for their production (purchase) and their useful life of up to two years.

The specific useful life of the overhead conductor is determined by the organization.

In accounting, the movement of machine tools received as inventories is reflected as follows <*>:

- when it arrives from production - in subaccount 10-10 “Special equipment and special clothing in warehouse”;

— transfer to operation — on subaccount 10-11 “Special equipment and special clothing in operation.”

However, it must be taken into account that the provisions of Instruction No. 133 do not apply to devices that, in accordance with the accounting policies of the organization, are classified as fixed assets <*>.

The accounting policy may establish the following criteria for classifying inventories as fixed assets:

- cost - depending on the cost of the item classified as inventory;

- production - depending on the participation of the item in production;

- a combination of the specified criteria.

As fixed assets, an organization accepts for accounting assets that have a tangible form if the recognition conditions specified in clause 4 of Instruction No. 26 are met.

Regardless of whether fixed assets are used in business activities, the organization determines their standard service life in accordance with Resolution No. 161, based on the types of fixed assets and their classification. Machine tools are classified as fixed assets with code 41021 and a standard service life of six years <*>.

In accounting, the movement of a machine tool arriving as a fixed asset is reflected as follows <*>:

— account 08 “Investments in long-term assets” shows the actual costs of creating a fixed asset;

- account 01 “Fixed assets” - the generated initial cost of the fixed asset;

- account 02 “Depreciation of fixed assets” - information on depreciation of fixed assets.

The cost of fixed assets is transferred to expenses when depreciation is calculated until the cost of the objects is completely written off or they are disposed of <*>.

Thus, depending on the provisions of the accounting policy, the overhead jig for drilling holes in the hub body, based on the decision of the commission on depreciation policy, can be classified either as inventories or fixed assets <*>.

Registration of ownership of real estate put into operation

After receiving an extract from the Unified State Register of Real Estate on the transfer of ownership of a real estate property, it is necessary to transfer its initial value from account 01.08 “Real estate objects for which ownership rights are not registered” to account 01.01 “Fixed assets in the organization.”

To do this, create a document Transaction entered manually, type of operation Transaction in the section Operations – Accounting – Transactions entered manually.

To correctly generate the Asset Depreciation Sheet , replace the Accounting Account in the information register of the Asset Accounting Account .

See also:

- Document Typical operation

- VAT accrual for construction and installation work of households. way

- Acceptance of VAT for deduction during construction and installation works in an economic way

- Acceptance of fixed assets for accounting

- OS accounting procedure

Did the article help?

Get another secret bonus and full access to the BukhExpert8 help system for 14 days free of charge