A power of attorney for the right to sign various documentation is issued for working with documents at enterprises by a trusted person. This document is prepared in writing. The Civil Code of the Russian Federation means that a power of attorney is a written authority entrusted by one person to another to represent interests before third parties.

Power of attorney for the right to sign documents

The appointment of powers with the right to sign business papers is considered a form drawn up to transfer the rights of a certain person, to certify various business documents. The form of such a document is filled out in any style.

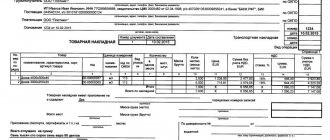

If authority is granted at an institution so that, in addition to the manager, another employee works with documents (invoices, contracts, invoices, protocols, etc.), then such a form is filled out on the institution’s letterhead.

In a company, a similar form can be issued for working with specified documents, for example, shipping invoices), for an accountant or other employee responsible for this area of activity.

At the enterprise, the right of both signatures belongs to the manager and chief accountant. When these persons go on vacation or a business trip, it will be necessary to issue a power of attorney to their replacement employees for the period of their absence.

An individual may also authorize another to represent the interests of the first (signing an agreement, statement of claim or other document) reflected in the contents of the approved form.

As a result, it can be noted that, whatever the reason for granting written authority to the authorized person, the form must be filled out correctly.

In what cases is a power of attorney needed?

This power of attorney is most often used to delegate powers from the head of an institution to an employee, to work with documentation during the absence of the head for various circumstances (vacation, business trip, illness).

Such a document, as a rule, displays a list of trusted documentation (agreements, invoices, protocols, etc.) that the authorized person has the right to sign. Today's Law of the Russian Federation determines that the following have the right to act as principals :

- Institutions, firms, companies, enterprises.

- Private entrepreneurs.

- Physical persons.

The document is issued to an authorized person by the manager for signing documentation related to the business activities of the company. Such a form can be issued to an employee leaving on a business trip. Thanks to this form, he will be able to resolve, within the limits of the powers granted, the issues of the company in front of its partners with the right to sign commercial contracts, etc.

A power of attorney with signing authority is issued under the following circumstances:

- To purchase inventory items.

- To issue various documentation on the basis of which goods can be sent.

To conclude agreements, projects and sign other documentation included in the document flow of the enterprise (signing a salary slip, sending reports, etc.).

Who can act as a proxy

The list of persons who are entrusted with signing accounting documents is indicated in the Regulations on the accounting policy of the enterprise, or in a separate administrative order issued by the manager. An organization, an entrepreneur, or a private person can become a trustee.

The document must contain a line that determines the possibility of transferring executive functions - “with the right of sub-assignment” or “without the right of sub-assignment”. In the first case, the authorized person has the right to entrust the execution of actions to other persons, in the second - he does not.

The power of attorney is carefully checked by third parties and representatives of the Federal Tax Service during the audit period. If there are errors in drafting, as well as corrections and inaccurate information, the document is considered invalid.

How to write a power of attorney for the right to sign documents in 2021

This document is usually drawn up on company letterhead in a free style and certified by the management of the company. The form must include the following information:

- place and date of filling.

- Information about the principal: – (name of the legal entity, OGRN, address, information about the manager, basis for issuing the form).

- Information about the authorized person.

- A list of rights that an individual is entitled to.

- Duration of validity of the form.

- Management signature, seal or stamp of the company.

Features when writing out the form:

- Without date display it is not valid.

- The authority of the document, if not specified in the form, will be considered within the 1st year.

- The form may not be valid for more than 3 years.

- The institution's form is signed and approved by the head.

- Dover. on behalf of an individual is drawn up by a notary.

Validity periods

The validity period of a power of attorney has limitations. In most cases, such time is displayed on the form and can be issued for a period of up to 3 years. If the term of office is not indicated on the form, then the document has legal status within 1 year from the date of registration.

Is notarization necessary?

A special feature of the drafting is that it does not require notarization. Here it is enough to put the signature of the head of the company and a seal.

A power of attorney issued by an individual requires certification by a notary.

Termination Procedure

The maximum validity period is reflected in the legislation of the Russian Federation and is 3 calendar years. If the form does not indicate the validity date of the power of attorney, by default the powers of the document are limited to one calendar year from the time of issue.

In some cases, the power of attorney may expire before the displayed time expires. These points include:

- Cancellation of legal status by the principal.

- Refusal of the authority of the person who received the document.

- Liquidation or reorganization of the institution on whose behalf the form was received.

- Liquidation or reorganization of the institution to which the form was issued.

- Death, missing person, limitation or complete incapacity of the principal individual.

- Death, missing person, limitation or complete incapacity of an individual.

Peculiarities

Documentation of the transfer of the right to sign primary documents can be made in two forms in the form of an order or a power of attorney. Also, the transfer of signature rights can be executed in both forms at the same time.

An order can register a legal entity only to a person who is a full-time employee of the organization (working on the basis of an employment contract). In other cases, the transfer of the right to sign is confirmed by issuing a power of attorney to the person to whom this right is transferred.

If the right to sign is transferred by an individual entrepreneur, but the transfer must be made strictly by power of attorney, regardless of whether the individual works on the entrepreneur’s staff or not (an order is not drawn up).

Another important condition for individual entrepreneurs is the need to confirm the right to sign by a notary. Primary documents signed by a power of attorney that is not certified by a notary will be considered invalid. This means that counterparties who received such documents will not be able to reflect them in their tax and accounting reports.

Organizations do not need to notarize powers of attorney issued to certain persons when granting the right to sign in primary documents.

Power of attorney for the right to sign bank documents

At enterprises, when preparing bank documentation, the first signature belongs to the boss, and the second - to the head. accountant. Other employees may be granted the right to sign these documents by issuing a power of attorney.

An individual of the institution can trust the status of the first signature. When transferring the status of signatures, it is necessary to keep in mind that the validity of the document, upon transfer, has no right to exceed the validity period of the main power of attorney.

The right to sign such signatures can be granted simultaneously to several employees of the institution identified when drawing up the power of attorney. In this case, one employee of the institution does not have the right to simultaneously have two signatures.

How to compose

The right to sign is issued at the institution. The form is issued in the usual written form, signed by the head or person endowed with the rights reflected in the constituent documents, certified by the seal of this institution. (Clause 5, Article 185 of the Civil Code of the Russian Federation).

If there is no accountant on the staffing table of the institution, then when filling out the card for the bank, indicate information for the “first signature”. In the “second signature” column it is displayed that “there is no position of accountant in the staffing table.”

How to apply

When the head of the company is going to entrust the right of signing to one of the employees, he first issues a corresponding order. Based on it, the secretary begins to fill out the power of attorney, entering into it the necessary information. The document is then submitted to the director for verification and signature. Many companies use letterhead for this purpose, although this is optional.

There are no strict rules for the preparation of this document. You just need to fill in all the important details. Essentially, this is a written confirmation that an employee is authorized to perform the duties of a manager. Here you should indicate information about the attorney in such a way that the person reading the document can easily identify him.

Instructions for filling

As already mentioned, there are no special requirements for drawing up the document. But don’t forget that this is business documentation, after all, so when drafting it, it is recommended to adhere to generally accepted rules:

- The business style of the document requires you to fill out a “header” here, which indicates the name of the company and detailed information about it. Legal form and address at which the organization is registered;

- Below, in the center of the line, the name of the document is written, namely, “Power of Attorney”. Typically, the document flow of an enterprise assigns a number to the power of attorney, which is written in the document. The date of issue and city are also indicated here;

- Then the text of the power of attorney itself is written. Here the position of the manager, his full name and passport details are noted. It is worth indicating which document gives him the right to occupy a leadership position;

- Below is information about the principal;

- The following are the powers assigned. If there are a lot of them, you can indicate them in bullet points for better perception. It would not be amiss to list exactly what documentation the employee is allowed to sign;

- The validity period is indicated. You can simply indicate that the power of attorney will become invalid after some event, for example, after completing a certain task. It is also allowed to mark a specific date until which the document can be used;

- It would be useful to note that the attorney has the right to draw up a power of attorney, or he does not have such powers;

- At the bottom of the document, both parties sign with transcripts.

General power of attorney for the right to sign documents

A general power of attorney provides the rights to the appointed person to represent the interests of the principal to resolve any transactions permitted by law. Of course, this must be a person whom the principal trusts completely.

Such a form is issued if, for example, management is unable to attend a business “date” on the date of the transaction.

Any person can act as a principal of an individual:

- Spouse).

- Next of kin.

- Best friend.

- Company employee.

It is important to keep in mind here that, having such a power of attorney, the authorized person is capable of abusing his right, for example, taking out a loan for the principal and appropriating the funds for himself. That is why the principal must think carefully before issuing such a form.

Standard templates for general powers of attorney are always available from a notary, who will always tell you what rights the law allows when drawing up a power of attorney. It is drawn up according to a standard template, like any other document. The maximum validity period of the document is no more than 3 years.

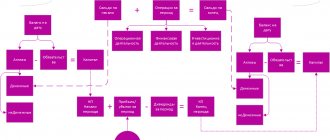

Types of accounting documents

Accounting documents are legally approved forms that reflect financial and economic transactions (primary or generalized), tax, statistical, and accounting reporting forms, reconciliation acts, and transfers of property. The chief accountant's signature is affixed to all financial documents, with the exception of analytical summaries and interim reports used as part of internal self-control.

The chief accountant signs on invoices, invoices, payroll and inventory sheets, bank checks, and reporting documentation issued on behalf of the enterprise. All of the listed types of official papers can be signed by another person when transferring the relevant powers to them by issuing a power of attorney.

Receiving electronic documents from the Federal Tax Service

Clause 3 of Article of the Tax Code of the Russian Federation lists categories of taxpayers who are required to submit tax reports only in electronic form through an electronic document management (EDF) operator. Thus, all VAT payers must submit declarations (calculations) for this tax exclusively in electronic form, regardless of the scale of the business and the number of employees. As for reporting on other types of taxes, it must be submitted electronically using the TKS if the average number of employees of the taxpayer exceeds 100 people.

For the named participants in electronic document flow, the Tax Code establishes additional responsibilities (clause 5.1 of Article of the Tax Code of the Russian Federation). Thus, they must ensure the possibility of receiving any documents from the tax authorities in electronic form using the TKS (to do this, you need to enter into an agreement with an electronic document management operator and have a certificate of an electronic signature verification key). In addition, the above taxpayers are required to send receipts to inspectors confirming the acceptance of documents received from them.

At the same time, the Tax Code directly allows the delegation of these responsibilities to an authorized person. To do this, it is necessary to provide the inspectorate at the place of registration not only with an agreement with the operator, but also with documents confirming the right of the representative to receive documents from this tax authority. If the representative is an organization, and the taxpayer is an individual, then in general, the inspectorate must also provide papers confirming the taxpayer’s right to receive documents from the Federal Tax Service (Clause 5.1 of Art. Tax Code of the Russian Federation). In this case, it is the authorized person who will be responsible for receiving information from tax authorities and sending them receipts.

The article of the Tax Code of the Russian Federation is silent on how to issue a power of attorney for such a delegation. This means that the general rules for drawing up a power of attorney, which we discussed above, apply.

At the same time, paragraph 5.1 of Article of the Tax Code of the Russian Federation lists additional actions for notifying inspectors about an authorized person. Thus, a copy of the power of attorney for the person to whom the functions of “electronic communication” with tax authorities have been transferred must be submitted to the tax authority within three working days from the date of its execution.

Submit reports for clients through Kontur.Extern

And if the specified powers are delegated to an organization (for example, an accounting service department), then it is additionally necessary to inform which individual will act on behalf of the authorized organization (if this individual is not its manager). In the case where “electronic correspondence” with tax authorities will be handled not by the manager, but by another employee of the authorized organization, among other things, a document confirming the authority of this employee will be required (that is, it will also be necessary to issue a power of attorney on behalf of the authorized organization for the employee of this organization). A copy of such a power of attorney can be submitted to the inspectorate personally or through a representative, or sent in electronic form through an electronic document management operator. In the latter case, the document is presented in the form of a scanned copy (Clause 5.1 of Article of the Tax Code of the Russian Federation).

Also see “Amendments to the Tax Code of the Russian Federation: prohibition on the “sudden” introduction of new reporting forms, exchange of documents with the inspectorate, blocking of accounts.”

Is notarization necessary?

The law does not establish a mandatory procedure for certification of a document by a notary. The document is signed personally by the head of the legal entity. If the organization has a seal, then it is advisable to put it on the document, but this is not mandatory.

Situations are common when counterparties to transactions ask for a power of attorney to be certified by a notary. This is usually associated with the high price of the upcoming transaction and is determined by the desire of the partners to play it safe. State authorities, as well as local governments, are also asking for certification.

It is mandatory to have a document certified by a notary if there is a need for state registration of the transfer of ownership of real estate.

Consequently, notarization of a power of attorney is not an obligation, but acts as an additional guarantee of the authenticity of the document.

What it is?

According to Article 185 of the Code, a power of attorney is a written permission to transfer powers on behalf of one person (“the Principal”) to another adult and capable individual or legal entity (“the Proxy”).

The Civil Code regulates:

- their characteristics of different types;

- their validity periods;

- re-confidence;

- termination.

One of the types of these acts in legal practice is a power of attorney for the right to sign invoices and invoices. Organizations and individual entrepreneurs can act as principals .

Signing personnel documentation

The Labor Code does not contain direct rules regulating the transfer of powers of the head of an organization to sign employment contracts and other personnel documents to other persons, but repeatedly mentions the very possibility of such a transfer. Thus, the article of the Labor Code of the Russian Federation determines that the rights and obligations of the employer in labor relations can be exercised, among other things, by authorized persons. At the same time, it is said that the powers of such persons are formalized in the manner established by the constituent documents of the organization and local regulations. And the article of the Labor Code of the Russian Federation notes that one of the mandatory conditions of an employment contract is information about the representative of the employer who signed the employment contract, and the basis on which this representative is vested with the appropriate powers. However, this article does not contain any specification of the procedure for delegation of powers.

The possibility of signing orders and other local regulations on personnel matters not only by the head of the organization, but also by another authorized person is also indicated by the by-laws that regulate the procedure for filling out primary accounting personnel documentation. For example, in the Instructions for the use and completion of forms of primary accounting documentation for the accounting of labor and its payment (approved by Resolution of the State Statistics Committee of Russia dated 01/05/04 No. 1; hereinafter referred to as Instructions for filling out unified forms) it is said that the order for employment (form No. T-1) can be signed not only by the manager, but also by an authorized person. However, these Instructions do not stipulate how to formalize the authority of such a person, and what changes need to be made to Form No. T-1 if it is signed by an authorized person.

Fill out and print out an order using form No. T‑1 for free

Unfortunately, the Plenum of the Supreme Court of the Russian Federation in its resolution of March 17, 2004 No. 2 “On the application by the courts of the Russian Federation of the Labor Code of the Russian Federation” also did not answer the question of how to formalize the delegation of the right to sign personnel documents. Paragraph 12 of this resolution only states that the representative of the employer is a person who, in accordance with the constituent documents of a legal entity or local regulations or by virtue of an employment contract concluded with this person, is endowed with the appropriate powers. In other words, in order to transfer the right to sign personnel documents, it is necessary to provide for the procedure for such transfer in the local regulatory act of the organization or make a corresponding clause in the employment contract concluded with an authorized person. However, the judges of the Supreme Court of the Russian Federation did not specify what specific documents can be used to confirm the temporary transfer of powers of a manager, and in particular, whether it is necessary to issue a power of attorney to an authorized person.

There are no formal grounds for issuing a power of attorney in this case, since labor legislation does not contain such a requirement. The provisions of Article 185 of the Civil Code of the Russian Federation that a power of attorney is issued to delegate the powers of a manager are not mandatory when transferring powers to sign personnel documents. Indeed, by virtue of the provisions of the article of the Labor Code of the Russian Federation, labor relations are regulated by labor legislation, which consists of the Labor Code, other federal laws and laws of constituent entities of the Russian Federation containing labor law norms. That is, the Civil Code, which contains norms of civil (and not labor) law, is not a normative legal act regulating labor relations.

However, courts do not always recognize that in order to transfer the authority of a manager to sign personnel documents, it is enough to issue an appropriate local regulatory act (for example, an order). Often, arbitrators require that in this case an additional power of attorney be issued to the authorized person (see Resolution of the Federal Antimonopoly Service of the Moscow District dated 01/09/04 No. KG-A41/10211-03). Although sometimes organizations still manage to defend in court personnel decisions made by an authorized person who acted only on the basis of an order (see resolution of the Federal Antimonopoly Service of the East Siberian District dated March 12, 2009 No. A19-7218/07-57-5-52-F02- 826/09).

Let's draw a conclusion. To avoid challenging and recognizing as illegal personnel decisions made by an authorized person, it is better to issue a power of attorney for him. Moreover, this does not contradict the law. After all, it is clear that an authorized person, when signing employment contracts, local acts and other personnel documents, does not act on his own behalf, but represents the interests of the employing organization. And legislative regulation of the issue of representing the interests of a legal entity before third parties is provided only by the norms of the Civil Code. Therefore, if an organization, in order to avoid risks, decides to issue a power of attorney to sign personnel documents, then when drawing it up, it is necessary to take into account the provisions of the Civil Code of the Russian Federation on power of attorney.

In the power of attorney issued to the authorized person, it is necessary to indicate exactly what actions in the “personnel department” on behalf of the organization he has the right to perform, and to establish the term of office. It is also advisable to note that the authorized person acts on behalf of the organization not as an individual, but as an employee of the organization holding a certain position. This will not allow him to abuse the granted rights in the event of dismissal, and will also limit the scope of the power of attorney to the “territory” of the organization, since information from the company’s staffing table will be needed to confirm his powers.

The wording of the power of attorney in this case may be as follows:

Limited Liability Company "Lazurit-FS" represented by Director Dmitry Anatolyevich Nikolaev, acting on the basis of the Charter, authorizes Ivan Dmitrievich Petrov (indicate passport details, date and place of birth, place of residence, etc.), holding the position of head of the department, with this power of attorney personnel of the Limited Liability Company "Lazurit-FS",...

Let's summarize. Labor legislation provides for the possibility of transferring the manager’s authority to sign personnel documents to third parties. At the same time, the Labor Code of the Russian Federation does not give a clear answer to the question of how to formalize the delegation of powers of the head of an organization, requiring only that the procedure for such delegation be fixed in local regulations or constituent documents. Judicial practice often requires additional execution of a power of attorney.

Since the authorized person in the situation under consideration represents the interests of the legal entity, and the procedure for registering such representation is fixed in the Civil Code, then in the case of delegation of authority to sign personnel documents, the power of attorney is drawn up according to the rules provided for by this code.

Maintain HR records in the web service for free

Additional rules to consider when drawing up a power of attorney

The list of powers of a director, depending on his type, may vary significantly. Features must be taken into account when preparing documentation. Thus, you may need a sample power of attorney for the right to sign for the general director. This person has the maximum list of powers. Therefore, the paper requires special elaboration.

If a power of attorney is issued from the commercial director, it contains a list of documentation that the person will have the right to sign on his behalf. The paper must be signed by senior management. If it is missing, the person will not receive the right to enter into transactions on behalf of the organization.

If the power of attorney is issued on behalf of the signatory, whose role is the executive director of a commercial company, links are provided to the constituent documentation governing the issuance of the paper. Additionally, you need to justify the need to issue a power of attorney. The form must be signed by the founder and general director. The transferred powers cannot go beyond the scope of the principal’s official duties.

Termination

A power of attorney may expire before its expiration.

Reasons for early termination of powers may include:

- drawing up a document in violation of established rules;

- lack of necessary information in the text of the power of attorney (a frequent omission is the lack of information about the principal or proxy);

- written cancellation by the principal;

- the attorney's refusal to renounce delegated powers;

- reorganization or liquidation of the organization that issued the power of attorney;

- death of the attorney or his incapacity, established in the necessary manner.

Also, a power of attorney may be declared invalid by a court decision if a controversial relationship arises between the parties.

Attention! Our qualified lawyers will assist you free of charge and around the clock on any issues. Find out more here.

Who in the company delegates their authority?

The most common situation is the transfer of part of the powers of the head of the company (director) to the chief accountant, including the right to sign.

Depending on the type of documentation, the right to confirm documents with a personal signature can be transferred to the shoulders of an accountant or deputy chief accountant, as well as a senior accountant. Such a power of attorney concerns accounting papers and is drawn up by the chief accountant of the enterprise.

The head of the organization has the legal opportunity to transfer the right to sign primary documents solely by his own decision, without taking into account the opinions of shareholders, founders or the board of directors, if their presence is provided for by the form of organization of the company. An exception can only be a clause provided for in the constituent agreement or charter.

Not only the director of the enterprise, but also the chief accountant can transfer his own power to sign accounting agreements and reporting. He can entrust this to the employee whose terms of reference include accounting.

Algorithms

The power of attorney must be drawn up in accordance with Articles 185-186 of the Civil Code. The information contained in the document should be written briefly and to the point. The presence of grammatical errors, obscene (and generally non-business) language in such documents should not take place, since this may be a reason for declaring the paper and agreements signed on its basis invalid.

Writings

A power of attorney issued to the document manager, authorizing him to sign, includes the following mandatory information:

- name of the issued paper;

- full details of the manager transferring authority (full name, position held, passport information, residential address);

- similar details of the attorney;

- specifically listed powers being transferred;

- power of attorney number;

- date of execution of the power of attorney;

- the period during which the transfer of signature rights is valid;

- signature of the principal;

- notarization note (if necessary).

Some of the necessary information is already included in the company form. You can use it to issue a power of attorney.

Forms and certifications

The basis for drawing up and executing a power of attorney for an accountant must be an order issued by the director that he authorizes one or more employees to sign the documentation. This order should be transmitted to the personnel department, which is responsible for the preparation and issuance of such papers.

Important! A power of attorney, executed and signed, is noted in a special document - the power of attorney register and then transferred to an authorized employee.

The peculiarity of the power of attorney form is that it does not have to be certified by a notary . The signature of the director of the company and the corporate seal of the organization are usually enough for the paper to be recognized as legal. You will need to contact a notary in the following cases:

- when transferring the right to sign an agreement that requires the participation of a notary;

- when transferring received powers to an attorney;

- if the enterprise does not have its own seal.

Read more about the specifics of issuing a power of attorney to sign documents on behalf of a legal entity here.

Who has the right to sign a power of attorney and when does it need to be executed?

When drawing up a document for concluding transactions on behalf of an LLC or a company that has chosen a different form of ownership, you need to be attentive to the details and thoroughly work through it. There are also certain requirements for signatures.

The head of the company and the person to whom the powers are transferred must sign the completed power of attorney. Additionally, a stamp must be affixed and the registration number of the paper must be reflected. A power of attorney is necessary so that a third party can enter into a transaction on behalf of the director, who for one reason or another cannot be present during the procedure. So, the paper can be issued in the name of his deputy.

Transfer of signature rights is necessary in the following situations:

- documents are drawn up, which must necessarily bear the signature of the manager;

- reporting is provided to government bodies;

- you need to sign contracts that for some reason must be reviewed immediately;

- it is necessary to approve the commercial proposal put forward to the company;

- required to sign documentation related to workers' compensation.

Typically, powers of attorney are issued to lawyers, heads of departments, accountants and other senior officials, taking into account their powers. The paperwork is completed by the organization's clerk or lawyer. The signature is affixed by the head of the company.

Power of attorney or order?

The question often arises: which of these two formats is better to choose for transferring authority?

Strictly speaking, the order is an internal document of the organization, and the powers granted by it apply only to its employees.

Therefore, it is advisable to choose the order format if you intend to entrust the employee with signing only internal documents. If documents will be transferred to external users (shipping notes, invoices, etc.), then it is better to use the power of attorney format.

Although, for example, from the point of view of the Tax Code, for the transfer of authority to sign invoices, these documents are equivalent (clause 6 of Article 169 of the Tax Code of the Russian Federation).

Clearly, in the format of a power of attorney, powers should be delegated to persons who are not on the company’s staff (for example, employees of an outsourcing company that provides accounting services).

How to avoid claims from your partner?

A power of attorney giving the right to sign documents is often issued in the form of a paper designed to transfer several types of powers simultaneously.

This is certainly convenient, but such a document risks raising doubts on the part of the partner. In the case when it is necessary to authorize a representative to sign invoices, acts and invoices with one power of attorney, this should be directly stated in the text of the document, listing everything point by point. This way, you will be able to avoid claims from third parties and from tax authorities filing deductions for the organization.

Do I need to have a power of attorney certified by a notary?

The law does not require mandatory certification of a power of attorney from an organization by a notary. To give the document legal force, the signature of the general director and the company seal are sufficient.

Notarization will be required when a power of attorney is issued by an individual entrepreneur, as well as in the following cases:

- if a power of attorney is issued to complete a transaction, which according to the law must go through a notary;

- when submitting applications for state registration (rights, transactions);

- if an irrevocable power of attorney is issued to the accountant.

A sample power of attorney for the chief accountant (general) can be taken as a basis when drawing up a similar document for your organization.