When organizing and maintaining accounting records, it is necessary to understand what applies to fixed and working capital.

This is due to the fact that the correctness of filling out documents and the economic side of the issue depend on understanding this. After reading this article, you will learn which funds are classified as fixed assets and which are classified as working capital and what is their difference. Fixed assets include all material and technical assets with the help of which the production process takes place. Fixed assets can only be expressed in kind, and their cost is reimbursed in equal shares during the process of use, the period of which cannot be less than one year.

Meanwhile, fixed assets are a significant and significant part of the property. Without them, it is impossible to open an enterprise, and they are the main participants in every process that results in the sale of a product or service.

- 1 Concept of fixed and current assets 1.1 Fixed assets

- 1.2 Working capital of the enterprise

Getting to know the goods and materials

The decoding of this concept combines general information about inventories and includes several types of funds, classified as follows:

• raw materials and materials;

• semi-finished products of own production in warehouses;

• purchased and finished products;

• fuel and lubricants;

• returnable waste and useful residues;

• container.

Inventory and materials are working capital, objects of labor used for business needs, consumed in the production process and increasing the cost of the manufactured product. Inventories are the most liquid (after financial assets) assets of a company. The period of effective use of materials does not exceed 1 year.

Working capital

Types of working capital

The distribution of fixed assets can occur in different ways. The individual categories included in the balance sheet are clearly distributed in accounting. Almost all real estate objects have only two sources of origin - artificial and natural. Fixed assets of enterprises are all plots of land used for production buildings or that are a source of finished products. An example of this could be the tree that the forest gives us, or the wheat that the field gives us. This category also includes subsoil and water bodies, although they are difficult to value, however, the enterprise requires initial costs to purchase some land in order to begin work.

Artificial structures have several purposes. This is commercial, residential or social real estate. Services also have their own fixed assets, usually they are the last category, which includes buildings of schools, kindergartens, libraries, shelters, and so on.

Own working capital and leased

It is clear that own funds include all material and technical assets purchased at the expense of the enterprise itself and included in the book value. For leased assets, depreciation costs are not calculated and are recorded on the balance sheet.

This issue applies to budgetary organizations.

REFERENCE! Almost all the equipment that a business has is considered leased because it cannot be used by the business at its own discretion.

Classification of an item as fixed assets and intangible assets

Quite often the question is asked whether a computer or other item is considered a fixed asset. In order to determine this, you need to answer several questions:

— has the computer/item been used for more than a year?

- Is he directly involved in the production process?

- is it used completely in the production cycle, is it processed or modified, does it change shape to produce the final product?

The answer to the first question is assumed to be positive. It is logical that the enterprise will use the computer for more than a year. Its cost will be distributed evenly in the form of depreciation over the entire period of intended use. The answers to the second and third questions in the case of a computer will be negative, which means that the computer is not a working capital. From all this it follows that the PC should be classified as a capital fund.

REFERENCE! By following the above scheme, one can determine whether any item is classified as a fixed asset or not.

Inventory accounting

Like all assets, inventories must be accounted for, and for this purpose several balance sheet accounts are provided and a number of unified primary documents and synthetic accounting registers have been developed. In the balance sheet, inventory items are accumulated in the second section “Current assets”. It reflects the balance of inventories in monetary terms at the beginning and end of the reporting period.

Information about the availability of inventories in the balance sheet is the final result of the accounting work carried out, information about the dynamics of the movement of materials is reflected in primary documents and generalized registers - order journals and materials accounting sheets.

Why is the methodology for analyzing the state of warehouse material resources used?

Analysis of the state of material inventories is one of the most important areas of activity of the enterprise employees responsible for working with these resources . It can be carried out, for example, in order to determine the company's need for these reserves.

You can learn more about the analysis of inventories in the article “Methodology for analyzing inventories.”

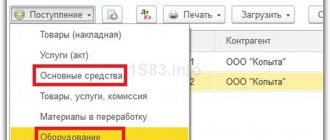

Admission

Receipt of inventory materials is usually carried out as follows:

• purchase for a fee from supplier companies;

• mutual exchange in barter transactions;

• free supply from the founders or higher organizations;

• posting of products produced in-house;

• receipt of useful residues during the dismantling of obsolete equipment, machines or other property.

Any receipt of supplies is documented. For valuables purchased from suppliers using invoices and invoices, a receipt order f is made in the storeroom. No. M-4. It becomes the basis for entering information about the quantity and cost of inventories into the warehouse accounting card f. No. M-17.

When making deliveries without an accompanying invoice or identifying differences in the cost or quantity of materials actually received with information in the documents, an acceptance certificate f. No. M-7. It is compiled by a special authorized commission, which receives materials based on actual availability and discount prices. The total surplus is subsequently reflected as an increase in debt to the supplier company, and the identified shortage of goods and materials is the reason for filing a claim against it.

Receipt of materials by the forwarder or other representative of the recipient company at the supplier's warehouse is formalized by issuing a power of attorney f. No. M-2 or M-2a - a document authorizing the receipt of goods and materials on behalf of the enterprise. For the arrival of materials of one's own production in the storeroom, a requirement-invoice f. No. M-11.

Useful residues coming from the dismantling of production equipment, buildings or other assets are included in the warehouse according to the act f. No. M-35, which indicates the object of dismantling, quantity, price and cost of incoming returnable waste.

Fixed assets: new concepts, features, accounting units

Information message dated November 3, 2020 No. IS-accounting-29

The Russian Ministry of Finance informed about changes that will occur in the near future in the accounting of fixed assets.

Innovations are associated with the adoption of FAS 6/2020 “Fixed assets”

(approved by order of the Ministry of Finance of Russia dated September 17, 2020 No. 204n). As soon as this document appeared, we already wrote briefly about it. The new standard replaces PBU 6/01 “Accounting for fixed assets” (approved by order of the Ministry of Finance of Russia dated March 30, 2001 No. 26n), which has faithfully served the accounting community for almost twenty years.

Now, as promised, we are starting to publish a number of materials reflecting the essence of the innovations introduced by the new standard. In this commentary we talk about the introduction into accounting of new concepts and features that characterize fixed assets

.

As follows from the message of the financial department IS-accounting-29, the new standard FSBU 6/2020 was developed on the basis of IFRS (IAS) 16 “Fixed Assets”, put into effect on the territory of the Russian Federation by order of the Ministry of Finance of Russia dated December 28, 2015 No. 217n. Thus, Russian accounting rules are becoming closer to international requirements, which will make it easier for users of financial statements to obtain information about the organization’s investments in fixed assets and changes in such investments.

Features characterizing fixed assets

As follows from paragraph 4 of FAS 6/2020, an asset can be recognized as an item of fixed assets if it simultaneously meets the following characteristics

:

- has a material form;

- is intended for use by the organization: in the course of normal activities

in the production and (or) sale of its products (goods), when performing work or providing services, for environmental protection, for provision for temporary use for a fee, for management needs, or for use in activities of a non-profit organization aimed at achieving the goals for which it was created; - for a period exceeding 12 months

or a normal operating cycle exceeding 12 months;

(income) to the organization in the future (to ensure that the non-profit organization achieves the goals for which it was created).

As you can see, in comparison with PBU 6/01, the number of conditions when classifying an asset as a fixed asset remains the same (four). In FSBU 6/2020, instead of the condition “the organization does not intend to resell this object” (subclause “c” of paragraph 4 of PBU 6/01), the sign “has a tangible

Changes in the approach to accounting for low-value assets

The current PBU 6/01 (paragraph 4, clause 5) allows organizations to include individual assets that meet the conditions for classifying them as fixed assets in inventories. At the same time, the economic entity in its accounting policy sets a maximum value limit - no more than 40,000 rubles.

We are talking

about low-value assets that have characteristics of fixed assets, but which may not be accounted for as fixed assets.

FAS 6/2020 establishes a general approach to determining low-value assets: objects are considered for accounting purposes as low-value based on the materiality of information about them.

Organizations are asked to independently set an asset value limit

, corresponding to the given criteria for classifying it as a fixed asset, but which will not be recognized as such, but

will be a low-value asset

. In other words, the new conditions for recognizing an asset as a fixed asset differ from the previous ones in that:

- there is no regulatory cost limitation;

- costs for the acquisition and creation of such assets are recognized as expenses of the period in which they are incurred.

At the same time, the organization is obliged to ensure proper control of the presence and movement of low-value assets in its accounting.

The decision on the accepted conditions for classifying assets as fixed assets is subject to disclosure in the accounting (financial) statements indicating the established value limit.

Exclusion from FAS 6/2020 of long-term assets and capital investments

Long-term assets for sale and capital investments are excluded from the scope of application of FAS 6/2020

.

Previously, long-term assets available for sale were accounted for as part of property, plant and equipment.

From 2021, this type of assets is accounted for in accordance with the Accounting Regulations PBU 16/02 “Information on Discontinued Operations” (approved by Order of the Ministry of Finance of Russia dated July 2, 2002 No. 66n (as amended by Order of the Ministry of Finance of Russia dated April 5, 2019 No. 54n)) . For information,

an entity classifies an item of property, plant and equipment as held for sale if its carrying amount will be recovered primarily through sale rather than through continuing use. In this case, the following criteria must be met at the same time:

- the item must be available for immediate sale in its current condition;

- the sale of the object is planned exclusively on the usual conditions for the sale of such objects;

- the sale of the asset is highly probable (there are active measures on the part of the organization to find a buyer and implement the sale plan, active actions to sell the asset at a price that is reasonable);

- there is an expectation that the sale of the item will be completed within one year from the date of classification, except as required by IFRS 5;

- The actions required to carry out the plan to sell the property must indicate that significant changes to the plan or its cancellation are unlikely.

At one time, such advice was given by the NRBU “BMC” fund in recommendation R-84/2017-KpR “Reclassification of fixed assets into assets for sale”.

As we have already noted, FAS 6/2020 does not apply to capital investments

.

For such assets, our own standard FSBU 26/2020

, details of which we will also publish in the near future.

Determination of useful life

As before, the organization must determine the useful life for each fixed asset.

Under useful life

fixed asset refers to the period during which the use of the object will bring economic benefits to the organization. For individual fixed assets, the useful life is determined based on the amount of production (volume of work in physical terms) that an economic entity expects to receive from the use of the object.

The starting point for determining the useful life of a fixed asset can be:

- the expected period of operation,

taking into account productivity or capacity, regulatory, contractual and other operating restrictions, and the intentions of the organization's management regarding the use of the facility; - expected physical wear and tear

, taking into account the operating mode (number of shifts), repair system, natural conditions, the influence of an aggressive environment and other similar factors; - expected obsolescence

, in particular as a result of changes or improvements in the production process or as a result of changes in market demand for products or services produced by fixed assets; - plan for the replacement of fixed assets

, modernization, reconstruction, technical re-equipment.

Accounting unit details

The unit of accounting for fixed assets is an inventory object.

As in PBU 6/01,

an inventory item of fixed assets is recognized as

:

- object

with all fixtures and fittings; - a separate structurally isolated object

designed to perform certain independent functions; - a separate complex of structurally articulated objects

, representing a single whole and intended to perform a specific job.

Definition : “a complex of structurally articulated objects”

repeats the concept given in PBU 6/01.

This is considered to be one or more objects of the same or different purposes

, having common devices and accessories, common control, mounted on the same foundation, as a result of which each object included in the complex can perform its functions only as part of the complex, and not independently.

FSBU 6/2020 retains the possibility of recognizing each part of a fixed asset as an independent inventory item if the cost and useful life of each part differ significantly from the cost and useful life of the object as a whole.

At the same time, FSBU 6/2020 supplemented the procedure for determining possible inventory items. Inventory objects can be significant in size costs of the organization for repairs, technical inspection, maintenance of fixed assets

. Provided that the listed work is carried out with a frequency of more than 12 months or a more normal operating cycle of more than 12 months.

The new standard invites organizations to classify fixed assets

:

- by type

(for example, real estate, machinery and equipment, vehicles, industrial and household equipment); - groups (a group is considered to be a set of fixed assets of the same type, combined based on the similar nature of their use).

A separate group is formed by fixed assets, which are real estate intended to be provided for a fee for temporary use and (or) to receive income from an increase in its value. This is investment property (fixed assets other than investment property). In connection with the introduction of the concept of “investment real estate”, the concept of “profitable investments in material assets” is not used in relation to fixed assets.

To be continued

Features of pricing in materials accounting

The completed documents for the receipt of goods and materials are transferred to the accountant who maintains the relevant records. The accounting policy of the enterprise accepts one of two existing options for cost accounting of inventories. They can be accounted for at actual or accounting prices.

Actual prices of inventory items are the amounts paid to suppliers in accordance with concluded agreements, reduced by the value of refundable taxes, but including payment of costs associated with the purchase. This accounting method is used mainly by companies with a small range of inventories.

Accounting prices are set by the enterprise independently in order to simplify cost accounting. This method is preferable if there are many types of values in the enterprise. Let's look at the differences between prices using the examples given.

What is the difference between fixed assets and inventories - in essence and lines in the balance sheet

The assets in question should be distinguished from fixed assets. The latter are represented by the following assets (clause 4 of PBU 6/01):

- intended for use in the production of goods, works, services, for the management needs of the company or for rental by the company;

- intended for use for a period exceeding 12 months;

- not originally intended for subsequent resale;

- capable of bringing economic benefits to the company in the future.

In general, fixed assets are values that are used as means of labor, which are used for the purpose of processing material reserves or using them as a finished surplus product.

Inventory and fixed assets are reflected in different lines of the balance sheet. The asset of the first type is in line 1210, the second is in line 1150.

Discount prices

This method involves the use of balance sheet account No. 15 “Procurement/purchase of inventory items”, the debit of which should reflect the actual costs of purchasing inventories, and the credit their accounting price.

The difference between these amounts is debited from the account. 15 on account No. 16 “Deviations in the cost of inventory items.” Total differences are written off (or reversed in case of negative values) to the main production accounts. When selling inventories, differences from the variance account are reflected in the debit of the account. 91/2 “Other expenses”.

Example No. 2

PJSC Antey purchased paper for work - 50 packages. In the supplier's invoice, the purchase price is RUB 6,195. with VAT, i.e. the price of 1 package is 105 rubles, with VAT – 123.9 rubles.

D 60 K 51 – 6,195 rub. (paying the bill). D 10 K 15 – 5,000 rub. (posting of paper at book price). D 15 K 60 – 6,195 rub. (the actual price is fixed). D 19 K 60 – 945 rub. (“input” VAT).

The accounting value was 5,000 rubles, the actual value was 5,250 rubles, which means:

D 16 K 15 – 250 rub. (the amount of excess of the actual price over the book price is written off).

D 26 K 10 – 5,250 rub. (the cost of paper transferred to production is written off).

At the end of the month, deviations taken into account in the debit of the account. 16, are written off to cost accounts:

D 26 K 16 – 250 rub.

Storage of goods and materials

Stored assets are not always reflected on balance sheet accounts as acquired. Sometimes a company's storerooms contain materials that do not belong to the company. This happens when warehouse space is rented out to other enterprises or goods and materials belonging to other companies are accepted for safekeeping, i.e. they are only responsible for the safety class=”aligncenter” width=”700″ height=”466″[/img]Such materials do not participate in the production process of the organization and are recorded on the balance sheet in account 002 “Inventory and materials accepted for safekeeping.”

The transfer of goods and materials for safekeeping is formalized by drawing up appropriate agreements that fix all the main terms of the contract: terms, cost, circumstances.

Disposal of inventory items

The movement of materials is a normal production process: they are regularly released for processing, transferred for their own needs, sold or written off in the event of emergencies. The release of supplies from the storeroom is also documented. Disposal accounting documents are different. For example, the transfer of limited materials is formalized with a limit-fence card (form M-8). When consumption rates are not established, the supply is made upon request - invoice f. M-11. The sale is accompanied by the issuance of an invoice f. M-15 for release of goods and materials to the side.

Order size optimization involves determining inventory requirements

This area of analysis deals with the calculation of the standard indicator of the company’s need for certain material reserves - so as to optimize their purchases in the required volume when ordering from suppliers. In this case, the task of responsible specialists comes down to finding such a quantity of reserves that, on the one hand, is sufficient to maintain the production process, and on the other hand, is not too much in terms of the cost of their acquisition and maintenance.

Thus, in most enterprises, determining the standard for inventory is a necessary part of analyzing the state of inventories, coupled with determining the factors influencing their volume.

Valuation of inventory items during release

When releasing inventories into production, as well as during other disposals, inventory items are assessed using one of the methods, which is necessarily stipulated by the company's accounting policy. They are applied for each group of materials, and one method is valid for one financial year.

Inventory materials are assessed by:

• cost of one unit;

• FIFO, i.e. at the price of the first materials at the time of acquisition.

The first of these methods is used for inventories used by companies in an unusual manner, for example, when producing products from precious metals, or with a small range of groups of materials.

The most common method is to calculate the price using the average cost. The algorithm is as follows: the total cost of a type or group of materials is divided by the quantity. The calculation takes into account inventory balances (quantity/amount) at the beginning of the month and their receipt, i.e. such calculations are updated monthly.

In the FIFO method, the cost of materials upon disposal is equal to the value of the acquisition price at an earlier date. This method is most effective if prices rise and loses relevance if the emerging situation provokes a fall in prices.

Rationing the consumption of inventories of material resources and factors influencing the amount of inventories

In terms of assessing the need for them, inventories can be classified on various grounds. Thus, a common approach is to divide reserves:

- for those that are necessary to ensure an assortment of goods or stable shipment of finished products under contracts (they are, as a rule, the least in volume);

- for those that are necessary to maintain the full production cycle (usually they are second in volume);

- for those needed to maintain production between deliveries of inventory from suppliers (it is assumed that there will be the most of them);

- for insurance - which are applied in the event of a supply interruption or an increase in the need for supplies not provided for by calculations (as a rule, they are about 10% of those that belong to the previous category).

For each of these reserves, the optimal and, as a result, standard indicator of duration or volume is considered based on factors such as:

- dynamics of consumption of inventories (in relation, for example, to the dynamics of demand for manufactured goods);

- frequency of deliveries of materials from the supplier, completeness of deliveries;

- range of products.

Accounting entries for disposal of inventory items

D 20 (23, 29) K 10 – transfer to production. D 08 K 10 – leave for self-construction. D 91 K 10 – write-off upon sale or gratuitous transfer.

Analytical accounting of inventory items is organized in storage areas, i.e. in storerooms, and represents the mandatory maintenance of accounting cards for each item of materials. The responsible persons are storekeepers, and the controllers are accounting workers. At the end of the month, the storekeeper displays the balances of inventory items on cards, which indicate the movement, beginning and ending balances, the accountant checks them with the documents and certifies the accuracy of the storekeeper's calculations with a signature in a special column of the card.

Inventory assets: what is it in accounting

To begin with, let's understand such concepts as inventory (material assets) and inventories (MPI). In general, these terms are used interchangeably. Is this true and what does it contain?

Currently, the concept of inventory has become more widespread, if only because it is used in the terminology of the current PBU 5/01 “Accounting for inventory”, approved by order of the Ministry of Finance of Russia dated 06/09/2001 No. 44n. According to clause 2, the MPZ includes:

- raw materials;

- goods;

- finished products;

- assets used for management needs.

We also note that clause 4 of PBU 5/01 does not include work in progress as part of the inventory.

The concept of inventory items is rarely found in legislative acts on accounting. Firstly, it can be found in the title of off-balance sheet account 002 “Inventory and materials accepted for safekeeping.” It follows from the meaning of the name of the account that inventory items are directly goods and materials, because only they can come from suppliers when it comes to current assets. Secondly, in paragraph 3.15 of the Methodological Guidelines for Inventory of Property and Financial Liabilities, approved by Order of the Ministry of Finance of the Russian Federation dated June 13, 1995 No. 49, it is deciphered that inventory and materials include industrial inventories, finished products, goods, and other inventories. In addition, work in progress is separated into a separate section of the Methodological Instructions from inventory items. On the question of whether work-in-progress is included in inventory and materials, we suggest that you familiarize yourself with the Methodological guidelines for accounting of inventories, approved by order of the Ministry of Finance of the Russian Federation dated December 28, 2001 No. 119n, namely their paragraph 258, which talks about the inventory of inventories inventory within the manager's shift. warehouse or storekeeper who is not known to be responsible for work in progress.

We raised the issue of including unfinished inventory in goods and materials in connection with the definition given in the Modern Economic Dictionary (Raizberg B.A., Lozovsky L.Sh., Starodubtseva E.B.): “inventory assets are a statistical indicator reflecting a certain date the cost of inventory, which includes inventories, work in progress, balances of finished products.” In our opinion, within the framework of accounting, the concept of inventory items is limited to the same list of components that are approved for inventories in PBU 5/01.

Fixed assets: differences in write-off rules and changes in accounting policies

The usual reasons for us (as well as according to the current PBU 6/01) for writing off fixed assets are

(clause 40 FSBU 6/2020):

- termination of use of the object due to its physical or moral wear and tear with no prospects for sale or resumption of use;

- transfer of an object to another person in connection with the sale of such an object, exchange, transfer in the form of a contribution to the capital of another organization, transfer to a non-profit organization;

- physical disposal of an object due to its loss, natural disaster, fire, accident and other emergency situations.

An item of fixed assets may be disposed of due to its transfer to a non-operating (financial) lease. The lessor classifies an item of property, plant and equipment as an item of non-operating (financial) lease accounting if the economic benefits and risks associated with the lessor's ownership of the leased item are transferred to the lessee. This is established by paragraph 25 of FSBU 25/2018 (approved by order of the Ministry of Finance of Russia dated October 16, 2018 No. 208n). This standard (as well as FSBU 6/2020) is mandatory for use from 2022. But an organization may decide to apply FAS 25/2018 earlier than the specified deadline. Such a decision must be disclosed in the accounting (financial) statements of the organization.

The disposal of property in connection with the transfer to a non-operating (financial) lease as an investment is recognized by the lessor as an asset. The lessor reflects interest on such an investment during the term of the contract in income. Rental payments are not included in income.

The transfer of an object to a non-operating (financial) lease in accounting is reflected by the following entries:

Debit 01 subaccount “Retirement of fixed assets” Credit account 01 subaccount “Fixed assets in operation”

– the initial cost of the leased fixed asset is written off;

Debit 02 Credit 01 subaccount “Disposal of fixed assets”

– accrued depreciation is written off;

Debit 76 subaccount “Calculations for rental income” Credit 01 subaccount “Disposal of fixed assets”

– the fair value* of a fixed asset recognized as an asset (rental investment) is written off;

Debit 01 subaccount “Disposal of fixed assets” Credit 91 subaccount “Other income”

– included in other income is the excess of the fair value* of a fixed asset over its residual value.

If the residual value of a fixed asset exceeds its fair value, the difference is included in other expenses:

Debit 91 subaccount “Other expenses” Credit 01 subaccount “Disposal of fixed assets”

– included in other expenses is the excess of the residual value of a fixed asset over its fair value*.

__________________________________

* The amount for which an asset can be exchanged or a liability can be repaid in a transaction between knowledgeable independent parties willing to complete such a transaction (Appendix A of IFRS 16 “Lease” (introduced by Order of the Ministry of Finance of Russia dated June 11, 2016 No. 111n)).

Among the reasons for writing off fixed assets, FAS 6/2020 additionally (compared to the current PBU 6/01) includes:

- expiration of normatively permissible periods or other maximum parameters for the operation of this object, as a result of which its use by the organization becomes impossible;

- termination by the organization of the activity in which this object was used, in the absence of the possibility of its use in continuing activities.

A fixed asset should be written off in the reporting period in which it is disposed of or becomes unable to bring economic benefits to the organization in the future (clause 41 of FSBU 6/2020). When writing off, the amounts of accumulated depreciation and accumulated impairment for a given object are included in the reduction of its original cost (revalued value) (clause 42 of FSBU 6/2020).

FSBU 6/2020 (clause 43) outlines the rule for accounting for the costs of dismantling, recycling of fixed assets and environmental restoration. Such costs are recognized as expenses of the period in which they were incurred,

unless a provision has previously been recognized for these costs.

The difference between the proceeds from the disposal of a fixed asset, the total book value of the written-off item and the costs of its disposal is recognized as income or expense in the profit (loss) of the period in which such write-off occurs.

Disclosure of information in reporting

Paragraph 45 of FSBU 6/2020 provides a list of information that must be disclosed, taking into account materiality, in the accounting (financial) statements. The list has been expanded compared to the list given in paragraph 32 of PBU 6/01. The disclosed information includes, in particular:

- book value of fixed assets and investment property at the beginning and end of the reporting period

- reconciliation of fixed asset balances by groups in terms of original (revalued) cost, accumulated depreciation, accumulated depreciation at the beginning and end of the reporting period and movement of fixed assets for the reporting period (receipt, disposal, reclassification into long-term assets for sale, change in value as a result of revaluation, depreciation, impairment, other changes);

- book value of depreciable and non-depreciable fixed assets;

- the result of disposal of fixed assets for the reporting period;

- methods of assessing fixed assets (by groups);

- elements of depreciation of fixed assets and their changes.

For fixed assets valued on a revalued basis, in addition to the disclosures specified in paragraph 45 of the standard, the following must be disclosed:

- date of the last revaluation of fixed assets;

- the fact of engaging an independent appraiser to carry out the revaluation;

- methods and assumptions adopted in determining the fair value of property, plant and equipment, including information on the use of observable market prices;

- the book value of the revalued groups of fixed assets, which would be reflected in the accounting (financial) statements if they were assessed at their historical cost, as of the reporting date;

- methods for recalculating the initial cost of revalued groups of fixed assets;

- the amount of accumulated revaluation of fixed assets not written off to retained earnings, indicating the method of its write-off to retained earnings.

An entity also needs to disclose information about impairment of property, plant and equipment as required by IAS 36 Impairment of Assets.

Change in accounting policy

Key questions when choosing accounting methods for inventory items

There are several key issues regarding the choice of accounting methods for inventory items that need to be fixed in the accounting policy. Firstly, at what cost will the inventory and materials be charged: immediately at actual prices or using accounting prices (subclause 80, 204 of the Methodological Instructions, order of the Ministry of Finance of the Russian Federation dated December 28, 2001 No. 119n).

Read about the use of accounts 15 and 16 when reflecting inventories at accounting prices in the article “Account 10 in accounting (nuances).”

Secondly, it is necessary to determine the way to include transportation and procurement costs in the cost of material assets.

All methods are discussed in detail in the article “How to take into account TRP in accounting (nuances)?”

In addition, there are 3 options for writing off inventories as expenses.

For more details on the methods of writing off materials, which are also applicable to other inventories, read the article “The procedure for writing off materials in accounting (nuances).”

It is also necessary to establish a method for writing off expenses for the purchase, storage and sale of inventories in non-trading organizations: monthly in full or in proportion to the goods sold (subclauses 227-228 of the Methodological Instructions, order of the Ministry of Finance of the Russian Federation dated December 28, 2001 No. 119n).

All methods of accounting for inventories are discussed in PBU 5/01 and Methodological Instructions approved by Order of the Ministry of Finance of the Russian Federation dated December 28, 2001 No. 119n.

How are inventories accounted for in account 10?

All legal entities are required to keep accounting records of material inventories - this is a mandatory requirement for their business activities (Clause 1, Article 2 of the Law “On Accounting” dated December 6, 2011 No. 402-FZ). In this case, business transactions reflecting the turnover of inventories are recorded on account 10 of the Chart of Accounts. Various sub-accounts are opened for it (for raw materials, fuel, containers, etc.). The corresponding business transactions are registered using supporting documents (invoices, orders, acts, etc.).

Regulations for accounting of material assets at an enterprise

The development of internal regulations is an important point for the effective establishment of processes at the enterprise, the implementation and compliance of internal controls, as well as the prevention of shortages and errors in accounting data. Note that the inventory accounting regulations describe the procedure for employees and document flow to complete a certain operation. And what accounting methods were chosen is described in the accounting policy; in addition, separate clarifying internal acts are possible. Let us describe the main points that can be disclosed in the regulations for accounting for inventories:

- Receipt of goods and materials at the warehouse:

- placing an order/purchase application;

- checking the order for compliance with the budget, plan or other standards;

- order approval;

- acceptance of inventories to the warehouse by the warehouseman, including a description of the process of checking incoming documents from contractors, the purchased inventories themselves;

- reflection by the storekeeper of data in the warehouse accounting system;

- transfer of primary documents to the accounting department;

- reconciliation of warehouse and accounting records;

- identification of shortages, uninvoiced supplies, etc.

- Release of materials from warehouse to production:

- filling out a request for a warehouse;

- approval of this request;

- registration of internal movement;

- reconciliation of warehouse accounting, workshop accounting and accounting data;

- accounting for the movement of materials in accounting.

- Acceptance of finished products to the warehouse.

- Shipment of finished products from the warehouse:

- execution of an agreement with the buyer;

- receiving an order from the buyer and approving it;

- preparation of primary documents for shipment;

- reflection by the warehouseman of shipment data in the warehouse accounting system;

- actions of the security service when exporting finished products from the territory of the enterprise;

- control of payment for finished products, etc.

Increase in the cost of inventory (which is included in account 340 of budget accounting)

The term “increase in the value of inventories” can be considered in several aspects. Thus, in budget accounting, it is understood as the fact that expenses for payment of contracts for the purchase of inventories are allocated to the article code KOSGU 340 (Order of the Ministry of Finance of Russia dated July 1, 2013 No. 65n).

The corresponding code for KOSGU is used by government, budgetary institutions, as well as organizations that have the authority to receive budgetary funds. It records the expenses of a state or municipal organization for the purchase or production of materials and equipment. They can be represented by objects such as:

- medicines and medical equipment,

- Food,

- fuel,

- building materials,

- furniture,

- spare parts,

- special equipment for research,

- stern.

In commercial accounting, an increase in the cost of inventories is understood as the fact of writing off certain expenses associated with the purchase of inventories to increase their value. Each such write-off is recorded as a separate entry.