Author of the article: Yulia Kaysina Last modified: January 2021 24151

Sometimes an employment contract is terminated due to circumstances beyond the wishes and intentions of the parties. They are listed in Art. 83 of the Labor Code of the Russian Federation. Among them, item 6 indicates the death of an employee. This happens relatively rarely, so personnel officers have questions about how to correctly formalize dismissal in connection with the death of an employee, what date to put in the documents and to whom to transfer the wages due to the deceased.

Options for employee death

The Labor Code of the Russian Federation clearly defines the algorithm of actions in such situations.

When completing all the necessary documents, you must refer to Article 83 “Dismissal due to the death of an employee”, Part 1 of the Labor Code of the Russian Federation. And yet, before we talk in detail about the stages of dismissal, we suggest that you familiarize yourself with all possible situations of death.

- an employee dies not at work, but in his free time (at home, on vacation, etc.);

- an employee dies at work or on a business trip while fulfilling official obligations.

If the event occurs during non-working hours, then the cause of death is determined without the participation of the enterprise management. In this case, the relatives, after receiving the death certificate, bring it to the place of work of the deceased, where the standard procedure for dismissing the deceased is carried out, in accordance with the Labor Code of the Russian Federation.

If the death occurs at work, then in any case an investigation of the accident is ordered, during which they can confirm the non-involvement of the manager, or bring him to justice.

The death of an employee on a business trip is the most difficult case, in which an investigation is also ordered to establish under what circumstances the employee died (during working or free time). Based on its results, the manager may be required to pay monetary compensation to the family of the deceased.

What number should I use for payment?

According to Art. 84.1 of the Labor Code of the Russian Federation, the day of dismissal of an employee is considered his last day of work. However, the day of termination of the contract with a deceased employee is the day of his death, established by the death certificate, or the day a court decision to recognize such a person as missing or deceased enters into legal force.

It is incorrect to talk about the dismissal of a deceased employee. Therefore, the order only talks about the date of termination of the employment contract.

In practice, relatives of the deceased do not always notify the administration of the enterprise (company) about the death of an employee. If such a situation arises, the employer gives the employee absenteeism.

After two absences have been recorded, the employer can legally dismiss the employee. However, if the employee died, such actions of the official are considered a violation of labor rights. Therefore, the employer should find out the reasons for the employee’s temporary absence from his workplace, and then make the necessary personnel decisions. Information about the death of a citizen can be obtained from the police .

If an employer decides to fire an employee for absenteeism because he cannot contact relatives and obtain information about the death, the documents must be completed correctly - send a letter to the employee inviting him to provide an explanation for his absence from work and record the fact that the letter was sent.

Death of an employee: registration of dismissal

How to fire a deceased employee? As with dismissal for any other reason, when dismissal due to the death of an employee, a corresponding order is issued (Article 84.1 of the Labor Code of the Russian Federation).

This is also important to know:

How to calculate average daily earnings upon dismissal: formulas and basic calculation rules

The document serving as the basis for issuing such an order is the employee’s death certificate.

Usually the order is issued on the same day that the employer is presented with this certificate. But what date of dismissal due to death should I indicate in the order?

Drawing up a dismissal order

The dismissal order must be drawn up in a certain unified form (T-8). It is inappropriate to use the word “dismiss” in such an order. It is better to formulate this as “terminate the employment relationship” and indicate the reason (in connection with death).

The “Date” field indicates the day on which the relatives provided the death certificate.

It is imperative to refer to clause 4.2 of Article 83 of the Labor Code of the Russian Federation. The date of dismissal of an employee is the date of his death.

The last line “I have read the order” remains blank, because the employee cannot do this, and relatives should not do this.

Step-by-step instructions for dismissal due to the death of an employee

If an employee of an organization passes away, the dismissal process is carried out in accordance with the standard scheme. It looks like this:

- Relatives report the incident and provide supporting documentation. Representatives of the company must copy it and draw up an appropriate order.

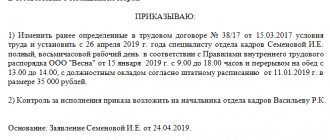

- The HR specialist prepares the order. It records the employee’s personal data. You can specify the specialist’s personnel number. Additionally, you must indicate the reason for dismissal. A copy of the document confirming the death of the specialist must be attached to the order.

- A notice of dismissal is filled out. It must clearly contain the number when cooperation with the specialist is terminated. The number must match the date of death. This rule applies even if the death certificate was provided on a different day. This is true when a person is listed as absent from the organization. Additionally, you need to indicate the name of the paper that serves as the basis for dismissal. The line that is supposed to confirm familiarization with the order remains blank.

- The order is transmitted to the head of the enterprise. A wet stamp is placed on it. The paper is then recorded in a journal.

- A settlement certificate is being issued. It must be completed by two specialists. One of them is an employee of the HR department, who must indicate the details of the organization, information about vacations used, the personal data of the specialist and the actual period of time worked. The information is necessary to perform accounting calculations. The second part of the certificate is filled out by an accountant. The specialist calculates the required payments based on the data provided by the personnel service.

- A citizen’s personal card is being issued. To close it, you must make a record of dismissal. No additional data required.

- An entry is made in the work book. The law obliges the head of the organization to state the fact of termination of the employment contract and the basis for the decision. All entries made are certified by the employer or other responsible person. Additionally, the organization's seal is affixed. The column intended for the employee’s signature is not filled in.

Additionally, you need to make an entry in the accounting book. When filling out the documentation is completed, the work book is provided to the relatives of the deceased.

Termination of contract with the deceased

The death of an employee is an unforeseen event that allows the manager to fire the person. This situation has some features due to its specificity.

First of all, this is due to the fact that the employee is physically absent. For this reason, it is impossible to require him to perform any actions, for example, to familiarize himself with the order, receive a personal work book or final payment.

Relatives, family members, as well as those who were dependent on the deceased, can count on receiving the deceased’s earnings and his documents. That is, persons who are not in an employment relationship with the company will be involved in the implementation of the procedure. Accordingly, those interested will need to provide supporting documentation confirming their rights.

It should be noted that this situation applies not only to cases where a person has actually died, but also if he is recognized as such by a court decision. The reason and place of death also do not matter.

Documentation

Relatives who apply for payments and have expressed a desire to pick up the work book of the deceased must have the following documents with them:

- Death certificate from the registry office + its copy;

- A court decision or act confirming the accident (in case of death at work);

- Original documents and its copies (passport) of the person who will receive payments and work record book;

- Sick leave (if death occurred during illness);

- Invoices or receipts confirming funeral expenses (if relatives are claiming benefits);

- Applications drawn up in any form for payment of the balance of wages, financial assistance, compensation, etc.

Grounds for dismissal

The regulatory documents clearly state that a manager cannot independently dismiss an employee without documents confirming the person’s death. These are:

- Death certificate from the registry office;

- A court decision in which a citizen is declared dead;

- A court decision in which a citizen is declared missing.

If relatives call the company and verbally convey the sad news, or the police report the incident, the manager does not have the right to terminate the employment relationship with the employee without the presence of the above documents. This also applies to certificates from medical institutions.

Relatives can provide a death certificate. If there are none, then the employer can independently contact the registry office to obtain a certificate.

A person is declared dead by a court decision if:

- law enforcement agencies have a statement from relatives that they do not know anything about the whereabouts of the citizen for 1 year;

- there is no information about the citizen at the place of residence or registration for more than 5 years;

- a person found himself in conditions that threatened his life. In this case, by a court decision, the person is declared dead after six months.

You can appeal this decision only within 1 month after it comes into force. After this period, his appeal becomes impossible.

No one has the right to fire an employee without a court decision or a death certificate. Another employee can occupy the position, but his employment must be temporary. That is, without documents confirming the death of an employee, his job is retained.

Dismissal of an employee due to death

As a general rule, when dismissing an employee, he must familiarize himself with the dismissal order against signature (Article 84.1 of the Labor Code of the Russian Federation). But in this situation, the employee himself will no longer be able to sign, and the employer should not familiarize the relatives of the deceased employee with the order, for example. Accordingly, only the employer will sign the order of dismissal upon death of an employee.

Free legal consultation

We will answer your question in 5 minutes!

Free legal consultation We will answer your question in 5 minutes!

Ask a Question

Ask a Question

This is also important to know:

How does redundancy happen?

Looking ahead, we note that the signature of relatives will not be needed on other personnel documents (work book, personal card).

How to properly fire a deceased employee

The procedure for dismissing an employee due to death is determined by labor legislation (Labor Code of the Russian Federation). In particular, the death of an employed citizen is grounds for termination of the contract in accordance with the dismissal article, clause 6, part 1 of Art. 83 Labor Code of the Russian Federation.

Upon dismissal due to the death of an employee, in accordance with Art. 84.1, an order must be issued. If, as a general rule, a resigning person must read and sign the administrative document, then there is no one to sign the order of dismissal due to death, which means this obligation is removed from the employer, and the documents will only contain the signature of the head of the organization.

A similar rule applies to the preparation of other types of documents - work book, card, etc.

Since it is impossible to obtain an application from the employee or his written consent to dismissal, the basis for formalizing the termination of the employment relationship will be an official notification of the fact of death:

- Certificate from the civil registry office.

- Court ruling recognizing the status of “deceased”.

If the employee did not have relatives, the employer himself is responsible for obtaining these documents, and if there is a family, the responsibility falls on the shoulders of the relatives.

The scheme of actions for terminating an employment contract, with some adjustments, corresponds to the general procedure:

- Issuance of an internal order.

- Making entries in the work book and personal card.

- Preparation of the final calculation.

- Issuance of personal papers and settlement documents to any of the immediate relatives who first contacted the management of the enterprise.

The legislation does not establish a special procedure for determining to whom exactly and in what proportions money should be paid for the deceased. Potential applicants for the inheritance, who apply after the final settlement with the employer, independently decide on the issue of collecting part of the funds if there are legal grounds for legal challenge. The employer is relieved of the obligation to resolve issues of distribution of payments between applicants.

What date is the order issued?

In order for dismissal to be carried out due to the death of an employee, there must be documentary evidence of the fact of death. The paper is drawn up and provided by the authorized government body. Having received news from the words of other citizens, you should not immediately issue an order. It is mandatory to request a death certificate. Based on this, an order is subsequently issued. If the dismissal process due to the death of an employee was completed without documentation, this will be considered a violation.

The date of dismissal is the date of death of the employee. The order must be issued upon receipt of the supporting certificate. If the event falls on a holiday or weekend, this does not eliminate the need to issue an order. If we set the dismissal date to the moment the certificate is provided, it turns out that the employee continued to work after death.

A similar dismissal procedure is followed in a situation where a person is declared dead. Such a decision is made in court in relation to an untimely absent citizen and disappeared people in conditions that threaten their lives.

Regulatory framework and documents confirming death

Legal relations between employees and their employers are in most cases terminated at the initiative of one of the parties or by mutual agreement.

However, there are circumstances in which the contract must be terminated for reasons beyond the control of the parties. The death of an employee is one such reason. Moreover, labor relations have such specificity that even if an employee is declared missing by the court, he must be dismissed as deceased. However, to confirm the fact of death, documents are required, such as:

- Death certificate. It is received from the civil registry office, the document is drawn up in accordance with the norms of the Law “On Acts of Civil Status” dated November 15, 1997 No. 143-FZ.

- Judgment. The verdict must contain one of two wordings: to declare the citizen dead (Article 45 of the Civil Code of the Russian Federation) or to recognize him as missing (Article 42 of the Civil Code of the Russian Federation). An interested person must submit an application to the court, and the consideration of the application is carried out in a special proceeding.

Dismissal due to death: entry in the work book

The following entry must be made in the work book of the deceased employee:

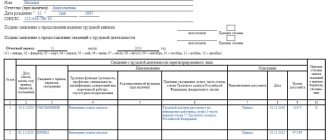

Record No. Date Information about hiring, transfer to another permanent job, qualifications, dismissal (indicating reasons and reference to the article, paragraph of the law) Name, date and number of the document on the basis of which the record was made number month year

| 1 | 2 | 3 | 4 | ||

| Limited Liability Company "Silk Road" (Silk Road LLC) | |||||

| 4 | 01 | 03 | 2013 | Recruited to the information technology department as department head | Order dated March 1, 2013 No. 2/p |

| 5 | 01 | 12 | 2016 | The employment contract was terminated due to the death of the employee, clause 6 of part 1 of article 83 of the Labor Code of the Russian Federation | Order dated December 5, 2016 No. 26/у |

| Specialist Krylova S.L. Krylova | |||||

This is also important to know:

Dismissal with 2 weeks of work: how to count days

We draw your attention to the fact that from November 27, 2016, the entry on dismissal in the work book is certified by the employer’s seal only if it is present (Order of the Ministry of Labor dated October 31, 2016 No. 589n, Order of the Ministry of Labor dated October 31, 2016 No. 588n).

Additional notices

Sometimes it is necessary to notify third parties that an employment contract has been terminated:

- bailiffs and debt collectors, if alimony or other amounts were withheld from the employee’s salary under a writ of execution. This must be done within three days (Article 11 of the RF IC). It is also necessary to return the document on which the deductions were made;

- military commissariat, if the employee was registered with the military. Two weeks are allotted for this (clause 32 of the Decree of the Government of the Russian Federation No. 719).

The notice is sent by registered mail. It is advisable to keep the postal receipt as proof that the shipment was made on time. Otherwise, the organization may be subject to an administrative fine.

What to do with the work book of a deceased employee

A spouse or one of his relatives can apply for the work book of an employee who has died.

Ask the applicant for a copy of the passport, as well as a document confirming marriage/kinship (for example, marriage certificate, birth certificate).

The work record book of a deceased employee can be issued to a spouse/relative against receipt or, at the request of the applicant, sent to him by mail in a valuable letter with a list of the contents and a receipt.

If no one applied for the work book, then the employer is obliged to keep it for 75 years (clause 664 of the List, approved by Order of the Ministry of Culture of Russia dated August 25, 2010 N 558).

Issuance of documents of the deceased

As a general rule, if no one comes to collect the work book, the employer sends a letter to the place of residence with a notification and a request to appear to receive documents and payment. This action relieves him of administrative and financial responsibility for the delay in issuing the work book.

The case of dismissal due to the death of an employee does not involve sending letters to relatives. The work record book will be kept in the personnel department until it is requested by the person having inheritance rights. These may include the categories listed in the Family Code: spouses, children, parents, including adoptive parents.

In the event that a relative of a deceased employee has expressed a desire to receive a document, the following must be done:

- Request a relative's passport.

- Request documents confirming family ties with the deceased. This could be: a marriage certificate, a birth certificate. In this case, the change of surname must be traced if the documents are received by the employee’s brother or sister.

- Copies of all listed documents must be left in the personnel department and kept in the personal file of the employee dismissed due to death.

- Issue a work book to the relative against receipt, in which he indicates his details: last name, first name and patronymic in full. If relatives live in another area, the right to send documents by mail also applies to the owner of the document. To do this, you need to receive a request letter from a relative indicating a request to send a work book to a specific address. The document will be sent in a plastic envelope by registered mail with acknowledgment of receipt and internal inventory. Once returned to the sender, the notice is kept in the employee's personal file.

- An appropriate entry is made in the Book of Accounting for the movement of work books and their inserts. “The document was sent by mail upon request, date, signature of the HR employee who sent the work book.” If a relative received the work book in person, he does not sign in the Accounting Book, for this there is a receipt of receipt. Opposite the date of registration of the document in the appropriate column, the HR specialist puts a note that “the document was issued against receipt.”

This is also important to know:

Forced dismissal: how an employee should behave, what threatens the employer

If the work book of an employee dismissed due to the death is not claimed by anyone, the employer will be obliged to keep it for 50 years, after which it will be sent to the city archive. This period is stipulated in paragraph 43 of the “Rules for the storage and maintenance of work books.”

Issuance of documents to relatives

The work book is issued to the relatives of the deceased upon their written request against signature. It can be sent by a valuable letter with a list of the attachments, if relatives cannot or do not want to come up for the document in person (clause 37 of the Decree of the Government of the Russian Federation “On work books”). It can also be received by a third party by proxy.

Relatives who can be issued a work book:

- spouses with whom the marriage is officially registered;

- parents and adoptive parents;

- children (including adopted children);

- brothers and sisters.

Theoretically, more distant relatives can also obtain a work book. The main difficulty lies in confirming the fact of relationship, without which the document cannot be issued.

Expert commentary

Leonov Victor

Lawyer

The relatives do not need to sign the deceased’s work book. They will only need to sign in the log book indicating that they received it. When receiving the document, it is advisable to carefully study it and verify all records, since the work book may be needed in the future to receive compensation or other payments.

If the relatives of the deceased did not come to pick up the work book themselves, they are sent a notification that it needs to be collected from the employer. Be sure to inform that upon request it can be sent by mail to the specified address. If relatives do not need a work book or the deceased was single, then the document is stored in the organization for at least 50 years, and in the event of liquidation of the company, it is transferred to the archive. After this period, the book can be destroyed in the prescribed manner.

If the relatives of the deceased required other documents (medical record, copies of personnel orders, certificate of wages and deductions), they must also be issued within three days of the request.

It is advisable to take a receipt filled out in free form regarding the issuance of all documents. It states:

- Full name and passport details of the relative;

- number and series of the death certificate;

- list of documents received;

- At the end they put the current date and signature.

How to fire an employee due to death: we make payments

The employer must pay the money due to the employee (salary, compensation for unused vacation, etc.) to the family members of the deceased employee or his dependents (Article 141 of the Labor Code of the Russian Federation).

Note that family members include (Article 2 of the Family Code):

- spouses;

- parents/adoptive parents;

- children, incl. adopted.

The above-mentioned persons have 4 months from the date of death of this employee to apply to the employer for receipt of the amounts due to the deceased employee (Clause 2 of Article 1183 of the Civil Code of the Russian Federation). And the employer has a week to pay from the day the family member/dependent submitted the necessary documents (Article 141 of the Labor Code of the Russian Federation). Such documents, in particular, are:

- application for payment;

- applicant's passport;

- document confirming relationship.

If the money for payment was withdrawn from the employer’s account, but no one applied for it within 5 working days, then it must be deposited (3210-Up. 6.5 Bank of Russia Instructions dated 03/11/2014 N).

Calculation rules

Relatives of a deceased employee are entitled to various payments and compensations. These payments are indicated in the corresponding calculation certificate.

The calculation certificate is filled out by two specialists - a personnel department employee and an accountant . The last of them calculates wages and other payments due to the deceased employee, based on the data provided by the personnel officer.

What payments and compensations are due and to whom should they be paid?

Wages, compensation for unused vacation and other payments due to the deceased employee must be paid to the relatives of the deceased (mother/father, spouse, children) or his dependents (Article 141 of the Labor Code of the Russian Federation).

Moreover, according to Art. 1183 of the Civil Code of the Russian Federation, one of the close relatives or dependents of the deceased must have time to contact the relevant employer within 4 months from the date of opening of the inheritance. From the moment of such an application, wages and other payments for the deceased are issued within 7 days.

To receive such payments, the applicant submits the following documents to the deceased’s employer:

- statement;

- personal passport;

- a document certifying the relationship with the deceased (birth, adoption or marriage certificate).

In addition, in some situations, relatives of a deceased employee are entitled to appropriate financial assistance. However, the clause on its provision must be specified in the employment contract (agreement) of the employer with the deceased employee or in the corresponding internal act of the head of the organization.

A relative of the deceased or another person who was involved in his funeral has the right to receive a separate social benefit for burial from the deceased’s employer. From the beginning of February 2021, the amount of such payment is 6124.86 rubles. Taking into account regional coefficients, this payment may be higher.

In accordance with paragraph 18 of Art. 217 of the Tax Code of the Russian Federation, wages and other payments earned by a deceased employee are not subject to personal income tax . Therefore, the entire amount is given to the applicant.

As a result, in the event of dismissal of an employee of an organization due to his death, the employer and relatives (dependents) of the deceased must keep in mind some of the nuances of this procedure. Relatives and dependents have the right to receive appropriate compensation and payments due to the deceased, but for this they must provide a death certificate of the employee.

The employer is obliged to hand over the work book of the deceased to the relatives. If the deceased had no relatives (he was single) or they did not take the work book, such a document is sent to the archives of the organization.

What other amounts must the employer pay to the relatives of the deceased employee?

A collective/labor agreement or LNA may provide for financial assistance to the relatives of a deceased employee. Also, the employer can pay financial assistance on its own initiative, even if it is not provided for in the above documents.

Free legal consultation

We will answer your question in 5 minutes!

Free legal consultation We will answer your question in 5 minutes!

Call: 8 800 511-39-66

Ask a Question

In addition, relatives who buried a deceased employee at their own expense can apply to the employer to receive a social benefit for burial, which is paid from the Social Insurance Fund.

Payment of funeral benefits

When buried at the expense of a relative of the deceased or another citizen who took upon himself the funeral efforts, he is paid a social benefit for the funeral. The benefit is due if the above-mentioned citizens applied for it no later than 6 months from the date of death and is paid on the day of application for it on the basis of a package of documents: an application (in any form) and a death certificate from the registry office. Important! The original must be provided.

It is unlawful to demand any other documents from an individual.

To pay benefits you do not need to calculate average earnings. The benefit is assigned in a fixed amount , which is indexed annually. From 02/01/2020, the amount of the funeral benefit, taking into account indexation, is 6124.86 rubles. In regions where a regional coefficient is applied, the amount increases by the size of the coefficient.

Funeral benefits for individuals are provided from budget funds. This means that the employer reduces the calculated social insurance contributions by the specified costs (with the offset method) or receives a refund (with direct payments).

Calculation of payments

After issuing the dismissal order, the accounting department must accrue the appropriate payments. The company can pay the accrued amount within 4 months from the date of death of the employee. If during this period the relatives do not apply, then the entire amount is added to the inheritance. If there is no inheritance, then the money remains with the employer.

This is also important to know:

How is the procedure for voluntarily dismissal carried out?

Relatives, spouses and persons who were dependent on the deceased can receive payments. If there are several applicants, the entire amount is given to the first applicant. If a controversial situation arises, you can invite relatives to come to an agreement or go to court.

The company must pay the entire amount within 1 week after the relatives apply.

A deceased employee is entitled to payments as for a normal dismissal:

- salary;

- sick leave;

- all necessary allowances;

- bonuses;

- compensation for unused vacation.

In addition to them, financial assistance to relatives or compensation for burial may be awarded for consideration by the management. We will consider the procedure for calculating all payments in the table.

| No. | Name of payments | Accrual procedure | Peculiarities |

| 1. | Wage | Payroll continues until the day of death. According to the timesheet, days worked are calculated and wages are calculated. In this case, all allowances, bonuses, etc. are taken into account. | The day of death is not paid. |

| 2. | Vacation compensation | The company is obliged to pay compensation for unused vacation. Accruals are made in accordance with current legislation. If at the time of death the employee was already on leave, which was provided to him in advance, then no one returns the money back. | |

| 3. | Sick leave | If a person died during his illness, then the ballot closes on the day of death. | The day of death is not paid |

| 4. | Compensation for burial | It is calculated based on receipts and invoices provided by relatives. This payment can be received by any person who spent his personal savings on funerals. | Amounts to 5740.24 rubles. |

Results

The death of a subordinate imposes certain obligations on his employer. The management of the enterprise must take the following organizational measures:

- Issue an order stating that the employment contract has terminated. One reason is given - the death of an employee, the basis is the provisions of clause 6 of Art. 83 TK. The date of termination of the relationship given in the order must fully correspond to the date of death.

- Draw up a work book by making the appropriate entry and hand over the document to the employee’s relatives or friends.

- Pay relatives or loved ones the money that is due to the employee for the period worked until death, as well as funeral benefits. Payment deadlines must be within the law.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Payments in connection with the death of an employee: personal income tax and insurance premiums

Amounts due to a deceased employee and paid to his relatives are not subject to personal income tax (Clause 18, Article 217 of the Tax Code of the Russian Federation). Those. relatives need to pay the full amount, without deducting tax from it.

In addition, these amounts are not subject to insurance premiums.

As for material assistance provided to relatives, it is also not subject to insurance premiums. And personal income tax on material assistance does not need to be withheld provided that it was paid to family members or relatives who lived with the deceased employee (clause 8 of Article 217 of the Tax Code of the Russian Federation, 03-04-06/4-318 Letter from the Ministry of Finance of Russia dated November 14, 2012 N).

date of dismissal

The employment relationship between a person and a company ends when certain circumstances occur. For example, if the dismissal is due to the expiration of the contract, then the professional cooperation will end at that moment. This rule also applies to the death of a worker. In fact, the deceased will be relieved of his position from the date of death indicated in the relevant certificate. The date of actual presentation of such a document is irrelevant.

The procedure for final settlement of payments for a deceased employee

All amounts due to the deceased employee must be paid to his next of kin within 1 week from the date of their application. At the same time, the following have the right to receive such payments (Article 141 of the Labor Code of the Russian Federation, clause 1 of Article 1183 of the Civil Code of the Russian Federation):

- members of his family living together with the deceased;

- persons dependent on him at the time of death .

The law does not establish a list of written evidence confirming the rights of these persons to the amounts of the deceased. They must present a passport and a document confirming a close relationship with the dismissed person. In addition, you need a written statement from relatives indicating the date of application for payments.

IMPORTANT!

Members of an employee’s family include not only children and parents, but also grandparents, brothers and sisters, and grandchildren (Article 2 of the Family Code of the Russian Federation).

When dismissing an employee due to the death of an employee, he is accrued the same amounts as when terminating an employment contract for other reasons. This:

- Payment for the time that he managed to work or for the amount of work performed at tariff rates, salaries, piece rates.

- Incentive payments, incl. bonuses, additional payments, allowances established by the employment contract and local regulations of the company.

- Compensation for unused vacation days.

IMPORTANT!

The order of payment of amounts is not regulated , so they are given to the first family member to apply for them. If you make a simultaneous demand from several relatives, you can ask them to indicate the shares due to them in a joint voluntarily signed written statement. If they fail to resolve this issue by mutual agreement, they can resolve their disputes in court.

How to proceed with the payment of benefits if an employee died on sick leave, see our article “Sick leave for a deceased employee: how to proceed.”

The procedure for issuing labor

The procedure for dismissing a worker involves issuing a work book to its owner. However, the deceased cannot receive it himself due to natural reasons. The current legislation determines that this can be done by one of the close people of the deceased. The degree of relationship in this case is not specified. There is no information about whether the work permit is issued to the spouse of the deceased, who are not classified as relatives and are only family members. Although in practice even such persons are not refused.

To obtain a work book, the interested party must provide documentary data confirming his right. These include:

- Birth certificate of the deceased. This is relevant for the employee’s parents who intend to receive a work permit.

- A similar document from the recipient himself if the book is claimed by a brother, sister or children of the deceased.

- Data on marriage, when the employee’s spouse wants to take the labor document. If the interested person has changed his last name, documents will be required for each of these facts.

The recipient must also have a passport with him.

The HR officer is usually responsible for issuing work permits. The specified specialist is obliged to check the submitted documents for their accuracy or compare copies with the originals. After this, the applicant must obtain a receipt confirming receipt of the work permit. The interested person signs in a special accounting form - a book or magazine. The deadlines for transferring a work book to relatives are not clearly defined in the legislation. In practice, this happens on the day of application.

In accordance with the established rules, the work report can be sent by mail. To do this, the interested recipient must submit supporting documentation as well as his/her request for forwarding of the workbook. Most often, this is practiced in cases where a relative or family member actually lives quite far from the location of the organization.

No death certificate? Need to find

It happens that the deceased employee does not have relatives or they do not contact the company, perhaps they live far away, and they do not want to send a notarized copy of the document. How to get a copy of the death certificate, because only on the basis of this document is it possible to begin the procedure for terminating the employment relationship?

The company has the right to obtain a copy of this certificate itself by sending a request to the authority where the death of their employee could have been registered. This could be the registry office:

- at the place of actual residence of the deceased;

- at the place of last registration;

- closest to the place where the death is recorded (for example, in a hospital) or the body is discovered;

- in the burial area.

When the question arises of searching for documentary evidence, but the employer does not have the exact facts, you can send a request to all possible registration authorities.