Individual entrepreneurs (IP) have the right to terminate their activities at any time. Federal Law No. 129-FZ dated 08.08.2001 “On State Registration of Legal Entities and Individual Entrepreneurs” specifies the following grounds for terminating the activities of individual entrepreneurs:

- a decision has been made to terminate activities;

- death of a person who is an individual entrepreneur;

- a court decision to declare an individual entrepreneur insolvent (bankrupt);

- forcibly by court decision;

- the entry into force of a court verdict, which sentences the individual entrepreneur in the form of deprivation of the right to engage in entrepreneurial activity for a certain period.

The most common of them is making a decision to terminate business activities.

State registration of the fact of termination of the activities of an individual entrepreneur is carried out at the tax office at the place of registration. To do this, the following documents must be submitted to the tax office at the place of registration:

- a signed application in the form approved by the federal executive body authorized by the Government of the Russian Federation.

Decree of the Government of the Russian Federation dated October 16, 2003 N 630 approved form N P26001 of an application for state registration of termination by an individual of activities as an individual entrepreneur in connection with his decision to terminate this activity. The signature of the individual entrepreneur, which is affixed to the page. 02 application must be notarized;

- document confirming payment of state duty.

Currently, for state registration of termination by an individual of activities as an individual entrepreneur, a state fee in the amount of 160 rubles is paid;

- a document confirming the submission of the necessary information to the territorial body of the Pension Fund.

The form of this document has not been approved. Therefore, any document confirming the sending of the necessary information to the territorial body of the Pension Fund of the Russian Federation should be submitted to the tax authority. In practice, such a document is a certificate of no debt. To obtain it, you need to contact the Pension Fund at the place of registration. This certificate is issued only after the submission of personalized accounting information for employees (if any) and individual entrepreneurs, as well as after payment of the corresponding amount of debt (if any).

These documents can be sent to the registration authority by the applicant personally or by mail in a letter with the declared value and an inventory of the investment (clause 1 of Article 9 of Law No. 129-FZ).

HOW LONG DOES THE LIQUIDATION OF AN LLC OR IP (INDIVIDUALE ENTREPRENEUR) TAKE?

If documents are sent by mail, it is recommended to mark the envelope as “Registration.” Then the tax authority issues a receipt to the applicant indicating the list and date of receipt of documents (clause 3 of Article 9 of Law No. 129-FZ):

- on the day of receipt of documents - if the documents are submitted to the registration authority directly;

- during the working day following the day of receipt of the documents, it is sent by the registration authority to the postal address specified by the applicant with a receipt receipt - upon receipt of documents sent by mail.

State registration is carried out within no more than 5 working days from the date of submission of documents to the registration authority (clause 8 of article 22.3, article 8 of Law N 129-FZ).

The state registration of an individual as an individual entrepreneur loses force after making an entry about this in the Unified State Register of Individual Entrepreneurs (USRIP). The applicant is issued a certificate of state registration of termination by an individual of activities as an individual entrepreneur in form N P65001, approved by Decree of the Government of the Russian Federation of June 19, 2002 N 439.

Procedure for termination of activities

The algorithm of actions that need to be performed in the process of terminating business activity differs depending on whether the entrepreneur acts as an insurer in relation to other individuals or not.

It is considered that an entrepreneur acts as an insurer of individuals if he:

- acts as an employer, that is, makes payments to employees under an employment contract;

- and (or) is a party to a civil contract obligated to pay remuneration for which insurance premiums are calculated (for example, he has entered into an agreement with an individual for the provision of paid services for advertising the entrepreneur’s products).

Such rules are established in paragraph 4 of Article 1 of Federal Law No. 27-FZ of April 1, 1996 “On individual (personalized) accounting in the compulsory pension insurance system” (hereinafter referred to as the Law on Individual Accounting).

If the entrepreneur does not act as an insurer in relation to other individuals, then the algorithm of actions in the process of terminating business activity is as follows:

1) receive a certificate from the Pension Fund of the Russian Federation stating that the entrepreneur is not an insurer of other individuals;

2) close the current account used in business activities;

Situation: is it necessary to notify the tax office and funds about the closure of the bank account of an individual entrepreneur?

No, it is not necessary, except for the case when the account was opened abroad.

Previously, the following authorities were required to be notified of the closure of any bank account.

1. Pension Fund of the Russian Federation and the Social Insurance Fund of Russia. This obligation was abolished on May 1, 2014 (clause 1 of article 5, part 2 of article 6 of the Federal Law of April 2, 2014 No. 59-FZ “On amendments to certain legislative acts of the Russian Federation in terms of reducing the time frame for registering legal entities persons and individual entrepreneurs in state extra-budgetary funds and invalidation of certain provisions of the Federal Law “On Insurance Contributions to the Pension Fund of the Russian Federation, Social Insurance Fund of the Russian Federation, Federal Compulsory Medical Insurance Fund”).

2. Tax office at the place of residence of the entrepreneur. This obligation was canceled on May 2, 2014 (subparagraph “b”, paragraph 1, article 1, part 1, article 7 of the Federal Law of April 2, 2014 No. 52-FZ “On Amendments to Parts One and Two of the Tax Code of the Russian Federation and certain legislative acts of the Russian Federation").

Now the closure of a bank account must be reported only if the account was opened abroad (Part 2 of Article 12 of the Federal Law of December 10, 2003 No. 173-FZ “On Currency Regulation and Currency Control”). In such a situation, a notification must be submitted to the tax office at the place of registration of the entrepreneur in the form approved by order of the Federal Tax Service of Russia dated September 21, 2010 No. ММВ-7-6/ [email protected] This must be done within a month from the date of account closure.

If an entrepreneur violates the deadline or form of notification, he may be subject to administrative liability in the form of a fine in the amount of 1,000 to 1,500 rubles. (Part 2 of Article 15.25 of the Code of Administrative Offenses of the Russian Federation). If an entrepreneur does not notify the inspectorate at all, he may be fined from 4,000 to 5,000 rubles. (Part 2.1 of Article 15.25 of the Code of Administrative Offenses of the Russian Federation).

3) register the fact of termination of activity as an entrepreneur (submit documents to the registration authority for the purpose of making an entry in the Unified State Register of Individual Entrepreneurs);

4) pay insurance premiums.

If the entrepreneur is the insurer of other individuals, then upon termination of business activities, the following actions must be taken:

1) submit information about the insured persons to the Pension Fund of the Russian Federation;

2) pay the insurance premiums accrued in relation to the insured persons;

3) resolve personnel issues;

4) close the current account used in business activities (notifying the tax office and funds is not required);

5) register the fact of termination of activities as an entrepreneur (submit documents to the registration authority for the purpose of making an entry in the Unified State Register of Individual Entrepreneurs);

6) pay insurance premiums assessed against the entrepreneur.

Situation: is it necessary to submit any documents to remove a person who is ceasing to operate as an entrepreneur from being registered in extra-budgetary funds?

No no need.

It is enough just to register the fact of termination of activity as an entrepreneur.

After this, the tax inspectorate independently informs the territorial bodies of the Pension Fund of the Russian Federation and the Social Insurance Fund of Russia about the loss of the status of an entrepreneur by a person (clause 9 of the Rules for submitting to the registration body by other state bodies information in electronic form necessary for the state registration of legal entities and entrepreneurs, as well as for maintaining unified state registers of legal entities and entrepreneurs, approved by Decree of the Government of the Russian Federation of December 22, 2011 No. 1092).

Within five days from the moment of receiving information from the inspection, the territorial bodies of the Pension Fund of the Russian Federation and the Social Insurance Fund of Russia remove the person from the registration of policyholders (paragraph 2, paragraph 2, article 11 of the Federal Law of December 15, 2001 No. 167-FZ “On Mandatory Pension insurance in the Russian Federation", clause 1, part 2, article 2.3 of the Federal Law of December 29, 2006 No. 255-FZ "On compulsory social insurance in case of temporary disability and in connection with maternity").

Situation: is a person terminating his activities as an entrepreneur obliged to appoint a liquidation commission and comply with other requirements of Article 63 of the Civil Code of the Russian Federation?

No, you don't have to.

The rules of Article 63 of the Civil Code of the Russian Federation do not apply to the procedure for terminating activities as an entrepreneur. They regulate the procedure for liquidation of a legal entity. Therefore, an entrepreneur does not need to:

- appoint a liquidation commission or liquidator;

- publish a message in the press;

- notify all your creditors in writing;

- draw up and approve an interim liquidation balance sheet and notify the tax office about this;

- pay off debts with creditors;

- draw up and approve the final liquidation balance sheet.

Definition and characteristics of entrepreneurial activity

Entrepreneurship is an activity that is registered in accordance with current laws, started by a business owner who is willing to take risks in order to regularly receive a profit and consists of performing any work, providing services or selling goods to the population.

The main features of the work of entrepreneurs:

- Only citizens registered with the tax authorities who have received the right to be called an individual entrepreneur apply for its implementation. If there is no registration, the activity does not cease to be called entrepreneurial, but is recognized as illegal. This must be understood in such a way that a person will not be saved from the need to pay debts to those with whom he entered into an agreement, the fact that at the time of the transaction he was not an individual entrepreneur. The court will not be on his side.

- Independence (organizational and property).

- Making profit (the list of methods for obtaining it is closed).

- The presence of risk (if business is not handled competently or by accident, circumstances may arise that will cause the individual entrepreneur to lose the property he has acquired).

Hired employees are not considered entrepreneurs - their activities do not have the above characteristics of entrepreneurship.

Notification of the Pension Fund of the Russian Federation and the Social Insurance Fund of Russia

Situation: is it necessary to notify social and pension insurance funds about the termination of activities as an individual entrepreneur?

No no need.

This requirement was previously in force, but as of January 1, 2015 it was canceled.

Previously, such a requirement was established in paragraph 3 of part 3 of Article 28 of the Federal Law of July 24, 2009 No. 212-FZ “On insurance contributions to the Pension Fund of the Russian Federation, the Social Insurance Fund of the Russian Federation, the Federal Compulsory Medical Insurance Fund” (hereinafter referred to as the Law about insurance premiums).

The law required written notification of termination of activities as an individual entrepreneur to the Pension Fund of the Russian Federation and the Social Insurance Fund of the Russian Federation. They control the payment of insurance premiums (Part 1, Article 3 of the Law on Insurance Contributions).

A written notice of termination of activities had to be submitted to the territorial authority of each of the funds. Messages were submitted within three working days from the date of the decision to terminate activities. For violation of the notice period, the organization could be charged a fine of 200 rubles. for each document not submitted (Article 48 of the Law on Insurance Contributions).

The law did not establish any requirements for the content of messages, so they could be sent in free form, indicating all the necessary information.

Features of the legal status of individual entrepreneurs

There are no laws that would contain a complete description of the essence of the civil legal status of individual entrepreneurs. Regional laws are adopted with the expectation of the most active growth of small enterprises, but at the federal level no single regulatory act has been adopted.

The status of individual entrepreneurs occupies an intermediate position between the position of commercial organizations and individuals. Individual entrepreneurs are participants in economic turnover who have not themselves formed any economic entity. In this regard, the legal status of individual entrepreneurs is special and has its own distinctive features.

Existing laws emphasize the special position of individual entrepreneurs, but they have to rely on a huge number of regulations in order to determine the rules and conditions for doing business.

Rights and benefits of individual entrepreneurs

An individual entrepreneur has certain rights and has benefits established at the federal and regional levels. By the way, regional authorities often assist in the development of entrepreneurship.

- The right to conduct any lawful commercial activity aimed at obtaining financial gain.

- In certain situations, an individual entrepreneur can act as an individual. For example, when operating a car in the course of business, an individual entrepreneur transfers transport tax to the Federal Tax Service on an equal basis with all car owners.

- An individual entrepreneur has the right to apply to the Arbitration Court (as an individual entrepreneur) and to courts of general jurisdiction (as a citizen of the Russian Federation).

- Income can be used in any amount for personal needs by the individual entrepreneur himself and his family.

- Individual entrepreneurs are exempt from calculating and transferring personal income tax to the budget.

- Individual entrepreneurs have the right to hire workers.

- The law allows individual entrepreneurs:

- work under an employment contract (but not in any position),

- become a founder of an LLC,

- establish or participate in public organizations,

- exercise all rights available to ordinary citizens.

- An individual entrepreneur has the right to make his own seal and open a current account, but is not obliged to do either one or the other.

- The individual entrepreneur and his family members have the right to use the property involved in the operation of the enterprise for personal needs.

Responsibilities and limitations of an individual entrepreneur

The status of an individual entrepreneur imposes certain responsibilities on its owner, and the legislation imposes some restrictions on his work:

- An individual entrepreneur must pay taxes and fees in accordance with the terms of his preferred taxation regime, as well as make payments to the Social Insurance Fund and the Pension Fund of the Russian Federation.

- Individual entrepreneurs are obliged to submit reports on time like commercial companies.

- Individual entrepreneurs must take on the role of tax and insurance agent for the employees they hire, withholding funds from their salaries to pay insurance premiums and personal income tax.

- Individual entrepreneurs are subject to a ban on combining business activities with public service, work in the prosecutor's office and other government bodies.

- An individual entrepreneur does not have the right to use real estate acquired during marriage if the spouse does not give him consent.

- The law limits individual entrepreneurs in the choice of types of economic activities. In particular, they are prohibited from selling medicines and alcoholic beverages, as well as opening a security agency.

- The individual entrepreneur risks everything he owns. The property of an individual entrepreneur is not divided into personal and those participating in the business.

- An individual entrepreneur does not have the right to transfer the right to engage in entrepreneurship by inheritance; after his death, only the property is transferred to the heir.

Submission of information about insured persons to the Pension Fund of the Russian Federation

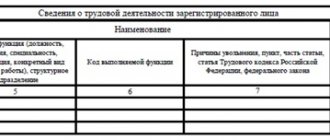

The entrepreneur (policyholder) is obliged to submit the following information about employees (insured persons) to the territorial body of the Pension Fund of the Russian Federation:

- information about each insured person listed in subparagraphs 1–10 of paragraph 2 of Article 11 of the Law on Individual Accounting;

- information on accrued and paid insurance premiums in general for all insured persons working for the entrepreneur (paragraph 13, paragraph 2 of Article 11 of the Law on Individual Accounting);

- information about periods of work and (or) other activities included in the insurance period, which were acquired by all insured persons working for the entrepreneur before their registration in the individual (personalized) accounting system (paragraph 14, paragraph 2, article 11 of the Law on Individual Accounting) ;

- information contained in the register of insured persons (clause 2.1 of article 11 of the Law on individual accounting, part 4 of article 9 of the Federal Law of April 30, 2008 No. 56-FZ “On additional insurance contributions for the funded part of the labor pension and state support formation of pension savings").

The listed information must be submitted within a month from the date of the decision to terminate activities as an entrepreneur, but no later than the day when the entrepreneur submits documents to register the fact of termination of activities (paragraph 5, paragraph 2, article 9, paragraph 3, article 11 Law on Individual Accounting).

Attention: if the entrepreneur does not provide the necessary information to the territorial body of the Pension Fund of the Russian Federation or submits it after submitting documents to the inspectorate, negative consequences will arise

Firstly, most likely, it will not be possible to register the fact of termination of activity as an entrepreneur (resolutions of the FAS Central District dated November 26, 2012 in case No. A14-745/2012 and FAS Volga District dated November 3, 2011 in case No. A12- 4595/2011). The inspectorate has the right to refuse registration if it does not receive evidence that the applicant has submitted information about the insured persons to the Pension Fund of the Russian Federation (subparagraph “c”, paragraph 1, article 22.3, subparagraph “h”, paragraph 1, article 23 of the Federal Law dated August 8, 2001 No. 129-FZ “On state registration of legal entities and individual entrepreneurs”; hereinafter referred to as the Law on State Registration).

Secondly, there will be a risk that a sanction will be applied to the entrepreneur in the form of a recovery of 10 percent of the amount of payments due to the Pension Fund of the Russian Federation for the reporting period (paragraph 3 of Article 17 of the Law on Individual Accounting).

Example from practice. The inspectorate refused to register the fact of termination of the person’s activities as an entrepreneur. The court considered the refusal to be lawful, since the entrepreneur did not provide the necessary information to the Pension Fund of the Russian Federation

Citizen O. applied to the inspectorate in order to register the termination of activities as an entrepreneur. The inspectorate considered that the applicant had not submitted all the necessary documents and refused registration.

Disagreeing with the inspection’s conclusion, citizen O. went to court with the following demands:

- invalidate the inspection decision;

- oblige the inspectorate to register the termination of the entrepreneur’s activities.

The court found that the inspection sent a request to the territorial body of the Pension Fund of the Russian Federation in order to obtain information about whether the applicant provided information about the insured persons. The body of the Pension Fund of the Russian Federation issued a certificate to the inspectorate regarding the failure to provide it with the necessary information about the employees of the entrepreneur O.

A document confirming the submission of information to the territorial body of the Pension Fund of the Russian Federation is one of the documents on the basis of which the registration of termination of activities as an entrepreneur is carried out (subclause “c” of paragraph 1 of Article 22.3 of the Law on State Registration). Since the inspection has not received evidence of the submission of such information, the refusal to register is considered lawful (subparagraph “h”, paragraph 1, article 23 of the Law on State Registration). As a result, the court did not satisfy the applicant’s demands (resolution of the Federal Antimonopoly Service of the Ural District dated July 26, 2012 No. F09-5709/12 in case No. A60-39155/2011).

Situation: does an entrepreneur need to submit information about insured persons to the Pension Fund of the Russian Federation if he does not act as an insured in relation to other individuals?

Information about the insured persons themselves does not need to be provided, since there are no such persons.

However, it makes sense for an entrepreneur to contact the territorial body of the Pension Fund of the Russian Federation in order to obtain a certificate confirming the absence of insured persons. This should be done within a month from the date of the decision to terminate activities as an entrepreneur, but no later than the day when the entrepreneur submits documents to register the fact of termination of activities.

Since the law does not establish the procedure for issuing a certificate of absence of insured persons, it makes sense for an entrepreneur to clarify the method of obtaining it at a specific branch of the Pension Fund of the Russian Federation.

Subsequently, the certificate will need to be submitted to the inspectorate to register the fact of termination of activities as an entrepreneur (subclause “c” of paragraph 1 of Article 22.3 of the Law on State Registration).

However, termination of activity can be registered without such a certificate. The fact is that an inspection that has not received a certificate from the applicant must independently request the necessary information from the Pension Fund of the Russian Federation. However, if this request is made, the risk of denial of registration will increase. In order to protect yourself as much as possible from such a refusal, it makes sense for an entrepreneur to obtain a certificate himself from the territorial body of the Pension Fund of the Russian Federation, and then submit it to the inspectorate.

Legal status of individual entrepreneurs

The civil legal status of an individual entrepreneur means the legal status of an individual entrepreneur in the field of commercial relations, affecting the list of his rights, obligations and level of responsibility and determining their position in the system of legal relations, taking into account the specifics and nuances of their business activities.

The Constitution of the Russian Federation promises Russian citizens the freedom to use their own skills, ideas and savings to organize their own business or realize themselves in other areas of labor, unless this is prohibited by Russian laws.

The Constitution of Russia gives every resident of the country the right to use knowledge, skills and savings for the purpose of carrying out commercial activities permitted by current legislation

The legal status of an individual entrepreneur is characterized by duality - at the same time, regulations that relate to all ordinary residents of the country and business entities are applicable to its work.

The right to engage in entrepreneurship arises from the date of registration of a citizen of the Russian Federation, a foreigner or a stateless person as an individual entrepreneur.

If a person wants to engage in livestock breeding or cultivation of crops, entrepreneurship will take the form of a peasant farm, which is also not a legal entity.

The heads of a peasant (farm) enterprise are required to undergo state registration and receive the official status of an individual entrepreneur

Entrepreneurial legal capacity and legal capacity appear at the same time, and the right to do business is realized exclusively independently - it does not happen that an incapacitated person becomes legally capable due to the fact that the legal representative has assumed part of his obligations.

The following have the right to organize their own business as an individual entrepreneur:

- capable citizens (without obtaining anyone's consent);

- partially capable minor citizens 14 years of age and older (after receiving the written consent of their legal representatives, certified by a notary) and minors who entered into an official marriage or were emancipated by a decision of the court or guardianship authorities.

The law prohibits the following groups of people from opening a company:

- Those who are in public service, law enforcement officers, and the military.

- Already previously registered individual entrepreneurs.

- Deprived of the right to conduct business on the basis of a court decision, if the ban has not expired.

- The enterprise of which was forcibly closed if 12 months have not passed since the entry into force of the court decision.

- Those who have a criminal record or have been prosecuted in the past for criminal acts, after the commission of which it is legally impossible to engage in certain types of business (for example, those convicted of murder do not have the right to open childcare centers) or entrepreneurship in general.

- Stateless persons and foreigners who are in the country without legal grounds (temporary stay permit, residence permit).

The law limits individual entrepreneurs in their choice of occupation. For example, alcohol sales are only available to business owners who have registered an LLC.

Individual entrepreneurs do not have the right to sell alcohol and medicines, to open a security company and to certain other types of activities

An individual entrepreneur performs actions on his own behalf and is subject to the same legal norms that apply to the work of commercial companies (unless this contradicts the essence of the legal relationship or legal norms).

Individual entrepreneurs are given the right to enter into any legal commercial agreements. Business owners can also participate in general partnerships and team up with firms and non-profit organizations for joint activities.

Individual entrepreneurs have the right to conduct business on their own, without hiring hired workers, or they can hire staff for the enterprise.

Individual entrepreneurs have the right to hire employees or work independently without hiring hired labor

Individual entrepreneurs pay off accumulated debts with all the property they own as owners - either theirs in full or with shares in joint holdings that do not participate in business affairs. Only the property listed in Art. 446 Code of Civil Procedure of the Russian Federation:

- Residential premises or shares in them, as well as the plots of land on which they are located, if the individual entrepreneur and his family do not have other housing that meets the conditions of normal living (not applicable to cases where the only housing is the subject of a mortgage).

- Clothing, shoes and other personal and household items (we are not talking about luxury items such as jewelry).

- Property without which it is impossible to carry out professional activities (within 100 times the federal minimum wage).

- Breeding animals and food for their maintenance, even if they are not used in business activities.

- State awards, memorable and honorary signs, prizes received by the entrepreneur.

- Property necessary in connection with the assignment of individual entrepreneurs to the disabled group (transport, etc.).

- Fuel, if without it it will not be possible to heat your living space during the heating season or cook food.

- Cash and food products, the total cost of which is not less than the current subsistence level of the individual entrepreneur and his dependents.

When seizing the property of an individual entrepreneur to fulfill debt obligations, bailiffs do not have the right to seize food and money, the total cost of which is equal to the subsistence level of the individual entrepreneur and his dependents

- Seeds for the next sowing.

Calculations of insurance premiums for employees

An entrepreneur acting as an insurer in relation to other individuals is obliged to submit to the territorial bodies of the Pension Fund of the Russian Federation and the Social Insurance Fund of Russia a calculation of accrued and paid insurance premiums (Part 15 of Article 15 of the Law on Insurance Contributions). This can be done any day before submitting documents to register termination of activities as an entrepreneur. It is advisable to submit the calculation to the territorial body of the Pension Fund of the Russian Federation simultaneously with information about the insured persons.

Attention: if an individual submits a calculation of accrued and paid insurance premiums after the tax office has registered the termination of activities as an entrepreneur, such a person may be fined.

The entrepreneur is obliged to promptly submit calculations for accrued and paid insurance premiums (Clause 3, Part 2, Article 28 of the Law on Insurance Contributions). If a person submits a calculation after registering the fact of termination of activities as an entrepreneur, the deadline for submitting the calculation will be considered violated (appeal ruling of the Kursk Regional Court dated April 9, 2013 in case No. 33-826-2013).

The sanction for such a violation is a fine in the amount of 5 percent of the amount of insurance premiums accrued for payment for the last three months of the billing period. Moreover, the fine is collected for each full or partial month from the day established for the submission of the calculation (i.e. from the day preceding the day of submission of documents for registration). The total amount of the fine cannot be less than 1,000 rubles, but cannot exceed 30 percent of the amount of insurance premiums accrued for payment for the last three months of the billing period (Part 1 of Article 46 of the Law on Insurance Contributions).

Situation: can an entrepreneur be held administratively liable for violating the deadline for submitting a calculation of accrued and paid insurance premiums?

No, they can't.

Despite the fact that the Code of the Russian Federation on Administrative Offenses provides for liability for violating the deadline for submitting a calculation (Part 2 of Article 15.33 of the Code of Administrative Offenses of the Russian Federation), it is impossible to attract an entrepreneur to it. An entrepreneur is excluded from the number of officials to whom liability is applicable on this basis (note to Article 15.33 of the Code of Administrative Offenses of the Russian Federation).

The calculation must be made for the period from the beginning of the billing period (i.e., from the beginning of the calendar year) to the day the calculation is submitted, inclusive. If a person registered as an entrepreneur after the beginning of the current calendar year, then the calculation must be made for the period from the date of registration (such a day is indicated in the registration certificate) to the day the calculation is submitted, inclusive (Part 3 of Article 10 of the Law on Insurance Contributions).

The calculation can be submitted in the form of an electronic document (subject to the requirements of Part 10 of Article 15 of the Law on Insurance Contributions and the Decree of the Government of the Russian Federation dated July 7, 2011 No. 553 “On the procedure for completing and submitting applications and other documents necessary for the provision of state and (or) municipal services, in the form of electronic documents").

If the calculation shows that the entrepreneur has not paid the amount of insurance premiums in full, he must do this within 15 calendar days from the date of submission of the calculation.

If the amount actually paid exceeds the amount indicated in the calculation, the entrepreneur can obtain a refund of the resulting difference according to the rules of Article 26 of the Law on Insurance Contributions.

What is needed to close a sole proprietorship

In order for the termination of the activities of an individual entrepreneur to be properly formalized, you need to create a package of documents:

- Application for liquidation of an individual entrepreneur based on a decision made by him. Filled out using form No. P26001, which can be found on the official website of the Federal Tax Service.

- The completed written application must be certified by a notary (or rather, the signature in it), if the business entity does not plan to visit the tax office in person. If an individual entrepreneur submits all documents for registration of closing his business in person, upon presentation of his passport, notarization of the signature is not necessary.

- You need to pay a state fee of 160 rubles, and also submit it to the registration authority. You can also generate a receipt for payment on the Federal Tax Service website, after which you can pay at the nearest bank branch.

- Along with the above materials, you can provide the tax authority with documentary evidence of timely provision of information to the Pension Fund. But, if the individual entrepreneur does not provide the specified document, the tax office will be able to request the necessary information on its own.

This is a general procedure for terminating the activities of an individual entrepreneur if his desire to liquidate the business is accepted independently. There are situations when forced cancellation of the registration of an individual entrepreneur occurs, or a record of its liquidation is made by decision of the judicial authorities. It should be noted that according to the law, no state or local government body has the right to make such decisions regarding an entrepreneur, but only the court.

Dismissal of employees

Since a person ceases to act as an entrepreneur, the task arises of terminating employment contracts with employees. The basis for termination is the fact of making a decision to terminate business activities (clause 1, part 1, article 81 of the Labor Code of the Russian Federation).

The territorial body of Rostrud (hereinafter referred to as the employment service body) at the place of residence of the entrepreneur must be notified in writing about the possible dismissal of employees. This must be done no later than two weeks before the termination of employment contracts (clause 2 of article 25 of the Law of the Russian Federation of April 19, 1991 No. 1032-1 “On employment in the Russian Federation”).

It is advisable to view the notification (message) form on the website of the territorial office of the employment service. If a sample notification is not provided on the website, the message can be submitted in any form, making sure to indicate the position, profession, specialty (along with qualification requirements) and terms of payment for each specific employee.

The procedure for terminating each employment contract will depend on its terms.

Situation 1. The employment contract provides for a notice period for dismissal, as well as the payment procedure and the amount of severance pay.

In such a situation, the entrepreneur is obliged to fulfill the terms of the agreement (Part 2 of Article 307 of the Labor Code of the Russian Federation). For example, if the contract stipulates that upon dismissal due to termination of activities as an entrepreneur, the employer must pay the employee severance pay in the amount of 30 thousand rubles, this obligation must be fulfilled.

Situation 2. The employment contract contains a condition that the dismissal of an employee on the basis of clause 1 of part 1 of Article 81 of the Labor Code of the Russian Federation is carried out according to the general rules of labor legislation.

In this case, the entrepreneur must be guided by the general norms of the Labor Code of the Russian Federation established for organizations (appeal ruling of the Orenburg Regional Court dated June 5, 2012 in case No. 33-3059/2012).

In particular, the entrepreneur must personally and against receipt warn the employee of the upcoming dismissal. Moreover, this must be done at least two months before dismissal (Part 2 of Article 180 of the Labor Code of the Russian Federation). It is advisable to notify the employee in the coming days after making the decision to terminate activities as an entrepreneur. If an entrepreneur fires an employee without warning, he will have the right to go to court with a claim for compensation for forced absence and compensation for moral damage (paragraph 2 of article 234, part 9 of article 394 of the Labor Code of the Russian Federation). At the same time, the mere fact of such dismissal will not prevent the registration of termination of business activity. In other words, the inspectorate will not be able to refuse registration solely on the basis that the entrepreneur fired an employee in violation of the rules of Article 180 of the Labor Code of the Russian Federation.

Upon termination of the employment contract, you will need to pay the employee severance pay in the amount of average monthly earnings (Part 1 of Article 178 of the Labor Code of the Russian Federation). In addition, the employee will retain his average monthly salary for the period of employment, but not more than two months from the date of dismissal (including severance pay).

Situation: is it possible to fire an employee before two months have passed after notice of dismissal? The employment contract provides that if a decision is made to terminate activities as an entrepreneur, the employer dismisses the employee according to the general rules of the Labor Code

Yes, you can.

An entrepreneur will have the right to dismiss an employee ahead of schedule if the following conditions are met (Part 3 of Article 180 of the Labor Code of the Russian Federation):

- the employee will give written consent to terminate the employment contract before the expiration of two months from the date of notice of dismissal;

- the employer will pay the employee additional compensation in the amount of average earnings, calculated in proportion to the time remaining before the expiration of the two-month period from the date of notice of dismissal.

In this case, the employee will retain the right to payments listed in Part 1 of Article 178 of the Labor Code of the Russian Federation.

Situation 3. The employment contract does not contain conditions regarding the notice period for dismissal, and also does not regulate the payment procedure and the amount of severance pay.

As a rule, the courts come to the conclusion that in such a situation the entrepreneur should not warn the employee about the upcoming dismissal and pay him severance pay (ruling of the Supreme Court of the Republic of Khakassia dated September 8, 2011 in case No. 33-2135/2011, cassation ruling Khabarovsk Regional Court dated July 9, 2010 in case No. 33-4591).

According to the majority of courts, the general norms of the Labor Code of the Russian Federation do not apply in this case. For example, in the ruling dated March 14, 2012 in case No. 33-1720/2012, the Krasnoyarsk Regional Court indicated: “The provisions of Article 180 of the Labor Code of the Russian Federation, which provides for the employer’s obligation to warn the employee about the upcoming dismissal in accordance with paragraph 1 of part 1 of Article 81 of the Labor Code Code of the Russian Federation personally and against signature at least two months before dismissal, cannot be applied to the situation under consideration, since they are directly aimed only at legal entities (organizations).”

However, sometimes the courts take the opposite position: if the employment contract does not regulate the notice period for dismissal and the procedure for paying severance pay, the rules of Articles 178 and 180 of the Labor Code of the Russian Federation apply. For example, in the appeal ruling dated May 2, 2012 No. 33-4377, the Kemerovo Regional Court referred to the following: “... upon termination of an employment contract in connection with the termination of the entrepreneur’s activities, a dismissed employee is paid severance pay in the amount of the average monthly salary, and he also retains the average monthly salary for the period of employment, but not more than two months from the date of dismissal (including severance pay).”

Since there is no single position, an entrepreneur can independently choose one of two behavior options.

1. Dismiss an employee according to the rules established for organizations. In this case, the entrepreneur will protect himself to the maximum extent from further disputes with the employee. However, the entrepreneur will have to bear the material costs of paying severance pay.

2. Do not notify the employee of dismissal two months before termination of the contract and do not pay severance pay. In such a situation, the entrepreneur will save time and money. At the same time, the risk of a dispute with the dismissed employee will increase. But, even if the employee goes to court, negative consequences for the employer may not occur. After all, the court hearing the dispute may take a position favorable to the entrepreneur.

Positive aspects of the legal status of individual entrepreneurs

The organizational and legal form of an individual entrepreneur in some aspects of doing business, when compared with an LLC, has a number of relaxations, plus the individual entrepreneur has access to the exercise of some rights that ordinary residents of the country are deprived of. For the purposes of this article, we will limit ourselves to the positive aspects of entrepreneurship due to the specific legal status of individual entrepreneurs.

Advantages of an individual entrepreneur over ordinary citizens

Individual entrepreneur status expands the capabilities of an ordinary individual largely due to the fact that:

- An individual entrepreneur has the opportunity to conduct commercial activities, while concluding transactions and regularly making a profit.

- Individual entrepreneurs do not have to pay personal income tax.

Advantages of individual entrepreneurs over legal entities

If we compare individual entrepreneurs and LLCs with regard to the advantages of the organizational and legal form, it turns out that in general it is easier for entrepreneurs to start doing business and further develop the business:

- Minor costs for paying state fees upon registration. No need to collect a large number of papers.

- Small amounts of fines and short-term suspension of the company’s work when violations are detected.

- The individual entrepreneur himself decides when and how much money to take from the enterprise’s proceeds for personal needs (the founders of the LLC are required to wait for the distribution of income).

An individual entrepreneur has the right to dispose of income from business activities at his own discretion.

- Individual entrepreneurs are not required to contribute funds as authorized capital or indicate the legal address of the company.

- Individual entrepreneurs can, at their own discretion, refuse to open a current account and refuse to issue a seal.

- Any property, both involved in the operation of the enterprise and not involved in its business, can be freely used by the owner of the company and his family.

- An individual entrepreneur can choose the optimal tax scheme for himself from a larger number of special tax systems.

- An individual entrepreneur, as an ordinary citizen, has the right to combine running a business with any other forms of legal relations.