It is very simple to terminate individual entrepreneurial activity; you just need to fill out an application and pay a fee of 160 rubles. You can submit documents for closure in different ways - in person to the Federal Tax Service or MFC, by mail, through a representative, online. In this article we will figure out how to close an individual entrepreneur remotely, which is especially important during a pandemic.

Before closing an individual entrepreneur, we suggest checking to see if your business is among the beneficiaries. Our deferment calculator will help you determine what deferment benefits your business may qualify for.

Who is eligible for additional tax deferrals?

COVID-19 Deferral Calculator

Let’s start very briefly with how the process of deregistering an individual entrepreneur occurs; see more details here.

- Fire employees if you have them.

- Deregister the cash register.

- Close your current account.

- Submit closure documents to the Federal Tax Service.

- Pay your insurance premiums.

- Submit a return according to your regime and pay taxes.

Prepare a simplified taxation system declaration online

As can be seen from this list, the deregistration of an individual entrepreneur from tax registration in itself does not cancel other obligations, including the payment of contributions and taxes. If the reason for closing the business is a complex and uncertain situation, perhaps you should switch to paying professional income tax for now rather than closing the individual entrepreneur.

NAP payers are not required to pay insurance premiums for themselves, and in downtime conditions this is one of the significant expense items. True, the transition is only possible for some entrepreneurs: those who do not have employees engaged in providing services or performing work, with an income of no more than 2.4 million rubles per year.

Fill out an application to close an individual entrepreneur

But if the transition to NAP does not suit you, then there is nothing wrong with deregistration. The law does not place restrictions on the number of registrations of individual entrepreneurs by the same person. After some time, you can register your business activity again. And now let’s talk in detail about how to close an individual entrepreneur remotely.

Reasons for stopping business

The grounds that contribute to the closure of existing individual entrepreneurs are established by law:

- Submit an online application to close an individual entrepreneur. This is the only reason why an entrepreneur can terminate the activity on his own if any of the reasons listed below are absent.

- If the validity period of the documents of a foreign person giving the right to reside in the Russian Federation has expired or been cancelled.

- Judicial recognition of the individual who created the individual entrepreneur as bankrupt.

- A court decision to close an individual entrepreneur due to a violation of the law.

- Commencement of a court verdict banning entrepreneurial activity.

- Death of an individual.

Whatever the reason for liquidation, the businessman needs to take some mandatory actions.

We use postal services

How to liquidate an individual entrepreneur remotely? Another option is to send documents by mail.

The postal item must be sent by a valuable letter, and an inventory of the enclosed documents must be made.

All submitted documents will have to be certified by a notary, of course, with the exception of the receipt for payment of the state fee. Federal Tax Service employees will notify the applicant of the decision in the same way in which he submitted the application, that is, by mail. Therefore, it is very important to indicate the exact address of residence.

The start date of consideration in this case is the date when the letter was received by tax service specialists. Five days are allotted for the closing procedure.

How to close an individual entrepreneur online

Service companies close their businesses, demanding impressive fees for this, so it is more profitable to carry out this procedure yourself, because via the Internet it has become easy to close an individual entrepreneur on the Federal Tax Service website.

To achieve your plans, you will need the following documents:

- passport of an individual entrepreneur;

- receipt of payment of state duty equal to 160 rubles.

If you are closing, you need to confirm that you have no debt to the Pension Fund, however, thanks to the interdepartmental exchange, the tax office has the opportunity to independently obtain information by making a request to the Pension Fund.

To pay the duty, you can also use the Federal Tax Service website by selecting the desired item from the menu and following the steps according to the instructions. After making the payment, you need to save the receipt.

Closing an individual entrepreneur through the tax office consists of several steps:

- In any browser, you need to visit the tax.ru website and to terminate the activities of the individual entrepreneur, click on the “Services” button.

- After that, follow the link “State registration of legal entities and individual entrepreneurs.”

- Click on the “Individual Entrepreneurs” button.

- In the window that opens, select “Cessation of activity as an individual entrepreneur.”

- After this, you will need to log in to the system using email or go through a simple registration if you do not have an account.

- Find and fill out the application that corresponds to number P26001.

- Choose the method of submitting (sending) the application to the registration authority - electronically without an electronic signature.

- Indicate the full name of the entrepreneur, OGRN, TIN, email and contact number of the applicant. At this stage, a scan of the passport is attached to the application by uploading an image. You need to choose how the businessman prefers to receive the answer (pick up in person, pick up through a legal representative, receive by mail). After filling out, you need to wait until the system checks the entered data. .

- Choose the method that suits you to receive final documents.

- You should generate a receipt.

- Next, the application is sent to the tax office.

- Once sent, the applicant will receive a message the next day at the specified address and telephone number confirming receipt of the documents by the department.

If a businessman does not have access to the tax website, you can send the required papers by mail. Residents of Moscow can turn to the transport companies Pony Express and DHL Express for services.

If the documents meet the requirements, they will be submitted for processing, but any discrepancy will leave the application without consideration.

Remote methods of generating and submitting documents to the Federal Tax Service

Acceptance and registration of a package of documents for closing a private business is carried out in several ways:

- You can personally submit documents to the tax office at the place of registration of the individual entrepreneur. Or send them through your legal representative (in this case, you need a notarized power of attorney). The best option in this case is to submit an application through any multifunctional city center (MFC).

- Option #2 is to follow the path of completing the application remotely by sending all the papers by mail. When sending documents, an inventory of all enclosed documents must be made, and the “value” of the item must also be indicated.

- Option No. 3 - generate an application and other necessary documents through the taxpayer’s Personal Account. There are 2 online resources here - a single portal of state and municipal services and the website of the Federal Tax Service of the Russian Federation.

- The fourth method is to send a package of electronic documents certified with an enhanced qualified electronic signature (ECES) through the Internet portal “Gosuslugi” or the resource of the Federal Tax Service of the Russian Federation.

Points numbered three and four differ only in the method of obtaining the result: if you have a UKEP, the entire process takes place remotely, and when filling out an application in the online account of an individual entrepreneur (or his representative), you must personally go to the inspectorate for an extract from the Unified State Register of Entrepreneurs. The choice is up to the businessman.

You can also use the personal account in the mobile version

Closing an individual entrepreneur through the website of the Federal Tax Service of the Russian Federation

If an individual entrepreneur has a Personal Taxpayer Account (PA) on the website of the Federal Tax Service of the Russian Federation, the best way to submit a package of documents for closing an individual entrepreneur is to complete the package of documents online.

To complete the procedure, just go to your account from the main page of the Federal Tax Service portal and take a few steps:

- Select and fill out an application according to standard form No. P26001, which indicates: ORGNIP IP (main state registration number of an individual entrepreneur), last name, middle name, TIN, contact phone number and email of the applicant. Be sure to indicate in your appeal how you will receive a response: in person, through a legal representative, or by mail.

- The system will check the data is correct. Please note this may take a few minutes.

- Generate a receipt through the “Payment of state duty” service.

- Send the prepared application to the tax office.

- After 5 working days, you will need to go to the Federal Tax Service and receive a completed document on termination of activity - a USRIP entry sheet. You can find out more information about the readiness of the document in your personal account.

A similar procedure awaits individual entrepreneurs on the Unified Portal of State and Municipal Services (EPGU).

A personal account on the State Services portal has advantages

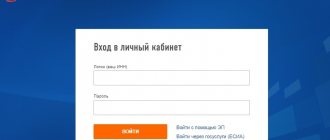

Closing an individual entrepreneur interactively on the State Services portal

One of the advantages of closing an individual entrepreneur through an EPGU is saving 30% when paying state duty. Only an entrepreneur who has an enhanced qualified electronic signature (ECES) can take advantage of the discount. Of course, the amount of savings is insignificant, but if you have such a visa, the individual entrepreneur has another preference: you can submit and, most importantly, receive a decision on closure without visiting the tax office.

You can register the UKEP using the link posted on the banner in your Personal Account of “Government Services”. The procedure is similar to registering a personal account.

Note! When authorizing using a public services portal account, if you fill out form P21001: Application for state registration of an individual as an individual entrepreneur and form P26001: Application for state registration of termination of activities by an individual as an individual entrepreneur, the amount of state duty is reduced by 30%. In this case, payment of the state duty is carried out by bank transfer; documents for state registration are submitted in the form of electronic documents signed with an electronic signature.

Federal Tax Service of the Russian Federation

https://www.nalog.ru/

By preparing documents using UKEP, we save not only time, but also money

Sending mail

Another remote way to submit notice of the closure of a private business is by sending a registered letter by Russian Post. Preparation - standard:

- Pay the state fee. This can be done in cash at a bank, on the website of the Federal Tax Service of the Russian Federation, by card or by bank transfer.

- Fill out an application in form No. P26001. You can fill it out in writing or print it out.

The application must be endorsed by the personal signature of the applicant (IP), and its authenticity must be certified by a notary. Here you must indicate the method of obtaining the decision: by mail, in person at the Federal Tax Service or through a legal representative.

With a package of documents, you need to go to the post office and send a registered letter to the Federal Tax Service with an inventory and notification.

According to the regulations of the tax service, the document on termination of the work of an individual entrepreneur - the Entry Sheet in the Unified State Register of Individual Entrepreneurs - must be ready in 5 days. Depending on which method was indicated in the application, the individual entrepreneur receives a response either in person or to his home address.

The document can be sent to your address by mail. Within the territory of Moscow, the document can also be obtained through DHL Express and Pony Express.

Federal Tax Service of the Russian Federation

https://www.nalog.ru/

Grounds for refusal to close an individual entrepreneur

The reason for refusing to register the termination of a private business must be stated.

The reasons for refusing to exclude an individual entrepreneur from the Unified State Register of Individual Entrepreneurs may be:

- Errors in completing the application;

- The application was signed by an unauthorized person, errors were found in the notarization;

- The documents were sent to the wrong Federal Tax Service;

- The purpose of payment for state duty was incorrectly formulated;

- If a liquidation procedure is underway in relation to this individual entrepreneur.

If the individual entrepreneur does not agree with the decisions of the regulator, or he does not understand the actions of the Federal Tax Service, the businessman has the right to file a complaint against the actions of the inspectors through the website of the Federal Tax Service of the Russian Federation.

Online service “Contact the Federal Tax Service of Russia”

On this resource, an individual entrepreneur can present his complaints about the actions (or inaction) of the tax service. To send a request you need:

- Select the addressee of the appeal (there is a drop-down list for this);

- Fill out the registration form, the subject of the application, and, if necessary, attach documents;

- Decide on how to receive a response and “send a request.” If an individual entrepreneur indicates his email address, a message with an incoming case number will be sent to this address within a day.

The response to the appeal, subject to consideration by the Federal Tax Service of Russia, is sent to the taxpayer signed by an official, the originating number and registration date, depending on the selected value of the field “How to send a response to you”: to the email address in the form of a scanned response file; by postal address in paper form.

Appeals that do not contain the sender's information and the address for sending a response (postal or electronic) will not be accepted for consideration.

Appeals and requests for information are considered within 30 days from the date of their registration. These deadlines may be extended in accordance with Federal Law No. 59-FZ dated 02.05.2006 “On the procedure for considering appeals from citizens of the Russian Federation” and Federal Law No. 8-FZ dated 02.09.2009 “On ensuring access to information on the activities of state bodies and bodies local government".

Federal Tax Service of the Russian Federation

https://www.nalog.ru/

Is it possible to close an individual entrepreneur through State Services?

It will not be possible to formally liquidate an individual entrepreneur on the government services website. You can find there a description of the service, what documents are needed to close an individual entrepreneur, as well as the appeal procedure. To do this, you need to be registered on the State Services website and go to it. In the upper right corner, click on the “For Entrepreneurs” link.

- Next, select from the menu “Registration of legal entities and entrepreneurs”.

- Select the menu item with termination of activity.

- Here you will find a description of how to close an individual entrepreneur: online, in person, through a representative or through the MFC, as well as the procedure for paying state duty, deadlines and contacts of your tax service.

Our prices

| Rate | List of services | Price |

| ECONOMY | -preparation of a package of documents for closing an individual entrepreneur -consultation with a lawyer -consultation with an accountant | From 2,000 rub. |

| STANDARD | -preparation of a package of documents for closing an individual entrepreneur -consultation with a lawyer -consultation with an accountant -submission and receipt of documents to the Federal Tax Service | From 3,500 rub. |

| ALL INCLUSIVE | -preparation of a package of documents for closing an individual entrepreneur -consultation with a lawyer -consultation with an accountant -submission and receipt of documents on the liquidation of an individual entrepreneur to the Federal Tax Service -necessary tax reconciliations with the budget, identifying the presence and absence of debts -preparation of all necessary accounting documentation and reporting -submission of declarations to the Federal Tax Service of Russia, incl. closing tax return | Price is negotiable |

State registration of termination of the activities of individual entrepreneurs

From the moment a businessman submits an application for state registration of the right to terminate activities, its end occurs after 5 working days. You can check whether the document is ready through the website in the Personal Account. Receiving a new sheet of the Unified State Register of Individual Entrepreneurs, indicating the completion of the activity, occurs in the manner that the applicant indicated when filling out the application. From the moment of the new entry into the Unified State Register of Individual Entrepreneurs, all aspects of the individual entrepreneur’s activities cease.

Having received the document, the individual must notify the Pension Fund about this within 12 days. It is necessary to convey this information to the territorial FSS. To exclude, a businessman should take care of paying off tax debts, deregistering a cash register if it was used in business, and closing bank current accounts.

If an individual entrepreneur has hired employees under his command, the employer must formalize the dismissal according to the Labor Code of the Russian Federation, pay them, and only after that submit an application to close the business. Filing a tax return and paying debts on taxes and fees can take place after the individual entrepreneur has been deregistered, but for this you need to strictly adhere to the established deadlines and follow the reporting regulations.

You need to know this: How to find out if an individual entrepreneur is closed

Typical mistakes when closing an individual entrepreneur

When closing an individual entrepreneur, it is important to take a lot into account: pay off employees, submit tax reports, deal with the cash register and put the documents in order. And if you have employees, the procedure will become more complicated.

But sometimes entrepreneurs make some mistakes.

Ignoring the need to submit tax reports

Some entrepreneurs, having closed their individual entrepreneurs before the end of the reporting period, forget to submit tax reports. Upon liquidation of an individual entrepreneur, an obligation arises to pay taxes within 15 days.

Violation of the requirement to deregister a cash register

The cash register used by the entrepreneur should be deregistered before filing an application to close the individual entrepreneur.

Destruction of documentation

Many people believe that after closing an individual entrepreneur they can get rid of documentation. But the law obliges all accounting and tax documentation to be stored for four years (clause 8 of article 23 of the Tax Code of the Russian Federation). This will protect you from possible misunderstandings and help resolve controversial situations in the event of inspections by regulatory authorities.

The storage period for personnel documentation is much longer—tens of years. It includes employment contracts, employer orders for the hiring and dismissal of employees, personal files, personal cards of employees (including temporary ones), personal accounts or payroll statements.

Checking the current status of the individual entrepreneur

As soon as the tax authority registers the termination of activity, this information will become publicly available, and anyone can find out the status of an individual entrepreneur. This opportunity is provided by the Federal Tax Service website, where you can check whether the individual entrepreneur is working by entering one of the types of data into the search engine:

- TIN;

- OGRN;

- Full name of the entrepreneur;

- the region in which he lives.

The data is processed, and then the system produces a table that has a cell for the date of termination of activity. The absence of information in this column means that the individual entrepreneur is carrying out activities at the time of the request.

FAQ

I fell behind on my insurance premiums as an individual entrepreneur. I haven't cried for 3 months now. What will it cost me and how can I close an individual entrepreneur with debts if I now live in another region?

The tax office will establish arrears and calculate all your debts and fines. Then he will ask them to pay, indicating the due date. To close an individual entrepreneur in another city: go to a notary and write an application to terminate the work of an individual entrepreneur using a special form - the notary will give it to you. Verifies your signature. Then to the bank to pay the state fee for closing - 160 rubles. Next, go to the post office and send the application and paid receipt by registered mail with acknowledgment of receipt to the address of the tax office where you opened the individual entrepreneur. Ask a question that interests you - use the online consultant form on the right or call by phone (Moscow). It's fast and free!

Is it possible to gradually pay off the balance of the debt after the closure of the individual entrepreneur?

You can repay the debt in parts, as an individual, but you must be prepared for the fact that you will have to pay off penalties for this delay. Ask a question that interests you - use the online consultant form on the right or call by phone (Moscow). It's fast and free!

Will an individual entrepreneur's current account be seized because of bank debts as an individual?

If an entrepreneur owes the bank on personal loans, and they sue, then the judge can seize all the entrepreneur’s accounts, including the current account, since an individual entrepreneur is an individual and is liable for debts with all his property. Ask a question that interests you - use the online consultant form on the right or call by phone (Moscow). It's fast and free!

Closing stages

Now let's discuss each stage of closure in more detail. So:

1. Will an individual entrepreneur be closed if there are debts? From September 1 of this year, the Federal Tax Service received the right to forcibly terminate the activities of individual entrepreneurs. And one of the reasons for forced liquidation may be the presence of debt. However, with this solution to the issue, the owner of a closed individual entrepreneur will be able to register a new one no earlier than in three years. Debts during forced closure will also have to be paid to the employer, but in the status of an individual. The first step towards closing an individual entrepreneur is the payment of debts.

2. Calculation and dismissal of employees. After this procedure, the owner submits reports in form RSV-1 to the Pension Fund of the Russian Federation, and insurance premiums must be paid. For those who are wondering how to close an individual entrepreneur in 2021 without employees, we inform you that the procedure is similar in both cases, but this point can be skipped in this case.

3. Next, you should change the status of the employer in the social insurance fund. You must write an application and attach a copy of the notice of registration as an insured.

Within 14 days, the funds are required to remove the applicant from the register.

• During the liquidation of an individual entrepreneur, an on-site tax audit is sometimes assigned. A review of the company's activities can be carried out at any time within the next three years after liquidation.

• The liquidation procedure is completed with the issuance of a USRIP record sheet; it certifies the liquidation of the individual entrepreneur. If problems arise during the process, the owner of the individual entrepreneur receives a notice of refusal to issue such a sheet.

Reasons for refusing to close a business

Tax authorities have the right to refuse an entrepreneur to close his business. In this case, the businessman receives a notification containing the reasons for the refusal. Such reasons include the following situations:

- the package of documents provided to the tax authorities is incomplete;

- the application contains errors (discrepancies in passport data, registration date, TIN, etc.);

- presence of errors in notarial certification;

- at the time of filing the application, legal proceedings are ongoing against this individual entrepreneur, as a result of which forced liquidation of the business is likely;

- documents were sent to the wrong department of the Federal Tax Service (to be on the safe side, you need to look at the address of the territorial tax authorities in advance);

- unreliability of the data specified in the documents;

- incorrectly signed documents (signed by an unauthorized person).

If you disagree with the reasons for the refusal received electronically, you should prepare a letter on paper, which indicates information about the attempt to electronically close the individual entrepreneur, the receipt of the refusal and the reasons that serve as justification for such a decision.

This should be done, if only because due to confusion in information about individual entrepreneurs, a considerable number of errors appear.

You need to provide the prepared letter to the tax authority serving this entrepreneur.

How long does it take to liquidate an individual entrepreneur?

An application sent through the State Services website must be registered within one hour. Individual entrepreneurs are required to close within five working days from the date of receipt of the application and documents by the tax service.

When the termination of business activity is officially registered, the Federal Tax Service sends the applicant a notice of deregistration and an entry sheet in the unified State Register of Individual Entrepreneurs. After receiving it, you can come to the tax office at your place of residence and pick up a certificate of closure of the individual entrepreneur.

Pros and cons of this method

By providing entrepreneurs with the opportunity to close an individual entrepreneur online, the tax office:

- Simplifies and speeds up the process of winding down activities. You can do without traveling and waiting in line. By following the instructions on the Federal Tax Service website and showing care and patience, achieving your goal will not be difficult.

- Allows you to save money because the businessman does not use intermediaries.

- Makes the business closing cycle accessible. Having an electronic digital signature, you can send an application to the Federal Tax Service from your office or home from a computer with access to the Internet and expect to receive a supporting document.

Although this method of termination is not ideal:

- if the flow of applications to the tax office is large, then receiving a response may take a long time;

- despite the convenience of digital signature, not every entrepreneur has his own digital signature;

- If you make a mistake when filling out an application or when signing the attached documents, the businessman runs the risk of being refused.

In comparison with the advantages of this method of closing a business, the listed disadvantages can be called features of this procedure that should be taken into account.

Articles:

Drawing up a statement of claim to the arbitration court

Execution of a court order for debt collection

Actions on the State Services website

After all the activities for submitting reports and dismissing employees, you can proceed to the procedure for submitting documents. To do this, go to the website and select the appropriate service and log in to the website.

Next, you will need to fill out the application form and go to the document transfer mode.

All scanned documents must meet the following requirements:

- resolution should be 300 dpi;

- All papers must be scanned in black and white format;

- If a document consists of several sheets, then they are all scanned into one document.

After uploading the documents, you should submit the application and wait until it is registered. In response to this, a receipt will be sent to your personal account confirming receipt of the papers.

After 5 working days, you can go back to the site and see the decision that was made by the Federal Tax Service employees.

If you have debts to the Pension Fund

Previously, until 2013, in order to close, it was necessary to provide a certificate from the Pension Fund stating that the open individual entrepreneur had no debts to it. Now the situation is different. You can also close your debts, but they won’t go away. It’s just that the private applicant will have a debt to the Pension Fund. Thus, there is no need to provide a certificate of no debt along with the paper.

The tax authority to which the application was submitted will independently make a request to the pension fund. With any answer, they will close (if all other parameters are in order), only at the same time they will notify the Pension Fund of this fact.

Components of the application

Since 2013, a simplified form has existed. It includes the following fields to fill out:

- OGRNIP number;

- separately - last name, first name, patronymic;

- TIN number;

- to whom and how is the response to the completed paper issued: to the applicant, his authorized representative, in person or by mail;

- telephone;

- E-mail address;

- signature of the applicant or his authorized representative;

- position, signature and its transcript of the employee receiving the application.

If the applicant does not submit the document personally, but prefers to send it by mail, then there is a space on the paper for the notary’s marks. Any authorized person who has the right to certify a notarial act can also perform the functions of confirming a document.

Important point! You only need to sign in the presence of a tax inspector. If the application is sent by mail (and personal presence is not possible), then a notary must be present when signing.

For reliability, the TIN of the person who is the guarantor of the applicant’s authenticity is indicated. The last point is needed for insurance in case of judicial practice on issues of illegal closure of an individual entrepreneur. The entire lower quarter of the application is left for official tax service marks. There is no need to fill it out.

Payment of state duty

In accordance with sub. 7 clause 1 art. 333.33 of the Tax Code of the Russian Federation, the amount of the state duty that must be paid when closing an individual entrepreneur is 160 rubles (20 percent of the amount of the fee charged when registering an individual entrepreneur; its amount is 800 rubles). You can save money by submitting documents not on paper, but via the Internet - in this case you will not have to pay (subclause 32, clause 3, article 333.35 of the Tax Code of the Russian Federation).

The payment document must be attached to the application in form P26001 - the tax office will accept (clause 3 of Article 333.18 of the Tax Code of the Russian Federation):

- payment order with a mark of execution, if paid by non-cash method;

- bank receipt if paid in cash.

A receipt for payment can be generated on the Federal Tax Service website - to do this, use the “Payment of state duty” service.

Requirements for filling

The form will be familiar to those who have applied to open an individual entrepreneur. Requirements for filling:

- All letters must be entered on the form only in printed form.

- All letters must be capitalized.

- It is acceptable to fill only with a black pen, with maximum brightness of the shade. This is due to the fact that the completed document will be processed by machine.

- Each character (including periods, commas, colons, and spaces) needs its own cell.

- The information must completely match the data already available in the system. ID numbers, passports, OGRNIP, TIN and other data must not be distorted. A mismatch of at least one character results in cancellation of the document acceptance.

- Abbreviations and hyphenations are possible only in accordance with the rules of Russian spelling.

- Duplicate information is not welcome.

The machine does not understand and does not accept corrections or illegible written letters.

If you decide to fill out the columns in Word on your computer, then the font size should be 18, and its name should be Courier New.

Filling out an application on form P26001

The application form for liquidation of individual entrepreneur R26001 is unified - it is fixed by order of the Federal Tax Service of Russia dated August 31, 2020 No. ED-7-14 / [email protected] The new form is valid from November 25, 2020. It can be filled out on a computer or by hand - in black ink, legibly and without corrections. The application indicates the applicant's phone number and email address - the result of the application to the tax office will be sent to it. Section 3 of the form does not need to be filled out - tax officials will do this when they receive the document.

You can see and download the form and sample of such an application in our material.

Do I need to visit foundations?

If the entrepreneur had employees, after the closure of the individual entrepreneur he will have to notify all the funds to which he made contributions.

Thus, information about employees who worked for the individual entrepreneur must be transferred to the Pension Fund within a month from the date of the decision to close (paragraph 5, paragraph 2, article 9 of the federal law “On Individual..." dated 04/01/1996 No. 27-FZ ). If this is not done, it will not be possible to close the individual entrepreneur through the tax office - the tax authorities will reject the application for liquidation (see, for example, the resolution of the Federal Antimonopoly Service of the Central District dated November 26, 2012 in case No. A14-745/2012).

After the dismissal of the last employee and registration of the fact of closure of the individual entrepreneur, an application for deregistration with the Social Insurance Fund is submitted to the tax office. Copies of the order(s) on termination of employment contracts with employees must be attached to it. Within 14 days from the date of receipt of the documents, the FSS will deregister the former entrepreneur (subclause 3, clause 3, article 6 of Federal Law No. 125).