INTRODUCTORY PART

Labor costs for production workers are a large category in the cost of manufacturing products, so special attention is paid to the issue of establishing the most rational form of payment, as well as maintaining or reducing the level of these costs.

The issue of remuneration is important not only for management in terms of the costs of the enterprise, but also for its employees. For them, the level of wages received is of the highest interest.

In addition, when implementing an effectively working remuneration system, high motivation of employees is guaranteed to perform their functional tasks that meet both quantitative and qualitative indicators.

The amount of wages is determined depending on the position held, the category of the employee, his qualifications, type of unit, professional level and personal contribution of the employee to the accomplishment of assigned tasks.

Each enterprise has the right to apply its own remuneration system , that is, the procedure for calculating the amount of wages to be paid to employees in accordance with the work functions performed and the results of work, including the size of tariff rates, salaries (official salaries), additional payments and compensation allowances. In this case, the enterprise is obliged to record the time actually worked by each employee.

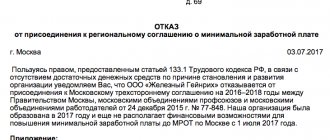

Labor legislation provides a number of guarantees to employees, including regarding wages. For example, a minimum wage (minimum wage) is established, which cannot be lower than the subsistence level of the working population. If an employee has fully worked the standard working hours during the period and fulfilled the labor standards, his monthly salary cannot be lower than the minimum wage.

Let us present the main blocks that are included in the remuneration of employees of an enterprise:

- tariff rate/official salary;

- compensation payments;

- incentive payments.

The tariff rate is a fixed amount of remuneration for an employee for fulfilling a standard of work of a certain complexity (qualification) per unit of time, without taking into account compensation, incentives and social payments (Article 129 of the Labor Code of the Russian Federation; hereinafter referred to as the Labor Code of the Russian Federation).

Salary is a fixed amount of remuneration.

Types of wages

From the point of view of economic theory, wages are divided into:

- nominal,

- real.

Nominal wages are wages expressed only in monetary terms, without taking into account inflation. Thus, an increase in nominal wages is not an indicator of an increase in worker welfare.

Real wages are wages expressed in terms of the quantity of goods and services that can be purchased for a nominal wage. Consequently, real wages decrease with every increase in the prices of goods and services.

BASIC FORMS OF REMUNERATION

There are two main forms of remuneration: time-based and piece-rate.

Time-based form of remuneration

Under this system, an employee’s wages are calculated based on the time actually worked and his tariff rate or official salary.

The time-based form of remuneration does not take into account the quantitative indicators of the activities of each employee.

Most often it is used to pay managers, administrative staff and specialists.

As for the main production workers, who have a direct influence on the quantity and quality of products produced, they are sometimes paid on a time-based basis.

This is due to three main reasons:

- ease of payroll calculation;

- it is impossible to determine time standards for remuneration or other quantitative measurement standards (part, product, specific operation or part of it, etc.);

- insufficiency of the quantitative standard for measuring labor.

For the main production workers, the time-based form of remuneration does not have the proper motivational component . After all, workers know that, regardless of the amount of work performed (products produced), they will receive their salary, prescribed in the staffing table (or the salary will be determined by multiplying the hours actually worked by the hourly tariff rate).

In this case, you need to motivate employees with other tools.

EXAMPLE 1

We will calculate the wages of employees of Alpha LLC based on the results of work for the month (the form of payment is time-based).

Fomin I.I. holds the position of shop manager, Petrov S.S. is a mechanical assembly mechanic of the 5th category.

In accordance with the Regulations on the remuneration of workers at the enterprise, the following types of accruals for time-based wages are established:

“With time-based wages, the employee’s earnings are accrued at the assigned tariff rate or salary for the time actually worked.

According to the method of calculating wages, this system is divided into hourly and monthly. When paying hourly, wages are calculated based on the worker’s hourly wage rate and the actual number of hours he worked during the pay period. When paying monthly wages, wages are calculated based on fixed monthly salaries (rates), the number of working days provided for by the work schedule for a given month, and the number of working days actually worked by the employee in a given month.”

The level of remuneration is specified in the employment contracts of employees.

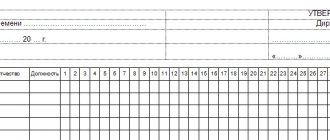

This information can also be seen in the staffing table of the enterprise (Table 1).

As can be seen from the staffing table, the monthly official salary of the workshop manager is 70,000 rubles, the hourly wage rate for a mechanical assembly mechanic of the 5th category is 280.20 rubles.

Column 9 of table. 1 for a mechanic is not filled in, since the monthly wage depends on working hours in a particular month (in column 10 “Note” there is a corresponding clarification).

Knowing the amount of remuneration (in this case, the official salary for the workshop manager and the hourly wage rate for a mechanical assembly mechanic of the 5th category), you need to determine the actual time worked. This information should be taken from the working time sheet (Table 2).

The time sheet shows how much each employee actually worked:

- Fomin I.I. - 21 days, 168 hours (worked a full working month);

- Petrov S.S. did not work on the 20th and 21st, as evidenced by the letter code “DO” (leave without pay granted to the employee with the permission of the employer). In total, Petrov has 19 working days; he worked 152 hours in a calendar month.

ON A NOTE

All alphabetic and numeric codes used in the working time sheet to indicate the attendance and absence of workers are presented in Resolution of the State Statistics Committee of Russia dated January 5, 2004 No. 1 “On approval of unified forms of primary accounting documentation for the accounting of labor and its payment.”

Based on the available information, we will calculate the monthly salary of employees.

1. Since the shop manager Fomin I.I. worked a full working month, as evidenced by the time sheet, he is entitled to accrual of the entire amount of his official salary - 70,000 rubles.

Income is subject to personal income tax (13%), so the employee received “clean”:

70,000 rub. – 13% = 60,900 rub .

2. According to the time sheet, S.S. Petrov worked part-time - 152 hours. According to the staffing table, the hourly wage rate for a mechanical assembly mechanic of the 5th category is 280.20 rubles. Hence the income of Petrov S.S.:

152 hours × 280.20 rub. = 42,590.40 rub.

“Net” income minus personal income tax:

RUB 42,590.40 – 13% = 37,053.65 rubles .

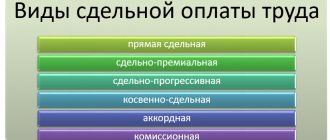

Piecework form of remuneration

This remuneration system is based on quantitative and qualitative indicators of labor results, is applied simultaneously with the standardization of labor and the establishment of time standards, production standards, etc. Employees receive wages depending on the quantity of products produced (work performed or services provided) according to internally approved enterprises at piece rates per unit of output ( work , services ).

Piece wages are most often established for key production workers, who have a direct impact on the quantity of products produced. This is primarily due to the dependence of the quantity and quality of products on the contribution of each employee. The more products the enterprise produces (produced by a team or a specific employee), the higher the employee’s wage level.

To pay piece workers, a tariff scale (for example, six-digit) must be developed. For each calendar year, the enterprise establishes uniform hourly wage rates for workers, taking into account wage indexation. An example of the design of uniform hourly tariff rates is in table. 3.

To determine the level of wages, in addition to hourly tariff rates, information is needed on the price for each type of work (procedures or for an individual part). To do this, enterprises approve time standards (labor intensity standards, prices for manufactured products, etc.).

Let's consider an option in which piece workers are paid for a standardized time, taking into account the type of work performed.

Standardized time is established for each type of work (product or service) of a production enterprise. It is developed by a standardization engineer, according to the head of the enterprise.

An example of an enterprise’s pricing for piecework work is given in Table. 4.

With an individual piecework form of remuneration, an individual personal account, work card, work order or other document established by a local act of the enterprise is issued for each employee, which displays how much and what kind of work he performed in the month for which his wages need to be calculated.

Let's consider an example of drawing up a document for calculating the actual salary of an employee with an individual piecework form of remuneration (Table 5).

According to table. 5 employee will receive 23,071.39 rubles . (excluding allowances and bonuses, if any).

Let's determine his individual output, that is, an indicator of labor productivity (the difference between standardized and actual time). The actual time is determined by the time sheet worked for the month (assuming 168 hours), the normalized time is determined by the personal account (208.98 hours). Hence the development of employee time standards - 40.98 hours , or 124%.

COMPENSATION PAYMENTS

Compensation payments are designed to compensate for work under conditions that deviate from normal conditions. Compensation payments include:

- payments to employees engaged in heavy work, work with harmful, dangerous and other special working conditions;

- for work in areas with special climatic conditions;

- for work in conditions deviating from normal (overtime, night work, combining professions, expanding service areas, increasing the volume of work or performing the duties of a temporarily absent employee without release from work specified in the employment contract, for working on weekends and non-working holidays days and when performing work in other conditions deviating from normal).

According to Art. 147 of the Labor Code of the Russian Federation, remuneration for workers engaged in work with harmful and ( or ) dangerous working conditions is established at an increased rate. The minimum increase in wages for employees engaged in work with harmful and (or) dangerous working conditions is 4% of the tariff rate (salary) established for various types of work with normal working conditions. The specific amounts of wage increases are established by the employer, taking into account the opinion of the representative body of employees.

Remuneration for work in areas with special climatic conditions is made in the manner and amounts not lower than those established by labor legislation and other regulatory legal acts containing labor law norms.

According to Art. 150 of the Labor Code of the Russian Federation, when an employee with a time wage performs work of various qualifications, his work is paid for work of a higher qualification .

If an employee with piecework wages performs work of various qualifications, his work is paid according to the rates of the work he performs .

IT IS IMPORTANT

In cases where, taking into account the nature of production, workers with piecework wages are entrusted with performing work that is charged below the grades assigned to them, the employer is obliged to pay them the difference between grades.

With the written consent of the employee, he may be assigned to perform, during the working day (shift), along with the work specified in the employment contract, additional work in a different or the same profession (position) for additional pay.

Payment terms are stipulated in Art. 151 of the Labor Code of the Russian Federation, however, the specific level of additional payment is not regulated, so the enterprise, represented by management, can independently set the amount of additional payment: both in a fixed form and as a percentage of the tariff rate or official salary.

Carrying out the work of a temporarily absent employee (business trip, sick leave, vacation, etc.) and receiving additional payment for performing work additional to the main job responsibilities can not only be temporarily transferred to one person, but also distributed among several employees.

Employees performing the duties of temporarily absent employees are recommended to establish such an additional payment so that in total it does not exceed the level of wages of the temporarily absent employee. Otherwise, the combination becomes economically infeasible.

NOTE

The working time sheet does not keep records of combined positions, therefore, to establish the actual time worked in a combined profession, data is taken from the employee’s main profession.

HR departments should carefully study job descriptions. The instructions may indicate that the deputy head of a department acts as the head of the department during his absence. In this case, additional payments are not mandatory; the final decision on them is made by the head of the enterprise.

EXAMPLE 2

Engineer Ivanov I.I. (salary - 35,000 rubles) for a full working month performed additional work to combine the position of temporarily absent engineer Petrov N.S., whose salary was set at 35,000 rubles.

For performing additional part-time work, Ivanov is given an additional payment of 30% of the official salary of engineer Petrov.

Taking into account the additional payment, Ivanov I. I.’s salary will be:

35,000 rub. + (RUB 35,000 × 30%) = RUB 45,500 .

EXAMPLE 3

Engineer Ivanov I.I. with a fixed salary of 35,000 rubles. Over the course of an incomplete working month, he performed additional work to combine the position of temporarily absent engineer N.S. Petrov with the established salary (RUB 35,000). He was hired to carry out work on the 15th.

For performing additional part-time work, Ivanov is given an additional payment of 30% of the official salary of engineer Petrov.

Additional Information:

- number of working days in a month - 22;

- the number of days actually worked in the combined position is 11 (according to the working time sheet).

Employee Ivanov I.I. will receive the following salary, taking into account additional payments:

35,000 rub. + (35,000 rub. / 22 days × 11 days × 30%) = 40,250 rub .

Overtime pay

Overtime work is paid for the first two hours of work at least one and a half times the rate, for subsequent hours - at least double the rate (Article 152 of the Labor Code of the Russian Federation). Specific amounts of payment for overtime work can be established by a collective and labor agreement, and local regulations.

At the request of the employee, overtime work, instead of increased pay, can be compensated by providing additional rest time, but not less than the time worked overtime.

EXAMPLE 4

Mechanic Ivanov S.I. was involved in overtime work due to the temporary absence of another employee. Let's calculate the amount of wages for Ivanov, provided that the hourly tariff rate according to the enterprise tariff schedule for a mechanic is 250 rubles , and the working week is set at 40 hours with an 8-hour working day (Saturday and Sunday are days off). Ivanov S.I. is involved in working overtime for 4 hours twice per calendar month - a total of 8 working overtime hours.

Additional Information:

- number of working days in a month - 22;

- the number of hours actually worked is 184 hours , including 8 hours (data from the time sheet).

Let's calculate the salary of Ivanov S.I.

1. Wages excluding overtime:

(184 hours – 8 hours) × 250 rub. = 44,000 rub .

2. Payment for overtime work (according to the internal regulations of the enterprise and the Labor Code of the Russian Federation: the first two hours - at one and a half times; subsequent ones - at double):

(2 hours × 250 rub. × 1.5) × 2 days. + (2 hours × 250 rub. × 2) × 2 days. = 3500 rub .;

3. Amount to be charged:

44,000 rub. + 3500 rub. = 47,500 rub .

Pay slip

Receipt of a salary is always accompanied by the issuance of a pay slip - this is required from employers by the Labor Code (Article 136 of the Labor Code of the Russian Federation). In his pay slip, the employee clearly sees what his salary includes: the total amount, taxes, insurance premiums, various deductions and other components.

Read more: Example of decoding pay slips

Article 136 of the Labor Code of the Russian Federation further clarifies that issuing a pay slip is the employer’s responsibility, not his right. The employee receives a payslip without fail in any method of receiving money - in cash or by transfer to a bank card. Refusal to issue a pay slip threatens the employer with a fine.

Sample pay slip for salary

INCENTIVE PAYMENTS

Incentive payments are additional payments and bonuses of an incentive nature, as well as bonuses and other incentive payments. To best motivate the work of employees, enterprises develop appropriate bonus provisions (features of providing incentive and incentive payments can be specified in the collective agreement or regulations on remuneration).

The provision standards or amounts of payments are not regulated at the legislative level, therefore the enterprise has the right to independently establish the appropriate additional payments (fixed monetary form/percentage of the official salary or tariff rate).

That is why, and in order to increase the stimulating value of remuneration, piece-rate and time-based wage systems are used in combination with bonuses for employees for meeting and exceeding their performance indicators (piece-rate and time-based bonus).

The bonus provision may provide for other one-time payments:

- in connection with state or professional holidays, significant or anniversary dates;

- for high individual achievements in work, active participation in the activities of the organization, etc.

Since there are no restrictions on material incentives for employees by law, bonus provisions can be established :

- individual bonuses to tariff rates or official salaries (for high achievements in work, high qualifications, etc.);

- allowances for training of newly hired employees or for continuous work experience in the organization.

In order to prevent negativity from the workforce in the event of non-payment of bonuses due to the lack of opportunity at the enterprise, it is worth writing the following in the appropriate section of the bonus regulations: “Bonuses are paid to the organization’s employees if there are available funds that can be spent on material incentives without compromising the main activities of the organization.