Electronic signature for the tax office and more - what is it?

The definition of an electronic signature is given in paragraph 1 of Art.

2 of the Law “On Electronic Signatures” dated April 6, 2011 No. 63-FZ (hereinafter referred to as Law No. 63-FZ). According to this definition, the main function of an electronic signature is to identify the person who signed the electronic document. Documents in electronic form are becoming increasingly common today. Reporting in electronic form is required to be submitted by:

- all VAT payers;

- organizations with more than 100 employees - to the Federal Tax Service;

- employers with 25 or more employees - documents containing information on the income of individuals and personal income tax, and reports to the Pension Fund of the Russian Federation and the Social Insurance Fund.

An electronic report without an electronic signature cannot be submitted, since the systems for receiving reports and declarations will not be able to identify the submitter of these electronic documents.

Law No. 63-FZ in Art. 5 identifies the following types of electronic signatures:

Figure 1. Types of electronic signatures in accordance with Art. 5 of Law No. 63-FZ

A simple signature is a type of identification formed using a password, code or other means.

How to make a simple electronic signature can be found in the article “How to make a simple electronic signature” .

Enhanced Electronic Signature (ESS), as shown in Fig. 1, divided into 2 types:

- qualified;

- unqualified.

The common features of these 2 types of electronic electronic signatures are that they are formed using cryptography (encryption) to transform the information entered on the key, more accurately identify the person who signed the document using such a signature, and control possible changes made to the documents after they have been signed . Another common feature for electronic signatures is that they are created using special devices for electronic signatures.

A qualified enhanced electronic signature is additionally confirmed by a qualified certificate. In the process of its creation and verification, special means of signature confirmation are used in accordance with the requirements of Law No. 63-FZ as amended by the Law “On Amendments...” dated December 30, 2015 No. 445-FZ.

A qualified enhanced electronic signature is provided by certification centers. An unqualified enhanced electronic signature can be obtained without certification centers by going through the identification procedure.

What is the difference between the two types of electronic signatures, you can learn more from the article “What is the difference between the two main types of electronic signatures?”

What you can do with an electronic signature:

- The first advantage of owners of an electronic signature is the opportunity to register on the websites of the Federal Tax Service, Pension Fund, Social Insurance Fund and become a user of a personal account on these electronic resources.

- The second advantage is that you can issue an electronic signature to participate in electronic trading on government trading platforms, and the key to this electronic signature is also suitable for users of the electronic resources of the Federal Tax Service, Pension Fund of the Russian Federation, Social Insurance Fund and the government services website.

How to manage taxes through the personal account of an individual taxpayer

Any tax payer can create a personal account on the Federal Tax Service website. This can be done with:

- Registration card, which a taxpayer can receive at any territorial branch of the Federal Tax Service that works with individuals. Where exactly the taxpayer is registered does not play any role.

- Qualified electronic signature. The key and the CEP verification certificate are issued by certification centers accredited by the Ministry of Telecom and Mass Communications of the Russian Federation.

- An account in the Unified Identification and Authentication System (USIA). An account in the ESIA can be obtained at post offices or MFCs when receiving government services.

Another way to get full access to all options of the Federal Tax Service website for taxpayers is to obtain a digital electronic signature. This method makes it possible to interact with the Federal Tax Service without opening a personal account. For example, to submit an application electronically for registration of an enterprise or individual entrepreneur or for making changes to the constituent documents, the creation of a personal account is not mandatory, but a digital electronic signature is required.

What can an individual do in his personal account on the Federal Tax Service website?

What a personal account on the Federal Tax Service website gives a person:

- The taxpayer - the user of his personal account - is always aware of what tax is accrued and when it needs to be paid. An individual taxpayer can conduct an online reconciliation with the Federal Tax Service.

- Receives current forms of payment receipts (taking into account territorial specifics).

- Has timely and complete information about tax rates and the possibility of applying for benefits.

- Has the opportunity to submit applications to the Federal Tax Service, receive answers, letters, clarifications and clarifications.

- Pay taxes through a special payment form.

- Download, fill out, send the 3-NDFL declaration.

Similar opportunities are provided to users by personal accounts on the websites of the Pension Fund and the Social Insurance Fund. On the Pension Fund website, users can calculate their pension, enter or clarify information about their length of service, apply for a pension, submit documents and come to the Pension Fund only at the stage of assigning a pension and receiving a pension certificate.

About unclear identifiers in payrolls

Often citizens are faced with the need to correctly fill out the necessary details in pay slips, tax returns, fine receipts, and payment slips paying for the services of budgetary organizations. Difficulties are usually caused by the fields where it is necessary to enter the payer identifier (IP) and another identifier - UIN (aka UIP). How do you know what it is? Citizens usually know what a payer identification number is: on the tax return form it is usually indicated as a Taxpayer Identification Number (TIN).

What is a UIN: assignment rules and instructions

UIN (UIP) stands for a unique identifier of charges (payments). To put it simply, this is a code that contains all the necessary information about the payment sent to the state budget and the correctness of its receipt.

When is it necessary to indicate the UIN

The decision on the need to indicate this detail in a number of cases was made in accordance with Order of the Ministry of Finance of the Russian Federation No. 107n dated November 12, 2013. Thus, the following payment orders for transfers to the state budget must necessarily contain the UIN and payer identifier:

- sent from tax authorities, demanding payment of arrears, fines, penalties;

- fines for administrative violations;

- transfers to the budget (for example, fees for kindergarten or education);

- transfers under an agreement, when the recipient of the money assigns a UIN to the payment order in advance and notifies the counterparty about this (used in mutual commercial settlements of legal entities).

The form of the receipt, in which you must indicate the UIN - 504 510.

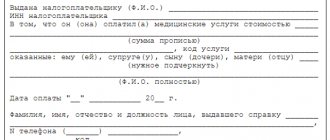

What identifier is indicated in personal income tax and tax collections?

The income statement does not indicate the UIN, but the payer identifier (IP):

- for a legal entity - TIN;

- physical - SNILS or other, including alternative, identifier of an individual;

- for a foreign organization (IO) - FIO code (FIO).

In line No. 22 “unique identifier of charges (payment)” you must enter “0”.

Attention! There is no need to form a UIN when paying land, property, or transport taxes. In these cases, in payment documents of Form N PD sent from the Tax Service, the index of the tax document must be indicated as the UIN.

A payment order can be issued directly on the website of the Federal Tax Service using the electronic service. In this case, the UIN will be assigned automatically.

Clarification on these issues was provided by the Federal Tax Service, which specified cases when indicating the UIN is not necessary.

Is it necessary to indicate the UIN in other payments?

In all other payment orders not sent to the state, municipal or city budget, it is not necessary to indicate a unique payment identifier. You must enter zero in the “code” field.

If the bank unlawfully demands to indicate the UIN on the payroll, employees must be reminded of the letter of the Federal Tax Service of the Russian Federation No. ZN-4−1/ dated April 8, 2021.

How is UIN assigned?

According to the order of the FS FBN No. 48 dated February 28, 2014, it is necessary to assign not only UIP, but also individual entrepreneurs:

- for payments for state or municipal services, and other payments to the state budget;

- imposition of sanctions from the tax authorities and fines, according to the Code of Administrative Offenses (in this case, the UIN is usually indicated in the payment document itself;

- drawing up protocols on administrative violations (AP) sent to the magistrate.

The rules for assigning an identifier are contained in Appendix 1 of the order of the FS FBN.

The UIN (UIP) code contains 20 digits, the individual payer identifier contains 25.

Composition of the UIN code by category

- The first three categories contain the code of the chief administrator for state budget revenue (state body, local administration, local government self-government - Article 6 of the Budget Code of the Russian Federation).

- Digits 4 - 6: last three digits of the RPBS code (register of recipient of budget funds). (The register was created on the basis of Order of the Ministry of Finance No. 163n dated December 23, 2014).

- Digits 7 - 9: index of the structural unit (if the organization does not have structural divisions, zeros are entered).

- Level 10 - case code: 1 - if a decision is made to punish for an accident in the form of a fine under the Code of Administrative Offenses; 2 - if the case is transferred to a magistrate.

- Digits 11 - 14: year and month of registration of the AP.

- Digits 15 - 19: serial number of AP registration.

- Bit 20 is a control key.

Note: In the absence of administrative cases of violations, zeros are entered in the identifier fields intended for digits 10 to 19.

From here it is clear that in a simple receipt for a kindergarten there will be a “0” in the ten penultimate fields of the code.

Where can I get the Chief Revenue Administrator code?

The code of the chief administrator of state revenues is taken from the list established by Federal Law No. 359 - Federal Law of November 22, 2016.

The list of codes can be seen here.

How to calculate the control key in the UIN code

The control key is a number from 0 to 9 and must occupy one digit (one field).

- To calculate the key, you need to assign a weight from one to ten to each digit (from the most significant digit, that is, the very first field, to the least significant one). After the 10th digit, they begin to assign weight again, starting from one.

- Each UIN digit is multiplied by the assigned weight and the sum of all products is added.

- The resulting amount is divided by 11. The remainder of the division is the control key.

- If during the calculation they receive a two-digit number, repeat the assignment of weight, but not from 1 to 10, but from 3 to 5 inclusive. Repeat the calculation. If this time the number is greater than 9, then in the 20th digit where the control key should be, put 0.

Payer ID - what is it?

There are individual entrepreneurs for legal entities, individuals and foreign organizations (IO). In this case, individual entrepreneurs are considered individuals.

For a legal entity, individual entrepreneur is the identification number of the payer (or taxpayer), that is, TIN. The TIN is usually indicated along with the reason code for registering the person with the tax authorities, i.e. KPP.

For an international organization, this is the KIO, that is, the code of the foreign organization, plus the checkpoint.

Payer ID of an individual

For individuals, the following can be used as identifiers:

- insurance number of a person insured by the Pension Fund of the Russian Federation (SNILS);

- series and number of passport or driver's license;

- series and number of the vehicle registration certificate received upon registration;

- other information permitted for use as personal identifiers, in accordance with the law (for example, military ID, sailor’s passport, etc.).

The individual ID code is a two-digit number. Allowed ID codes for individuals:

Assigning an alternative identifier to an individual

An alternative payer identifier provides information about an identity document (or other document permitted by law for personal identification) and citizenship of an individual.

- The first two digits of the IP are occupied by the document code.

- The next 20 digits (from 3 to 22) are the series and document number in one line without a space between them).

- The last three digits are the code of the country whose citizenship the payer has.

What does a legal entity receive by issuing an electronic signature with the Federal Tax Service?

For legal entities, setting up a personal account on the Federal Tax Service website is also beneficial, as it allows you to:

- Know everything about what taxes are assessed, how much payment is credited, make reconciliations and receive information about existing overpayments or arrears.

- Receive and send requests and letters to the Federal Tax Service.

- Receive consultations.

- Save time: contact the Federal Tax Service without leaving the office.

A legal entity can use a personal account with an unqualified electronic signature.

If an enterprise has issued a certificate for the use of an electronic signature key that has all the characteristics of a qualified signature, then it can submit reports through special resources on the websites of the Federal Tax Service, the Social Insurance Fund and the Pension Fund of the Russian Federation. In addition, it is possible to submit electronic reporting through electronic reporting operators. The consumer has the right to independently choose the most convenient method for himself.

You can learn how to take into account the costs of purchasing an electronic signature in accounting and tax accounting from the Ready-made solution from ConsultantPlus.

How to make an electronic signature for the tax office

An electronic signature for tax reporting can be done at one of the certification centers licensed by the Ministry of Telecom and Mass Communications. You must first prepare a package of documents. The maximum package for a legal entity includes:

- a copy of the constituent agreement;

- a copy of the charter;

- a copy of the order appointing the director;

- passport details, SNILS and TIN of the director;

- a copy of the legal entity registration certificate;

- a copy of the tax registration certificate;

- an extract from the Unified State Register of Legal Entities received no later than six months before applying to the certifier of extracts from the Unified State Register of Legal Entities may be different - check this point at the certification center where you apply to receive keys and an electronic signature certificate).

A specific certification center may not require all documents to generate a signature key. It is better to clarify the contents of the package in advance.

See also “Which certification center can I obtain an electronic digital signature?”

An individual entrepreneur can not only contact a certification center. Individuals have the opportunity to obtain an electronic signature at the territorial office of the tax inspectorate or by obtaining an Unified Identification and Logistics account at one of the post offices or at the MFC.

The procedure for contacting is not much different from working with a certification center. It is also necessary to prepare copies of constituent documents and documents identifying the owner of the signature, and apply for an electronic signature. There is also a certification center within the structure of the Federal Tax Service of Russia.

How to obtain a certificate from a certification center of the Federal Tax Service of Russia

Certification centers of the Federal Tax Service of Russia were created in order to carry out certification and automation of data exchange between state enterprises that are part of the electronic information exchange system.

In this regard, an individual who is not an official of a state-owned enterprise, or a legal entity that is not a state-owned enterprise, cannot obtain a certificate from a certification center of the Federal Tax Service of Russia.

For state enterprises and officials vested with the right of electronic signature, certification is carried out in accordance with the procedure established by the regulations. The first document that such potential applicants need to familiarize themselves with is the Regulations on the infrastructure of the certification center of the Federal Tax Service (Moscow, 2013), which can be downloaded on the Federal Tax Service website.

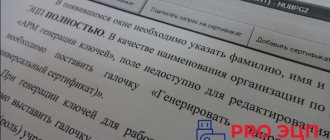

1.3. Installing the KSKKEP key in the “Personal” certificate store

- We connect the KSKPEP media (flash card Rutoken or JaCarta) to the computer.

- From the Start , select Programs -> CRYPTO-PRO -> CryptoPro CSP

- Click " Service "

- Next “ View certificates in the container... ”

- Click " Browse... " next to the "Key Container Name" field:

- Select the key container corresponding to the connected electronic signature medium and click “ Ok ”

- Confirm by clicking “Next”

- Click “ Install ”

- «OK»

- Click “ Finish ” and close the program.

- The KSKPEP key is installed in the “Personal” certificate store

Electronic signature for reporting: how to check relevance on the tax website

Holders of digital signature certificates can check its relevance on the government services website. The path to verification is simple. You need to log into the website using the link www.gosuslugi.ru/pgu/eds. The service that opens allows you to check the authenticity (relevance) of the certificate and electronic digital signature documents.

Read here what the purpose of an EDS key certificate is.

To verify, in the form that opens, select the certificate or electronic document that needs to be verified, and enter the confirmation code (anti-bot). After a short waiting time, the system will display the result of whether the selected electronic signature document is current.

As a rule, if the certificate is issued by an enterprise licensed by the Ministry of Telecom and Mass Communications, the problem of checking its relevance does not arise. When connecting to services using an electronic signature key in the name of the certificate, the user always sees the validity period of his key. A few weeks in advance, any system (trading platform or Federal Tax Service service) notifies the user that the validity period of his certificate is coming to an end, every time he uses the key. The user’s task is to contact his certification center in time to renew the certificate.

Subscriber code is a unique subscriber identifier.

Where and how can I get an ID?

What is a unique identifier

Dear taxpayers! 02/09/2012 00:43 Dear taxpayers! The Federal Tax Service is conducting a pilot project to operate software that ensures the submission of tax and accounting reports in electronic form through the website of the Federal Tax Service of Russia.

You are given the opportunity to take part in the pilot project to submit tax and accounting reports in electronic form through the official website of the Federal Tax Service of Russia on the Internet. The service is located at www.nalog.ru in the “Electronic” section. To use this Internet service, you must fulfill a number of technical conditions.

1. Obtain an electronic signature and subscriber ID 1.1 If the taxpayer has a valid electronic signature key (ES), the qualified certificate of which was issued by a certification center (CA) that is part of the network of trusted CAs (DCA) of the Federal Tax Service of Russia: The taxpayer must contact the CA that previously issued ES key, with a request to provide him with the opportunity to submit reports through the website of the Federal Tax Service of Russia using the previously received ES key. After completing the procedure for registering a taxpayer to work through the Internet site of the Federal Tax Service of Russia, the CA issues the taxpayer a subscriber code (unique subscriber identifier) for working with the Internet service.

A taxpayer who has an electronic signature key and a unique subscriber identifier can submit reports through the website of the Federal Tax Service of Russia. 1.2. If the taxpayer does not have an ES key: The taxpayer must contact any CA that is part of the DTC network of the Federal Tax Service of Russia. The list of certification centers accredited in the network of the RTC of the Federal Tax Service of Russia, and from which you can obtain an electronic signature key for the ability to work with the Internet service, is presented on the Internet sites of the Federal Tax Service of Russia (https://www.nalog.ru) and the Federal State Unitary Enterprise GNIVTs FTS of Russia ( https://www.gnivc.ru).

After completing the procedure for registering a taxpayer to work through the Internet site of the Federal Tax Service of Russia, the CA issues the taxpayer a unique subscriber identifier for working with the Internet service. A taxpayer, having an electronic signature key and a unique subscriber identifier, can submit reports through the website of the Federal Tax Service of Russia. 2. Install a specialized program To draw up a declaration and upload the file, you need the “Legal Taxpayer” program.

You can download it on the website www.nalog.ru in the “Electronic” section. To ensure the possibility of submitting tax returns (calculations) electronically using electronic signatures, a single acceptance point has been created. The taxpayer can submit reports from any location with an Internet connection.

To submit reports electronically, the taxpayer must: prepare a transport container file (using the PC “Taxpayer Legal Entity”) containing a tax return (calculation) encrypted on the public key of the recipient (MI Federal Tax Service of Russia for the Data Center); transfer the received encrypted file to the MI of the Federal Tax Service of Russia via the data center using the file download service

New opportunities for presenting tax and accounting reports in electronic form

Publication date: 07/19/2013 09:39 (archive) The Federal Tax Service is conducting a pilot project for the operation of software that ensures the submission of tax and accounting reports in electronic form through the website of the Federal Tax Service of Russia. As part of the pilot project, it is possible to submit tax and accounting reports in electronic form form through the official website of the Federal Tax Service on the Internet.

To use this Internet service, it is necessary to fulfill a number of technical conditions in accordance with the submission of tax and accounting reports in electronic form through the website of the Federal Tax Service of Russia. To provide tax and accounting reports through the website of the Federal Tax Service of Russia, you must have: 1. Digital signature key issued by the Federal Tax Service of Russia 2. Unique subscriber identifier 3.

PC “Taxpayer Legal Entity” If the taxpayer has a valid digital signature key, the qualified certificate of which was issued by a CA that is part of the DTC network of the Federal Tax Service of Russia. The taxpayer must contact the Certification Center (CA), which previously issued the EDS key, with a request to provide him with the opportunity to submit reports through the Internet site of the Federal Tax Service of Russia using the previously received EDS key. After completing the procedure for registering a taxpayer to work through the Internet site of the Federal Tax Service of Russia, the CA issues the taxpayer a subscriber code (unique subscriber identifier) for working with the Internet service.

If the taxpayer does not have an EDS key, it is necessary to contact any Certification Center that is part of the RTC network of the Federal Tax Service of Russia.

The list of certification centers accredited in the network of the RTC of the Federal Tax Service of Russia, and from which you can obtain an electronic signature key for the ability to work with the Internet service, is presented on the Internet sites of the Federal Tax Service of Russia (/) and the Federal State Unitary Enterprise GNIVTs Federal Tax Service of Russia (). After completing the registration procedure for working through the Internet site of the Federal Tax Service of Russia, the CA issues the taxpayer a unique subscriber identifier for working with the Internet service. Share:

Results

In order to become the owner of an electronic signature key for the tax office, a legal entity can obtain an electronic signature certificate from one of the certification centers licensed by the Ministry of Telecom and Mass Communications.

Individuals can obtain a Federal Tax Service registration card or register for an Unified Self-identification System account. To do this, they will have to go to the Federal Tax Service or, for the unified identification and authentication system, to the nearest post office or MFC. Individuals can also obtain a key from a certification center.

Purchasing an electronic digital signature certificate from a certification center, for example, to participate in government auctions, allows the owner of such a key to use the services of the Federal Tax Service, Pension Fund or Social Insurance Fund, which require an electronic identity card.

Often, electronic signature certificates purchased at certification centers provide the user with a range of opportunities: they provide access to electronic services of special programs (for example, online accounting), provide access to state trading and services of the Federal Tax Service, Pension Fund of the Russian Federation, Social Insurance Fund or a government services website where electronic identification is required. In any case, the choice remains with the user.

Sources: Federal Law of April 6, 2011 N 63-FZ “On Electronic Signature”

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

1.4. Building the KSKPEP chain

In some cases, after installing KSKPEP in the certificate store, it is necessary to build a chain of trust to the installed personal certificate.

To find information about the next certificate in the chain, from the Start select Programs -> Crypto-Pro -> Certificates . Open the folder “ Certificates - current user ” -> Personal -> Registry -> Certificates :

Select the installed certificate by double-clicking on it with the left mouse button.

If under the inscription “Certificate information you see “ This certificate is intended for: ” (Fig. 1), then you can skip this section and proceed to the next section 1.5. If you see an exclamation mark and the words “ There is not enough information to verify this certificate ” (Fig. 2) or something similar, continue according to the instructions.

Fig.1

Fig.2

Go to the " Composition " tab:

In the upper window, select the line “ Access to information about certification authorities ” and in the lower window a link to the certificate will be displayed, which should end with “ . crt ". You can download the certificate from this link by pasting it into the address bar of your browser and confirming by pressing Enter .

After downloading the certificate, open it. Answer the warning with “ Open ”.

On the “ General ” tab (window with information about the certificate), click “ Install certificate ”. Click “ Next ”

Select “ Place all certificates in the following store ”, and then click “ Browse… ”:

Specify “ Trusted Root Certification Authorities ”, click “ OK ”:

Click “ Next ”:

To complete the Certificate Import Wizard, click “ Finish ”:

If a security warning appears, confirm installing the certificate by clicking Yes .