Pay taxes in a few clicks!

Pay taxes, fees and submit reports without leaving your home!

The service will remind you of all reports. Try for free

Since the beginning of 2021, insurance premiums have been under the control of the tax service, so all calculations for insurance premiums are now sent to the Federal Tax Service. But the Pension Fund must receive information about the insured persons, so it has developed a whole list of other reports and personalized forms. Among them is the annual SZV-experience report, which we will discuss in this article.

SZV-experience: what kind of report is this?

The SZV-experience report form is approved in Appendix No. 1 to Resolution of the Board of the Pension Fund of the Russian Federation dated December 6, 2018 No. 507P. And in Appendix No. 5 to this resolution the procedure for filling it out is approved.

The SZV-experience report is one of the recently introduced mandatory forms of personalized reporting. Its task is to convey to the Pension Fund those data on the length of service of employees that were previously submitted under the RSV-1 form.

The report is filled out separately for each insured person, and in essence this form is personalized. Although the form is called SZV-experience, it also indicates data on insurance premiums for the employee, and in this part it somewhat duplicates the Calculation of insurance premiums for the tax office.

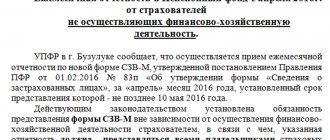

All legal entities and individual entrepreneurs take the SZV experience. The report is submitted to all insured persons with whom you have concluded employment contracts or civil contracts. Including the leaders of the organization, who are the only participants and owners of the property.

The report is submitted annually; for the first time, employers submitted it in 2018 before March 1. The 2021 report was required to be submitted by March 2, 2021.

You can download the SZV-experience form here.

Deadlines for submitting the SZV-experience form

All organizations and their separate divisions, individual entrepreneurs with employees, as well as lawyers and notaries must submit this report. The SZV-experience report is submitted to the territorial office of the Pension Fund of the Russian Federation at the place of registration.

It is presented once a year from January 1 to March 1. The report for 2019 must be submitted by March 2, 2021, the report for 2021 must be submitted by March 1, 2021. Remember that the deadline for submission may be postponed if the last day falls on a weekend or holiday.

Sometimes a report must be submitted during the inter-reporting period:

- the employee retires and quits - submit a report with the “Pension Assignment” type within three days from the date of receipt of the application from the employee.

- liquidation of an organization - within a month from the date of approval of the interim liquidation balance sheet;

- bankruptcy of a company - pass the SZV-experience before submitting a report on the results of bankruptcy proceedings to the arbitration court.

Remember that simultaneously with information on the length of service, the Pension Fund of Russia is waiting for additional information on the EDV-1 form. It must be submitted along with the SZV-experience report. The EDV-1 form was also approved by Resolution of the Board of the Pension Fund of the Russian Federation dated December 6, 2018 No. 507P.

Reissue of information

The law provides for a former employee to apply for a certificate again. In this case, a written application is submitted to the head of the organization with a request to issue a duplicate of the SZV-STAZH certificate form, upon dismissal, issued to the employee along with the work book. The employer (insurer) is obliged to draw up and issue it to the applicant within 5 days.

How to fill out the SZV-experience for employees - future retirees?

Many employers will have to fill out this form for employees retiring. Therefore, we provide a detailed procedure for filling out the report.

First of all, when an employee is preparing to retire due to old age or disability, he turns to the policyholder with a request to submit a SZV-experience report for him with the type “Pension Assignment”. The employer is obliged to satisfy this request so that the months worked in the current year are included in the employee’s length of service.

In this case, ask the employee for an application to submit a SZV-experience report to the Pension Fund (a sample application is given below). After this, prepare a report on the employee and send it to the Pension Fund no later than three calendar days from the date of submission of the application. This procedure is provided for in paragraph 2 of Article 11 of Federal Law No. 27-FZ of April 1, 1996.

Sample application:

To the director of Romashka LLC, I.I. Ivanov, and florist P.P. Petrova.

STATEMENT.

In accordance with paragraph 2 of Article 11 of Federal Law No. 27-FZ of April 1, 1996 and Part 6 of Art. 21 of Federal Law No. 400-FZ of December 28, 2013, I inform you that on June 17, 2021 I will turn 56 years old. In connection with reaching retirement age and having the necessary work experience, from June 17, 2021, I have the right to receive an old-age pension.

Please provide the necessary personalized accounting information in the SZV-STAZH form, necessary for assigning a pension, to the territorial office of the Pension Fund of the Russian Federation within 3 calendar days from the date of submission of this application.

05/10/2020 Petrova P.P. ___________

When filling out the SZV-experience form in the name of an employee - a future pensioner, make the following notes:

- in the “Information Type” section, mark the “Pension Assignment” field with a cross;

- in section 2, enter the current year;

- in section 3, indicate the periods when the person worked, was on vacation, was on sick leave, or was absent from the workplace for other reasons;

- in column 7, enter the expected date of retirement: if the employee’s application was written before reaching retirement age, then this is his closest date of birth; if the application is written after reaching retirement age, this is the date when the employee plans to provide documents to the Pension Fund (in this case, ask the employee to indicate the date in his application);

- in column 11 you need to indicate the period of work in special conditions, hazardous work. This applies to those who have the right to retire early. For the same reasons, columns 8-10, 12, 13 are filled in;

- in section 4, indicate whether pension insurance contributions have been accrued for the period specified in section 3 - put an X;

- Section 5 should be completed only if the future pensioner worked in hazardous industries for which there is an agreement with the NPF on early pension provision. Indicate the periods for which contributions were paid.

- attach the EDV-1 inventory to the SZV-experience form: in the “Reporting period” field put “0”, in the “Year” field - the year of submission of information, in the field with the type of information “Initial” put a cross and indicate the number of employees for whom you are submitting information .

Liability of the policyholder

Federal Law 27-FZ, the Code of Administrative Violations or the regulations of the Pension Fund do not provide for the employer's liability for intentional or unintentional failure to provide pension accounting information upon termination of employment relations. But this does not mean that the policyholder who did not issue SZV-M and STAZH certificates when dismissing an employee or who provided incorrect information will not be held liable.

Failure to provide personalized accounting information on the day of dismissal is a clear violation of the rights of an employee. For officials (managers) of organizations and individual entrepreneurs, punishment is imposed under Part 1 of Article 5.27 of the Code of Administrative Offenses of the Russian Federation - a warning or fines from 1 thousand to 5 thousand rubles. The fine for the organization is from 30 thousand to 50 thousand rubles.

It is important that administrative punishment for the employer is applicable only if SZV-STAZH and SZV-M were not issued to the employee. But if certificates are issued in a timely manner with erroneous or unreliably indicated information, the insured cannot be held liable under the law.

Rules for filling out the SZV-experience report in the general manner

The employer fills out each form for one employee and certifies the report. You can fill out the form by hand in block letters or using a computer. The ink color when filling out the report can be any color except red and green. Marks and corrections are unacceptable. The SZV-experience report can be submitted on paper and electronically.

To fill out the report, the employer must have information about his employee:

- data on salaries and all other payments and remunerations;

- data on contributions - accrued, additionally accrued and withheld;

- information about the employee's work experience.

The SZV-experience form is filled out for all citizens with whom labor, copyright or civil law contracts have been concluded, including directors of organizations, if an agreement has been concluded with them. It is interesting that the Pension Fund will expect SZV-experience even for those individuals who are insured and have unemployed status: this data will be presented by the employment service.

Abbreviation or symbol: what's the difference?

An abbreviation (Italian abbreviatura from Latin вrevis - short) is formed as a result of shortening a phrase and is read by the alphabetical names of the initial letters or by the initial sounds of the words included in it.

Conventional designation is an alphanumeric or numeric code that defines, in a given sequence, the features of the object that it defines; the symbol can be unified, alphabetic, numerical or mixed, established by a standard or other document.

Thus, these definitions are not identical. If the first is strictly tied to the full name of the object and can be guessed by its meaning, then the second is not at all connected with the name of the object to which it relates, and may not be decipherable without a special key document.

Features when filling out a report

Let's go through the sections of the form.

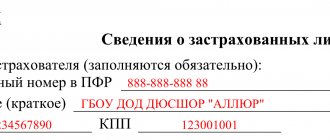

Section 1 “Information about the policyholder” - indicate your registration number in the Pension Fund, TIN, KPP, abbreviated name of the organization. Pay attention to the field “Registration number in the Pension Fund of Russia”. In it, indicate the policyholder's registration number of 12 characters. In the “TIN” field, indicate the individual number of the organization or individual entrepreneur of 10 or 12 characters, and if there are empty cells left, put dashes.

In the “Information Type” field, mark the desired type of report with an “X”: initial, supplementary, or pension assignment. When submitting a report according to the latter type, the form is submitted without connection with reporting deadlines, and only for those employees who need to take into account their work experience for the current calendar year to establish a pension. We send a supplementary report to the Pension Fund for employees who for some reason were not included in the main report.

Section 2 “Reporting period” - indicate the year for which you are submitting the report. If you report when an employee retires, the current year.

Section 3 “Information about the period of work of insured persons” is presented in the form of a table with columns. Assign a serial number to each covered employee, even if the job information spans multiple lines.

- in columns 2-5, indicate the full name and SNILS of the employee;

- in columns 6-7 the start and end dates of work. Indicate the dates within the reporting period that you indicated in the second section of the report. If there was a break in your work experience, start a new line, but do not duplicate the employee’s data and SNILS number.

- in column 8, indicate the code of territorial conditions in accordance with the section of the Classifier;

- in column 9, indicate the code of special working conditions that give the right to early assignment of a pension. Codes of special conditions are indicated in accordance with the corresponding section of the classifier. The code must be indicated for the period of work giving the right to early retirement if the working conditions were classified as harmful or dangerous and contributions were paid for them at additional rates. This also includes periods during which the employer paid contributions for the employee under early non-state pension agreements;

- in columns 10 and 11 - indicate the code of the basis on which the insurance period is calculated, as well as additional information for each period from columns 6-7: whether there were maternity leaves, leaves without pay, advanced training, etc.

- in columns 12 and 13 - indicate information about the conditions for early assignment of a pension

- in column 14 - only if the employee quits on the last day of the year

Sections 4 and 5 should only be completed when assigning a pension.

When is the “Calculation of Work Experience” section completed?

Column No. 10 is filled out for a certain type of working conditions: expeditions or work in other field conditions (code “FIELD”), seasonal work (“SEASON”), diving work (code “DIVER”), labor duties in leper colonies (code “LEPRO”) "), work while serving a criminal sentence in a penal institution (code "UIK104").

Column No. 11 contains additional information that affects the calculation of length of service - work under unpaid contracts, parental leave, additional days of vacation, periods of downtime due to the fault of the employee, suspension from work, etc.

Column 14: o is entered if you quit on December 31. The following sections numbered “4” and “5”, located below the table, are not filled out in the certificate intended for the resigning employee.

At the bottom of the form (see sample SZV-STAZH certificate), when an employee is dismissed, the date of filling out the document is indicated. Typically, this is the date the employee leaves. Next, the position is indicated, the signature of the head of the organization (entrepreneur) is deciphered, the signature of the head and the seal of the organization are affixed.

In what form is the SZV internship submitted?

When the form is filled out, we indicate the position of the manager and certify the report with his signature; if available, we affix a stamp. Before sending the SZV-experience forms to the Pension Fund, we collect them in a bundle and make an inventory of them according to the OVD-1 form, without which the reports will not be accepted.

You can submit your work experience in paper or electronic form - it depends on the number of people whose work experience information is submitted by the employer. If there are 25 or more, information can be submitted on paper; if there are less than 25, only electronic submission is acceptable.

It will be possible to submit the SZV-experience report in 2021 from the online service Kontur.Accounting. By the end of calendar year 2021, we will have this form available in the service. Also with us you can keep records, calculate salaries, send reports, use the support of our experts and other service capabilities. The first 14 days of operation are free for all new users.

Try for free