Regulatory framework

The SZV-STAZH form represents a relatively new format for reporting to the Pension Fund of Russia. It must be submitted to the Federal Tax Service every year. The reporting procedure submitted by policyholders – legal entities and individual entrepreneurs – has recently undergone changes. Today, this issue is being resolved by the Federal Tax and Duty Service, which accepts a single report in a new format .

But the funds managed to retain some of their powers, so they have recently introduced new reports. The updates are enshrined in Resolution of the Board of the Pension Fund of the Russian Federation No. 507p dated December 6, 2021. In accordance with them, policyholders undertake to provide the following forms:

- SZV-STAZH (information about the insurance experience of citizens working at the enterprise);

- EDV-1 (information about the policyholder transferred to the Pension Fund of the Russian Federation for the purpose of conducting personalized accounting operations);

- SZV-KORR (data on updating personal account information);

- SZV-ISH (information about earnings, amount of payments and other remuneration).

The SZV-STAZH form is the main one, so it requires detailed consideration.

Six required documents for dismissed employees

On the last working day of the dismissed employee, be sure to give him the following documents:

- Certificate SZV-STAZH.

- Certificate SZV-M.

- Information on the amount of earnings according to the Ministry of Labor form dated April 30, 2013 No. 182n (as amended on January 9, 2017).

- Extract from the “Calculation of insurance premiums”, section 3.

- Work book.

- 2-NDFL.

Always remember that if you violate the procedure for issuing mandatory documents to an employee, you may be subject to unnecessary penalties.

Responsibility measures

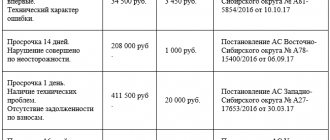

Relatively recently, policyholders began to report to the Pension Fund about their length of service by submitting the SZV-STAZH form. For erroneous data in the information provided, ignoring deadlines, or failure to provide a document, the law provides for penalties, the amounts of which will be discussed further.

Failure to submit the form in 2021

In paragraph 2 of Art. 11 Federal Law No. 27 of April 1, 1996 states that the employer must report to the Pension Fund by March 1 . This is the deadline when you need to provide information about the length of service gained by employees in the past year. Despite the fact that some branches of this organization have developed their own schedules for receiving information (before the due date), the fund has the right to charge fines only if the information was not submitted before March 1 (inclusive) .

The official websites of regional branches of the Pension Fund of the Russian Federation began to post information about individual schedules for submitting annual reports. The deadlines that are present in them differ from the time frames prescribed in the law.

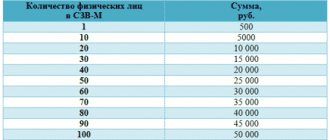

The amount of fines imposed for ignoring the reporting requirement depends on the number of insured persons about whom information must be submitted. For each individual employed, you will have to pay 500 rubles, which is prescribed in Part 3 of Art. 17 Federal Law No. 27.

Providing Incorrect Data

Indication of false information that contradicts reality also implies the accrual of fines. It will also be impossible to avoid punishment if the employer makes an accidental mistake. The penalty amount will be 500 rubles for each individual in respect of whom incomplete or incorrect information is found.

In a number of situations, officials will also be forced to pay the amount of the penalty, as specified in Art. 15.33.2 Code of Administrative Offenses of the Russian Federation. However, there is a range of fines for them, amounting to 300-500 rubles .

Punishment will also follow if the format of the reporting provided is not followed. If the number of employees of the institution exceeds 25 people, the report is submitted using electronic channels. Ignoring this rule results in a fine in an amount equal to 1000 rubles.

To avoid such fines, it is recommended to report on the documents in advance, so that there is time to correct the information provided if fund employees discover erroneous or missing data.

Failure to issue the SZV-STAZH form to employees

The company that is the insurer is obliged to provide information about the length of service to employees who quit on the last day of work, which is prescribed in Part 4 of Art. 11 Federal Law No. 27. And this does not depend on whether the employee asks to show him a document or not.

Along with this, if the retiring specialist retires, it is required to send the data to the Pension Fund of the Russian Federation 3 days from the date of the employee’s request, as stated in Part 2 of Art. 11 Federal Law No. 27.

If the data was not presented to the employee and was not sent to the fund, the policyholder will be forced to pay a fine in accordance with the provisions of Art. 5.27 Code of Administrative Offenses of the Russian Federation. The amount in this case depends on several factors:

- the number of times the offense is committed;

- person who is subject to a penalty.

Thus, organizations that are policyholders pay 30,000 - 50,000 rubles in case of a primary violation, and in case of repeated non-compliance with the law - 50,000 - 70,000 rubles. Pension Fund officials are sometimes given a warning. However, in a number of situations they are given a fine of 1,000 - 5,000 or 10,000 - 20,000 rubles. depending on the time the violation was committed. Another penalty is a ban on doing business for a period of 1-3 years.

Late delivery deadline

The SZV-STAGE form contains detailed information about the insurance length of employees who were active and terminated. It also includes information about the persons with whom contracts were concluded. In Art. 11 Federal Law No. 27 states that the deadline for submitting the report is March 1 of the year following the reporting period. If you miss it, the employer will be forced to pay fines, the amount of which depends on the number of employees.

Form and procedure for passing SZV-STAZH in 2021

The SZV-STAZH form was approved by Resolution of the Pension Fund Board of December 6, 2018 No. 507p. The report form can be downloaded here.

ATTENTION! For reporting for 2021, use the form as amended by the Pension Fund Resolution No. 612p dated September 12, 2020.

ConsultantPlus experts explained step by step what has changed in the form and how to fill out each line. To do everything correctly, get trial access to the system and go to the Ready solution. It's free.

The decree does not provide for the submission of a zero form.

Read more about this in the material “SZV-STAZH - is zero reporting submitted?”

NOTE! If the company employs only a manager—the only founder—then the SZV-STAZH form must also be drawn up for him and submitted to the Pension Fund.

For a sample of the SZV-STAZH form for 2021 and the nuances of filling it out, see ConsultantPlus, having received a free trial demo access to the K+ system using the link below:

The report includes information about employees with whom employment or civil law contracts were in force in the previous year, regardless of whether wages were accrued to them:

- FULL NAME.;

- SNILS;

- period of work in the reporting year;

- information about working conditions;

- information about the employee's dismissal.

Employers have the right to submit a SZV-STAZH report to the Pension Fund of Russia both on paper and in electronic form. But a paper version of the report will be accepted only if the employer has 24 employees or fewer. If information is issued for 25 or more people, then only an electronic report format certified by an electronic signature is available (Clause 2 of Article 8 of Law No. 27-FZ).

When sending reports electronically, be sure to ensure that you receive a receipt from the Pension Fund for accepting the reports.

How to transfer a copy correctly

In a number of situations, the Pension Fund offers legal entities and officials personal deadlines for submitting reporting documentation . This approach helps reduce the load on reception points during the period when legal entities begin to bring filled out forms en masse.

Traditionally, such situations arise in the last days before reporting deadlines. Institutions have the right to ignore them and report on a general basis until March 1 without the need to subsequently pay fines .

Filling out this form is the responsibility of all persons with whom an enterprise or individual entrepreneur has employment or civil law contracts. It is also noteworthy that the Pension Fund of the Russian Federation expects reporting for those persons who are insured and do not officially work. Information on them is provided by the Employment Center of the Russian Federation.

Ways to avoid a fine for SZV-TD

The most effective way to avoid any punishment is not to commit an offense, and in this case, an offense.

Try not to delay the preparation of the report; prepare it in advance. In work, as in life, there is always room for unplanned processes and phenomena. These could be technical failures or human factors. Preparing the report in advance will minimize these risks.

Including in the job descriptions of a personnel officer or accountant the obligation to generate and submit the SZV-TD form, indicating the legally established deadlines, will stimulate these employees to perform their duties responsibly and in a timely manner.

If you still cannot avoid a fine, it can be reduced or replaced with a warning. To do this, after receiving the report from the Pension Fund of Russia, it is necessary to send a reasoned response indicating the objective reasons for the delay in delivery or incorrect content of the report. And it is likely that representatives of the Pension Fund or State Tax Inspectorate will meet you.

If you have any unresolved questions, you can find answers to them in ConsultantPlus.

Full and free access to the system for 2 days.

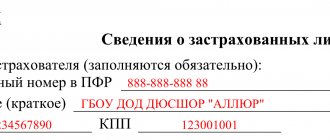

What information is indicated?

One page of the document must contain the following details :

- FULL NAME;

- SNILS;

- working conditions code;

- code of grounds for early retirement;

- duration of performance of labor duties at the enterprise.

Each form must be completed by one employee only.

Next, it is certified by the signature of the originator. Certification is carried out by hand or in electronic format. The color used to design the document can be any color, but not green or red. In practice, it is unacceptable to make mistakes and make corrections. The new reporting form can be submitted in electronic format.

In order to correctly fill out the document, it is necessary to enter the following information about the insured person:

- salary and other income information;

- information about benefits provided to employees;

- materials on insurance premiums;

- data on the period of the citizen’s labor activity, including corrective information.

About receiving notifications electronically

Within 5 days after receiving the notification, you must correct the information and resubmit the report. And this begs the question: what date should be considered the day of receipt of the notification if it was sent electronically?

This is exactly the question that the insurer asked in court. The Pension Fund of Russia imposed a fine on the company for violating the 5-day deadline for making corrections to SZV-STAZH. The situation is considered in the Resolution of the Arbitration Court of the North-Western District dated July 7, 2020 N F07-6319/20 in case N A21-14238/2019. Let's figure out what came of it.

On March 15, the organization received a notification and sent the corrected information to the fund within the prescribed period. The inspectors thought otherwise, because the notification arrived on the company’s server on March 3, therefore, the five-day period had to be counted from the 3rd, and not from the 15th. The fact that the policyholder discovered and became familiar with the document only 12 days later does not give him any reason to count the period exactly from this date.

The auditors came to the conclusion that the organization failed to timely familiarize itself with the notification received. The fund issued a fine because corrections in the reporting were sent within an unspecified time frame.

Changes in 2021

Representatives of the Government of the Russian Federation developed and approved a new form of this form for 2021, so there have been some changes in the structure of the document.

- Props "page" has been completely eliminated, so specifying the page number value is no longer required.

- There is no need to duplicate the TIN, checkpoint, or registration number.

The changes also affected the rules for drawing up the document.

- Column 8 does not need to be filled out if column 11 contains the code value DETIPRL.

- The list of persons for whom reports are submitted has been expanded. Additionally, changes were made to clause 1.5. The heads of enterprises, who were the only participants, were included in the form.

- Adjustments were also made to the procedure by which the report is filled out by the Employment Center. Currently in gr. 14 the indication “BEZR” is required.

Let's sum it up

- The deadline for submitting the SZV-TD upon admission or dismissal is the next day.

- The deadline for submitting the SZV-TD in other cases is the 15th of the next month.

- The fines for organizations and individual entrepreneurs are quite substantial - 500 rubles for each employee for whom data has not been provided. Fines may also be imposed on officials.

- If you do not want to pay fines, do not violate the deadlines and ensure the accuracy of the information sent.

- Increased penalties are provided for persistent violators.

- If you cannot avoid a fine, try to reduce it or replace it with a warning.

If you find an error, please select a piece of text and press Ctrl+Enter.

Court position

Three authorities came to the same conclusion that the Pension Fund did not have the right to equate errors made in the primary report with failure to submit reports and, on this basis, impose a fine on the organization.

The judges substantiated their position by the fact that reflecting work periods and vacation periods in the wrong order in no way affects and cannot in any way affect the reliability or unreliability of the information. At the same time, the fund did not have the right not to accept reports.

The court also took into account such quality as the conscientiousness of the insured, because he quickly made corrections after receiving the notification. The judges did not see any gross violations in the shortcomings made by the policyholder. As a result, the fine was canceled.