A fine is a monetary penalty from an organization for violating the rules established by current legislation or contracts concluded by the organization with its suppliers and customers.

Compliance with current legislation is verified by regulatory authorities, which are authorized to impose penalties in case of identified violations.

The tax inspectorate carries out its control function most frequently, imposing sanctions for various violations of tax legislation, including:

- for late submission of reports;

- for errors in reporting;

- for accepting cash without a cash register;

- for gross violation of the rules for accounting for income and expenses, and others.

If the organization owns vehicles, it will have to periodically pay traffic police fines for violating traffic rules.

Other control bodies that may impose sanctions during an inspection include:

- Rospotrebnadzor;

- Fire Inspectorate (EMERCOM);

- Sanitary inspection;

- Rostechnadzor;

- Labour Inspectorate;

- Federal Migration Service and others.

When an organization pays fines, the accounting entries depend on what the penalties were imposed for: for violation of tax laws or for other reasons.

Calculation of fines: postings

In case of violation of tax laws, the accrued amounts of penalties are charged to the profit and loss account. In accordance with Order of the Ministry of Finance dated October 31, 2000 No. 94n, a subaccount 99.09 “Other profits and losses” is opened to account 99 “Profits and losses”. This sub-account records fines assessed for violation of tax laws in correspondence with the corresponding tax account. In general, the entry for calculating penalties for violation of the law looks like this: Dt 99.09 Kt 68 (69).

Examples of postings for violation of tax laws:

- Dt 99.09 Kt 68.01 - for non-payment of personal income tax;

- Dt 99.09 Kt 68.02 - for violation of the procedure for submitting reports electronically;

- Dt 99.09 Kt 69.01 - for failure to provide reports.

To calculate all other penalties, including traffic police fines and penalties under business contracts, you should use account 91 “Other income and expenses” in correspondence with account 76 “Settlements with other debtors and creditors.”

The organization's expenses for paying penalties are reflected in the debit of account 91.02 as part of other expenses (clause 11 of PBU 10/99).

The organization's income from receiving fines due under business contracts is reflected in the credit of account 91.1 as part of other income (clause 7 of PBU 9/99, Order of the Ministry of Finance dated October 31, 2000 No. 94n).

Fine and penalty: what are their differences?

It should be noted that a fine and a penalty are different concepts:

- The fine is assessed immediately when the above reasons occur. In addition, its size is clearly regulated by deadlines at the legislative level.

- A penalty is a penalty payment that is charged for each day of late payment as a percentage of 1/300 of the refinancing rate of the Central Bank of the Russian Federation.

The procedure for collecting taxes and penalties from organizations:

Administrative fine: accounting entries

Depending on the type of offense, the administrative fine can reach 60 million rubles.

| Type of offense | Amount of administrative penalty, rub. | Debit | Credit |

| A fine was assessed for work without using a cash register. | 30 000 | 99.09 | 76.02 |

| A fine was paid for working without a cash register | 30 000 | 76.02 | 51 |

Penalty for failure to submit a report to the Pension Fund

By the way, the Pension Fund fine is the only one that is calculated not on the number and level of errors, not on the size of underpayments, but only on the presence and number of employees of the organization or individual entrepreneur. It turns out that for the same mistake (for example, an error in the SNILS of one employee or failure to submit a report), a company with a large number of employees will have to pay many times more than if the organization has 2-3 employees. Therefore, it is better for large companies not to make mistakes, because such a mistake can cost them a decent amount.

- When a Pension Fund specialist detects late submission of reporting forms by the policyholder (company or individual employer), he draws up a report of the violation.

- The completed document about the offense is handed over to the employer.

- The employer has the right to provide reasoned objections within 15 days after receiving the report, which can help avoid or reduce the fine for failure to submit a report to the Pension Fund.

- After considering the reasoned objections of the entrepreneur or legal entity, a final decision is made on whether to prosecute or on the absence of grounds for punishment, of which the policyholder is notified in writing.

- The next step is to send a demand to the employer to pay a fine.

- The last stage is the repayment of penalties or their forced collection in court.

- A collection order is sent to the payer's bank;

- By a court decision, bailiffs can collect the required amount of debt from the debtor’s property assets;

- If the debtor is an individual, then debt collection may occur through confiscation of the payer's assets.

Let's consider how justified the opinion of the judges and the Pension Fund itself is. The arbitration courts found that from the calculation of penalties available in the case materials, it is impossible to determine the amount of debt for which penalties were accrued, the reporting (calculation) period for the formation of arrears, the timing of payment of insurance premiums, and therefore the courts came to the conclusion that the applicant did not provide evidence sending to the Company a demand for payment of penalties accrued on the disputed amount of debt on insurance premiums.

Accounting for penalties under a contract in 1C 8.3

Regulatory regulation and scheme in 1C

Penalties against the counterparty under the contract (agreement) are taken into account by the seller in:

- BU: Dt 76.02 Kt 91.01;

- in non-operating income for income tax;

Design scheme in 1C

To reflect contractual penalties automatically and without errors, pay attention to the Type of agreement and Type of transaction when entering the current account. Select the analytics shown in the diagram above.

Penalties recognized by the Organization under the contract (agreement) are taken into account by the buyer in:

- BU: in Dt 91.02 Kt 76.09;

- in non-operating expenses for income tax;

Design scheme in 1C

More details What document in 1C is used to calculate fines received from organizations and accepted claims?

How to charge a fine in 1C 8.3 transactions in the seller’s accounting

Let's look at calculation and registration in 1C using an example:

On February 13, the Organization fulfilled its obligations to supply goods.

According to the terms of the contract, payment for goods is transferred within 5 days after their delivery. The buyer violated the contract and did not pay for the goods on time.

On February 28, the Organization charged a penalty of 0.05% for each day of delay and issued penalties to the buyer.

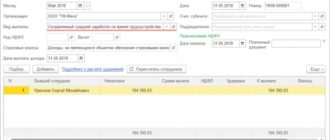

Accrue penalties to the buyer using the standard document Accrual of penalties in the Sales .

In the document, fill in the counterparty and the agreement under which the obligations were violated.

- from – date of accrual of penalties;

Calculate penalties automatically using the Fill or fill out the tabular part manually.

The document Accrual of penalties is used only by the seller if the buyer or principal fails to pay on time.

With this document, the buyer cannot be charged fines and penalties for failure to fulfill obligations by the supplier. For example, if goods are not delivered on time.

Posting Dt 76.02 Kt 91.01 in 1C 8.3 Accounting will be generated automatically.

Analytics for account 91.01 was specified by the developers - the item for which the Default Use is set Document “Calculation of Penalties” .

If there is no such article, it will be automatically created in the database.

Learn more How to reflect a claim to a buyer?

Fine – postings in 1C 8.3 and its recognition in the buyer’s accounting

Let's look at calculation and registration in 1C using an example:

On February 13, goods arrived at the Organization’s warehouse. According to the terms of the contract, payment for goods is transferred within 5 days after their delivery.

Due to financial problems, the Organization did not make payment on time.

On February 28, the Supplier filed a claim and imposed penalties in the amount of 0.05% for each day of delay.

On the same day, the Organization recognized them and reflected them in accounting.

Create a document Transaction entered manually (Operations – Transactions entered manually).

To correctly reflect incoming penalties from the counterparty, pay attention to the article Fines, penalties and penalties for receipt (payment) and Type of agreement . Check the analytics in your accounting with the data given above.

So, we have successfully dealt with the calculation of penalties and postings in 1C 8.3 Accounting.

Current position

The situation changed when Resolution No. 57 was published by the Supreme Arbitration Court in August 2013. It provided clarifications on all controversial issues. The Tax Code specifies inconsistencies between tax and advance payment. At the same time, in Art. 80 shows the distinction between two documents - a declaration and an advance payment calculation. In Art. 119 does not stipulate liability for failure to submit a declaration for calculating the advance payment, regardless of what this document is called in the Tax Code of the Russian Federation. These clarifications are mandatory for arbitration courts. For all other bodies they are advisory in nature.

Making a claim

The claim settlement procedure is mandatory if such a dispute resolution procedure is determined by the Federal Law or the terms of the contract.

The claim must be made in writing; the claim letter must reflect the applicant's requirements and indicate the amount of the claim. The supplier organization reviews the claim within 30 days and provides a written response.

If you agree to pay, the date is indicated - the number and amount of the payment document with which the debt is repaid. In case of refusal, the letter contains a reference to the legislation.

If the supplier refuses to satisfy the claim, the purchasing organization has the right to go to court.

Types of taxes

Let's consider all current types of reporting.

| Tax | Term | Payer |

| VAT | Quarterly, until the 25th of the next reporting month. | The report is provided by all organizations operating on the common taxation system at the place of registration. |

| Income tax | Quarterly, until the 28th of the next reporting month. | |

| Z-NDFL | Every year until April 30. | Individuals are tax agents. |

| 2-NDFL | Every year until April 1. | Individual entrepreneurs who have hired employees submit a report at the place of registration. |

| 6-NDFL | Quarterly, until the 1st day of the next reporting month. | |

| simplified tax system | Annually: individual entrepreneur – until April 30; LLC – until March 31. | At the place of registration. |

| UTII | Quarterly, until the 20th day of the next reporting month. | To the Federal Tax Service at the place of business. |

Penalty from the buyer for violating the delivery deadline for wiring and VAT! Help me please!

Decisions of the arbitration court enter into legal force one month after their adoption, unless an appeal has been filed (clause 1 of Article 180 of the Arbitration Procedure Code of the Russian Federation). Consequently, the reflection of penalties for violation of contractual obligations based on a court decision in accounting should occur in the reporting period when a month has passed from the date of the decision of the arbitration court. Amounts of claims (claims) submitted that are not recognized by the payer (not awarded by the court) are not accepted for accounting. Penalties collected from counterparties for non-compliance with contractual obligations, in amounts recognized by payers or awarded by the court, are reflected in the following entries: - debit 76-2 “Settlements on claims” credit 91-1 “Other income”: penalties recognized by the debtor or awarded by the court; — debit 51 credit 76-2: penalties received.

Reflection of penalties in the debtor’s accounting

In the debtor’s accounting, penalties paid (fines, penalties) for violation of contractual obligations are included in other expenses (clause 12 of the accounting regulations “Organization expenses” (PBU 10/99), approved by Order of the Ministry of Finance of Russia dated May 6, 1999 N 33n). Penalties ( fines, penalties ) in accordance with clause 14.2 of PBU 10/99 are accepted for accounting in amounts recognized by the organization or awarded by the court in the reporting period in which the court decision on their collection was made, regardless of the time of actual payment of funds and other forms of implementation . After recognizing (awarding) a penalty, the debtor attributes it to the increase in other expenses. To do this, in the same reporting period, they make an entry for the corresponding amount: - debit 91-2 “Other expenses” credit 76-2: penalties for violation of contractual obligations awarded by the court or recognized by the organization are reflected.

Accounting for buyer complaints

After considering the buyer's complaint, the supplier can either decide to satisfy it or refuse it.

Orchid LLC received materials worth 20,000 rubles from the supplier. During the inspection, a shortage of 4,000 rubles was discovered.

The organization filed a claim with the supplier.

| Dt | CT | Operation description | Sum | Document |

| 10 | 60 | Received materials have been capitalized | 16000 | TORG-12 |

| 60 | Payment for goods receipt from the current account | 20000 | Payment order | |

| 76.2 | 60 | Complaint to supplier for shortage | 4000 | Claim letter |

If the supplier decides to satisfy the claim, then Orchid LLC reflects this as follows:

| Dt | CT | Operation description | Sum | Document |

| 76.2 | Receipt of funds to cover the shortfall | 4000 | Payment order |

In case of refusal to compensate for the shortfall, its amount is written off to the expenses account:

| Dt | CT | Operation description | Sum | Document |

| 76.2 | The shortage has been written off | 4000 | Accounting information |

If the supplier fails to comply with the terms of the contract, a fine, penalty or penalty is usually imposed. These amounts are also reflected in the expense account.

Accountant's Directory

So, if the price does not exceed 3 million rubles, the fine will be 10% of the price (clause

3 of Regulation No. 1042). For small businesses and socially oriented non-profit organizations with which contracts have been concluded, the amount of the fine is set as a fixed amount, determined in the following order (clause 4 of Rules No. 1042):

- from 3 million rub. up to 10 million rubles (inclusive) – 2%;

- up to 3 million rubles – 3%;

- from 10 million rubles. up to 20 million rubles (inclusive) – 1%.

If the obligation stipulated by the contract does not have a value expression, the amount of the fine is set as a fixed amount (up to 3 million rubles.

the amount is 1,000 rubles, from 3 million rubles. up to 5 million rubles – 5,000 rub. etc.) (p.

6 of Regulation No. 1042). For improper fulfillment by the contractor of obligations to carry out types and volumes of work on construction, reconstruction of capital construction projects, which the contractor is obliged to carry out independently without the involvement of other persons, the fine is set at 5% of the cost of these works (clause 7 of Rules No. 1042). If the contract provides for the provision of civil liability of suppliers (contractors, performers) for failure to fulfill the condition of involving subcontractors, co-executors from among small businesses, socially oriented non-profit organizations in the execution of the contract in the form of a fine, this fine is set at 5% of the volume such attraction provided for by the contract (clause

8 Rules No. 1042)

Lately filed tax return: penalties

Situation 2: a “zero” return was filed after 180 days. The taxpayer is held accountable for failure to submit a return more than 180 days after the deadline for filing it. At the same time, the minimum amount of the fine is not provided (clause 2 of Article 119 of the Tax Code of the Russian Federation). There are also two opposing points of view on this issue. First: if the deadline for submitting a “zero” declaration is exceeded by more than 180 days, a fine of 100 rubles must be paid . (Resolutions of the Federal Antimonopoly Service of the East Siberian District dated March 21, 2007 N A78-4063/06-S2-8/216-F02-1433/07, dated March 1, 2007 N A19-15990/06-32-F02-743/07). Second: if the deadline for submitting a “zero” declaration is violated by more than 180 days, a fine of 100 rubles. no need to pay. This point of view is shared by the Ministry of Finance of Russia in Letter dated 02/13/2007 N 03-02-07/1-63, and by the Federal Tax Service of Russia for Moscow in Letter dated 03/16/2009 N 20-14/4/