Registration of a cash receipt order is an important element of cash discipline. It is filled out when cash arrives at the company's cash desk and always goes in conjunction with a receipt.

A cash receipt order can be issued in absolutely any situation: when money comes from the founder, when compensating for damage caused by employees of the enterprise, from the sale of company property, as payment for goods from the buyer, etc.

Since 2014, the execution of cash receipt orders, due to the simplification of the procedure for maintaining cash in organizations, has ceased to be mandatory; however, this document is still widely used there.

- Form and sample

- Free download

- Online viewing

- Expert tested

FILES

How is a PKO issued?

The document is drawn up in a single copy. Corrections are not allowed when filling out. If suddenly the form is damaged, then you just need to fill it out again.

You can fill it out either by hand or using an accounting program on your computer. In addition, some sites allow you to create a cash receipt order online.

The main instructions for correctly filling out the PQS are prescribed in Bank of Russia Instructions No. 3210-U (as amended on June 19, 2017 No. 4416-U).

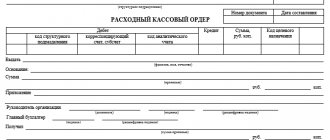

Please note that the form is divided by a tear line into two parts, both of which must be filled out at the same time.

On the left is the receipt document itself; this part remains in the budget organization. It is signed by the chief accountant and cashier.

On the right is the receipt. It is signed and certified by the seal of the budget organization, and then given to the person who deposits the cash.

PKO can be compiled:

- for each operation of accepting cash at the cash desk;

- for the entire amount of money received at the cash desk of a budget organization per day. Such a PKO is drawn up on the basis of a control tape removed from cash register equipment, strict reporting forms equivalent to a cash register receipt, and other documents provided for by Law No. 54-FZ dated May 22, 2003.

IMPORTANT!

The cash book is kept by the cashier (clause 4, clause 4.6, clause 4 of Directive No. 3210-U). The Central Bank allows any employee to fill out the book. When the amendments come into force, the director will be able to fill out the book, for example (clause 4 of Directive No. 3210-U).

What requirements must the cash receipt order form meet?

On our website you can use the KO-1 form (corresponding to OKUD number 0310001), approved by Decree of the State Statistics Committee of the Russian Federation dated 08/18/1998 No. 88. Russian organizations are prescribed to use only this form by Bank of Russia Directive No. 3210-U dated 03/11/2011.

For more information about what standards primary documents must comply with, read the article “Primary document: requirements for the form and the consequences of violating it .

NOTE! Individual entrepreneurs who, in accordance with the legislation of the Russian Federation on taxes and fees, keep records of income or income and expenses and (or) other objects of taxation or physical indicators characterizing a certain type of business activity, may not draw up cash documents and a cash book (clauses 4.1, 4.6 of instruction No. 3210-U).

Instructions for filling

You were able to study and download the cash receipt order (form) for free at the beginning of the article. Now let's figure out how to fill it out correctly.

Let's look at this procedure step by step.

Step 1. Fill out the header

We indicate the full name of the organization. If there is a cash desk in a structural unit, enter its name, and if not, put a dash.

The OKUD and OKPO codes assigned by the statistics agency are also indicated here.

Step 2. Fill out the “Debit” and “Credit” sections

The document number corresponds to the serial number in the registration journal (form No. KO-3) from the beginning of the calendar year. The date must coincide with the day the money is transferred.

The lines “Debit” and “Credit” are filled in according to the approved chart of accounts.

Step 3. We indicate who contributed the funds and why

In the “Accepted” line, enter your full name. the person from whom the cash was accepted.

In the line “Base” you need to clarify the business transaction. For example, payment for paid educational services.

Step 4. Enter the amount

The amount is indicated in words.

IMPORTANT!

Remember that the amount of cash payments under one agreement can be no more than 100,000 rubles. Accepting several PKOs for a total amount greater than the permitted amount will also be a violation!

The line “Including” indicates the amount of VAT, which is recorded in numbers, or the entry “Excluding tax (VAT)”.

Step 5. Fill out the receipt

The receipt for the PKO is filled out in the same way.

We only stamp the receipt. The left part of the PKO is issued without a seal.

Finally, we recommend checking the availability of supporting documents and whether the specified amount corresponds to the actual amount, and only then print the PQS.

Receipt cash order (form KO-1)

Home / Cash discipline

| Table of contents: 1. Procedure and methods for registering PQS 2. Instructions for filling out a receipt order 3. Sample of filling out RKO 4. Fines for the absence and storage periods of PKO | PKO in excel or word format Download samples of PKO: Founder’s contribution, Return of account, Compensation for damage, Money from the bank for salary, LLC loan from the founder, According to the contract from the legal entity. persons, Retail revenue from individual entrepreneurs, LLC trading revenue |

A receipt order is a unified form that is filled out upon receipt of cash at the cash desk of an organization (IP).

The company is obliged to issue a PKO in the following cases:

- Contribution of funds to the authorized capital;

- Return of unused amounts of accountable funds;

- Compensation for damage by an employee;

- Sale of property owned by the company;

- Return or receipt of borrowed funds;

- Receipt of money from the company account;

- Receipt of cash revenue from business activities (at the end of the working day, one PQR is filled in for the entire amount of revenue).

Individual entrepreneurs are not required to draw up PKO, as well as other cash discipline forms (for example: cash register, cash book, etc.), but can use such documents on their own initiative for the purpose of accounting and control over the movement and expenditure of cash.

Procedure and methods of registration of PKO

The unified order form (No. KO-1) was approved by Resolution of the State Statistics Committee of Russia dated August 18, 1998 No. 88.

The document consists of two parts: a cash receipt order and a receipt for the PKO.

The order is issued in one copy. Numbering is carried out in order in chronological sequence, the reference date is January 1 of each new year.

The person whose responsibilities include filling out the receipt order may be:

- an employee of the organization (cashier, accountant, etc.), appointed by order of the head of the company;

- Chief Accountant;

- manager (if the company does not have a chief accountant or accountant on staff).

The PKO is signed by: the chief accountant (accountant or director) and the cashier.

If the head of the organization (IP) single-handedly carries out cash transactions and draws up primary documentation, only the signature of the head (IP) is placed on the PKO.

The form is completed:

1) Manually.

2) On a computer with subsequent printing:

- in a text or spreadsheet editor;

- using specialized programs and online services.

3) In electronic form. With this method of document management, cash forms must be certified by a qualified electronic signature.

Corrections and blots when filling out the PQS are strictly not allowed!

The receipt for the order is filled out simultaneously with the PKO, signed and sealed.

To affix a seal impression the following can be used:

1) The main round seal of the organization.

It should be noted that since the entry into force of the law dated 04/06/2015 No. 82-FZ, organizations have the right to refuse to use a round seal.

2) Simple (auxiliary) seals and stamps kept by company employees responsible for their safety and use.

The seal impression should be located entirely on the receipt and not go onto the receipt order itself.

The cashier who receives the completed form from the accounting department is obliged to:

- check all order data;

- check the document for erasures and corrections;

- verify the authenticity of the signature of the chief accountant (or other responsible person);

- check the availability of the specified applications.

If all the rules are followed, the cashier accepts the money. The documents attached to the order should be stamped or handwritten: “Received” (“Paid”) with the date.

The executed PKO remains in the organization and is filed with the cashier’s report (the second copy of the cash book sheet), and the receipt is handed over to the person who deposited the cash.

Information about the order is entered into the order registration journal (No. KO-3). A record of received funds is reflected in the company's cash book.

Instructions: how to fill out a cash receipt order

The unified form is filled out as follows:

- In the “Organization” field, the full name of the company is indicated in accordance with the constituent documents.

- In the “according to OKPO” window, the corresponding code is indicated according to the Rosstat notification.

- The line “Structural division” is filled in if the company has divisions and only in situations where money is handed over by an employee of the representative office.

- Next, fill in the serial number of the form and the current date.

- The “Debit” and “Credit” cells indicate accounting account numbers or codes (if the company uses coding).

Individual entrepreneurs do not fill out these cells.

Transactions on the receipt of cash into the organization are reflected in the debit of account 50 (you should also indicate a subaccount in accordance with the company’s working chart of accounts).

For a loan, a corresponding account is recorded - the source of cash inflow, for example:

- 51 (52) – receipt of cash from the company’s bank account;

- 60 – the supplier returned the advance;

- 62 (76) – money received from customers and buyers;

- 66 (67) – borrowed funds received;

- 73-1 (2) – the employee compensated for material damage;

- 75-1 – the owner contributed a share to the authorized capital;

- 90-1 – revenue was received from the sale of products (services, works).

- “Structural unit code” is filled in if the unit for which the order is issued has a code.

- “Analytical accounting code” – enter the analytics code of the corresponding account (if such codes are provided in the organization).

- The amount of cash received in numerical terms is recorded in the “Amount” cell.

- The “Purpose Code” cell is filled in if the company uses a coding system.

- Full name is entered in the “Accepted from” line. company employee. When making payments between counterparties, the company name and full name are indicated. the employee who handed over the money, using the preposition “through”. For example: Meridian LLC through K.M. Ivanov.

- The content of the operation is entered in the “Base” line.

- In the “Amount” line, the amount of funds received is deciphered in words, with kopecks indicated in numbers.

- The “Including” line records the VAT rate and amount. If the transaction is not subject to VAT, it is indicated: “Without VAT”.

- The “Attachment” field lists the names, numbers and dates of the attached documents.

When filling out printed forms by hand, you should put dashes in the empty cells. Also, after entering the amount in words, be sure to cross out the empty space on the line to avoid falsification of the document.

The PKO receipt contains information identical to the data on the receipt order.

Sample of filling out a cash receipt order 2021

Contribution of the founder to the authorized capital

Return of accountable funds

Compensation for damage by the guilty party

Receiving money from the bank to pay salaries

LLC loan from the founder

Payment under an agreement from a legal entity

Retail revenue from individual entrepreneurs

LLC trading revenue

Penalties for the absence of PKO and storage periods for the form

For the lack of primary documents (gross violation of accounting rules), inspectors may fine the company under Art. 120 Tax Code of the Russian Federation:

- For 10,000 – 30,000 rubles;

- Or 20% of the unpaid amount if the tax base is understated, but not less than 40,000 rubles.

There are no sanctions for incorrect execution of the PKO, but a form filled out with errors can be equated to the absence of a document.

The absence of a PKO receipt from the counterparty may lead to the inspectors’ refusal to recognize expenses taken into account when calculating income tax (single tax under the simplified tax system). In such a situation, the counterparty will incur additional costs for paying taxes, fines and penalties.

The organization is obliged to store primary documentation, which includes the cash receipt order, for 5 years after the end of the reporting year.

Read in more detail: Form KO-1

Did you like the article? Share on social media networks:

- Related Posts

- Cash accounting book (form KO-5)

- Application for the release of money for reporting

- Journal of registration of incoming and outgoing cash documents

- Sample of filling out form T-51

- Order to abolish the cash limit in 2021

- Order establishing a cash limit in 2021

- Cash limit for LLCs and individual entrepreneurs in 2021

- Order on accountable persons

Discussion: there is 1 comment

- Victor:

01/03/2020 at 08:31The PKO is filled out as follows: - organization (above) - one name (not related to the operation) - seal - another organization - There is no order itself - The receipt is filled out after the seal has been affixed (the handwriting of the second person) To whom should I appeal about the nullity of this document?

Answer

Leave a comment Cancel reply

Procedure for using the receipt

The Central Bank of the Russian Federation has approved a unified procedure for conducting cash transactions for business entities. According to it, all incoming cash transactions must be processed using a receipt order (PKO). The document can be generated either manually or using software, for example, the 1C program.

When writing out this document, the cashier or other responsible person should not make any errors in its execution. Since corrections in the PQS are not allowed. If suddenly an error is discovered, the document should be reissued.

A cashier, an accountant, a chief or senior accountant, as well as a manager can issue cash receipt orders. In addition, third-party specialists may be hired to prepare documents. It must be remembered that they do not have the right to sign documents.

The completed document is sent to the cash desk to a specialist who checks its correctness and then registers it in the journal.

After checking all the required details, the cashier accepts cash, the amount of which must correspond to the amount specified in the document. If the receipt is income, then the amount must be entered according to the cash register. Money can be transferred to the cash desk using a register or receipt. In this case, they go as an attachment to the software and must be indicated in it.

If the depositor has transferred the correct amount, the cashier tears the receipt from the depositor, puts all the necessary stamps and his visa on it and hands it to him.

Attention! When the working day or shift comes to an end, all cash documents, including PKO, are submitted along with the cashier’s report to the accounting department to check and reflect their business transactions.

Responsibility for the absence of a cash order

If an organization does not generate cash documents (“receipts” and “consumables”), or does so untimely, then it faces both administrative and tax liability.

Primary documents must be prepared in accordance with accounting rules. Their absence is a gross violation, for which liability is provided under Article 120 of the Tax Code of the Russian Federation. The fine for violation will be:

- 10,000 rubles – for a violation in one tax period;

- 30,000 rubles – for violation in several tax periods.

If this violation led to a decrease in the amount of income, and therefore to a smaller value of the tax base, then the fine will be 20% of the unpaid tax amount, but not less than 40 thousand rubles.

In order to avoid fines and disputes with the tax office, the receipt of revenue must be processed on the same day on which it was received. That is, it is necessary to form a PKO.

Administrative responsibility applicable to the head of an organization may be:

- 4000 – 5000 rubles – for the complete absence of a PQS or its untimely execution;

- 2000 – 3000 rubles – violation of storage procedures and deadlines;

- 300 – 500 rubles – for failure to submit cash documents for tax control.

The administrative liability applied to the organization will be 40,000 - 50,000 rubles.

It should be borne in mind that the absence of such a cash document as an expense cash order (RKO) also leads to liability. Moreover, the amount that was not carried out through cash settlement will lead to a shortage of money in the cash register and it will be collected from the employee who is financially responsible for the cash. This person is usually the cashier.

Useful information: ⇒ “Cash discipline in 2021.”

Results

A cash receipt order is a primary document drawn up on the unified form KO-1. The PQO is filled out when funds are received at the cash desk and can be in either paper or electronic form. In the latter case, the PCP is signed using electronic signatures.

Sources:

- Resolution of the State Statistics Committee of the Russian Federation dated August 18, 1998 N 88

- Order of the Ministry of Finance of the Russian Federation dated October 31, 2000 N 94n

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

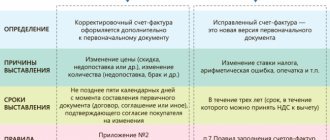

Retail revenue

To reflect retail sales revenue with VAT, you must:

- Generate an outgoing invoice.

- Make the appropriate entry in the sales book.

- Perform accounting entry D9003 - K68-02. For more information, see “Retail Revenue” below.

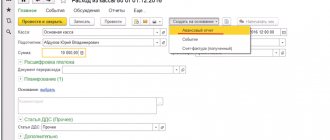

To solve this problem, when generating KO-1, in the “PKO” tab, enable the Invoice

. Pre-set up VAT transactions in the “Cash Order” tab in the properties of the KO-1 journal (see the “Journal Settings” section above). If these conditions are met, after specifying the document amount, debit and credit, accounting entries will be made automatically:

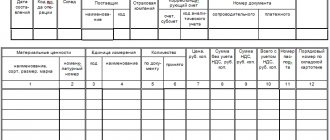

| Sum: | Name: | ||

| 50-01 | 90-01 | 1000,00 | Funds have been received for products, goods, works, and services sold. |

| 90-03 | 68-02 | 180,00 | VAT in the sales book - Funds received for sold products, goods, works, services. |

To reflect retail trade transactions, it is recommended to open a separate journal (KO-1 Revenue) in which all retail trade documents are entered according to the cash register z-report at the end of the working day. In the properties of this journal, enable the Invoice

with its initialization in newly created documents of this journal.

First, set up VAT postings in the journal. In documents of such a journal, the Invoice

is set automatically, therefore, the necessary postings will be made. It is also very convenient to store all retail cash receipts in one journal.

Registration procedure

- The accountant prepares the PKO, accepting cash. And then hands it to the cashier.

- After this, the cashier must check the presence of all signatures in the cash document, and also compare them with sample signatures. In addition, the consistency of the amount written in numbers and in words is checked. The presence of the documents listed in the “Appendix” is also checked.

- Verification of the document is followed by a recount of money. The cashier does this in the presence of the depositor, so that he sees the cashier’s actions. Large organizations do not count cash manually, but using special equipment. These machines record the value of the amount being checked, and the depositor can see this process.

- If the cash amount matches the amount specified in the document, then the cashier signs and seals the order. The cashier gives the tear-off receipt to the depositor. If the amount upon recalculation does not agree with that specified in the order, the cashier either returns the extra money to the depositor or offers to pay extra. If the depositor refuses to deposit money into the cash register, then the cashier is obliged to return the money and return the crossed out PKO to the accountant. Read also the article: ⇒ “Sample journal for registering cash documents (how to fill out, form KO-3).”

Registration of a parishioner and subsequent actions with him

Before entering the cash register, the PKO must be registered in a special registration register. Once it has been completed and recorded, an authorized officer must sign the receipt. This is done before the funds arrive at the cash desk.

As soon as the cashier has received the receipt, he must check whether it has the signature of the chief accountant and whether it is genuine. It also checks whether the document is filled out correctly.

If at least one of the requirements is not met, the recipient returns for revision. If the document is filled out correctly, the cashier accepts the cash, he signs the document and puts his initials on it. On the receipt he puts the date of receipt of cash and puts the company seal of the organization. Near the applications you need to put a stamp or the inscription “received”.

After receiving funds at the cash desk, the cashier tears the receipt from the order itself and hands it to the depositor.

How and when to issue a receipt order?

To issue a receipt order, you must accept cash.

This is usually done by the cashier. When he receives money, first of all he must count it and compare it with the amount that must be deposited at the cash desk.

After that, he draws up a receipt order.

The receipt order form consists of two parts - the order itself and the receipt for it. The cashier must complete both parts. He keeps the left one (the order itself), this is part of the cashier’s report for the day. He gives the right side (receipt) to the person from whom he accepted the money.

The receipt order can be filled out manually or on the computer.

Filling it out manually will of course take longer. In this case, you need to buy or print blank receipt order forms in large quantities. You can number them in advance, and all other fields need to be filled in as you complete them.

Filling out on a computer is easier and faster. This can be done in common MS Word or MS Excel formats by downloading the current order form (this can be done below on this page). But it is most convenient to use the capabilities of accounting programs - all major programs for an accountant necessarily include forms for receipt and expenditure orders.

In what case is a receipt order used?

A cash receipt order is a document that is issued by an accountant or other specialist when money is received at the cash desk.

Its standard form is in force, but enterprises can rebuild it in accordance with the specifics of their activities.

The legislation establishes that companies and entrepreneurs must issue a cash receipt order every time money is posted to the cash register.

Such situations include:

- Registration of cash receipts from buyers and customers. A receipt order must be issued even when cash is received via BSO. In this case, it is compiled for the total amount of revenue either per day or per shift.

- When the amount previously received unused by the accountable person is returned.

- When money is received at the cash desk from a current account to finance business expenses, as well as to pay salaries.

- Return of funds previously provided under the loan agreement.

- Payments by founders for contributions to the authorized capital.

- Refunds of erroneously paid wages, compensation for material damage, etc.

- In other cases established by law.

Attention! It is allowed not to issue PKO only to entrepreneurs who, in accordance with the rules of law, carry out accounting according to a simplified scheme. When issuing money from the cash register, an expense cash order in the KO-2 form is used.

Log Settings

First study the section “General properties of primary documents”: “General”, “Access”, “Accounting codes”, “Limiting connections”, “Signatures”, “Accounting”

In AUBI, you can open several KO-1 journals with various individual settings that allow you to automate the corresponding operations when generating primary documents in this journal. The settings are concentrated in the log properties tabs. Bookmarks are divided into public and private. Public bookmarks are present in various types of primary documents, private bookmarks are present only in documents of a certain type. As a rule, the name of the private property tabs coincides with the name of the primary document.

Cash order

The “Cash Order” tab contains private settings for KO-1. Below, in the figure, is an example of setting up an accounting entry for VAT at the property level of the KO-1 journal, by specifying the corresponding subaccounts in the “Cash Order” tab.

For more information, see “Retail Revenue” below.

Figure 2.

Properties form for the cash receipt order journal KO-1, “Cash order” tab

Accounting

Subaccounts of debit and credit

- indicate one or more accounts for debit (5001; 5002...) and credit (6000, 6200, 7100,7000, 7301,7302, 7601, 7602, 7902, 9001, 9003...). When generating KO-1, the list of debit and credit account values is limited to the values specified in the journal properties. One of the listed debit and credit accounts can be specified as the default value. This subaccount will be entered automatically when creating a new document. As a rule, the default account is 5001 by debit.

VAT

— indicate one or more VAT rates. One VAT rate can be specified as the default value. It is this VAT rate that will be entered automatically in the newly created KO-1.

Bank (current account)

— indicate one or more bank current accounts. Specify one current account as the default value. It is this current account that will be entered automatically in the newly created KO-1. The current account is used only when withdrawing cash from the current account.

Currency

— indicate the currency in which the amounts of documents in this journal will be expressed. This option is used very rarely for specific accounting tasks.

Standard accounting entries

— As a rule, standard wiring is used for KO-1. If this option is not specified at all, then standard postings are still used by default. Specify one or more standard entries for a given journal to limit the standard entries that are used.

Custom accounting transactions (posting templates)

are used quite rarely only for solving very specific problems.

For more details, see the section “User accounting entries”

.

For more details, see the description of the corresponding tab in the “General Document Properties” section.

Signatures

The tab indicates the status (role) and full name of the official signing the primary document. KO-1 is signed by the chief accountant and cashier. As a rule, at the enterprise level, in the settings tab of the same name, all roles and full names of officials signing primary documents are indicated. In all primary documents, the specified roles will be present even if the signatures are not indicated in the corresponding journals. If you want to override the signer's name for documents in a specific journal, specify the status and name in the "Signatures" tab of that journal.

For more details, see the description of the corresponding tab in the “General Document Properties” section.

Accounting codes

The tab indicates (“attaches”) the analytical accounting codes that are necessary for the documents of this journal. Cash accounting codes are first created in the appropriate directory. To maintain analytical cash flow, in each document, indicate the code corresponding to the receipt of cash at the cash desk. Subsequently, generate accounting statements in the context of the specified accounting codes.

For more details, see the description of the corresponding tab in the “General Document Properties” section.

For more details, see the section “Reference statements”.

For more details, see the section “Reference of Accounting Codes”.

Documentation

For KO-1, as a rule, the following parameters are indicated in the “Documents” tab:

- Agreement

– link to the journal(s) of outgoing agreements for which cash payments are accepted. If in the properties of the KO-1 journal a link to the contract journal is specified, then in the documents of this journal the contract field opens, which indicates the contract itself under which cash is accepted at the cash desk. - Numbering

– set parameters for automatic numbering of documents in the journal. - …

For more details, see the description of the corresponding tab in the “General Document Properties” section.

Remember that the VAT rate, bank (current account), currency, standard and custom accounting entries, signatures of officials do not have to be specified in the settings of a specific journal of primary documents. If these parameters are absent in the log settings, the settings of the same name made at the level of the root node of the enterprise will be used explicitly.