Online loan application

Typically, bills are issued when the person who purchased the product or service does not pay for it immediately. In this case, there is a need for instructions explaining how to pay the bill and what actions need to be taken to do this. The document can be sent to the buyer by email, courier or mail. Payment is required in all cases, the main thing is to choose a method that is convenient for you.

The question of how long it takes to repay an invoice remains relevant. Usually the buyer receives the goods only after paying for it. All that remains is to find out how many days he is given to transfer funds using the specified details. It is not always possible to make payment within the first 24 hours after purchase.

The day the payment is made is usually designated by the company providing the service or selling the product. The date is written on the invoice, and the buyer just needs to not miss the deadline. Very often, only three days are given for payment. It is best to clarify information regarding the period for depositing money from the organization’s employees.

You may also be interested in: How to pay for utilities through ERIP

Necessary conditions for payment

In order to make a payment for a service provided or a product purchased, only two things are needed:

- All payment details. Usually they are provided in full, but if something is missing, you will have to separately request information from the counterparty.

- Sufficient amount in the account.

In addition to the above, also, which is quite logical, access to the Sberbank Online service is required. To do this, you need to be a client of Sberbank and first register. If all conditions are met, then making the payment will not be difficult. The entire procedure takes a maximum of half an hour (including double-checking the data). If you need to make such payments regularly, then it makes sense to save the operation in templates or even enable automatic payment.

Is it possible to issue an invoice without a contract?

Those who are against issuing an invoice if there is no agreement refer to Articles 161 and 162. The Civil Code, which stipulates that, according to the general rules, transactions must be concluded in written format, otherwise they can be declared invalid. You can also refuse an invoice if the parties (buyer and supplier) act without an agreement.

But the usual form of an agreement is to conclude when the parties have accepted its terms. And then they sign, it is not considered the only possible one. The Civil Code established that if a (written) proposal entering into a contractual relationship is accepted by the opposite party, by fulfilling the terms of payment, shipment, etc., the required form of the form is considered to be met.

Such an offer, in private, is an organization issuing an invoice, which specifies what, in what amount and at what markup the buyer can buy from it; from the point of view of legislation, this is an offer that is expressed by the intention of the supplier or seller. Paying the invoice without an agreement means that the buyer agrees to the offer and their terms, that is, the parties enter into a contractual relationship . This action is equated to acceptance - acceptance of the offer. The transfer of funds to the supplier confirms that the concluded contract was actually concluded.

When completing a transaction, you can use forms such as an agreement and an invoice for payment. It must be done on paper.

You can conclude an agreement using the following options: (click to expand)

- The parties to the agreement exchange several forms;

- A written offer is drawn up;

- One document is drawn up and signed by all parties to the contract.

The contract must contain all the necessary details, seal and signature.

Connection Sberbank Online

To connect to Sberbank Online you need:

- Go to the official website of the financial institution in question.

- In the upper right corner, find the personal account icon and click on it.

- Click on the registration button on the login page that opens in your personal account.

- Enter your Sberbank card number and click on the “Continue” button.

- An SMS notification with a code will be sent to the phone number associated with the card in question. You will need to enter it in the window that appears and click on the “Continue” button again.

- In a new window, the client will receive a login and password for authorization in the system. In the future, they can be changed by installing any option that suits the client.

- After this, you should return to the authorization window and enter your login and password. Click on the “Login” button.

- An SMS message with a verification code will be sent to your phone number again. It is entered in the window that opens. After this, the client receives full access to the system.

Is it possible to pay without an invoice?

For example, when buying and selling, the essential conditions are the name of the goods, their price and quantity.

If the invoice does not specify all the terms of the transaction, then such a transaction will already exist, it is considered that it did not exist. The way out of such situations is considered to be the execution of a document upon completion of the transaction (invoice, act), in which all the terms of the transaction will still be clarified. In this case, the transaction will be considered concluded on the terms specified in these documents (invoice, services, work completion certificate).

How to pay a bill through Sberbank Online?

You can actually pay your bill in two ways - online from your phone or also online, but from your computer. Despite the fact that payments from the phone may seem more convenient due to the fact that they are not tied to a specific location, it is recommended to make payments using a computer at least for the first time. In the future, the operation can be saved in templates and used both on a computer and on a mobile phone. There are two main payment options - by the name of the organization or by details. Let's look at both.

Accepting payments by an unregistered individual: pros and cons

Imagine the situation: a teacher decided to record his own Chinese language course and sell it online. He is just starting a business and wants to try his hand, so he decides not to register an individual entrepreneur or legal entity. He creates his own website and goes in search of payment systems that can be connected to accept payments online.

Most payment systems refuse to work with him because he has not registered his business. Law No. 264-FZ of August 2, 2019 prohibits operators of electronic payment instruments, legal entities and entrepreneurs from working with individuals who have not passed identification.

But there are always loopholes. After spending a couple of hours, a novice businessman finds a system that processes online payments through the site and credits money to the individual’s personal card or e-wallet. The teacher decides that he will use this option for the first time.

However, the legislation of the Russian Federation does not contain the concept of “first time”. But it does contain the terms “illegal business” and “tax evasion.” According to Art. 171 of the Criminal Code of the Russian Federation, an illegal businessman can be punished with a fine of up to 500 thousand rubles or imprisonment for up to 5 years.

Even if you manage to find a payment system that works with individuals, there is always a risk of being targeted by government services. And the payment intermediary may, without warning, stop cooperating with an individual and block his account.

Organizational translation

This option is considered a priority for many reasons. There is no need to enter most of the details, there is less chance of errors, it is easier to search, and so on. The only drawback is that the required organization/firm/company may simply not exist in the Sberbank directory. As a result, you will have to enter all the data manually. But first, let’s look at the payment option by organization name:

- Log in as shown above.

- Go to the “Transfers and Payments” tab.

- Scroll down the page to the search bar.

- Enter the name of the desired organization/company/firm. In theory, you can find it manually, among the proposed categories, but it is much faster to immediately search by name.

- Find the organization you need and select it.

- Fill in all required details. Most of them will “catch up” on their own, but the payer’s data, payment amount and some other information are filled in automatically only in some cases.

- After filling in the data, you need to double-check it and confirm the operation. For this purpose, another SMS notification will be sent.

Document form

If, due to the nature of the company’s activity, it is necessary to constantly accept payments from counterparties, the logical solution would be to prepare a template in which to enter all the unchanged data, and before issuing, change only the names of payers, lists of goods and the payment amount. The most convenient option is to download a ready-made form and adapt it to suit your purposes. Filling out a ready-made form will only take a few minutes, and preparing a new one from scratch will take at least 20-30 minutes.

Download: Invoice form for payment

If the organization uses 1C software, registration will be even simpler. How to prepare an invoice for payment in 1C: Accounting:

- Open the “Sales” tab and find “Invoices for payment to customers” in the list.

- Clicking on this link will open a list of all previously created documents.

- Next, you need to click the “Create” button or the Ins button. A blank form will open.

- In the new document, fill in the payer’s information and all other fields (some will be filled in automatically).

- When the document is ready and verified, click “Burn.” The file will be saved. The document is ready. It can be printed or sent by email.

Payment by details

Payment of a bill through Sberbank is also possible using the details. This is only relevant if a suitable company is not in the directory. To do this, you need:

- Log in to your personal account.

- Go to the payments section.

- Select a category.

- Fill in the details (this time absolutely everything).

- Recheck the data. Considering the fact that nothing is filled in automatically in this case, you need to check it very carefully.

- Enter the payment amount and confirm the transaction.

How to select and connect a payment system for an individual

In addition to the size of the commission, there are other criteria for choosing a payment aggregator for a self-employed individual. But the integration rules are generally standard for all services.

Criteria for choosing a payment system

The following factors need to be taken into account:

- additional fees besides the main one: for example, for withdrawing funds to a card;

- quality of technical support, availability of reference information on the service website;

- conditions for connection and integration: term, need to sign an agreement, verification of the merchant, etc.;

- Convenience of your personal account: availability of tools for creating reports, simple interface;

- additional features: support for mass, recurring and other types of payments;

- period of presence of the system on the market: usually the older the service, the higher its reliability.

other methods

There are other ways to pay bills. They are relevant if there is no access to a computer or phone. In addition, alternative options are often preferred by people who do not work well on the Internet.

At a Sberbank branch

The simplest, but also the most inconvenient option. The simplicity lies in the fact that the client practically does not need to do anything - the operator will do everything. All that remains is to transfer the money or make a payment by card. The inconvenience is that you will have to look for the nearest branch, somehow get there and wait for your turn. Brief instructions:

- Select the appropriate department. For example, using a special service on the bank’s website.

- Appear there in person, taking with you your account (payment details), money/card and identification document.

- Wait for your turn.

- Explain the essence of the request to the operator/manager.

- Wait for the documents to be processed.

- Pay the bill.

- Receive a payment receipt.

In the Sberbank terminal

The general principle is similar to both payment at a bank branch and through Sberbank Online. First you need to find a suitable ATM. This can be done using the same service shown above. Next, insert the card and select the item regarding payments and transfers. We enter all the necessary details and confirm the operation.

Accepting payments for self-employed

Self-employed citizen - official status. It gives the right to work in certain directions and receive money from buyers or customers. Law No. 422-FZ of November 27, 2018 determines that self-employed persons have the right to receive remuneration in cash, transfers to a bank card or to an electronic wallet. You can also use a bank account, but this is not necessary.

Excerpt from the Yandex.Checkout service for self-employed:

Trade acquiring of bank cards is not available to self-employed people. If you want to accept payments from cards through a POS terminal, you will have to register as an individual entrepreneur or legal entity. But the ban does not apply to online acquiring from payment systems. It is completely official if the self-employed person issues checks to clients through the My Tax app. We talked about Internet acquiring for the self-employed.

There are two options for payment systems for self-employed people:

- Payment service aggregator - ensures acceptance of payments from clients in different ways (from a bank card, electronic wallet, mobile account, payment terminal). The money is credited to the aggregator’s account, and then to the individual’s card or account.

- A separate bank card to separate income from other income. To receive payments on a card, you will have to provide its details to each individual client. This is not always convenient and limits the options for buyers who use cards from other banks or, for example, electronic wallets. They will not want to pay commissions and will refuse orders.

Self-employed people who work through payment aggregators also need a separate bank card. Firstly, it’s easier to keep records. Secondly, the risk of blocking is reduced. Not all banks have adapted their conditions to the law on self-employed people. Therefore, it is better to open a separate card account - if possible, a specialized one. For example, Sberbank offers self-employed people a digital card.

Account elements

There is no specific form for drawing up an invoice, but there are mandatory components that must be contained in it.

- Requisites individual entrepreneur or LLC (both seller and buyer):

- name of the enterprise;

- legal form of organization;

- legal address of registration;

- Checkpoint (for legal entities only).

- Information about the bank servicing the transaction:

- name of the banking institution;

- his BIC;

- numbers of current and correspondent accounts.

- Payment codes:

- OKPO;

- OKONH.

- Account number and date of its registration (this information is for internal use of the company; numbering is continuous, starting from the beginning every year).

- VAT (or lack thereof). If VAT is present, its amount is indicated.

- Last name, initials, personal signature of the compiler.

Transaction settlement

Transactions in writing must be concluded by drawing up a document that expresses its content and signed by the person or persons who make the transaction, or otherwise authorized by them.

Transactions between legal entities and citizens must be carried out in a simple form, that is, in writing. With the exception of transactions that require notarization.

For transactions of a legal entity between itself and citizens, the law provides for their mandatory conclusion in simple written form.

The written form presupposes that an act must be drawn up that expresses the content of the transaction, which is signed by the person making this transaction or by persons duly authorized by him.

The conclusion of an agreement through the exchange of documents via mail, telegraph, telephone, electronic or other communication, which makes it possible to reliably establish that the document comes from the party, is also equated to the written form of concluding a transaction.

Form

The paper is drawn up in two copies. One of them is given to the buyer, and the second remains with the seller.

The report is completed on a piece of A4 paper. It can also be issued on company letterhead. Most often, an invoice from an individual entrepreneur is issued on the company’s letterhead. This way, you do not need to constantly enter company details into reporting documents.

There is no uniform template for filling out the document. Each company develops its own form for filling out the document. According to the law of the Russian Federation, the document is drawn up in free form. Long-running companies and entrepreneurs develop their own check form for payment.

It only changes:

- buyer information;

- name of goods or services;

- total amount;

- date of.

Some companies indicate on the receipt the terms of delivery, payment, validity period of the paper, and other information.

Important! There should be no errors in the payment receipt. If there are errors, the seller will have to fill out the form again.

Who issues invoices for payment?

An invoice for payment is always issued by an employee of the accounting department. After the form is completed, the document is handed over to the head of the organization, who certifies it with his signature. It is not necessary to put a stamp on the document, since individual entrepreneurs and legal entities (since 2021) have the right not to use the seal.

An invoice for payment is drawn up in two copies , one of which is sent to the service consumer or buyer, the second remains with the organization that issued it. You can fill out the invoice either on a regular A4 sheet or on the organization’s letterhead. The second option is more convenient, since you do not need to enter information about the company each time.

This document does not have a unified template, therefore organizations and individual entrepreneurs have the right to develop and use their own template or issue an invoice for payment in free form. As a rule, for long-established organizations and individual entrepreneurs the form of the form is standard; only the information about the invoice recipient, the name of the product or service, as well as the amount and date change. Sometimes organizations additionally indicate in the invoice the terms of delivery and payment (for example, percentage or prepayment amount), the validity period of the invoice and other information.

If any errors are made in the document during registration, it is better not to correct them, but to issue the invoice again.

It should be remembered that in some cases, when resolving disagreements between the parties in court, the invoice for payment is a document of legal force and can be presented in court.

Can I issue an invoice from an individual?

Since individuals who are not registered as individual entrepreneurs do not pay VAT, and an invoice can only be issued by an organization or individual entrepreneur with VAT, this function is not directly available to them .

Any serious company will not pay an invoice issued by an individual, exposing itself to taxes. Or you will have to register as an individual entrepreneur/closed joint stock company/LLC in order to be able to issue invoices, or draw up an agreement with an organization for the provision of a certain type of service, and it makes payment as an individual for the work performed. So, from a legal point of view, an individual and invoicing are incompatible concepts.

Invoice for payment from an individual entrepreneur or LLC

Today there is no form approving the type of account or suggesting its standard . It is not even considered an accounting document. An invoice is issued and issued for payment electronically or in paper form. Be sure to indicate the following:

- details of an individual entrepreneur or legal entity (identification code, name of the organization, its legal form and legal address);

- details of the servicing bank (name, address, current and correspondent accounts, BIC);

- codes (OKPO, OKONH).

After the individual entrepreneur has indicated his and the buyer’s details, the invoice number and the date of its formation are entered and the presence or absence of VAT is indicated. At the end of the individual entrepreneur’s document, you must indicate your last name, initials and sign. It is not necessary to put a stamp.

It’s even better to use a special program that generates invoices. In addition, it will automatically keep records of all completed transactions, significantly simplifying accounting reporting. It will also allow you to track the payment of bills, eliminating the occurrence of errors, for example, transferring money to another account.

What is the difference between invoices for payment from LLC and individual entrepreneur

The sample received from the “private owner” has one signature. The LLC will issue a paper containing two “autographs” - the chief accountant and the director. Besides:

- Individual entrepreneurs indicate only full name, companies - the name recorded in the charter;

- The individual entrepreneur form contains only the TIN, the organization - TIN and KPP.

Differences when issuing with VAT and without VAT

VAT payers show the tax amount separately.

If the supplier is exempt from the contribution due to the use of a special tax regime (simplified system, single tax, patent), then the VAT amount is not included when writing the document. However, the corresponding mark is still affixed. And the reason must be given. For example, under the simplified tax system it is written:

- for individual entrepreneurs - paragraph 2 of Article 346.11 of the Tax Code of Russia>;

- organizations - paragraph 3 of this regulatory act.

Invoice for delivery of goods

An invoice agreement can be drawn up as requiring the signature of two parties, or perhaps drawn up as an offer, in which payment according to the specified details is considered confirmation of acceptance.

But, in the opinion of many, an invoice agreement is a convenient form of contractual relations, especially among small and medium-sized businesses, which, due to its simplicity, does not require lengthy changes and approvals.

IMPORTANT! The most important thing to remember is that delivery of goods on invoice without a contract is dangerous for both suppliers and buyers.

Returnable packaging tab

the Returnable packaging functionality setting . PDF

The tabular part of the Returnable contains the following columns:

Nomenclature

In the Nomenclature , select the name of the returnable container from the Nomenclature directory. If the item type is Service PDF, then this item cannot be selected in the tabular part of the Returnable the Buyer Invoice document .

The nomenclature specified on the Returnable packaging tab is not reflected in the standard printed form, and filling it out is only necessary to automatically fill out a similar tab in the document Receipt (act, invoice) .

Quantity

In the Quantity , indicate the quantity of packaging that is returned to the supplier.

Price

In the Price the price of the deposit for the container is displayed. The column is filled in:

- manually;

- automatically based on data from the previously entered document Invoice from supplier or Receipt (act, invoice) ;

- automatically according to the price type specified in the Price type via the VAT . PDF-13

Sum

Amount column is calculated as the product of the Quantity and Price .

Additional tabular columns

to the tabular part of Returnable packaging using the More – Change form button:

- Code;

- vendor code.

Code

Code column is convenient to use when the Nomenclature contains a large number of similar items. This column displays the value of the Nomenclature directory element code .

vendor code

Article column is convenient to use when the Nomenclature contains a large number of similar items. This column displays the value of the Article number Nomenclature directory element .

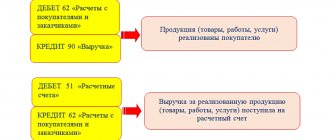

Basic transactions for the current account

We have grouped the most popular transactions for account 51 in the table.

| Situation | Debit | Credit |

| Receipts to the current account | ||

| Payment received from buyer | 51 | 62 (sub-account “Payment”) |

| Advance received from buyer | 51 | 62 (sub-account “Advances”) |

| Refund of prepayment by supplier | 51 | 60 (sub-account “Advances”) |

| Claim paid by supplier | 51 | 76 (sub-account “Claims”) |

| Received funds from other persons | 51 | 76 (corresponding subaccount) |

| Dividends received | 51 | 76 (sub-account “Dividends”) |

| Refund of tax, contribution | 51 | 68, 69 |

| Contribution to the authorized capital received | 51 | 75 |

| Cash deposited into account | 51 | 50 |

| Received money on account (through transfers on the way) | 51 | 57 |

| Received money from another bank account | 51 (sub-account of the recipient's bank) | 51 (sub-account of the sender's bank) |

| Interest accrued on account | 51 | 91 |

| Receipt of credit, loan | 51 | 66, 67 |

| Budget funding received | 51 | 86 |

| Debits from current account | ||

| Payment made to supplier | 60 (sub-account “Payment”) | 51 |

| Advance paid to supplier | 60 (sub-account “Advances”) | 51 |

| The advance was returned to the buyer | 62 (sub-account “Advances”) | 51 |

| Paid upon claim to buyer | 76 (sub-account “Claims”) | 51 |

| Cash received from the account to the cash desk | 50 | 51 |

| Write-offs (withdrawals) of money through transfers while in transit | 57 | 51 |

| Money transferred to another account | 51 (sub-account of the recipient's bank) | 51 (sub-account of the sender's bank) |

| Paid by cash account to other persons | 76 (corresponding subaccount) | 51 |

| Taxes and fees paid | 68, 69 | 51 |

| Written off as payment for banking services | 91 | 51 |

| Salary transferred | 70 | 51 |

| Accountable funds paid | 71 | 51 |

| Dividends paid | 75 | 51 |

| Loan issued to employees | 73 | 51 |

| Settlements have been made with the customs service | 76 (corresponding subaccount) | 51 |

| Repayment of a loan | 66, 67 | 51 |

ConsultantPlus experts told us how to withdraw cash from a bank. Get free demo access to K+ and go to the Ready Solution to find out all the details of this procedure.