One of the priority areas for the development of the Russian economy is agriculture. In this regard, a special tax regime was developed for enterprises in this area - a single agricultural tax. Unified agricultural tax - what is it in simple words?

Payers on this system are exempt from income tax (individual entrepreneurs from personal income tax), as well as partially from property tax. Instead, they pay a single tax on the difference between income and expenses. In this case, the person must have the status of an agricultural producer. These include legal entities, peasant (farm) enterprises and individual entrepreneurs who are engaged in the production, processing or sale of crops, livestock products, fisheries, and also provide services in the field of agriculture. In addition, the key condition for applying the special regime is a limit on income from other activities. The share of revenue from sales of agricultural products in total revenues must be at least 70%.

Currently, the procedure for taxing persons on the Unified Agricultural Tax has changed somewhat. What innovations have appeared in the Unified Agricultural Tax system since 2021? You can find the latest news in our article.

What is Unified Agricultural Tax

The Unified Agricultural Tax is a tax regime created specifically for entrepreneurs and organizations engaged in the production of agricultural products.

A feature of the Unified Agricultural Tax, like any other special regime, is the replacement of the main taxes of the general system with one - a single one. The following are not subject to payment on the Unified Agricultural Tax:

- Personal income tax (for individual entrepreneurs).

- Income tax (for organizations).

- VAT (except for export).

- Property tax (except for objects for which the tax base is determined as their cadastral value).

What products are considered agricultural

Agricultural products include products of crop production, agriculture, forestry, and livestock (including those obtained as a result of growing and rearing fish and other aquatic biological resources).

Who benefits from it?

Agricultural producers (individual entrepreneurs and LLCs) have been reluctant to use unified agricultural tax in the last few years. Let's figure out why this happens.

Firstly, the Unified Agricultural Tax exempts people from paying value added tax. But, according to statistics, most of the contractors of farms are large companies that use OSNO. Transactions between VAT payers and non-payers become inconvenient due to complex reporting and the inability to make a VAT refund.

Secondly, the VAT rate on agricultural products is now only 10%. And this tax can be reimbursed at a general rate of 18%. For example, a farmer sells wheat with VAT of 10% and buys a tractor with VAT of 18%. The benefits of using OSNO in this case are obvious.

Thirdly, the property tax is very low, and since 2013 another benefit has been in effect - a zero rate on movable property. Therefore, the benefits of using OSNO in some cases outweigh its disadvantages.

Of course, it’s up to you to decide whether to use the Unified Agricultural Tax or stay on OSNO, but don’t forget to take into account the specifics of your business. The simplicity of the Unified Agricultural Tax may seem like a great bonus to you, but you should take into account the taxation system of your partners. Take a responsible approach to your business, and your business will go uphill.

Who has the right to apply the Unified Agricultural Tax in 2021

Individual entrepreneurs and organizations whose income from agricultural activities is more than 70%

from all income.

Fishery organizations and entrepreneurs also have the right to apply the unified agricultural tax, but their income from the sale of fish products must be more than 70%, and the number of employees must not exceed 300 people

.

Note

: from January 1, 2021, LLCs and individual entrepreneurs that provide services to agricultural producers in the field of livestock and crop production can apply the unified agricultural tax (Federal Law of June 23, 2016 No. 216). More details about this here.

Who cannot apply the Unified Agricultural Tax

- Organizations and individual entrepreneurs producing excisable goods (for example, alcohol-containing and alcoholic products, tobacco, etc.).

- Organizations involved in gambling.

- Budgetary and government institutions.

- Individual entrepreneurs and organizations that are not producers of agricultural products, but are only involved in their primary and subsequent processing.

- Individual entrepreneurs and organizations whose income from agricultural activities is less than 70% of their total income.

State support for peasant farms

The state provides support in the creation and development of a lending system for agricultural producers and ensures equal rights in access to loans for business development.

The state provides property support to peasant farms on the basis of the federal law regulating the development of small businesses: a farm can receive for use state or municipal property in the form of plots of land, buildings, buildings, non-residential premises, equipment, vehicles, special equipment, etc. Help can provided under different conditions: free of charge, in consideration or as benefits.

Transition to EXSN in 2021

If you are just planning to register an individual entrepreneur or organization, then the notification must be submitted either with the remaining documents for registration, or within 30 calendar days

after registration.

note

, that if you do not meet the specified deadline, you will be automatically transferred to the main taxation regime - the most difficult and unprofitable for small and medium-sized businesses.

You can switch to Unified Agricultural Tax only once

in year. To do this, you must fill out a notification in 2 copies and submit it to the tax authority (individual entrepreneur at your place of residence, organizations at your location).

Existing individual entrepreneurs and organizations can switch to the Unified Agricultural Tax only from January 1 of the next year. To do this, you must submit a notification before December 31

current year.

Calculation of the Unified Agricultural Tax tax

The unified agricultural tax is calculated using the following formula:

EXSN = Tax base x 6%

The tax base

– this is the monetary expression of income reduced by the amount of expenses (expenses for which the tax base can be reduced are listed in clauses 2-4.1, 5 of Article 346.5 of the Tax Code of the Russian Federation).

The tax base can also be reduced by the amount of the loss

(the excess of expenses over income) received in previous years. If losses have been recorded for several years, then they are transferred in the order in which they were received.

Recommendations for creating a successful peasant farm

Entrepreneurs with experience consider the following points important in creating their own agricultural business:

- It is better to purchase your own plot of land, even if it is far from home. This is an additional security measure.

- If the capital is small, then it is better to start with vegetable growing. In a few years, this area will bring significant income.

- If you have significant start-up capital, it is better to start a business with animal breeding. Pig farming is one of the most profitable options.

- It is necessary to use additional labor, since it is usually difficult to cope with the existing volume of work alone. Employees are a great option.

- It is necessary to sell manufactured products correctly and in full: you need to enter into agreements with wholesale buyers, markets and supermarkets.

Tax payment deadlines

Note! The deadlines for paying taxes and filing reports for some individual entrepreneurs and organizations have been postponed due to the coronavirus epidemic. Read the article for details.

The tax period under the Unified Agricultural Tax is a calendar year. Reporting period is half a year.

Organizations and individual entrepreneurs must pay an advance payment during the year based on the results of the reporting period.

The advance payment deadline is no later than 25 days from the end of the reporting period (six months).

In 2021, organizations and individual entrepreneurs must pay an advance payment for six months from July 1-25.

In 2021, it is necessary to calculate and pay tax based on the results of 2018 (minus the previously paid advance).

The deadline for paying tax under the Unified Agricultural Tax for 2021 is until April 1, 2019

.

The deadline for paying tax under the Unified Agricultural Tax for 2021 is until April 1, 2020

.

Example of calculation and payment of Unified Agricultural Tax

Advance payment

IP Petrov I.M. in the first 6 months of 2021, I received an income of 500,000

rubles.

Expenses amounted to 420,000

rubles.

The advance payment will be equal to: 4,800 rubles.

((RUB 500,000 – RUB 420,000) x 6%). It must be paid by July 25, 2021.

Tax at the end of the year

In the next 6 months (from July to December) IP Kotov I.N. received income in the amount of 600 000

rubles, and his expenses amounted to

530,000

rubles.

In this case, the tax at the end of the year will be equal to: 4,200 rubles.

((RUB 1,100,000 – RUB 950,000) x 6% – RUB 4,800). Unified agricultural tax for 2019 will need to be paid no later than April 1, 2020.

General conditions of use

In fact, after reading this article, you yourself will understand that the Unified Agricultural Tax is very similar to a simplified version with an “income-expenses” base. And it is true. Among the general conditions for using the Unified Agricultural Tax, we note:

- The tax can be used by both legal entities and individual entrepreneurs. The main thing is that they must meet certain criteria - I’ll tell you about them later;

- The regime is voluntary - if you meet the criteria, you can switch to it, or you can remain on another regime. Here you decide for yourself what is better.

- Legal entities paying the unified agricultural tax are exempt from : Income tax;

- Property tax.

- personal income tax;

- All rules for the application of the Unified Agricultural Tax also apply to one specific type of business organization - peasant (farm) enterprises.

Please note that the main innovation for 2021 is that now entrepreneurs located on the Unified Agricultural Tax will be required to pay VAT in the general manner (see 335-FZ of November 27, 2017, paragraph 12, article 9). It will have to be accrued upon the sale of agricultural products, and input VAT can be refunded. Entrepreneurs will be required to issue invoices, keep books of purchases and sales, and submit VAT returns quarterly.

However, the above law also provides for exemption from the obligation to pay VAT. It can be used by notifying the tax office with a corresponding application. It turns out that an entrepreneur can voluntarily choose what will be beneficial for him - to pay only the Unified Agricultural Tax or the Unified Agricultural Tax plus VAT, which, for example, will be relevant for large agricultural producers with large amounts of input VAT.

The right to release can be exercised if:

- the transition to the Unified Agricultural Tax and exemption from VAT by application occur in the same calendar year;

- income from business activities, excluding VAT, did not exceed 100 million rubles, this is for 2021, for 2021 the limit will be 90 million rubles.

If one of the conditions is met, VAT may not be paid in 2021, only by notifying the tax office in advance.

What is also important is that entrepreneurs selling excisable goods during the last three months before the legislative amendments enter into force cannot take advantage of the right to be exempt from VAT.

Another nuance is that an entrepreneur who has received the right to exemption from VAT cannot subsequently refuse it (Article 145 of the Tax Code of the Russian Federation, paragraph 2, paragraph 4). The only exception will be the fact of loss of this right. This can happen either due to exceeding the annual revenue threshold (90 million in 2021), or due to the sale of excisable goods. If this happens, the entrepreneur loses the right to VAT exemption; the tax amount will need to be restored and transferred to the budget. Moreover, in the future the entrepreneur will no longer be able to take advantage of the repeated right to VAT exemption. This is stated in Art. 145 Tax Code of the Russian Federation, paragraph. 2 p. 5.

Tax accounting and reporting

Tax return

At the end of the calendar year, all individual entrepreneurs and organizations using the Unified Agricultural Tax are obliged no later than March 31

fill out and submit a tax return (in case of termination of activity, the declaration is submitted no later than the 25th day of the next month after the month in which the activity was terminated).

Accounting for income and expenses (KUDiR)

In addition to the tax return, individual entrepreneurs must keep a book of income and expenses received (KUDiR).

Accounting and reporting

Individual entrepreneurs using the unified agricultural tax are not required to submit financial statements and keep records.

Organizations on the Unified Agricultural Tax, in addition to the tax return and KUDiR, are required to maintain accounting records and submit financial statements.

Accounting statements for different categories of organizations vary. In general, it consists of the following documents:

- Balance sheet (form 1);

- Statement of financial results (form 2);

- Statement of changes in capital (Form 3);

- Cash flow statement (form 4);

- Report on the intended use of funds (form 6);

- Explanations in tabular and text form.

Read more about financial statements here.

Reporting for employees

They rent only to individual entrepreneurs and organizations that have employees.

Read more about reporting for employees here.

Cash discipline

Organizations and individual entrepreneurs carrying out operations related to the receipt, issuance and storage of cash (cash transactions) are required to comply with the rules of cash discipline.

Read more about cash discipline here.

note

, from 2021, individual entrepreneurs and organizations carrying out settlements using cash and electronic means of payment are required to switch to online cash registers.

Additional reporting

Carrying out certain types of activities, as well as owning certain property, requires paying additional taxes and maintaining records.

Read more about additional taxes for LLCs here.

Read more about additional taxes for individual entrepreneurs here.

Legal regulation

Legislative control of the Unified Agricultural Tax regime operates within the framework prescribed in Chapter 26 of the Tax Code of the Russian Federation. This section interprets the rules for applying this scheme, the specifics of keeping records of expenses and income, as well as the procedure for paying advance payments and the final tax amount.

In addition, a number of additional acts define the requirements for the Unified Agricultural Tax declaration form and the proper procedure for filling it out. In particular, the currently existing sample declaration, which was approved by the Order of the Federal Tax Service under the number MMV-7-3/384, as amended in 2021.

Separate accounting

When combining tax regimes, it is necessary to separate

income and expenses for the Unified Agricultural Tax from income and expenses for other types of activities. As a rule, there are no difficulties with the division of income. In turn, with expenses the situation is somewhat more complicated.

There are expenses that cannot be clearly attributed either to the Unified Agricultural Tax or to other activities, for example, the salaries of employees who are engaged in all types of activities at the same time (director, accountant, etc.). In such cases, costs must be divided

into two parts

in proportion

to the income received on an accrual basis from the beginning of the year.

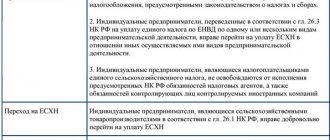

Transition to other taxation systems

Individual entrepreneurs and organizations located on the Unified Agricultural Tax can voluntarily

switch to a different tax regime only from the beginning of the next calendar year. To do this, they need to submit a corresponding notification to the tax authority before January 15 (clause 6 of Article 346.3 of the Tax Code of the Russian Federation).

Mandatory

Unified agricultural tax payers switch to the general taxation system from the beginning of the tax period in which the right to use the unified agricultural tax was lost.

You can switch back to paying the Unified Agricultural Tax no earlier than one year

after losing the right to use it.

Content

- General conditions of use

- Who can become a payer of the Unified Agricultural Tax

- Transition to Unified Agricultural Tax and leaving the special regime

- Main parameters of the Unified Agricultural Tax

- Pros and cons of Unified Agricultural Tax

- Conclusion

It, as the name implies, can be used by a rather narrow circle of taxpayers, but it is still worth talking about. Firstly, among the readers there are those who are involved in agriculture. Secondly, the information may be useful to those who are just planning to start a business in this area. Moreover, in our country recently the topic of agriculture and import substitution has been developing quite actively - everyone who at least occasionally watches TV and reads the news has probably heard about this.

So, Unified Agricultural Tax is a special taxation regime for agricultural producers.

What are its features? Let's figure it out in order.