Dear Colleagues!

Today we will talk to you about gift certificates, as a favorite opportunity for many companies to attract more potential customers or show loyalty to current customers. And, of course, we have some interesting postings!

The pages of the Financial Blog and the work that we put into its development are aimed at covering as many needs as possible of our target audience - accountants, heads of organizations, financiers, lawyers and personnel officers. Any article we write is another step towards revealing a new topic to the reader or dwelling in more detail on an old, well-known problem.

Actually, gift certificates and methods of working with them are something between a new product and an “old one” and, therefore, it is advisable to talk about them too. The fact is that, most likely, your business has been using this marketing tool for a long time? and you know well how to work with it. However, as the survey showed, not everyone decides to take such actions? And those who have decided are not always happy about it. Why? Let's talk about this too...

The essence and features of transactions with a gift certificate

The offer announced by the company to sell gift certificates is recognized as a public offer, and its purchase by the consumer implies the latter’s acceptance of the offer (acceptance) and all the parameters specified in it (Articles 432, 433, 435, 437, 438 of the Civil Code of the Russian Federation).

The rules for using a bonus document are often specified in the document itself, and it is not possible to exchange it for money. At the end of its validity period, the amount intended for use is redeemed, that is, it remains with the seller and is not returned to the purchaser of the card. Also, a lost or damaged document cannot be restored.

A gift obligation is a variant of a preliminary agreement, according to which, within a certain period, the seller is obliged to draw up a purchase and sale agreement with the bearer of the document for the amount indicated in the form. The money paid for it acts as an advance payment for goods purchased in a future period.

For your information! Only the transaction amount is recorded on the card, and the name of the product and its price at the time of purchasing the certificate are not determined.

Why do people like and dislike certificates?

It is clear that having touched on such a popular topic as accounting for gift certificates, we could not help but ask our clients about their opinion on this matter. We wondered if they are using them as a marketing tool in their organizations, how they work with them and how clients react to them. Here's what we know:

“I like to receive gift certificates in stores, but I don’t like working with them. We are a small company. The CEO is my husband. And I do the accounting myself. We do tire fitting. I don’t understand this area, which is probably why my husband told me that clients can only be attracted by some kind of, excuse me, “freebie.” From the moment we introduced gift coupons into circulation, there were no significantly more customers, and discounts had to be given to those who were already “changing their shoes” with us. In general, it doesn’t work.”

— Tell me, on what basis did the client have the right to receive a certificate? How did you distribute them?

“Yes, no way, by and large. At first we thought of placing a promoter dressed in a life-size doll at the entrance to the repair bay so that he would hand out coupons, but then we realized that this would be costly for us. It turns out that those who used our services received certificates. And, as I already said, only my husband’s friends come to us. Essentially, there are no outsiders.”

—Maybe it makes sense to place an advertisement on the Internet so that your tire service is reflected in searches? You can also place advertisements about discounts there.

“If they had thought about this earlier, then, of course, they would have already done it. There's no time for that now. The income is small, but it is enough for now. Let’s see, maybe someday in the future we’ll do something similar.”

There is another story, but with a more successful experience.

“We have been producing gift certificates for a long time, and they are very popular among our clients. Unlike many other companies, we do not distribute them to everyone, but offer our customers to first purchase products for a certain amount, and only after that we are ready to give a discount on subsequent purchases. We sell cosmetics made from natural ingredients, the products are in demand, and there are always customers. They are happy that after just 2-3 orders they can save significantly.”

—Do you think it’s worth something to “lure” new customers even before they leave their money in your store? Maybe gift certificates, but should they be given in smaller denominations “at the entrance”?

“We considered this option, but, I admit, our director doesn’t like it. To be honest, I don’t see the point in this. People come every day, some for soap, some for shampoo, some for hair dye. These discounts will not make us any more or less clients. But in the future it will be necessary to “keep” them, that’s for sure.”

— Do you personally have difficulties with accounting or tax accounting of discounts?

“When certificates were first introduced, there were questions. Now, in principle, everything is clear, especially since the regulatory framework in this area does not change. At least, I haven’t read or heard about anything fundamentally new yet.”

Tax accounting of the certificate

The purchase of a certificate is an advance payment for a service planned to be received in the future (upon presentation of a card), and the actual sale of a product/service is the exchange of documentary evidence of the prepayment made for the service or product. Therefore, when selling, the taxpayer organization does not have an object subject to mandatory payment of profit (Article 251 of the Tax Code of the Russian Federation). Income received as an advance payment for future goods is not taken into account when calculating the profit tax base.

Therefore, the amount of payment for gift obligations received by the distributor from a potential buyer on account of future services is taken into account when calculating the tax on profit in proceeds from sales at the time of the actual provision of the service (letter of the Ministry of Finance of the Russian Federation No. 03-03-06/1/268 dated April 25, 2011 , Article 248, 274 of the Tax Code of the Russian Federation).

If the buyer does not present (do not use) the certificate within a certain period, then the amount of the advance payment transferred to the seller for profit taxation is taken into account as property received free of charge or non-operating income (Article 250 of the Tax Code of the Russian Federation).

When calculating the amount of the obligatory value added payment (VAT), the sale of goods within the territory of the country is taken into account as an object for taxation (Article 146 of the Tax Code of the Russian Federation). Therefore, for VAT, the amount for determining the tax is calculated:

- On the day of realization of gift obligations, since advance payment for future services is made before the provision of these services (Article 167 of the Tax Code of the Russian Federation). The basis for calculating tax if there is a payment for future services is formed from revenues including tax - at the rate of 18/118 (Article 154 of the Tax Code of the Russian Federation).

- The next time the VAT base is determined during the direct provision of the service (exchange of the bonus document). The previously calculated VAT is deductible if the cost of the services provided is not less than the amount paid for the obligation (Articles 154, 171 of the Tax Code of the Russian Federation). When the cost of the service provided is less than the amount of the advance payment or the certificate has not been used, the previously accrued VAT is not accepted for deduction on the difference.

When identifying an object for calculating tax using the simplified method of taxation (USNO), enterprises take into account proceeds from sales (Article 346 of the Tax Code of the Russian Federation). In this case, the date of receipt will be the day of receipt of money, the day of receipt of other property or rights to it.

When purchasing a gift certificate, first of all, money is received, and after some time, the service is provided. Therefore, the object for calculating tax under the simplified tax system is the amount of payment for the obligation received by the seller on the day of its sale.

For taxpayers who use the amount of income received minus the amount of expenses as the object of taxation, proceeds from sold gift certificates are taken into account in the same way. They also have the right to reduce the indicated income by the amount of expenses incurred. The expenses of the enterprise include expenses after the actual payment, which includes the end of the buyer’s obligation to the seller regarding the transfer of a product or rights to property (Article 346 of the Tax Code of the Russian Federation).

For your information! All expenses incurred must have reasonable confirmation in the form of documents (Articles 346, 252 of the Tax Code of the Russian Federation).

Drawing up internal rules

We will not start with accounting or taxes, or even with the letter from the financial department announced above.

First of all, we need to talk about the internal documents that the organization will need to draw up if it decides to sell gift certificates. And the main document here is the manager’s order, which approves the rules for the issuance, circulation and use of gift certificates. This document must describe in as much detail as possible for which goods (works, services) or groups of goods, works, services gift certificates will be issued. Thus, gift certificates can be commodity (that is, the certificate is exchanged for a specific product, work, service, group of goods; for example, for an iron, or a SPA procedure) or monetary (that is, for the amount specified in the certificate you can choose any goods, work or services). If it is intended to introduce any restrictions on the use of certificates - by validity period, by assortment, by the circle of people who can use the certificate, etc. - they also need to be recorded in this document.

Further, the order fixes technical aspects - where the certificates will be printed, what anti-counterfeiting mechanisms they will have, who will organize their delivery and issuance to customers, what operations sellers must perform when receiving these certificates from clients, etc. And in the development of this part document, it makes sense for the accountant to take an active part, since it is at this stage that he has the opportunity to fix the most profitable and simple option for processing transactions with gift certificates.

As you probably noticed, the manager’s order on gift certificates is clearly divided into two large parts - technical and organizational. If the technical part concerns exclusively the seller, then the organizational part contains points that the buyer should also know. Therefore, we recommend that this document be drawn up in the form of an order itself, which will contain technical aspects, as well as appendices to it in the form of rules for using certificates. In the future, it will be necessary to ensure that the text of these rules is available at each retail outlet so that customers have the opportunity to familiarize themselves with it. In addition, a reference to these rules must be made on each certificate indicating that the purchaser of the certificate is familiar with them. And it’s even better if, when selling a certificate, a written document is drawn up, where the buyer will sign that he has read the rules for the circulation and use of gift certificates - this will greatly help the organization in case of any disputes with buyers.

Accounting certificate

The procedure for recording bonus documents is divided into several stages:

- manufacturing;

- sale (realization);

- repayment (exchange) of a gift obligation for a product;

- redemption of certificates not provided for exchange.

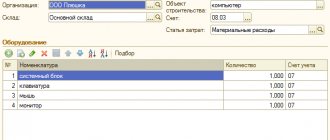

In relation to gift forms, accounting provides for accounting for expenses associated with their production. Such costs related to the acquisition and sale of goods are classified as expenses for ordinary activities. The following entries must be made in accounting:

- expenses for creating documents: Debit 44 accounts. (Sales costs) / Credit 60 inc. (Settlements with suppliers/contractors);

- accounting for mandatory budget payment (input VAT) on the forms recorded in accounting: Debit 19 accounts. / Credit 60 credit;

- acceptance of tax for deduction (input VAT): Debit 68 accounts. (VAT calculations) / Credit 19 counts;

- posting of liabilities: Debit 006 account. (Strict reporting documents, sub-account “Gift Certificates”).

On the off-balance sheet account (006), forms are recorded by quantity, identification numbers or nominal value.

Expenses for the production of forms are classified as other expenses, they are subject to write-off as expenses of the current period (month), and can also be counted against the items of advertising expenses of the enterprise in the form of the cost of their purchase (no more than 1% of sales revenue).

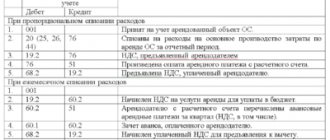

When accepting gift forms for payment, sales tax is calculated and the amount of tax calculated from the prepayment is taken for deduction. Transaction transactions will be as follows:

- reflection of the received prepayment: Debit 50 account. (Cash) / Credit 62 accounts. (Settlements with customers, subaccount “Advances received”);

- accrual of tax (VAT) on received prepayment: Debit 62 accounts. / Credit 68 credits;

- writing off forms: Credit 006 account;

- reflection of receipts from the sale of a product: Debit 62 accounts. / Credit 90 credit (Sales, subaccount “Revenue”);

- write-off of goods/services sold: Debit 90 account. / Credit 41 credits (Goods);

- accrual of tax (VAT) on revenue: Debit 90 account. / Credit 68 credits;

- offset of prepayment: Debit 62 accounts. / Credit 62 credits;

- offset (reversal) of previously paid (prepaid) VAT: Debit 62 inc. / Credit 68 credit

For your information! VAT paid on an advance payment previously received is not refundable in a situation where the sold certificates are not used by buyers within the prescribed period.

Postings for unused gift obligations:

- reflection of the size of unused documents in the amount of receipts: Debit 62 accounts. / Credit 91 credit (Other income and expenses);

- attribution to expenses of VAT paid on prepayment: Debit 91 account. / Credit 62 credits (sub-account “Advances received”).

Certificates that are not sold within the period established for use are subject to destruction with the drawing up of an appropriate act and subsequent deregistration.

What conclusions can be drawn?

Firstly, I would like to say that reflecting production costs, as well as using gift certificates, should not be difficult if you know how to do it. Secondly, if we talk about the commercial benefits of this marketing move, then its success will largely depend on the target audience and the “promotion” of the current brand. Contrary to many assumptions, discount coupons do not so much attract new customers as they allow you to “retain” current customers.

Thank you for your attention and see you again!

Using cash registers when selling certificates

Companies that make payments when providing services/selling a product using payment cards or cash are required to carry out all payments based on technical devices of a cash register type (CCP). In this case, copies of the cash register must be registered in the state register (Federal Law No. 54, 05/22/2003). When working with a cash register, at the time the buyer pays money, the seller must give him a cash receipt printed on the cash register.

A gift obligation is a specific advance payment (not a product), therefore, when selling it, an enterprise must use a cash register and run a check (at the time of sale). Similarly, a check at the cash register must be entered (in a separate section of the cash register) when paying for goods using a gift document (letter of the Ministry of Finance of the Russian Federation No. 03-03-06/1/268, 04/25/2011).

What if no one uses the gift card at all?

Yes, this happens often.

You sell a gift card and no one comes.

In this case, you must recognize revenue from the unclaimed portion when it is no longer probable that the customer will exercise its rights .

For example, if gift cards have a specific expiration date, you can recognize revenue on the unclaimed portion after that period.

If your gift cards do not have an expiration date and are valid forever, then you will need to collect some historical statistics to estimate how long it will take before the customer forgets about the unused gift cards and the likelihood of them redeeming them becomes negligible .