How to issue an invoice for payment from - this question sooner or later arises for any entrepreneur in the course of business activities. Indeed, despite the fact that the rules for preparing this document are not established by law, there are requirements developed in practice. Let's take a closer look at what details should be included in the invoice from an individual entrepreneur.

An individual entrepreneur does not always have sufficient knowledge to draw up complex financial documents. This is especially true for newly minted businessmen. Therefore, legislators have given individual entrepreneurs some freedom in drawing up accounts. Nevertheless, some rules should still be followed.

Purpose and content of the document

An invoice for payment is a recommendation document, not a mandatory one. Its main goal is to fix the obligation to reimburse funds for the goods taken and the amount of the required payment.

There is no set writing regulation. When checking out, information about the product and the parties to the agreement is displayed. In special cases, the time period during which the obligation must be fulfilled is additionally noted.

Regardless of the situation, the document should display the following information:

- Information about the seller: full name, legal address, checkpoint and tax identification number;

- Buyer information: similar to the previous paragraph;

- List of goods or services provided, indicating their final cost;

- Total amount to be paid;

- Details for crediting funds;

- Date of document creation.

How to prepare an invoice for payment

It is exhibited by the seller. Payment is the responsibility of the buyer or his representative.

It is completed both before and after the purchase of a product or service - everything will depend on the agreements between the participants. The completed sample is sent to the customer.

Who issues invoices for payment?

The accountant is in charge of the preparation. The form is then submitted to the director of the company for approval.

Two copies are made: one for each participant. It is printed on plain paper or on the company’s letterhead (this option is better because it eliminates the need to write down the company’s details each time). Corrections are not allowed.

When to exhibit

If there is a cooperation agreement between the participants, then the terms of delivery and payment are usually specified in the text.

When parties work together only periodically, and the size and cost of supplies differ, each transaction is shown separately. The contract is concluded later; only general provisions are stated in its text. This happens if delivery is required urgently.

In a situation where the buyer only needs a one-time purchase of goods, there is no agreement between the companies - there is simply no need for it. The invoice for the provision of services is issued in the usual manner.

Note: if no agreement has been concluded between the counterparties, then the document can act as a public offer, provided that it contains all the required terms of the agreement (based on Article 435 of the Civil Code of the Russian Federation). Making payment is acceptance of the offer (Article 438, paragraph 3 of the Civil Code of the Russian Federation). And the paper itself, with confirmation of the sending of funds, will be evidence of a completed transaction between its participants (Article 434, paragraph 3 of the Civil Code of the Russian Federation). This will be a “plus” in the event of a possible trial.

Can an individual entrepreneur issue a VAT invoice?

When generating a document for the transfer of funds, the entrepreneur must indicate whether VAT is included in the total amount. This obligation is enshrined in Article 21 of the Tax Code of the Russian Federation. To do this, the document must have a special column where about or “Without VAT” is entered. It is worth considering that entrepreneurs using the simplified tax system and UTII do not include tax in the amount of payment for goods and services. After all, these taxation systems imply the replacement of all mandatory payments with a single tax. Thus, only individual entrepreneurs using the general taxation system should include it. Such businessmen may include VAT in the cost of goods or services or charge it on top. For example, if the purchase price is 100 rubles and the tax is already included in this amount, then the following wording can be used in the document:

Transaction amount = 100 rubles, including VAT 18% = 18 rubles, total payable = 100 rubles.

If it is charged on top, you need to indicate this as follows:

Transaction amount = 100 rubles, including VAT 18% = 18 rubles, total payable = 118 rubles.

What is the difference between invoices for payment from LLC and individual entrepreneur

The sample received from the “private owner” has one signature. The LLC will issue a paper containing two “autographs” - the chief accountant and the director. Besides:

- Individual entrepreneurs indicate only full name, companies - the name recorded in the charter;

- The individual entrepreneur form contains only the TIN, the organization - TIN and KPP.

Read also: Explanatory note to the balance sheet

There are no other fundamental differences.

Differences when issuing with VAT and without VAT

VAT payers show the tax amount separately.

If the supplier is exempt from the contribution due to the use of a special tax regime (simplified system, single tax, patent), then the VAT amount is not included when writing the document. However, the corresponding mark is still affixed. And the reason must be given. For example, under the simplified tax system it is written:

- for individual entrepreneurs - paragraph 2 of Article 346.11 of the Tax Code of Russia;

- organizations - paragraph 3 of this regulatory act.

Note: if a buyer operating under a preferential tax regime is issued an invoice with VAT, then the entire amount must be paid, but then o.

How is an invoice issued?

The invoice can be issued in the following order:

- the buyer contacts the seller and communicates his intention to purchase certain goods; an appeal can be submitted either orally or in the form of a written appeal; electronic document flow is also allowed;

- the seller analyzes the received request and clarifies the information, creates an order;

- the seller draws up an invoice based on available information and transmits the invoice to the buyer;

- the buyer pays the agreed amount if it suits him and complies with the existing agreements;

- the seller clarifies the fact of the transfer - this can be confirmed by the fact of receipt of funds or by providing an additional document, for example, a confirming certificate from the bank;

- the seller sends the goods to the buyer - the method of transfer can be any, depending on the specifics of the legal relationship (this can be delivery at the expense of the seller, personal delivery in the store, and so on).

If the invoice is not paid, the buyer will have no obligation to the seller unless there has been some agreement between them.

An invoice for an individual entrepreneur is issued in the same way as an invoice for an LLC or any other organization.

List of forms for issuing an invoice for payment

There are several known options, which can sometimes lead to confusion.

What are the features of each type:

- Invoice-agreement is identical to the “usual” one, but additionally contains contract details. This type records the terms of delivery and payment (prepayment or postpayment, cash or non-cash payment), the procedure for complaints, exchanges, and other issues. Usually it replaces the standard agreement (if the transaction amount is small).

- Invoice - indicates the fact of purchase of goods (services), records the presence of VAT. Used by individual entrepreneurs and companies operating under the general taxation regime.

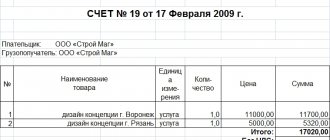

Samples of filling out invoices

Example 1—filling inclusive of tax.

Example 1 - with VAT

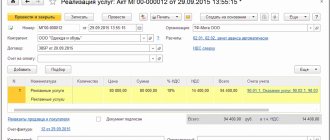

Example 2 - without taking into account.

Example 2 - without taking into account

Is it possible to return funds paid on an invoice?

You can get a refund in the following situations:

- If they were listed incorrectly, using incorrect details. In this case, the claim relates to unjust enrichment.

- If the seller's obligation was not fulfilled, the goods were not sent. But here everything depends to a greater extent on the specifics of the practical situation. It is necessary to clarify how the procedure is regulated by the contract, what period of transfer of goods is provided, and so on.

In other cases, everything will depend on the contract or the rules for the provision of goods in force with the seller.

Instructions for preparing an invoice for payment

There are no clear rules for writing.

However, a specific order of completion is usually followed. At the top are the buyer and seller details. Below are recorded:

- Bank data;

- form number (numbering starts from January 1 of the current year);

- date of issue;

- a list of goods (works, services), fixing their quantity, price and final cost, including or excluding VAT;

- upon request - other conditions.

The signature of the authorized person is placed below.

Requisites

This section is required when completed. What is indicated:

- name of the participants (for example, individual entrepreneur Svetlana Igorevna Minina, Stroyservis LLC);

- TIN for individual entrepreneurs, for companies - TIN and KPP;

- bank data (for example, Sberbank of Russia OJSC Anapa, BIC 1234567, account No. 454773777, account No. 57585998696);

- addresses of participants (individual entrepreneurs indicate the actual address). For example: 353440, Anapa, st. Astrakhanskaya, house 12, tel.;

- signatures (position, full name, transcript).

Important: if a representative signs instead of an individual entrepreneur, then the details of the power of attorney must also be indicated.

Invoice registration

It is allowed not to register, since all expenses are taken into account using invoices, and income – based on the actual crediting of funds.

Only invoices are subject to registration - they are entered in the “sales book” or “purchase book”. Only those companies that operate under the OSN are required to do this.

Firms operating under the simplified tax system do not pay VAT, but they cannot claim its reimbursement from budget funds.

The need for certification with a seal

From 2021, having a seal is not a mandatory attribute. This rule applies to individual entrepreneurs and organizations. To certify the invoice, the signature of the responsible person is sufficient.

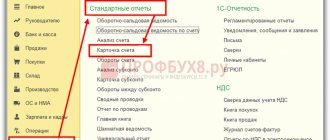

How can I generate an invoice for payment?

All companies and individual entrepreneurs create and issue invoices differently. The most popular options are when the invoice is issued:

- using accounting programs;

- filled out in Word or Excel;

- manually enter data into a prepared form (and this happens, since an invoice is not a unified form or even a primary accounting document);

- using online services like the one we offer.

As for issuing an invoice for payment, this process is also not regulated by law. The invoice can be issued in person, electronically, by fax or mail, or even sent to the buyer by courier.

Does the payer need the original invoice?

Nowadays, electronic documentation is mainly used.

Scanned copies of the papers are sent to the counterparty by fax or mail. Read also: How to calculate income tax from salary

If there is a need to transfer originals, then use a courier service or mail. The original copy of the invoice is handed over to the VAT payer (required for tax deduction). Therefore, two copies are prepared, one of which remains with the seller, the second is sent to the buyer.

Important: VAT payers can also use an electronic version of the invoice, but it must have a digital signature. Other options for document endorsement are unacceptable.

How to issue an invoice for payment by bank transfer

Federal Law No. 161 “On the National Payment System” states that all payments made by non-cash form can only be carried out with the consent of the client.

The procedure for filling out the document is identical to that used for other types of payment.

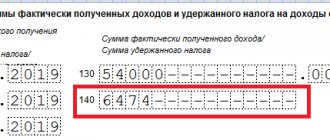

How to reflect VAT on an invoice

If a businessman is a VAT payer, then the amount of the contribution must be displayed in payment documents. You can do it like this:

- The tax is included in the final cost, but is highlighted as a separate line for clarity.

- The cost of the service (product) is shown excluding tax, then its size is calculated. The final price is formed as the sum of these two quantities.

Important: it is recommended to always enter the tax amount on a separate line - this will avoid possible errors in calculations.

When should you indicate the due date on your invoice?

The money must arrive to the seller within the period stipulated by the agreement. It is indicated in the text of the contract, or on the payment document itself. Changing the deposit period is not allowed.

Note: if funds were deposited by bank transfer and inaccuracies in the details were discovered, the supplier must be notified of the error as soon as possible. This is done in writing. This procedure will increase the payment period.

Are there any special features when working with individuals?

Entrepreneurs quite often cooperate with the public - they sell goods to individuals, provide services, but can an individual entrepreneur issue an invoice to an individual or is this prohibited?

Yes, such a possibility exists. In connection with the widespread introduction of electronic payments, it is necessary to inform the individual buyer of the payment details of the individual entrepreneur. Usually this is enough to make a payment through a mobile bank or through a payment terminal.

If the client plans to pay for the order through a bank branch with a personal visit, then in this case you will need to use the method of issuing an invoice to an individual from an individual entrepreneur: the form is the same for both legal entities and individuals.

We will look at the universal form below.

We issue invoices in English

We are talking about invoices used when working with foreign counterparties. Invoices must contain information:

- outgoing and incoming document number;

- data of counterparties, their contacts;

- date of discharge;

- taxation system in the companies participating in the transaction;

- date of dispatch of the goods, its receipt;

- information allowing the parties to the contract to track the status of the order;

- total transaction amount;

- payment terms;

- other necessary information - for example, return conditions, a description of penalties for violation of the contract, etc.

You need to take into account everything, even the smallest details, since the legislation under which foreign partners work differs from the Russian one.

What do you need to receive a completed invoice?

As you already understand, our service allows you to issue an invoice, automatically fill in the data and print the finished document. How to use this service?

It's so simple that even a child could do it. There are 4 tabs that you have to fill out:

- The supplier (that is you). Here you need to enter the name, address, tax identification number, checkpoint and account number (for internal accounting).

- The next tab is the bank. Here you indicate your account number, the name of the bank, its BIC and correspondent account.

- In the third tab, write the name of the purchasing company and its address.

- The fourth tab allows you to directly indicate what is being sold, in what quantity and at what price. You can also specify VAT here (10 or 18%). You don't have to specify it.

When all fields are filled in, click “Generate an invoice for payment.” The finished document will open in PDF format, which you can either immediately send to print, or first save to your computer and then print or send electronically.

By the way, below there is an “Example” button, by clicking on which you can see how the filled fields should look.

Basic mistakes when issuing an invoice

The most common errors found in this paper:

- failure to comply with invoice deadlines - on the basis of Article 168, paragraph 3 of the Tax Code of the Russian Federation, it is established that payment must be made no later than 5 days after receipt of the goods (contains inaccuracies or outdated information;

- the dates on the copies of the document are different;

- violation of the deadlines for submitting a document for processing a VAT tax deduction - it is recommended to claim the deduction in the same reporting period when the invoice was received;

- when writing, facsimile signatures of authorized persons were used - in this case, the deduction may be denied;

- no decryption of signatures.

Note: the use of a digital signature already eliminates the error associated with the lack of decryption, since the electronic digital signature already contains all the necessary information.

If an error is identified in the document, it must be corrected: cross out the incorrect data, enter valid information, indicate the date of the changes, affix the company seal and have it endorsed by the manager.

When is it necessary to exhibit

The document proves to the accounting department the shipment of goods or services from one business entity to another. The need to issue a form for payment is dictated by the following factors:

- If business activity is carried out in accordance with Art. 145 Tax legislation without value added tax.

- The delivery of goods or services occurred before the formalization of contractual relations between business partners. The manufacturer hands over the paper to the counterparty for payment, and the contract is drawn up later.

- In accordance with paragraph 1 of Art. 169 of Tax Legislation, entrepreneurial work is carried out using SES.

- When transferring an advance payment (in accordance with Article 168 of the Tax Code of the Russian Federation).

- For one-time cooperation, when formalization of contractual relations is not required.

Note! If the form displays all the parameters of cooperation, then the transaction is recognized as an offer. Such a document confirms the legal significance of business relationships without signing contracts.

General filling rules

Despite the fact that there is no strictly defined sample for an invoice for payment of services, there is a filling procedure that must be followed. It involves entering the following data:

- The header of the document indicates the details of the service provider (product) and the recipient.

- Enter the required bank details.

- Write down the serial number of the document and the date of its signing.

- Indicate the name of services or goods, their quantity and cost.

- If necessary, additional terms of the transaction are listed.

- The document is certified by a signature.

Attention! Separately, you should indicate whether the sale of goods is carried out taking into account VAT or without. In the first case, a separate column is allocated for it in the document, and in the second, a note “excluding VAT” is placed next to the price.

There are online services that allow you to create an invoice from an individual entrepreneur, a sample of which is provided above, and fill it out online. Some provide the opportunity to download a blank template, which can later be used on an ongoing basis to run a business. To fill out a document on your computer, you will need to install Word or Excel on it. If necessary, such an electronic document can be printed.

There are 2 most common services that provide such and “Issue - invoice. rf". Both web resources have a user-friendly interface and allow you to quickly and easily create a document online in Excel or Word, fill it out, download it and, if necessary, convert it into paper form.

Circuit. Accounting - convenient service

Invoicing from an individual entrepreneur

Many people wonder whether an individual entrepreneur can issue an invoice or not? If the business entity is registered, then no problems with invoicing should arise. Otherwise, this is impossible, since citizens do not pay VAT. Companies will not pay invoices issued by an individual, otherwise the responsibility for paying taxes falls on them.

There are only two options here:

- An individual will have to register as an individual entrepreneur or LLC in order to be able to issue invoices.

- You need to draw up an agreement with the organization, which will stipulate the provision of goods/services for a certain fee.

When do you require an invoice?

Business entities operating under special regimes (UTII, simplified tax system) are not VAT payers. That's why they don't issue invoices. However, counterparties often ask them to issue a debit. The individual entrepreneur faces a choice: lose a client or issue an invoice. Please note that the preparation of such invoices entails the payment of tax. You will also need to submit a VAT return.

Customers may request an invoice in several cases:

- out of ignorance that the individual entrepreneur should not do this;

- It is customary for the customer’s accounting department to issue an invoice for each purchase;

- this is required by the customer's business processes.