Among the main state guarantees for wages, Article 130 of the Labor Code of the Russian Federation names measures that are taken to increase the level of real earnings of employees.

One of such measures, which is carried out due to an increase in prices for primary services and goods, is considered to be indexation of earnings. How does this affect the amount of vacation pay, and should it be taken into account when calculating vacation pay?

What about salary increases?

Increasing wages is a common procedure carried out by employers. Moreover, such an increase can be achieved using different methods:

- by indexing;

- salary increase.

Despite the fact that these methods are similar in their results, their nature is different in essence. Indexation is a guarantee provided at the state level (Articles 130, 134 of the Labor Code of the Russian Federation). The salary increase is voluntary.

The differences between these procedures are discussed in more detail below:

| Criterion | Indexing | Salary increase |

| Need for use | Mandatory | Voluntary |

| Circle of people | Applies to all employees | Does not apply to all employees |

| Causes | Impact of rising prices | Employer's decision |

| Increase size | Regulated at the state level | Set by the employer |

Salary increases in the form of indexation should be applied by all employers. Moreover, one of the conditions for using such an increase is the presence of a mention of this in the collective agreement or other local regulatory act of the enterprise (definition of the Constitutional Court of the Russian Federation dated November 19, 2015 No. 2618-O, letter of Rostrud dated April 19, 2010 No. 1073-6-1). In addition, it is within the competence of each employer to independently establish indexation rules, as well as determine the indexation coefficient itself.

The indexation coefficient (CI) is determined in the following way:

CI = Salary after indexation / Salary before indexation

NOTE! Since indexation is a government measure to bring the income received by citizens into line with the level of current market prices, the value of the CI provided by the employer is recommended to be correlated with the inflation rate for a specific region or country (determination of the St. Petersburg City Court dated March 21, 2011 No. 3866).

At the same time, it is also necessary to adjust the average earnings (AS). Note that the SZ should be adjusted if the wages themselves (salaries and tariff rates) change. If the size of other payments, for example compensation or incentives, has increased, this does not entail the need to adjust the SZ (clause 16 of the Regulations on the specifics of the procedure for calculating the average salary, approved by Decree of the Government of the Russian Federation of December 24, 2007 No. 922, hereinafter referred to as the Regulations).

If you have access to ConsultantPlus, check whether you indexed your average earnings correctly when calculating vacation pay. If you don't have access, get a free trial of online legal access.

Legislative justification

The features of calculating average earnings with a salary increase are described in the act dated 24/XII - 2007. It explains the procedure for recalculating the average salary in case of indexation. In such a situation, according to the provisions of paragraph 16 of this legal act, an increase in average earnings is required by the salary increase factor.

The list of payments subject to indexation includes:

- allowances,

- surcharges,

- bonuses that are provided for by the labor remuneration system and comply with the norms of paragraph 15 of the Regulations,

- other salary bonuses established within the company.

Only payments that depend on the size of the salary as a multiple of it and are stated in fixed percentages will need an amendment.

Most accountants, after indexing wages, encounter some difficulties when calculating vacation payments to employees due to changes in the mechanism for calculating average earnings for the period. In this article we will look at the features of these calculations.

What is the procedure for wage indexation?

All changes in working conditions must be fixed in the employee’s employment contract. In this connection, when indexing earnings, the employer should certainly enter into an additional agreement with the employee to the employment contract indicating the updated amount of remuneration. In this case, it is important to make reference to the provision of the local act, in accordance with which the change in wages occurred (Article 134 of the Labor Code of the Russian Federation).

How to correctly index wages, see here.

conclusions

Increasing employee wages has a dual effect. In particular, the wage fund increases, which further increases the financial burden on the institution.

The base for calculating tax deductions on profits is also reduced, and the amount of necessary transfers directly to the budget is reduced.

This may raise certain questions from the tax office. To avoid claims on her part, experts recommend that in documents defining the indexation procedure, refer to Articles 130 and 134 of the Russian Labor Code.

Is it necessary to index vacation pay?

Due to the fact that the calculation of vacation pay depends on the size of the SZ, the indexation carried out in the organization affects the amount of vacation pay.

SZ for the purposes of the Labor Code of the Russian Federation is determined in accordance with Art. 139 Labor Code and Regulations.

According to clause 16 of the Regulations, an increase in the employee’s SZ is carried out with an increase in tariff rates, salaries (official salaries), and monetary remuneration in the organization (branch, structural unit). From the provisions of this norm it follows that the indexation of SZ is carried out if the increase affected all employees of the company. If such an increase is not carried out in relation to at least one employee, then the SZ is not indexed. The rationale for this conclusion can be found in letters from the Ministry of Health and Social Development of Russia dated January 30, 2009 No. 22-2-176 and Rostrud dated October 31, 2008 No. 5920-TZ. Thus, the indexation of vacation pay is influenced by the fact whether the SZ was increased or not.

Should it be indexed?

The system according to which the amount due to a worker is calculated when he goes on a well-deserved rest for 28 (or more) days has long been established. In 2021, no new rules for calculating vacation pay have been developed.

Vacation pay = Average daily salary × Number of vacation days

When calculating vacation pay, you need to take into account all the employee’s income that is associated with the wage system. That is, these are salaries, allowances, bonus payments and other additional payments. There is no need to take into account amounts that are not assigned in the form of labor compensation (in particular, sick leave or financial assistance).

The internal documentation of the institution must prescribe specific rules for the implementation of wage indexation:

- frequency of the process of increasing salaries and tariff rates (monthly, quarterly, annual, and so on);

- list of payments to employees that are subject to indexation (salaries, bonuses, etc.);

- rules according to which the indexation coefficient is calculated to increase income.

The approved adjustments begin to take effect with the approval of the order of the head of the enterprise, which must indicate the coefficient of increase in earnings and the date from which the changes made will take effect.

Based on such a document, changes to the organization’s staffing table are approved - a new increased amount of employee salaries is indicated. HR officers prepare additional agreements to employees’ employment agreements and send them to each of them for signing.

You can calculate vacation pay for a salary increase using the online calculator here.

Simple, convenient and free calculator.

How to calculate the indexing coefficient for vacation when salary increases?

Article 135 of the Labor Code of the Russian Federation determines that municipal and state departments index salaries in accordance with established legal standards in the field of labor protection.

Commercial enterprises independently develop a procedure for increasing salaries, enshrining it in collective agreements or other internal agreements.

In accordance with practice, indexation conditions are specified in the internal documents of large companies that have joined inter-industry agreements.

Small companies often neglect this responsibility. They do not sign collective agreements with employees or include provisions for periodic salary increases. Attempts at such “savings” result in proceedings with the labor inspectorate, after which a fine may be imposed on the enterprise.

Thus, if immediately before the employee’s vacation the company’s salary was increased, then it is necessary to recalculate the average salary, on the basis of which vacation pay is calculated.

The measure to increase salaries applies to every employee, except for persons who are involved in work under a civil agreement.

Expert opinion

Mikhailov Vladislav Ivanovich

Lawyer with 6 years of experience. Specializes in family law. Knows everything about the law.

To carry out indexation of vacation pay when increasing tariff rates and salaries, you must be guided by clause 16 of the Regulations on average earnings.

First you need to determine the CI - the salary indexation coefficient (salary increase).

To do this, you need to divide the new increased salary by the old one.

Indexation coefficient = New salary / Old salary.

Let’s say that the salary portion of an employee’s salary was 25 thousand rubles, and after an increase - 30 thousand rubles. In this case, the salary increase factor will be as follows:

CI = 30 thousand rubles. / 25 thousand rubles = 1.2

How is vacation pay indexed?

The indexation of vacation pay depends on the following factors:

- If the salary increase occurred during the period that is used to calculate vacation pay, then the SZ must be adjusted to the CI for the entire billing period.

- If the increase occurred during a period that is not included in the calculation of vacation pay, but precedes the vacation, then the SZ must be indexed for the calculation period.

- In cases where the salary increase occurred on vacation days, the SZ is adjusted from the date of the salary increase.

To index vacation pay, you must use the CI calculated using the above formula.

Note that the calculation period for determining the SZ for vacation pay is 12 months preceding the start date of the vacation.

For more information about the nuances of calculating vacation pay, see the article “What is the calculation period for vacation - vacation experience .

Step-by-step procedure for calculating average earnings

Step 1. Calculate the indexation coefficient using the formula given in the previous paragraph.

Step 2. Recalculation (indexation) of average earnings for vacation pay, taking into account the moment of the increase in staff salaries.

In this case, there are 3 options for calculation: indexation can occur in the billing period, after its end, but before the start of the vacation, or while on annual vacation.

Salary increased in the billing period

Option 1 - the salary increase occurred in the RP (settlement period).

In this case, it is necessary to multiply all payments directly from the beginning of the billing period to the month when the salary increased by the resulting indexation coefficient.

Example, if indexation is included in the billing period:

The employee is granted vacation, its duration is 28 days. The date from which it begins is February 9, 2021. The salary is 24 thousand rubles. There were no exclusion days during the billing period. It is equal to 12 months - from February 1, 2021 to January 31, 2021.

Between February and December 2021, salaries did not change. In January 2021, it was increased by 5 thousand rubles.

The indexation coefficient is calculated as follows: 29 thousand/24 thousand = 1.208.

After this, the formula determines the average salary for vacation pay: (24 thousand × 1.2 × 11 months + 29 thousand × 1 month): (29.3 × 12) = 983.5 rubles.

Salary increased after the billing period

Option 2 is when the salary increase occurred after the end of the pay period, but before the 1st vacation day.

In this case, the entire average salary of the billing period is multiplied by the indexation coefficient.

Example for indexation after the billing period:

Leave for 28 days is provided to the employee from March 9, 2019.

Earnings for the last year - from March 1, 2021 to February 31, 2019 - equal to 240 thousand rubles.

There are no exclusion days.

Increase in earnings - from March 1, 2021

The indexation coefficient is 1.25.

The average salary is determined by the corresponding formula: (240 thousand / 11 / 29.3) = 744.65 rubles.

Salary increased after the start of vacation

The third option is the case of a salary increase after the employee has already gone on vacation. In this case, the part of the vacation pay that remained at the time when new salaries were introduced is multiplied by the indexation coefficient.

An example of a salary increase while staying in the period of maintaining average earnings:

The employee goes on vacation on March 10. 2021

Its duration is 28 days.

Over the last year, I earned 150 thousand rubles. (from March 1, 2021 to February 31, 2021).

There are also no exclusion days.

From 19.03. 2021 salary increase - by 1.23.

According to the corresponding formula, the average salary is determined: (150 thousand / 12 / 29.3) = 427 rubles.

The amount of vacation pay is calculated taking into account the salary increase:

In the period from March 10 to March 18, 2021 - for 9 days - 3840 rubles are released. (427x9).

From March 19 to April 5, 2021 - for 19 days - the amount will be 9970 rubles. (4271 × 1.23 × 19).

After indexation, according to 1 of 3 options, the amount of vacation funds that should be paid to the employee going on vacation is determined.

If the employer does not increase income for employees

The institution where an employee works may sometimes “forget” to index the average earnings for the billing period for vacation pay if the salary was increased.

However, in accordance with clause 16 of the above-mentioned government resolution number 922, if rates increase in the cases provided for in clause 16, then it is necessary to recalculate vacation payments.

Expert opinion

Mikhailov Vladislav Ivanovich

Lawyer with 6 years of experience. Specializes in family law. Knows everything about the law.

In particular, such “forgetfulness” manifests itself in relation to women on maternity leave. And this is a violation of Article 132 of the Labor Code of the Russian Federation, which is considered an infringement in the field of wages.

It should be taken into account that when a company has not prescribed a procedure for increasing earnings in internal regulations and has not changed the salaries of its employees for years, then an administrative fine may be imposed on it under Article 5.27 of the Russian Administrative Code.

The following penalties have been established:

- for enterprise managers – from 1 to 5 thousand rubles;

- for individual entrepreneurs - from 1 to 5 thousand rubles;

When an enterprise specifies the indexation process in a collective agreement, but does not increase payments to employees, a fine of 3-5 thousand rubles is imposed on it.

The procedure for indexing vacation pay: examples

Let's look at examples of how vacation pay is indexed depending on the indexation period.

Example 1

From June 1, 2021, Markova T.V. was on vacation for 14 days. During the billing period, from June 1, 2021 to May 31, 2021, the employee’s salary was indexed from 20,000 to 25,000 rubles. The indexation date is November 2021. Markova's billing period was fully worked out. She did not receive bonuses or other payments.

To calculate the amount of vacation pay, it is necessary to determine the SZ. To do this, calculate the CI:

CI = 25,000 / 20,000 =1.25

To determine the size of the SZ, it is necessary to divide the billing period into 2 parts: the first part, preceding the increase, was 5 months, from June to October 2021; the second, from November 2020 to May 2021, 7 months. Due to the fact that indexation took place in the billing period, the SZ for calculating vacation pay should be indexed from the beginning of the billing period. Thus, the formula should contain a reflection of indexation for 5 months (20,000 × 1.25 × 5) and the calculation of SZ taking into account the new salary (25,000 × 7).

SZ = (20,000 × 1.25 × 5 + 25,000 × 7) / (29.3 × 12) = 853.25 rubles.

The amount of vacation pay will be: 853.25 × 14 = 11,945.50 rubles.

Example 2

Pushkov A.A. was on vacation from May 17 to May 26, 2021. During the period from May 17, 2021 to May 16, 2021, the employee was not on vacation. The employee’s salary during this period was 759 rubles. On May 22, the organization indexed wages by 5%.

The amount of vacation pay due to indexation must be recalculated starting from May 22.

To calculate the amount of vacation pay, we determine how many days were on vacation before indexation and after indexation: from May 17 to May 21 inclusive - 5 days, from May 22 to May 26 - 5 days. In this case, to calculate vacation pay for the first 5 days, the indexation coefficient will not be applied; for the remainder of the vacation, a coefficient of 1.05 must be used.

Thus, the amount of vacation pay for the entire vacation period will be:

5 × 759 + 5 × 759 × 1.05 = 7779.75 rubles.

That is, the employee’s vacation pay will be recalculated from the moment of indexation.

Using the above examples, you can once again be convinced that the rules that should be followed when indexing vacation pay depend primarily on the moment when the salary indexation was made: before the date of accrual of the corresponding payments or after.

Should average earnings be indexed if the salaries of not all employees of the department were increased? The answer to this question is in ConsultantPlus. And learn the material by getting trial access to the system for free.

Examples

Let's look at specific examples of how to calculate vacation pay when indexing wages.

Example 1. Ivanov I.I. goes on vacation for 28 days from 04/01/2019. The billing period is from 04/01/2018 to 03/31/2019. During this time, no exception days were recorded. The employee's salary is 25,000 rubles. From January 2021, wages have been indexed to 30,000 rubles.

CI = 30,000 / 25,000 = 1.2.

SZ = (25,000 × 1.2 × 9 months + 30,000 × 3 months) / (29.3 × 12) = 1023.89 rubles.

Payment for vacation = 1023.89 × 28 days = 28,668.92 rubles.

Example 2. Petrov P.P. goes on vacation from 03/02/2019 for 28 days. The billing period is from 03/01/2018 to 02/28/2019. Total earnings of Petrov P.P. for the billing period - 300,000 rubles. Exclusion days are not recorded.

Salaries in the institution have increased by 1.3 times since 03/01/2019 - how to calculate vacation pay if there was a salary increase in this case?

SZ = (300,000 / 11 / 29.3) = 930.81 rub.

Payment for vacation taking into account CI = (930.81 × 28 × 1.3) = 33,881.48 rubles.

Is it possible to hold an employer liable if indexation was not carried out?

Some employers, in order not to increase the organization's costs, do not want to index salaries. However, such savings may entail administrative liability for the employer:

- If a local document contains information about wage indexation, but the actual absence of such a procedure, a fine in the amount of 3,000 to 5,000 rubles is imposed on the employer. (Article 5.31 of the Code of Administrative Offenses of the Russian Federation).

- If there is a simultaneous absence of information about indexation in local documents and the indexation itself, a fine for the legal entity employer is from 30,000 to 50,000 rubles, for officials and individual entrepreneurs - from 1,000 to 5,000 rubles. (Part 1 of Article 5.27 of the Code of Administrative Offenses of the Russian Federation).

These are not the only costs that an employer may incur due to the lack of indexation. If an employee, whose interests are infringed by its failure to carry out the work, goes to court, then the employer, in the event of a positive outcome, will have to pay the lost salary for all periods of violation of the law. And the amount of such payment will be obtained by calculating the difference between the indexed salary and the one actually paid (determination of the Primorsky Regional Court dated August 20, 2015 in case No. 33-7280/2015).

Let us note that some arbitrators take the employer’s side and believe that salary indexation is not his responsibility (appeal ruling of the Judicial Collegium for Civil Cases of the Supreme Court of the Republic of Mordovia dated April 30, 2015 in case No. 33-918/2015).

However, there are a number of valid reasons for not indexing. These include:

- the difficult financial situation of the employer (appeal ruling of the Kostroma Regional Court dated May 26, 2014 No. 33-797/2014);

- a good level of employee salaries that does not require an increase (appeal ruling of the Omsk Regional Court dated November 25, 2015 No. 33-8541/2015).

Answers to frequently asked questions

Question No. 1: How to calculate severance payments for unused vacation days if the company has recently undergone indexation?

Should it be taken into account in this case? Answer: Yes, the calculation of payments in case of dismissal for unused vacation days will be similar to the usual calculation of vacation pay after indexation of earnings (i.e., a conversion factor for average earnings must be applied).

Question No. 2: If salaries were increased for part of the department, and not for all employees, is it necessary to recalculate vacation pay in this case?

Answer: No, since such an increase in wages will not be considered indexation, and, therefore, the rules for calculating vacation pay after indexation do not apply to these employees.

Question No. 3: Is it necessary to index the salaries of employees on maternity leave under the age of three if there is a salary increase of 10% of all employees of the enterprise?

Answer: Yes, it is necessary to conclude an additional annex to the employment contract with this employee with a new salary, in accordance with the general indexation for the enterprise. Otherwise, an increase in employee salaries will not be considered indexation with all the ensuing consequences (i.e., vacation pay will not be recalculated, payments for unused vacation upon dismissal will not be recalculated, etc.).

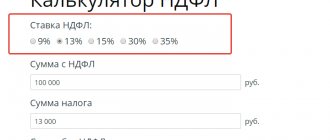

Question No. 4: Is the amount of paid vacation pay and the amount of additional payments made taking into account the indexation of wages subject to personal income tax?

Answer: Yes, according to the Tax Code of the Russian Federation, “vacation pay” and the amounts of recalculation of vacation payments are equal to wages and are subject to the same taxes (personal income tax) and contributions to compulsory health insurance funds.

Question No. 5: Should the amount of compensation for meals paid to the organization’s employees (a fixed amount of 1,000 rubles) be taken into account when calculating vacation pay after indexation?

Answer: No, this amount is not subject to indexation when calculating vacation pay, since this payment (compensation for food) is set in an absolute amount, it must be taken into account without changes.

Source – online-buhuchet.ru

Results

Not every employer is ready to index wages, despite the fact that this is required by law. However, if the enterprise nevertheless decides on such indexation, it is important to follow all the necessary procedures for the correct calculation of payments that are affected by such a change in wages.

Sources:

- Labor Code of the Russian Federation

- Decree of the Government of the Russian Federation dated December 24, 2007 No. 922

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Key points when indexing

When recalculating vacation payments, be sure to take into account several points:

- A reduction in wages for an enterprise does not have a “retroactive effect” (indexation can only be for an increase), i.e. the average earnings calculated for the issuance of vacation pay are not adjusted downward; all payment amounts must be taken into account according to the actual value.

- Indexation is only considered to be an increase in wages for the entire enterprise, branch, division, and not for some part of the staff.

- The system for calculating average earnings for part-time workers is similar to the general procedure.

- Those payments and allowances that are established at the enterprise in absolute amounts (fixed amounts) are not subject to adjustment.

Comments

- 07/11/2019 Margarita

Good afternoon Please seek advice regarding this situation. In November 2018, the organization changed its remuneration system: bonuses for length of service and for complexity increased, but the salary did not change. The employee goes on vacation in June 2021; do these payments need to be indexed separately from the salary?

Reply Link

Add a comment

Rating

9 1 10

Examples of calculating vacation pay in various situations

Example #1. Indexation occurred during the billing period

To calculate the average salary in the period before indexation (August 2014 – January 2015), we will use the KP:

Vacation payments for 21 days will be:

784.98*21 days = 16484.58 rubles

Example #2. Indexation occurred after the billing period, but before the onset of vacation

To calculate the average salary for the entire period, we will use the KP:

Vacation payments for 14 days will be:

784.98*14 days = 10989.72 rubles

Example No. 3. Indexation occurred during vacation

(20000 * 12) / (29.3 * 12) * 7 days = 4778.15 rubles

To recalculate vacation payments for 2 days of vacation (August 15 and 16, the vacation period from the moment of indexation), we will use the CP:

Vacation payments will be:

682.59 *5 days + 682.59 *1.15 *2 days = 4982.90 rubles

What amounts are not adjusted when recalculating vacation pay?

Let's look at what amounts are not adjusted when calculating vacation payments:

- Cash payments that are set in relation to the tariff rate, salary or other types of remuneration in a specific range of values (in the form of a multiple, percentage of salary, etc.);

- Cash payments that are taken into account when calculating the average “salary” if they are set in an absolute amount (for example, various compensations: for travel, for food, permanent bonuses set in a specific amount)