The organization of accounting for any company requires strict accounting of fixed assets: the means of labor with which products, work or services are produced. One of the main mechanisms for monitoring the safety and movement of OSes is the assignment of inventory numbers to them: unique digital and symbol combinations that do not change throughout the entire operational life of the OS. When assigning an inventory number, certain techniques are used that allow you to encode in numbers and symbols all the basic information about each OS. In addition to the operating system, inventory numbers are assigned to some other objects important for the functioning of the company.

Assigning an inventory number

Therefore, they are assigned a separate inventory number.

The inventory number assigned to the object must be designated by the financially responsible person in the presence of an authorized member of the commission for the receipt and disposal of assets by attaching a token to it, applying paint to the accounting object or in another way that ensures the safety of the marking. It is allowed, if it is impossible to designate an inventory number on a fixed asset object in cases determined by the requirements of its operation, to use it only when reflected in the relevant accounting registers without applying it to the fixed asset object. The inventory number assigned to an object of fixed assets is retained by it for the entire period of its presence in the institution. Inventory numbers of inventory fixed assets that have been removed from the balance sheet are not assigned to newly accepted objects for accounting; 2) intangible assets. According to paragraph 56 of Instruction No. 157n, intangible assets should include objects of non-financial assets intended for repeated and (or) permanent use on the basis of operational management in the activities of an institution, which simultaneously satisfy the following conditions: - the object is capable of bringing economic benefits to the institution in the future; - the object lacks a material form; — the possibility of identification (separation, separation) from other property; - the object is intended for use for a long time, that is, a useful life of more than 12 months or a normal operating cycle if it exceeds 12 months; — subsequent resale of this asset is not expected; — availability of properly executed documents confirming the existence of the asset; — availability of properly executed documents establishing the exclusive right to the asset; — the presence, in cases established by the legislation of the Russian Federation, of properly executed documents confirming the exclusive right to the asset (patents, certificates, other documents of protection, agreements on the alienation of the exclusive right to the result of intellectual activity or to a means of individualization, documents confirming the transfer of the exclusive right without an agreement, etc.) or exclusive rights to the results of scientific and technical activities protected as a trade secret, including potentially patentable technical solutions and production secrets (know-how). However, the following are not intangible assets (clause 57 of Instruction No. 157n): - research, development and technological work that did not produce the expected and (or) results stipulated by the contract (state (municipal) contract); — unfinished and not formalized in the manner established by the legislation of the Russian Federation, research, development and technological work; — material objects (material media) in which the results of intellectual activity are expressed, and means of individualization equated to them (hereinafter referred to as means of individualization). According to clause 58 of Instruction No. 157n, the accounting unit for intangible assets is an inventory item. An inventory object of intangible assets is considered to be a set of rights arising from one patent, certificate, agreement (state (municipal) contract) providing for the acquisition (alienation) in favor of the Russian Federation, a subject of the Russian Federation, a municipal entity, the establishment of exclusive rights to the results of intellectual activity (to a means of individualization ), or in another manner established by the legislation of the Russian Federation, intended to perform certain independent functions. A complex object is recognized as an object of intangible assets, including several protected results of intellectual activity (movie film, other audiovisual work, theatrical performance, multimedia product, unified technology, etc.). Intangible assets also need to be assigned an inventory number. The inventory number assigned to an intangible asset is retained by it for the entire period of its accounting. The inventory number assigned to an intangible asset is used exclusively in accounting registers; 3) non-produced assets. Non-produced assets should include objects of non-financial assets that are not products of production, the property right to which must be assigned in the prescribed manner to the institution, used by it in the course of its activities, namely (clauses 70, 79 of Instruction No. 157n): - land - objects of non-produced assets in the form of land plots, as well as capital expenses inseparable from land plots, which include non-inventory expenses (not related to the construction of structures), with the exception of buildings and structures built on this land (for example, roads, tunnels, administrative buildings, etc.), plantings, underground water or biological resources; - subsoil resources - objects of non-produced assets in the form of natural resources, which include confirmed reserves of subsoil resources (oil, natural gas, coal, reserves of mineral ore and non-metallic minerals lying underground or on its surface, including the seabed), uncultivated biological resources (animals and plants that are state and municipal property), water resources (aquifers and other groundwater resources); - other non-produced assets - objects of non-produced assets that are not related to other types of objects of non-produced assets, for example, radio frequency spectrum. These objects are also assigned inventory numbers, which are used exclusively in accounting registers (clause 81 of Instruction No. 157n). The inventory number assigned to an item of non-produced assets remains with it for the entire period of its accounting. At the same time, inventory numbers of retired (written off) inventory items of non-produced assets are not assigned to newly accepted non-financial asset items for accounting. Certain types of non-financial assets must be assigned inventory numbers.

In this article, we will define the types of non-financial assets to which they are assigned, indicate how they should be applied to objects, and also propose a structure for generating an inventory number.

Surplus property identified

Often, during an inventory, “extra” inventories and, oddly enough, even fixed assets are identified. The reasons may be errors made during previously carried out control and accounting activities.

In accounting, surplus property is accounted for at market value (excluding VAT and excise taxes), which affects the amount of taxation. They are credited on the date of the inventory and the corresponding amount is reflected as part of other income (clause 29 of the Methodological Instructions for Inventory).

Identified surpluses are subject to reflection on the following accounting accounts: in the debit of the corresponding account of material assets (01 “Fixed assets”, 10 “Materials”, 41 “Goods”, 43 “Finished products”) and in the credit of account 91-1 “Other income” .

Example 1.

During the inventory, surplus goods were identified at a market value of 15,000 rubles.

The accountant makes the following entry:

Debit 41 Credit 91-1 – 15,000 - the cost of surplus goods is included in non-operating income

Example 2.

The organization, during its annual inventory, identified surplus construction materials. The market value of these materials is 20,000 rubles. Based on the decision of the inventory commission, the accountant made the following entry:

Debit 10 Credit 91-1 – 20,000 - surplus construction materials are taken into account

In addition, it is necessary to establish the reasons for the occurrence of surpluses and the perpetrators (clause 5.1 of the Inventory Guidelines).

If materials or goods identified during the inventory are illiquid, or, simply put, damaged, or there are other reasons that do not allow them to be sold, for example, spare parts for equipment that is no longer produced, goods that have gone out of fashion, etc., then they should also be written off, reflected in the accounting records: Debit 91 Credit 10.

In tax accounting, income in the form of the value of surplus inventories and other property that are identified as a result of inventory is recognized as non-operating income (clause 20 of Article 250 of the Tax Code of the Russian Federation). Surpluses are also accounted for at market value (excluding VAT and excise taxes) (clauses 5 and 6 of Article 274 of the Tax Code of the Russian Federation).

How to correctly assign an inventory number

An inventory number is assigned to a property at the time it is accepted for registration. After this, it acquires the status of an inventory object - a control unit. The number is applied to the object using durable paint, a barcode, engraving, using a token that cannot be quickly and discreetly removed, or in another similar way. The number must be applied so that during an inventory it can be easily and without errors identified with the BU data.

- The inventory number is applied in the presence of a commission specially created for this purpose and recorded in the inventory number journal.

- If the inventory object is a whole consisting of separate functional parts, a number is applied to each part.

- Moving an inventory item within the organization or its divisions is not a reason to change the number or adjust it. The inventory number does not change during the entire operation of the object to which it is assigned.

- If fixed assets are leased by a company, they are usually accounted for by numbers assigned by the lessor. At the same time, from Resolution 11 of the Arbitration Court of Appeal No. A55-24142/2021 dated 04/28/14, it follows that when the rights to an inventory item are transferred, for example, when signing a leasing agreement, it may be assigned a new inventory number of the organization that acquired such rights. It is argued that the assignment of inv. numbers are an internal matter of the organization.

- The inventory number of an object deregistered (sold, written off, etc.) cannot be assigned to another object in the same organization.

We recommend reading: Is it possible to return things without a receipt?

Responsibility for failure to take inventory

The law does not provide for liability for failure to carry out an inventory. However, the inspection may fine you for unreliable accounting and reporting data (Article 120 of the Tax Code of the Russian Federation; Article 15.11 of the Code of Administrative Offenses of the Russian Federation). True, to do this she will have to find the discrepancies between the credentials and the real ones herself. Although this is not easy to do in previous periods, it is not impossible.

We recommend watching the recording of the webinar “How to conduct and process an inventory in accounting and tax accounting.” The lecturer will use practical examples to show how to make adjustments in accounting if surpluses or shortages are identified during inventory. He will also examine the most controversial and challenging issues that arise during the inventory process.

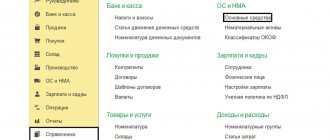

How to correctly assign an inventory number to a fixed asset in 1c

When entering a new template, you should indicate in the “Inventory number length” attribute the number of characters in the inventory number code (no more than 30 characters). The template may consist of component parts and may include the following fields:

In our demo database, one template has already been created, so it will not be possible to save another one. Let's look at the procedure for creating a template without saving. Clicking the “Create” button opens the following form: The “Name” attribute is a free text field that specifies the name of the template.

Budget accounting of fixed assets in 2021-2021 (nuances)

To account for fixed assets, a synthetic account 010100000 “Fixed Assets” is provided. The budget accounting account number consists of 26 digits, and only 18–26 digits are used in the accounting of the institution. Depending on the group and type of fixed assets, as well as the essence of their movement, the code in the 22–26 digits changes in the account number.

The remaining government institutions, maintaining accounting and tax accounting of fixed assets in 2021-2021, in addition to the unified chart of accounts, use charts of accounts approved by order of the Ministry of Finance of Russia dated December 16, 2021 No. 174n or dated December 23, 2021 No. 183n (depending on the type of organization) and others regulations.

Cases when an inventory is required:

- when transferring property for rent, redemption, sale, as well as during the transformation of a state or municipal unitary enterprise;

- before preparing annual financial statements;

- when changing financially responsible persons;

- when facts of theft, abuse or damage to property are revealed;

- in the event of a natural disaster, fire or other emergency situations caused by extreme conditions;

- during reorganization or liquidation of the organization;

- other cases provided for by law.

If the inventory was carried out no earlier than October 1 of the reporting year, then there is no need to repeat this procedure before drawing up the annual balance sheet.

Fixed assets must be checked once every three years (clause 27 of the Regulations on Accounting and Reporting in the Russian Federation, approved by Order of the Ministry of Finance of the Russian Federation dated July 29, 1998 No. 34n.)

In addition, the head of the organization has the right to independently appoint an inventory. To do this, he needs to determine the number of these activities in the reporting year, their dates, the list of inspected property and financial obligations for each of them (clause 2.1, clause 2 of the Inventory Guidelines).

Assigning an Inventory Number to Fixed Assets in the Budget in 2021

Government institutions charge depreciation of fixed assets linearly over their service life. There is also a rule of monthly accruals in the amount of 1/12 of the annual amount. Depreciation charges begin to be reflected in the month following the month the facility is put into operation.

Inventory of objects must be carried out by attentive and responsible accountants according to regulations. Errors in accounting for funds are punished by regulatory authorities. The company will pay fines if the accounting procedure is violated.

Correctly filling out the “Power Tool Inspection and Test Log”

This is not a position, but an “honorable duty,” as Rostechnadzor inspectors joke. Let’s quote PTEEP: “1.2.3.

When using materials in full or in part, an active link to spmag.ru is required, subject to compliance.

To directly fulfill the responsibilities for organizing the operation of electrical installations, the head of the Consumer (except for citizens who are owners of electrical installations with voltages above 1000 V) appoints with the appropriate document the person responsible for the electrical equipment of the organization (hereinafter referred to as the person responsible for the electrical equipment) ... The person responsible for the electrical equipment and his deputy are appointed from among the managers and specialists of the Consumer.” It is this specialist who is responsible for conducting special and organizing measurements and testing of power tools. Electric impact wrenches, electric drills, electric planers, grinding and polishing machines and other electrified mechanisms that are not fixed to a permanent foundation, as well as electric extension cords and portable lamps

How to assign an inventory number to a fixed asset

- the inventory number should not be repeated, i.e. There should not be several objects numbered identically in the company;

- when a single object is assembled from several elements, the entire complex is assigned one inventory number;

- numbers are assigned in accordance with the order of the number series;

- the inventory number of an object cannot change when moving within one company, attached to the asset when accepted for accounting, it remains with him throughout the entire period of his stay in the organization;

- inventory numbers are not saved upon disposal, for example, sale. Companies purchasing fixed assets assign numbers to objects in accordance with the developed in-house methodology;

- Inventory numbers may be retained for leased PFs (at the discretion of the lessee).

The general requirements for the process of numbering fixed assets are set out in the above-mentioned Instructions and Guidelines for accounting of fixed assets (Rule of the Ministry of Finance of the Russian Federation No. 91n dated October 13, 2021 with additions). These include, for example, the following conditions:

Introductory information

Inventory consists of actual confirmation of the organization’s assets declared in accounting, i.e. in the reconciliation of actual and accounting data (Article 11 of the Federal Law of December 6, 2011 No. 402-FZ “On Accounting”, hereinafter referred to as the Law on Accounting). To carry out such a check, each object is assigned a special inventory number in advance. The legislation regulating accounting in commercial organizations does not impose any special requirements for these numbers. As a result, accountants number objects, as they say, as God pleases, which often creates difficulties during inventory. Especially if the numbers were assigned by one chief accountant, and the inventory is carried out by another. However, there are ways to streamline this aspect of accounting activities, making object accounting simple, convenient and transparent.

Inventory number of fixed assets in budgetary institutions

- the inventory number is the serial number of the fixed asset within the institution;

- the required number of zeros is placed before the serial number to obtain the established total number of characters;

- changing the principles for generating an inventory number in accordance with accounting policies;

- changing the fixed asset account;

- elimination of identified cases of non-compliance with accounting policies regarding the procedure for assigning inventory numbers.

Inventory procedure

The procedure for conducting an inventory of the organization’s property and liabilities must be prescribed in the accounting policy (clause 3 of article 6 of Federal Law No. 402-FZ).

Yulia Busygina, head of accounting training at Kontur.School, comments: “Not mandatory cases of inventory are recorded in the accounting policy. Indicate the cases, deadlines, and composition of the inventory commission. Cases where inventory is required by law do not need to be recorded in the accounting policy.”

Why do we need inventory numbers of fixed assets?

In the practice of accountants, there are cases when it is impossible to apply numbering to an object using accessible methods; in such situations, data about the operating system is stored only on accounting registers. Objects to be numbered can be marked using any method possible for the organization:

Knowing how inventory numbers are assigned to fixed assets, an enterprise accountant will constantly have up-to-date information about the state of fixed assets accounting and promptly provide it to the organization’s management and regulatory authorities.

Documenting

Well, in conclusion, let’s say a few words about documenting all the above rules. As we have already said, “accounting numerology” is not regulated in any way by law. This means that the organization can implement the listed rules independently by approving the corresponding local act.

There are several ways to do this. For example, add a corresponding section to the organization’s accounting policy, or make an appendix to it. However, we do not recommend using this option, because... The accounting policy is subject to special rules regarding the introduction of changes and adjustments (clauses 6 and 7 of Article 8 of the Accounting Law). Therefore, it is not worth introducing additional provisions into it, so as not to deprive yourself of freedom of maneuver.

It is better, in our opinion, to use another option - to include rules for numbering objects in the Regulations on conducting an inventory in an organization. In such a document, the numbering rules will look quite logical. And it would be useful to familiarize yourself with them not only for the accountant, but also for any employee included in the inventory commission.

Finally, you can approve a separate document in the organization - Regulations on the procedure for assigning inventory numbers.

Before a fixed asset can be used, it must be registered. The unit of accounting for fixed assets is an inventory object. In order to monitor the commissioning, movement, storage and write-off of inventory objects, they are assigned inventory numbers. The mechanism for assigning an inventory number to a fixed asset is regulated in clause 46 of Instruction No. 157n: inventory numbers are assigned to all real and movable property worth 3,000 rubles or more, regardless of whether the object is in operation or is under conservation or in reserve. It is also required to assign inventory numbers to objects of the library collection without restrictions on the minimum value.

How to keep records of low-value fixed assets

Cost limits have been adjusted. Now, fixed assets subject to immediate write-off on the balance sheet should include objects that cost 10,000 rubles or less. Let us recall that until 2021, fixed assets with a value of up to 3,000.00 rubles were recognized as such property.

Last year, new federal accounting standards radically adjusted the procedure for recognizing fixed assets. Key changes are enshrined in Order of the Ministry of Finance No. 257n. Officials also presented methodological recommendations for the transition to new standards in Letter No. 02-07-07/79257 dated November 30, 2021.

What objects are subject to numbering

Codes are assigned to the following objects:

- Fixed assets. These are tangible items that can be used in work for 12 months or more. For example, equipment, tools, furniture, etc.

- Intangible objects. For example, a movie, a multimedia product, technology.

- Non-produced assets. These are the resources of the earth's interior, land plots, etc.

The codes are indicated in the documentation for accounting for fixed assets and are used during inventory. Movable and immovable property is taken into account. Items worth up to RUB 3,000. are not taken into account.

Library collection objects are assigned codes regardless of cost. All objects are subject to numbering, regardless of whether they are used in work or are in stock.

Inventory number of fixed assets

Example. A government agency purchased a printer. The printer was accepted for accounting as a fixed asset and issued to a department assigned code 15. The last inventory number assigned to fixed asset objects is 156 (6 characters are allocated for the number). According to OKOF, the printer belongs to the “Machinery and Equipment” group. The synthetic accounting code is 101, the analytical accounting code is 34 (clause 5 of Instruction No. 162n). The inventory number assigned to the printer will look like this - 15110134000157, where: - 15 - department code; — 1 — code of the type of activity through which the printer was purchased; — 101 — synthetic account code; — 34 — analytical account code; — 000157 — serial number.

We recommend reading: Do you need a Stamp for 2 Personal Income Taxes in 2021?

According to clause 45, an inventory object of fixed assets is an object with all fixtures and accessories, a separate structurally isolated object, a separate complex of structurally articulated objects. By virtue of the norms of paragraph 46, each inventory item of real estate, as well as an inventory item of movable property, except for objects worth up to 3,000 rubles. inclusive, and objects of the library collection, regardless of their value, must be assigned an inventory number, regardless of whether it is in operation, stock or conservation. Before assigning an inventory number to complex objects, the following features must be taken into account: a) if one structurally articulated object has several parts - fixed assets that have different useful lives, each such part must be accounted for as an independent inventory object. That is, each part of a structurally articulated object that has a different useful life should be assigned a separate inventory number; b) if a complex has structurally articulated objects, consisting of several items, for which a common useful life has been established for all objects, all parts of the specified object must be taken into account as an independent inventory object. That is, in this case, all objects of a complex of structurally articulated objects will be assigned one inventory number. In addition, when assigning inventory numbers to fixed assets, one should take into account the requirements of the All-Russian Classifier of Fixed Assets OK 013-94, approved by Decree of the State Standard of Russia dated December 26, 1994 N 359 (hereinafter referred to as OKOF): - if the buildings are adjacent to each other and have a common wall, but each of them represents an independent structural whole, they are considered separate inventory objects, therefore each building must be assigned a separate inventory number; - outbuildings, extensions, fences and other outbuildings that ensure the functioning of the building (barn, fence, well, etc.) together form one inventory object. If these buildings and structures ensure the functioning of two or more buildings, they are considered independent inventory objects. In this case, inventory numbers are assigned to each object; - external extensions to the building that have independent economic significance, detached boiler house buildings, as well as capital outbuildings (warehouses, garages, etc.) are independent inventory objects. In this case, inventory numbers are assigned to each object; — individual premises of buildings that have different functional purposes, and are also independent objects of property rights, are accounted for as independent inventory objects of fixed assets. They will have different accession numbers; — road conditions (technical means of organizing traffic, including road signs, fencing, markings, guide devices, traffic lights, automated traffic control systems, lighting networks, landscaping and small architectural forms) are taken into account as part of the road, unless otherwise established by the procedure property register of the relevant public legal entity. That is, the road includes the road conditions, and all this is taken into account as one inventory object, which will have one inventory number; — in cases provided for by the accounting policies of accounting entities, aircraft engines must be accounted for as independent inventory items of fixed assets. Therefore, they are assigned a separate inventory number. The inventory number assigned to the object must be designated by the financially responsible person in the presence of an authorized member of the commission for the receipt and disposal of assets by attaching a token to it, applying paint to the accounting object or in another way that ensures the safety of the marking. It is allowed, if it is impossible to designate an inventory number on a fixed asset object in cases determined by the requirements of its operation, to use it only when reflected in the relevant accounting registers without applying it to the fixed asset object. The inventory number assigned to an object of fixed assets is retained by it for the entire period of its presence in the institution. Inventory numbers of inventory fixed assets that have been removed from the balance sheet are not assigned to newly accepted objects for accounting; 2) intangible assets. According to paragraph 56 of Instruction No. 157n, intangible assets should include objects of non-financial assets intended for repeated and (or) permanent use on the basis of operational management in the activities of an institution, which simultaneously satisfy the following conditions: - the object is capable of bringing economic benefits to the institution in the future; - the object lacks a material form; — the possibility of identification (separation, separation) from other property; - the object is intended for use for a long time, that is, a useful life of more than 12 months or a normal operating cycle if it exceeds 12 months; — subsequent resale of this asset is not expected; — availability of properly executed documents confirming the existence of the asset; — availability of properly executed documents establishing the exclusive right to the asset; — the presence, in cases established by the legislation of the Russian Federation, of properly executed documents confirming the exclusive right to the asset (patents, certificates, other documents of protection, agreements on the alienation of the exclusive right to the result of intellectual activity or to a means of individualization, documents confirming the transfer of the exclusive right without an agreement, etc.) or exclusive rights to the results of scientific and technical activities protected as a trade secret, including potentially patentable technical solutions and production secrets (know-how). However, the following are not intangible assets (clause 57 of Instruction No. 157n): - research, development and technological work that did not produce the expected and (or) results stipulated by the contract (state (municipal) contract); — unfinished and not formalized in the manner established by the legislation of the Russian Federation, research, development and technological work; — material objects (material media) in which the results of intellectual activity are expressed, and means of individualization equated to them (hereinafter referred to as means of individualization). According to clause 58 of Instruction No. 157n, the accounting unit for intangible assets is an inventory item. An inventory object of intangible assets is considered to be a set of rights arising from one patent, certificate, agreement (state (municipal) contract) providing for the acquisition (alienation) in favor of the Russian Federation, a subject of the Russian Federation, a municipal entity, the establishment of exclusive rights to the results of intellectual activity (to a means of individualization ), or in another manner established by the legislation of the Russian Federation, intended to perform certain independent functions. A complex object is recognized as an object of intangible assets, including several protected results of intellectual activity (movie film, other audiovisual work, theatrical performance, multimedia product, unified technology, etc.). Intangible assets also need to be assigned an inventory number. The inventory number assigned to an intangible asset is retained by it for the entire period of its accounting. The inventory number assigned to an intangible asset is used exclusively in accounting registers; 3) non-produced assets. Non-produced assets should include objects of non-financial assets that are not products of production, the property right to which must be assigned in the prescribed manner to the institution, used by it in the course of its activities, namely (clauses 70, 79 of Instruction No. 157n): - land - objects of non-produced assets in the form of land plots, as well as capital expenses inseparable from land plots, which include non-inventory expenses (not related to the construction of structures), with the exception of buildings and structures built on this land (for example, roads, tunnels, administrative buildings, etc.), plantings, underground water or biological resources; - subsoil resources - objects of non-produced assets in the form of natural resources, which include confirmed reserves of subsoil resources (oil, natural gas, coal, reserves of mineral ore and non-metallic minerals lying underground or on its surface, including the seabed), uncultivated biological resources (animals and plants that are state and municipal property), water resources (aquifers and other groundwater resources); - other non-produced assets - objects of non-produced assets that are not related to other types of objects of non-produced assets, for example, radio frequency spectrum. These objects are also assigned inventory numbers, which are used exclusively in accounting registers (clause 81 of Instruction No. 157n). The inventory number assigned to an item of non-produced assets remains with it for the entire period of its accounting. At the same time, inventory numbers of retired (written off) inventory items of non-produced assets are not assigned to newly accepted non-financial asset items for accounting.

We recommend reading: Data Bank of Enforcement Proceedings Rostov Region

Enter the site

Murnya-murneya, but how can you write off a chair five years later that has broken down, without knowing what year the guy was, from what ship and on what seas have you been a sailor? conduct a private investigation? call up a drunk who retired and was a witness, describing to him a speckled or striped chair. which you want to write off, but at your arrival you have 15 of them, which arrived at different times and in different places.

6. To organize accounting and ensure control over the safety of fixed assets, each inventory item of fixed assets, regardless of whether it is in operation, in stock or on conservation, is assigned a separate inventory number. Inventory numbers are assigned by the organization's accounting department at the time the objects are accepted for accounting. In cases where an inventory item has several parts that have different useful lives and are accounted for as separate inventory items, each part is assigned a separate inventory number. If an object consisting of several parts has a common useful life for the objects, the specified object is listed under one inventory number. The number assigned to an inventory item must be indicated on it by attaching a metal token, applying paint or other means. If one inventory item includes several parts, which are a complex of structurally articulated items that have a common inventory number, it is sufficient to indicate the common inventory number on one part of the inventory item. The inventory number assigned to an object of fixed assets remains with it for the entire period of its presence in the organization. Inventory numbers of retired objects cannot be assigned to other fixed assets newly accepted for accounting for five years starting from the year following the year of write-off.

This is interesting: Benefits for pensioners living with preferential economic status

Inventory number

If one object has several parts with different useful lives, then each such part is accounted for as an independent inventory item. So, if buildings are adjacent to each other and have a common wall, but each of them represents an independent structural whole, they are considered separate inventory objects. Outbuildings, extensions, fences and other outbuildings that ensure the functioning of the building (shed, fence, well, etc.) together form one inventory object. However, if these buildings and structures ensure the functioning of two or more buildings, they are considered independent inventory objects. External extensions to the building that have independent economic significance, detached boiler house buildings, as well as capital outbuildings (warehouses, garages, etc.) are also independent inventory objects.

Until 2021, the inventory number consisted of eight digits. Paragraph 48 of Instruction No. 107n presented the structure in accordance with which the inventory number was to be formed. Instruction No. 70n does not contain such requirements. Therefore, the institution must determine for itself what the structure of the inventory number of non-financial assets will look like. Inventory numbers must be assigned not only to fixed assets, but also to non-produced and intangible assets.

What needs to be checked during inventory?

All property and all types of financial obligations are subject to inventory, regardless of its location, that is, not only for the parent enterprise, but also for its divisions.

It is imperative to check:

- intangible assets;

- fixed assets;

- financial investments;

- inventory items;

- work in progress and deferred expenses;

- cash, monetary documents and strict reporting document forms;

- settlements with suppliers, buyers, tax authorities and funds, settlements with other debtors (creditors);

- reserves for future expenses and payments, estimated reserves;

- assets and liabilities of the company.

Please note that you need to check not only the property that belongs to the company. Inventory is also subject to values recorded in off-balance sheet accounts for which the company does not have ownership rights (for example, leased fixed assets; goods received for safekeeping; materials accepted for processing, etc.).

Assigning an Inventory Number to Fixed Assets in the Budget in 2021

The formation of inventory numbers and their assignment to objects can be done both in documents that formalize the acceptance for accounting of fixed assets (intangible assets, legal acts, treasury property) to account 101 (102, 103, 108), and when entering information into the object card (directory element “ Fixed assets”), provided that a template for generating an inventory number is specified for the institution. In the absence of a template, inventory numbers are automatically generated in order (ascending) within the institution. If there is a template, the numbers are automatically generated in order (ascending) within a group made up of the remaining fields of the template.

If the fixed asset object is complex (a complex of structurally articulated objects), i.e. includes separate elements (structural objects) that together form a single whole, then each such element (structural object) must be marked with an inventory number assigned to the fixed asset (complex object, complex of structurally articulated objects). Consequently, the absence of inventory numbers on fixed assets (if it is possible to apply them) or unreliably applied inventory numbers (for example, glued with tape), the absence of inventory numbers on the components of the complex can be considered a serious violation of accounting standards. According to clause 46 of Instruction No. 157n, the inventory number assigned to an object of fixed assets is retained by it for the entire period of its presence in the institution.

Normative base

The legislation does not contain a clear regulatory framework regulating step by step how to assign inventory numbers. There is Instruction of the Ministry of Finance No. 174n (Appendix 2), containing general instructions on the assignment of inventory numbers. In addition, Instruction No. 157n (clause 46) applies to municipal unitary enterprises, where the procedure for such appointment is discussed in somewhat more detail. Guided by these documents and current legislation, the organization independently develops the structure of inventory numbers and the procedure for assigning them, enshrining it in local regulations (accounting policies, etc.). The procedure for assigning numbers can also be regulated at the departmental level, established by a higher organization.

Accounting for fixed assets for public sector employees: what has changed since 2021

The developers of the federal standard did not ignore reporting issues. As of January 1, 2021, accountants must report the book value of assets, depreciation method, accumulated depreciation, and more. It is important to reflect in the reporting changes in the valuation of objects in the reporting period, which will affect the SPI, and the depreciation method. In addition, it is necessary to provide a comparison of the residual value of the object at the beginning and end of the reporting period.

Information must be prepared for all groups of fixed assets, this applies to investment real estate, assets with zero residual value, idle facilities, etc. Before the FAS “Fixed Assets” came into force, the institution included reporting information only for some types of fixed assets. Now information about the amounts is reflected in the reporting, but not for all groups that are listed in the standard. Therefore, in the near future we expect changes to Instruction No. 157n, related, in particular, to accounts 0 10100 000, as well as the appearance of new lines in forms 0503168, 0503768, as well as balance sheet 0503130, 0503730. These changes will be reflected in the reporting for 2021.