Normative base

Order of Rosstat dated July 15, 2019 N 404 (as amended on July 24, 2020) “On approval of federal statistical observation forms for organizing federal statistical observation of the number, conditions and remuneration of workers, the need of organizations for workers by professional groups, the composition of state civil and municipal service"

Order of Rosstat dated 07/08/2020 N 365 "On approval of federal statistical observation forms for organizing federal statistical observation of the number and wage fund, additional professional education of state civil servants and municipal employees"

Order of the Ministry of Internal Affairs of Russia dated July 30, 2020 N 536

Law of the Russian Federation dated April 19, 1991 N 1032-1 (as amended on July 31, 2020) “On employment in the Russian Federation”

Federal Law of December 16, 2019 N 439-FZ “On amendments to the Labor Code of the Russian Federation regarding the generation of information about labor activity in electronic form”

Resolution of the Board of the Pension Fund of the Russian Federation dated December 7, 2016 N 1077p “On approval of the format of information for maintaining individual (personalized) records (form SZV-M)”

Resolution of the Board of the Pension Fund of the Russian Federation dated 01.02.2016 N 83p “On approval of the form “Information about insured persons”

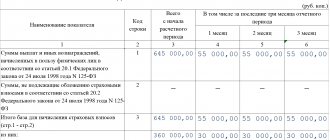

Social Insurance Fund

Calculation of 4-FSS: we submit based on the results of the 1st quarter, half year, 9 months and year. Until the 20th of the month, if the reporting is submitted in paper form, and in electronic form - before the 25th. The calculation reflects the amount of contributions accrued and paid to the fund in case of injuries and occupational diseases.

Fines: failure to submit on time - for each month 5% of the contributions due, but not less than 1000 rubles and not more than 30% of this amount. If the organization submitted a report in paper version, but is obliged to submit it electronically - 200 rubles. For an unsubmitted payment for the manager - 300-500 rubles.

Application and certificate confirming the main type of activity: sent once a year until April 15. Entrepreneurs and organizations annually confirm their main type of activity with the Social Insurance Fund, after which the Fund will set for them a tariff for contributions for injuries.

There is no penalty for failure to submit, but if you do not submit documents, Social Insurance will assign you the highest tariff for the most dangerous type of activity from your OKVED.

Statistical reporting forms updated

Rosstat approved Order No. 404 dated July 15, 2019 (as amended on July 24, 2020), which since 2021 changes most statistical reporting forms filled out by HR departments. In 2021, the list of reports that a HR specialist makes has changed.

Once a year, starting with the report for 2021, you must submit updated data using the following forms:

- 1-T “Information on the number and wages of employees”;

- 1-T (working conditions) “Information on the state of working conditions and compensation for work with harmful and (or) dangerous working conditions”;

- 2-GS (ГЗ) “Information on additional professional education of federal state civil servants and state civil servants of the constituent entities of the Russian Federation” - becomes invalid as of the report for 2021 in accordance with Rosstat order No. 365 dated 07/08/2020;

- 2-MS “Information on additional professional education of municipal employees” - becomes invalid from the report for 2021 in accordance with Rosstat order No. 365 dated 07/08/2020;

- 1-T (GMS) “Information on the number and remuneration of employees of state bodies and local self-government bodies by personnel categories” - becomes invalid as of the report for 2021 in accordance with Rosstat order No. 365 dated 07/08/2020.

Quarterly, starting with the report for the first quarter of 2021, employers fill out and send personnel reports to Rosstat using updated forms:

- P-4 (NZ) “Information on underemployment and movement of workers”;

- Salary education “Information on the number and remuneration of employees in the education sector by personnel category”;

- ZP-science “Information on the number and remuneration of employees of organizations carrying out scientific research and development, by personnel category”;

- ZP-health “Information on the number and remuneration of healthcare workers by categories of personnel”;

- ZP-social “Information on the number and remuneration of workers in the social service sector by personnel category”;

- ZP-culture “Information on the number and remuneration of cultural workers by categories of personnel.”

Every month in 2021, employers are expected to provide data on new forms:

- 3-F “Information on overdue wages”;

- 1-PR “Information on the suspension (strike) and resumption of work of labor collectives”;

- P-4 “Information on the number and wages of employees.”

In addition, the order of Rosstat states that:

- Once every 2 years for odd-numbered years, you will have to submit Form 57-T “Information on wages of employees by profession and position.”

- Once every 3 years you will have to submit additionally:

- 1-GS “Information on the composition of employees holding government positions and positions in the state civil service, by gender, age, length of service in public service, education”;

- 1-MS “Information on the composition of employees filling municipal positions and municipal service positions, by gender, age, length of service in municipal service, education.”

Instructions and samples from ConsultantPlus experts will help you fill out all reports correctly. Use free access to the system to find and download what you need.

HR department reporting. Automate!

Many companies simplify the process of creating reports using special reporting and analytical systems. Large companies choose serious and difficult decisions. But the disadvantage of such solutions is their cost and the need to hire specialists who will service this solution (analysts and developers).

Today, “lightweight” reporting and analytical solutions like Tableau are also gaining popularity:

- Easy to install (like a regular program)

- Easy to learn

- Transparent cost

What reports need to be submitted now?

“One-time” HR reports in 2021

Ministry of Internal Affairs

Employers who have entered into or terminated an employment contract (GPC contract) with a foreign citizen are required to notify the migration department of the Ministry of Internal Affairs about this. Notice period: within 3 working days from the date of conclusion (termination) of the employment contract. The form of the document that must be sent to law enforcement agencies is established by Order of the Ministry of Internal Affairs No. 536 dated July 30, 2020.

Read more: On the procedure for labor relations with citizens of other states - in the section “Foreign workers”

Military registration and enlistment office

If a citizen liable for military service who is in the reserves is accepted into the organization, a corresponding notice must be sent to the military commissariat. In this case, the schedule for submitting reports to the HR officer is individual: you have 2 weeks from the date of hiring the new employee to prepare documents. A similar notice must be sent within the specified time frame if the employment contract with a person liable for military service is terminated (Appendix No. 9 to the methodological recommendations for maintaining military records in organizations, approved by the Russian Ministry of Defense on July 11, 2017). In addition, the law requires the transfer of information about changes in marital status, education, structural unit of the organization, position, place of residence or place of stay, and health status of an employee subject to military registration (Appendix No. 13).

Read more: Methodological recommendations for maintaining military records in organizations, approved by the Russian Ministry of Defense on July 11, 2017

Employment Service

If an organization is planning to be liquidated or a reduction in staff is being prepared, the first step is to notify the employment service. Deadline - no later than 2 months before the start of the relevant events. A period of 3 months is provided for cases where the closure of an organization will lead to mass layoffs of personnel. If an individual entrepreneur is liquidated, then it is necessary to notify about the upcoming closure no later than 2 weeks in advance.

In addition, it is necessary to transmit data to the employment service about the introduction of a part-time working day (shift) and (or) part-time working week and about the suspension of production. 3 days are given to prepare the information. This follows from Law No. 1032-1 of April 19, 1991 “On Employment in the Russian Federation”.

IMPORTANT!

The law obliges employers to report to the employment service in strictly defined cases - when liquidating an organization and reducing numbers or staff. In these cases, the employer sends a report to the CNZ no later than two months before the start of the procedures. If the reduction leads to mass layoffs, then reporting is required no later than three months in advance. In addition, the administration is obliged to report the introduction of a part-time working regime or in the event of a suspension of production - this information must be submitted within three working days after the decision is made (issuance of the order). Until recently, these provisions remained unshakable. On April 13, 2021, new temporary rules for the provision of information came into force (see Government Decree No. 486 of April 12, 2020). Now employers are required to report on liquidation, reduction in number or staff, and possible termination of employment contracts to the “Work in Russia” information system no later than the working day following the day the data included in such information is changed. These special temporary rules are in effect until 12/31/2020.

Read more: How to fill out the form for the number of employees on the “Work in Russia” portal

Rosstat

Since January 2021, the list of reports from the HR department to Rosstat has been supplemented with the monthly form 1-PR “Information on the suspension (strike) and resumption of work of labor collectives” (Appendix No. 14 to Order No. 404 dated July 15, 2019). But the sample includes organizations where strikes were held as a result of a collective labor dispute or the resumption of work by the labor collective (end of the strike). If such an event did not occur, there is no need to report.

What should the HR manager do at the end of the year?

Is there a time during the year when HR people can relax a little? Hardly. And in any case, this is not the end of the year - it’s a busy time when there is a lot to be done. And in order to correctly calculate your strength at the end of the year, get everything done on time and calmly leave for the New Year holidays, you need to plan everything carefully.

So what does the HR manager need to do before the end of the outgoing year (or at the very beginning of the next)? The to-do list is quite impressive...

MANDATORY: APPROVAL THE HOLIDAY SCHEDULE FOR THE NEXT YEAR

Drawing up a vacation schedule is still the responsibility, not the right of the employer. And you need to treat this with full responsibility, because during the inspection, the labor inspector can check the availability of the schedule and the correctness of its preparation, and if there are errors, bring him to administrative responsibility under Part 1 of Art. 5.27 Code of Administrative Offenses of the Russian Federation and issue a fine.

According to Art. 123 of the Labor Code of the Russian Federation, the employer must draw up a vacation schedule no later than two weeks before the start of the calendar year for which it is drawn up.

For example, the vacation schedule for 2021 must be drawn up and approved no later than December 16 (Friday), 2021. And even if none of the employees go on vacation in January and February, the employer should not postpone the preparation of the schedule to a later date.

Some employers believe that drawing up a vacation schedule is an outdated and formal procedure, and it is carried out only in compliance with the law.

However, this document may be useful to the employer. The vacation schedule not only guarantees the employee’s right to annual rest, but also allows the employer to:

- ensure the uninterrupted operation of production by finding in advance a replacement for an employee going on vacation;

- arrange vacation in advance and pay vacation pay no later than three days before the start of the vacation (Article 136 of the Labor Code of the Russian Federation);

- control the timely provision of vacations to employees and prevent the accumulation of unused vacation days.

When drawing up a vacation schedule, the length of service must be taken into account, giving the employee the right to annual paid leave, basic and additional (Article 121 of the Labor Code of the Russian Federation). To determine the duration of vacation, only the length of service with a given employer is important.

Since when calculating the total duration of annual paid leave, additional paid leaves are summed up with the annual main paid leave (Article 120 of the Labor Code of the Russian Federation), the total number of vacation days is planned.

Most employers draw up a schedule according to the unified form No. T-7, approved by the State Statistics Committee. However, employers have the right to develop their own local forms of documents.

MANDATORY: PREPARATE HR STATISTICAL REPORTS

According to Art. 8 of the Federal Law of November 29, 2007 No. 282-FZ “On official statistical accounting and the system of state statistics in the Russian Federation” (as amended on July 23, 2013), organizations are required to submit reports to statistical authorities.

To monitor the number, conditions and remuneration of workers, Rosstat Order No. 580 dated September 24, 2014 “On approval of statistical tools for organizing federal statistical monitoring of the number, conditions and remuneration of workers, activities in the field of education, science, innovation and information technology” ( as amended on September 25, 2015) several forms were approved:

1. Information on the number and wages of employees (form No. 1-T).

This report must reflect the name of the type of economic activity, the average number of employees, the salary fund of external part-time workers and payroll employees, as well as payments accrued to them. The deadline for submitting the report is January 20 after the reporting period.

2. Information on the number and wages of employees (form No. P-4).

This information is provided by legal entities (except for small businesses) of all types of economic activity and forms of ownership:

- the average number of employees exceeds 15 people - monthly, no later than the 15th day after the reporting period;

- the average number of employees does not exceed 15 people, including part-time workers - quarterly, no later than the 15th day after the reporting period.

3. Information on part-time employment and movement of workers (form No. P-4 (NZ)).

Provided by employers no later than the 8th day after the reporting quarter. This form focuses on the number of employees who:

- worked part-time or were idle;

- were on leave without pay at their request;

- were hired, fired or are planning to quit,

and also reflects the number of employees and vacancies at the end of the reporting month.

Despite the fact that the deadline for submitting reports is in January, it is better to carry out the preparatory work at the end of December, because the first half of January falls on the New Year holidays.

Recently, by Order of Rosstat dated July 5, 2016 No. 325 “On approval of statistical tools for organizing federal statistical monitoring of the number and need of organizations for workers by professional groups, composition of personnel of the state civil and municipal service”, another form of statistical reporting was approved - 1-T ( professional) “Information on the number and needs of organizations for workers by professional groups” (Appendix No. 3).

It applies starting from reporting as of 10/31/2016. It must be submitted only once every two years on November 28 to legal entities engaged in all types of economic activities (except for financial activities, public administration and military security; activities of public associations and extraterritorial organizations).

This form indicates the organization’s need for workers to fill existing vacant jobs, distributed by professional groups. Vacancies include positions vacated in the event of employee dismissal, maternity or child care leave, as well as newly created positions for which employees are planned to be hired within 30 days after the reporting period.

MANDATORY: APPROVED THE PLAN AND ORDER FOR MILITARY REGISTRATION FOR THE NEW YEAR

The end of the year is a good time to start keeping military records if your employer has not kept them up to this point.

If the employer maintains military records, the order appointing the person responsible for its maintenance and the work plan should be updated by the end of December.

Documents should be drawn up exactly according to the forms given in the Methodological Recommendations for maintaining military records in organizations approved by the General Staff of the Armed Forces of the Russian Federation on April 11, 2008, otherwise the military registration and enlistment office may return them for revision.

The order must indicate the full name and position of the person responsible for maintaining military records and his deputy. Each document must have a place for the military commissar’s approval visa. The order and plan are signed by the officials specified in the form. Before submitting documents to the military registration and enlistment office, do not forget to update your reservation certificate with the local authorities.

For example, in Moscow, this is the security and mobilization training service in the district government at the location of the organization.

MANDATORY: PREPARATE DOCUMENTS FOR ARCHIVE STORAGE

Do not forget about the need to prepare for submitting documents to the archive. As a rule, this should be done after the end of the office year, that is, in January, but already in December you can determine which documents will need to be submitted to the archive.

The main regulatory act regulating the procedure for processing documents in the archive is the Rules for organizing the storage, acquisition, recording and use of documents from the Archive Fund of the Russian Federation and other archival documents in government bodies, local governments and organizations, approved by Order of the Ministry of Culture of Russia dated March 31, 2015 No. 526 (hereinafter referred to as the Rules; Order of the Ministry of Culture of Russia No. 526).

According to the Rules, documents with a storage period of more than 10 years must be submitted to the archive. They are transferred to the organization’s archive no earlier than one year and no later than three years after the completion of office work. Therefore, in January 2021, documents drawn up before December 31, 2015 (of those stored for more than 10 years) must be submitted to the archives.

The storage periods for documents are indicated in the List of standard management archival documents generated in the course of the activities of state bodies, local governments and organizations, indicating their storage periods, approved by Order of the Ministry of Culture of the Russian Federation dated August 25, 2010 No. 558 (as amended on February 16, 2016). It is also necessary to take into account the changes made by the Federal Law of March 2, 2016 No. 43-FZ to the Federal Law of October 22, 2004 No. 125-FZ “On Archival Affairs in the Russian Federation.”

MANDATORY: COMPLETE A PERSONNEL CALVING NOMENCLATURE FOR THE NEW YEAR

The document that must be followed is Order No. 526 of the Ministry of Culture of Russia.

It is worth checking whether new areas of work have appeared, new cases that need to be added to the list of cases for the next year. If nothing has changed in the nomenclature, it still needs to be re-approved.

OPTIONAL: APPROVED STAFF SCHEDULE

The employer's obligation to draw up a staffing table is provided for in Art. 15 and 57 of the Labor Code of the Russian Federation, since, according to these articles, the name of the position must be indicated in the employment contract in accordance with the organization’s staffing table. According to Rostrud, hiring an employee for a position not included in the staffing table is unacceptable (letter No. PG/13229-6-1 dated January 21, 2014).

Labor legislation does not establish any deadlines or frequency for approval of the staffing table. Changes can be made at any time by issuing an appropriate order. But some employers make all the changes on the eve of the new year in order to approve the new staffing table from January 1.

Staffing form No. T-3 is also optional, and, like the vacation schedule, the staffing schedule can be drawn up according to a local form developed by the employer.

The staffing table can be drawn up by any employee who is entrusted with such a function (the head of the organization, personnel officer, accountant).

OPTIONAL, BUT IMPORTANT: CHECK IF AN INSPECTION OF GOVERNMENT AGENCIES IS PLANNED IN THE NEXT YEAR

Determining whether an employer is the subject of scheduled inspections in 2017 is a very important matter.

To do this, you need to go to the website of the Prosecutor General's Office of Russia and enter the TIN or OGRN of the organization. The website contains information about all inspections by government agencies. The personnel department concerns, first of all, inspections by the labor inspectorate, as well as verification of compliance with quota legislation (these are usually carried out by the employment service). If your organization is on the list of those being inspected, you should contact the manager with a memo and report this. It is also worth discussing with the manager the preparation plan for the audit (conducting a personnel audit will provide an opportunity to check whether everything is in order in the employer’s personnel documents).

OPTIONAL BUT USEFUL: CONDUCT A REGULAR HR AUDIT

The end of the year is a good time to conduct a regular HR audit. Although the law does not establish such an obligation, many personnel services do not neglect this - after all, it is easier to make any corrections immediately than after a long time.

In addition, the results of the HR audit will help improve the business process in the HR department next year.

You should be especially careful when conducting a personnel audit if there is information about inspections by government agencies in the coming year.

Whether or not to formalize a personnel audit depends on the employer. For example, you can formalize its implementation by an order for the organization or an order for the department.

What documents should you check first? Of course, those that the labor inspectorate pays attention to first of all, for example:

1. Local regulations (hereinafter referred to as LNA):

- Internal labor regulations (part 4 of article 189 of the Labor Code of the Russian Federation);

- Regulations on remuneration (Article 135 of the Labor Code of the Russian Federation);

- Regulations on the protection of personal data (Article 87 of the Labor Code of the Russian Federation).

Although job descriptions are not mandatory for LNA, practice shows that their use is useful for organizing the work of employees. Therefore, it is worth checking whether they are developed for all positions.

If employees go on business trips, then the Regulations on Business Travel are mandatory (Article 168 of the Labor Code of the Russian Federation).

2. Employment contracts and additional agreements thereto (if any).

It is important to check:

- the content of employment contracts for compliance with the law, since a fine is provided for improper execution under Part 4 of Art. 5.27 Code of Administrative Offenses of the Russian Federation;

- do all employment contracts contain current conditions - that is, are all changes to the conditions formalized in written additional agreements;

- does the organization have fixed-term employment contracts (Article 59 of the Labor Code of the Russian Federation) with a period until December 31, 2016, and notify employees of their termination in advance (Article 79 of the Labor Code of the Russian Federation), otherwise they will turn into contracts for an indefinite period.

Also worth checking:

- orders on hiring and dismissal, transfer to another job;

- orders for granting leaves (of various types) and applications for those that are issued based on applications from employees;

- time sheets;

- personal cards of employees;

- workers' work books;

- documents relating to the maintenance of work books (an order appointing a person responsible for maintaining work books, a book for recording the movement of work books and inserts in them);

- orders for sending on a business trip (if available);

- orders to apply disciplinary sanctions (if any);

- orders on bringing to financial responsibility (if any);

- civil law agreements (CLA), if they are concluded in an organization (they will receive especially close attention).

- documents relating to certain categories of workers (foreigners, “harmful workers”, pregnant workers, workers on maternity leave, disabled people, youth, etc.).

OPTIONAL, ACCORDING TO INTERNAL REGULATIONS: PREPARATE INTERNAL REPORTS OF THE HR DEPARTMENT

The manager, as a rule, is interested in how many employees are hired, how many are fired, what is the turnover rate, which personnel selection tools are most effective, etc. Each organization has its own forms of such reports and its own frequency. The manager will probably want to see such reports for the year. If monthly reports were compiled, then bringing the information together will not be difficult. Otherwise you will have to work.

In practice, staff turnover most often means the movement of labor caused by employee dissatisfaction with the workplace or organization with a specific employee. The indicator is calculated using the formula:

T = U/H,

where T is staff turnover;

Y is the number of employees who quit during a certain period;

H is the average number for the same period.

For example, if 30 people left the organization during a quarter, while the average headcount during this period was 300 people, then the staff turnover rate is 0.1 (10%).

It is also worth compiling a report on the work of the HR department for the year. Most often, management requires such a report. But even if the organization is small and there are no formal reporting requirements, we still recommend doing this. Why not show the department's work in the best possible light?

So, you can specify how much:

- personnel operations (dismissal, hiring, vacations, business trips, disciplinary actions, etc.) were done;

- LNA has been drawn up or finalized;

- workers have been selected (if the selection function is available);

- labor conflicts prevented;

- workers trained, etc.

More than original understanding of vacant positions by officials. — Approx. scientific editor.

Appendices No. 17 and 4 respectively.

For more information about the design of the organization’s archive, see: Zhizherina Yu. Yu. Preparing documents for storage // Personnel decisions. 2021. No. 3. P. 64–73; Zhizherina Yu. Yu. Organization of storage of personnel documents //Personnel decisions. 2021. No. 4. pp. 71–77. — Approx. editors.

Clause 4.2 of the Rules.

Monthly reports

Employment Service

Employers are required to inform the employment service every month before the 25th about the availability of available places (quota places for people with disabilities). There is no notification form, but there are still certain requirements.

Read more: How to draw up a report to the employment center on job quotas

Rosstat

The following are required to report monthly to the statistical authorities in form P-4 (information on the number and wages of employees):

- legal entities whose average number of staff over the previous two years exceeds 15 people, and whose annual turnover during the same period exceeds 800 million rubles;

- holders of mining licenses, regardless of average number of employees and turnover;

- organizations registered or reorganized in the current or previous year, regardless of the average number of staff and turnover.

The report must be submitted no later than the 15th. Its form and rules for filling out are regulated by order of the Federal State Statistics Service No. 404 dated July 15, 2019 “On approval of federal statistical observation forms for organizing federal statistical observation of the number, conditions and remuneration of workers, the need of organizations for workers by professional groups, the composition of personnel of the state civil and municipal service."

Read more: How to calculate man-hours for statistics

Pension Fund

By the 15th day of each month, it is necessary to prepare and send information about the insured persons (form SZV-M). Regularly, the Pension Fund wants to find out about employees with whom employment contracts, civil law contracts, copyright contracts, contracts for the alienation of exclusive rights to works of science, literature, art, and publishing license agreements have been concluded, continue to be valid, or have been terminated. The regulatory acts that introduce and describe the SZV-M form are Resolution of the Board of the Pension Fund of the Russian Federation No. 83p dated 01.02.2016 and Resolution of the Board of the Pension Fund of the Russian Federation No. 1077p dated 07.12.2016.

Read about the features of filling out this report in our selection.

Filling out SZV-M upon dismissal of an employee

How to submit reports to the Pension Fund via the Internet

How to check financial statements in the Pension Fund online

In addition, the authorities have launched a reform to transfer work records into electronic format. But in order for the system to work, and for the data to be promptly and fully included in the Pension Fund of the Russian Federation, which calculates the length of service of working citizens, employers are forced to provide detailed information about the work activities of their employees.

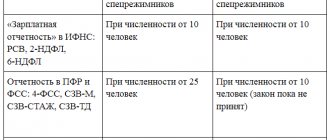

From federal laws No. 439-FZ of December 16, 2019 and No. 436-FZ of December 16, 2019, it follows that companies report to the Pension Fund from 2021:

- Place of work (name of the employer, data on his renaming, the basis for the renaming and data on the corresponding document on the renaming).

- Registration number of the organization in the Pension Fund of Russia.

- Work performed by the employee and periods of work, including:

- date of admission;

- name of position (specialty, profession);

- level of qualification (rank, class, category);

- information about transfers to another job;

- information about dismissal and grounds for termination of the employment contract;

- data of the relevant orders (instructions), decisions or other documents on the basis of which the employment relationship was formalized, amended, or terminated.

In fact, the new report completely duplicates the data that the personnel officer (authorized person) enters into work books. According to officials, this information must be transmitted monthly, before the 15th day of the month following the reporting month. Only about dismissals and cases of hiring new employees will have to be reported no later than the working day following the day the corresponding order (instruction) is issued.

Punishments are being prepared for violation of reporting rules. If there is no information about work activity or it is incomplete, the Pension Fund of Russia will inform the labor inspectorate. Since the State Tax Inspectorate has the authority not only to check, but also, under certain circumstances, to immediately punish violators, an employer who fails to report will have a hard time. For failure to transfer data to the Pension Fund, in accordance with the proposed amendments to Art. 5.27 of the Code of Administrative Offenses of the Russian Federation, it is planned to issue warnings to officials. But if inspectors find other violations, you may have to pay a fine.

The reform to transfer work books into electronic format and collect information for their maintenance started on 01/01/2020. But first, data from employers is expected monthly (if something has changed in the work activities of the insured person), and from 2021, the obligation to notify about personnel decisions will be added within a few days after they are made.

The Pension Fund of Russia has already prepared a form for transmitting data on the work activities of employees, on which employers will have to report, and called it SZV-TD.

Read more: How to fill out a new monthly report SZV-TD (step-by-step instructions)

Reporting in 2021 to the Pension Fund

As before, the employer reports on SZV-M monthly and annually on SZV-STAZH. A new HR department report was introduced in 2021 after the transition to electronic work books - this is the SZV-TD report.

Form SZV-M

Approved by Resolution of the Board of the Pension Fund of the Russian Federation No. 83p in 2021. The report includes information about those employees for whom the employer makes contributions to the Pension Fund. These are workers under civil law and labor contracts. Anyone who employs employees must submit a report to the pension fund:

- Russian enterprises and their branches;

- foreign organizations;

- Individual entrepreneurs and self-employed: lawyers, detectives, notaries.

If the company has employees who work under GPC or labor contracts, reporting in the SZV-M form is submitted, even if in the billing period:

- there were no payments;

- there was no activity.

| HR reporting deadlines: no later than the 15th day of the month following the billing month. |

For more information on how to fill out and when to submit the SZV-M report, see the material on our website.

SZV-STAZH report

This is an annual report. The deadline for submission is no later than March 1 after the end of the reporting year (for the report for 2021 - until March 1, 2021). All employers who pay insurance premiums for employees submit reports in the SZV-STAZH form: Russian and foreign companies, individual entrepreneurs.

| Important! By Resolution No. 612p dated September 2, 2020, a new codification was added to the form, indicating preferential rates of pension contributions. |

New codes for personnel reports in 2021/2021 in the table

| Code | Decoding |

| MS | Employee of a small or medium-sized business |

| IPMS | Temporary SME Employee |

| VJMS | Temporary resident SME worker |

| HF | An employee of an organization included in the register of socially oriented non-profit organizations |

| VPKV | Temporary resident employee of the organization -//- |

| VZhKV | Temporary employee of the organization -//- |

Code “VIRUS” - for health workers employed in organizations providing medical care to patients with COVID-19 and suspected infection. Filled out from 01/01/2020 to 09/30/2020.

Completed sample report SZV-STAZH

Read expert material on the procedure for filling out and submitting a report, as well as analyzes of non-standard situations

SZV-TD

The HR officer is obligated to provide this report to the Pension Fund only in certain events: dismissal/hiring or filing an application to continue maintaining a paper work record book.

Deadlines for submitting personnel reports for SZV-TD from 2021:

- no later than the 15th day of the next month after transfer to another job or receipt of an application for the type of work record (paper / electronic);

- upon dismissal / hiring, no later than 1 working day after the issuance of an order to terminate / formalize the employment relationship.

Methods for transmitting reports through the Policyholder's Account:

- service “Upload a prepared document” to the Unified Automated Identification System;

- if you do not have registration in the Unified Automated Identification of Authorities, use the “Download draft reporting” service on the Pension Fund website.

.

| Important! A service has been launched on the PF website for remote contact with the PF technical support service at the following address. Contacts regarding SZV-TD reporting issues are carried out using a template. Requirements:

|

Quarterly reports

Rosstat

Organizations whose average number of employees over the previous two years does not exceed 15 people, and whose annual turnover does not exceed 800 million rubles, must report in Form P-4 to the statistical authorities quarterly. The deadline for submitting reports is no later than the 15th day of the month following the reporting period. The filling rules were approved in Rosstat Order No. 404 dated July 15, 2019.

In addition, all legal entities (except for small businesses) whose average number of employees exceeds 15 people (including part-time workers and civil servants) must quarterly send to the statistical authorities data on underemployment and movement of employees in the form P-4 (NZ ). The report and the rules for filling it out were approved by Rosstat Order No. 404 dated July 15, 2019. But it should be submitted no later than the 8th day after the reporting quarter.

HR department reporting. Problems and difficulties

The main problems when creating reports:

- Lots of employees, which means even more data

- Data is stored in various sources (spreadsheets, 1C, CRM, other reporting systems)

- Data is collected manually (by simple copying!)

Of course, in this case, creating reports becomes a problem, and precious time is wasted on copying data.

_____________

What is Tableau? Read more>>

_____________

Annual reports

Military registration and enlistment office

In September (a specific date has not been established), lists of male citizens aged 15 and 16 years should be sent to the military registration and enlistment office, and before November 1 - lists of male citizens subject to initial military registration next year.

The form of the reporting lists is given in Appendix No. 11 to the methodological recommendations approved by the Russian Ministry of Defense on July 11, 2017.

Before December 1 of each year, it is necessary to submit a “Report on the number of working and reserved citizens in reserve” to the military commissariats, and prepare personal employee cards for reconciliation with the military commissariat’s credentials.

Read more: How to obtain an organization registration card

Pension Fund

No later than March 1 of the year following the reporting year, employers must submit the SZV-STAZH form - information about the insurance experience of the insured persons. If an employee has submitted an application for a pension, then in this case the SZV-STAZH form is provided to the Pension Fund of the Russian Federation within three calendar days from the date the insured person contacts the policyholder. If the legal entity of the policyholder is liquidated, then the Pension Fund of the Russian Federation provides data in the form SZV-STAZH within one month from the date of approval of the interim liquidation balance sheet.

The report itself was approved by Resolution of the Board of the Pension Fund of the Russian Federation No. 507p dated December 6, 2018, and the procedure for filling it out is also presented here.

Rosstat

Until January 21 of the year following the reporting year, the statistical authorities are waiting for Form 1-T (working conditions). Only small businesses should not take it. We recommend that others read Rosstat Order No. 404 dated July 15, 2019 and study the materials that we have prepared on this topic. Please note that if a company does not operate for part of the reporting period, it will still report this data on a general basis, indicating the date on which no activity was carried out.

Another annual report is Form 7-Injury. It must be filled out and sent before January 25, taking into account the requirements of Rosstat Order No. 417 dated June 21, 2017. Micro-enterprises and organizations that are engaged in certain types of activities - education, credit and financial activities, etc. - do not report.

From 2021, the following will be reported to the statistical authorities once a year on the number and wages of employees:

- consumer cooperatives;

- public organizations;

- employers' associations;

- farm associations;

- self-regulatory organizations;

- associations (associations and unions) of charitable organizations;

- real estate owners' associations;

- foundations (including charitable, public, environmental);

- private institutions (charitable, public).

For them, by order of Rosstat No. 404 dated July 15, 2019, a special form was introduced - 1-T “Information on the number and wages of employees” (Appendix No. 1). These organizations report according to it if the average number of employees is less than 15 people and their annual turnover does not exceed 800 million rubles. The deadline is January 30 after the reporting period.

Checklist

We are publishing the final table so that you can check which HR reports need to be submitted in 2021.

Make sure you submitted all reports this month.

Personnel reporting in 2021: deadlines, table

| Month | Last date of submission | Report name |

| January | January 15 | Information on the number and wages of employees (form P-4) is sent to Rosstat. The report is submitted:

|

| Information about insured persons (form SZV-M) - in the Pension Fund for the last month. | ||

| January 20th | Form No. 1-T (working conditions) for last year - to Rosstat. | |

| The 25th of January | Form No. 7 - injuries for the past year - to Rosstat. | |

| Information about the availability of vacancies is sent to the employment service. | ||

| February | February 3rd | Data on advanced training and professional training of employees of organizations (form No. 1-personnel). IMPORTANT! The report is submitted once every 3-4 years! |

| February, 15 | Information about insured persons (form SZV-M) - in the Pension Fund for the last month. | |

| Information on the number and wages of employees (form P-4) - to Rosstat for the last month. | ||

| 25 February | Information about the availability of available places is sent to the employment service. | |

| March | March 1 | Information on the insurance experience of the insured persons (form SZV-STAZH) based on the results of the year. |

| March 15th | Information about insured persons (form SZV-M) - in the Pension Fund for the last month. | |

| Information on the number and wages of employees (form P-4) - to Rosstat for the last month. | ||

| March 25 | Information about the availability of vacancies is sent to the employment service. | |

| April | April 8 | Information on underemployment and movement of workers (form No. P-4 (NZ)) - to Rosstat for the first quarter. |

| April 15 | Information about insured persons (form SZV-M) - in the Pension Fund for the last month. | |

Information on the number and wages of employees (form P-4) is sent to Rosstat. The report is submitted:

| ||

| 25th of April | Information about the availability of vacancies is sent to the employment service. | |

| May | May 15 | Information about insured persons (form SZV-M) - in the Pension Fund for the last month. |

| Information on the number and wages of employees (form P-4) - to Rosstat for the last month. | ||

| May 25 | Information about the availability of available places is sent to the employment service. | |

| June | June 15 | Information about insured persons (form SZV-M) - in the Pension Fund for the last month. |

| Information on the number and wages of employees (form P-4) - to Rosstat for the last month. | ||

| June 25 | Information about the availability of vacancies is sent to the employment service. | |

| July | July 8 | Information on underemployment and movement of workers (form P-4 (NZ)) - to Rosstat for the second quarter. |

| July 15 | Information about insured persons (form SZV-M) - in the Pension Fund for the last month. | |

Information on the number and wages of employees (form P-4) is sent to Rosstat. The report is submitted:

| ||

| July 25 | Information about the availability of available places is sent to the employment service. | |

| August | August 15 | Information about insured persons (form SZV-M) - in the Pension Fund for the last month. |

| Information on the number and wages of employees (form P-4) to Rosstat for the last month. | ||

| 25-th of August | Information about the availability of vacancies is sent to the employment service. | |

| September | Within a month | Send lists of male workers aged 15 and 16 to the military registration and enlistment office. |

| September 15th | Information about insured persons (form SZV-M) - in the Pension Fund for the last month. | |

| Information on the number and wages of employees (form P-4) - to Rosstat for the last month. | ||

| September 25 | Information about the availability of available places is sent to the employment service. | |

| October | October 8 | Information on underemployment and movement of workers (form P-4 (NZ)) - to Rosstat for the third quarter. |

| October 15 | Information on the number and wages of employees (form P-4) is sent to Rosstat. The report is submitted:

| |

| Information about insured persons (form SZV-M) - in the Pension Fund for the last month. | ||

| the 25th of October | Information about the availability of available places is sent to the employment service. | |

| November | Nov. 1 | Send lists of male workers subject to initial military registration next year. |

| 15th of November | Information about insured persons (form SZV-M) - in the Pension Fund for the last month. | |

| Information on the number and wages of employees (form P-4) - to Rosstat for the last month. | ||

| November 25 | Information about the availability of available places is sent to the employment service. | |

| December | December 2nd | A report on the number of working and reserved citizens in the reserve is sent to the military registration and enlistment office. |

| Prepare personal cards of employees for verification with the credentials of the military commissariat. | ||

| Information on wages to employees by profession and position (Form No. 57-T). The report is submitted once every two years - in odd-numbered years - for October of the current year. | ||

| December 15 | Information about insured persons (form SZV-M) - in the Pension Fund for the last month. | |

| Data on the number and wages of employees (form P-4) - to Rosstat for the last month. Please note: technical corrections have been made to the report, see Order of Rosstat dated 08/04/2018 No. 485. | ||

| December 25 | Information about the availability of vacancies is sent to the employment service. |

Periodic reports

Rosstat

Statistical authorities often request information not every year, but once every 2 years or for a longer period. In particular, an irregular report is form 1-cadre (“Information on advanced training and professional training of employees of organizations”). It is handed over before February 3 once every 3-4 years. The document and procedure for filling out were approved by Rosstat order No. 554 dated September 28, 2016.

Since 2021, another periodic report has been introduced - “Appendix to Form No. 7-Injuries”. It must be submitted once every 3 years in accordance with the instructions for filling out contained in Rosstat Order No. 493 dated August 10, 2018. Like Form 57-T (“Information on wages of employees by profession and position”), which is submitted once every 2 years, the report must be submitted only at the end of the current year, that is, in 2021.

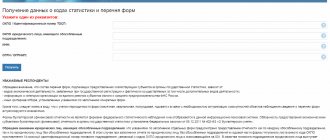

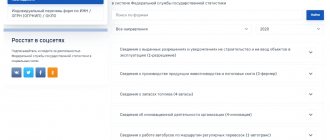

Employment Service

The specific procedure, deadlines and forms for reporting are established by territorial authorities. Which forms to submit to the territorial office of Rosstat can be found on the website statreg.gks.ru.

Information about vacancies. The form was approved by order of the Ministry of Labor of Russia dated February 26, 2015 No. 125n. Submitted monthly. The report includes information about available and vacant jobs. Some regions have their own reporting form.

Fulfillment of quotas for disabled people. The form of the written report is optional. Submitted monthly. The report includes information about the availability of vacant jobs, local acts that contain information about these jobs, and the fulfillment of the quota for disabled people.

Notification of liquidation and reduction of the number or staff of employees. The form is arbitrary. Notification is sent two months before the start of liquidation or reduction, or three months in case of mass layoffs. The document specifies positions, professions, specialties and qualification requirements for the position and terms of remuneration for each released employee.

Notifications about the introduction of part-time working hours and the beginning of downtime. The form is arbitrary. The notification is sent within three working days from the moment the employer introduces a part-time working regime on its own initiative or stops production and declares downtime.

Fines for late reporting

We recommend that you carefully study what reports the HR officer submits and where in 2021 in order to avoid sanctions provided for by law. Failure to submit or untimely submission of reports to Rosstat constitutes an administrative offense, liability for which is provided for by the provisions of Article 13.19 of the Code of Administrative Offenses of the Russian Federation and is punishable by fines in the amount of:

- for officials - from 10,000 to 20,000 rubles;

- for legal entities - from 20,000 to 70,000 rubles.

Repeated violation will increase the costs of enterprises:

- for officials - from 30,000 to 50,000 rubles;

- for legal entities - from 100,000 to 150,000 rubles.

Currently, cases under Article 13.19 of the Code of Administrative Offenses of the Russian Federation are considered by Rosstat itself, the period for bringing to responsibility is 2 months from the date of commission of the administrative offense. Since there are many enterprises, and Rosstat is one, it does not have time to punish everyone, and this is lost profit in the form of lost fines to the country’s budget.

HR department reporting. Classification

The HR specialist collects huge amounts of data, all this information needs to be collected, classified, and recorded. And later make a report on this data. Moreover, such reports are mostly collected manually! That is, information is simply copied from one table to another.

What reports are required from a HR specialist:

- Reporting to management (statistics and analysis - why are these numbers and what can be improved)

- Reporting to regulatory authorities

Reports are needed regularly and constantly, and a lot of time is spent creating them.

Report on specialist training (made in Tableau)

Adaptation of new employees

1C:ZUP KORP 3.1 implements adaptation control. It includes assigning adaptation measures indicating those responsible, monitoring the completion of tasks by performers, creating mailing reminders to performers about new tasks, as well as mailing notifications to the “task completion coordinator” in case of failure to complete tasks at the appointed time.

To monitor the adaptation process, the system provides a report “Employees undergoing adaptation and those being dismissed.” The report is located in the “Recruitment Reports” section. The report view is shown in the figure below. In the report, critical tasks are highlighted in red - those that are already overdue, or tasks that must be completed today.

Fig. 15 Adaptation of new employees

The report will help the HR director track whether existing employees are helping their new colleague integrate into the team.

Filling out the form

Applying for the SZV-TD form is quite simple. The only thing is that in column 4 “Type of event (reception, transfer, dismissal)” the following codes must be entered:

| Code | Event name | Explanation |

| 1 | RECEPTION | Hiring (service) |

| 2 | TRANSLATION | Transfer to another job |

| 3 | DISMISSAL | Dismissal from work |

| 4 | RENAME | Changing the name of the policyholder |

| 5 | EDUCATION | Completing training while working (advanced training, retraining and training courses) |

| 6 | ESTABLISHMENT (ASSIGNMENT) | Establishment (assignment) to an employee of a second and subsequent profession, specialty or other qualification (indicate ranks, classes or other categories of these professions, specialties or qualification levels - class, category, class rank, etc.) |

| 7 | PROHIBITION TO OCCUPY A POST (TYPE OF ACTIVITY) | Deprivation of the right, in accordance with a court verdict, to hold certain positions or engage in certain activities |

The following link shows a sample of filling out the SZV-TD for January 2020 using the example of one employee:

SZV-TD REPORT FOR JANUARY 2020

Please note that in the column “Type of assigned work” the code is given in the format “XXXX X” from the reference book “All-Russian Classifier of Occupations” (OK 010-2014 (MSKZ-08). It was adopted and put into effect by order of Rosstandart dated December 12, 2014 No. 2020-st.

How to write an HR report?

For reporting, each block of the program has a “Reports” section. It is located on the first line of the menu.

Fig.2 Section Reports

If we enter the reporting section, we will see that there is a search there. For example, you need to find data on employee experience. To do this, type the word “experience” in the search bar. The program will show all reports that contain data on experience. In this case, reports from all sections will be visible, and not just from the one in which the search was specified (if the “In all sections” checkbox is selected).

The ability to customize reports yourself allows you to obtain data for making management decisions, since these reports provide accurate data in the required sections.

Fig.3 Report options

Report options configured by the user will also be visible here. All that remains is to select the desired report or report option, and to make the list start with the most popular reports, click on the “Settings” button.

Now you can remove the report descriptions for a compact display of the list of reports (uncheck the corresponding box), and also move the report to “Quick Access”. To do this, stand on the report, right-click, and then select “Move to quick access” from the context menu.

Fig.4 Quick access report

Reasons for the appearance of new reports

In mid-2021, the Pension Fund of Russia, in connection with the introduction of electronic work books in Russia, began to prepare a new reporting form called SZV-TD (not to be confused with STD-R). It was approved by Resolution of the PFR Board of December 25, 2019 No. 730p, which came into force on February 4, 2021.

At the same time, the Government of the Russian Federation introduced 3 bills to the State Duma, which established the possibility of maintaining information about the labor activities of employees in electronic form. They contain amendments to the Labor Code of the Russian Federation, the Law on Individual (Personified) Accounting dated April 1, 1996 No. 27-FZ and the Code of Administrative Offenses of the Russian Federation.

For more information, see “The Ministry of Labor has developed 3 bills on the transition to electronic work books: review.”

Accounting for all major personnel changes at each enterprise is compiled by Pension Fund employees. But so that they have all the necessary information and the Pension Fund of Russia can personalize it for each employee, employers are required to submit a new monthly report SZV-TD from 2021 (resolution of the Board of the Pension Fund of the Russian Federation “On approval of the form and format of information about the work activity of a registered person, as well as the procedure for it filling").

The pension fund needs as much information as possible about the length of service. Therefore, starting from 2021, the corresponding data is entered into the individual personal account of the insured person.

All information about labor activity from 2021 can be obtained:

- from the Pension Fund;

- in the MFC (“My Documents”);

- on the government services website;

- at the last employer.